Asia Pacific Water Detection Sensors Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

357.63 Million

USD

578.67 Million

2025

2033

USD

357.63 Million

USD

578.67 Million

2025

2033

| 2026 –2033 | |

| USD 357.63 Million | |

| USD 578.67 Million | |

|

|

|

|

Segmentación del mercado de sensores de detección de agua en Asia-Pacífico, por tipo de sensor (sensor de cloro residual, sensor de pH, sensor de TOC, sensor de ORP, sensor de conductividad y otros), tamaño (menos de 38 mm y más de 38 mm), peso (menos de 60 g y más de 60 g), alcance del dispositivo (menos de 76 m y más de 76 m), rango de voltaje (menos de 15 VCC, de 15 VCC a 25 VCC y más de 25 VCC), propósito (constituido en agua [concentraciones químicas, sólidos] y sustitutos de medida), conectividad (inalámbrica y cableada), uso final (industrial, agua potable, aguas subterráneas, acuicultura, aguas residuales y otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de sensores de detección de agua en Asia-Pacífico

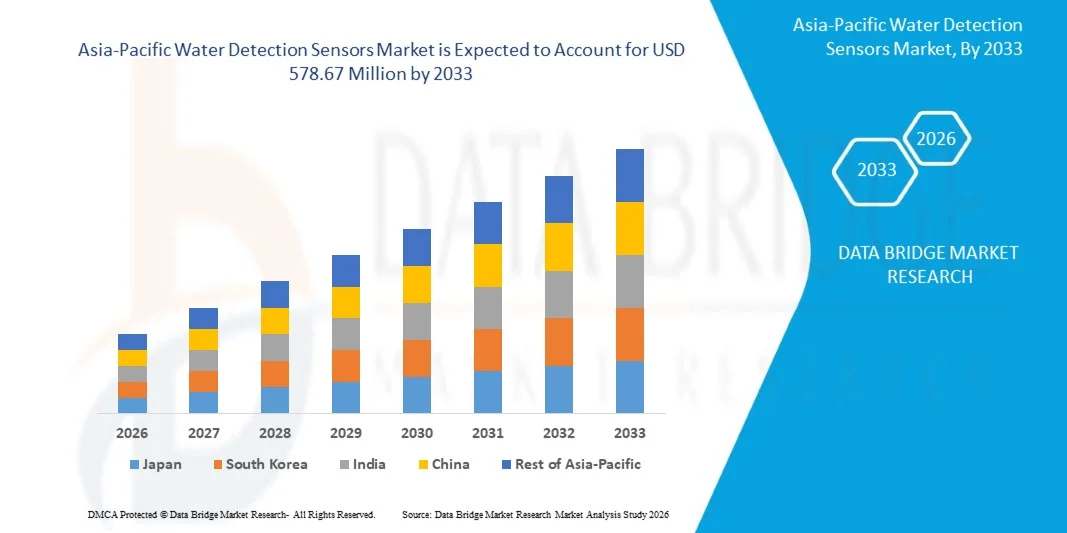

- El tamaño del mercado de sensores de detección de agua de Asia-Pacífico se valoró en USD 357,63 millones en 2025 y se espera que alcance los USD 578,67 millones para 2033 , con una CAGR del 6,20 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de detección automatizada de fugas en los sectores industrial, comercial y residencial.

- La creciente adopción de sensores inteligentes habilitados para IoT para el monitoreo y la gestión del agua está impulsando la expansión del mercado

Análisis del mercado de sensores de detección de agua en Asia-Pacífico

- El mercado está siendo testigo de rápidos avances tecnológicos, incluidos sensores inalámbricos, inteligentes y multiparamétricos para la detección precisa de fugas y niveles de agua.

- La creciente integración de sensores de detección de agua en edificios inteligentes, plantas industriales y sistemas de agua municipales está mejorando la eficiencia operativa y reduciendo los costos de mantenimiento.

- China dominó el mercado de sensores de detección de agua con la mayor participación en los ingresos en 2025, impulsada por la rápida industrialización, la urbanización y el creciente énfasis en la gestión eficiente del agua y la protección de la infraestructura.

- Se espera que Japón registre la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado de sensores de detección de agua de Asia-Pacífico gracias a su avanzado ecosistema tecnológico, el fuerte enfoque en la monitorización de precisión y la creciente adopción de soluciones de infraestructura inteligente. El creciente énfasis en la conservación del agua, el envejecimiento de la infraestructura de tuberías y la demanda de sensores de alta precisión en aplicaciones industriales y municipales están acelerando el crecimiento del mercado.

- El segmento de sensores de cloro residual registró la mayor cuota de mercado en 2025, impulsado por su amplio uso en la monitorización de la calidad del agua en aplicaciones industriales y de agua potable. Estos sensores proporcionan mediciones precisas y en tiempo real de los niveles de cloro, lo que garantiza la seguridad del agua, el cumplimiento normativo y la eficiencia operativa.

Alcance del informe y segmentación del mercado de sensores de detección de agua en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de sensores de detección de agua en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

• Adopción de sensores de detección de agua habilitados para IoT |

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de sensores de detección de agua en Asia-Pacífico

“El auge de los sistemas de detección de agua inteligentes y en tiempo real”

La creciente adopción de sensores inteligentes de detección de agua está transformando el panorama de la gestión hídrica al permitir la monitorización en tiempo real y la detección de fugas. Estos sensores permiten la identificación inmediata de filtraciones de agua o fugas en tuberías, lo que reduce las pérdidas operativas y previene daños materiales. La integración con plataformas IoT permite alertas automatizadas y mantenimiento predictivo, minimizando aún más el tiempo de inactividad y las costosas reparaciones. Los análisis avanzados proporcionan información práctica para optimizar el uso del agua y la conservación de los recursos.

La creciente demanda de detección rápida y precisa en entornos industriales, comerciales y residenciales está acelerando la adopción de sensores con IoT y sistemas de alerta automatizados. Estas soluciones son especialmente eficaces en infraestructuras críticas, donde la detección oportuna evita costosos tiempos de inactividad y daños relacionados con el agua. Los sensores inteligentes también permiten la monitorización remota mediante aplicaciones móviles y en la nube, lo que permite a los operadores gestionar múltiples sitios de forma eficiente. Los datos recopilados se pueden utilizar para la elaboración de informes de cumplimiento normativo y la planificación del mantenimiento predictivo.

La asequibilidad, la facilidad de implementación y la escalabilidad de los sensores modernos de detección de agua los hacen atractivos para un uso generalizado. Los operadores se benefician de la monitorización continua sin necesidad de inspecciones manuales exhaustivas, lo que mejora el mantenimiento preventivo y la eficiencia operativa. Los diseños modulares de los sensores permiten una instalación flexible en infraestructuras nuevas y existentes, lo que reduce los costes de modernización. Estas soluciones son compatibles tanto con instalaciones industriales a gran escala como con aplicaciones comerciales o residenciales más pequeñas, ampliando así el alcance del mercado.

Por ejemplo, en 2023, varias instalaciones comerciales integraron sensores de agua inteligentes en sus sistemas de gestión de edificios, lo que permitió la detección temprana de fugas, redujo el desperdicio de agua y disminuyó los costos de mantenimiento. Las notificaciones automatizadas permitieron a los equipos de mantenimiento responder de inmediato, evitando daños importantes. La implementación de estos sensores también ayudó a reducir las primas de seguros y mejoró la sostenibilidad general de las instalaciones.

Si bien los sistemas de detección inteligente están mejorando la gestión del agua y reduciendo las pérdidas, su eficacia depende de la innovación continua, la integración con los sistemas del edificio y la facilidad de mantenimiento. Los fabricantes deben centrarse en soluciones robustas, escalables y rentables para aprovechar al máximo la creciente demanda del mercado. El aumento de la interoperabilidad con otros sistemas de automatización de edificios y el análisis basado en IA fortalecerán aún más la eficiencia operativa y reducirán las falsas alarmas.

Dinámica del mercado de sensores de detección de agua en Asia-Pacífico

Conductor

Incrementar los esfuerzos de conservación del agua y centrarse en la seguridad de la infraestructura

La creciente preocupación por la escasez de agua y la necesidad de una gestión hídrica eficiente impulsan la adopción de sensores avanzados de detección de agua. Estos sistemas ayudan a detectar fugas, prevenir pérdidas de agua y respaldan iniciativas de sostenibilidad. También desempeñan un papel fundamental en la minimización del impacto ambiental y la promoción de la gestión responsable de los recursos en los sectores comercial e industrial. Las campañas generalizadas de concienciación sobre la conservación del agua fomentan aún más su adopción.

Las crecientes inversiones en infraestructura de edificios inteligentes y sistemas de monitorización automatizados están incrementando la demanda de sensores de agua conectados que se integran con las plataformas de gestión de edificios. Esta integración permite paneles de control en tiempo real, alertas remotas y mantenimiento predictivo, lo que garantiza la continuidad operativa. Las organizaciones aprovechan cada vez más los análisis basados en la nube para optimizar el uso del agua y reducir los costes operativos, a la vez que cumplen con los requisitos normativos.

Los operadores industriales y comerciales priorizan cada vez más la prevención de daños causados por el agua para evitar costosas reparaciones, tiempos de inactividad y sanciones regulatorias, lo que acelera la implementación de tecnologías de detección inteligente. La capacidad de monitorear continuamente puntos críticos y predecir posibles fallas ayuda a minimizar los riesgos operativos. Los sensores de agua se están incorporando en estrategias más amplias de gestión de instalaciones para garantizar la sostenibilidad, la seguridad y el cumplimiento normativo.

Por ejemplo, en 2023, varias plantas de fabricación implementaron sensores de detección de agua basados en IoT, lo que redujo las interrupciones operativas relacionadas con el agua y mejoró la eficiencia de los recursos. Estas implementaciones también permitieron la programación de mantenimiento predictivo, lo que evitó costosas reparaciones de emergencia. Además, las empresas informaron mejoras en los KPI operativos, como la reducción de pérdidas de agua, una mayor vida útil de los activos y una menor inactividad operativa.

Si bien la creciente concienciación y la adopción de tecnología impulsan el crecimiento del mercado, la fiabilidad de los sensores, la capacidad de integración y la escalabilidad del sistema siguen siendo cruciales para una expansión sostenida. La mejora continua de la precisión de los sensores, la conectividad inalámbrica y el análisis de datos basado en IA es esencial para maximizar el retorno de la inversión. Un sólido servicio posventa y unas interfaces intuitivas también son vitales para mantener altas tasas de adopción.

Restricción/Desafío

Altos costos y requisitos de mantenimiento de los sistemas avanzados de detección de agua

La elevada inversión inicial en sensores avanzados de detección de agua, especialmente en sistemas de monitoreo en tiempo real o con IoT, limita su adopción en instalaciones más pequeñas y usuarios residenciales. Los costos de implementación, incluyendo la instalación, las licencias de software y la calibración de sensores, pueden ser prohibitivos. Los operadores más pequeños pueden retrasar la adopción hasta que los costos disminuyan o las soluciones integradas sean más asequibles.

Los requisitos de mantenimiento y calibración de sensores sofisticados pueden aumentar la complejidad y los costos operativos, lo que reduce la accesibilidad general. Los sensores requieren pruebas periódicas, actualizaciones de firmware y, en ocasiones, el reemplazo de piezas para mantener la precisión. La necesidad de personal cualificado para gestionar estos procesos añade una carga operativa adicional, lo que afecta la adopción en entornos con recursos limitados.

Los problemas de integración con los sistemas de gestión de edificios o industriales existentes pueden retrasar la implementación y reducir la eficiencia operativa. Los problemas de compatibilidad con sistemas heredados o plataformas de terceros pueden requerir una inversión adicional en middleware o una integración personalizada. Garantizar una interoperabilidad fluida, manteniendo al mismo tiempo la seguridad del sistema, sigue siendo un reto para muchos operadores.

Por ejemplo, en 2023, varios pequeños operadores comerciales pospusieron la instalación de sensores debido a los altos costos de equipo e integración, destacando la asequibilidad como un obstáculo clave. En algunos casos, el retraso en la implementación resultó en mayores daños relacionados con el agua, lo que ilustra la compensación entre costo y mitigación de riesgos. Las empresas enfatizaron la necesidad de soluciones modulares y fáciles de instalar para superar estos desafíos.

Si bien la innovación tecnológica continúa impulsando las capacidades de los sensores, es fundamental abordar la rentabilidad, la simplicidad del mantenimiento y la integración fluida de los sistemas para aprovechar al máximo el potencial del mercado. Es probable que los fabricantes que se centran en soluciones listas para usar, modelos de precios basados en suscripción y mantenimiento predictivo basado en IA experimenten una adopción más rápida y una mayor penetración en el mercado.

Alcance del mercado de sensores de detección de agua en Asia-Pacífico

El mercado está segmentado según el tipo de sensor, tamaño, peso, rango del dispositivo, rango de voltaje, propósito, conectividad y uso final.

• Por tipo de sensor

Según el tipo de sensor, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en sensores de cloro residual, sensores de pH, sensores de TOC, sensores de ORP, sensores de conductividad y otros. El segmento de sensores de cloro residual registró la mayor participación en los ingresos del mercado en 2025, gracias a su amplio uso en la monitorización de la calidad del agua en aplicaciones industriales y de agua potable. Estos sensores proporcionan mediciones precisas y en tiempo real de los niveles de cloro, lo que garantiza la seguridad del agua, el cumplimiento normativo y la eficiencia operativa.

Se prevé que el segmento de sensores de pH experimente el mayor crecimiento entre 2026 y 2033, impulsado por su papel fundamental en el mantenimiento del equilibrio químico y la prevención de la corrosión en los sistemas de agua. Los sensores de pH se integran cada vez más con sistemas de monitorización basados en IoT, lo que permite alertas en tiempo real y gestión remota. Su tamaño compacto y facilidad de instalación los hacen adecuados para diversas aplicaciones de agua industriales y municipales, lo que fomenta prácticas sostenibles de gestión del agua.

• Por tamaño

En cuanto a tamaño, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en menos de 38 mm y más de 38 mm. El segmento de menos de 38 mm registró la mayor cuota de mercado en 2025, debido a la demanda de sensores compactos y compactos que se puedan instalar fácilmente en tuberías estrechas y sistemas de agua confinados. Los sensores más pequeños son cada vez más preferidos para instalaciones modulares y dispositivos de detección portátiles.

Se prevé que el segmento de más de 38 mm experimente el mayor crecimiento entre 2026 y 2033 gracias a su idoneidad para sistemas de agua industriales de alto caudal y plantas de tratamiento a gran escala, donde se requiere durabilidad y un rendimiento robusto. Los sensores de mayor tamaño ofrecen mayor estabilidad de medición y una mayor vida útil, lo que los hace ideales para aplicaciones de monitorización continua.

• Por peso

En función del peso, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en menos de 60 g y más de 60 g. El segmento de menos de 60 g registró la mayor participación en los ingresos en 2025, impulsado por la creciente adopción de sensores de agua ligeros y portátiles de fácil manejo e instalación. Estos sensores son especialmente adecuados para inspecciones de campo, análisis móviles de la calidad del agua y monitoreo remoto.

Se prevé que el segmento de más de 60 g registre el mayor crecimiento entre 2026 y 2033, impulsado por la demanda de sensores industriales de alta resistencia que ofrezcan mayor durabilidad y resistencia a condiciones operativas adversas. Estos sensores se utilizan ampliamente en el tratamiento de aguas residuales y sistemas de acuicultura a gran escala, donde la robustez es fundamental.

• Por rango de dispositivo

En función del alcance de los dispositivos, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en menos de 76,5 m (250 pies) y más de 76,5 m (250 pies). El segmento de menos de 76,5 m (250 pies) registró la mayor participación en los ingresos en 2025, gracias a su idoneidad para el monitoreo localizado de agua en entornos residenciales, industriales y municipales. Los sensores de corto alcance permiten un monitoreo preciso de sistemas a pequeña escala y reducen la latencia en la recopilación de datos.

Se prevé que el segmento de más de 76,5 m (250 pies) experimente el mayor crecimiento entre 2026 y 2033 debido a su aplicación en grandes redes de distribución y plantas industriales. Los sensores de largo alcance facilitan la monitorización centralizada y la integración con sistemas SCADA, lo que permite alertas en tiempo real y mantenimiento preventivo en redes de agua extensas.

• Por rango de voltaje

Según el rango de voltaje, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en menos de 15 VCC, de 15 VCC a 25 VCC y más de 25 VCC. El segmento de menos de 15 VCC registró la mayor participación en los ingresos del mercado en 2025, gracias a su bajo consumo y a la compatibilidad con dispositivos de detección de agua portátiles y que funcionan con baterías. Los sensores de bajo consumo son cada vez más populares en los sistemas sostenibles de monitoreo de agua.

Se prevé que el segmento de 15 VCC a 25 VCC experimente el mayor crecimiento entre 2026 y 2033 gracias a su equilibrio entre la eficiencia energética y el rendimiento del sensor. Estos sensores se utilizan ampliamente en aplicaciones industriales donde la estabilidad del voltaje es crucial para obtener mediciones precisas.

• Por propósito

En función de su finalidad, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en Constituido en Agua (Concentraciones Químicas, Sólidos) y Sustitutos de Medición. El segmento Constituido en Agua registró la mayor participación en los ingresos en 2025, impulsado por el aumento de los requisitos de cumplimiento normativo y la necesidad de un monitoreo preciso de los contaminantes del agua. Estos sensores permiten la detección en tiempo real de niveles químicos, sólidos y contaminantes.

Se prevé que el segmento de Indicadores Sustitutos de Medición experimente el mayor crecimiento entre 2026 y 2033, impulsado por la demanda de soluciones de monitoreo indirecto que estiman los parámetros de calidad del agua mediante indicadores sustitutos. La medición sustitutiva permite una evaluación rápida y rentable de los sistemas hídricos, reduciendo la necesidad de realizar frecuentes análisis de laboratorio.

• Por Conectividad

En cuanto a la conectividad, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en inalámbricos y cableados. El segmento cableado registró la mayor participación en los ingresos del mercado en 2025, gracias a su fiabilidad, transmisión estable de datos y su idoneidad para la integración en redes de monitoreo de agua consolidadas. Los sensores cableados se utilizan ampliamente en plantas industriales, plantas de tratamiento y grandes sistemas municipales.

Se prevé que el segmento inalámbrico experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de sistemas de monitoreo de agua basados en IoT. La conectividad inalámbrica permite el monitoreo remoto, reduce los costos de instalación y ofrece flexibilidad para la modernización de tuberías y redes de agua distribuidas existentes.

• Por uso final

Según el uso final, el mercado de sensores de detección de agua en Asia-Pacífico se segmenta en: Industrial, Agua Potable, Aguas Subterráneas, Acuicultura, Aguas Residuales y Otros. El segmento industrial registró la mayor participación en los ingresos en 2025, debido a la necesidad crítica de detección de fugas y monitoreo de calidad en plantas de fabricación, industrias de alimentos y bebidas y química. Las aplicaciones industriales requieren un monitoreo continuo y preciso para prevenir pérdidas operativas y garantizar el cumplimiento de las regulaciones ambientales.

Se prevé que el segmento de agua potable experimente el mayor crecimiento entre 2026 y 2033 debido al creciente enfoque en la salud pública, la seguridad y los mandatos regulatorios para el agua potable segura. Los sensores en los sistemas de agua potable permiten la monitorización en tiempo real de parámetros químicos y microbianos, garantizando así los estándares de calidad y reduciendo los riesgos de contaminación.

Análisis regional del mercado de sensores de detección de agua en Asia-Pacífico

• China dominó el mercado de sensores de detección de agua con la mayor participación en los ingresos en 2025, impulsada por la rápida industrialización, la urbanización y el creciente énfasis en la gestión eficiente del agua y la protección de la infraestructura.

• Los operadores industriales y comerciales valoran mucho la monitorización en tiempo real, la detección temprana de fugas y la integración con sistemas automatizados para el mantenimiento preventivo.

• La adopción generalizada está respaldada además por políticas gubernamentales de apoyo, avances tecnológicos y un enfoque cada vez mayor en la sostenibilidad, posicionando a los sensores de detección de agua como esenciales para la eficiencia operativa.

Análisis del mercado de sensores de detección de agua en Japón

Se prevé que el mercado japonés de sensores de detección de agua experimente su mayor crecimiento entre 2026 y 2033, impulsado por los avances tecnológicos, la creciente adopción de sistemas de edificios inteligentes y la atención prioritaria a la prevención de desastres. Las empresas están implementando cada vez más sensores con IoT para monitorizar la entrada de agua, prevenir daños a la propiedad y optimizar el uso de recursos. La integración con plataformas de monitorización centralizadas y el apoyo gubernamental a iniciativas de sostenibilidad impulsan aún más el crecimiento del mercado.

Cuota de mercado de sensores de detección de agua en Asia-Pacífico

La industria de sensores de detección de agua de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Horiba Ltd. (Japón)

- Corporación Eléctrica Yokogawa (Japón)

- Corporación TDK (Japón)

- JFE Engineering Corporation (Japón)

- Hach Co., Ltd. (Japón)

- SATO Holdings Corporation (Japón)

- Mitsubishi Electric Corporation (Japón)

- Corporación IDEC (Japón)

- Endress+Hauser (China)

- Global Water Instrumentation, Inc. (Japón)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.