Asia Pacific Courier Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

172.37 Billion

USD

312.03 Billion

2025

2033

USD

172.37 Billion

USD

312.03 Billion

2025

2033

| 2026 –2033 | |

| USD 172.37 Billion | |

| USD 312.03 Billion | |

|

|

|

|

Segmentación del mercado de mensajería en Asia-Pacífico por tipo (saliente y entrante), modo de entrega (entrega normal y exprés), tipo de cliente (B2B (empresa a empresa), B2C (empresa a consumidor) y consumidor a consumidor (C2C), destino (nacional e internacional/transfronterizo), usuario final (comercio mayorista y minorista (comercio electrónico), mensajería médica, manufactura, servicios (BFSI), construcción, servicios públicos e industrias primarias): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de mensajería de Asia-Pacífico

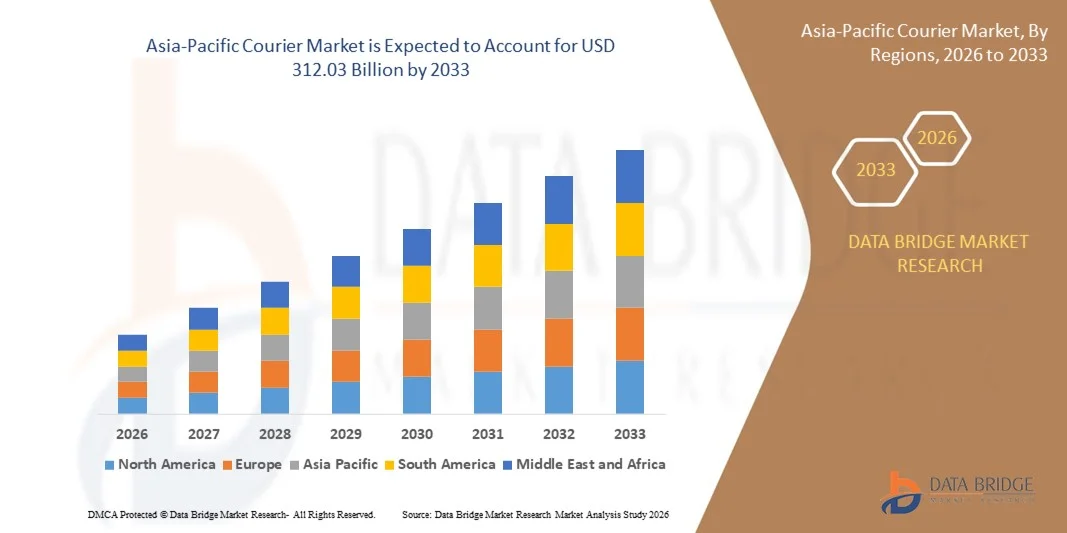

- El tamaño del mercado de mensajería de Asia-Pacífico se valoró en USD 172,37 mil millones en 2025 y se espera que alcance los USD 312,03 mil millones para 2033 , con una CAGR del 7,7% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la rápida expansión del comercio electrónico y las plataformas minoristas en línea, lo que impulsa una mayor demanda de servicios de entrega rápidos, confiables y basados en tecnología en áreas urbanas y rurales.

- Además, las crecientes expectativas de los consumidores en cuanto a entregas el mismo día, al día siguiente y sin contacto, junto con la adopción de tecnologías avanzadas de seguimiento, optimización de rutas y clasificación automatizada, están consolidando los servicios de mensajería como componentes esenciales del comercio moderno. Estos factores convergentes están acelerando la adopción de soluciones de mensajería y logística, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de mensajería de Asia-Pacífico

- Los servicios de mensajería, que brindan entregas rápidas y confiables de paquetes, documentos y mercancías, son componentes cada vez más vitales de la cadena de suministro y las operaciones de comercio electrónico debido a su eficiencia, flexibilidad e integración con plataformas digitales.

- La creciente demanda de servicios de mensajería se ve impulsada principalmente por el crecimiento del comercio electrónico, la creciente urbanización, la creciente penetración de los teléfonos inteligentes e Internet y la preferencia de los consumidores por opciones de entrega convenientes de puerta a puerta.

- China dominó el mercado de mensajería en 2025, debido a su amplia infraestructura logística, el rápido crecimiento del comercio electrónico y la creciente demanda de los consumidores de servicios de entrega rápidos y confiables.

- Se espera que India sea el país de más rápido crecimiento en el mercado de mensajería durante el período de pronóstico debido a la creciente adopción del comercio electrónico, el aumento de la urbanización y la creciente penetración de teléfonos inteligentes e Internet.

- El segmento de envíos salientes dominó el mercado con una cuota de mercado del 61,3 % en 2025, debido al alto volumen de envíos que realizan empresas, plataformas de comercio electrónico, fabricantes y proveedores de servicios a clientes finales. El crecimiento del comercio minorista en línea, el comercio transfronterizo y los modelos de negocio directos al consumidor siguen impulsando el movimiento de paquetería saliente a nivel mundial. Las empresas de mensajería se centran en la optimización de la logística de salida para garantizar la entrega puntual, la rentabilidad y la satisfacción del cliente.

Alcance del informe y segmentación del mercado de mensajería

|

Atributos |

Perspectivas clave del mercado de mensajería |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de mensajería en Asia-Pacífico

Cambio creciente hacia servicios de mensajería digitalizados, de alta velocidad y basados en la tecnología

- Una tendencia significativa en el mercado de la mensajería es la creciente transición hacia soluciones de entrega de alta velocidad basadas en tecnología, impulsada por la rápida expansión del comercio electrónico, la venta minorista en línea y las crecientes expectativas de los consumidores de un servicio rápido y confiable. Las empresas están invirtiendo fuertemente en plataformas digitales, automatización y sistemas de seguimiento para optimizar las operaciones y mejorar la experiencia del cliente en áreas urbanas y semiurbanas.

- Por ejemplo, DHL ha implementado centros de clasificación automatizados y un software avanzado de optimización de rutas para optimizar la velocidad de entrega y reducir las ineficiencias operativas. Estas soluciones tecnológicas refuerzan la fiabilidad del servicio y permiten el seguimiento en tiempo real de los paquetes desde el envío hasta la entrega.

- La adopción de plataformas logísticas basadas en IA está en auge, lo que permite tiempos de entrega predictivos, optimización de rutas y una mejor conectividad de última milla. Esto posiciona a los servicios de mensajería como facilitadores esenciales de la eficiencia de las operaciones de la cadena de suministro y la satisfacción del cliente.

- Los sectores sanitario y farmacéutico recurren cada vez más a los servicios de mensajería para la entrega puntual de medicamentos, vacunas y muestras de laboratorio esenciales. Empresas como FedEx y UPS ofrecen soluciones de entrega prioritaria con control de temperatura que garantizan un transporte seguro y rápido.

- Los minoristas están expandiendo el uso de redes de mensajería digitalizadas para respaldar modelos de entrega en el mismo día y al día siguiente, aprovechando sistemas de rastreo, aplicaciones móviles y envíos automatizados para satisfacer la creciente demanda de los consumidores. Esta tendencia está acelerando la adopción en el mercado de servicios de entrega con tecnología integrada.

- El mercado está experimentando un fuerte crecimiento en los servicios logísticos internacionales exprés y transfronterizos, donde las plataformas digitales, la automatización del despacho de aduanas y las soluciones integradas de seguimiento son cruciales. El auge del comercio global, las compras en línea transfronterizas y la demanda de envíos internacionales rápidos refuerzan la transición hacia servicios de mensajería digitalizados y tecnológicos.

Dinámica del mercado de mensajería en Asia-Pacífico

Conductor

Crecimiento rápido del comercio electrónico y creciente demanda de entregas rápidas

- La rápida expansión de las plataformas de comercio electrónico, la mayor penetración de las compras en línea y las crecientes expectativas de los consumidores en cuanto a entregas puntuales impulsan una fuerte demanda de servicios de mensajería. Las soluciones tecnológicas, el seguimiento en tiempo real y las opciones de entrega flexibles generan oportunidades de crecimiento del mercado.

- Por ejemplo, Amazon Logistics aprovecha la inteligencia artificial sofisticada, la robótica y el análisis predictivo para gestionar entregas de gran volumen y ofrecer servicios de última milla rápidos y fiables. Estas capacidades permiten a la empresa satisfacer la creciente demanda de entregas en el mismo día y al día siguiente en múltiples regiones.

- La creciente urbanización, el mayor uso de teléfonos inteligentes e internet, y la preferencia de los consumidores por la comodidad impulsan aún más la adopción de la mensajería. Empresas de todos los sectores recurren cada vez más a redes logísticas digitalizadas para garantizar entregas puntuales y eficiencia operativa.

- La creciente importancia de la fiabilidad de la cadena de suministro, en particular para productos perecederos y de alto valor, refuerza la necesidad de servicios de mensajería avanzados. Las empresas están integrando el seguimiento en la nube, la clasificación automatizada y la optimización de rutas para mantener el rendimiento y la confianza del cliente.

- La expansión de los mercados de comercio electrónico y los modelos de venta directa al consumidor está intensificando la demanda de soluciones de mensajería escalables y tecnológicamente avanzadas. Esta dependencia sostenida de servicios de entrega rápidos y fiables posiciona el mercado para un crecimiento continuo.

Restricción/Desafío

Altos costos operativos y limitaciones de infraestructura

- El mercado de la mensajería se enfrenta a desafíos debido al alto coste de la infraestructura, las flotas de vehículos, los centros de clasificación automatizados y las inversiones tecnológicas necesarias para satisfacer la creciente demanda de entregas. Estos factores incrementan los gastos operativos generales y limitan los márgenes de beneficio de los proveedores.

- Por ejemplo, Blue Dart y FedEx incurren en costos significativos asociados con la entrega de última milla, la automatización de almacenes y la integración de sistemas de seguimiento digital. Mantener la calidad del servicio y controlar los costos sigue siendo un desafío operativo clave.

- La limitada infraestructura logística en las regiones semiurbanas y rurales genera cuellos de botella en las entregas, lo que afecta la velocidad y la eficiencia. La expansión a estas zonas requiere una inversión significativa en redes de transporte y sistemas de entrega con tecnología avanzada.

- El aumento de los costos del combustible, la escasez de mano de obra y la fluctuación de los gastos de mantenimiento contribuyen aún más a los desafíos operativos para los proveedores de mensajería. Equilibrar la gestión de costos con la confiabilidad del servicio es fundamental para mantener la competitividad en el mercado.

- El mercado sigue enfrentando limitaciones para escalar redes de distribución de alta velocidad basadas en tecnología, manteniendo al mismo tiempo la asequibilidad y la eficiencia. Estos desafíos, en conjunto, requieren soluciones innovadoras, alianzas e inversiones en infraestructura para satisfacer las crecientes expectativas de los consumidores.

Alcance del mercado de mensajería de Asia-Pacífico

El mercado está segmentado según el tipo, modo de entrega, tipo de cliente, destino y usuario final .

- Por tipo

Según el tipo, el mercado de mensajería se segmenta en servicios de salida y de entrada. El segmento de salida dominó el mercado con una cuota estimada del 61,3 % en 2025, impulsado por el alto volumen de envíos que realizan empresas, plataformas de comercio electrónico, fabricantes y proveedores de servicios a clientes finales. El crecimiento del comercio minorista en línea, el comercio transfronterizo y los modelos de negocio directos al consumidor siguen impulsando el movimiento de paquetería de salida a nivel mundial. Las empresas de mensajería se centran en la optimización de la logística de salida para garantizar la entrega puntual, la rentabilidad y la satisfacción del cliente.

Se prevé que el segmento de receptividad crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el aumento de las devoluciones, la logística inversa, las entregas a proveedores y la reposición de inventario entrante. El creciente enfoque en la gestión eficiente de la cadena de suministro y la optimización del inventario está acelerando la demanda de servicios de mensajería entrante.

- Por modo de entrega

Según el modo de entrega, el mercado de mensajería se segmenta en Entrega Normal y Entrega Exprés. El segmento de Entrega Normal tuvo la mayor cuota de mercado, con un 54,8%, en 2025, gracias a su rentabilidad y a su amplio uso para envíos no urgentes en los sectores minorista, manufacturero y de servicios. Las empresas siguen recurriendo a las opciones de entrega estándar para gestionar los costes logísticos y garantizar un servicio fiable.

Se proyecta que el segmento de Entrega Exprés registrará la tasa de crecimiento más rápida entre 2026 y 2033, impulsado por la creciente demanda de entregas en el mismo día, al día siguiente y con horario definido. La expansión del comercio electrónico, la entrega de alimentos, la logística sanitaria y los servicios premium está impulsando significativamente la adopción de soluciones de mensajería exprés.

- Por tipo de cliente

Según el tipo de cliente, el mercado de mensajería se segmenta en B2B (empresa a empresa), B2C (empresa a consumidor) y C2C (consumidor a consumidor). El segmento B2B dominó el mercado con una participación del 46,5 % en 2025, impulsado por altos volúmenes de envíos en las cadenas de suministro de manufactura, comercio mayorista, productos farmacéuticos, BFSI e industria. Los servicios de mensajería confiables, programados y por contrato siguen impulsando una fuerte demanda B2B.

Se prevé que el segmento B2C crezca a su tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la rápida expansión del comercio electrónico, los mercados digitales y las marcas de venta directa al consumidor. Las crecientes expectativas de los consumidores de opciones de entrega rápidas, rastreables y flexibles están acelerando el crecimiento de los servicios de mensajería B2C.

- Por destino

Según el destino, el mercado de mensajería se segmenta en entregas nacionales e internacionales/transfronterizas. El segmento nacional representó la mayor cuota de mercado, con un 63,9 %, en 2025, impulsado por el alto volumen de paquetería intranacional, las entregas urbanas y la expansión del comercio electrónico y las redes minoristas nacionales. La eficiente infraestructura de última milla y las redes locales de mensajería respaldan la fuerte demanda nacional.

Se prevé que el segmento internacional/transfronterizo crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el aumento del comercio global, el comercio electrónico transfronterizo y el envío internacional de documentos y paquetes. Las mejoras en la tramitación aduanera, la documentación digital y las redes logísticas internacionales están acelerando el crecimiento de la mensajería transfronteriza.

- Por el usuario final

Según el usuario final, el mercado de mensajería se segmenta en Comercio Mayorista y Minorista (Comercio Electrónico), Mensajería Médica, Manufactura, Servicios (BFSI), Construcción, Servicios Públicos e Industrias Primarias. El segmento de Comercio Mayorista y Minorista (Comercio Electrónico) dominó el mercado con una participación del 49,2 % en 2025, impulsado por los enormes volúmenes de paquetería generados por las plataformas de compra en línea, el comercio minorista omnicanal y los mercados digitales. El crecimiento continuo del gasto de los consumidores en línea sustenta una demanda sostenida.

Se prevé que el segmento de mensajería médica crezca a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de entregas urgentes de productos farmacéuticos, muestras de diagnóstico, equipos médicos y suministros sanitarios. El creciente enfoque en la fiabilidad y el cumplimiento de la logística sanitaria está fortaleciendo su adopción.

Análisis regional del mercado de mensajería de Asia-Pacífico

- China dominó el mercado de mensajería con la mayor participación en los ingresos en 2025, impulsada por su amplia infraestructura logística, el rápido crecimiento del comercio electrónico y la creciente demanda de los consumidores de servicios de entrega rápidos y confiables.

- Las sólidas inversiones gubernamentales en centros logísticos inteligentes, conectividad ferroviaria de alta velocidad y políticas comerciales favorables refuerzan el liderazgo de China en el mercado regional.

- La presencia de empresas líderes de mensajería nacional, las alianzas con actores globales del comercio electrónico y la introducción de soluciones de entrega basadas en tecnología siguen consolidando la posición dominante de China durante el período de pronóstico. La creciente urbanización, la creciente penetración del comercio minorista en línea y la creciente preferencia de los consumidores por las entregas en el mismo día y al día siguiente fortalecen aún más el alcance del mercado en ciudades de primer y segundo nivel.

Perspectiva del mercado de mensajería en Japón

Se prevé un crecimiento sostenido del mercado japonés entre 2026 y 2033, impulsado por su avanzada tecnología logística, la alta penetración de teléfonos inteligentes y las sólidas expectativas de los consumidores en cuanto a entregas puntuales. Los consumidores japoneses optan cada vez más por servicios de mensajería premium con ofertas de valor añadido, como seguimiento en tiempo real y entrega sin contacto. La demanda de soluciones compactas de entrega de última milla está en aumento debido a la densidad urbana y a la reducción de los espacios residenciales. La continua innovación en automatización, robótica y plataformas logísticas digitales, junto con las colaboraciones entre proveedores de mensajería japoneses e internacionales, refuerzan las perspectivas de crecimiento sostenido del mercado. La prioridad de Japón en la fiabilidad, el avance tecnológico y la confianza del consumidor respaldan su sólido posicionamiento regional.

Perspectivas del mercado de mensajería en India

Se proyecta que India registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado de mensajería de Asia Pacífico durante el período 2026-2033, impulsada por la creciente adopción del comercio electrónico, la creciente urbanización y la creciente penetración de teléfonos inteligentes e internet. La creciente conciencia sobre los servicios de entrega a domicilio y la creciente preferencia de los consumidores por opciones de envío rápidas y asequibles están acelerando su adopción. La demanda de soluciones de mensajería rentables y tecnológicas es especialmente fuerte entre las pequeñas empresas y quienes compran por primera vez en línea. El rápido crecimiento de las plataformas de comercio electrónico, la expansión de las redes de entrega de última milla y las alianzas entre actores logísticos nacionales e internacionales están mejorando la accesibilidad a los servicios. Iniciativas gubernamentales como la India digital y políticas comerciales de apoyo garantizan el surgimiento de India como el mercado de más rápido crecimiento de la región.

Cuota de mercado del servicio de mensajería en Asia-Pacífico

La industria de mensajería está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- FedEx (EE. UU.)

- Deutsche Post AG (Alemania)

- United Parcel Service of America, Inc. (UPS) (EE. UU.)

- SF Express (China)

- Royal Mail Group Limited (Reino Unido)

- Yamato Transport Co., Ltd. (Japón)

- Koninklijke PostNL (Países Bajos)

- Aramex (EAU)

- Singapore Post Limited (Singapur)

- Sagawa Express Co., Ltd. (Japón)

- Qantas Airways Limited (Australia)

- Allied Express (Australia)

- Unique Air Express (India)

- Gati-Kintetsu Express Private Limited (India)

- DTDC Express Limited (India)

- Hermes Europe GmbH (Alemania)

- GO! Express & Logistics (Deutschland) GmbH (Alemania)

- GEODIS (Francia)

- Delhivery Pvt Ltd (India)

- LaserShip Inc (EE. UU.)

Últimos avances en el mercado de mensajería de Asia-Pacífico

- En junio de 2025, JD.com lanzó su primer servicio exprés internacional autónomo para fortalecer su presencia logística global y competir directamente con los líderes consolidados del sector de la mensajería. Esta iniciativa refleja la ambición de JD.com de ampliar sus capacidades de entrega transfronteriza y mejorar el control sobre las cadenas de suministro internacionales.

- En mayo de 2025, DHL eCommerce UK se fusionó con Evri para crear una red de entrega a gran escala que gestiona más de mil millones de paquetes al año en todo el país. Esta fusión pone de manifiesto la consolidación del sector, cuyo objetivo es mejorar la eficiencia en la última milla, la velocidad de entrega y la cobertura nacional.

- En febrero de 2024, Emirates Post Group, renombrado como 7X, presentó EMX como una nueva filial enfocada en transformar la industria de mensajería, mensajería urgente y paquetería en los EAU mediante tecnologías avanzadas y soluciones logísticas centradas en el cliente. Esta iniciativa subraya la estrategia del grupo para modernizar los servicios de CEP y fortalecer la competitividad regional.

- En mayo de 2023, Interroll lanzó su plataforma de transporte de alto rendimiento, diseñada específicamente para operaciones de mensajería, mensajería exprés y paquetería, con módulos de desvío inteligentes y capacidades de clasificación de alto rendimiento. Este desarrollo demuestra la creciente importancia de la automatización y la eficiencia en entornos de gestión de paquetería a gran escala.

- En noviembre de 2022, DHL Express inauguró un punto de servicio digital totalmente automatizado en el Parque Digital de Dubái, la primera instalación de este tipo en Oriente Medio y dentro de la red global de DHL. Este lanzamiento estableció un nuevo referente en la atención al cliente automatizada y reforzó el liderazgo de DHL en innovación logística.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.