Asia Pacific Oil Refining Catalyst Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.37 Billion

USD

4.95 Billion

2024

2032

USD

3.37 Billion

USD

4.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 4.95 Billion | |

|

|

|

|

Segmentación del mercado de catalizadores para refinación de petróleo en Asia Pacífico, por tipo (hidrotratamiento, craqueo catalítico fluidizado (FCC), craqueo catalítico fluidizado de residuos (RFCC), hidrocraqueo y otros), catalizador (zeolitas, metales y productos químicos ), canal de distribución (ventas directas/B2B, distribuidores/comerciantes/distribuidores externos, comercio electrónico y otros), aplicación (diésel, queroseno, desparafinado de destilados y otros): tendencias del sector y previsiones hasta 2032.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de catalizadores para refinación de petróleo en la región Asia-Pacífico?

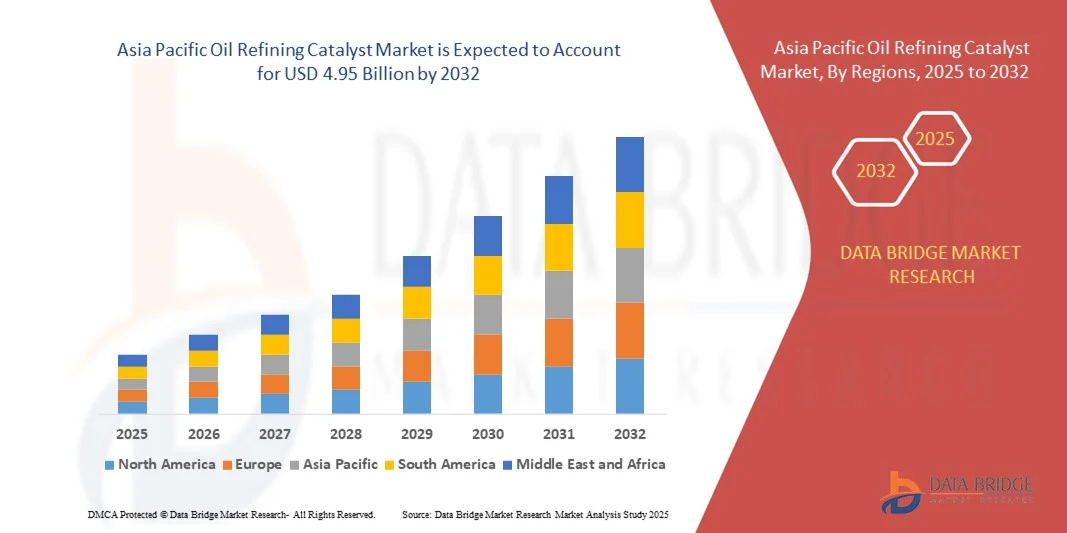

- El tamaño del mercado de catalizadores para refinación de petróleo en Asia Pacífico se valoró en 3.370 millones de dólares en 2024 y se espera que alcance los 4.950 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 4,9% durante el período de pronóstico.

- El crecimiento se debe principalmente al aumento de la urbanización, los cambios en los hábitos alimentarios y la creciente conciencia sobre la salud en economías emergentes como China, Japón e India.

- El creciente uso de edulcorantes bajos en calorías en alimentos y bebidas, junto con la expansión de sus aplicaciones en productos farmacéuticos y de cuidado personal, está impulsando aún más la demanda del mercado.

¿Cuáles son las principales conclusiones del mercado de catalizadores para la refinación de petróleo?

- La creciente demanda de productos sin azúcar, la mayor prevalencia de enfermedades relacionadas con el estilo de vida, como la diabetes y la obesidad, y la expansión de los esfuerzos de investigación y desarrollo de edulcorantes artificiales avanzados son factores clave para el crecimiento del mercado.

- Sin embargo, se prevé que las preocupaciones sanitarias relacionadas con los edulcorantes artificiales, las estrictas normas regulatorias y la disponibilidad de sustitutos naturales como la estevia supongan retos para la expansión del mercado durante el período de previsión.

- En 2024, China dominó el mercado de catalizadores para refinación de petróleo en la región Asia-Pacífico, con la mayor cuota de ingresos (46,3%), impulsada por la fuerte demanda interna de envases para bebidas, alimentos y productos farmacéuticos.

- Se prevé que el mercado indio de catalizadores para la refinación de petróleo experimente el mayor crecimiento anual compuesto (CAGR) del 8,58%, impulsado por el aumento del consumo de bebidas, alimentos y productos farmacéuticos tanto en zonas urbanas como rurales. Los incentivos gubernamentales para la fabricación, el reciclaje y la producción sostenible están acelerando la adopción de estas tecnologías en el mercado.

- El segmento de craqueo catalítico fluidizado (FCC) dominó el mercado en 2024, representando una cuota de mercado del 42,6%, impulsado por su uso generalizado en la conversión de fracciones de crudo pesado en productos más ligeros y de alto valor, como gasolina y olefinas.

Alcance del informe y segmentación del mercado de catalizadores para la refinación de petróleo

|

Atributos |

Información clave del mercado de catalizadores para la refinación de petróleo |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de cuota de mercado de marcas, encuestas a consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la principal tendencia en el mercado de catalizadores para la refinación de petróleo?

Transición hacia catalizadores sostenibles y de alto rendimiento

- Una tendencia clave que está configurando el mercado de catalizadores para la refinación de petróleo es la transición hacia tecnologías de catalizadores sostenibles, energéticamente eficientes y de alto rendimiento, destinadas a mejorar la eficiencia de la refinación y minimizar las emisiones de carbono. Este cambio se debe en gran medida a las estrictas regulaciones ambientales y al movimiento global hacia combustibles más limpios.

- Los fabricantes están invirtiendo en catalizadores de última generación con actividad, selectividad y capacidad de regeneración mejoradas para reducir los residuos y optimizar el rendimiento del combustible.

- Además, los catalizadores de base biológica y nanoestructurados están adquiriendo mayor relevancia, ya que ofrecen una mayor estabilidad y una menor dependencia de materias primas no renovables.

- Un ejemplo destacado es BASF SE (Alemania), que lanzó su plataforma de catalizadores FortiForm en 2024, diseñada para aumentar el rendimiento de las refinerías y reducir las emisiones de CO₂.

- Este cambio continuo hacia la sostenibilidad y la eficiencia operativa está transformando el panorama de la refinación, lo que impulsa a las empresas a invertir en I+D para catalizadores que cumplan con los objetivos tanto económicos como ambientales.

¿Cuáles son los principales impulsores del mercado de catalizadores para la refinación de petróleo?

- La creciente demanda de combustibles más limpios, junto con las estrictas normas de emisiones impuestas por los gobiernos, impulsa significativamente el mercado de catalizadores para la refinación de petróleo. Los catalizadores son esenciales para producir combustibles con bajo contenido de azufre y mejorar el rendimiento general de las refinerías.

- Por ejemplo, en febrero de 2024, Exxon Mobil Corporation (EE. UU.) amplió sus instalaciones de I+D de catalizadores de refinación para acelerar el desarrollo de catalizadores de hidroprocesamiento más eficientes.

- El creciente consumo de gasolina, diésel y combustible para aviones en economías emergentes como India y China está impulsando aún más la demanda.

- Además, las refinerías se están modernizando para cumplir con las normas de azufre de la Organización Marítima Internacional (OMI) de 2020, lo que ha impulsado importantes mejoras en los catalizadores a nivel mundial.

- Estos avances, en conjunto, fomentan la innovación tecnológica, la optimización de las refinerías y la producción sostenible de combustibles, impulsando así el mercado mundial de catalizadores para la refinación de petróleo.

¿Qué factor está frenando el crecimiento del mercado de catalizadores para la refinación de petróleo?

- El elevado coste del desarrollo y la regeneración de catalizadores sigue siendo un desafío clave para la expansión del mercado. Los complejos procesos de fabricación, la fluctuación de los precios de las materias primas y la necesidad de un manejo especializado de metales raros como el platino y el paladio contribuyen a los elevados costes operativos.

- Por ejemplo, en 2024, la volatilidad de los precios de los metales afectó significativamente la rentabilidad de Clariant (Suiza) y otros importantes productores de catalizadores.

- Además, las estrictas regulaciones de eliminación de catalizadores usados aumentan los desafíos operativos y los costos de gestión de residuos para las refinerías.

- Empresas como Albemarle Corporation (EE. UU.) y Johnson Matthey (Reino Unido) están abordando estas limitaciones mediante el desarrollo de soluciones catalíticas reciclables y reactivables para reducir los costes del ciclo de vida.

- Sin embargo, lograr un equilibrio óptimo entre el rendimiento del catalizador, la rentabilidad y el cumplimiento de las normativas medioambientales sigue siendo un obstáculo importante, lo que requiere una inversión sostenida y la innovación en la tecnología de catalizadores.

¿Cómo se segmenta el mercado de catalizadores para la refinación de petróleo?

El mercado de catalizadores para la refinación de petróleo se segmenta según el tipo, el catalizador, el canal de distribución y la aplicación.

- Por tipo

Según su tipo, el mercado de catalizadores para refinación de petróleo se segmenta en hidrotratamiento, craqueo catalítico fluido (FCC), craqueo catalítico fluido de residuos (RFCC), hidrocraqueo y otros. El segmento de craqueo catalítico fluido (FCC) dominó el mercado en 2024, con una cuota de mercado del 42,6%, impulsado por su uso generalizado en la conversión de fracciones de crudo pesado en productos más ligeros y de alto valor, como gasolina y olefinas. Los catalizadores FCC mejoran la flexibilidad de las refinerías y el rendimiento de combustible, a la vez que reducen los costos operativos, lo que los hace indispensables para las refinerías a gran escala.

Se prevé que el segmento de hidrocraqueo registre la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la transición mundial hacia combustibles más limpios y la necesidad de producir diésel con contenido ultrabajo de azufre. El aumento de las inversiones en plantas de hidrocraqueo en Asia Pacífico y Oriente Medio está acelerando aún más la trayectoria de crecimiento de este segmento.

- Por Catalyst

Según el tipo de catalizador, el mercado se divide en zeolitas, metales y productos químicos. El segmento de zeolitas ostentó la mayor cuota de mercado, con un 48,3 % en 2024, principalmente debido a su alta selectividad, estabilidad térmica y eficiencia en las reacciones de craqueo catalítico e hidrocraqueo. Las zeolitas se utilizan ampliamente en refinerías para aumentar el rendimiento de combustible y eliminar impurezas, lo que las convierte en el tipo de catalizador preferido a nivel mundial.

Se prevé que el segmento de metales experimente el mayor crecimiento anual compuesto (CAGR) entre 2025 y 2032, impulsado por la creciente demanda de catalizadores para hidroprocesamiento e hidrogenación que utilizan metales activos como el níquel, el cobalto y el platino. El creciente interés en las tecnologías de refinación energéticamente eficientes y de regeneración de catalizadores de alto rendimiento está reforzando aún más la adopción de catalizadores metálicos.

- Por canal de distribución

Según el canal de distribución, el mercado de catalizadores para refinación de petróleo se segmenta en Ventas Directas/B2B, Distribuidores/Comerciantes/Distribuidores Externos, Comercio Electrónico y Otros. El segmento de Ventas Directas/B2B dominó el mercado en 2024, con una cuota de mercado del 56,4%, debido a la preferencia de las refinerías y empresas petroquímicas por contratos de suministro a largo plazo y soluciones de catalizadores personalizadas directamente de los fabricantes. Las alianzas directas también garantizan soporte técnico, monitoreo del rendimiento y optimización del producto.

Se prevé que el segmento de comercio electrónico experimente la mayor tasa de crecimiento anual compuesto (CAGR) entre 2025 y 2032, impulsado por la transformación digital en las cadenas de suministro industriales. Las plataformas en línea ofrecen cada vez más opciones de adquisición de catalizadores refinados, lo que reduce los plazos de entrega y amplía el acceso a refinerías más pequeñas y operadores independientes.

- Por solicitud

Según su aplicación, el mercado se segmenta en diésel, queroseno, desparafinado de destilados y otros. El segmento del diésel lideró el mercado en 2024 con una cuota de mercado del 45,7%, debido a la creciente demanda mundial de diésel limpio y a las estrictas normativas sobre emisiones que exigen procesos avanzados de refinado catalítico. El uso de catalizadores en la producción de diésel mejora la desulfuración y la calidad del combustible, lo que los convierte en elementos esenciales para el cumplimiento de las normas medioambientales.

Se prevé que el segmento de desparafinado de destilados registre la mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la creciente demanda de lubricantes de alto rendimiento y combustibles para bajas temperaturas. El aumento del consumo de lubricantes de alta calidad en los sectores automotriz e industrial está impulsando la adopción de catalizadores de desparafinado especializados en refinerías de todo el mundo.

¿Qué región concentra la mayor parte del mercado de catalizadores para la refinación de petróleo?

- En 2024, China dominó el mercado de catalizadores para refinación de petróleo en la región Asia-Pacífico, con la mayor cuota de ingresos (46,3%), impulsada por la fuerte demanda interna de envases para bebidas, alimentos y productos farmacéuticos.

- La sólida infraestructura manufacturera del país, su capacidad de producción rentable y la abundancia de materias primas como la sílice y el vidrio reciclado respaldan la producción a gran escala de catalizadores y envases de vidrio. Las políticas gubernamentales que promueven la fabricación ecológica, las iniciativas de reciclaje y la inversión en tecnologías avanzadas de conformado y refinado de vidrio fortalecen aún más su dominio del mercado.

- La creciente orientación exportadora de China hacia las bebidas alcohólicas, el cuidado personal y los alimentos procesados, junto con el aumento del consumo interno de productos prémium, refuerza su posición de liderazgo en el mercado regional. En general, la condición de China como centro estratégico de fabricación y sus capacidades de I+D consolidan su papel preponderante en la industria de catalizadores para la refinación de petróleo en la región Asia-Pacífico.

Perspectivas del mercado de catalizadores para la refinación de petróleo en la India

Se prevé que el mercado indio de catalizadores para refinación de petróleo experimente el mayor crecimiento anual compuesto (CAGR) del 8,58%, impulsado por el aumento del consumo de bebidas, alimentos y productos farmacéuticos tanto en zonas urbanas como rurales. Los incentivos gubernamentales para la fabricación, el reciclaje y la producción sostenible están acelerando la adopción de estas tecnologías en el mercado. La creciente preferencia de las empresas de procesamiento de bebidas, cosméticos y alimentos por catalizadores de alta calidad y respetuosos con el medio ambiente impulsa la demanda en todos los sectores. El aumento de las exportaciones de alimentos procesados, bebidas alcohólicas y no alcohólicas, y productos de cuidado personal fortalece la posición de la India en el mercado regional. Las inversiones en modernas instalaciones de producción y en tecnologías de catalizadores mejoradas están incrementando la competitividad de la India, convirtiéndola en un actor clave para el crecimiento del mercado de catalizadores para refinación de petróleo en la región Asia-Pacífico.

Perspectivas del mercado de catalizadores para la refinación de petróleo en Vietnam

El mercado vietnamita de catalizadores para la refinación de petróleo está en expansión debido a la creciente industrialización y al aumento del consumo de bebidas embotelladas, salsas y cosméticos. El país se beneficia del apoyo gubernamental a la producción sostenible, de los acuerdos comerciales que impulsan las exportaciones y de la colaboración con empresas globales de envasado y catalizadores. El crecimiento de la población urbana y el aumento del consumo de alimentos y bebidas de alta gama impulsan la demanda de productos de alta calidad y estéticamente atractivos. Los avances en las tecnologías de producción, refinación y reciclaje están mejorando la eficiencia operativa. En conjunto, estos factores posicionan a Vietnam como un actor cada vez más importante en el mercado de catalizadores para la refinación de petróleo de Asia-Pacífico.

Perspectivas del mercado de catalizadores para la refinación de petróleo en Indonesia

El mercado de catalizadores para la refinación de petróleo en Indonesia experimenta un crecimiento sostenido, impulsado por el aumento del consumo interno de bebidas, alimentos y productos farmacéuticos. La abundancia de materias primas en el país, como la arena de sílice y el vidrio reciclado, facilita la producción local. Las iniciativas gubernamentales que promueven la manufactura ecológica y sostenible fomentan las inversiones en tecnologías modernas de refinación y producción de vidrio. Las industrias de procesamiento de alimentos y bebidas, orientadas a la exportación, impulsan aún más la demanda de catalizadores y envases duraderos y de alta calidad. La creciente conciencia del consumidor sobre la calidad, la seguridad y la sostenibilidad de los productos también está impulsando la adopción en el mercado. Las inversiones en I+D para productos catalíticos funcionales y diseños innovadores mejoran la competitividad, convirtiendo a Indonesia en un actor clave para el mercado de Asia-Pacífico.

¿Cuáles son las principales empresas en el mercado de catalizadores para la refinación de petróleo?

La industria de catalizadores para la refinación de petróleo está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Royal Dutch Shell plc (Reino Unido)

- 3M (EE. UU.)

- Dow (EE. UU.)

- Corporación Exxon Mobil (EE. UU.)

- BASF SE (Alemania)

- WR Grace & Co.-Conn (EE. UU.)

- Anten Chemical Co., Ltd (China)

- Johnson Matthey (Reino Unido)

- Clariant (Suiza)

- Corporación Petroquímica de China (China)

- Corporación Albemarle (EE. UU.)

- Honeywell International Inc. (EE. UU.)

- Haldor Topsoe A/S (Dinamarca)

- Arkema (Francia)

- Kuwait Catalyst Company (Kuwait)

- JGC C&C (Japón)

- Axens (Francia)

- Gazpromneft-Sistemas Catalíticos (Rusia)

- UNICAT Catalyst Technologies, LLC (EE. UU.)

- TAIYO KOKO Co., Ltd (Japón)

¿Cuáles son los últimos avances en el mercado de catalizadores para la refinación de petróleo en Asia Pacífico?

- En enero de 2023, Albemarle Corporation anunció el lanzamiento de Ketjen, una subsidiaria de su propiedad que ofrece soluciones catalíticas sofisticadas y personalizadas para las industrias químicas especializadas, de refinación y petroquímicas, fortaleciendo así su cartera y su presencia en el mercado a nivel mundial.

- En febrero de 2021, Numaligarh Refinery Limited (NRL), filial de Bharat Petroleum Corporation Limited, designó a Axens para suministrar tecnologías avanzadas para el bloque de gasolina de su Proyecto de Expansión de la Refinería de Numaligarh (NREP), con el objetivo de aumentar la capacidad de la refinería en 9000 KT anuales y mejorar la eficiencia operativa.

- En septiembre de 2020, Clariant anunció la construcción de una nueva planta de producción de catalizadores en China, invirtiendo significativamente para fortalecer su presencia local y brindar un mejor soporte a sus clientes regionales. Esta planta producirá catalizadores CATOFIN para la deshidrogenación de propano, impulsando así su capacidad de producción y su competitividad en el mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.