Mercado de licor de maíz fermentado en Asia y el Pacífico, por tipo de producto (inorgánico/convencional, orgánico), forma (polvo, líquido), aplicación ( alimento para animales , fertilizantes, productos fermentados, industrias farmacéuticas, cebos de pesca, otras aplicaciones industriales), tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

El maíz se utiliza ampliamente en una variedad de aplicaciones, incluida la alimentación humana para aumentar el valor nutricional, la alimentación del ganado , los productos químicos y los biocombustibles, como producto básico y muchos otros.

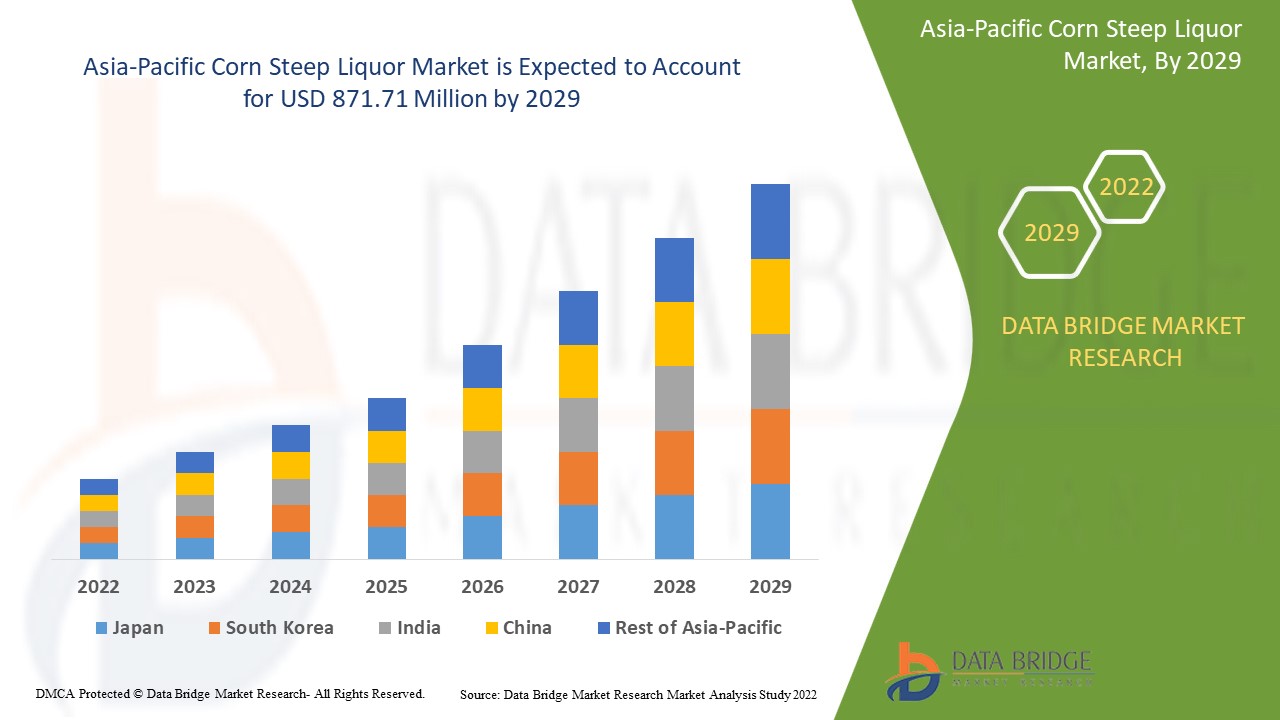

Data Bridge Market Research analiza que el mercado de licor de maíz, que creció a un valor de 555,25 millones en 2021 y se espera que alcance el valor de USD 871,71 millones para 2029, a una CAGR del 5,8% durante el período de pronóstico de 2022-2029. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción, análisis de patentes y comportamiento del consumidor.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (inorgánico/convencional, orgánico), forma (polvo, líquido), aplicación (alimentos para animales, fertilizantes, productos fermentados, industrias farmacéuticas, cebos para pesca, otras aplicaciones industriales) |

|

Países cubiertos |

China, India, Japón, Corea del Sur, Indonesia, Filipinas, Vietnam, Tailandia, Australia, Nueva Zelanda, Malasia, Singapur, Resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

Cargill Incorporated (EE. UU.), DuPont (EE. UU.), Bluestar Adisseo Co. Ltd (China), BASF SE (Alemania), Kemin Industries, Inc. (EE. UU.), DSM (Países Bajos), Associated British Foods plc (Reino Unido), Novozymes (EE. UU.), Biocatalysts Ltd. (Reino Unido), Amano Enzyme Inc. (Japón), Kerry Group plc (Irlanda), Jiangsu Boli Bioproducts Co. Ltd. (China), AUM Enzymes (India), Antozyme Biotech Pvt Ltd (India), Xike Biotechnology Co. Ltd. (China), SUNSON Industry Group Co. Ltd. (China) |

|

Oportunidades |

|

Definición de mercado

El maíz, también conocido como maíz, es un cereal que se cultiva ampliamente en todo el mundo. El licor de maceración de maíz, un subproducto de la molienda húmeda del maíz, tiene un alto contenido de aminoácidos, minerales y vitaminas. La molienda húmeda del maíz es el proceso de descomponer los granos de maíz en elementos individuales como proteínas, aceite, almidón, etc. El licor de maceración de maíz es un líquido espeso y amarillento que se utiliza en el crecimiento de microorganismos durante la fabricación de antibióticos y otros productos fermentados.

Dinámica del mercado de licor de maíz fermentado

Conductores

- Los usos industriales del licor de maceración de maíz impulsan la demanda del mercado

El licor de maceración de maíz tiene una variedad de aplicaciones industriales, incluida la biodegradación del petróleo crudo, el tratamiento de grietas en el hormigón y la posconversión de maíz de desecho municipal para su uso en la agricultura orgánica. Se espera que estos beneficios y aplicaciones aumenten la adopción del licor de maceración de maíz por parte de los consumidores, lo que impulsará el crecimiento del mercado durante el período de pronóstico.

- La creciente demanda de proteínas animales y productos derivados de animales

Con una población en constante crecimiento en Asia y el Pacífico y una demanda de proteínas en aumento debido al aumento del ingreso per cápita, la carne y los productos cárnicos nunca han sido tan abundantes. Para satisfacer la creciente demanda de carne y productos cárnicos, los productores ganaderos deben confiar en una nutrición adecuada para garantizar un crecimiento óptimo y una carne de alta calidad.

El licor de maceración de maíz es un ejemplo de aditivo que puede proporcionar el perfil nutricional necesario a una fracción del costo de los productos nutricionales de primera calidad. Debido a que los costos de los alimentos representan la mayoría de los costos asociados con las operaciones ganaderas, reducirlos es fundamental para los dueños de negocios, lo que hace que el licor de maceración de maíz sea el aditivo preferido por los criadores de ganado.

Oportunidad

El aumento de los gastos de investigación y desarrollo, el crecimiento y la expansión de la industria de alimentos para animales en las economías en desarrollo y el creciente consumo de carne y productos relacionados contribuirán al crecimiento del valor del mercado.

Restricciones

Sin embargo, la amplia disponibilidad de sustitutos planteará un desafío importante para el crecimiento del mercado. Los altos costos asociados con las capacidades de I+D y la mayor competencia entre los fabricantes también impedirán el crecimiento del mercado. La distribución inadecuada y las interrupciones en la gestión de la cadena de suministro descarrilarán una vez más el crecimiento del mercado.

Este informe sobre el mercado de licor de maíz macerado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de licor de maíz macerado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de licor de maíz fermentado

Durante la situación de COVID-19, la agricultura y la producción de alimentos se han identificado como sectores críticos en Asia-Pacífico. Como resultado, los agricultores han seguido proporcionando nutrición de alta calidad a los animales de granja para alimentar a un número cada vez mayor de consumidores de Asia-Pacífico. Sin embargo, el factor más importante que afecta al mercado de alimentos para animales es la interrupción de la cadena de suministro. China es un importante productor y exportador de alimentos para animales, y almacenó suficiente producto para 2-3 meses de suministro durante el surgimiento de la situación de COVID-19 mientras las empresas estaban cerradas por el Año Nuevo Lunar. Además, los problemas logísticos han obstaculizado el suministro de contenedores y buques, así como el transporte de microingredientes específicos.

Desarrollo reciente

- TEREOS STARCH & SWEETENERS EUROPE lanzó su oferta en el mercado chino en abril. La división de negocios de Tereos, Starch & Sweeteners asistió a la feria Food Ingredients China en Shanghái. Esto permitió a la empresa presentar su oferta de productos a los consumidores chinos, lo que le permitió ampliar su base de clientes.

Alcance del mercado de licor de maíz fermentado en Asia y el Pacífico

El mercado de licor de maíz macerado está segmentado en función de la forma, el tipo de producto y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Forma

- Polvo

- Líquido

Tipo de producto

- Inorgánico/Convencional

- orgánico

Solicitud

- Alimento para animales

- Fertilizantes

- Productos fermentados

- Industrias farmacéuticas

- Cebo de pesca

- Otras aplicaciones industriales

Análisis y perspectivas regionales del mercado de licor de maíz fermentado

Se analiza el mercado de licor de maíz y se proporcionan información y tendencias del tamaño del mercado por país, forma, tipo de producto y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de licor de maíz son China, India, Japón, Corea del Sur, Indonesia, Filipinas, Vietnam, Tailandia, Australia, Nueva Zelanda, Malasia, Singapur y el resto de Asia-Pacífico.

China domina el mercado del licor de maceración de maíz, que tiene una gran demanda para diversas aplicaciones, como la nutrición animal, los fertilizantes y otros, debido a su alto valor nutricional y bajo costo. Varios fabricantes también participan en la comercialización del producto. Como la producción de maíz en la India es alta y los fabricantes pueden producir el producto a un alto nivel, la India representa la segunda participación más grande. Indonesia representa la tercera participación más grande de la producción de maíz después de China y la India, lo que permite a los fabricantes producir productos fácilmente. Además, el licor de maceración de maíz tiene una gran demanda en una variedad de industrias, incluidos los aditivos para piensos y los fertilizantes.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de licor de maíz

El panorama competitivo del mercado de licor de maíz macerado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de licor de maíz macerado.

Algunos de los principales actores que operan en el mercado de licor de maíz fermentado son:

- Cargill Incorporated (Estados Unidos)

- DuPont (Estados Unidos)

- Bluestar Adisseo Co.Ltd (China)

- BASF SE (Alemania)

- Kemin Industries, Inc. (Estados Unidos)

- DSM (Países Bajos)

- Associated British Foods plc (Reino Unido)

- Novozymes (Estados Unidos)

- Biocatalysts Ltd. (Reino Unido)

- Amano Enzyme Inc. (Japón)

- Kerry Group plc (Irlanda)

- Jiangsu Boli Bioproducts Co.Ltd. (Porcelana)

- Enzimas AUM (India)

- Antozyme Biotech Pvt Ltd (India)

- Xike Biotecnología Co. Ltd. (China)

- Grupo industrial SUNSON Co. Ltd (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 MULTIPLE BENEFITS OF CORN STEEP LIQUOR IN DIFFERENT SECTORS

5.1.2 HIGH DEMAND FOR ANIMAL NUTRITION PRODUCTS

5.2 RESTRAINT

5.2.1 VARIABILITY IN CHEMICAL COMPOSITION

5.3 OPPORTUNITY

5.3.1 GROWING TREND FOR ORGANIC AGRICULTURE

5.4 CHALLENGE

5.4.1 LOW PENETRATION RATE AGAINST CHEMICAL FERTILIZERS

6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY FORM

6.1 OVERVIEW

6.2 POWDER

6.3 LIQUID

7 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANIMAL FEED

7.2.1 SWINE

7.2.2 POULTRY

7.2.3 RUMINANTS

7.2.4 PETS

7.2.5 OTHERS

7.3 FERTILIZERS

7.4 FERMENTED PRODUCTS

7.4.1 YEASTS

7.4.2 BEER

7.4.3 LEAVENED DOUGH PRODUCTS

7.5 PHARMACEUTICAL INDUSTRY

7.6 FISHING BAIT

7.7 OTHER INDUSTRIAL APPLICATIONS

8 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INORGANIC/CONVENTIONAL

8.3 ORGANIC

9 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY COUNTRY

9.1 CHINA

9.2 INDIA

9.3 INDONESIA

9.4 PHILIPPINES

9.5 VIETNAM

9.6 THAILAND

9.7 AUSTRALIA

9.8 NEW ZEALAND

9.9 SOUTH KOREA

9.1 MALAYSIA

9.11 JAPAN

9.12 SINGAPORE

9.13 REST OF ASIA-PACIFIC

10 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, COMPANY LANDSCAPE

11 SWOT & DBMR ANALYSIS

11.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

12 COMPANY PROFILE

12.1 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 TEREOS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 MERCK KGAA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ROQUETTE FRÈRES

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 BAOLINGBAO BIOLOGY CO.,LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT & SERVICE PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 FRIENDSHIP CORN STARCH CO., LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 GULSHAN POLYOLS LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT & SERVICE PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 JUCI CORN BIOTECHNOLOGY CO.,LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SANSTAR BIO – POLYMERS LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 SHANDONG SHANSHI CHEMICAL CO., LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 YANTAI LU SHUN HUITONG BIOLOGICAL TECHNOLOGY CO.,LTD

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 2 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 4 ASIA-PACIFIC FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 5 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 7 CHINA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 8 CHINA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 9 CHINA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 10 CHINA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 11 CHINA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 INDIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 13 INDIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 14 INDIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 INDIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 16 INDIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 INDONESIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 18 INDONESIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 19 INDONESIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 INDONESIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 21 INDONESIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 PHILIPPINES CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 23 PHILIPPINES CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 24 PHILIPPINES CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 25 PHILIPPINES FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 26 PHILIPPINES ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 27 VIETNAM CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 28 VIETNAM CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 29 VIETNAM CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 30 VIETNAM FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 31 VIETNAM ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 32 THAILAND CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 33 THAILAND CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 34 THAILAND CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 THAILAND FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 THAILAND ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 AUSTRALIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 AUSTRALIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 39 AUSTRALIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 AUSTRALIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 AUSTRALIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 43 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 44 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 NEW ZEALAND FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 46 NEW ZEALAND ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 47 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 48 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 49 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 SOUTH KOREA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 SOUTH KOREA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 MALAYSIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 MALAYSIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 54 MALAYSIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 MALAYSIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 MALAYSIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 JAPAN CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 58 JAPAN CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 59 JAPAN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 60 JAPAN FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 61 JAPAN ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 62 SINGAPORE CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 SINGAPORE CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 64 SINGAPORE CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 SINGAPORE FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 SINGAPORE ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 REST OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SEGMENTATION

FIGURE 9 HIGH DEMAND FOR ANIMAL NUTRITION PRODUCTS AND MULTIPLE BENEFITS OF CORN STEEP LIQUOR IN DIFFERENT SECTORS ARE THE MAJOR FACTORS TO DRIVE THE MARKET FOR CORN STEEP LIQUOR IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 10 INORGANIC/CONVENTIONAL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET IN 2020 & 2027

FIGURE 11 DRIVERS, RESTRAINT, OPPORTUNITES AND CHALLENGE OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET

FIGURE 12 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY FORM, 2019

FIGURE 13 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY APPLICATION, 2019

FIGURE 14 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY PRODUCT TYPE, 2019

FIGURE 15 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SNAPSHOT (2019)

FIGURE 16 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2019)

FIGURE 17 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2020 & 2027)

FIGURE 18 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2019 & 2027)

FIGURE 19 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 20 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.