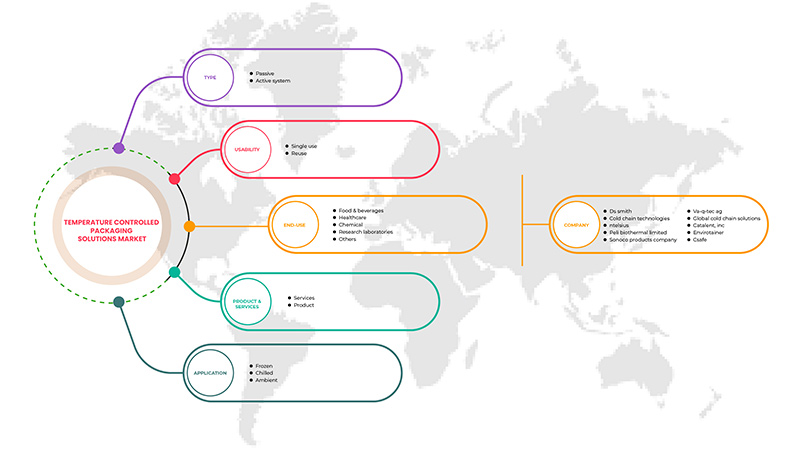

Mercado de soluciones de envasado con temperatura controlada de Asia y el Pacífico, por tipo (sistema pasivo y activo), producto y servicios (servicios, producto), usabilidad (uso único, reutilización), aplicación (congelado, refrigerado y ambiente), uso final (alimentos y bebidas, atención médica, productos químicos, laboratorios de investigación y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de soluciones de envasado con control de temperatura en Asia y el Pacífico

El mercado de soluciones de embalaje con control de temperatura de Asia-Pacífico está ganando un crecimiento significativo debido a diferentes tipos, como hielo seco, nitrógeno líquido y ladrillos de espuma, entre otros. Se utilizan comúnmente para transportar medicamentos, productos perecederos, muestras de sangre y numerosos ensayos clínicos. Las soluciones de embalaje con control de temperatura están preparadas con poliestireno estirado, poliuretano y paneles aislados al vacío. Se espera que la creciente demanda en el sector de la salud y la creciente necesidad de control de temperatura en el sector farmacéutico impulsen significativamente el crecimiento del mercado. La demanda de soluciones de embalaje con control de temperatura en cadenas de frío, productos alimenticios perecederos y alimentos preparados contribuye al crecimiento del mercado.

Por lo tanto, los fabricantes deben cumplir con las normas y regulaciones cada vez más estrictas de los organismos gubernamentales para vender sus productos y garantizar que se cumplan las demandas de los consumidores, lo que impulsará el crecimiento del mercado. Es probable que la falta de conocimientos técnicos en las pequeñas empresas restrinja el crecimiento del mercado en la región.

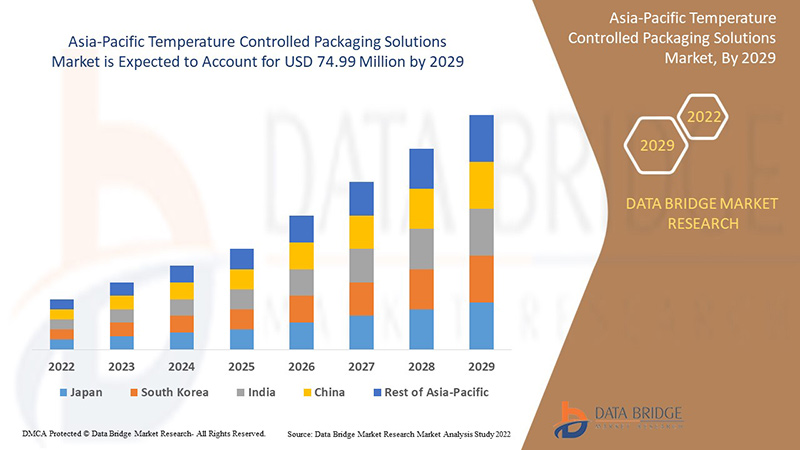

Data Bridge Market Research analiza que el mercado de soluciones de envasado con temperatura controlada de Asia-Pacífico crecerá a una CAGR del 6,4 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (sistema pasivo y activo), producto y servicios (servicios, producto), usabilidad (uso único, reutilización), aplicación (congelado, refrigerado y ambiente), uso final (alimentos y bebidas, atención médica, productos químicos , laboratorios de investigación y otros). |

|

Regiones cubiertas |

China, Japón, Australia y Nueva Zelanda, India, Filipinas, Indonesia, Singapur, Corea del Sur, Malasia, Tailandia y el resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer y CSafe, entre otros. |

Definición de mercado

El embalaje con temperatura controlada se utiliza principalmente para enviar productos, sustancias o muestras que requieren una temperatura determinada durante todo el proceso de transporte. Los transportistas confían en el embalaje con temperatura controlada, que les permite mantener la temperatura del producto transportado de acuerdo con los requisitos del transportista. El embalaje con temperatura controlada se utiliza en numerosas industrias, entre ellas la industria médica, alimentaria y de bebidas, la de ensayos clínicos , la de investigación y desarrollo y la de transporte de sangre.

Las soluciones de embalaje con control de temperatura se presentan en dos formas: sistema activo y sistema pasivo. Las soluciones de embalaje activo cuentan con sistemas de enfriamiento con hielo seco o calefacción y enfriamiento eléctricos. Por otro lado, las soluciones pasivas consisten en cajas o contenedores aislados sin control de temperatura activo. Como resultado, el embalaje pasivo no cambia en respuesta a las temperaturas ambientales. Las soluciones de embalaje activo se utilizan ampliamente porque permiten el transporte de paquetes de cualquier tamaño a distancias más largas sin dañar los productos; debido a su propiedad de reutilización y su alto nivel de tecnología, las soluciones de embalaje con control de temperatura han dejado su huella en el mercado de Asia-Pacífico en aplicaciones de almacenamiento.

Dinámica del mercado de soluciones de envasado con control de temperatura en Asia y el Pacífico

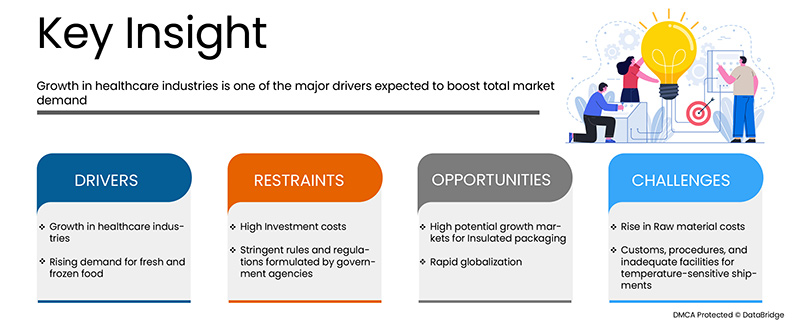

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

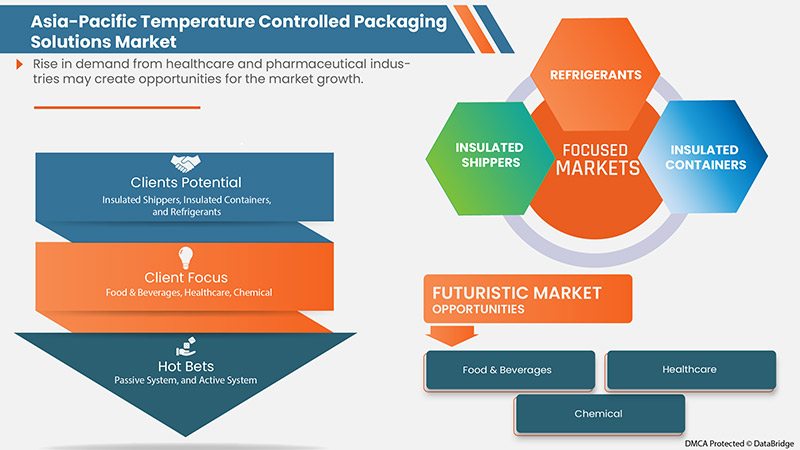

Crecimiento de las industrias de la salud

La industria de la salud es una de las que crece más rápidamente en todo el mundo. La industria está ayudando a descubrir nuevos fármacos o fármacos farmacéuticos que se utilizan como medicamentos. El crecimiento reciente de las industrias de la salud y farmacéutica permite satisfacer la demanda de productos médicos que se envían de forma segura. El embalaje farmacéutico es una forma rentable de proporcionar protección, información de identificación, contención, comodidad y cumplimiento a un producto durante el almacenamiento, el transporte y la exposición hasta que se consume. El embalaje debe proteger contra diversas condiciones climáticas, incluidas las biológicas, físicas y químicas, y ser económico para los fabricantes. Además, el embalaje debe mantener la estabilidad de los productos durante toda su vida útil. Los dos tipos de sistemas de embalaje en la industria de la salud son pasivos y activos. La calidad de los productos sanitarios afecta directamente a la seguridad del paciente y a la eficacia del producto en las terapias del paciente. Las variaciones de temperatura suponen una enorme diferencia en el transporte de productos terminados, el transporte de materiales de ensayos clínicos o la entrega de medicamentos de muestra. Una de las principales soluciones asociadas a este problema son las soluciones de embalaje con control de temperatura, que ayudarán a que el mercado se expanda en los próximos años.

Por ejemplo,

- En julio de 2020, Softbox anunció el lanzamiento de Tempcell ECO. Tempcell ECO está fabricado 100 % con cartón corrugado y utiliza. Esta solución de embalaje ECO está diseñada para transportar productos farmacéuticos sensibles a la temperatura y de amplia estabilidad.

Por lo tanto, se espera que la mayor necesidad de soluciones de embalaje con temperatura controlada para el transporte de medicamentos en todo el mundo impulse el mercado de soluciones de embalaje con temperatura controlada de Asia-Pacífico en el período de pronóstico.

Demanda creciente de alimentos frescos y congelados

Los alimentos congelados se procesan comercialmente para que sean más fáciles de almacenar y requieran menos preparación. Los alimentos frescos suelen ser perecederos por naturaleza. Los alimentos perecederos se dividen en dos categorías: alimentos perecederos y alimentos semiperecederos. Los alimentos perecederos incluyen carne, aves, pescado, leche, huevos y muchas frutas y verduras crudas, y deben refrigerarse. Los alimentos semiperecederos almacenados a una temperatura óptima permanecen intactos durante seis meses a un año. La cadena de frío es una forma importante de conservar y transportar alimentos perecederos dentro del rango de temperatura adecuado. Estos métodos de conservación ralentizan los procesos de descomposición biológica y aumentan la seguridad y la calidad de los alimentos para los consumidores. Los países asiáticos como China e India muestran un creciente interés en consumir alimentos importados, congelados y frescos. Los productos de soluciones de envasado con control de temperatura ofrecen una gama de cajas y otros productos diversos para atender a las mismas industrias. La creciente tendencia de los consumidores a consumir alimentos frescos y congelados permite que las soluciones de envasado con control de temperatura de Asia y el Pacífico se expandan globalmente.

Por ejemplo,

- En junio de 2020, Smurfit Kappa lanzó una nueva alternativa basada en papel que puede mantener los productos alimenticios cárnicos y no cárnicos esterilizados y fríos durante más tiempo. El envase también ofrece mayor flexibilidad que el EPS, ya que se puede almacenar en posición horizontal, lo que reduce los costos de almacenamiento.

Debido al cambio en el perfil del consumidor, la industria alimentaria ha cambiado significativamente. Este aumento en el crecimiento del mercado aumenta la necesidad de material de envasado con control de temperatura para conservar la calidad de los alimentos durante mucho tiempo y se espera que impulse el mercado de soluciones de envasado con control de temperatura de Asia-Pacífico en el período de pronóstico.

Oportunidades

- Mercados con alto potencial de crecimiento para envases aislantes

Los envases con control de temperatura están diseñados específicamente para mantener la temperatura adecuada de los productos sensibles. Este tipo de envases actúa como un escudo y protege a los productos de daños o deterioro. Los envases con control de temperatura tienen aplicaciones en diversos campos, como el farmacéutico, el de alimentos y bebidas, y muchos otros. El aumento del uso de envases con control de temperatura en productos farmacéuticos se debe a que las autoridades de control de medicamentos en todas las geografías se centran en elaborar una legislación estricta para la manipulación y distribución de productos farmacéuticos y en aumentar la demanda de productos biológicos. Varios actores clave, como Intelsius, una empresa de DGP (Reino Unido), ofrecen soluciones de envasado de cadena de frío para el sector farmacéutico. FedEx (EE. UU.), una empresa de mensajería líder, proporciona envases aislantes para diversos productos farmacéuticos, alimentos y bebidas, y ensayos clínicos en todo el mundo. El envase aislante es costoso, ya que mantiene los productos en su forma original y ayuda a mantener la vida útil del producto.

El mercado de alimentos y bebidas es uno de los mercados en crecimiento en lo que respecta a los materiales de embalaje aislantes. Los materiales de embalaje preservan las propiedades físicas de los alimentos y aumentan la vida útil de los productos. La empresa, concretamente Coca-Cola (EE. UU.), fabrica agua embotellada, zumos y té helado. Unilever (Reino Unido), uno de los mayores fabricantes de platos preparados, salsas y tés, utiliza materiales de embalaje aislantes. A medida que las empresas importantes obtengan importantes beneficios, se espera que el mercado de alimentos y bebidas crezca y genere importantes oportunidades para el mercado de soluciones de embalaje con control de temperatura de Asia y el Pacífico.

Restricciones/Desafíos

- Aumento de los costes de las materias primas

Para fabricar soluciones de embalaje con control de temperatura se utilizan diversos tipos de materias primas, como poliestireno expandido, poliuretano y nitrógeno líquido. Las empresas Cold Chain Technologies (EE. UU.) e Intelsius - A DGP Company (Reino Unido) ofrecen soluciones de embalaje con control de temperatura para mantener la integridad térmica de los productos durante su transporte hasta que llegan a su destino. Se utilizan materiales como el poliuretano y el nitrógeno líquido para fabricar revestimientos de cajas, bolsas, sobres y palés.

El precio de las materias primas está aumentando y los fabricantes enfrentan desafíos en cadena a lo largo de las cadenas de suministro a medida que los precios continúan su ascenso, lo que desacelera las entregas de los proveedores y la disponibilidad de mano de obra.

- En julio de 2022, según un artículo publicado por Agro & Food Processing, el mercado se está volviendo cada vez más incierto debido al aumento de la demanda, la capacidad y los problemas de suministro, la disponibilidad restringida de opciones de transporte y los costos de las materias primas que aumentan exponencialmente a diario. El precio de las resinas de poliuretano, los disolventes y otras materias primas y derivados petroquímicos ha aumentado significativamente recientemente.

Por lo tanto, se espera que el aumento de los precios de las materias primas utilizadas en la fabricación de soluciones de envasado con temperatura controlada, como el poliestireno y el poliuretano, suponga un desafío para el mercado de soluciones de envasado con temperatura controlada de Asia y el Pacífico.

Impacto posterior a la COVID-19 en el mercado de soluciones de envasado con control de temperatura de Asia y el Pacífico

Después de la pandemia, la demanda de soluciones de embalaje con control de temperatura ha aumentado, ya que no habrá más restricciones de movimiento, por lo que el suministro de productos será fácil. Además, las empresas desarrollaron su sistema de embalaje para enviar vacunas y medicamentos a todo el mundo, y la demanda de embalajes con control de temperatura para productos perecederos también ha aumentado, lo que puede impulsar el crecimiento del mercado.

La mayor demanda de soluciones de envasado con temperatura controlada permite a los fabricantes lanzar productos de envasado con temperatura controlada innovadores y multifuncionales, lo que en última instancia aumenta la demanda de soluciones de envasado con temperatura controlada y ha ayudado a que el mercado crezca.

Además, la alta demanda de productos de envasado con control de temperatura impulsará el crecimiento del mercado. Además, la demanda de soluciones de envasado para medicamentos sensibles a la temperatura después de la pandemia de COVID-19 ha aumentado, ya que la alta demanda del sector sanitario y farmacéutico dio lugar al crecimiento del mercado. Además, se espera que el interés de los consumidores en las nuevas tecnologías y los productos multiusos impulse el crecimiento del mercado de soluciones de envasado con control de temperatura de Asia y el Pacífico.

Acontecimientos recientes

- En septiembre de 2022, va-Q-tec lanzó un contenedor de transporte va-Q-one 300P en tamaño de europalé, una opción de transporte con temperatura controlada. La caja es especialmente adecuada para envíos transnacionales en áreas sin opciones de transporte de retorno. Este lanzamiento ayudará a la empresa a expandirse globalmente.

- En julio de 2022, DS Smith colaboró con la empresa valenciana y desarrolló un innovador packaging para su nueva línea de exprimidores Soul Series 2. El packaging es 100% reciclable. Este lanzamiento ayudará a la empresa a expandirse en el mercado.

Alcance del mercado de soluciones de envasado con control de temperatura en Asia y el Pacífico

El mercado de soluciones de envasado con control de temperatura de Asia-Pacífico está segmentado en función del tipo, producto y servicios, facilidad de uso, aplicación y uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Pasivo

- Sistema activo

Según el tipo, el mercado de soluciones de envasado con temperatura controlada de Asia-Pacífico está segmentado en sistemas pasivos y activos.

Productos y servicios

- Servicios

- Producto

Sobre la base de productos y servicios, el mercado de soluciones de envasado con temperatura controlada de Asia-Pacífico se segmenta en productos y servicios.

Usabilidad

- De un solo uso

- Reutilizar

On the basis of usability, the Asia-Pacific temperature controlled packaging solutions market is segmented into single use and reuse.

Application

- Frozen

- Chilled

- Ambient

On the basis of application, the Asia-Pacific temperature controlled packaging solutions market is segmented into frozen, chilled, and ambient.

End Use

- Food & Beverages

- Healthcare

- Chemical

- Research Laboratories

- Others

On the basis of application, the Asia-Pacific temperature controlled packaging solutions market is segmented into food & beverages, healthcare, chemical, research laboratories, and others.

Asia-Pacific Temperature Controlled Packaging Solutions Market Regional Analysis/Insights

The Asia-Pacific temperature controlled packaging solutions market is analyzed, and market size insights and trends are provided based on country, type, product & services, usability, application, and end-use, as referenced above.

Some countries covered in the Asia-Pacific temperature controlled packaging solutions market are China, Australia & New Zealand, Japan, South Korea, Singapore, Malaysia, Indonesia, Thailand, Philippines, India, and the rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific temperature controlled packaging solutions market in terms of market share and revenue. It is projected to maintain its dominance during the forecast period due to strong market players and high demand for pharmaceutical products in Asia-Pacific.

The region section of the report also provides individual market-impacting factors and changes in regulations that impact the market's current and future trends. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Temperature Controlled Packaging Solutions Market Share Analysis

The competitive Asia-Pacific temperature controlled packaging solutions market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company’s focus on the Asia-Pacific temperature controlled packaging solutions market.

Algunos de los principales actores que operan en el mercado de soluciones de embalaje de temperatura controlada de Asia-Pacífico son DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer, CSafe, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, Asia-Pacífico vs. Regional y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION COVERAGE

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 GOVERNMENT'S ROLE

5.3 PRE COVID AND POST COVID ANALYSIS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN HEALTHCARE INDUSTRIES

7.1.2 RISING DEMAND FOR FRESH AND FROZEN FOOD

7.2 RESTRAINTS

7.2.1 HIGH INVESTMENT COSTS

7.2.2 STRINGENT RULES AND REGULATIONS FORMULATED BY GOVERNMENT AGENCIES

7.3 OPPORTUNITIES

7.3.1 RAPID GLOBALIZATION

7.3.2 HIGH POTENTIAL GROWTH MARKETS FOR INSULATED PACKAGING

7.4 CHALLENGES

7.4.1 RISE IN RAW MATERIAL COSTS

7.4.2 CUSTOMS, PROCEDURES, AND INADEQUATE FACILITIES FOR TEMPERATURE-SENSITIVE SHIPMENTS

8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.3 ACTIVE SYSTEM

9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES

9.1 OVERVIEW

9.2 SERVICES

9.2.1 AIRWAYS

9.2.2 ROADWAYS

9.2.3 WATERWAYS

9.3 PRODUCT

9.3.1 INSULATED CONTAINERS

9.3.1.1 EXPANDED POLYSTYRENE

9.3.1.2 POLYURETHANE

9.3.1.3 VACUUM INSULATED PANELS

9.3.2 INSULATED SHIPPERS

9.3.3 REFRIGERANTS

9.3.3.1 DRY ICE

9.3.3.2 GEL PACKS

9.3.3.3 ADVANCED PHASE CHANGE MATERIALS

9.3.3.4 LIQUID NITROGEN

9.3.3.5 FOAM BRICKS

9.3.3.6 OTHERS

10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FROZEN

10.3 CHILLED

10.4 AMBIENT

11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY

11.1 OVERVIEW

11.2 REUSE

11.3 SINGLE USE

12 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 PASSIVE SYSTEM

12.2.2 ACTIVE SYSTEM

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY END USE

12.3.1.1 PHARMACEUTICAL AND BIOTECHNOLOGY

12.3.1.2 BLOOD TRANSPORTATION

12.3.1.3 R&D AND CLINICAL TRIALS

12.3.1.4 MEDICAL DEVICES

12.3.1.5 OTHERS

12.3.2 HEALTHCARE, BY TYPE

12.3.2.1 PASSIVE

12.3.2.2 ACTIVE SYSTEM

12.4 CHEMICAL

12.4.1 PASSIVE

12.4.2 ACTIVE SYSTEM

12.5 RESEARCH LABORATORIES

12.5.1.1 PASSIVE

12.5.1.2 ACTIVE SYSTEM

12.6 OTHERS

12.6.1 PASSIVE

12.6.2 ACTIVE SYSTEM

13 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY

13.1 ASIA PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 SINGAPORE

13.1.7 INDONESIA

13.1.8 AUSTRALIA & NEW ZEALAND

13.1.9 PHILIPPINES

13.1.10 MALAYSIA

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 EXPANSION

14.3 PRODUCT LAUNCHES

14.4 ACQUISITION

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 DS SMITH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 VA-Q-TEC AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SONOCO PRODUCTS COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 CATALENT, INC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ENVIROTAINER

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 COLD CHAIN TECHNOLOGIES

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CSAFE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 GLOBAL COLD CHAIN SOLUTIONS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 INTELSIUS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 PELI BIOTHERMAL LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 ( KILO TONS)

TABLE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, USABILITY, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 20 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 23 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 24 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 25 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 CHINA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 CHINA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 29 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 CHINA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 31 CHINA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 40 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 41 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 42 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 INDIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 44 INDIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 46 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 INDIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 48 INDIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 INDIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 INDIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 INDIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 57 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 JAPAN INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 JAPAN REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 JAPAN IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 74 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 90 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 91 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 92 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 93 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 THAILAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 THAILAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 97 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 THAILAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 99 THAILAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 101 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 THAILAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 THAILAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 THAILAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 108 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 110 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 111 SINGAPORE INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 SINGAPORE REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 125 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 142 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 144 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA & NEW ZEALAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 AUSTRALIA & NEW ZEALAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 148 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA & NEW ZEALAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 150 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA & NEW ZEALAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 AUSTRALIA & NEW ZEALAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA & NEW ZEALAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 159 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 175 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 176 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 MALAYSIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 MALAYSIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 MALAYSIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 RISING TREND OF FRESH AND FROZEN FOOD AND GROWING HEALTHCARE INDUSTRIES ARE EXPECTED TO DRIVE THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN THE FORECAST PERIOD

FIGURE 12 PASSIVE SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

FIGURE 14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE, 2021

FIGURE 15 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY PRODUCT & SERVICES, 2021

FIGURE 16 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY APPLICATION, 2021

FIGURE 17 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY USABILITY, 2021

FIGURE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY END-USE, 2021

FIGURE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SNAPSHOT (2020)

FIGURE 20 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY COUNTRY (2020)

FIGURE 21 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022 & 2029)

FIGURE 22 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2021 & 2029)

FIGURE 23 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022-2029)

FIGURE 24 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.