Asia Pacific Rubber Testing Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

116.54 Million

USD

192.87 Million

2024

2032

USD

116.54 Million

USD

192.87 Million

2024

2032

| 2025 –2032 | |

| USD 116.54 Million | |

| USD 192.87 Million | |

|

|

|

|

Segmentación del mercado de equipos de prueba de caucho en Asia-Pacífico, por tipo de prueba (prueba de viscosidad, prueba de densidad, prueba de dureza, prueba de flexión, probador de espesor, probador de estabilidad mecánica, probador de impacto y prueba de horno de envejecimiento), tecnología (viscosímetro Mooney, reómetro de matriz móvil, probador de densidad automatizado, probador de dureza automatizado y analizador de procesos), tipo de caucho (caucho de estireno butadieno, caucho EPDM, caucho butílico, caucho natural, caucho de silicona, caucho de neopreno, caucho de nitrilo y otros), rango de frecuencia (más de 4 Hz, de 1 a 4 Hz y menos de 1 Hz), aplicación (neumáticos y piezas de automoción, productos de caucho industriales, sellos de caucho y juntas tóricas, suelas de zapatos, cintas transportadoras, correas, tapetes y alfombras de caucho, y deportes y fitness) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de equipos de prueba de caucho en Asia-Pacífico

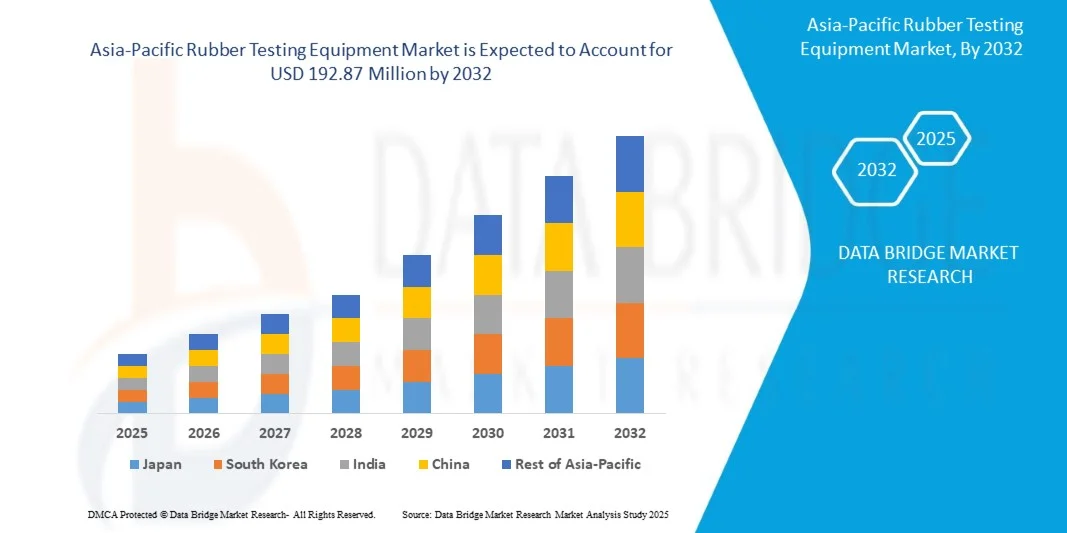

- El tamaño del mercado de equipos de prueba de caucho de Asia-Pacífico se valoró en USD 116,54 millones en 2024 y se espera que alcance los USD 192,87 millones para 2032 , con una CAGR del 6,5% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de componentes de caucho de alto rendimiento en los sectores automotriz, aeroespacial e industrial, junto con estrictas regulaciones de calidad y seguridad que impulsan la adopción de soluciones de prueba avanzadas.

- Además, los avances tecnológicos en equipos de prueba, como la automatización, el análisis de datos en tiempo real y la integración con plataformas digitales, están mejorando la precisión y la eficiencia de las pruebas, lo que respalda aún más la expansión del mercado.

Análisis del mercado de equipos de prueba de caucho en Asia-Pacífico

- El mercado de equipos de prueba de caucho está experimentando un crecimiento constante a medida que los fabricantes se centran cada vez más en el aseguramiento de la calidad para cumplir con los estándares de rendimiento en las aplicaciones industriales.

- El creciente énfasis en la consistencia y seguridad de los productos en sectores como la automoción y la fabricación está fomentando el uso de soluciones de pruebas de caucho precisas y automatizadas.

- China dominó el mercado de equipos de prueba de caucho con la mayor participación en los ingresos del 38,5 % en 2024, impulsada por la rápida industrialización, el aumento de la producción automotriz y las estrictas regulaciones de calidad.

- Se espera que Japón sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de equipos de prueba de caucho de Asia-Pacífico debido a la creciente inversión en tecnologías de prueba avanzadas, la creciente demanda de precisión y durabilidad en productos de caucho automotrices e industriales y la innovación continua en automatización y sistemas de prueba modulares.

- El segmento de pruebas de viscosidad representó la mayor cuota de mercado en 2024, impulsado por su papel crucial en la evaluación de la procesabilidad y las características de flujo de los compuestos de caucho. Los fabricantes dependen en gran medida de las pruebas de viscosidad para garantizar la consistencia en la producción y cumplir con los requisitos de rendimiento de las aplicaciones finales.

Alcance del informe y segmentación del mercado de equipos de prueba de caucho en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de equipos de prueba de caucho en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de equipos de prueba de caucho en Asia-Pacífico

“Aumento de la adopción de soluciones avanzadas para pruebas de caucho”

- El creciente uso de equipos avanzados de prueba de caucho está transformando el panorama del control de calidad al permitir una evaluación precisa y fiable de propiedades del caucho como la resistencia a la tracción, la dureza y la elasticidad. Estos sistemas permiten a los fabricantes garantizar un rendimiento constante del producto y el cumplimiento de las normas del sector, reduciendo los defectos y mejorando la calidad general del producto. Además, la integración con informes digitales y análisis de datos ayuda a los fabricantes a realizar un seguimiento de las tendencias de producción y a tomar decisiones informadas para la mejora del producto.

- La creciente demanda de productos de caucho en aplicaciones automotrices, industriales y de consumo está acelerando la adopción de dispositivos de prueba automatizados y portátiles. Estas soluciones son especialmente eficaces para identificar inconsistencias en los materiales y garantizar que los componentes de caucho cumplan con los requisitos de seguridad y durabilidad. Esta tendencia se ve reforzada por el aumento de las regulaciones de calidad a nivel mundial y la necesidad de certificaciones en los mercados de exportación.

- La facilidad de uso, la precisión y la versatilidad de los instrumentos modernos para pruebas de caucho los hacen atractivos para las inspecciones de calidad rutinarias, lo que ayuda a los fabricantes a mantener la eficiencia de la producción y reducir el desperdicio de material. Además, estos sistemas suelen contar con diseños modulares y funciones de monitorización remota, lo que permite una implementación flexible en múltiples líneas de producción e instalaciones. Su adopción también contribuye a los objetivos de sostenibilidad al minimizar los productos defectuosos y el desperdicio de recursos.

- Por ejemplo, en 2023, varios fabricantes de neumáticos y caucho industrial de la región informaron una mejor consistencia de sus productos y una reducción de defectos de producción tras la implementación de máquinas automatizadas de ensayos de tracción y dureza. Estas mejoras mejoraron la reputación de la marca y la satisfacción del cliente, a la vez que redujeron las tasas de retirada de productos y las reclamaciones de garantía. La integración de sensores inteligentes y la retroalimentación en tiempo real permitió a los fabricantes optimizar sus procesos y mantener una calidad uniforme del producto.

- Si bien los equipos avanzados para pruebas de caucho están ganando terreno, su impacto depende de la innovación tecnológica continua, la capacitación de los operadores y la asequibilidad. Los fabricantes deben centrarse en el desarrollo de sistemas modulares, escalables y fiables para aprovechar al máximo el crecimiento del mercado. Las actualizaciones continuas de software y la compatibilidad con las soluciones emergentes de IoT también son fundamentales para mantener la eficiencia operativa y cumplir con los estándares cambiantes de la industria.

Dinámica del mercado de equipos de prueba de caucho en Asia-Pacífico

Conductor

“Creciente énfasis en la calidad, la seguridad y la estandarización de los productos”

- La creciente atención a la seguridad de los productos y al cumplimiento de las normas internacionales impulsa la adopción de equipos de prueba de caucho. Las empresas priorizan cada vez más las soluciones de prueba que garantizan la durabilidad, el rendimiento y el cumplimiento normativo en los segmentos automotriz, industrial y de consumo. La creciente concienciación sobre la seguridad del usuario final y la responsabilidad de la marca también impulsa a los fabricantes a adoptar sistemas de prueba de alta precisión.

- Los fabricantes buscan cada vez más sistemas de prueba automatizados, precisos y fiables para optimizar los procesos de producción, reducir el desperdicio y mantener una calidad constante en todos los lotes. Los equipos de prueba avanzados permiten una caracterización detallada de los materiales, lo que ayuda a mejorar el diseño y el rendimiento del producto. El uso de dispositivos conectados y análisis garantiza la trazabilidad del proceso, lo que facilita las auditorías regulatorias y las iniciativas internas de control de calidad.

- La expansión de la industria del caucho, en particular en neumáticos para automóviles, sellos industriales y bienes de consumo, impulsa aún más la demanda del mercado. Las soluciones de prueba proporcionan información crucial sobre las propiedades de los materiales, garantizando que los productos finales cumplan con las expectativas de rendimiento y los requisitos del cliente. Además, el aumento de las exportaciones a regiones con estrictas normas de seguridad anima a las empresas a adoptar protocolos de prueba avanzados para mantener su acceso al mercado.

- Por ejemplo, en 2022, varios fabricantes de componentes de caucho de la región integraron sistemas automatizados de pruebas de dureza y tracción en sus líneas de producción, lo que mejoró la uniformidad del producto y redujo las tasas de fallos. Esta adopción también mejoró la eficiencia operativa al reducir la intervención manual y minimizar los errores humanos, lo que se tradujo en un mayor rendimiento y menores costes.

- Si bien la calidad y la estandarización de los productos son factores clave para el crecimiento, su adopción depende de la rentabilidad, la facilidad de uso y la disponibilidad de personal capacitado para operar equipos de prueba sofisticados. Los programas de capacitación continua y los servicios de soporte técnico son cada vez más esenciales para garantizar un uso óptimo y evitar tiempos de inactividad, lo que, en última instancia, impulsa la expansión del mercado a largo plazo.

Restricción/Desafío

“Alto costo de los equipos de prueba avanzados y accesibilidad limitada en operaciones a pequeña escala”

- El alto costo de los instrumentos avanzados de prueba de caucho, incluyendo máquinas universales de prueba, durómetros y reómetros, limita su adopción entre los fabricantes pequeños y medianos. Las restricciones de precio restringen el acceso a tecnologías de vanguardia que mejoran el control de calidad. Además, los costosos contratos de mantenimiento y los requisitos de calibración aumentan los gastos operativos, lo que disuade a las pequeñas empresas de invertir.

- En muchas regiones, existe escasez de personal cualificado capaz de operar y mantener equipos de prueba complejos. La falta de formación y experiencia técnica dificulta su utilización eficaz, reduciendo así los beneficios de los sistemas avanzados. Este desafío es especialmente pronunciado en los mercados emergentes, donde la formación profesional para equipos de laboratorio avanzados es limitada.

- Los desafíos de la cadena de suministro y la disponibilidad limitada de instrumentos de prueba especializados en las regiones en desarrollo restringen aún más la penetración en el mercado. Los pequeños fabricantes suelen recurrir a métodos de prueba manuales o anticuados, lo que puede resultar en una calidad inconsistente. Los retrasos en la importación de equipos y repuestos de alta gama pueden interrumpir los cronogramas de producción, lo que afecta la eficiencia operativa general.

- Por ejemplo, en 2023, varios productores de componentes de caucho del Sudeste Asiático informaron retrasos en la actualización a equipos de prueba automatizados debido a limitaciones presupuestarias y logísticas, lo que afectó la eficiencia de la producción y la fiabilidad de los productos. Estos contratiempos provocaron el incumplimiento de los plazos y limitaron su capacidad para cumplir con los estándares de calidad de exportación, lo que afectó sus ingresos y su competitividad en el mercado.

- Mientras las tecnologías de prueba continúan evolucionando, abordar los costos, la accesibilidad y la falta de habilidades es esencial para una adopción más amplia y un crecimiento sostenible en el mercado de equipos de prueba de caucho. La colaboración con la industria, el apoyo gubernamental y las opciones de financiamiento flexibles podrían facilitar que las empresas más pequeñas adopten sistemas de prueba avanzados y mejoren los estándares generales del mercado.

Análisis del mercado de equipos de prueba de caucho en Asia-Pacífico

El mercado de equipos de prueba de caucho de Asia-Pacífico está segmentado según el tipo de prueba, la tecnología, el tipo de caucho, el rango de frecuencia y la aplicación.

- Por tipo de prueba

Según el tipo de prueba, el mercado se segmenta en pruebas de viscosidad, pruebas de densidad, pruebas de dureza, pruebas de flexión, medidores de espesor, medidores de estabilidad mecánica, medidores de impacto y pruebas de envejecimiento en horno. El segmento de pruebas de viscosidad representó la mayor cuota de mercado en 2024, gracias a su papel fundamental en la evaluación de la procesabilidad y las características de flujo de los compuestos de caucho. Los fabricantes dependen en gran medida de las pruebas de viscosidad para garantizar la consistencia de la producción y cumplir con los requisitos de rendimiento de las aplicaciones finales.

Se prevé que el segmento de pruebas de dureza experimente su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de componentes de caucho de alto rendimiento en sectores como la automoción, la construcción y la industria aeroespacial. Las pruebas de dureza proporcionan evaluaciones precisas de la resistencia del material bajo presión, lo que garantiza la durabilidad y la fiabilidad de las piezas de caucho utilizadas en condiciones extremas.

- Por tecnología

En cuanto a la tecnología, el mercado se segmenta en viscosímetros Mooney, reómetros de matriz móvil, densímetros automatizados, durómetros automatizados y analizadores de procesos. El segmento de viscosímetros Mooney tuvo la mayor participación en 2024, ya que sigue siendo un estándar ampliamente aceptado para medir la viscosidad del caucho crudo y sus compuestos. Su fácil manejo y amplia aplicabilidad lo convierten en una herramienta fundamental en los procesos de control de calidad del caucho.

Se prevé que el segmento de analizadores de procesos experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de monitorización en tiempo real de los parámetros de producción. Los analizadores de procesos mejoran la eficiencia operativa al reducir el tiempo de inactividad y permitir la toma de decisiones basada en datos, algo fundamental en entornos de fabricación automatizados y a gran escala.

- Por tipo de caucho

Según el tipo de caucho, el mercado se segmenta en caucho de estireno butadieno, caucho EPDM, caucho butílico, caucho natural, caucho de silicona, caucho de neopreno, caucho de nitrilo, entre otros. El caucho natural dominó el mercado en 2024 gracias a su amplio uso en aplicaciones automotrices, industriales y de consumo gracias a su elasticidad y resistencia mecánica. Su compatibilidad con diversos métodos de prueba y su disponibilidad en los mercados globales refuerzan aún más su dominio del segmento.

Se prevé que el segmento del caucho de silicona experimente el mayor crecimiento entre 2025 y 2032, gracias a su excelente estabilidad térmica, sus propiedades de aislamiento eléctrico y su creciente uso en los sectores de la electrónica y la salud. Este material requiere rigurosas pruebas para cumplir con los estrictos estándares de calidad, lo que impulsa la demanda de equipos especializados para pruebas de caucho.

- Por rango de frecuencia

Según el rango de frecuencia, el mercado se segmenta en más de 4 Hz, de 1 a 4 Hz y menos de 1 Hz. El segmento de 1 a 4 Hz registró la mayor cuota de mercado en 2024 gracias a su amplia aplicación en análisis mecánicos dinámicos estándar y ensayos de fatiga. Este rango es óptimo para evaluar el rendimiento en condiciones de tensión repetitiva en sectores como la automoción y el calzado.

Se prevé que el segmento de más de 4 Hz experimente el mayor crecimiento entre 2025 y 2032, impulsado por su creciente uso en aplicaciones avanzadas de ensayos de fatiga e impacto. Los equipos que operan en este rango permiten ciclos de ensayo más rápidos y una mayor precisión, crucial para entornos industriales de alto rendimiento.

- Por aplicación

Según su aplicación, el mercado se segmenta en neumáticos y autopartes, productos industriales de caucho, sellos y juntas tóricas de caucho, suelas de calzado, cintas transportadoras, cinturones, tapetes y alfombras de caucho, y artículos deportivos y de fitness. El segmento de neumáticos y autopartes representó la mayor participación en 2024, impulsado por los estrictos requisitos de calidad y las normas de seguridad del sector automotriz. Las pruebas garantizan que componentes como neumáticos y bujes cumplan con los criterios de rendimiento de resistencia al desgaste, la presión y la temperatura.

Se prevé que el segmento de cintas transportadoras experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente industrialización y la necesidad de materiales duraderos en logística y minería. Las pruebas rigurosas de las propiedades mecánicas y la resistencia al envejecimiento son cruciales para garantizar un rendimiento duradero en condiciones de funcionamiento continuo y entornos abrasivos.

Análisis regional del mercado de equipos de prueba de caucho en Asia-Pacífico

- China dominó el mercado de equipos de prueba de caucho con la mayor participación en los ingresos del 38,5 % en 2024, impulsada por la rápida industrialización, el aumento de la producción automotriz y las estrictas regulaciones de calidad.

- Los fabricantes están adoptando sistemas de pruebas automatizados y de precisión para garantizar un rendimiento constante del producto y el cumplimiento de las normas internacionales.

- La adopción generalizada se ve respaldada además por la creciente demanda de neumáticos, sellos industriales y productos de caucho para el consumidor, lo que impulsa las inversiones en equipos de prueba avanzados.

Análisis del mercado de equipos de prueba de caucho en Japón

Se prevé que el mercado japonés experimente el mayor crecimiento entre 2025 y 2032, impulsado por los avances tecnológicos, la alta adopción de sistemas de pruebas automatizados y la demanda de productos de caucho industrial de alto rendimiento. Los fabricantes se centran en la mejora de la calidad, la optimización de procesos y la integración de soluciones de prueba basadas en IoT, con el apoyo de regulaciones gubernamentales que priorizan la seguridad y la estandarización.

Cuota de mercado de equipos de prueba de caucho en Asia-Pacífico

La industria de equipos de prueba de caucho de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Compañía de Fabricación de Semiconductores de Taiwán (TSMC) (Taiwán)

- Samsung Electronics (Corea del Sur)

- Toyota Motor Corporation (Japón)

- Reliance Industries Limited (India)

- Banco de la Commonwealth de Australia (CBA) (Australia)

- Singapore Airlines (Singapur)

- PetroChina (China)

- Grupo BHP (Australia)

- LG Electronics (Corea del Sur)

- Corporación Estatal de Ingeniería de Construcción de China (CSCEC) (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.