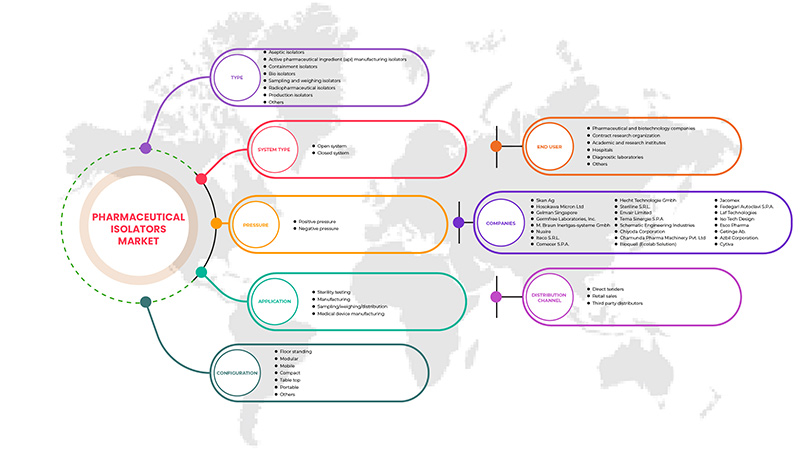

Mercado de aisladores farmacéuticos de Asia y el Pacífico, por tipo (aisladores asépticos, aisladores de contención, aisladores biológicos, aisladores de muestreo y pesaje, aisladores de fabricación de ingredientes farmacéuticos activos (API), aisladores radiofarmacéuticos, aisladores de producción, otros), tipo de sistema (sistema cerrado, sistema abierto), presión (presión positiva, presión negativa), configuración (de suelo, modular, móvil, compacto, de sobremesa, portátil, otros), aplicación ( pruebas de esterilidad , fabricación, muestreo/pesaje/distribución, fabricación de dispositivos médicos), usuario final (hospitales, laboratorios de diagnóstico, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, organizaciones de investigación por contrato, otros), canal de distribución (licitación directa, ventas minoristas, distribuidores externos), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de aisladores farmacéuticos de Asia y el Pacífico

Los aisladores farmacéuticos se utilizan en la industria farmacéutica como un sistema de barrera libre de contaminación. Las pruebas microbiológicas, el procesamiento de terapia celular, la fabricación farmacéutica avanzada (ATMP) y el pesaje, envasado y distribución de productos inyectables estériles son solo algunas de las aplicaciones de los aisladores farmacéuticos. El uso de aisladores farmacéuticos se ve impulsado por el crecimiento continuo del mercado farmacéutico en los países en desarrollo y desarrollados y el aumento de los gastos de I+D para producir tratamientos innovadores. Los aisladores médicos avanzados y los requisitos de la industria farmacéutica han llevado a los principales fabricantes a hacer crecer la industria de aisladores médicos. El uso creciente de compuestos peligrosos, el aumento del costo del incumplimiento y el aumento de los laboratorios de investigación son factores importantes que impulsan el mercado de aisladores farmacéuticos durante el período de pronóstico.

Sin embargo, la mayoría de los expertos no están de acuerdo en que las entidades reguladoras ya no impidan avances como el desarrollo de aislantes farmacéuticos.

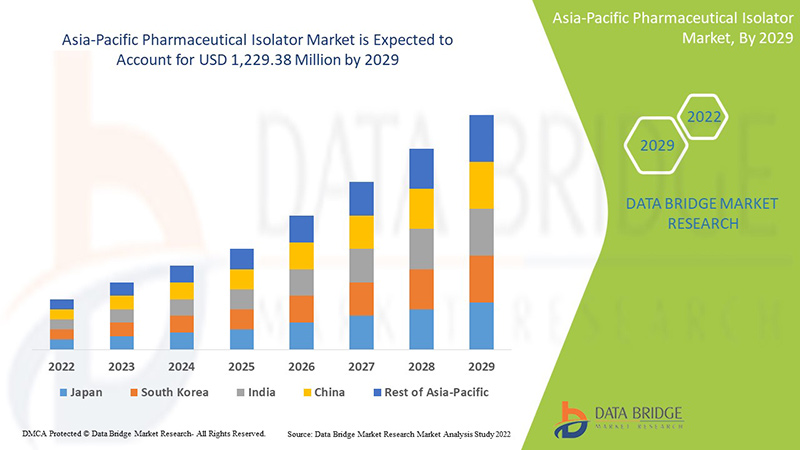

Data Bridge Market Research analiza que se espera que el mercado de aisladores farmacéuticos de Asia-Pacífico alcance un valor de USD 1229,38 millones para 2029, con una CAGR del 15,7 % durante el período de pronóstico. El tipo representa el segmento de tipo más grande en el mercado debido a la rápida demanda de aisladores farmacéuticos a nivel mundial. Este informe de mercado también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others), System Type (Closed System, Open System), Pressure (Positive Pressure, Negative Pressure), Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others), Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing), End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors). |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia and rest of Asia-Pacific. |

|

Market Players Covered |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma among others. |

Asia-Pacific Pharmaceutical Isolator Market Definition

The isolation concept protects the process from the operator and or the operator from the process, while protecting the environment. The key to containment, is minimal exposure. By controlling the exposure range below the hazard level set for the compound, the Operator and the environment are properly protected. Hence, the product is protected and therefore a key regulatory issue is addressed. A pharmaceutical isolator is a sealed bacterial enclosure used in the pharmaceutical surrounding for aseptic filling and toxic process. It is made of a perfectly sterile main isolator where the products are handled, stored or packaged using shoulder-high gloves placed on one of the walls. The pharmaceutical isolator enables the control and containment of pharmaceutical processes. The conditions required for working of a pharmaceutical isolator are sterile environment and free of viable microorganisms. A pharmaceutical isolator ensures that production area and aseptic environment are placed in separate positions. A pharmaceutical industry isolator is cost effective and efficient, in comparison to cleanrooms for the pharmaceutical industry in an aseptic environment. It creates a controlled atmosphere during the microbial and drug production process by adjusting with the different standards certification standard required for isolators and restricted access barriers. It ensures the protection of the product, the operators and the environment at the same time.

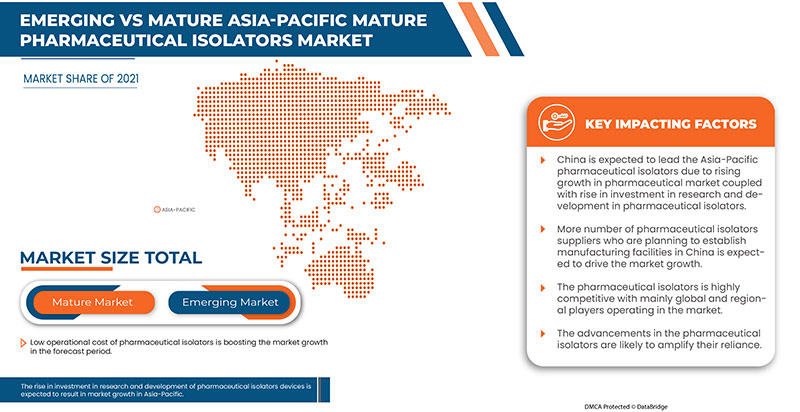

The abundant applications of pharmaceutical isolators, vary for production and control purposes. It is used while handling, transferring or packing solid semi-solid or powder pharma drugs, handling and filing solutions and infusions. The pharmaceutical isolators are applied in sterility testing, aseptic handling of tissues or biological production systems or pathogenic samples, etc. It can be used for the production and control of drugs and pharmaceutical products. The surge in demand for the isolators across pharmaceutical and biotechnology industry, along with low operational cost, high maintenance of aseptic condition in the production of pharmaceutical products and growing demand of biopharmaceutical industry are the factors expected to drive the market growth, in the forecast period.

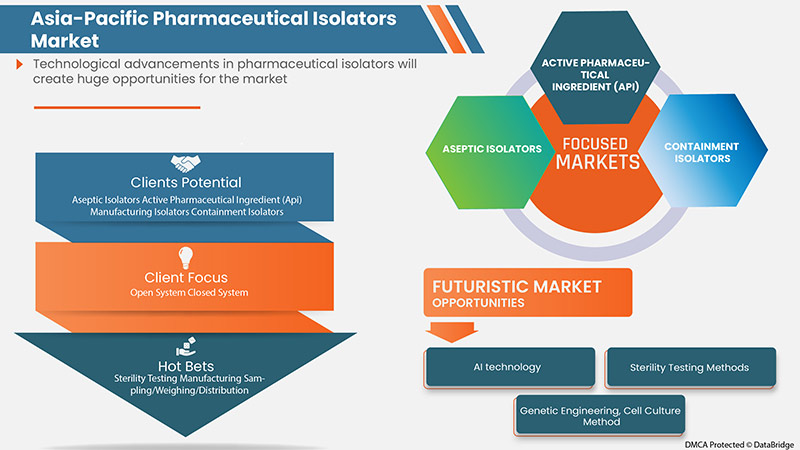

Also, strategic initiatives by market players, technological progressions in pharmaceutical isolators, high sterility assurance and increasing investment for healthcare infrastructure increase the growth of the pharmaceutical isolators market.

Asia-Pacific Pharmaceutical Isolator Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

Growing demand for the pharmaceutical isolators across booming pharmaceutical

Pharmaceutical isolator is a separative device that divides a pharmaceutical procedure or activity from the operator and the adjacent environment. It is used for various purposes such as:

- Providing a categorized aseptic environment for an activity or procedure and guarding it from microbial and non-microbial contamination rising from the operator and adjacent environment which is referred to product protection.

- Protective product from contamination produced by other product and procedure, moreover at the same time or during earlier operations. This is referred to as safeguard against method generated contamination or cross- contamination.

The Increasing contamination problems in the manufacturing unit in which comes isolator that create a demand for Pharmaceutical isolator that helps in contamination and de-contamination.

- Low operational cost of pharmaceutical isolators

Enclosures that are sealed to some standard of leak tightness that comprises inside qualified controlled environment, at modification with the surrounding conditions isolator application reaches from R&D by the production of pharmaceuticals to laboratory use, especially for the microbiological quality control. Whereas pharmaceutical aseptic production has extremely high standards of cleanness almost completely particle free and germ free environments for the aseptic production.

Due to growth in the pharma industry and the widening product range more and more manufacturers and suppliers needs to think about investments in latest added technologies of the clean room technology.

Aseptic processing of the pharmaceutical drugs is the major factor need to be included in good manufacturing practices meeting the government regulations. The high cost of the maintenance of the aseptic condition by clean room technology which is around 62% higher than the pharmaceutical isolators, shifting the manufacturers to acquire isolator’s technology and constraining the overall manufacturing cost of the pharmaceutical products.

Restraint

Stringent governmental regulations

Active Pharmaceutical Ingredients (API) and intermediates for pharmaceutical use (for instance biological, radiopharmaceutical, and pharmaceutical) and those used to production drugs for clinical trials are regulated under the Divisions 1A and 2, Part C of the Food and Drug Regulations.

- Division 1A, Part C of the Food and Drug Regulations describes activities for which Good Manufacturing Practices (GMP) compliance is required and must be demonstrated prior to the issuance of an API establishment license (EL).

- Division 2, Part C of the Food and Drug Regulations defines the requirements for the GMP of APIs and API intermediates, which are interpreted in the present guidance document.

Due to this strict regulation by the government that has to be followed for the production by the Good Manufacturing Practices (GMP) Guidelines for Active Pharmaceutical Ingredients (API) - (GUI-0104) which constraining the market growth rate.

Opportunity

-

Strategic initiatives by market players

The rise in the pharmaceutical isolators market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for excipient and to cope with this demand companies are building new manufacturing sites among other strategic initiatives.

These strategic initiatives such as product launches, agreement and business expansion by the major market player will boost the pharmaceutical isolators market growth and is expected to act as an opportunity for the Asia-Pacific medical display market.

Challenge

Lack of skilled expertise

The shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the people who are unemployed in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to lack of expertise.

Lack of skilled professionals while handling the pharmaceutical isolators poses a major challenge while selecting and developing the pharmaceutical isolators. The data by the Phys.org 2003 mentions the medical display industries are facing a shortage of workers due to increase demand of pharmaceutical isolators in Asia-Pacific region and severe scarcity of micro chips used in LED and LCD display, which increases the price lead times of LCD production.

As skill demands are too high, it has manifested as a challenge to retain and manage skill-specified professionals. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Neurologists report significant unmet supportive care needs and barriers in their centers with only a small minority rating themselves as competently providing supportive care. There is an urgent need for education of neurologists and professionals for treatment of dementia and procuring available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. It is therefore apparent that availability of professionals equipped with adequate skills is expected to challenge the market growth.

Post-COVID-19 Impact on Asia-Pacific Pharmaceutical Isolator Market

The COVID-19 pandemic has become the world's most serious threat. It wreaked havoc in many stores and businesses around the world. The pandemic, on the other hand, has provided many opportunities for pharmaceutical and biopharmaceutical companies to expand their research and development activities to develop new vaccines against the new coronavirus. Companies are conducting clinical trials to try to stop the spread of the COVID-19 virus. Pharmaceutical insulator suppliers to biopharmaceutical organizations have more opportunities as the number of clinical trials increases.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pharmaceutical medical display market.

Recent Developments

- In June 2022, the company announced a partnership with Medical Supply Company (MSC) to market and service Jacomex equipment to the pharmaceutical and pharmaceutical industries in Ireland. MSC has many years of recognized expertise in the market with field teams closest to customers and company’s commercial team currently working abroad had the pleasure of welcoming Cian Murphy and finalizing the agreement between Jacomex and MSC. The beginning of a long and fruitful collaboration. This has helped the company to expand their business.

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and positron emission tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

Asia-Pacific Pharmaceutical isolator market Scope

El mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado por tipo, presión, aplicación, configuración, tipo de sistema, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR TIPO

- AISLADORES ASÉPTICOS

- AISLADORES DE CONTENCIÓN

- BIO AISLADORES

- AISLADORES DE MUESTREO Y PESAJE

- AISLADORES PARA FABRICACIÓN DE INGREDIENTE FARMACÉUTICO ACTIVO (API)

- AISLADORES RADIOFARMACÉUTICOS

- AISLADORES DE PRODUCCIÓN

- OTROS

Según el tipo, el mercado de aisladores farmacéuticos de Asia y el Pacífico está segmentado en aisladores asépticos, aisladores de contención, aisladores biológicos, aisladores de muestreo y pesaje, aisladores de fabricación de ingredientes farmacéuticos activos (API), aisladores radiofarmacéuticos, aisladores de producción y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR TIPO DE SISTEMA

- Sistema cerrado

- SISTEMA ABIERTO

Sobre la base del tipo de sistema, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en sistema cerrado y sistema abierto.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA-PACÍFICO, POR PRESIÓN

- PRESIÓN POSITIVA

- PRESIÓN NEGATIVA

Sobre la base de la presión, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en presión positiva y presión negativa.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR CONFIGURACIÓN

- DE PIE

- MODULAR

- MÓVIL

- COMPACTO

- TABLERO DE MESA

- PORTÁTIL

- OTROS

Sobre la base de la configuración, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en aisladores de suelo, modulares, móviles, compactos, de sobremesa, portátiles y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR APLICACIÓN

- PRUEBA DE ESTERILIDAD

- FABRICACIÓN

- MUESTREO/ PESAJE/ DISTRIBUCIÓN

- FABRICACIÓN DE DISPOSITIVOS MÉDICOS

- OTROS

Sobre la base de la aplicación, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en pruebas de esterilidad, fabricación, muestreo/pesaje/distribución, fabricación de dispositivos médicos y otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR USUARIO FINAL

- HOSPITALES

- LABORATORIOS DE DIAGNÓSTICO

- INSTITUTOS ACADÉMICOS Y DE INVESTIGACIÓN

- EMPRESAS FARMACÉUTICAS Y BIOTECNOLÓGICAS

- ORGANIZACIONES DE INVESTIGACIÓN POR CONTRATO

- OTROS

Sobre la base del usuario final, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en hospitales, laboratorios de diagnóstico, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, organizaciones de investigación por contrato, otros.

MERCADO DE AISLADORES FARMACÉUTICOS DE ASIA Y EL PACÍFICO, POR CANAL DE DISTRIBUCIÓN

- LICITACIÓN DIRECTA

- VENTAS AL POR MENOR

- DISTRIBUIDORES DE TERCEROS

Sobre la base del canal de distribución, el mercado de aisladores farmacéuticos de Asia-Pacífico está segmentado en licitación directa, ventas minoristas y distribuidores externos.

Análisis y perspectivas regionales del mercado de aisladores farmacéuticos de Asia y el Pacífico

Se analiza el mercado de aisladores farmacéuticos de Asia-Pacífico y se proporciona información sobre el tamaño del mercado: tipo, presión, aplicación, configuración, tipo de sistema, usuario final y canal de distribución.

Los países que cubre este informe de mercado son China, Japón, India, Corea del Sur, Singapur, Tailandia, Malasia, Australia, Filipinas, Indonesia y el resto de Asia-Pacífico. En 2022, China dominará debido al aumento de las inversiones en I+D.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de Asia-Pacífico y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de aisladores farmacéuticos en Asia-Pacífico

El panorama competitivo del mercado de aisladores farmacéuticos de Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de aisladores farmacéuticos de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de aisladores farmacéuticos de Asia y el Pacífico son Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Metodología de investigación: mercado de aisladores farmacéuticos en Asia y el Pacífico

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Asia-Pacífico frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 CHINA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CHINA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CHINA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 JAPAN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 JAPAN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 JAPAN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 JAPAN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 101 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 INDIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 INDIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 INDIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 INDIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 THAILAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 THAILAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 THAILAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 INDONESIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 PHILIPPINES DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 REST OF ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.