Europe Acrylic Resin Dispersion Based Primers In Construction Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

398,204.90 Million

USD

699,687.92 Million

2022

2030

USD

398,204.90 Million

USD

699,687.92 Million

2022

2030

| 2023 –2030 | |

| USD 398,204.90 Million | |

| USD 699,687.92 Million | |

|

|

|

Imprimaciones a base de dispersión de resina acrílica en el mercado de la construcción de Europa, por material (sustrato absorbente, sustrato no absorbente), superficie (cemento, hormigón, yeso, plástico, baldosas para pisos y otros), tipo (a base de agua y a base de solvente), aplicación (antes de pinturas para interiores, antes de capas de acabado y revestimientos, antes del sistema de fachada de aislamiento térmico, debajo de compuestos autonivelantes, debajo de adhesivos para baldosas, en sistema de paneles de yeso sobre placas de yeso ), uso final (nueva construcción residencial, nueva construcción no residencial, nueva ingeniería civil, renovación de ingeniería civil, renovación no residencial y renovación residencial) - Tendencias de la industria y pronóstico de 2023 a 2030.

Análisis y tamaño del mercado de imprimaciones a base de dispersión de resina acrílica en la construcción en Europa

Los factores esenciales que contribuyen al crecimiento del mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción durante el período de pronóstico de 2023 a 2030 incluyen la facilidad de aplicación y las amplias propiedades de protección. Además, las imprimaciones a base de dispersión de resina acrílica ofrecen excelentes propiedades de adhesión, lo que contribuye significativamente al crecimiento del mercado.

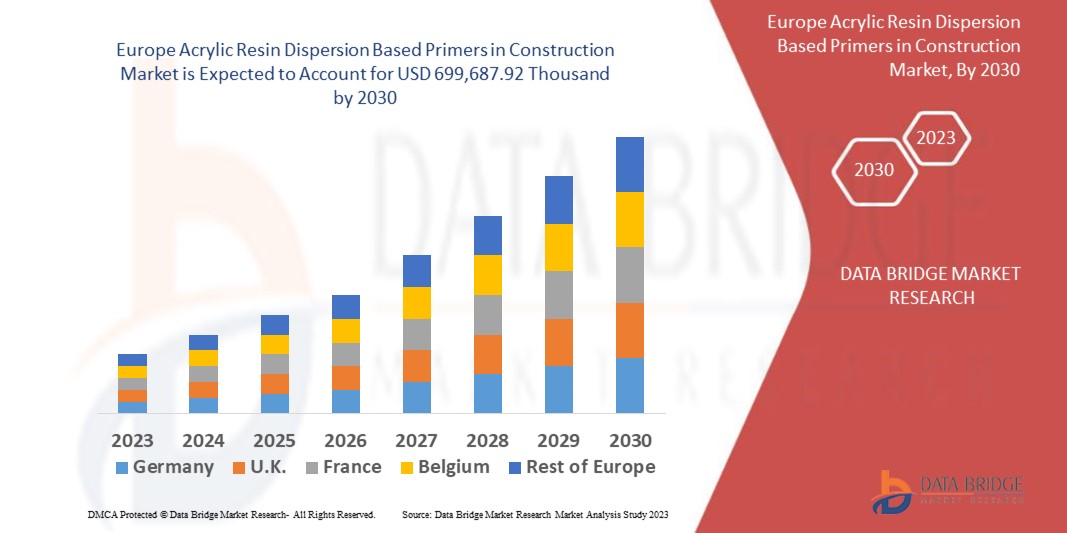

Data Bridge Market Research analiza que el mercado de imprimaciones a base de dispersión de resina acrílica en la construcción, que fue de USD 398,204.90 mil en 2022, se espera que alcance los USD 699,687.92 mil para 2030, creciendo a una CAGR de 7.30% durante el período de pronóstico de 2023 a 2030. Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis experto en profundidad, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

Alcance y segmentación del mercado europeo de imprimaciones a base de dispersión de resina acrílica en la construcción

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Material (sustrato absorbente, sustrato no absorbente), superficie (cemento, hormigón, yeso, plástico, baldosas para pisos y otros), tipo (a base de agua y a base de solvente), aplicación (antes de pinturas para interiores, antes de capas de acabado y revestimientos, antes del sistema de fachada de aislamiento térmico, debajo de compuestos autonivelantes, debajo de adhesivos para baldosas, en sistema de paneles de yeso sobre placas de yeso), uso final (nueva construcción residencial, nueva construcción no residencial, nueva ingeniería civil, renovación de ingeniería civil, renovación no residencial y renovación residencial) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Italia, Rusia, España, Suiza, Bélgica, Países Bajos, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

PPG Industries, Inc. (EE. UU.), Axalta (EE. UU.), Henkel Adhesives Technologies India Private Limited (Alemania), The Sherwin-Williams Company (EE. UU.), Sika Deutschland GmbH (Alemania), Nippon Paint Holdings Co., Ltd. (Japón), Akzo Nobel NV (Países Bajos), Hempel A/S (Dinamarca), Baumit (Alemania), ATLAS Sp. z oo (Polonia), Rust-Oleum (EE. UU.), entre otros. |

|

Oportunidades de mercado |

|

Definición de mercado

Las dispersiones acrílicas son resinas acrílicas sin surfactantes que se utilizan para diversas aplicaciones de revestimiento. Estas resinas acrílicas se utilizan a menudo en formulaciones de revestimiento para brindar ventajas de rendimiento sólidas, como dureza, resistencia química e inhibición de la corrosión.

Dinámica del mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción en Europa

Conductores

- Facilidad de aplicación

Las imprimaciones a base de resina acrílica en dispersión suelen ser fáciles de aplicar y ofrecen buenas propiedades de fluidez y nivelación. Se pueden aplicar con brocha, rodillo o pistola, lo que proporciona flexibilidad y comodidad a los profesionales de la construcción.

- Amplias propiedades de protección y adhesión.

Las imprimaciones a base de dispersión de resina acrílica ofrecen excelentes propiedades de adhesión, lo que les permite adherirse de manera eficaz a diversos sustratos que se encuentran comúnmente en la construcción, como hormigón, mampostería, madera y metales. Esta fuerte capacidad de adhesión garantiza una preparación adecuada del sustrato y mejora el rendimiento general de los recubrimientos o acabados posteriores.

Oportunidades

- Expansión de la industria de infraestructura y construcción

La industria de la construcción se está expandiendo a medida que las economías emergentes experimentan crecimiento económico, urbanización y una clase media en expansión. Esto impulsa el crecimiento de las imprimaciones a base de dispersión de resina acrílica en el mercado de la construcción, ya que estos ingredientes se utilizan ampliamente en varios productos de cuidado personal.

- Consideraciones ambientales favorables

Debido a su bajo contenido de COV (compuestos orgánicos volátiles), las imprimaciones a base de resina acrílica en dispersión suelen ser las preferidas en la construcción. Se consideran más respetuosas con el medio ambiente que las imprimaciones a base de disolventes, lo que coincide con el creciente interés de la industria por la sostenibilidad y las prácticas de construcción ecológicas.

Restricciones/Desafíos

- Altos costos y volatilidad de precios

Las imprimaciones a base de resina acrílica en dispersión pueden ser relativamente más caras que otros tipos disponibles en el mercado. Este mayor costo puede limitar su adopción, en particular en proyectos con presupuestos ajustados o aplicaciones sensibles al costo.

- Restricciones de aplicación en determinadas condiciones ambientales

Las imprimaciones a base de dispersión de resina acrílica pueden tener limitaciones cuando se aplican en determinadas condiciones ambientales. Factores como la temperatura, la humedad y el contenido de humedad del sustrato pueden afectar el rendimiento de estas imprimaciones y las características de secado/curado, lo que puede afectar su aplicación y su eficacia general.

Este informe sobre el mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Desarrollo reciente

- En 2021, Axalta Coating Systems lanzó un nuevo producto, Cromac XP, una capa base a base de disolvente. La empresa espera mejorar su cartera y lanzar productos de alta eficiencia para ampliar los resultados relacionados con la producción y los ingresos.

Alcance del mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción en Europa

El mercado de las imprimaciones a base de dispersión de resina acrílica para la construcción está segmentado en función del material, la superficie, el tipo de aplicación y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material

- Sustrato absorbente

- Sustrato no absorbente

Superficie

- Cemento

- Concreto

- Yeso

- Plástico

- Azulejos para pisos

- Otros

Tipo

- A base de agua

- A base de disolvente

Solicitud

- Antes de pintar interiores

- Antes de aplicar capas de acabado y revestimientos

- Antes del sistema de aislamiento térmico de fachada

- Compuestos autonivelantes inferiores

- Adhesivos para debajo de las baldosas

- En sistema de paneles de yeso sobre placas de yeso

Uso final

- Nueva construcción residencial

- Nueva construcción no residencial

- Nueva Ingeniería Civil

- Renovación de ingeniería civil

- Renovación no residencial

- Renovación residencial

Análisis regional y perspectivas del mercado europeo de imprimaciones a base de dispersión de resina acrílica para la construcción

Se analiza el mercado de imprimaciones a base de dispersión de resina acrílica en la construcción y se proporcionan información y tendencias del tamaño del mercado por material, superficie, tipo de aplicación y uso final como se menciona anteriormente.

Los países cubiertos en el informe sobre el mercado europeo de imprimaciones a base de dispersión de resina acrílica en la construcción son Alemania, Francia, Reino Unido, Italia, Rusia, España, Suiza, Bélgica, Países Bajos, Turquía y el resto de Europa.

Alemania es el país de más rápido crecimiento y se espera que domine el mercado europeo de imprimaciones a base de dispersión de resina acrílica en la construcción debido a la gran expansión del sector de la construcción.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y análisis de la cuota de mercado de las imprimaciones a base de resina acrílica dispersa en la construcción en Europa

El panorama competitivo del mercado de las imprimaciones a base de dispersión de resina acrílica en la construcción proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con las imprimaciones a base de dispersión de resina acrílica en el mercado de la construcción.

Algunos de los principales actores que operan en el mercado de imprimaciones a base de dispersión de resina acrílica en la construcción son:

- PPG Industries, Inc. (Estados Unidos)

- Axalta (Estados Unidos)

- Henkel Adhesives Technologies India Private Limited (Alemania)

- La empresa Sherwin-Williams (Estados Unidos)

- Sika Deutschland GmbH (Alemania)

- Nippon Paint Holdings Co., Ltd. (Japón)

- Akzo Nobel NV (Países Bajos)

- Hempel A/S (Dinamarca)

- Baumit (Alemania)

- ATLAS Sp. z oo (Polonia)

- Rust-Oleum (EE. UU.), entre otros

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of the Europe Acrylic Resin Dispersion based Primers in Construction Market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material LIFELINE CURVE

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- DBMR MARKET CHALLENGE MATRIX

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Market Overview

- drivers

- GROWING DEMAND FOR PRIMERS IN NEW RESIDENTIAL CONSTRUCTION

- SUBSTANTIAL RISE IN THE ECONOMIC AND LIVING STANDARDS

- RestrainTs

- PRESENCE OF VOLATILE ORGANIC COMPOUNDS COULD RESULT IN TOXICITY AND HEALTH HAZARDS

- AVAILABILITY OF ALTERNATIVES SUCH AS PLASTERS AND WHITE CEMENT

- opportunities

- INCREASING NUMBER OF OFFICE ESTABLISHMENTS DUE TO DIGITALIZATION AND GLOBALIZATION

- RISING DEMAND FOR MORE RESIDENTIAL BUILDINGS AND COMPLEXES

- GROWTH IN THE TOURISM INDUSTRY

- challenge

- COMMERCIALIZATION OF VARIOUS TYPE OF PAINTS WHICH DON’T REQUIRE PRIMERS

- COVID-19 Impact on Europe Acrylic Resin Dispersion based Primers in Construction Market

- ANALYSIS ON IMPACT OF COVID-19 ON the Market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE Market

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- PRICE IMPACT

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe acrylic resin dispersion based primers in construction market, BY material

- overview

- Absorbent Substrate

- Non Absorbent Substrate

- Europe acrylic resin dispersion based primers in construction market, BY Surface

- overview

- Cement

- Plaster

- Concrete

- Plastic

- Flooring Tiles

- Others

- Europe acrylic resin dispersion based primers in construction market, BY type

- overview

- Solvent Based

- Water Based

- Europe acrylic resin dispersion based primers in construction market, BY Application

- overview

- Before Interior Paints

- Before Skim Coats And Renders

- Before Thermal Insulation Facade System

- Under Self-Levelling Compounds

- Under Tile Adhesives

- In Dry Wall System On Gypsum Boards

- Europe acrylic resin dispersion based primers in construction market, BY End User

- overview

- New Residential Construction

- New Non-Residential Construction

- New Civil Engineering

- Civil Engineering Renovation

- Residential Renovation

- Non-Residential Renovation

- Latin America Acrylic Resin Dispersion Based Primers in Construction market: by region

- Europe

- germany

- U.K

- france

- italy

- poland

- Romania

- czech republic

- Europe Acrylic resin dispersion based primers in Construction Market: COMPANY landscape

- company share analysis: Europe

- company share analysis: latin america

- Swot analysis

- company profile

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Jotun

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- PPG INDUSTRIES, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Hempel A/S

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Nippon Paint Holdings Co., Ltd.

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Baumit

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- sika Deutschland gmbh

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- atlas sp z.o.o

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- rust-oleum (As a subsidiary of RPM international inc.)

- COMPANY SNAPSHOT

- Revenue Analysis

- product portfolio

- RECENT UPDATE

- THE SHERWIN-WILLIAMS COMPANY

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Axalta Coating Systems

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- TIKKURILA OYJ

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- AKZO NOBEL N.V

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Fixall

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- questionnaire

- related reports

Lista de Tablas

TABLE 1 The annual quantity and growth of import of primers

TABLE 2 Maximum voc content limit values for paints and varnishes (U.K.)

TABLE 3 Maximum voc content limit values inPrimers (U.S.)

TABLE 4 Maximum voc content limit values for paints and varnishes

TABLE 5 Europe acrylic resin dispersion based primers in construction market, BY material, 2019-2028 (USD Thousand)

TABLE 6 Europe acrylic resin dispersion based primers in construction market, BY material, 2019-2028 (Tons)

TABLE 7 Europe acrylic resin dispersion based primers in construction market, BY Surface, 2019-2028 (USD Thousand)

TABLE 8 Europe acrylic resin dispersion based primers in construction market, BY type, 2019-2028 (USD Thousand)

TABLE 9 Europe acrylic resin dispersion based primers in construction market, BY Application, 2019-2028 (USD Thousand)

TABLE 10 Europe acrylic resin dispersion based primers in construction market, BY End User, 2019-2028 (USD Thousand)

TABLE 11 europe Acrylic Resin Dispersion Based Primers in Construction market, By COUNTRY, 2019-2028 (Tons)

TABLE 12 europe Acrylic Resin Dispersion Based Primers in Construction market, By COUNTRY, 2019-2028 (USD Thousand)

TABLE 13 europe Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 14 europe Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 15 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 16 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 17 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 18 europe Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 19 Germany Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 20 Germany Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 21 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 22 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 23 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 24 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 25 U.K Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 26 U.K Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 27 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 28 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 29 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 30 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 31 France Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 32 France Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 33 France Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 34 France Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 35 France Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 36 France Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 37 Italy Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 38 Italy Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 39 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 40 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 41 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 42 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 43 poland Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 44 poland Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 45 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 46 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 47 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 48 poland Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 49 Romania Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 50 Romania Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 51 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 52 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 53 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 54 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 55 Czech republic Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 56 Czech republic Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 57 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 58 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 59 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 60 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

Lista de figuras

FIGURE 1 Europe Acrylic Resin Dispersion based Primers in Construction Market segmentation

FIGURE 2 Europe Acrylic Resin Dispersion based Primers in Construction Market : data triangulation

FIGURE 3 Europe Acrylic Resin Dispersion based Primers in Construction Market: DROC ANALYSIS

FIGURE 4 Europe Acrylic Resin Dispersion based Primers in Construction Market: REGIONAL VS. country MARKET ANALYSIS

FIGURE 5 Europe Acrylic Resin Dispersion based Primers in Construction Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe Acrylic Resin Dispersion based Primers in Construction Market: THE material LIFELINE CURVE

FIGURE 7 Europe Acrylic Resin Dispersion based Primers in Construction Market: INTERVIEW DEMOGRAPHICS

FIGURE 8 Europe Acrylic Resin Dispersion based Primers in Construction Market: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ACRYLIC RESIN DISPERSION BASED PRIMERS IN CONSTRUCTION MARKET : THE MARKET CHALLENGE MATRIX

FIGURE 10 Europe Acrylic Resin Dispersion based Primers in Construction Market : SEGMENTATION

FIGURE 11 Growing demand of primers in new residential construction IS EXPECTED TO DRIVE THE Acrylic PRIMERS in construction MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 Absorbent segment is expected to account for the largest share of the Europe Acrylic Resin Dispersion based Primers in Construction Market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF Europe Primers in Construction Market

FIGURE 14 Private new housing contributed the most to the rise in new work in recent year

FIGURE 15 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 16 Mean Equivalized Net Income (Euros) for sweden, iceland and u.k.

FIGURE 17 MEAN EQUIVALIZED NET INCOME (EUROS) FOR ICELAND

FIGURE 18 Private new housing contributed the most to the rise in new work in recent years

FIGURE 19 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 20 Europe acrylic resin dispersion based primers in construction market: BY material, 2020

FIGURE 21 Europe acrylic resin dispersion based primers in construction market: BY Surface, 2020

FIGURE 22 Europe acrylic resin dispersion based primers in construction market: BY type, 2020

FIGURE 23 Europe acrylic resin dispersion based primers in construction market: BY Application, 2020

FIGURE 24 Europe acrylic resin dispersion based primers in construction market: BY End User, 2020

FIGURE 25 Europe Acrylic Resin Dispersion Based Primers in Construction market: SNAPSHOT (2020)

FIGURE 26 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2020)

FIGURE 27 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 28 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 29 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY Material (2019-2028)

FIGURE 30 Europe Acrylic resin dispersion based primers in Construction Market: company share 2020 (%)

FIGURE 31 LATIN AMERICA Acrylic resin dispersion based primers in Construction Market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.