Asia-Pacific Electric Vehicle Thermal Management System Market, By Propulsion Type (BEV, PHEV, HEV, and FCV), Technology (Active and Passive), Battery Type (Conventional and Solid-State), Battery Capacity (30-60 Kwh, 60-90 Kwh, Below 30 Kwh, and Above 90 Kwh), Vehicle Type (Passenger and Commercial), System Type (Battery Thermal Management, HVAC, Powertrain, and Others) Industry Trends and Forecast to 2029.

Asia-Pacific Electric Vehicle Thermal Management System Market Analysis and Size

Electric vehicles are a promising renewable substitute to gasoline power-based vehicles to protect the environment. Many governments are taking initiatives to promote electric vehicles and are providing tax rebates and redemption. The rise in the electric vehicles market is because the technology is upgrading at a fast rate, making the demand for electric vehicle thermal management systems in the market. The Asia-Pacific electric vehicle thermal management system market is growing rapidly due to the rise in demand for electric vehicles in the market. The companies are even launching new products to gain a larger market share.

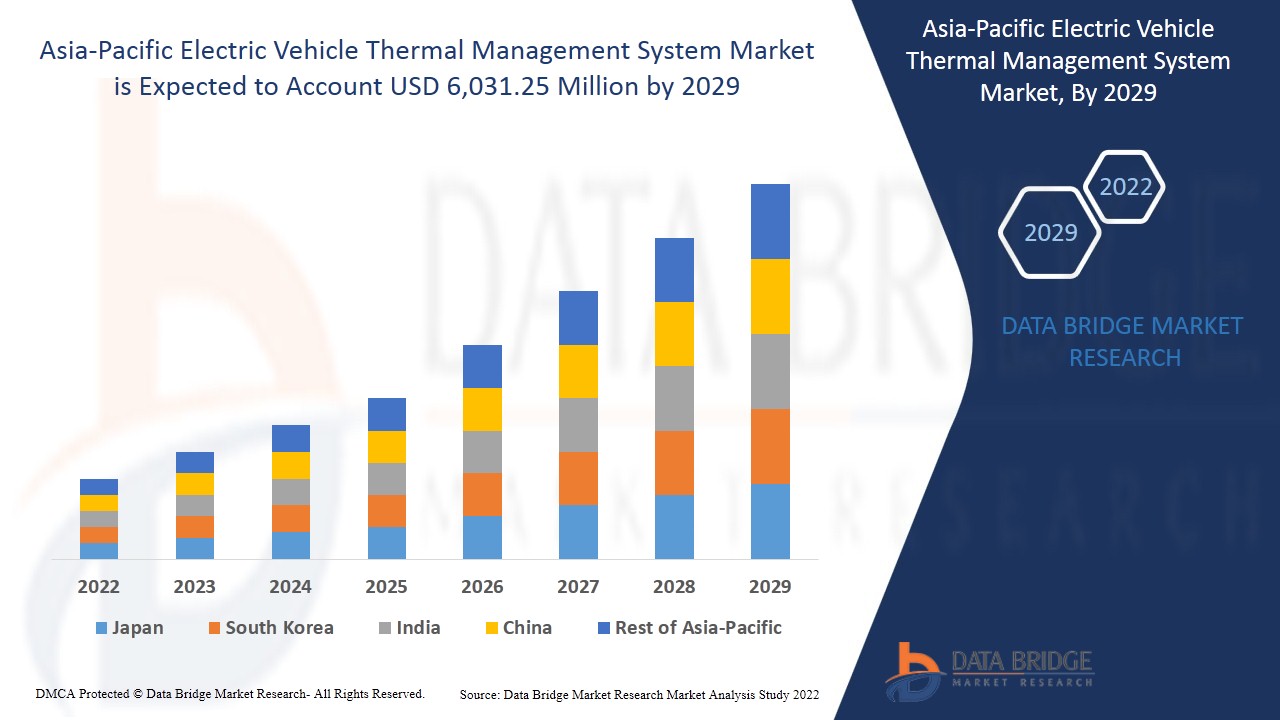

Data Bridge Market Research analyses that the Asia-Pacific electric vehicle thermal management system market is expected to reach the value of USD 6,031.25 million by 2029, at a CAGR of 24.3% during the forecast period. "BEV" accounts for the most prominent propulsion type segment as they are energy efficient, turning 80% of their energy input into propelling the car, and they have a regenerative braking system that collects energy and returns it to the battery when a car stops. The Asia-Pacific electric vehicle thermal management system market report also covers pricing analysis, patent analysis, and technological advancements in depth.

Asia-Pacific Electric Vehicle Thermal Management System Market Definition

The thermal management system in an electric vehicle is the solution that helps in managing the heat generated during the electrochemical processes occurring in cells, allowing the battery to operate safely and efficiently. Effective thermal management systems are required in electric vehicles to keep battery temperatures in the correct range and prevent the temperature from fluctuating inside the battery pack. Thus, thermal management systems play a vital role in the control of the battery thermal behavior.

La adopción de vehículos eléctricos está aumentando a nivel mundial debido a su cero emisiones y su alta eficiencia de tanque a rueda. Esto ha hecho necesario un sistema de gestión de batería adecuado para alcanzar el máximo rendimiento al operar en diversas condiciones. Además, la creciente tendencia hacia el aumento de las tasas de carga, lo que permitiría una carga más rápida y viajes más largos, ha aumentado la demanda de una gestión térmica más eficiente en los vehículos eléctricos.

|

Métrica del informe |

Detalles |

|

Año base |

2021 |

|

Período de pronóstico |

2022 - 2029 |

|

Año histórico |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de propulsión (BEV, PHEV, HEV y FCV), tecnología (activa y pasiva), tipo de batería (convencional y de estado sólido), capacidad de la batería (30-60 Kwh, 60-90 Kwh, menos de 30 Kwh y más de 90 Kwh), tipo de vehículo (de pasajeros y comercial), tipo de sistema (gestión térmica de la batería, HVAC, tren motriz y otros) |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Marelli Holdings Co., Ltd., Robert Bosch GmbH, BorgWarner Inc., Continental AG, VOSS Automotive GmbH, Kendrion NV, LG Chem, DENSO Corporation, NORMA Group, MODINE MANUFACTURING COMPANY, GENTHERM, A. KAYSER AUTOMOTIVE SYSTEMS GmbH, Ymer Technology, Grayson, entre otros. |

Dinámica del mercado de sistemas de gestión térmica de vehículos eléctricos en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

- Demanda creciente de vehículos eléctricos

La industria automotriz ha experimentado un enorme crecimiento debido a la creciente demanda de vehículos eléctricos de lujo. Algunos de los factores que impulsan las ventas de vehículos eléctricos incluyen las estrictas regulaciones gubernamentales sobre las emisiones de los vehículos y la creciente demanda de vehículos de bajo consumo de combustible, alto rendimiento y bajas emisiones.

- Incentivos y subsidios del gobierno para vehículos eléctricos

El aumento de la contaminación y la escasez de recursos, en particular en el sector automotor, ha permitido al gobierno tomar medidas de protección ambiental, lo que ha llevado a un cambio de tendencia en la industria automotriz, que ha pasado de utilizar vehículos motorizados convencionales a utilizar vehículos híbridos eléctricos para proteger el medio ambiente. Muchos gobiernos nacionales han tomado medidas para ofrecer incentivos a la adopción de vehículos eléctricos en lugar de vehículos convencionales, como descuentos en las compras, exenciones de impuestos, créditos fiscales y algunos otros.

- Demanda creciente de una solución de refrigeración térmica

El aumento de la demanda de vehículos eléctricos ha llevado a un avance en la fabricación de baterías para ofrecer más potencia y requerir cargas menos frecuentes, pero con esto, también existe la necesidad de un sistema de refrigeración eficaz para evitar que la batería se sobrecaliente. La descarga de la batería genera calor; cuanto más rápido se descarga la batería, más calor se genera. Este calor puede provocar el fallo de los dispositivos. Por lo tanto, para mantener la batería y el vehículo seguros, se ha hecho necesario un sistema de gestión térmica adecuado que ha aumentado su demanda en el mercado.

- Alto costo inicial

Los vehículos eléctricos son los más adecuados para el transporte, ya que tienen un menor impacto en el medio ambiente, ya que ayudan a controlar la contaminación del aire. Sin embargo, el costo inicial de los vehículos eléctricos es más alto que el de los vehículos con motor de gasolina porque incluyen componentes tecnológicamente mejorados que no dañan el medio ambiente. Por el contrario, los costos operativos de los vehículos eléctricos son más baratos que los de los vehículos con motor de gasolina. Por lo tanto, el costo inicial de los vehículos eléctricos puede restringir el crecimiento del mercado.

- Rendimiento de la batería en diferentes condiciones ambientales

La batería es un sistema electroquímico que implica reacciones y el transporte de iones y electrones. La velocidad de carga/descarga de la batería o el mecanismo de degradación se ve afectado por el cambio de temperatura. Por ejemplo, una temperatura ambiental alta permite una velocidad de carga relativamente alta, pero también aumenta la tasa de crecimiento de SEI (interfaz de electrolito sólido), lo que acorta la vida útil de la batería. Por otro lado, una temperatura ambiental baja ralentiza el crecimiento de SEI, pero esto promueve el recubrimiento de litio. Como resultado, las baterías se pueden optimizar para temperaturas altas o bajas, pero mantener el mismo rendimiento a diferentes temperaturas puede ser problemático. Por lo tanto, estos factores pueden actuar como un desafío importante para el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia y el Pacífico.

Impacto posterior a la COVID-19 en el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia y el Pacífico

La COVID-19 ha tenido un gran impacto en el mercado de sistemas de gestión térmica de vehículos eléctricos, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se ocupan de esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de sistemas de gestión térmica de vehículos eléctricos está aumentando debido a las políticas gubernamentales diseñadas para apoyar el crecimiento de los vehículos eléctricos. Además, las crecientes preocupaciones sobre la sostenibilidad y los problemas ambientales están aumentando la demanda de vehículos eléctricos en el mercado. Por lo tanto, las regulaciones e incentivos gubernamentales probablemente impulsarán el crecimiento del mercado. Sin embargo, factores como el alto costo inicial del vehículo eléctrico y la complejidad en el diseño de la solución de gestión térmica están restringiendo el crecimiento del mercado. El cierre de las instalaciones de producción durante la pandemia ha tenido un impacto significativo en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el sistema de gestión térmica de vehículos eléctricos. Las empresas traerán al mercado controladores avanzados y precisos con esto. Además, las iniciativas gubernamentales para la adopción de vehículos eléctricos han llevado al crecimiento del mercado.

Acontecimientos recientes

- En diciembre de 2021, Continental AG anunció que había recibido su primer pedido de un ordenador de alto rendimiento (HPC) para vehículos de un importante fabricante de vehículos chino. El HPC gestionará la comunicación de datos, las actualizaciones inalámbricas y la gestión térmica y del par. En virtud de este acuerdo, la empresa proporcionará el hardware del HPC, el software básico, los servicios de integración y el diseño de la arquitectura a su cliente. De este modo, la empresa dará un paso hacia soluciones informáticas centrales multidominio para la movilidad del futuro.

- En septiembre de 2021, MAHLE GmbH anunció el desarrollo de un sistema de refrigeración de baterías completamente nuevo. Este nuevo sistema de refrigeración por inmersión acorta los tiempos de carga de los coches eléctricos. Además, este sistema hace que las baterías sean más compactas, lo que hace que los coches eléctricos sean más baratos y eficientes en el uso de los recursos. De este modo, la empresa está penetrando profundamente en el mercado de la movilidad eléctrica.

Alcance del mercado de sistemas de gestión térmica de vehículos eléctricos en Asia y el Pacífico

El mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico está segmentado en función del tipo de propulsión, la tecnología, el tipo de batería, la capacidad de la batería, el tipo de vehículo y el tipo de sistema. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de propulsión

- VEB

- Vehículo híbrido enchufable (PHEV)

- Vehículo eléctrico híbrido (HEV)

- FCV

Sobre la base del tipo de propulsión, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico está segmentado en BEV, PHEV, HEV y FCV.

Tecnología

- Activo

- Pasivo

Sobre la base de la tecnología, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico se ha segmentado en activo y pasivo.

Tipo de batería

- Convencional

- Estado sólido

Sobre la base del tipo de batería, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico se ha segmentado en convencional y de estado sólido.

Capacidad de la batería

- 30-60 Kwh

- 60-90 Kwh

- Por debajo de 30 Kwh

- Más de 90 Kwh

Sobre la base de la capacidad de la batería, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico se ha segmentado en 30-60 kWh, 60-90 kWh, menos de 30 kWh y más de 90 kWh.

Tipo de vehículo

- Pasajero

- Comercial

Sobre la base del tipo de vehículo, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico se ha segmentado en vehículos de pasajeros y comerciales.

Tipo de sistema

- Gestión térmica de la batería

- Climatización

- Tren motriz

- Otros

Sobre la base del tipo de sistema, el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico se ha segmentado en gestión térmica de baterías, HVAC, tren motriz y otros.

Análisis y perspectivas regionales del mercado de sistemas de gestión térmica de vehículos eléctricos en Asia y el Pacífico

Se analiza el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico y se proporcionan información y tendencias del tamaño del mercado por país, tipo de propulsión, tecnología, tipo de batería, capacidad de la batería, tipo de vehículo y tipo de sistema como se menciona anteriormente.

Algunos de los países cubiertos en el informe del mercado del sistema de gestión térmica de vehículos eléctricos de Asia-Pacífico son China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico.

Es probable que China sea el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico de más rápido crecimiento. El creciente desarrollo de infraestructuras, comercio e industria en países emergentes como China, Japón, India y Corea del Sur se atribuye al dominio del mercado. China domina la región de Asia-Pacífico debido a las altas capacidades de fabricación y fabricación subcontratada de productos de batería y la alta adopción de vehículos eléctricos.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de gestión térmica de vehículos eléctricos en Asia-Pacífico

El panorama competitivo del mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la extensión de los productos, y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de sistemas de gestión térmica de vehículos eléctricos de Asia-Pacífico son:

- MAHLE GmbH

- Valeo

- Dana limitada

- Sistemas Hanon

- Compañía: Marelli Holdings Co., Ltd.

- Robert Bosch GmbH

- BorgWarner Inc.

- Continental AG

- VOSS Automotriz GmbH

- Kendrion NV

- LG Química

- Corporación DENSO

- Grupo NORMA

- EMPRESA FABRICANTE MODINE

- GENTHERM

- A. KAYSER AUTOMOTIVE SYSTEMS GmbH

- Tecnología Ymer

- Grayson

Metodología de investigación: Mercado de sistemas de gestión térmica de vehículos eléctricos en Asia y el Pacífico

La recopilación de datos y el análisis del año base se realizan mediante módulos de recopilación de datos con muestras de gran tamaño. Esta etapa incluye la obtención de información de mercado o datos relacionados a través de diversas fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, incluye el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave que utiliza el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (por parte de expertos de la industria). Además de esto, los modelos de datos incluyen una cuadrícula de posicionamiento de proveedores, un análisis de la línea de tiempo del mercado, una descripción general y una guía del mercado, una cuadrícula de posicionamiento de la empresa, un análisis de patentes, un análisis de precios, un análisis de la participación de mercado de la empresa, estándares de medición, Asia-Pacífico versus región y un análisis de la participación de los proveedores. Para saber más sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE CHALLENGE MATRIX MARKET

2.9 MULTIVARIATE MODELING

2.1 PROPULSION TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BATTERY COOLING LINES FOR ELECTRIC AND HYBRID VEHICLES (MATERIAL)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASING ENVIRONMENTAL CONCERNS

5.1.4 RISING DEMAND FOR THERMAL COOLING SOLUTIONS

5.1.5 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGES

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BEV

6.3 PHEV

6.4 HEV

6.5 FCV

7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE

7.3 PASSIVE

8 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SOLID-STATE

9 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

9.1 OVERVIEW

9.2 30-60 KWH

9.3 60-90 KWH

9.4 BELOW 30 KWH

9.5 ABOVE 90 KWH

10 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER

10.2.1 BEV

10.2.2 PHEV

10.2.3 HEV

10.2.4 FCV

10.3 COMMERCIAL

10.3.1 BEV

10.3.2 PHEV

10.3.3 HEV

10.3.4 FCV

11 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

11.1 OVERVIEW

11.2 BATTERY THERMAL MANAGEMENT SYSTEM

11.3 HVAC

11.4 POWERTRAIN

11.5 OTHERS

12 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 SOUTH KOREA

12.1.3 JAPAN

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MAHLE GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DANA LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HANON SYSTEMS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MARELLI HOLDINGS CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A. KAYSER AUTOMOTIVE SYSTEMS GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BORGWARNER INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTINENTAL AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DENSO CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 GENTHERM

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 GRAYSON

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KENDRION N.V.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LG CHEM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 NORMA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH GMBH

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VOSS AUTOMOTIVE GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 YMER TECHNOLOGY

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 2 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC BEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PHEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC FCV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ACTIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PASSIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CONVENTIONAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SOLID-STATE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC 30-60 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC 60-90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC BELOW 30 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ABOVE 90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 ASIA PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC BATTERY THERMAL MANAGEMENT SYSTEM IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC HVAC IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 ASIA PACIFIC POWERTRAIN IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 ASIA PACIFIC OTHERS IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 28 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 37 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 41 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 57 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 66 INDIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 68 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 76 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 81 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 SINGAPORE PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 83 SINGAPORE COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 84 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 85 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 86 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 89 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 90 THAILAND PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 91 THAILAND COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 92 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 94 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 97 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 98 MALAYSIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 99 MALAYSIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 100 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 109 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 110 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 112 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 113 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 114 PHILIPPINES PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 115 PHILIPPINES COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 116 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 117 REST OF ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 BEV PROPULSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 14 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE 2021

FIGURE 15 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 16 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY TYPE, 2021

FIGURE 17 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2021

FIGURE 18 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2021

FIGURE 20 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE (2022-2029)

FIGURE 25 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.