Asia Pacific Transfection Reagents And Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

194.68 Million

USD

439.05 Million

2024

2032

USD

194.68 Million

USD

439.05 Million

2024

2032

| 2025 –2032 | |

| USD 194.68 Million | |

| USD 439.05 Million | |

|

|

|

|

Segmentación del mercado de reactivos y equipos de transfección en Asia-Pacífico, por producto (reactivos, kits e instrumentos), etapa (investigación, preclínica, clínica y comercial), tipo (reactivos y equipos de transfección transitoria, reactivos y equipos de transfección estable), métodos (métodos no virales y virales), tipos de moléculas (ADN plasmídico, ARN de interferencia pequeño [ARNip], proteínas, oligonucleótidos de ADN, complejos de ribonucleoproteína [RNP] y otros), organismo (células de mamíferos, plantas, hongos, virus y bacterias), aplicación (in vitro, in vivo, bioproducción y otras), usuario final (biofarmacéutica, CRO, CMO/CDMO), sector académico, hospitales, laboratorios clínicos y otros), canal de distribución (licitación directa, venta minorista y otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de reactivos y equipos de transfección en Asia-Pacífico

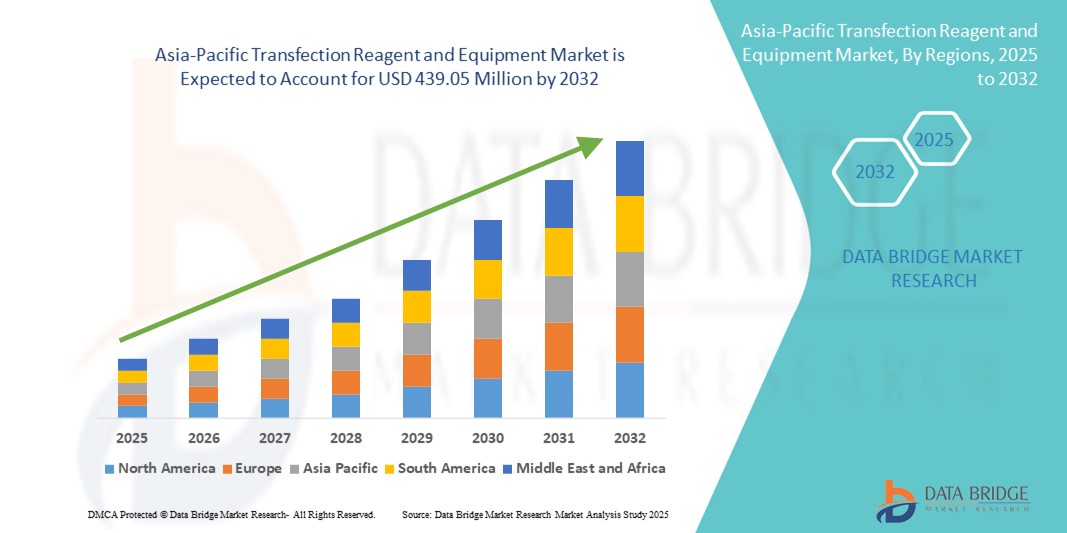

- El tamaño del mercado de reactivos y equipos de transfección de Asia-Pacífico se valoró en USD 194,68 millones en 2024 y se espera que alcance los USD 439,05 millones para 2032 , con una CAGR del 10,70 % durante el período de pronóstico.

- El crecimiento del mercado de reactivos y equipos de transfección en Asia-Pacífico se debe principalmente a la creciente demanda de soluciones fiables de administración de genes, el mayor acceso a la atención médica y los avances en biología molecular e investigación celular, lo que permite una transfección precisa y eficiente para aplicaciones en el descubrimiento de fármacos, la genómica y la proteómica. La región está experimentando un auge en la externalización de la investigación y las actividades biofarmacéuticas, especialmente en países en rápido desarrollo como India, China e Indonesia, lo que contribuye a la creciente adopción de reactivos y equipos de transfección.

- Además, la creciente inversión en infraestructura biotecnológica , la expansión de las instalaciones de investigación en entornos académicos y clínicos, y el aumento de la colaboración público-privada impulsan la innovación y la disponibilidad de tecnologías de transfección especializadas. Las iniciativas gubernamentales que apoyan la investigación en ciencias de la vida, junto con la creciente presencia de proveedores internacionales de reactivos y el fortalecimiento de las capacidades de fabricación locales, están impulsando significativamente el crecimiento del mercado de reactivos y equipos de transfección en Asia-Pacífico.

Análisis del mercado de reactivos y equipos de transfección en Asia-Pacífico

- El mercado de reactivos y equipos de transfección de Asia-Pacífico está experimentando un fuerte crecimiento, impulsado por la rápida expansión de los sectores de investigación farmacéutica, biotecnológica y académica en países como China, India, Japón, Corea del Sur, Australia, Tailandia, Indonesia y Vietnam.

- Las crecientes inversiones en I+D en genómica, proteómica y biología celular, la creciente adopción de tecnologías avanzadas de administración de genes, el aumento de los ensayos clínicos y la creciente demanda de medicina de precisión están impulsando la expansión del mercado en toda la región.

- China dominó el mercado de reactivos y equipos de transfección de Asia-Pacífico, representando la mayor participación en los ingresos del 42,6 % en 2024, respaldada por su sólida base de fabricación biofarmacéutica, una creciente cartera de ensayos de terapia génica y celular, instituciones de investigación bien establecidas e iniciativas gubernamentales para fortalecer la innovación biotecnológica.

- Se proyecta que India registre la CAGR más rápida del 19,4% en el mercado de reactivos y equipos de transfección de Asia-Pacífico durante el período de pronóstico, impulsada por un sector de biotecnología en expansión, una creciente subcontratación de investigación preclínica y clínica, una creciente adopción de tecnologías de transfección en organizaciones de investigación académica y por contrato, y el apoyo del gobierno a la innovación biofarmacéutica.

- Los métodos no virales dominaron el mercado de reactivos y equipos de transfección en Asia-Pacífico, con una participación del 63,2 % en 2024, gracias a su perfil de seguridad, facilidad de implementación y ventajas económicas. Técnicas como la electroporación, las nanopartículas lipídicas y los reactivos químicos se utilizan cada vez más en los flujos de trabajo de investigación y preclínicos, ya que minimizan los riesgos de bioseguridad y ofrecen resultados reproducibles.

Alcance del informe y segmentación del mercado de reactivos y equipos de transfección en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de reactivos y equipos de transfección en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de reactivos y equipos de transfección en Asia-Pacífico

Creciente demanda de soluciones de transfección avanzadas y soporte para el cumplimiento normativo

- Una tendencia significativa y en auge en el mercado de reactivos y equipos de transfección de Asia-Pacífico es el creciente enfoque en métodos de transfección de alta eficiencia y reproducibilidad, así como en un sólido cumplimiento normativo. Esto incluye esfuerzos para mejorar la precisión de la transfección, la escalabilidad, los plazos de entrega y el cumplimiento de las normas internacionales de calidad y GMP, en constante evolución.

- Proveedores y prestadores de servicios líderes de la región colaboran con organizaciones farmacéuticas, biotecnológicas y de investigación académica para ofrecer plataformas de transfección de última generación, como sistemas de electroporación automatizados, tecnologías de nanopartículas lipídicas (LNP) y reactivos compatibles con vectores virales. Estas innovaciones satisfacen la creciente demanda de soluciones validadas, fiables y listas para auditoría que respalden los flujos de trabajo preclínicos, clínicos y de fabricación.

- La creciente adopción de reactivos y equipos de transfección avanzados en áreas como la terapia celular y génica, el desarrollo de vacunas de ARNm, la investigación oncológica y la producción de biosimilares está impulsando aún más el crecimiento del mercado. Estas soluciones son reconocidas por su capacidad para garantizar una alta eficiencia de transfección, la consistencia del producto y el cumplimiento de estrictas normativas.

- Las instituciones académicas, los centros de investigación y los laboratorios financiados por el gobierno en países como Japón, China, India y Australia están realizando activamente estudios sobre nuevas químicas de transfección, tecnologías de administración de genes y automatización de flujos de trabajo de ingeniería celular, lo que conduce a mejoras continuas de servicios y productos adaptados a las necesidades específicas de la industria.

- A medida que la región de Asia y el Pacífico continúa enfatizando la garantía de calidad, la innovación en biofabricación y la competitividad de las exportaciones globales, el mercado de reactivos y equipos de transfección está preparado para una expansión sostenida, impulsada por el rigor regulatorio, los avances tecnológicos y una integración más profunda de la I+D con la experiencia de laboratorio.

Dinámica del mercado de reactivos y equipos de transfección en Asia-Pacífico

Conductor

La creciente demanda impulsada por los avances en la terapia génica, la investigación celular y la biotecnología

- El mercado de reactivos y equipos de transfección de Asia-Pacífico está experimentando un crecimiento rápido y sostenido, impulsado principalmente por la expansión de la investigación biotecnológica, la innovación farmacéutica y el desarrollo de infraestructuras sanitarias avanzadas en importantes economías como China, India, Japón, Corea del Sur y Australia. El aumento de las inversiones en terapia celular, producción de vacunas, biosimilares y medicina personalizada está impulsando significativamente la adopción de tecnologías de transfección de alta calidad, eficientes y fiables en entornos de investigación académicos e industriales.

- Por ejemplo, en marzo de 2024, Takara Bio Inc. anunció la expansión de sus operaciones de I+D en Japón, con el objetivo de fortalecer su cartera de tecnologías de transfección. Se espera que esta expansión impulse las capacidades de la compañía para respaldar las líneas de desarrollo de terapia génica, las aplicaciones de células madre y los estudios avanzados de investigación celular, reforzando así la trayectoria de crecimiento del mercado regional.

- La creciente incidencia de enfermedades crónicas y genéticas en Asia-Pacífico está generando una fuerte demanda de soluciones terapéuticas de última generación. Esta creciente carga de morbilidad, sumada al creciente enfoque en la medicina de precisión y personalizada, está impulsando la adopción generalizada de métodos avanzados de transfección en laboratorios de investigación, estudios preclínicos y fases de ensayos clínicos, donde la administración fiable de genes es crucial para obtener resultados satisfactorios.

- Las iniciativas gubernamentales de apoyo que fomentan la innovación biotecnológica, junto con los incentivos para las actividades de ensayos clínicos, desempeñan un papel fundamental en el fortalecimiento del ecosistema de mercado. Países como Singapur y Corea del Sur se están consolidando como centros regionales de excelencia en la investigación molecular y celular, ofreciendo sólidos marcos de propiedad intelectual, infraestructura de alta calidad y costos de investigación competitivos, lo que atrae a actores biofarmacéuticos globales para establecer alianzas y expandir sus operaciones.

- La integración de plataformas digitales de gestión de laboratorio, tecnologías de automatización e instrumentos de transfección de última generación permite a los laboratorios y empresas biofarmacéuticas optimizar los flujos de trabajo experimentales. Estos avances mejoran la reproducibilidad, la precisión y la escalabilidad de los procedimientos de transfección, a la vez que reducen el error humano. En consecuencia, la región está experimentando una creciente adopción de sistemas automatizados y digitalizados, que mejoran la eficiencia general y el cumplimiento normativo de los experimentos a gran escala y los programas de investigación clínica.

Restricción/Desafío

Altos costos y accesibilidad limitada en regiones emergentes

- A pesar del significativo progreso científico, el mercado de reactivos y equipos de transfección de Asia-Pacífico sigue enfrentando importantes desafíos para penetrar en laboratorios de menor escala, institutos académicos con recursos limitados e instalaciones de investigación ubicadas en regiones rurales o semiurbanas. Los altos costos de los reactivos especializados, el desconocimiento de las ventajas de las tecnologías de transfección modernas y las persistentes limitaciones de infraestructura constituyen importantes barreras para su adopción, impidiendo que estas instituciones accedan a soluciones de vanguardia.

- Los obstáculos logísticos, como los sistemas de cadena de frío poco desarrollados y el acceso limitado a infraestructura de laboratorio avanzada fuera de los centros metropolitanos, limitan aún más la disponibilidad de productos y equipos de transfección. Estas limitaciones retrasan la entrega y utilización eficiente de reactivos e instrumentos sensibles, lo que afecta el ritmo y la calidad de la investigación en curso en zonas menos desarrolladas.

- Un número considerable de instituciones pequeñas aún dependen de métodos de transfección convencionales y de baja eficiencia, como métodos químicos o mecánicos, que carecen de la precisión y la escalabilidad de las tecnologías más recientes. Esta dependencia reduce la reproducibilidad de los experimentos y dificulta su capacidad para realizar estudios de alto rendimiento, lo que limita tanto los resultados de la investigación como su posible aplicación clínica.

- La distribución geográfica desigual de proveedores y distribuidores en Asia-Pacífico genera desafíos adicionales para los laboratorios remotos. En muchos casos, las instituciones deben transportar muestras o adquirir reactivos desde centros urbanos distantes, lo que conlleva plazos de entrega más largos, mayores costos operativos e interrupciones en los plazos de investigación.

- Para superar estos obstáculos, los principales actores del mercado están desarrollando e introduciendo activamente kits de reactivos rentables, sistemas portátiles de electroporación y nucleofección, e instrumentos fáciles de usar que requieren una infraestructura mínima. Además, las empresas están formando cada vez más alianzas con distribuidores regionales y asociaciones locales de biotecnología para ampliar su alcance en el mercado. Estas iniciativas buscan mejorar la accesibilidad, reducir costos y fomentar la adopción entre organizaciones de investigación más pequeñas, laboratorios académicos y empresas emergentes de biotecnología, acortando así la brecha entre las capacidades de investigación avanzadas y las regiones desatendidas.

Alcance del mercado de reactivos y equipos de transfección en Asia-Pacífico

El mercado está segmentado en función de productos, etapa, tipo, métodos, tipos de moléculas, organismo, usuario final y canal de distribución.

- Por productos

En cuanto a productos, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en reactivos, kits e instrumentos. El segmento de reactivos y kits dominó el mercado con una cuota de mercado del 61,4 % en 2024, gracias a su papel indispensable para garantizar una alta eficiencia, reproducibilidad y versatilidad en un amplio espectro de flujos de trabajo de investigación y terapia. Estos productos son esenciales en aplicaciones como la administración de genes, la genómica funcional, los ensayos celulares y el desarrollo de fármacos, y su popularidad se ve reforzada por su facilidad de uso, protocolos estandarizados y rentabilidad.

En contraste, se proyecta que el segmento de instrumentos registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,5 %, entre 2025 y 2032, impulsada por la creciente demanda de plataformas de electroporación automatizadas, sistemas de alto rendimiento y dispositivos de transfección de precisión. Estos instrumentos avanzados son especialmente valorados por su capacidad para facilitar la fabricación escalable de grado clínico, lo que permite una transición fluida de los experimentos de laboratorio a pequeña escala a la producción comercial a gran escala.

- Por etapa

Según la etapa, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en investigación, preclínica, clínica y comercial. La etapa de investigación representó la mayor participación, con un 39,8 %, en 2024, gracias a su amplio uso en instituciones académicas, laboratorios de investigación y proyectos de descubrimiento de fármacos en fase inicial. Este predominio se debe, en gran medida, al creciente énfasis en la genómica funcional, los estudios de expresión génica y los experimentos de prueba de concepto iniciales, que dependen en gran medida de métodos de transfección eficientes.

Se prevé que el segmento de la fase comercial se expanda a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 11,1 %, entre 2025 y 2032, impulsada por la creciente necesidad de soluciones de transfección a gran escala que cumplan con las normas GMP. La expansión en la fabricación de terapias celulares y génicas, la producción de vacunas basadas en ARNm y el desarrollo de productos biológicos está acelerando la demanda de flujos de trabajo fiables a escala comercial que cumplan con los estrictos estándares regulatorios.

- Por tipo

Según el tipo, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en reactivos y equipos de transfección transitoria y reactivos y equipos de transfección estable. El segmento de transfección transitoria dominó con una participación en los ingresos del 58,6 % en 2024, gracias a su amplio uso en estudios de expresión de proteínas a corto plazo, desarrollo de ensayos y validación rápida de dianas. Sigue siendo una opción preferida por los laboratorios que requieren rapidez, flexibilidad y rentabilidad en sus experimentos.

Mientras tanto, se proyecta que el segmento de transfección estable crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,9 %, entre 2025 y 2032, lo que refleja su importancia crucial en la generación de líneas celulares a largo plazo, los flujos de trabajo de biofabricación y la investigación terapéutica. La creciente dependencia de modelos de expresión génica sostenida para el desarrollo y la producción de fármacos está impulsando la adopción de tecnologías de transfección estable tanto en entornos de investigación como comerciales.

- Por métodos

En cuanto a los métodos, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en métodos no virales y virales. Los métodos no virales dominaron el mercado con un 63,2 % en 2024, gracias a su perfil de seguridad, facilidad de implementación y ventajas en términos de costo. Técnicas como la electroporación, las nanopartículas lipídicas y los reactivos químicos se utilizan cada vez más en los flujos de trabajo de investigación y preclínicos, ya que minimizan los riesgos de bioseguridad y ofrecen resultados reproducibles.

Por otro lado, se prevé que los métodos virales crezcan a una robusta tasa de crecimiento anual compuesta (TCAC) del 10,4 % entre 2025 y 2032, gracias a su alta eficiencia de administración y su capacidad para integrar material genético de forma estable. Estos métodos son indispensables en áreas terapéuticas avanzadas como las terapias con células CAR-T, las terapias génicas basadas en AAV y la edición génica mediada por lentivirus, donde la fiabilidad y la expresión a largo plazo son fundamentales.

- Por tipos de moléculas

Según el tipo de molécula, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en ADN plasmídico, ARN de interferencia pequeño (siRNA), proteínas, oligonucleótidos de ADN, complejos de ribonucleoproteína (RNP) y otros. El ADN plasmídico lideró el segmento con una participación en los ingresos del 37,5 % en 2024, lo que refleja su papel central en la clonación molecular, el desarrollo de vacunas y las líneas de desarrollo de terapia génica. Su versatilidad y rentabilidad han asegurado su continuo dominio en aplicaciones académicas e industriales.

Sin embargo, se prevé que el segmento de complejos RNP se expanda a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 11,3 %, hasta 2032, impulsada por la creciente adopción de las tecnologías de edición genómica CRISPR-Cas9. Los sistemas basados en RNP son valorados por su capacidad para realizar modificaciones genéticas precisas y eficientes, lo que los posiciona como una herramienta transformadora en el desarrollo terapéutico de próxima generación.

- Por organismo

En cuanto al organismo, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en células de mamíferos, plantas, hongos, virus y bacterias. Las células de mamíferos dominaron el mercado con una participación del 54,7 % en 2024, ya que son el estándar de oro para la expresión de proteínas, el descubrimiento terapéutico y la investigación traslacional. Su similitud genética con los humanos y su capacidad para producir proteínas complejas las convierten en el sistema predilecto tanto en aplicaciones preclínicas como clínicas.

Sin embargo, se proyecta que el segmento de plantas registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,8 %, entre 2025 y 2032, gracias a los avances en agricultura molecular, productos biológicos de origen vegetal y biotecnología agrícola. Se espera que el creciente interés en la producción biológica rentable y escalable a partir de sistemas vegetales impulse aún más el crecimiento de este segmento.

- Por aplicación

En cuanto a su aplicación, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en aplicaciones in vitro, in vivo, bioproducción y otras. El segmento de aplicaciones in vitro tuvo la mayor participación, con un 46,1 %, en 2024, debido principalmente a su amplio uso en ensayos celulares, mapeo de vías, cribado de fármacos y genómica funcional. Sigue siendo un pilar fundamental para los laboratorios de investigación de la región.

Se prevé que el segmento de bioproducción crezca a la tasa de crecimiento anual compuesta (TCAC) más alta, del 10,7 %, entre 2025 y 2032, ya que las tecnologías de transfección desempeñan un papel crucial en la fabricación a gran escala de productos biológicos, biosimilares y vacunas de ARNm. Se espera que el enfoque en sistemas de producción escalables y que cumplan con las normativas impulse un sólido crecimiento en este segmento durante el período de pronóstico.

- Por el usuario final

En función del usuario final, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en biofarmacéutica, CRO, CMO/CDMO, sector académico, hospitales, laboratorios clínicos y otros. El segmento biofarmacéutico dominó el mercado con una participación del 43,9 % en los ingresos en 2024, lo que refleja sus importantes inversiones en el descubrimiento de fármacos, la I+D terapéutica y la producción de nuevos productos biológicos. Las empresas biofarmacéuticas dependen en gran medida de las tecnologías de transfección para el desarrollo de líneas celulares, la validación de dianas y la optimización de la fabricación.

Se proyecta que el segmento de CMO/CDMO registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,2 %, entre 2025 y 2032, impulsada por la creciente tendencia a externalizar la biofabricación y los servicios especializados de transfección. Su inversión en plataformas de alto rendimiento, rentables y con certificación GMP los posiciona como facilitadores clave de la cadena de valor biofarmacéutica de la región .

- Por canal de distribución

Según el canal de distribución, el mercado de reactivos y equipos de transfección de Asia-Pacífico se segmenta en licitación directa, venta minorista y otros. El segmento de licitación directa dominó con la mayor participación, un 57,8 %, en 2024, gracias a la adquisición a gran escala por parte de empresas farmacéuticas y biofarmacéuticas, instituciones académicas y organizaciones de investigación con respaldo gubernamental. Este canal garantiza la rentabilidad y la seguridad del suministro a largo plazo para los grandes usuarios.

Se proyecta que el segmento de ventas minoristas se expandirá a su tasa de crecimiento anual compuesto (TCAC) más rápida, del 9,5 %, durante el período 2025-2032, impulsado por el rápido crecimiento de las plataformas en línea, las redes de distribuidores y los proveedores especializados en ciencias de la vida. La creciente demanda de kits de transfección listos para usar, instrumentos de menor escala y consumibles está impulsando la adopción de la distribución minorista en toda la región.

Análisis regional del mercado de reactivos y equipos de transfección en Asia-Pacífico

- Asia-Pacífico representó una participación en los ingresos del 20,7 % en el mercado global de reactivos y equipos de transfección en 2024. Este liderazgo se sustenta en la vasta base poblacional de la región, la rápida expansión de sus sectores biotecnológico y farmacéutico, y la creciente adopción de métodos avanzados de administración de genes, tanto en investigación como en aplicaciones clínicas. La sólida posición de la región se ve respaldada además por un crecimiento significativo en la investigación académica, los ensayos de terapia celular y génica, y el aumento de las colaboraciones entre empresas biofarmacéuticas globales e instituciones regionales.

- Un mayor enfoque en la medicina de precisión, las terapias personalizadas y los productos biológicos de última generación está acelerando la demanda de reactivos de transfección innovadores y equipos automatizados. La expansión de las organizaciones de investigación por contrato (CRO), el aumento de la actividad de ensayos preclínicos y clínicos, y la integración de plataformas de laboratorio digitales refuerzan la importancia de Asia-Pacífico como centro global para la investigación avanzada en ciencias de la vida.

- La demanda de soluciones de transfección se ve impulsada además por inversiones a gran escala de los sectores público y privado destinadas a fortalecer la infraestructura biotecnológica, las instalaciones de investigación académica y los programas de medicina traslacional. Entre los factores clave se incluyen la creciente prevalencia de enfermedades crónicas y genéticas, el auge en el desarrollo de vacunas y biosimilares, y el creciente papel de las instalaciones de bioproducción en toda la región. Las alianzas estratégicas entre laboratorios regionales y proveedores internacionales de tecnología de transfección también están acelerando la transferencia de tecnología, la innovación y la accesibilidad regional.

Análisis del mercado de reactivos y equipos de transfección de China y Asia-Pacífico

El mercado chino de reactivos y equipos de transfección ostentó la mayor cuota de mercado en la región Asia-Pacífico, con un 42,6% en 2024, lo que reafirma su liderazgo gracias a una sólida base de fabricación biofarmacéutica y una robusta infraestructura de I+D. La creciente cartera de ensayos de terapia génica y celular del país, sumada a instituciones de investigación académica y clínica consolidadas, está generando una demanda sostenida de reactivos de transfección avanzados y sistemas de electroporación. Las iniciativas gubernamentales destinadas a fortalecer la innovación biotecnológica, junto con importantes inversiones en investigación genómica y programas de medicina de precisión, impulsan aún más el crecimiento del mercado. Además, la posición de China como centro líder en la producción de productos biológicos y vacunas continúa impulsando la adopción de tecnologías de transfección eficientes para aplicaciones a gran escala.

Perspectiva del mercado de reactivos y equipos de transfección de India y Asia-Pacífico

Se proyecta que el mercado indio de reactivos y equipos de transfección registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 19,4 %, durante el período de pronóstico, impulsado por la expansión del sector biotecnológico y la creciente adopción de herramientas avanzadas de biología molecular. La creciente externalización de la investigación preclínica y clínica a la India, sumada al crecimiento de las organizaciones de investigación académica y por contrato (CRO), está impulsando significativamente la demanda de métodos de transfección de alta eficiencia. Iniciativas gubernamentales como "Make in India" e inversiones específicas en infraestructura de I+D en biotecnología están fortaleciendo las capacidades nacionales de innovación. Además, el rápido establecimiento de centros de investigación e instalaciones de diagnóstico en ciudades de segundo y tercer nivel, sumado a las colaboraciones entre instituciones indias y actores biofarmacéuticos globales, está posicionando a la India como uno de los mercados de mayor crecimiento y dinamismo en el panorama de la transfección en Asia-Pacífico.

Cuota de mercado de reactivos y equipos de transfección en Asia-Pacífico

La industria de equipos y reactivos de transfección de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

-

- Mirus Bio LLC (EE. UU.)

- Promega Corporation (EE. UU.)

- Transfección Polyplus (Francia)

- Bio-Rad Laboratories, Inc. (EE. UU.)

- Merck KGaA (Alemania)

- Lonza (Suiza)

- MaxCyte, Inc. (EE. UU.)

- Altogen Biosystems (EE. UU.)

- SBS Genetech (China)

- FUJIFILM Irvine Scientific (Japón)

- Cytiva (EE. UU.)

- Geno Technology Inc., EE. UU. (EE. UU.)

- R&D Systems, Inc. (EE. UU.)

- Takara Bio Inc. (Japón)

- Thermo Fisher Scientific Inc. (EE. UU.)

- QIAGEN (Alemania)

- OriGene Technologies, Inc. (EE. UU.)

- Applied Biological Materials Inc. (abm) (Canadá)

- Beckman Coulter, Inc. (EE. UU.)

- Amyris (Estados Unidos)

- Codexis (EE. UU.)

- Autolus (Reino Unido)

- Laboratorios SignaGen (EE. UU.)

- Impossible Foods Inc. (EE. UU.)

- Genlantis Inc. (EE. UU.)

- Ginkgo Bioworks (EE. UU.)

- Verve Therapeutics, Inc. (EE. UU.)

- Conagen, Inc. (EE. UU.)

- Poseida Therapeutics, Inc. (EE. UU.)

- Twist Bioscience (EE. UU.)

Últimos avances en el mercado de reactivos y equipos de transfección en Asia-Pacífico

- En marzo de 2021, Polyplus-transfection SA anunció la adquisición de los principales activos de Biowire para fortalecer sus soluciones de entrega global para terapia génica y celular y acelerar su expansión en los mercados de Asia-Pacífico.

- En julio de 2021, Polyplus abrió y amplió oficinas comerciales en Shanghái para localizar el suministro y el soporte para el sector de terapia celular y génica de China/APAC.

- En agosto de 2021, Polyplus lanzó FectoVIR AAV GMP, un reactivo de transfección de grado GMP para la producción de AAV (vector viral) a gran escala, que aborda la creciente demanda de fabricación escalable de vectores virales para terapias genéticas.

- En septiembre de 2022, Polyplus lanzó in vivo-jetRNA+ (un reactivo de transfección para la administración de ARNm in vivo) para respaldar la investigación y las aplicaciones de la administración de ARNm in vivo.

- En mayo de 2023, Thermo Fisher Scientific inauguró una nueva planta de medicamentos estériles en Singapur, ampliando así las capacidades de fabricación e investigación de Asia-Pacífico que respaldan productos biológicos, vacunas y flujos de trabajo posteriores utilizados junto con la transfección y el desarrollo de procesos basados en células.

- En enero de 2024, MaxCyte anunció una asociación estratégica (con Lion TCR) que incluía medidas para mejorar su presencia y operaciones comerciales en Asia, apoyando una adopción más amplia de plataformas de ingeniería celular no viral en APAC.

- En marzo de 2024, Takara Bio lanzó nuevos reactivos (por ejemplo, PrimeCap T7 ARN polimerasa con bajo dsRNA) y anunció expansiones de I+D, fortaleciendo su cartera de reactivos que respalda el trabajo de ARNm y los flujos de trabajo de transfección en Japón y la comunidad de investigación de APAC.

- En mayo de 2024, Merck KGaA firmó un acuerdo definitivo para adquirir Mirus Bio (una empresa especializada en reactivos de transfección), una medida que consolida la propiedad intelectual de los reactivos de transfección y aumenta la escala para el suministro de APAC y la distribución global.

- En noviembre de 2024, Thermo Fisher amplió aún más su presencia en India al anunciar un centro de diseño de bioprocesos en Hyderabad, lo que subraya la inversión continua en bioprocesos de APAC y la infraestructura que permite la terapia celular.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.