Mercado de ácido fosfórico en Asia-Pacífico, por tipo de proceso (proceso húmedo y proceso térmico), forma (sólido y líquido), grado (grado técnico, grado alimenticio y grado de pienso), aplicación (alimentos y bebidas, piensos para animales, cuidado personal, fabricación de productos químicos, cuero y textiles, agentes de limpieza, cerámica y refractarios, fertilizantes agrícolas, metalurgia, tratamiento de agua, construcción, minería, semiconductores, cuidado bucal y dental, productos farmacéuticos y otros), país (Japón, China, Corea del Sur, India, Australia, Singapur, Taiwán, Hong Kong, Nueva Zelanda, Malasia, Indonesia, Filipinas y resto de Asia-Pacífico) Tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de ácido fosfórico en Asia y el Pacífico

Análisis y perspectivas del mercado: mercado de ácido fosfórico en Asia y el Pacífico

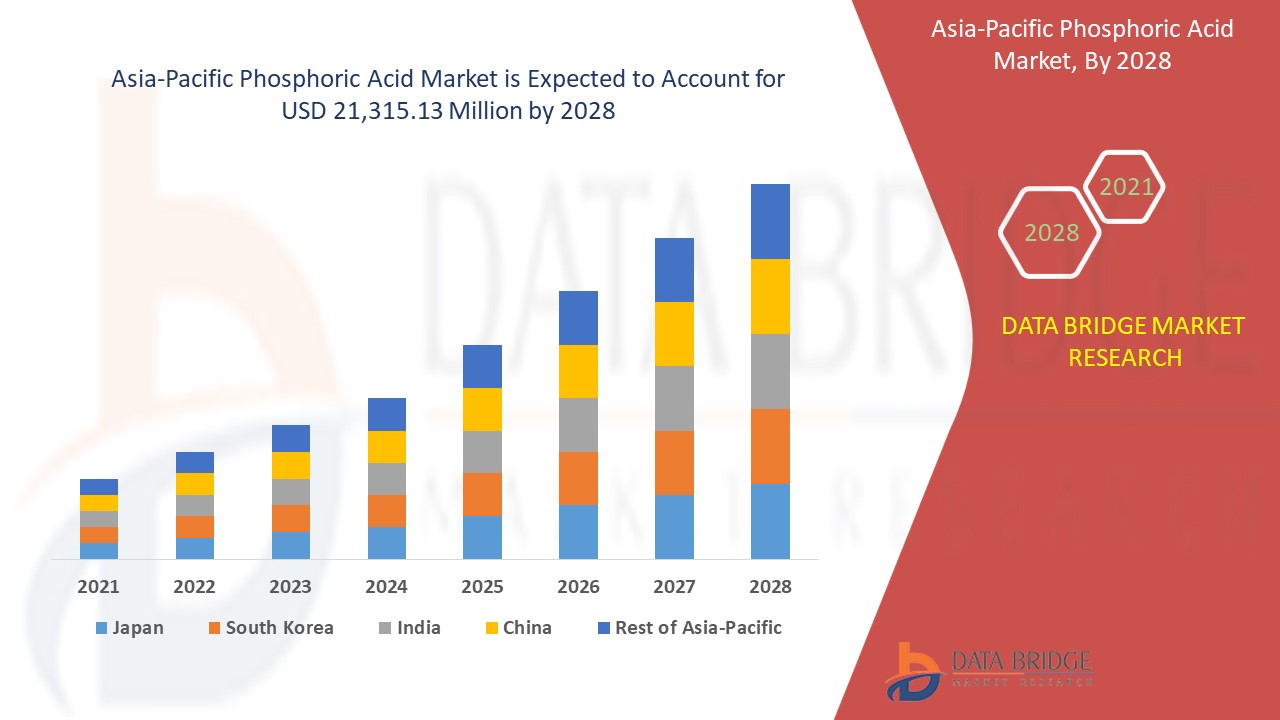

Se espera que el mercado de Asia-Pacífico crezca en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,0% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 21.315,13 millones para 2028. Aumento de la demanda de ácido fosfórico en las industrias de alimentos y bebidas y farmacéutica, lo que impulsa el crecimiento del mercado de ácido fosfórico de Asia-Pacífico.

El ácido fosfórico es un ácido cristalino que generalmente es débil, incoloro e inodoro. Estos materiales inorgánicos son corrosivos para los metales ferrosos y las aleaciones y poseen una buena solubilidad en agua. Estos tienden a descomponerse a altas temperaturas. Pueden formar humos tóxicos cuando se combinan con alcohol. El proceso térmico, el proceso de secado en horno y el proceso húmedo se utilizan para la producción de ácido fosfórico. Le da a los refrescos un sabor ácido y evita el crecimiento de moho y bacterias, que pueden multiplicarse fácilmente en una solución azucarada. La mayor parte de la acidez de los refrescos también proviene del ácido fosfórico.

El ácido fosfórico se elabora a partir del mineral fósforo, que se encuentra de forma natural en el organismo. Trabaja junto con el calcio para formar huesos y dientes fuertes. También ayuda a mantener la función renal y la forma en que el cuerpo utiliza y almacena la energía. El fósforo ayuda a que los músculos se recuperen después de un entrenamiento intenso. El mineral desempeña un papel importante en el crecimiento del cuerpo e incluso es necesario para producir ADN y ARN, los códigos genéticos de los seres vivos.

El fósforo se convierte primero en pentóxido de fósforo mediante un proceso de fabricación química. Luego se trata nuevamente para convertirse en ácido fosfórico.

Los principales factores que se espera que impulsen el crecimiento del mercado de ácido fosfórico de Asia-Pacífico en el período de pronóstico son el uso considerable de ácido fosfórico para la producción de fertilizantes de fosfato. Además, las estrictas regulaciones gubernamentales para el ácido fosfórico están impulsando aún más el mercado de ácido fosfórico de Asia-Pacífico. Por otro lado, se anticipa que la innovación significativa y los lanzamientos de nuevos productos descarrilen el crecimiento del mercado de ácido fosfórico de Asia-Pacífico. Además, la disponibilidad de productos sustitutos podría crear más obstrucciones en el mercado de ácido fosfórico de Asia-Pacífico en el futuro cercano.

El informe del mercado de ácido fosfórico de Asia-Pacífico proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de ácido fosfórico de Asia-Pacífico, comuníquese con Data Bridge Market Research para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado del ácido fosfórico en Asia y el Pacífico

Alcance y tamaño del mercado del ácido fosfórico en Asia y el Pacífico

El mercado de ácido fosfórico de Asia-Pacífico está segmentado en cuatro segmentos importantes que se basan en el tipo de proceso, la forma, el grado y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

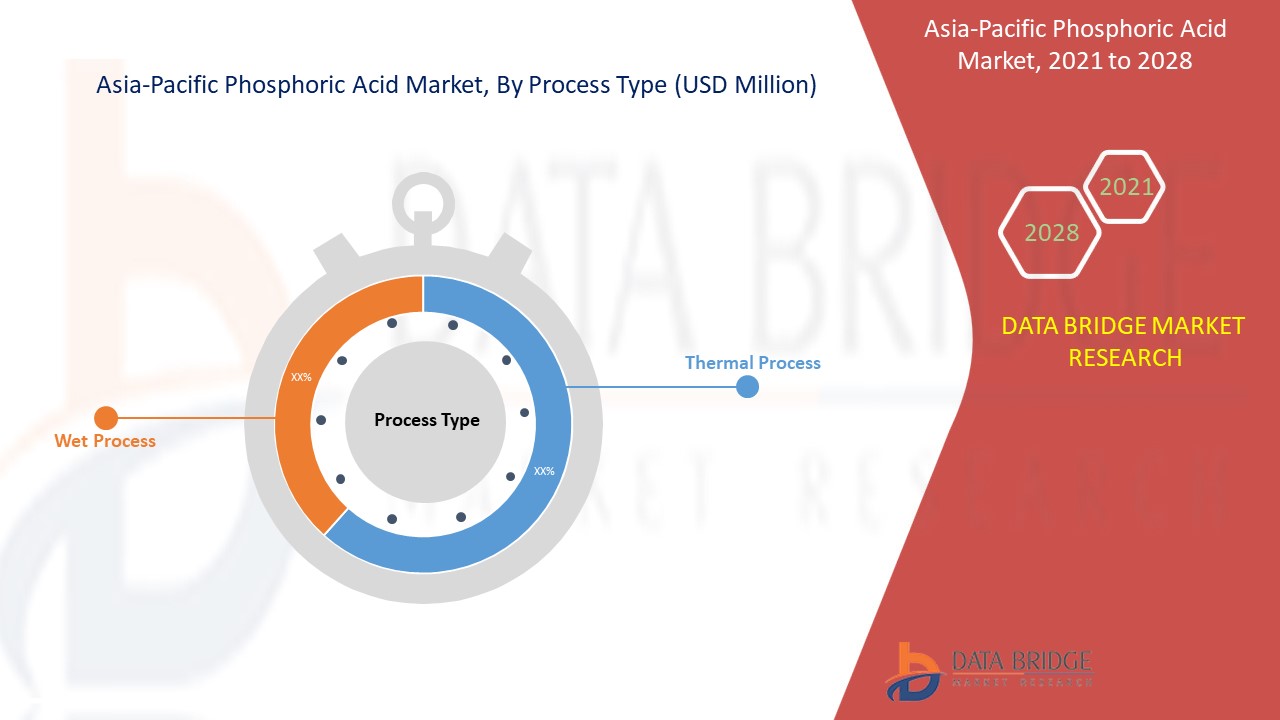

- Según el tipo de proceso, el mercado del ácido fosfórico se segmenta en proceso húmedo y proceso térmico. En 2021, se espera que el segmento de proceso húmedo tenga la mayor participación de mercado, ya que las impurezas del ácido de proceso húmedo promueven el súper enfriamiento y reducen la tendencia a la cristalización.

- En función de la forma, el mercado del ácido fosfórico se segmenta en líquido y sólido . En 2021, el mercado está dominado por la forma líquida debido a su aplicación en diversas aplicaciones industriales y la creciente demanda de forma fosfórica líquida en la industria de alimentos y bebidas.

- En función del grado, el mercado del ácido fosfórico se segmenta en grado alimenticio, grado para piensos y grado técnico . En 2021, el mercado está dominado por el segmento de grado técnico debido a su uso en la producción de STTP (tripolifosfato de sodio), que es un conservante. También se utiliza para la producción de fertilizantes, nutrientes para cultivos, alimentos para animales, etc.

- En función de la aplicación, el mercado del ácido fosfórico se segmenta en alimentos y bebidas, piensos para animales, cuidado personal, fabricación de productos químicos, cuero y textiles, agentes de limpieza, cerámica y refractarios, fertilizantes agrícolas , metalurgia, tratamiento de aguas, construcción, minería, semiconductores, cuidado bucal y dental, productos farmacéuticos y otros. En 2021, el mercado está dominado por el segmento de fertilizantes agrícolas porque la demanda de ácido fosfórico para fertilizantes de fosfato está aumentando en países como India, China y otros debido al aumento de las actividades agrícolas en la región.

- Según el país, el mercado del ácido fosfórico está segmentado en Japón, China, Corea del Sur, India, Australia, Singapur, Nueva Zelanda, Malasia, Taiwán, Hong Kong, Indonesia, Filipinas y el resto de Asia-Pacífico. En 2021, el mercado está dominado por China debido al creciente uso del ácido fosfórico en diferentes industrias.

Análisis a nivel de país del mercado de ácido fosfórico en Asia y el Pacífico

Se analiza el mercado de ácido fosfórico de Asia-Pacífico y se proporciona información sobre el tamaño del mercado por país, tipo de proceso, forma, grado y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de ácido fosfórico de Asia-Pacífico son Japón, India, Australia, Singapur, Malasia, Indonesia, Corea del Sur, Tailandia, Filipinas y el resto de Asia-Pacífico.

Se espera que el segmento de tipo de proceso en la región de Asia-Pacífico crezca a la tasa de crecimiento más alta en el período de pronóstico de 2021 a 2028 debido al creciente uso de ácido fosfórico en el segmento de alimentos y bebidas. El segmento de productos en China domina el mercado de Asia-Pacífico debido al creciente uso de ácido fosfórico en el sector de la atención médica.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre el ácido fosfórico están impulsando el crecimiento del mercado de ácido fosfórico en Asia-Pacífico.

El mercado de ácido fosfórico de Asia-Pacífico también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2019.

Análisis del panorama competitivo y de la cuota de mercado del ácido fosfórico en Asia-Pacífico

El panorama competitivo del mercado de ácido fosfórico de Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de ácido fosfórico de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de ácido fosfórico de Asia-Pacífico son Nutrien Ltd, OCP, JR Simplot Company, Brenntag North America, Inc., Arkema, ICL, Innophos, Spectrum Chemical, Solvay, Merck KGaA, Prayon SA, YPH, Clariant AG, Jordan Phosphate Mines Company (PLC) y Quadra Chemicals, entre otros.

Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchos lanzamientos de productos también son iniciados por empresas de todo el mundo, lo que también acelera el mercado de ácido fosfórico en Asia-Pacífico.

Por ejemplo,

- En septiembre de 2020, Clariant AG lanzó un nuevo e innovador éster de fosfato que ofrece un rendimiento excepcional y una sostenibilidad superior en formulaciones de fluidos para trabajar metales. Este lanzamiento de producto ha ayudado a la empresa a ampliar su cartera de productos.

- En agosto de 2020, OCP puso en marcha la construcción de una nueva planta para la producción de ácido fosfórico purificado, a través de su filial Euro Maroc Phosphore (EMAPHOS). Este lanzamiento ha ayudado a la empresa a aumentar la capacidad de producción de la empresa.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias del actor del mercado mejoran la presencia de la empresa en el mercado de ácido fosfórico de Asia y el Pacífico, lo que también beneficia el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PHOSPHORIC ACID MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL PRICING ANALYSIS

4.2 PRODUCTION AND CONSUMPTION PATTERN

4.2.1 PRODUCTION PATTERN:

4.2.2 CONSUMPTION PATTERN:

4.2.3 CONCLUSION:

4.3 MARKETING STRATEGIES

4.4 LIST OF SUBSTITUTES IN THE MARKET

5 REGULATORY FRAMEWORK

6 PHOSPHORIC ACID MANUFACTURING PROCESS

7 BRAND ANALYSIS

8 COMPARITIVE ANALYSIS WITH PARENT MARKET

9 PRICING ANALYSIS

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 CONSIDERABLE USE OF PHOSPHORIC ACID FOR PRODUCTION OF PHOSPHATE FERTILIZERS

10.1.2 GROWING USAGE OF PHOSPHORIC ACID IN MEDICAL APPLICATIONS

10.1.3 INCREASING USE AS A FOOD ADDITIVE IN THE FOOD & BEVERAGE INDUSTRY

10.1.4 RISING USE IN KEY COMMERCIAL APPLICATIONS

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS FOR PHOSPHORIC ACID

10.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE BASED PRODUCTS

10.2.3 AVAILABILITY OF SUBSTITUTE PRODUCTS

10.3 OPPORTUNITIES

10.3.1 SIGNIFICANT INNOVATION AND NEW PRODUCT LAUNCHES

10.3.2 GROWING USE OF PHOSPHORIC ACID IN FUEL CELLS

10.4 CHALLENGES

10.4.1 GROWING AWARENESS REGARDING THE ENVIRONMENTAL IMPACT OF PHOSPHORIC ACID

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 COVID-19 IMPACT ON THE ASIA PACIFIC PHOSPHORIC ACID MARKET

11.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE ASIA PACIFIC PHOSPHORIC ACID MARKET

11.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

11.3 IMPACT ON PRICE

11.4 IMPACT ON DEMAND

11.5 IMPACT ON SUPPLY CHAIN

11.6 CONCLUSION

12 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE

12.1 OVERVIEW

12.2 WET PROCESS

12.3 THERMAL PROCESS

13 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY GRADE

13.1 OVERVIEW

13.2 TECHNICAL GRADE

13.3 FOOD GRADE

13.4 FEED GRADE

14 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY FORM

14.1 OVERVIEW

14.2 LIQUID

14.3 SOLID (CRYSTAL SOLID)

15 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 AGRICULTURE FERTILIZERS

15.3 FOOD & BEVERAGES

15.3.1 BEVERAGES

15.3.1.1 BEVERAGES

15.3.1.2 FRUIT JUICE

15.3.1.3 OTHERS

15.3.2 DAIRY PRODUCTS

15.3.2.1 CHEESE

15.3.2.2 MAYONNAISE

15.3.2.3 OTHERS

15.3.3 BAKERY PRODUCTS

15.3.4 CANNED FOOD

15.3.5 EDIBLE OIL

15.3.6 SAUCES

15.3.7 JAMES, JELLIES

15.3.8 SUGAR

15.3.9 OTHERS

15.4 ANIMAL FEED

15.5 CHEMICAL MANUFACTURING

15.5.1 PHOSPHORIC ACID LINE CLEANERS

15.5.2 METAL PHOSPHATING SOLUTION

15.5.3 ALUMINUM BRIGHT DIP SOLUTION

15.5.4 TRANSITION METAL PHOSPHATE SALT

15.6 PHARMACEUTICAL

15.7 PERSONAL CARE

15.7.1 SOAP

15.7.2 PERFUMES

15.7.3 SHAMPOO

15.7.4 NAIL PAINTS

15.7.5 CLEANERS

15.7.6 CREAMS

15.7.7 OTHERS

15.8 MINING

15.9 CLEANING AGENTS

15.9.1 FOOD PROCESSING CLEANING AGENTS

15.9.2 LAUNDRY CLEANING AGENTS

15.9.3 HOUSEHOLD CLEANING AGENTS

15.9.4 TRANSPORTATION CLEANING AGENTS

15.9.5 OTHERS

15.1 ORAL & DENTAL CARE

15.10.1 ABRASIVE

15.10.2 MOUTHWASHES

15.10.3 WHITENING & SENSITIVE TEETH

15.10.4 TARTAR CONTROL

15.11 WATER TREATMENT

15.12 SEMICONDUCTORS

15.13 LEATHER & TEXTILE

15.14 CONSTRUCTION

15.15 METALLURGY

15.16 CERAMIC & REFRACTORIES

15.17 OTHERS

16 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 INDIA

16.1.3 JAPAN

16.1.4 SOUTH KOREA

16.1.5 AUSTRALIA AND NEW ZEALAND

16.1.6 SINGAPORE

16.1.7 THAILAND

16.1.8 INDONESIA

16.1.9 MALAYSIA

16.1.10 PHILIPPINES

16.1.11 TAIWAN

16.1.12 HONG KONG

16.1.13 REST OF ASIA-PACIFIC

17 ASIA PACIFIC PHOSPHORIC ACID MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17.2 MERGER & ACQUISITION

17.3 EXPANSION

17.4 NEW PRODUCT DEVELOPMENTS

17.5 PRESENTATIONS

17.6 AGREEMENTS

17.7 AWARDS AND CERTIFICATIONS

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 OCP

19.1.1 COMPANY SNAPSHOT

19.1.2 COMPANY SHARE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 ICL

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 NUTRIEN LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 BRENNTAG SE

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MERCK KGAA

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUS ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 JORDAN PHOSPHATE MINES COMPANY (PLC).

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUS ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 ARKEMA

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 CLARIANT AG

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUS ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 INNOPHOS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 J.R. SIMPLOT COMPANY.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 PRAYON S.A.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 QUADRA CHEMICALS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 SOLVAY

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENT

19.14 SPECTRUM CHEMICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 YPH

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 2 EXPORT DATA OF PRODUCT: 2809 DIPHOSPHORUS PENTAOXIDE; PHOSPHORIC ACID; POLYPHOSPHORIC ACIDS, WHETHER OR NOT CHEMICALLY DEFINED

TABLE 3 WORLD PRODUCTION/SUPPLY OF PHOSPHORIC ACID (2015 – 2020)

TABLE 4 WORLD CONSUMPTION OF PHOSPHORIC ACID (2019 – 2022)

TABLE 5 REGULATORY FRAMEWORK

TABLE 6 AVERAGE PRICE OF PHOSPHORIC ACID (2020-2022)

TABLE 7 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 8 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (TONS)

TABLE 9 ASIA PACIFIC WET PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 ASIA PACIFIC THERMAL PROCESS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 12 ASIA PACIFIC TECHNICAL GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 ASIA PACIFIC FOOD GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 ASIA PACIFIC FEED GRADE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 16 ASIA PACIFIC LIQUID IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 ASIA PACIFIC SOLID (CRYSTAL SOLID) IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 ASIA PACIFIC PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 ASIA PACIFIC AGRICULTURE FERTILIZERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 ASIA PACIFIC FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 ASIA PACIFIC FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 ASIA PACIFIC BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 23 ASIA PACIFIC DAIRY PRODUCT IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 ASIA PACIFIC ANIMAL FEED IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 ASIA PACIFIC CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 ASIA PACIFIC CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 27 ASIA PACIFIC PHARMACEUTICAL IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 ASIA PACIFIC PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 ASIA PACIFIC PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 ASIA PACIFIC MINING IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 ASIA PACIFIC CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 ASIA PACIFIC CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 33 ASIA PACIFIC ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 ASIA PACIFIC ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 ASIA PACIFIC WATER TREATMENT IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 ASIA PACIFIC SEMICONDUCTORS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 ASIA PACIFIC LEATHER & TEXTILE IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 ASIA PACIFIC CONSTRUCTION IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 ASIA PACIFIC METALLURGY IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 ASIA PACIFIC CERAMIC & REFRACTORIES IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 ASIA PACIFIC OTHERS IN PHOSPHORIC ACID MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 43 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY COUNTRY, 2019-2028 (THOUSAND METRIC TONS)

TABLE 44 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 45 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 46 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 47 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 ASIA-PACIFIC FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 52 ASIA-PACIFIC PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 53 ASIA-PACIFIC CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 ASIA-PACIFIC CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 ASIA-PACIFIC ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 CHINA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 57 CHINA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 58 CHINA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 59 CHINA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 60 CHINA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 CHINA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 CHINA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 CHINA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 CHINA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 CHINA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 CHINA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 CHINA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 INDIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 69 INDIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 70 INDIA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 71 INDIA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 72 INDIA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 INDIA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 INDIA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 INDIA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 INDIA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 INDIA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 78 INDIA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 INDIA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 80 JAPAN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 81 JAPAN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 82 JAPAN PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 83 JAPAN PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 84 JAPAN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 JAPAN FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 JAPAN DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 87 JAPAN BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 88 JAPAN PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 89 JAPAN CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 90 JAPAN CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 JAPAN ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 SOUTH KOREA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 93 SOUTH KOREA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 94 SOUTH KOREA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 95 SOUTH KOREA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 96 SOUTH KOREA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 97 SOUTH KOREA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 98 SOUTH KOREA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 SOUTH KOREA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 100 SOUTH KOREA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 101 SOUTH KOREA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 102 SOUTH KOREA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 103 SOUTH KOREA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 104 AUSTRALIA AND NEW ZEALAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 105 AUSTRALIA AND NEW ZEALAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 106 AUSTRALIA AND NEW ZEALAND PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 107 AUSTRALIA AND NEW ZEALAND PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 108 AUSTRALIA AND NEW ZEALAND PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 AUSTRALIA AND NEW ZEALAND FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 110 AUSTRALIA AND NEW ZEALAND DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 AUSTRALIA AND NEW ZEALAND BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 AUSTRALIA AND NEW ZEALAND PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 113 AUSTRALIA AND NEW ZEALAND CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 114 AUSTRALIA AND NEW ZEALAND CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 AUSTRALIA AND NEW ZEALAND ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 SINGAPORE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 117 SINGAPORE PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 118 SINGAPORE PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 119 SINGAPORE PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 120 SINGAPORE PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 121 SINGAPORE FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 SINGAPORE DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 123 SINGAPORE BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 SINGAPORE PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 SINGAPORE CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 SINGAPORE CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 127 SINGAPORE ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 128 THAILAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 129 THAILAND PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 130 THAILAND PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 131 THAILAND PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 132 THAILAND PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 133 THAILAND FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 134 THAILAND DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 135 THAILAND BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 136 THAILAND PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 137 THAILAND CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 138 THAILAND CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 139 THAILAND ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 140 INDONESIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 141 INDONESIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 142 INDONESIA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 143 INDONESIA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 144 INDONESIA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 INDONESIA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 146 INDONESIA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 147 INDONESIA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 148 INDONESIA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 149 INDONESIA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 150 INDONESIA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 151 INDONESIA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 152 MALAYSIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 153 MALAYSIA PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 154 MALAYSIA PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 155 MALAYSIA PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 156 MALAYSIA PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 157 MALAYSIA FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 158 MALAYSIA DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 159 MALAYSIA BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 160 MALAYSIA PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 161 MALAYSIA CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 162 MALAYSIA CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 163 MALAYSIA ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 164 PHILIPPINES PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 165 PHILIPPINES PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 166 PHILIPPINES PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 167 PHILIPPINES PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 168 PHILIPPINES PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 169 PHILIPPINES FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 170 PHILIPPINES DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 171 PHILIPPINES BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 172 PHILIPPINES PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 173 PHILIPPINES CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 174 PHILIPPINES CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 175 PHILIPPINES ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 176 TAIWAN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 177 TAIWAN PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 178 TAIWAN PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 179 TAIWAN PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 180 TAIWAN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 181 TAIWAN FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 182 TAIWAN DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 183 TAIWAN BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 184 TAIWAN PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 185 TAIWAN CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 186 TAIWAN CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 187 TAIWAN ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 188 HONG KONG PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 189 HONG KONG PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

TABLE 190 HONG KONG PHOSPHORIC ACID MARKET, BY GRADE, 2019-2028 (USD MILLION)

TABLE 191 HONG KONG PHOSPHORIC ACID MARKET, BY FORM, 2019-2028 (USD MILLION)

TABLE 192 HONG KONG PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 193 HONG KONG FOOD & BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 194 HONG KONG DAIRY PRODUCTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 195 HONG KONG BEVERAGES IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 196 HONG KONG PERSONAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 197 HONG KONG CHEMICAL MANUFACTURING IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 198 HONG KONG CLEANING AGENTS IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 199 HONG KONG ORAL & DENTAL CARE IN PHOSPHORIC ACID MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 200 REST OF ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (USD MILLION)

TABLE 201 REST OF ASIA-PACIFIC PHOSPHORIC ACID MARKET, BY PROCESS TYPE, 2019-2028 (THOUSAND METRIC TONS)

Lista de figuras

FIGURE 1 ASIA PACIFIC PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHOSPHORIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHOSPHORIC ACID MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHOSPHORIC ACID MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHOSPHORIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHOSPHORIC ACID MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC PHOSPHORIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PHOSPHORIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PHOSPHORIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PHOSPHORIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHOSPHORIC ACID MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC PHOSPHORIC ACID: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC PHOSPHORIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE ASIA PACIFIC PHOSPHORIC ACID MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 CONSIDERABLE USE OF PHOSPHORIC ACID FOR THE PRODUCTION OF PHOSPHATE FERTILIZERSIS DRIVING THE GROWTH OF THE ASIA PACIFIC PHOSPHORIC ACID MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 16 WET PROCESS SUB-SEGMENT IN PROCESS TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHOSPHORIC ACID MARKET IN 2021 & 2028

FIGURE 17 FIG: AVERAGE PRICE OF PHOSPHATE ROCK FROM FEB 2021-SEPT-2021 (PER METRIC TON)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF ASIA PACIFIC PHOSPHORIC ACID MARKET

FIGURE 19 ASIA PACIFIC PHOSPHORIC ACID MARKET: BY PROCESS TYPE, 2020

FIGURE 20 ASIA PACIFIC PHOSPHORIC ACID MARKET: BY GRADE, 2020

FIGURE 21 ASIA PACIFIC PHOSPHORIC ACID MARKET: BY FORM, 2020

FIGURE 22 ASIA PACIFIC PHOSPHORIC ACID MARKET: BY APPLICATION, 2020

FIGURE 23 ASIA-PACIFIC PHOSPHORIC ACID MARKET: SNAPSHOT (2020)

FIGURE 24 ASIA-PACIFIC PHOSPHORIC ACID MARKET: BY COUNTRY (2020)

FIGURE 25 ASIA-PACIFIC PHOSPHORIC ACID MARKET: BY COUNTRY (2021 & 2028)

FIGURE 26 ASIA-PACIFIC PHOSPHORIC ACID MARKET: BY COUNTRY (2020 & 2028)

FIGURE 27 ASIA-PACIFIC PHOSPHORIC ACID MARKET: BY PROCESS TYPE (2021 & 2028)

FIGURE 28 ASIA PACIFIC PHOSPHORIC ACID MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.