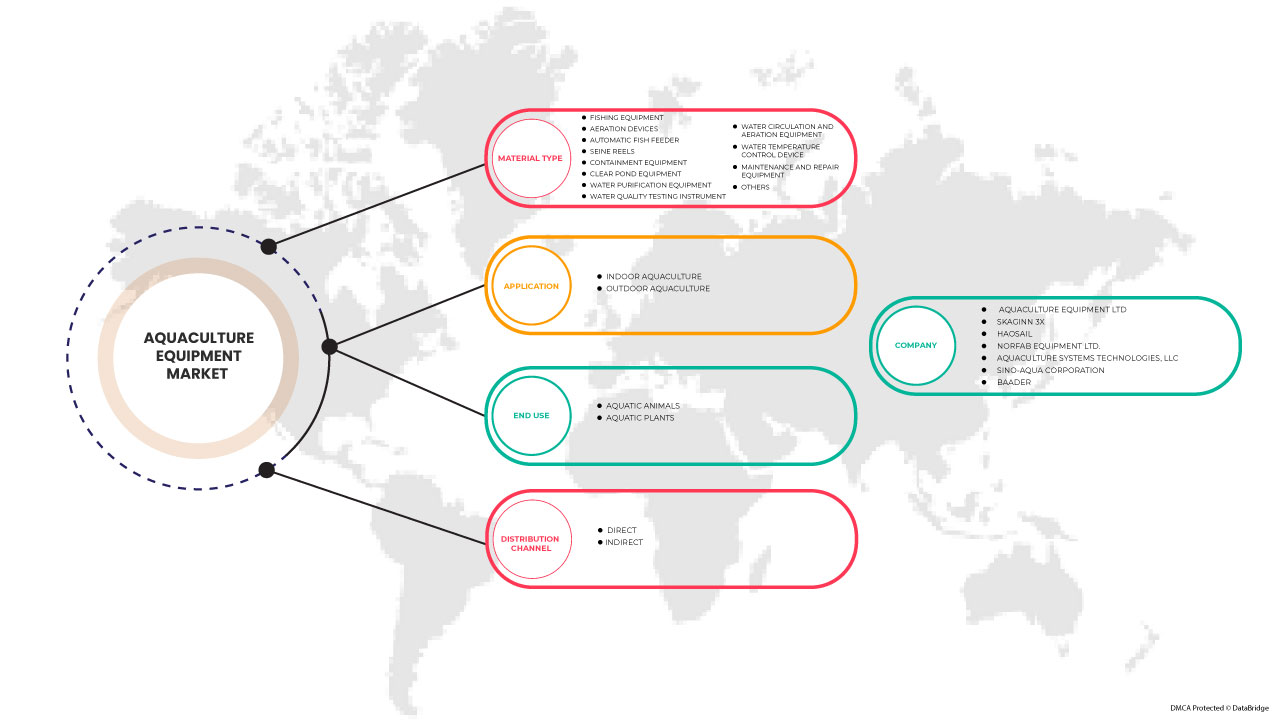

Mercado europeo de equipos de acuicultura, por tipo (equipos de purificación de agua, dispositivos de aireación, equipos de circulación y aireación de agua, comederos automáticos de peces, equipos de pesca, equipos de contención, carretes de red, equipos de mantenimiento y reparación, dispositivos de control de temperatura del agua, instrumentos de prueba de calidad del agua, equipos para estanques transparentes y otros), aplicación (acuicultura al aire libre, acuicultura en interiores), uso final (animales acuáticos, plantas acuáticas), canal de distribución (directo, indirecto), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de equipos de acuicultura en Europa

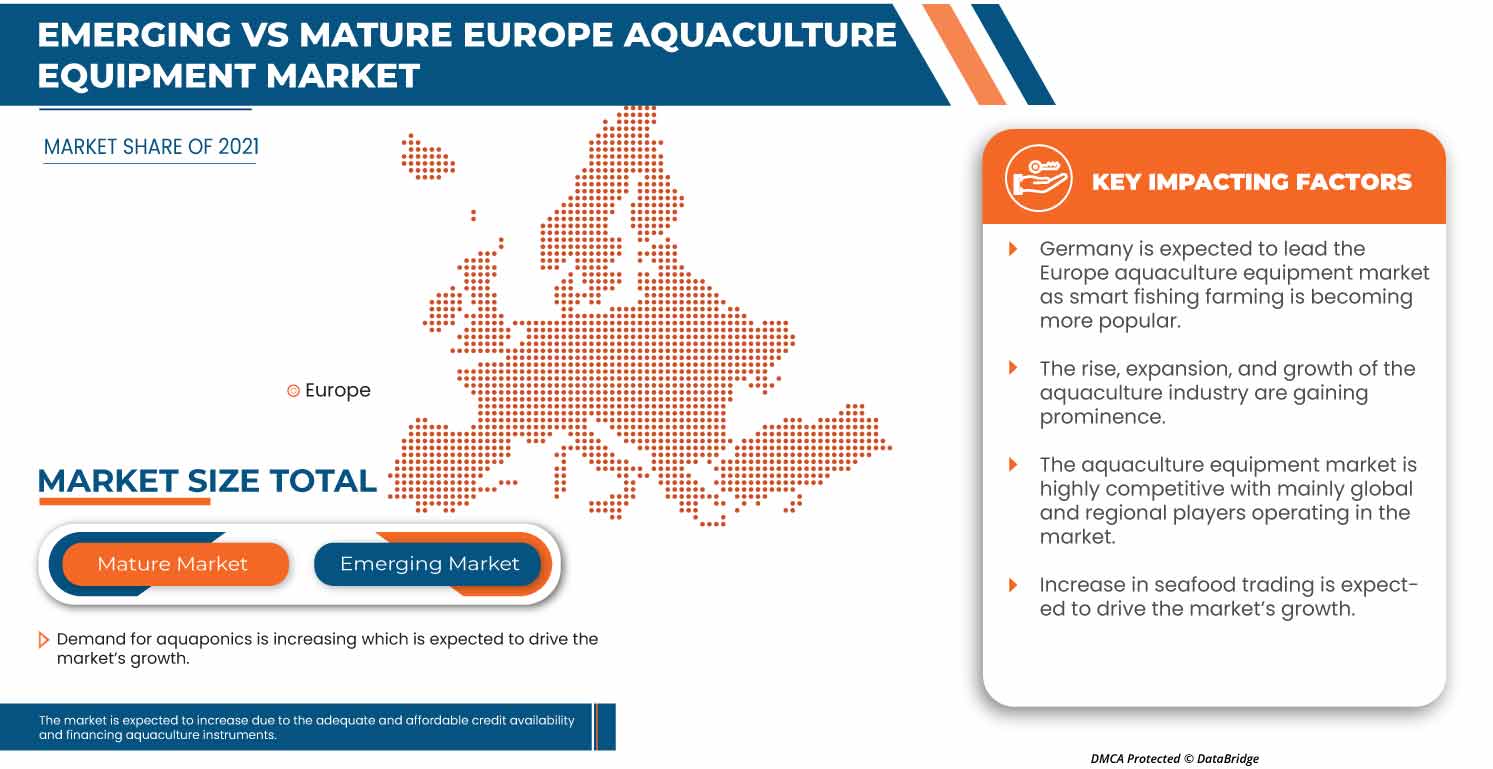

Se espera que el aumento del comercio de productos del mar y la creciente demanda de equipos de acuicultura impulsen la demanda del mercado europeo de equipos de acuicultura. Sin embargo, las preocupaciones sobre la seguridad alimentaria en la acuicultura y la propagación de enfermedades y parásitos mortales pueden restringir aún más el crecimiento del mercado.

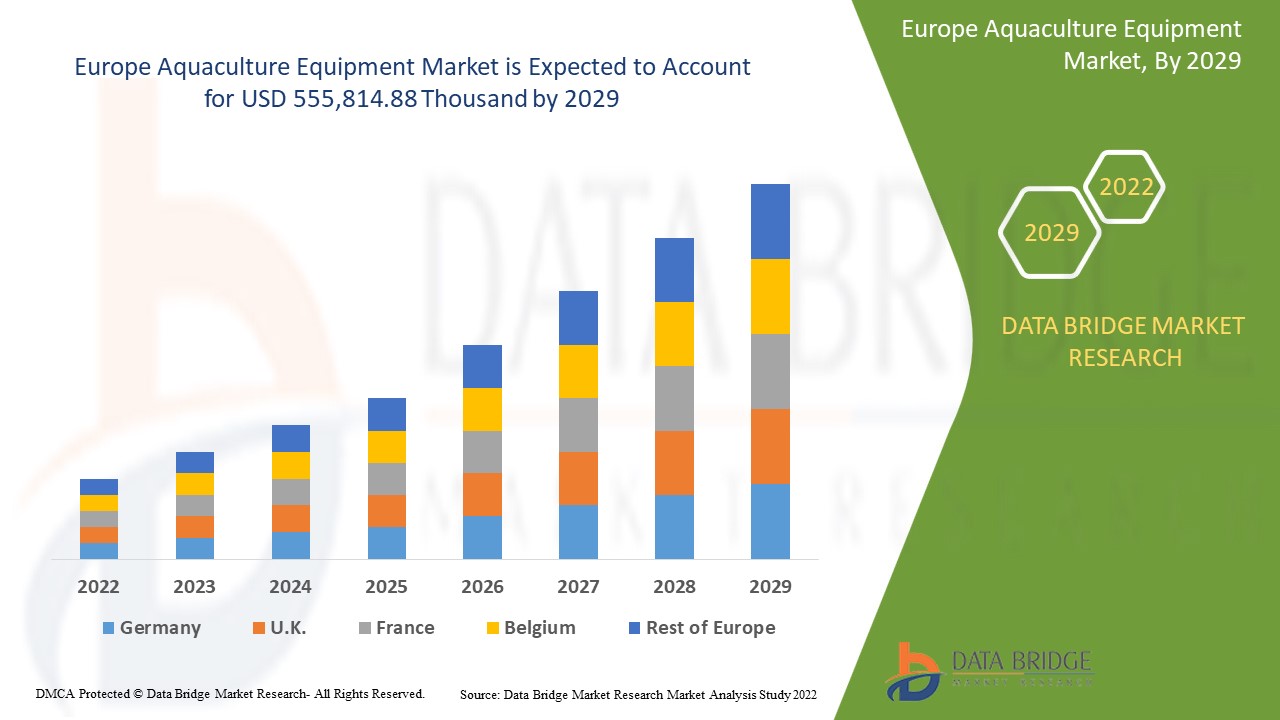

Data Bridge Market Research analiza que se espera que el mercado de equipos de acuicultura de Europa alcance un valor de USD 555.814,88 mil para 2029, con una CAGR del 4,0% durante el período de pronóstico. Los equipos de purificación de agua representan el segmento de tipo más grande en el mercado de equipos de acuicultura de Europa. El informe del mercado de equipos de acuicultura de Europa también cubre el análisis de precios, el análisis de patentes y los avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo (equipo de purificación de agua, dispositivos de aireación, equipos de circulación y aireación de agua, comedero automático de peces, equipo de pesca, equipo de contención, carretes de red, equipos de mantenimiento y reparación, dispositivo de control de temperatura del agua, instrumento de prueba de calidad del agua, equipo para estanques transparentes y otros), aplicación (acuicultura al aire libre, acuicultura en interiores), uso final (animales acuáticos, plantas acuáticas), canal de distribución (directo, indirecto). |

|

Países cubiertos |

Alemania, Reino Unido, Francia, Italia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Dinamarca, Polonia, Suecia y el resto de Europa. |

|

Actores del mercado cubiertos |

Aquaculture Equipment Ltd, SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Rastaquaculture, Cflow, FishFarmFeeeder, FREA SOLUTIONS y Aquamof Aquaculture Technologies Ltd., entre otros. |

Definición de mercado

La acuicultura es el cultivo de plantas acuáticas, animales acuáticos y otros organismos acuáticos. Es la cría, crianza y recolección de organismos en entornos acuáticos. Por lo tanto, el equipo de acuicultura se refiere al equipo que se utiliza en el proceso de cultivo de acuicultura. A lo largo de los años, la industria de la acuicultura ha ganado un impulso significativo en su tasa de crecimiento y ha mostrado un gran potencial de crecimiento. Como resultado, cada vez más actores están ingresando a este campo.

Dinámica del mercado de equipos de acuicultura en Europa

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

-

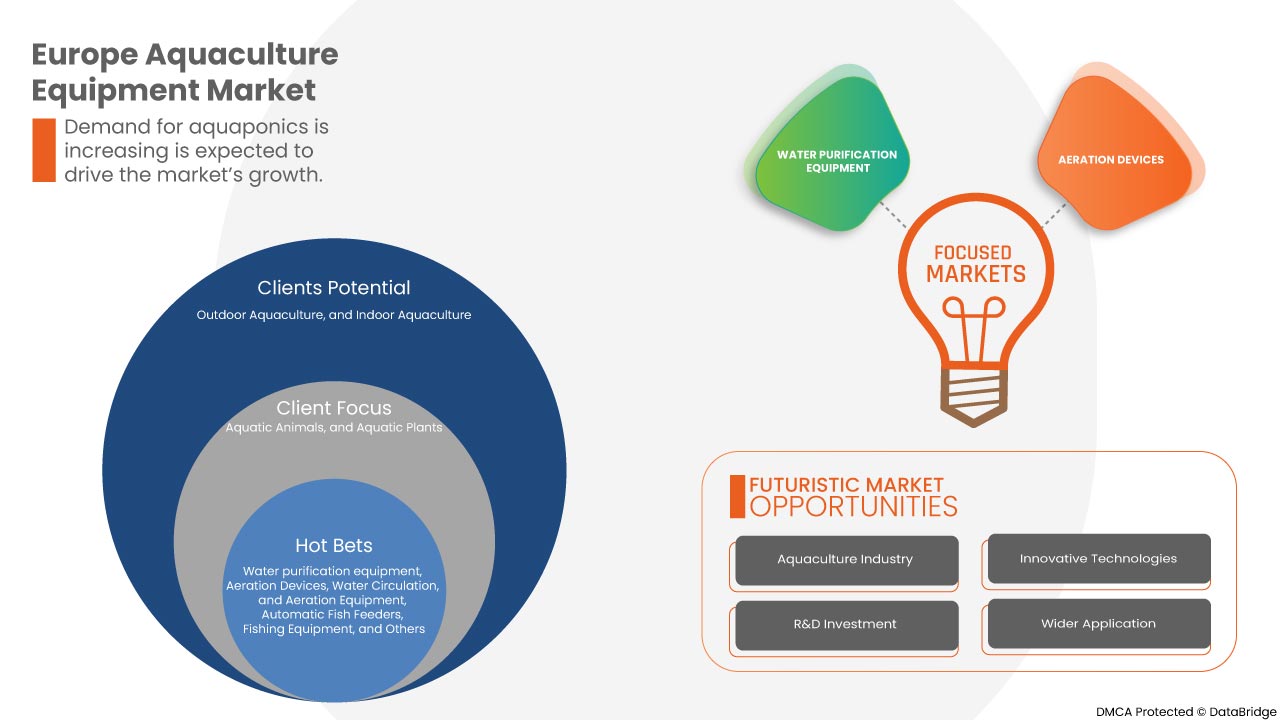

El auge, la expansión y el crecimiento de la industria de la acuicultura

La acuicultura, o cría de peces y mariscos, es el sector de más rápido crecimiento del negocio de los productos para la alimentación animal. El crecimiento de la acuicultura se ha visto impulsado por la expansión del comercio en Europa, la disminución de la disponibilidad de peces salvajes, los precios competitivos de los productos, el aumento de los ingresos y la urbanización, todo lo cual contribuye al aumento del consumo per cápita de productos del mar en todo el mundo. Además, la realización de desarrollos técnicos creativos, la inversión en I+D y la cooperación con los principales actores de la industria ampliarán y expandirán el alcance mundial del negocio de la acuicultura. Esto también aumentará el crecimiento de los equipos de acuicultura, como aireadores, bombas, alimentadores, filtros y otros que dependen de las industrias de la acuicultura. Por lo tanto, como resultado del crecimiento del negocio de la acuicultura, la demanda de equipos de acuicultura aumentará. En el futuro previsible, se espera que esto impulse el mercado de equipos de acuicultura de Europa.

-

Aumento del comercio de productos del mar

Gracias a décadas de aumento de los rendimientos de la pesca y la acuicultura y a la creciente demanda en Europa, los productos del mar son una de las categorías de alimentos más comercializadas en el mundo en la actualidad. La tasa de crecimiento más rápida del comercio de productos acuáticos revela que una mayor proporción de los volúmenes de comercio de productos del mar comprendía diversas especies. Los países en desarrollo desempeñan un papel importante en las exportaciones de productos del mar, ya que los países desarrollados dependen cada vez más de los países en desarrollo para las importaciones de especies de alto valor. Por lo tanto, el aumento del comercio de productos del mar aumenta el crecimiento de las industrias de la acuicultura, y esto dará como resultado una mayor demanda de equipos de acuicultura. Se espera que esto impulse el mercado de equipos de acuicultura en el futuro cercano.

Oportunidades

-

Aumentan las medidas gubernamentales para impulsar la acuicultura

La pesca y la acuicultura proporcionan alimentos a cientos de millones de personas en todo el mundo todos los días. Contribuyen a la producción de alimentos y ayudan a los animales en peligro de extinción al cumplir diversas funciones. Las iniciativas de los gobiernos, como las reglamentaciones y los programas que promueven la expansión del sector de la acuicultura, sólo sirven para preparar el camino para el desarrollo futuro junto con las soluciones tecnológicas. Esta expansión creará oportunidades adicionales para importantes participantes de la industria y agricultores en el futuro previsible, haciendo de la acuicultura un sector que hay que vigilar. Como resultado de esto, se espera que el aumento de las medidas gubernamentales para impulsar la acuicultura proporcione una oportunidad de crecimiento del mercado para el mercado de equipos de acuicultura.

Restricciones/Desafíos

- Preocupaciones sobre la seguridad alimentaria en la acuicultura

Los datos epidemiológicos sobre las infecciones transmitidas por los alimentos muestran que el pescado recogido en alta mar suele ser un alimento seguro y saludable si se refrigera rápidamente y se manipula adecuadamente. Por otra parte, los productos de la acuicultura se han relacionado con ciertos problemas de seguridad alimentaria, ya que el peligro de contaminación por agentes químicos y biológicos es mayor en los hábitats costeros y de agua dulce que en alta mar. Como resultado, la falta de infraestructura y las restricciones gubernamentales constantes pueden limitar la expansión del mercado. La producción acuícola se convertirá sin duda en un medio cada vez más importante para producir productos acuáticos para el consumo humano, pero el riesgo relacionado con la seguridad alimentaria en relación con la acuicultura se verá muy afectado en la economía. Esta preocupación por la seguridad alimentaria en la acuicultura obstaculizará el crecimiento de la industria acuícola y, por lo tanto, restringirá el crecimiento del mercado de equipos para la acuicultura.

- Dificultades de la sobrepesca

Con el 90% de las reservas de peces silvestres del mundo totalmente explotadas, sobreexplotadas o agotadas, la acuicultura está en aumento; sin embargo, sigue siendo discutible si la acuicultura es una solución a la sobrepesca. La sobrepesca está en aumento a medida que los productos del mar se han convertido en uno de los productos alimenticios más comercializados del planeta. Cuando las poblaciones de peces están sobreexplotadas, se alteran los frágiles ecosistemas marinos de los que depende nuestro planeta. La acuicultura, que abarca tanto las especies de agua salada como las de agua dulce, es la técnica de cultivo de peces en circunstancias controladas. Es la industria de producción de alimentos de más rápido crecimiento del mundo, representando alrededor del 44% de todo el pescado consumido, pero para mantener su expansión, depende principalmente de la captura de peces silvestres. Por lo tanto, las dificultades relacionadas con la sobrepesca pueden actuar como un desafío para la industria de la acuicultura, y esto puede afectar el crecimiento del mercado de equipos de acuicultura.

Impacto post COVID-19 en el mercado europeo de equipos de acuicultura

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones en el transporte. Debido al confinamiento, el mercado ha experimentado una caída en las ventas debido al cierre de los puntos de venta minoristas y a las restricciones en el acceso de los clientes en los últimos años.

Sin embargo, el crecimiento del mercado en el período posterior a la pandemia se atribuye a una mayor conciencia y conciencia de la salud entre los consumidores y a la creciente demanda de productos del mar saludables y nutritivos. Esto ha llevado a una mayor popularidad de la acuicultura entre las personas debido a los diversos beneficios para la salud y la creciente popularidad de los alimentos ricos en proteínas. Los actores clave del mercado están tomando varias decisiones estratégicas para recuperarse después de COVID-19. Los actores están llevando a cabo múltiples actividades de I+D para mejorar sus ofertas. Están mejorando su participación de mercado explorando diferentes canales minoristas y expandiéndose a nuevas regiones.

Acontecimientos recientes

- En agosto de 2022, SKAGINN 3X firmó un contrato con BlueWild, Noruega, para suministrar una planta de procesamiento de pescado completa a bordo del nuevo e innovador arrastrero de la empresa. El arrastrero está diseñado para ofrecer sostenibilidad, calidad y eficiencia en todos los niveles. Se trata de un acuerdo histórico para la organización.

- En abril de 2022, Cflow AS participó en Nor-Shipping, que tuvo lugar del 4 al 7 de abril. Nor-Shipping está en el centro de los océanos. Aquí es donde las industrias marítimas y oceánicas se reúnen cada dos años: un centro natural para que los principales tomadores de decisiones de todo el mundo se conecten, colaboren y hagan negocios para desbloquear nuevas oportunidades comerciales.

Alcance del mercado de equipos de acuicultura en Europa

El mercado europeo de equipos para acuicultura está segmentado en función del tipo, la aplicación, el uso final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Equipos de purificación de agua

- Dispositivos de aireación

- Equipos de circulación y aireación de agua

- Alimentador automático de peces

- Equipo de pesca

- Equipo de contención

- Carretes de cerco

- Equipos de mantenimiento y reparación

- Dispositivo de control de temperatura del agua

- Instrumento de prueba de calidad del agua

- Equipo para estanques transparentes

- Otros

Según el tipo, el mercado europeo de equipos de acuicultura está segmentado en equipos de purificación de agua, dispositivos de aireación, equipos de circulación y aireación de agua, comederos automáticos para peces, equipos de pesca, equipos de contención, carretes de red, equipos de mantenimiento y reparación, dispositivos de control de temperatura del agua, instrumentos de prueba de calidad del agua, equipos para estanques transparentes y otros.

Solicitud

- Acuicultura al aire libre

- Acuicultura de interior

Según la aplicación, el mercado europeo de equipos de acuicultura está segmentado en acuicultura al aire libre y acuicultura en interiores.

Uso final

- Animales acuáticos

- Plantas acuáticas

Según el uso final, el mercado europeo de equipos de acuicultura está segmentado en animales acuáticos y plantas acuáticas.

Canal de distribución

- Directo

- Indirecto

Según el canal de distribución, el mercado europeo de equipos de acuicultura está segmentado en directo e indirecto.

Análisis y perspectivas regionales del mercado de equipos de acuicultura en Europa

Se analiza el mercado de equipos de acuicultura de Europa y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación, uso final y canal de distribución, como se mencionó anteriormente.

El mercado europeo de equipos de acuicultura abarca países como Alemania, Reino Unido, Francia, Italia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Dinamarca, Polonia, Suecia y el resto de Europa.

Se espera que Alemania domine el mercado europeo de equipos para acuicultura debido a la creciente conciencia de la salud entre los consumidores y la demanda de alimentos ricos en proteínas. También se debe al creciente interés en la acuicultura. Alemania domina el mercado con la mayor participación de mercado, seguida por el Reino Unido y Francia. Italia y España son dos países más donde la demanda está aumentando debido a la creciente adopción de la acuicultura y la creciente popularidad de los productos del mar entre los consumidores.

La sección de países del informe sobre el mercado de equipos de acuicultura de Europa también proporciona factores individuales que impactan en el mercado y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación son algunos de los indicadores importantes que se utilizan para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de equipos de acuicultura en Europa

El panorama competitivo del mercado de equipos de acuicultura de Europa proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de equipos de acuicultura de Europa.

Algunos de los principales actores que operan en el mercado de equipos de acuicultura de Europa son Aquaculture Equipment Ltd, SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Rastaquaculture, Cflow, FishFarmFeeeder, FREA SOLUTIONS y Aquamof Aquaculture Technologies Ltd., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 EUROPE AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 SWITZERLAND

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 NETHERLANDS

11.1.11 DENMARK

11.1.12 POLAND

11.1.13 SWEDEN

11.1.14 REST OF EUROPE

12 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 GERMANY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 GERMANY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 GERMANY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 U.K AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.K AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.K AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 U.K OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 U.K AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 U.K AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 U.K AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 U.K AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 FRANCE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 FRANCE AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 FRANCE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 FRANCE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 FRANCE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 74 ITALY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 ITALY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 ITALY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 ITALY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 ITALY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 ITALY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 ITALY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 81 ITALY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 82 ITALY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 83 ITALY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 84 SPAIN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SPAIN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 SPAIN WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SPAIN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 SPAIN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 SPAIN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 SPAIN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 91 SPAIN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 92 SPAIN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 93 SPAIN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 RUSSIA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 RUSSIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 RUSSIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 101 RUSSIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 102 RUSSIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 103 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 104 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 SWITZERLAND WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SWITZERLAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SWITZERLAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 111 SWITZERLAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 112 SWITZERLAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 113 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 114 TURKEY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 TURKEY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 TURKEY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 TURKEY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 TURKEY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 TURKEY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 TURKEY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 121 TURKEY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 122 TURKEY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 123 TURKEY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 BELGIUM WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 BELGIUM MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 BELGIUM OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 131 BELGIUM AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 132 BELGIUM AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 133 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 134 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 136 NETHERLANDS WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 NETHERLANDS MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 NETHERLANDS OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 141 NETHERLANDS AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 142 NETHERLANDS AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 143 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 144 DENMARK AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 DENMARK AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 DENMARK WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 DENMARK MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 DENMARK AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 DENMARK OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 DENMARK AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 151 DENMARK AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 152 DENMARK AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 153 DENMARK AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 154 POLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 POLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 156 POLAND WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 POLAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 POLAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 159 POLAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 POLAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 161 POLAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 162 POLAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 163 POLAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 164 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 SWEDEN WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 SWEDEN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 SWEDEN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 170 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 171 SWEDEN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 172 SWEDEN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 173 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 174 REST OF EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 REST OF EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

Lista de figuras

FIGURE 1 EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 2 EUROPE AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AQUACULTURE EQUIPMENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 EUROPE AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE EUROPE AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 18 EUROPE AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 EUROPE AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 EUROPE AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 EUROPE AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 EUROPE AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.