Asia Pacific Distributed Antenna System Das Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2022 –2028 | |

| USD 6,062.05 | |

|

|

|

|

Mercado de sistemas de antenas distribuidas (DAS) de Asia-Pacífico, por oferta (hardware y servicios), cobertura (interior y exterior), propiedad (operador, host neutral y empresa), tecnología (wifi de operador y celdas pequeñas), facilidad de usuario (>500 000 FT2, 200 000-500 000 FT2 y

Análisis y perspectivas del mercado : mercado de sistemas de antenas distribuidas (DAS) en Asia y el Pacífico

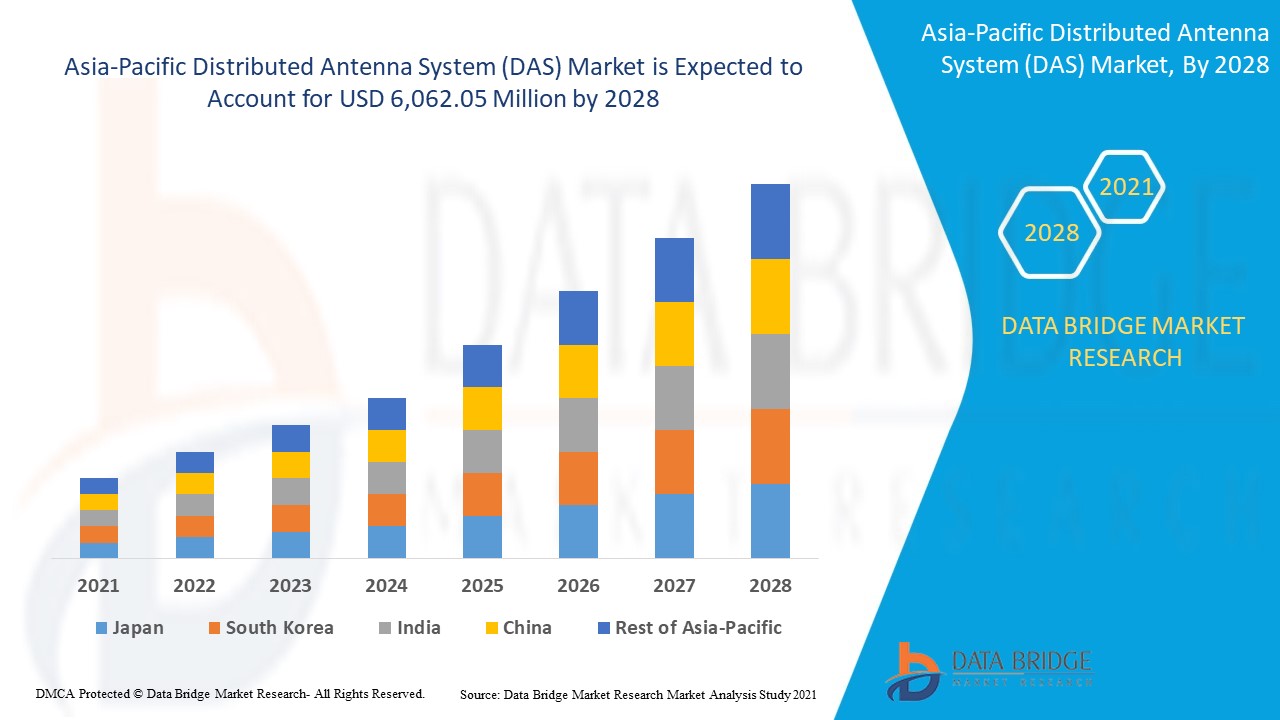

Se espera que el mercado de sistemas de antenas distribuidas (DAS) gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 12,4% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 6.062,05 millones para 2028. El aumento del consumo de tráfico de datos móviles y la gran demanda de 5G en todo el mundo están impulsando el crecimiento del mercado de sistemas de antenas distribuidas (DAS).

Un sistema de antenas distribuidas (DAS) es un grupo de antenas separadas espacialmente y distribuidas en un área geográfica determinada para ampliar los servicios inalámbricos existentes, incluidas las señales de radio y celulares. La señal digital se convierte en RF y RF a digital con la ayuda de una antena para proporcionar la señal celular.

La creciente demanda de los segmentos de usuarios finales, como los deportes, las empresas, los edificios inteligentes y otros, está impulsando el crecimiento del mercado de sistemas de antenas distribuidas (DAS). La disponibilidad de soluciones alternativas, como la conectividad interior de próxima generación y el amplificador único, está limitando la venta de sistemas para el mercado de sistemas de antenas distribuidas (DAS). La gran demanda de servicios de red 5G está creando una gran oportunidad para el crecimiento del mercado de sistemas de antenas distribuidas (DAS). Las dificultades tecnológicas, como el backhaul y el alto costo de actualización, son un gran desafío para el crecimiento del mercado de sistemas de antenas distribuidas (DAS).

Este informe de mercado de sistemas de antenas distribuidas (DAS) proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sistemas de antenas distribuidas (DAS) en Asia y el Pacífico

El mercado de sistemas de antenas distribuidas (DAS) está segmentado en función de la oferta, la cobertura, la propiedad, la tecnología, las instalaciones para el usuario y la vertical. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de la oferta, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en hardware y servicios. En 2021, el segmento de hardware domina el mercado de sistemas de antenas distribuidas (DAS) debido a la creciente demanda de componentes avanzados para mejorar el alcance y la velocidad.

- En función de la cobertura, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en interiores y exteriores. En 2021, el segmento de interiores domina el mercado de sistemas de antenas distribuidas (DAS) debido a la alta adopción de la tecnología para una mejor conectividad y comunicación de la red.

- En función de la propiedad, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en operador, host neutral y empresa. En 2021, el segmento de operadores domina el mercado de sistemas de antenas distribuidas (DAS) debido a la asequibilidad y la mayor cobertura.

- En función de la tecnología, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en Wi-Fi de operador y celdas pequeñas. En 2021, el segmento de Wi-Fi de operador domina el mercado de sistemas de antenas distribuidas (DAS) con la máxima participación de mercado y crecerá con la CAGR más alta debido a factores como el diseño y el mecanismo de trabajo mejorados y el fácil control con un costo de instalación mínimo.

- En función de la facilidad de uso, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en >500K FT2, 200K–500K FT2 y <200K FT2. En 2021, el segmento >500K FT2 domina el mercado de sistemas de antenas distribuidas (DAS), ya que tiene una adopción importante debido a la red de cobertura espacial más grande.

- Sobre la base de la vertical, el mercado de sistemas de antenas distribuidas (DAS) se segmenta en seguridad pública y comercial. En 2021, el segmento comercial domina el mercado de sistemas de antenas distribuidas (DAS) debido a la alta adopción por parte de los proveedores de servicios comerciales para mejorar su servicio y ofrecer soluciones avanzadas para las operaciones.

Análisis a nivel de país del mercado de sistemas de antenas distribuidas (DAS)

Se analiza el mercado de sistemas de antena distribuida (DAS) y se proporciona información sobre el tamaño del mercado por país, oferta, cobertura, propiedad, tecnología, instalaciones del usuario y vertical como se menciona anteriormente.

Los países cubiertos en el informe del mercado del sistema de antena distribuida (DAS) de Asia-Pacífico son China, Japón, India, Corea del Sur, Australia, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico.

China domina el mercado de sistemas de antenas distribuidas (DAS) de Asia-Pacífico debido al mayor uso de teléfonos inteligentes, a que es uno de los primeros países en adoptar servicios 5G en áreas como AR/VR, conducción autónoma y al tráfico por teléfono inteligente presente para los sistemas de antenas distribuidas (DAS). Se espera que Japón ocupe la segunda posición debido a la finalización de las pruebas 5G en los países con la creciente construcción de infraestructuras inteligentes con IA y a que la demanda de los deportes, las empresas y otros está impulsando el crecimiento. India ocupa la tercera posición debido al creciente crecimiento de la infraestructura junto con los rápidos desarrollos en el campo de las redes 5G para el mercado de sistemas de antenas distribuidas (DAS).

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Technological Advancements such as AI and Sensors

The distributed antenna system (DAS) market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in distributed antenna system (DAS) and changes in regulatory scenarios and technology & innovation with their support for the distributed antenna system (DAS) market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Distributed Antenna System (DAS) Market Share Analysis

The distributed antenna system (DAS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Asia-Pacific distributed antenna system (DAS) market.

The major players covered in the report are AT&T, ATC IP LLC, Corning Incorporated, CommScope, Inc., Hughes Network Systems, LLC (a subsidiary of EchoStar Corporation), Anixter Inc., Bird, BTI Wireless, Cobham Wireless, Comba Telecom Systems Holdings Ltd., Dali Wireless, GALTRONICS (A subsidiary of Baylin Technologies), HUBER+SUHNER, RFI Technology Solutions, Westell Technologies, Inc., CenRF Communications Limited among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of distributed antenna system (DAS) market.

For instance,

- In December 2020, ATC IP LLC announced that it has acquired InSite Wireless Group, LLC with a combination of direct cash and revolver borrowings and the deal was valued at USD 3.50 billion. This has helped the company to accelerate their deployment network which will further support the antenna systems in-place.

La expansión de la producción, el lanzamiento de nuevos productos, las adquisiciones, la colaboración y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a las organizaciones la ventaja de mejorar su oferta de plataformas o servicios de sistemas de antenas distribuidas (DAS).

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET VERTICAL COVERAGE GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MULTIVARIATE MODELLING

2.11 OFFERING LIFELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC

5.1.2 GROWING DEMAND FROM THE VARIOUS END USERS

5.1.3 DIGITAL TRANSFORMATION OF BUSINESS

5.1.4 INCREASING NUMBER OF CONNECTED DEVICES DUE TO INTERNET OF THINGS (IOT)

5.1.5 RISING DEMAND FOR UNINTERRUPTED CONNECTIVITY AND EXTENDED NETWORK COVERAGE

5.1.6 DEVELOPMENT OF PUBLIC INFRASTRUCTURE AND BUILDINGS BASED ON MODERN AND SUSTAINABLE CONCEPTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF THE ALTERNATIVE SOLUTION

5.2.2 HIGH COST OF INSTALLATION NEXT GENERATION INDOOR

5.2.3 STRICT GOVERNMENT REGULATORY NORMS

5.3 OPPORTUNITIES

5.3.1 INTEGRATION WITH GROWING 5G AND 6G INFRASTRUCTURE ASIA-PACIFICLY

5.3.2 NETWORK IMPROVEMENT OPPORTUNITIES IN THE RURAL AREAS

5.3.3 UPSURGE IN A REQUIREMENT FOR SAFE CONNECTIVITY FOR PEOPLE

5.4 CHALLENGES

5.4.1 TECHNOLOGICAL CHALLENGES RESTRICTING THE ADOPTION IN ORGANISATIONS

5.4.2 DIFFICULTY IN UPGRADATION OF DISTRIBUTED ANTENNA SYSTEMS

6 IMPACT OF COVID-19 ON ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

6.1 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 IMPACT ON DEMAND

6.3 IMPACT ON PRICE

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.5 TO FORM PARTNERSHIP WITH INTERNET SERVICE PROVIDERS FOR SCHOOLS, AIRPORTS, STADIUM AND OTHER FACILITIES

6.6 CONSLUSION

7 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ANTENNA NODES/ RADIO NODES

7.2.2 DONOR ANTENNA

7.2.3 BIDIRECTIONAL AMPLIFIERS

7.2.4 RADIO UNITS

7.2.5 HEAD END UNITS

7.2.6 OTHERS

7.3 SERVICES

7.3.1 INSTALLATION SERVICES

7.3.2 PRE-SALES SERVICES

7.3.3 POST-INSTALLATION SERVICES

8 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE

8.1 OVERVIEW

8.2 INDOOR

8.2.1 PASSIVE

8.2.2 ACTIVE

8.2.3 HYBRID

8.2.4 OTHERS

8.3 OUTDOOR

9 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP

9.1 OVERVIEW

9.2 CARRIER

9.3 NEUTRAL HOST

9.4 ENTERPRISE

10 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CARRIER WI-FI

10.3 SMALL CELLS

11 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY

11.1 OVERVIEW

11.2 >500K FT2

11.3K–500K FT2

11.4 <200K FT2

12 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 COMMERCIAL

12.2.1 PUBLIC VENUE

12.2.2 AIRPORTS AND TRANSPORTATION

12.2.3 ENTERPRISES

12.2.3.1 Large Enterprises

12.2.3.2 Small and Medium Enterprises

12.2.4 INDUSTRIAL

12.2.5 RETAIL

12.2.6 GOVERNMENT

12.2.7 HOSPITALITY

12.2.8 HEALTHCARE

12.2.9 EDUCATION

12.2.10 SHIPS

12.3 PUBLIC SAFETY

13 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AT&T

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ATC IP LLC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CORNING INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 APPLICATION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 COMMSCOPE, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HUGHES NETWORK SYSTEMS, LLC (A SUBSIDIARY OF ECHOSTAR CORPORATION)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVANCED RF TECHNOLOGIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ANIXTER INC. (A SUBSIDIARY OF WESCO INTERNATIONAL, INC.)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SOLUTION PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BETACOM

16.8.1 COMPANY SNAPSHOT

16.8.2 SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIRD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BOINGO WIRELESS, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 BTI WIRELESS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CENRF COMMUNICATIONS LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 COBHAM WIRELESS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 COMBA TELECOM SYSTEMS HOLDINGS LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 DALI WIRELESS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 DECYPHER

16.16.1 COMPANY SNAPSHOT

16.16.2 SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 FIXTEL SERVICES AUSTRALIA

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 GALTRONICS (A SUBSIDIARY OF BAYLIN TECHNOLOGIES)

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 HUBER+SUHNER

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 JMA WIRELESS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 RFI TECHNOLOGY SOLUTIONS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SKYCOMMS AUS

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SOLID

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SYMPHONY TECHNOLOGY SOLUTIONS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 WESTELL TECHNOLOGIES, INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

16.26 ZINWAVE

16.26.1 COMPANY SNAPSHOT

16.26.2 SOLUTION PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 2 ASIA-PACIFIC HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 3 ASIA-PACIFIC HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 4 ASIA-PACIFIC SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 5 ASIA-PACIFIC SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 6 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 8 ASIA-PACIFIC INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 9 ASIA-PACIFIC OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 10 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC CARRIER IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 12 ASIA-PACIFIC NEUTRAL HOST IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 13 ASIA-PACIFIC ENTERPRISE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 14 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 15 ASIA-PACIFIC CARRIER WI-FI IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 16 ASIA-PACIFIC SMALL CELLS IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 17 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2018-2027 (USD MILLION)

TABLE 18 ASIA-PACIFIC >500K FT2 IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 19 ASIA-PACIFIC 200K–500K FT2 IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 20 ASIA-PACIFIC <200K FT2 IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 21 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 22 ASIA-PACIFIC COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 23 ASIA-PACIFIC COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 24 ASIA-PACIFIC ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 25 ASIA-PACIFIC PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 26 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 27 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 28 ASIA-PACIFIC HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 29 ASIA-PACIFIC SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 30 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 33 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 34 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 35 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 ASIA-PACIFIC ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 39 CHINA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 40 CHINA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 41 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 42 CHINA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 43 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 44 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 45 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 46 CHINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 47 CHINA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 CHINA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 49 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 50 JAPAN HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 51 JAPAN SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 52 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 53 JAPAN INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 54 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 55 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 56 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 57 JAPAN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 58 JAPAN COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 JAPAN ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 61 INDIA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 INDIA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 64 INDIA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 66 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 67 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 68 INDIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 69 INDIA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 INDIA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 72 SOUTH KOREA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 73 SOUTH KOREA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 75 SOUTH KOREA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 77 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 79 SOUTH KOREA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 80 SOUTH KOREA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 SOUTH KOREA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 82 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 83 AUSTRALIA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 84 AUSTRALIA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 85 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 86 AUSTRALIA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 88 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 90 AUSTRALIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 91 AUSTRALIA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 92 AUSTRALIA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 94 SINGAPORE HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 SINGAPORE SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 97 SINGAPORE INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 99 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 100 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 101 SINGAPORE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 102 SINGAPORE COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 SINGAPORE ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 104 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 105 THAILAND HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 THAILAND SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 107 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 108 THAILAND INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 109 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 110 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 112 THAILAND DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 113 THAILAND COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 114 THAILAND ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 115 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 116 MALAYSIA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 MALAYSIA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 118 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 119 MALAYSIA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 120 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 121 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 122 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 123 MALAYSIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 124 MALAYSIA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 125 MALAYSIA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 126 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 127 INDONESIA HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 INDONESIA SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 129 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 130 INDONESIA INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 131 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 132 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 134 INDONESIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 135 INDONESIA COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 136 INDONESIA ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 137 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 138 PHILIPPINES HARDWARE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 PHILIPPINES SERVICES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2019-2028 (USD MILLION)

TABLE 141 PHILIPPINES INDOOR DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 142 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2019-2028 (USD MILLION)

TABLE 143 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 144 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2019-2028 (USD MILLION)

TABLE 145 PHILIPPINES DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 146 PHILIPPINES COMMERCIAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 147 PHILIPPINES ENTERPRISE DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 148 REST OF ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 9 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC IS EXPECTED TO DRIVE ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2021 & 2028

FIGURE 13 FIGURE: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 14 ADOPTION OF TECHNOLOGY

FIGURE 15 DISTRIBUTED ANTENNA SYSTEM (DAS) COST, USD

FIGURE 16 EMPLOYEES PREFERRING TO WORK FROM HOME PERMANENTLY

FIGURE 17 CUSTOMERS REVIEWS ABOUT CELL SIGNAL AT HOME

FIGURE 18 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2020

FIGURE 19 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2020

FIGURE 20 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2020

FIGURE 21 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2020

FIGURE 22 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY USER FACILITY, 2020

FIGURE 23 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2020

FIGURE 24 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SNAPSHOT (2020)

FIGURE 25 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COUNTRY (2020)

FIGURE 26 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 27 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COUNTRY (2020& 2028)

FIGURE 28 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING (2021-2028)

FIGURE 29 ASIA-PACIFIC DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.