Mercado de envases de retorta de Asia y el Pacífico , por tipo de producto (bolsas, bandejas, cartones y otros), material (PET, polipropileno, papel de aluminio, poliamida (PA), papel y cartón, EVOH y otros), canal de distribución (fuera de línea y en línea), uso final (alimentos, bebidas, productos farmacéuticos y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

La industrialización y la urbanización han cambiado las técnicas de procesamiento y las formas de transporte de medios o fluidos, lo que ha llevado a la necesidad de envases de plástico en casi todas las industrias donde los fluidos juegan un papel importante. Por lo tanto, el mercado de envases de plástico se ha visto impulsado por la necesidad de una producción más segura y una infraestructura adecuada.

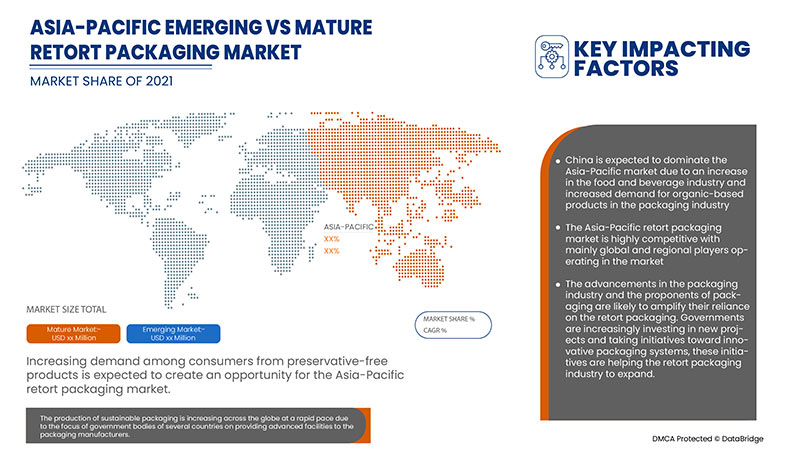

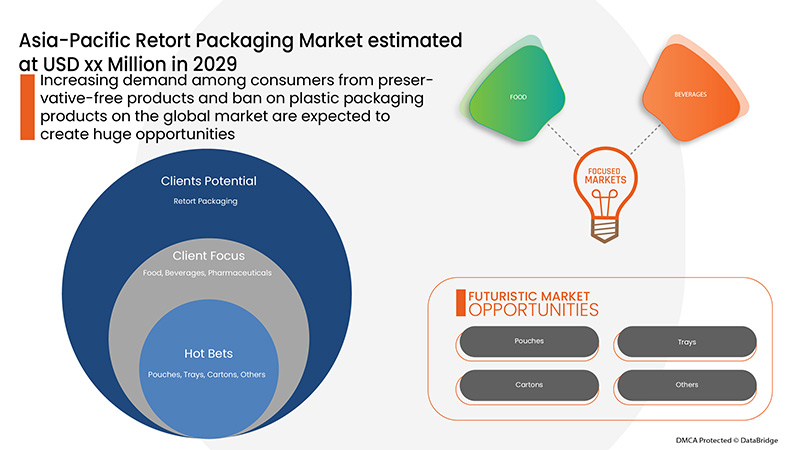

Algunos de los factores que impulsan el mercado son la creciente demanda de productos sin conservantes por parte de los consumidores, la creciente demanda de soluciones de envasado sostenibles y estéticas y la creciente demanda de envases inteligentes para evitar el desperdicio de alimentos. Sin embargo, el alto coste asociado a las actividades de investigación y desarrollo es el freno que frena el crecimiento del mercado.

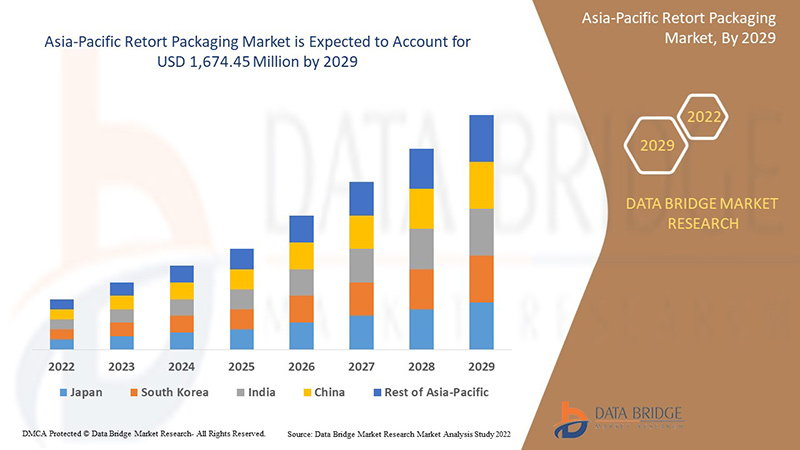

Data Bridge Market Research analiza que se espera que el mercado de envases de retorta alcance un valor de USD 1.674,45 millones para 2029, con una CAGR del 6,4 % durante el período de pronóstico. Las "bolsas" representan el segmento de tipo de producto más grande en el mercado de envases de retorta debido a que los patrones dietéticos cambiantes y las crecientes influencias occidentales han aumentado la demanda de productos alimenticios envasados y de una sola porción. El informe del mercado de envases de retorta también cubre el análisis de precios, el análisis de patentes y los avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (bolsas, bandejas, cartones y otros), por material (PET, polipropileno, papel de aluminio, poliamida (PA), papel y cartón, EVOH y otros), por canal de distribución (offline y online), por uso final (alimentos, bebidas, productos farmacéuticos y otros) |

|

Países cubiertos |

China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico en la región Asia-Pacífico (APAC) |

|

Actores del mercado cubiertos |

ProAmpac, Coveris, Berry Asia-Pacific Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC., entre otros. |

Definición de mercado

El envase de retorta es un tipo de envase para alimentos hecho de un laminado de plástico flexible y láminas de metal. Permite el envasado estéril de una amplia variedad de alimentos y bebidas manipulados mediante procesamiento aséptico y se utiliza como una alternativa a los métodos tradicionales de enlatado industrial. Los alimentos envasados varían desde agua hasta comidas completamente cocidas, termoestabilizadas (tratadas térmicamente) y de alto contenido calórico (1300 kcal en promedio), como las comidas listas para comer (MRE), que se pueden comer frías, calentar sumergiéndolas en agua caliente o calentarlas con un calentador de raciones sin llama, un componente de las comidas introducido por primera vez por los militares en 1992. Las raciones de campaña, la comida espacial, los productos de pescado, las comidas para acampar, los fideos rápidos y empresas como Capri Sun y Tasty Bite utilizan envases de retorta.

Inicialmente, los envases de retorta se desarrollaron para aplicaciones industriales y órganos de tubos. Poco a poco, el diseño se adaptó a la industria biofarmacéutica para métodos de esterilización mediante el uso de materiales compatibles. Y ahora se está utilizando en casi todas las industrias para una producción segura y una infraestructura adecuada, como alimentos y bebidas y procesamiento químico, entre otros sectores verticales.

Dinámica del mercado de envases retortables

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Creciente demanda entre los consumidores de productos sin conservantes

El retortado se produce cuando los productos no estériles se sellan herméticamente, lo que literalmente significa que el envase no es estéril. El envase se carga en un recipiente a presión de retorta y se somete a vapor presurizado. Además, el producto se expone a altas temperaturas durante un período mucho más largo que en el llenado en caliente. El tiempo adicional puede deteriorar significativamente la calidad general y el contenido nutricional del producto.

La creciente demanda de productos sin conservantes entre los consumidores de todo el mundo es un factor clave para el mercado de envases termosellables de Asia y el Pacífico. A medida que los consumidores se preocupan cada vez más por los efectos nocivos de los conservantes en sus bebidas, la demanda de productos sin conservantes está en su punto máximo.

- Aumento de la demanda de envases retortables por parte de las aerolíneas

Recientemente, los consumidores se están inclinando cada vez más por opciones de embalaje sostenibles y respetuosas con el medio ambiente, lo que ha llevado a la introducción de embalajes totalmente reciclables y bolsas verticales de diversos diseños. Además de ofrecer ventajas medioambientales, los embalajes sostenibles también pueden ayudar a las empresas a aumentar sus beneficios y eliminar piezas de repuesto innecesarias, mejorando así la seguridad de las líneas de producción y minimizando los costes de eliminación. El objetivo principal del embalaje no es solo proteger el producto de daños durante el transporte, sino también proteger el almacén y las tiendas minoristas antes de vender el producto. Se utilizan distintos tipos de embalajes para distintos tipos de productos. Además, los embalajes termosellables se utilizan para productos alimenticios pesados y voluminosos y también para otros productos.

- Crece la demanda de envases inteligentes para evitar el desperdicio de alimentos

Los envases inteligentes ofrecen diversas soluciones para reducir el desperdicio de alimentos, ya que proporcionan diferentes indicadores para evitar que los alimentos se estropeen. Por ello, el creciente desperdicio de alimentos está atrayendo a los consumidores a comprar alimentos con envases inteligentes.

Los envases inteligentes incluyen indicadores (indicadores de tiempo y temperatura; indicadores de integridad o de gas; indicadores de frescura); códigos de barras y etiquetas de identificación por radiofrecuencia (RFID); sensores (biosensores; sensores de gas; sensores de oxígeno basados en fluorescencia), entre otros. Por lo tanto, los envases inteligentes ayudan a los fabricantes de alimentos a rastrear el estado de sus productos alimenticios en tiempo real, contribuyendo así a la reducción del desperdicio de alimentos.

Además, los envases inteligentes también pueden actuar como herramienta principal para que los consumidores elijan sus productos en el comercio minorista, ya que los conceptos de envases inteligentes pueden permitir a los consumidores juzgar la calidad de los productos. Como resultado, se espera que los envases inteligentes desempeñen un papel importante a la hora de atraer a los consumidores.

- Altos costos asociados con las actividades de investigación y desarrollo

Los gastos de investigación y desarrollo están directamente relacionados con la investigación y el desarrollo de los bienes o servicios de una empresa y con cualquier propiedad intelectual generada en el proceso. Una empresa generalmente incurre en gastos de I+D en el proceso de búsqueda y creación de nuevos productos o servicios.

Las empresas de envasado dependen en gran medida de sus capacidades de investigación y desarrollo, por lo que pueden aumentar relativamente los gastos de I+D. Por ejemplo, pueden cambiar las preferencias de los consumidores de envases convencionales a envases inteligentes y activos, aumentar la conciencia de los consumidores sobre la seguridad alimentaria, entre otros. Por lo tanto, las empresas tienen que invertir en actividades de investigación y desarrollo para diversificar su negocio y encontrar nuevas oportunidades de crecimiento a medida que la tecnología continúa evolucionando.

- Prohibición de productos con envases de plástico en el mercado de Asia y el Pacífico

Ante el aumento de las preocupaciones ambientales en varias regiones, el gobierno ha tomado medidas estrictas para prohibir en el mercado los productos de plástico de un solo uso y los envases no biodegradables, ya que los productos de plástico tardan más en descomponerse y son peligrosos para los animales acuáticos y terrestres.

Por ejemplo,

Natural Environment estima que aproximadamente 100.000 tortugas marinas y otros animales marinos mueren cada año porque se estrangulan en bolsas o las confunden con comida.

En América del Norte, las bolsas de plástico de un solo uso que se utilizan para envasar alimentos y bienes de consumo están prohibidas. Como resultado, la demanda de envases de cartón y de plástico retorcido está aumentando en la región.

Se utilizan varios tipos de envases en diferentes aplicaciones, lo que genera residuos y es muy perjudicial para el medio ambiente. Los envases de plástico se utilizan para envasar bienes de consumo, lo que produce residuos de envases de plástico no biodegradables y libera gases tóxicos en el suelo, lo que es peligroso para los animales y las aguas subterráneas. Por lo tanto, se han tomado medidas para prohibir los envases de bolsas de plástico, ya que son perjudiciales para el medio ambiente.

- Interrupción de la cadena de suministro debido a la pandemia

El COVID-19 ha interrumpido la cadena de suministro y ha reducido los mercados de envases de retorta en todo el mundo. Las interrupciones han provocado retrasos en el stock de los productos, así como un menor acceso y suministro de productos alimenticios y bebidas. Con la persistencia del COVID-19, ha habido restricciones en el transporte, la importación y la exportación de materiales. Además, con la restricción de movimiento de los trabajadores también se ha visto afectada la fabricación de envases de retorta debido a que no se ha satisfecho la demanda de los consumidores. Además, con las restricciones a la importación y exportación, se ha dificultado que los fabricantes suministren las materias primas y sus productos finales en todos los países del mundo, lo que también ha afectado a los precios de los envases de retorta. Por lo tanto, con las restricciones en curso debido al COVID-19, la cadena de suministro de envases de retorta se ha visto interrumpida, lo que está creando un gran desafío para los fabricantes.

Con la persistencia del COVID-19 y las restricciones de movimiento, existe una interrupción en la cadena de suministro que representa un desafío importante para el mercado de envases retortables de Asia y el Pacífico.

Impacto posterior al COVID-19 en el mercado de envases retortables

La COVID-19 ha tenido un gran impacto en el mercado de envases de plástico, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

Debido al brote de la pandemia provocada por el virus, muchos pequeños sectores cerraron y, por otro lado, algunos sectores decidieron despedir a algunos de sus empleados, lo que dio lugar a un importante desempleo. Los envases termosellados también se utilizan en el envasado de productos y en las industrias. Debido al brote de una pandemia, la demanda de dichos productos ha aumentado en cierta medida, especialmente en el sector médico, la atención sanitaria, la industria farmacéutica, la alimentación, el comercio electrónico y varios otros sectores. Pero la demanda inesperada, junto con las capacidades de producción limitadas y las interrupciones de la cadena de suministro, siguen causando dificultades en todas estas industrias.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el envasado en autoclave. Con esto, las empresas traerán al mercado controladores avanzados y precisos. Además, el uso de envases en autoclave por parte de las autoridades gubernamentales en alimentos y bebidas ha impulsado el crecimiento del mercado.

Desarrollo reciente

- En abril de 2022, Berry Global Inc. anunció que todas sus plantas de fabricación de servicios de alimentación en América del Norte habían obtenido la certificación internacional de sostenibilidad y carbono (ISCC) PLUS para respaldar la creciente demanda de sus clientes de América del Norte de envases más sostenibles. Esta certificación ayudó a mejorar la cartera de productos de la empresa.

- En enero de 2022, Floeter prioriza la sostenibilidad; la empresa perfecciona su proceso y sus bolsas para reducir la huella de carbono y ser más eficiente energéticamente. Con las bolsas retortables, Floeter ofrece a las empresas una mayor neutralidad de carbono en los envases en comparación con otras alternativas. Este desarrollo ayudará a fortalecer los envases y también las ganancias. Amplía aún más la cartera de envases de la empresa.

Alcance del mercado de envases de retorta en Asia y el Pacífico

El mercado de envases de retorta está segmentado en función del tipo de producto, el material, el canal de distribución y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Bandejas

- Bolsas

- Cajas de cartón

- Otros

Según el tipo de producto, el mercado de envases retortables de Asia-Pacífico está segmentado en bandejas, bolsas, cartones y otros.

Material

- MASCOTA

- Polipropileno

- Papel de aluminio

- Poliamida (PA)

- Papel y cartón

- EVOH

- Otros

Sobre la base del material, el mercado de envases de retorta de Asia-Pacífico se ha segmentado en PET, polipropileno, papel de aluminio, poliamida (PA), papel y cartón, EVOH y otros.

Canal de distribución

- Desconectado

- En línea

Sobre la base del canal de distribución, el mercado de envases de retorta de Asia-Pacífico se ha segmentado en en línea y fuera de línea.

Uso final

- Alimento

- Bebidas

- Productos farmacéuticos

- Otros

Sobre la base del uso final, el mercado de envases retortables de Asia-Pacífico se ha segmentado en alimentos, bebidas, productos farmacéuticos y otros.

Análisis y perspectivas regionales del mercado de envases retortables

Se analiza el mercado de envases de retorta y se proporcionan información y tendencias del tamaño del mercado por tipo de producto, material, canal de distribución e industria de uso final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de envases de retorta son China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico en Asia-Pacífico (APAC).

China domina el mercado de envases termorretráctiles de Asia-Pacífico. Se prevé que la demanda en esta región se vea impulsada por el aumento de la demanda de envases termorretráctiles en el sector de alimentos y bebidas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los envases termosellados

El panorama competitivo del mercado de envases de retorta proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de envases de retorta.

Algunos de los principales actores que operan en el mercado de envases de retorta son ProAmpac, Coveris, Berry Asia-Pacific Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE ASIA PACIFIC MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 ASIA PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 ASIA PACIFIC RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 ASIA PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 ASIA PACIFIC RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 ASIA PACIFIC RETORT PACKAGING MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 SINGAPORE

10.1.7 INDONESIA

10.1.8 THAILAND

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY ASIA PACIFIC INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 ASIA PACIFIC POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 ASIA PACIFIC POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 ASIA PACIFIC CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 ASIA PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 ASIA PACIFIC PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 ASIA PACIFIC POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 ASIA PACIFIC ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 ASIA PACIFIC POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 ASIA PACIFIC PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 ASIA PACIFIC EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 ASIA PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 ASIA PACIFIC OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 ASIA PACIFIC ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 ASIA PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 ASIA PACIFIC FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 ASIA PACIFIC FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 ASIA PACIFIC BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 ASIA-PACIFIC RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 ASIA-PACIFIC POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 ASIA-PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 ASIA-PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 ASIA-PACIFIC FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 CHINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 CHINA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 CHINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 CHINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CHINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 CHINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 CHINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 CHINA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 CHINA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 JAPAN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 JAPAN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 JAPAN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 JAPAN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 JAPAN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 JAPAN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 SOUTH KOREA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 SOUTH KOREA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 SOUTH KOREA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 SOUTH KOREA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 INDIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 INDIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 INDIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 INDIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 INDIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 INDIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 INDIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 INDIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 INDIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 AUSTRALIA & NEW ZEALAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 AUSTRALIA & NEW ZEALAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA & NEW ZEALAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 116 SINGAPORE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 119 SINGAPORE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 121 SINGAPORE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 123 SINGAPORE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 127 INDONESIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 130 INDONESIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 132 INDONESIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 134 INDONESIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 138 THAILAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 THAILAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 141 THAILAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 THAILAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 143 THAILAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 144 THAILAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 145 THAILAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 THAILAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 149 MALAYSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 152 MALAYSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 154 MALAYSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 156 MALAYSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 158 PHILIPPINES RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 160 PHILIPPINES POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 163 PHILIPPINES RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 165 PHILIPPINES RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 167 PHILIPPINES FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 169 REST OF ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 REST OF ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

Lista de figuras

FIGURE 1 ASIA PACIFIC RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC RETORT PACKAGING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 ASIA PACIFIC RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE ASIA PACIFIC RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF ASIA PACIFIC RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 ASIA PACIFIC RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 ASIA PACIFIC RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 ASIA PACIFIC RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 ASIA PACIFIC RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 ASIA-PACIFIC RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 ASIA PACIFIC RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.