Mercado de servicios petrolíferos de Europa y Oriente Medio, por tipo (alquiler de equipos, operaciones de campo, servicios analíticos y servicios de consultoría), tipo de servicio (servicios de perforación, servicios de terminación y reacondicionamiento, servicios de producción, servicios de procesamiento y separación, servicios de yacimientos, servicios sísmicos, servicios submarinos y otros servicios), aplicación (en tierra y en alta mar): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de servicios petrolíferos de Europa y Oriente Medio

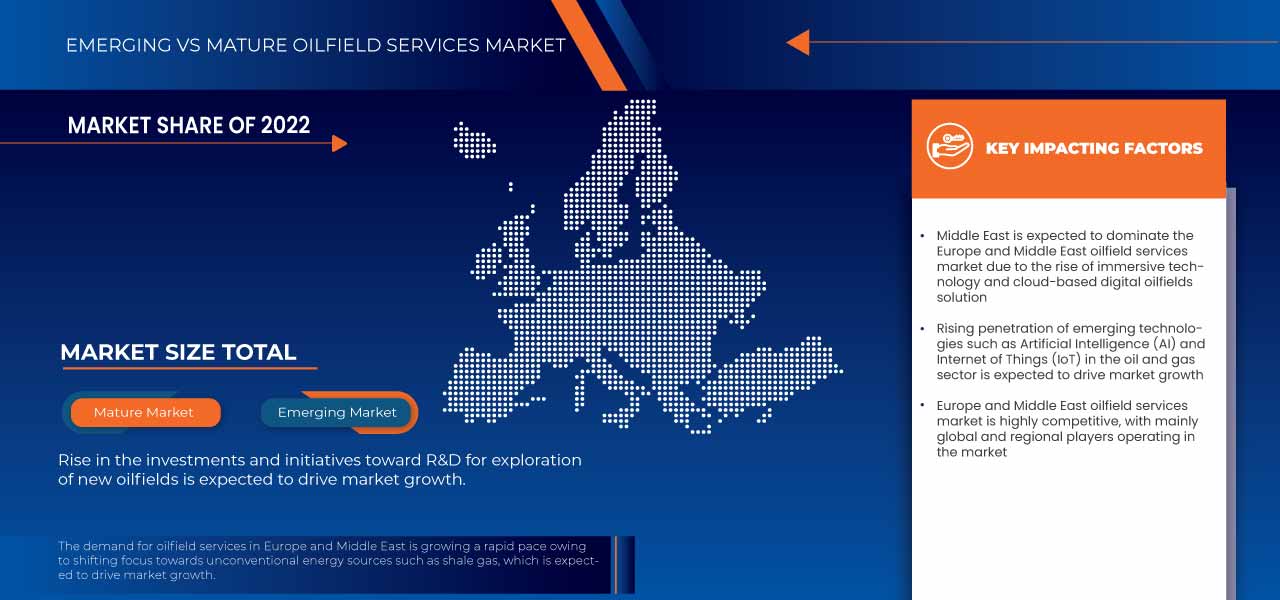

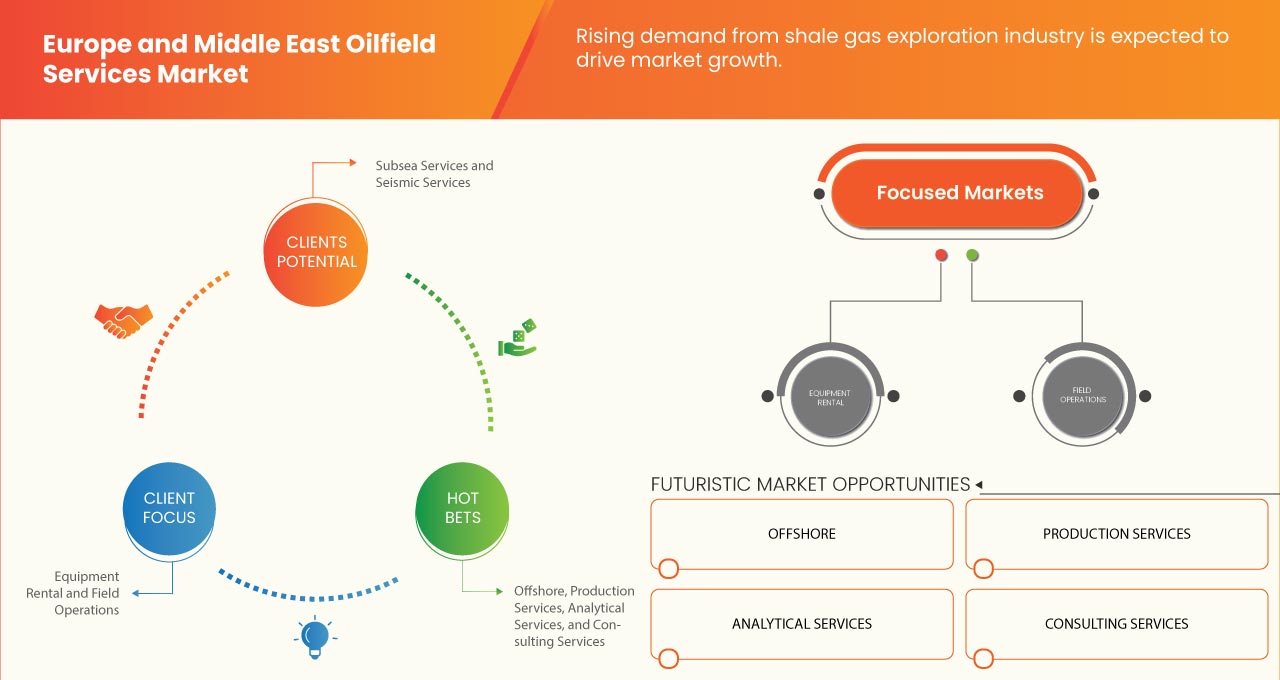

La creciente penetración de tecnologías emergentes como la inteligencia artificial (IA) y la Internet de las cosas (IdC) en el sector del petróleo y el gas ha aumentado la demanda del mercado. El cambio de enfoque hacia fuentes de energía no convencionales como el gas de esquisto también contribuye al crecimiento del mercado. Los principales actores del mercado se centran en diversos lanzamientos y aprobaciones de servicios durante este período crucial. Además, la creciente adopción de tecnologías como la recuperación mejorada de petróleo (EOR), especialmente para los yacimientos petrolíferos antiguos, también contribuye a la creciente demanda del mercado.

Se espera que el mercado de servicios petrolíferos de Europa y Oriente Medio crezca en el año de pronóstico debido al aumento de la demanda de servicios de intervención de pozos y soluciones digitales operativas para yacimientos petrolíferos. El auge de la tecnología inmersiva y las soluciones digitales para yacimientos petrolíferos basadas en la nube están impulsando aún más el crecimiento del mercado. Sin embargo, se espera que las estrictas leyes y regulaciones de varios organismos reguladores limiten el crecimiento del mercado en el período de pronóstico.

Data Bridge Market Research analiza que se espera que el mercado de servicios petrolíferos de Europa y Medio Oriente alcance los USD 131.230,78 millones para 2030, con una CAGR del 5,8% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo (alquiler de equipos, operaciones de campo, servicios analíticos y servicios de consultoría), tipo de servicio (servicios de perforación, servicios de terminación y reacondicionamiento, servicios de producción, servicios de procesamiento y separación, servicios de yacimientos, servicios sísmicos, servicios submarinos y otros servicios), aplicación (en tierra y en alta mar) |

|

Países cubiertos |

Rusia, Noruega, Reino Unido, Dinamarca, Italia, Turquía, Alemania, Países Bajos, Francia, España, Suiza, Bélgica, Finlandia, Suecia y resto de Europa, Arabia Saudita, Emiratos Árabes Unidos, Kuwait, Qatar, Omán, Baréin, Israel y resto de Oriente Medio |

|

Actores del mercado cubiertos |

NAPESCO, SLB, Halliburton, Baker Hughes Company, ABB, Weatherford, Rockwell Automation, Siemens Energy, Saipem, Petrofac Limited, Oil States International, Inc., Oceaneering International, TRANSOCEAN LTD., NOV Inc., TAQA KSA, Superior Energy Services, Stark Oilfield Service Company, Middle East Oilfield Services LLC, Abu Dhabi Oilfield Services Company y ADNOC Group, entre otros. |

Definición de mercado

Los servicios petrolíferos se refieren a la gama de productos y servicios proporcionados a la industria del petróleo y el gas para respaldar la exploración, el desarrollo, la producción y el transporte de recursos de petróleo y gas. Los servicios petrolíferos abarcan una amplia gama de actividades especializadas, equipos y conocimientos técnicos necesarios en varias etapas del ciclo de vida del petróleo y el gas. Estos servicios incluyen estudios sísmicos para identificar posibles yacimientos, perforación de pozos utilizando plataformas y equipos especializados, servicios de terminación y producción para preparar los pozos para la producción, servicios de intervención y mantenimiento de pozos, servicios de cableado para operaciones de recopilación de datos e intervención, y servicios ambientales para la gestión de residuos y el cumplimiento normativo. El mercado de servicios petrolíferos se refiere a la industria que proporciona diversos productos y servicios para respaldar las actividades de exploración, perforación, producción y transporte de petróleo y gas.

Dinámica del mercado de servicios petrolíferos en Europa y Oriente Medio

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente penetración de tecnologías emergentes como la inteligencia artificial (IA) y la Internet de las cosas (IdC) en el sector del petróleo y el gas

La tecnología juega un papel importante en el crecimiento de cada negocio y también ayuda a las organizaciones a mejorar la calidad y la velocidad de trabajo al respaldar y mejorar las operaciones. Las empresas están adoptando técnicas de análisis de big data en sus negocios para mejorar las operaciones y facilitar el rendimiento de las instalaciones. Las tecnologías disruptivas como la inteligencia artificial (IA) y la Internet de las cosas (IdC) están impulsando la transformación digital en todo el mercado, aumentando así la eficiencia, la seguridad y la sostenibilidad. El sector del petróleo y el gas ha sido testigo de una creciente penetración de tecnologías emergentes en los últimos años. Las tecnologías están transformando varios aspectos de la industria, desde la exploración y la producción hasta la refinación y la distribución.

- Cambio de foco hacia fuentes de energía no convencionales como el gas de esquisto

El gas de esquisto es un recurso de gas natural no convencional que se encuentra en formaciones rocosas de esquisto, y su exploración y extracción requieren técnicas y servicios especializados proporcionados por empresas petroleras. El desarrollo de tecnologías avanzadas como la perforación horizontal y la fracturación hidráulica ha sido crucial para liberar el vasto potencial de los recursos de gas de esquisto. La exploración de gas de esquisto implica la perforación de múltiples pozos y su finalización con fracturación hidráulica. Se realizan estudios sísmicos para mapear y analizar las formaciones de esquisto del subsuelo. Esto ayuda a identificar los posibles yacimientos de gas de esquisto, evaluar sus características geológicas y determinar las mejores ubicaciones para la perforación. La fracturación hidráulica o fracking es una técnica fundamental que se utiliza para extraer gas de las formaciones de esquisto. Las empresas de servicios petroleros proporcionan experiencia y equipos para las operaciones de fracturación hidráulica. Diseñan e implementan tratamientos de fracturación que implican la inyección de agua, arena y productos químicos a alta presión para crear fracturas en la roca de esquisto que permiten que el gas fluya una vez que se completa la perforación y la fracturación hidráulica, cementando la carcasa, instalando tubos de producción e implementando conjuntos de cabezales de pozo para garantizar un control de flujo adecuado y la seguridad. Los servicios de yacimientos petrolíferos se ocupan de optimizar la producción de gas de esquisto mediante el uso de diferentes técnicas, como estimulación de pozos, etapas adicionales de fracturación hidráulica o acidificación para aumentar los caudales de gas y mejorar la productividad de los pozos. Los servicios de monitoreo y optimización de la producción ayudan a maximizar la producción general de los yacimientos de gas de esquisto.

Oportunidad

-

Aumento de la demanda de servicios de intervención de pozos y soluciones digitales operativas para yacimientos petrolíferos

El creciente número de yacimientos maduros en Europa y Oriente Medio se debe a la creciente demanda de energía primaria, como petróleo y gas natural, en todo el mundo. Además, existe una enorme escasez de suministro de energía primaria y la mayoría de las empresas internacionales están invirtiendo más en la creación de sistemas de producción eficientes. La adopción de soluciones digitales o la transformación del proceso de trabajo de los yacimientos petrolíferos hacia la digitalización mejorarán la capacidad de producción y extracción de petróleo y reducirán los errores humanos.

Muchos yacimientos de petróleo y gas en todo el mundo están entrando en la etapa de madurez o de vida útil avanzada, donde las tasas de producción disminuyen naturalmente. Los servicios de intervención de pozos son muy demandados para optimizar la producción, mejorar las tasas de recuperación y extender la vida útil de estos yacimientos envejecidos. Las técnicas de intervención, como la estimulación de pozos, las reparaciones y la gestión de la integridad de los pozos, ayudan a abordar los problemas de los pozos, mejorar el rendimiento de los yacimientos y restablecer o mejorar los niveles de producción. Los servicios de intervención de pozos desempeñan un papel vital en los esfuerzos de la industria por maximizar la eficiencia de la producción. Estos servicios ayudan a identificar y abordar los cuellos de botella de la producción, optimizar los diseños de terminación de pozos e implementar estrategias de gestión de yacimientos.

Desafíos/Restricciones

- La caída de la industria debido a factores geopolíticos y económicos

La caída industrial debido a factores geopolíticos y económicos puede tener implicaciones significativas para el mercado. Los factores geopolíticos como la inestabilidad política, los conflictos, las disputas comerciales y las sanciones pueden perturbar la industria mundial del petróleo y el gas. Los factores económicos como las fluctuaciones en los precios del petróleo, la devaluación de la moneda y los cambios en la dinámica de la oferta y la demanda pueden afectar aún más al mercado. Estos desafíos pueden crear varios obstáculos potenciales para el mercado.

La producción y exploración de petróleo en las regiones de Europa y Oriente Medio puede verse afectada por la inestabilidad geopolítica. La inestabilidad en los principales países productores de petróleo puede provocar una disminución de la inversión, daños a la infraestructura e interrupciones del suministro. Estas preocupaciones pueden limitar las actividades de exploración y producción, reduciendo la necesidad de servicios de perforación, terminación de pozos y mantenimiento. Esto puede ser perjudicial para la industria de servicios petroleros. Además, en las regiones de Europa y Oriente Medio, las decisiones financieras y los presupuestos de los proyectos pueden verse influidos por factores económicos como los cambios en los precios del petróleo. Las empresas de petróleo y gas pueden reducir los gastos de capital como resultado de los precios volátiles del petróleo, lo que reduciría la demanda de servicios petroleros. Además, los cambios en la dinámica de la oferta y la demanda del mercado y la devaluación de la moneda en algunos países de Europa y Oriente Medio pueden tener un impacto en el mercado de esa región. Estos factores pueden aumentar los costos operativos para los proveedores de servicios petroleros y reducir su rentabilidad y competitividad. Las actividades de exploración y producción de petróleo y gas pueden disminuir como resultado de factores como los cambios en los patrones de consumo de energía, un mayor énfasis en las fuentes de energía renovable y políticas que apoyan la transición energética. Este cambio puede resultar en una disminución de la demanda de servicios petrolíferos, lo que resultará difícil para los proveedores de servicios que hacen negocios en las regiones de Europa y Medio Oriente.

- Leyes y regulaciones estrictas de varios organismos reguladores

Diversas organizaciones y gobiernos han impuesto diversas leyes y regulaciones estrictas en el mercado de servicios petrolíferos de Europa y Oriente Medio. Estas normas tienen por objeto garantizar la etnicidad de la industria, la protección del medio ambiente y la seguridad. Sin embargo, también pueden establecer restricciones al mercado.

La protección del medio ambiente es un aspecto de la regulación que impacta en el negocio. Los gobiernos y las organizaciones han promulgado leyes para reducir y controlar el impacto ambiental de las operaciones petroleras. Esto abarca las normas de eliminación de residuos o subproductos, la reducción de emisiones y la protección de los ecosistemas naturales. Los costos para los proveedores de servicios petroleros pueden aumentar debido al aumento de las inversiones en equipos, tecnología y procedimientos necesarios para cumplir con estas leyes, lo que puede ser un desafío a superar en el futuro cercano. Además, las leyes de salud y seguridad juegan un papel importante en el mercado. Las corporaciones y los gobiernos imponen regulaciones estrictas para proteger a los empleados y garantizar entornos de trabajo seguros. El equipo de protección personal, la identificación de peligros y la planificación de respuesta a emergencias son solo algunos de los temas cubiertos por estas reglas. Las empresas pueden tener que gastar dinero en iniciativas de capacitación, equipo de seguridad y medidas de cumplimiento para cumplir con estas reglas, lo que puede aumentar los gastos operativos. Además, existen leyes y reglas para garantizar una competencia justa y la transparencia en el sector de servicios petroleros. Estas reglas pueden aumentar la cantidad de cumplimiento requerido de las empresas ya existentes y aumentar las barreras de entrada para nuevas empresas, cambiando la dinámica del mercado.

Acontecimientos recientes

- En julio de 2023, ABB y Microsoft colaboraron para llevar la inteligencia artificial generativa a las aplicaciones industriales para lograr operaciones más seguras, inteligentes y sostenibles. Esto ayudará a la empresa a acelerar la transformación digital del sector industrial.

- En enero de 2023, NOV lanzó el sistema Agitator ZP para aumentar la eficiencia de la perforación sin disminuir la presión, y afirmó que esta tecnología de presión cero ofrece más flexibilidad para proyectos de perforación que requieren laterales más largos y herramientas duales de reducción de fricción para alcanzar objetivos desafiantes mientras se preserva una ROP más alta.

Alcance del mercado de servicios petrolíferos en Europa y Oriente Medio

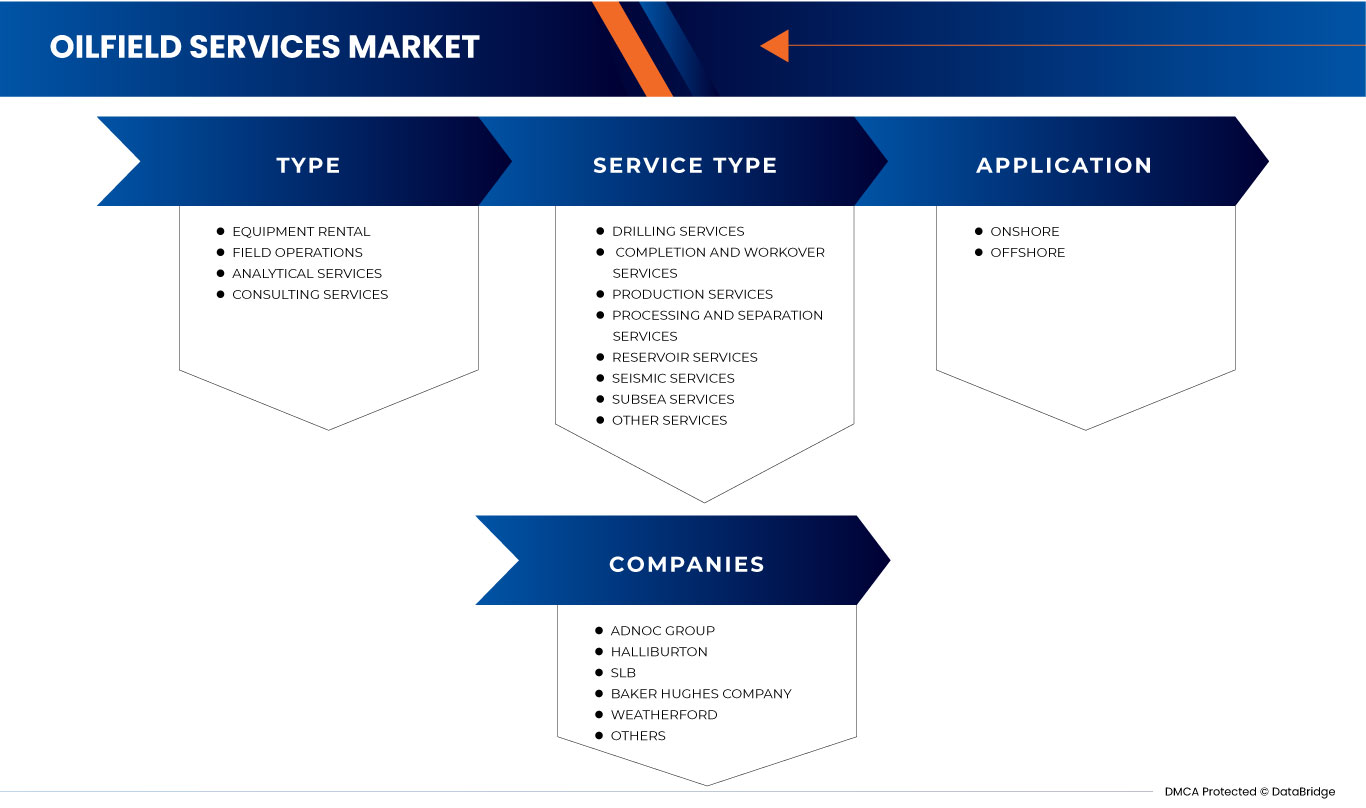

El mercado de servicios petrolíferos de Europa y Oriente Medio se divide en tres segmentos importantes según el tipo, el tipo de servicio y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

Tipo

- Alquiler de equipos

- Operaciones de campo

- Servicios Analíticos

- Servicios de Consultoría

Según el tipo, el mercado está segmentado en alquiler de equipos, operaciones de campo, servicios analíticos y servicios de consultoría.

Tipo de servicio

- Servicios de perforación

- Servicios de terminación y reacondicionamiento

- Servicios de producción

- Servicios de procesamiento y separación

- Servicios de embalse

- Servicios Sísmicos

- Servicios submarinos

- Otros servicios

Según el tipo de servicio, el mercado está segmentado en servicios de perforación, servicios de terminación y reacondicionamiento, servicios de producción, servicios de procesamiento y separación, servicios de yacimientos, servicios sísmicos, servicios submarinos y otros servicios.

Solicitud

- En tierra

- Costa afuera

En función de la aplicación, el mercado se segmenta en onshore y offshore.

Análisis y perspectivas regionales del mercado de servicios petrolíferos de Europa y Oriente Medio

El mercado de servicios petrolíferos de Europa y Medio Oriente está segmentado en tres segmentos notables según el tipo, el tipo de servicio y la aplicación.

Los países cubiertos en este informe de mercado son Rusia, Noruega, Reino Unido, Dinamarca, Italia, Turquía, Alemania, Países Bajos, Francia, España, Suiza, Bélgica, Finlandia, Suecia y el resto de Europa, Arabia Saudita, Emiratos Árabes Unidos, Kuwait, Qatar, Omán, Bahréin, Israel y el resto de Medio Oriente.

Se espera que Oriente Medio domine el mercado debido a la presencia de actores clave en el mayor mercado de consumo con un alto PIB. Se espera que Arabia Saudita domine en la región de Oriente Medio debido al aumento del avance tecnológico y la creciente inversión en diversas tecnologías. Se espera que Rusia domine en la región de Europa debido a la fuerte presencia de actores clave.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los servicios petrolíferos en Europa y Oriente Medio

El panorama competitivo del mercado de servicios petrolíferos de Europa y Oriente Medio proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de vida útil de los tipos de productos. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores del mercado que operan en el mercado de servicios petrolíferos de Europa y Oriente Medio son NAPESCO, SLB, Halliburton, Baker Hughes Company, ABB, Weatherford, Rockwell Automation, Siemens Energy, Saipem, Petrofac Limited, Oil States International, Inc., Oceaneering International, TRANSOCEAN LTD., NOV Inc., TAQA KSA, Superior Energy Services, Stark Oilfield Service Company, Middle East Oilfield Services LLC, Abu Dhabi Oilfield Services Company y ADNOC Group, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES: EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 RAW MATERIAL COVERAGE

4.5.1 STEEL

4.5.2 ALLOYS

4.5.2.1 NICKEL ALLOYS

4.5.2.1.1 INCONEL

4.5.2.1.2 HASTELLOY

4.5.2.2 CHROMIUM-MOLYBDENUM (CR-MO) ALLOYS

4.5.2.2.1 4130 AND 4140

4.5.2.2.2 9CR AND 13CR STAINLESS STEELS

4.5.2.3 TITANIUM ALLOYS

4.5.2.3.1 GRADE 5 (TI-6AL-4V)

4.5.2.3.2 GRADE 2 (TI-CP)

4.5.3 TUNGSTEN AND COBALT

4.5.4 SYNTHETIC DIAMONDS

4.5.5 TITANIUM

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 PRICING ANALYSIS BENCHMARKING OVERVIEW

4.8.1 DRILLING COSTS

4.8.2 WELL COMPLETION SERVICES

4.8.3 FLUIDS, CEMENTING, AND TOOLS SERVICES

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND INTERNET OF THINGS (IOT) IN THE OIL AND GAS SECTOR

6.1.2 SHIFTING FOCUS TOWARDS UNCONVENTIONAL ENERGY SOURCES SUCH AS SHALE GAS

6.1.3 GROWING ADOPTION OF TECHNOLOGIES SUCH AS EOR ESPECIALLY FOR AGING OIL FIELDS

6.2 RESTRAINTS

6.2.1 STRINGENT LAWS & REGULATIONS BY VARIOUS REGULATORY BODIES

6.2.2 VOLATILITY IN THE PRICES OF CRUDE OIL

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR WELL-INTERVENTION SERVICES AND OPERATIONAL DIGITAL OILFIELD SOLUTIONS

6.3.2 RISE OF IMMERSIVE TECHNOLOGY AND CLOUD-BASED DIGITAL OILFIELDS SOLUTION

6.4 CHALLENGES

6.4.1 INDUSTRIAL DOWNFALL DUE TO GEOPOLITICAL AND ECONOMIC FACTORS

6.4.2 REALIGNING THE FOCUS TOWARDS RENEWABLE OR CLEAN ENERGY RESOURCES

7 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY REGION

7.1 OVERVIEW

7.2 MIDDLE EAST

7.2.1 SAUDI ARABIA

7.2.2 UNITED ARAB EMIRATES

7.2.3 KUWAIT

7.2.4 QATAR

7.2.5 OMAN

7.2.6 BAHRAIN

7.2.7 ISRAEL

7.2.8 REST OF MIDDLE EAST

7.3 EUROPE

7.3.1 RUSSIA

7.3.2 NORWAY

7.3.3 U.K.

7.3.4 DENMARK

7.3.5 ITALY

7.3.6 TURKEY

7.3.7 GERMANY

7.3.8 NETHERLANDS

7.3.9 FRANCE

7.3.10 SPAIN

7.3.11 SWITZERLAND

7.3.12 BELGIUM

7.3.13 FINLAND

7.3.14 SWEDEN

7.3.15 REST OF EUROPE

8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE AND MIDDLE EAST

8.2 COMPANY SHARE ANALYSIS: EUROPE

8.3 COMPANY SHARE ANALYSIS: MIDDLE EAST

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 ADNOC GROUP

10.1.1 COMPANY SNAPSHOT

10.1.2 PRODUCT PORTFOLIO

10.1.3 RECENT DEVELOPMENTS

10.2 HALLIBURTON

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENTS

10.3 SLB

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 PRODUCT PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 BAKER HUGHES COMPANY

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 WEATHERFORD

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 PRODUCT PORTFOLIO

10.5.4 RECENT DEVELOPMENTS

10.6 ABB

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENT

10.7 ABU DHABI OILFIELD SERVICES COMPANY

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 MIDDLE EAST OILFIELD SERVICES LLC.

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 NAPESCO

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT DEVELOPMENT

10.1 NOV INC.

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 OCEANEERING INTERNATIONAL, INC.

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT DEVELOPMENT

10.12 OIL STATES INTERNATIONAL, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 PETROFAC LIMITED

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT DEVELOPMENTS

10.14 ROCKWELL AUTOMATION

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 SAIPEM

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENTS

10.16 SIEMENS ENERGY

10.16.1 COMPANY SNAPSHOT

10.16.1 REVENUE ANALYSIS

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENT

10.17 STARK OILFIELD SERVICE COMPANY

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 SUPERIOR ENERGY SERVICES

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT DEVELOPMENTS

10.19 TAQA KSA

10.19.1 COMPANY SNAPSHOT

10.19.2 REVENUE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 TRANSOCEAN LTD.

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 2 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE AND MIDDLE EAST DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPE AND MIDDLE EAST COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE AND MIDDLE EAST PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 EUROPE AND MIDDLE EAST RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE AND MIDDLE EAST OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST OILFIELD SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 SAUDI ARABIA OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 29 UNITED ARAB EMIRATES DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 UNITED ARAB EMIRATES COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 UNITED ARAB EMIRATES PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 UNITED ARAB EMIRATES RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 34 UNITED ARAB EMIRATES OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 KUWAIT OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 KUWAIT OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 37 KUWAIT DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 KUWAIT COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 KUWAIT PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 KUWAIT RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 KUWAIT OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 KUWAIT OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 QATAR OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 QATAR OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 QATAR DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 QATAR COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 QATAR PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 QATAR RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 QATAR OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 QATAR OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 OMAN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 OMAN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 53 OMAN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 OMAN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 OMAN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 OMAN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 OMAN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 OMAN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 BAHRAIN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 BAHRAIN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 61 BAHRAIN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 BAHRAIN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 BAHRAIN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 BAHRAIN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 BAHRAIN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 66 BAHRAIN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 REST OF MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 EUROPE OILFIELD SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 77 EUROPE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 EUROPE OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 79 EUROPE DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 EUROPE COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 EUROPE PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 EUROPE RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 EUROPE OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 EUROPE OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 RUSSIA OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 RUSSIA OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 87 RUSSIA DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 RUSSIA COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 RUSSIA PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 RUSSIA RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 RUSSIA OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 RUSSIA OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORWAY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORWAY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORWAY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORWAY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORWAY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORWAY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORWAY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 NORWAY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.K. OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.K. OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.K. DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.K. COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 U.K. PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.K. RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.K. OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 U.K. OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 DENMARK OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 DENMARK OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 111 DENMARK DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 DENMARK COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 DENMARK PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 DENMARK RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 DENMARK OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 116 DENMARK OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 ITALY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 ITALY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 119 ITALY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 ITALY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 ITALY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 ITALY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 ITALY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 ITALY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 TURKEY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 TURKEY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 127 TURKEY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 TURKEY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 TURKEY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 TURKEY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 TURKEY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 132 TURKEY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 GERMANY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 GERMANY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 135 GERMANY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 GERMANY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 GERMANY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 GERMANY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 GERMANY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 GERMANY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 NETHERLANDS OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NETHERLANDS OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 143 NETHERLANDS DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 NETHERLANDS COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 NETHERLANDS PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 NETHERLANDS RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 NETHERLANDS OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 NETHERLANDS OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 FRANCE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 FRANCE OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 151 FRANCE DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 FRANCE COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 FRANCE PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 FRANCE RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 FRANCE OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 156 FRANCE OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 SPAIN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 SPAIN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 159 SPAIN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 SPAIN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 SPAIN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 SPAIN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SPAIN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 164 SPAIN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SWITZERLAND OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 SWITZERLAND OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 167 SWITZERLAND DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 SWITZERLAND COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SWITZERLAND PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SWITZERLAND RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SWITZERLAND OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 172 SWITZERLAND OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 BELGIUM OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 BELGIUM OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 175 BELGIUM DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 BELGIUM COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 BELGIUM PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 BELGIUM RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 BELGIUM OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 BELGIUM OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 FINLAND OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 FINLAND OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 183 FINLAND DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 FINLAND COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 FINLAND PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 FINLAND RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 FINLAND OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 188 FINLAND OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 SWEDEN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 SWEDEN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 191 SWEDEN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 SWEDEN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 SWEDEN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 SWEDEN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 SWEDEN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 196 SWEDEN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 REST OF EUROPE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SEGMENTATION

FIGURE 11 RISING PENETRATION OF EMERGING TECHNOLOGIES IN THE OIL AND GAS SECTOR IS EXPECTED TO DRIVE THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 THE EQUIPMENT RENTAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET

FIGURE 15 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 16 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2022)

FIGURE 17 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2023 & 2030)

FIGURE 18 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2022 & 2030)

FIGURE 19 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY TYPE (2023-2030)

FIGURE 20 MIDDLE EAST OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST OILFIELD SERVICES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 EUROPE OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 26 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2022)

FIGURE 27 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 EUROPE OILFIELD SERVICES MARKET: BY TYPE (2023 - 2030)

FIGURE 30 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 EUROPE OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.