India and Europe Generic Injectable Market, By Therapeutic Application (Oncology, Cardiovascular Disorders, Infectious Diseases, Pain Management, Metabolic Disorder (Diabetes), and Immunology Disorders), Biosimilar Drugs (Semaglutide, Ibutidlide Fumarate, Evolocumab, Alirocumab, Anidulafungin, Dulaglutide, Lixisenatide, Exenatide, Liraglutide, and Adalimumab), End User (Direct Sales Distributors, Pharmaceutical Wholesalers, Drug Stores, Pharmacy, Group Purchasing Organizations (GPOs), and Others), Distribution Channel (Pharmaceutical Wholesalers, Contract Manufacturers, Pharmacy Chains, Group Purchasing Organizations (GPOs), and Others) - Industry Trends and Forecast to 2035.

India and Europe Generic Injectable Market Analysis and Size

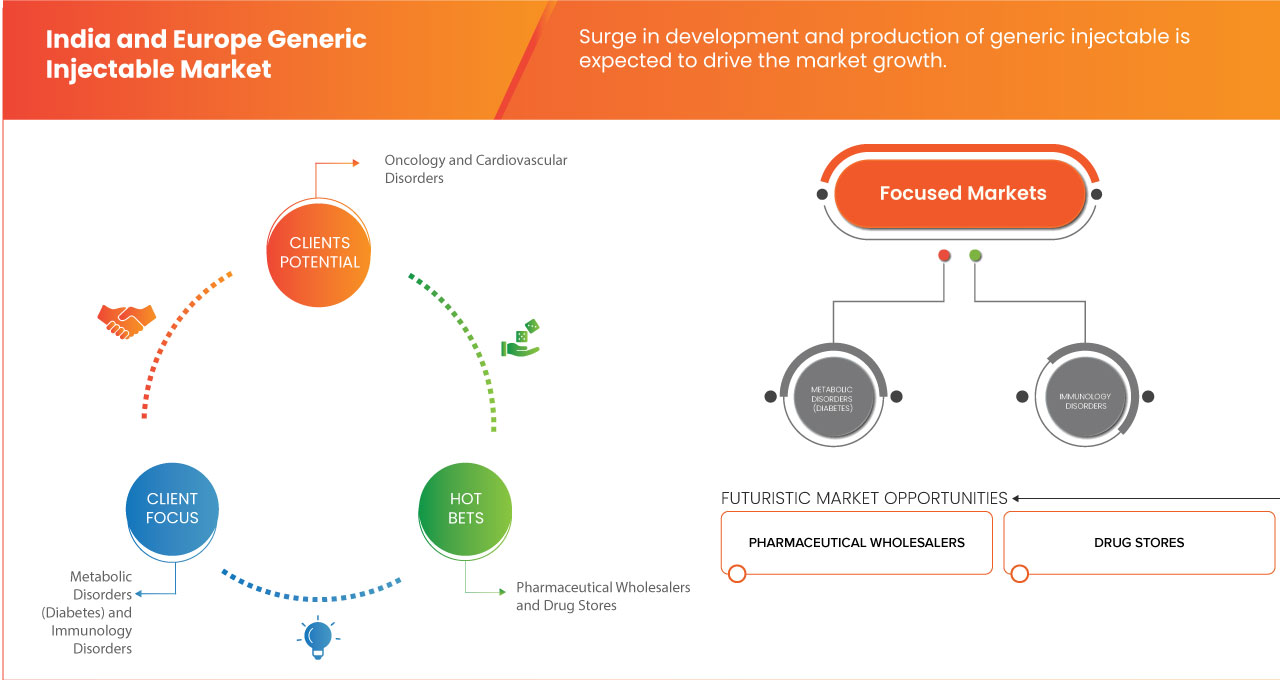

Generic injectable, being more economical than their branded counterparts, offer an attractive solution for healthcare systems aiming to manage costs without compromising quality is driving the market growth. The ascendance of market growth through increased emphasis on contract research manufacturing is expected to create an opportunity for market growth.

Data Bridge Market Research analyzes that the India and Europe generic injectable market is growing at a CAGR of 9.0% in the forecast period of 2024 to 2035 and is expected to reach USD 119,063.77 million by 2031 from USD 43,499.40 million in 2023. Escalating the incidence of chronic diseases and a surge in the development and production of generic injectable is expected to drive the market's expansion.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2035 |

|

Base Year |

2023 |

|

Historic Year |

2022 (Customizable 2016-2021) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Therapeutic Application (Oncology, Cardiovascular Disorders, Infectious Diseases, Pain Management, Metabolic Disorder (Diabetes), and Immunology Disorders), Biosimilar Drugs (Semaglutide, Ibutidlide Fumarate, Evolocumab, Alirocumab, Anidulafungin, Dulaglutide, Lixisenatide, Exenatide, Liraglutide, and Adalimumab), End User (Direct Sales Distributors, Pharmaceutical Wholesalers, Drug Stores, Pharmacy, Group Purchasing Organizations (GPOs), and Others), Distribution Channel (Pharmaceutical Wholesalers, Contract Manufacturers, Pharmacy Chains, Group Purchasing Organizations (GPOs), and Others) |

|

Country/Region Covered |

India and Europe |

|

Market Players Covered |

Cipla Inc., Dr. Reddy’s Laboratories Ltd, Sanofi, Viatris Inc., Fresenius Kabi AG, Sandoz Group AG, GLENMARK PHARMACEUTICALS LTD, Gland Pharma Limited, Par Pharmaceutical, and Sun Pharmaceutical Industries Ltd., among others |

Market Definition

The term "generic injectable" describes the injectable administration of pharmaceuticals using generic drugs. The drug delivery method is preferred due to its effectiveness in providing accurate dosage management and serving as a backup when oral administration is not feasible or is not as effective. Generic injectable medication administration is essential to healthcare because it offers reasonably priced substitutes without sacrificing therapeutic requirements.

India and Europe Generic Injectable Market Dynamics

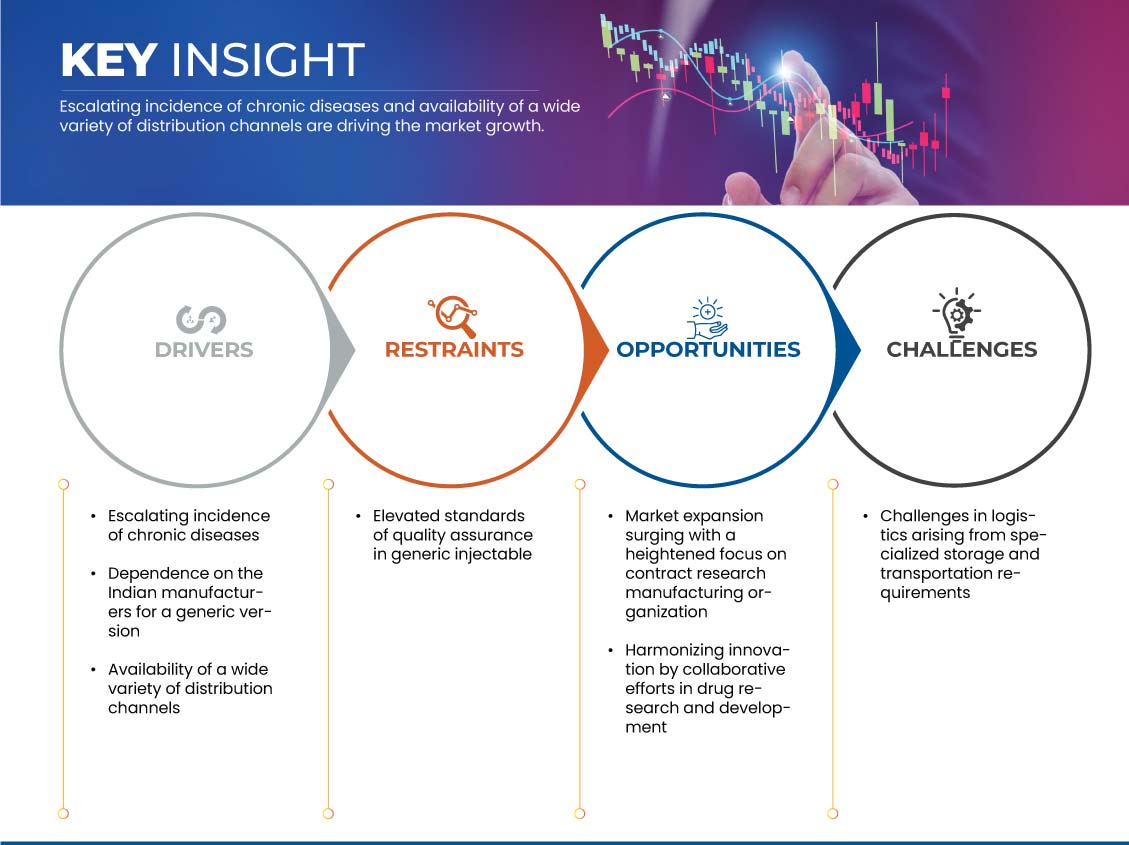

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Surge in Development and Production of Generic Injectable

The market is experiencing a noteworthy boost due to the escalating development and production of generic injectable. Several factors, including the growing emphasis on cost-effectiveness in healthcare, propel this surge.

Generic injectable, being more economical than their branded counterparts, offer an attractive solution for healthcare systems aiming to manage costs without compromising quality.

The expiration of patents for various branded injectable drugs has further opened avenues for generic alternatives, fostering healthy competition and expanding choices for healthcare providers. Regulatory support and favorable environments in Europe play a pivotal role encouraging generic injectable approval and market entry. In addition, the rising demand for biosimilar, especially generic versions of complex biologic injectable, contributes significantly to the increasing landscape of generic injectable drug development.

- Escalating Incidence of Chronic Diseases

This rise in chronic illnesses has created an unprecedented demand for targeted and efficient therapeutic interventions. Injectable drug delivery systems have emerged as indispensable tools in addressing the complexities of managing these persistent health challenges. The inherent nature of chronic diseases often demands precise dosage control and continuous medication administration, areas in which injectable drug delivery excels. The market gains prominence by offering solutions that lead to enhanced treatment outcomes, improved patient management, and increased therapeutic efficacy as healthcare systems globally grapple with the escalating burden of chronic conditions.

In conclusion, the market's direction is intricately tied to its capability to address the complex healthcare demands arising from the escalating prevalence of chronic diseases. The market solidifies its pivotal role as a

Opportunity

- Ascendance of Market Growth Through Increased Emphasis on Contract Research Manufacturing

Contract Research and Manufacturing Organizations (CRMOs) are becoming increasingly popular among pharmaceutical businesses, especially those engaged in developing generic drugs. Contract manufacturing is utilizing specialized expertise, improving procedures, and increasing the output of generic drugs. Pharmaceutical businesses can concentrate on their primary skills, which include marketing, research, and regulatory compliance by using CRMOs to handle production. The pharmaceutical sector is changing, and with it, the need for efficiency, economy, and flexibility in drug discovery and production is rising. CRMOs, or contract research and manufacturing organizations, are essential in helping generic drug producers satisfy these expectations since they provide specialized services. Pharmaceutical businesses are outsourcing different stages of their operations due to restricted regulatory requirements, the increasing complexity of drug research procedures, and the necessity for innovative manufacturing technology.

Restraints/Challenges

- Ensuring and Maintaining High-Quality Standards

The stringent quality control processes inherent in injectable manufacturing demand meticulous attention to detail at every stage. Meeting these standards necessitates substantial investments in technology, infrastructure, and skilled personnel, which can contribute to elevated production costs. In addition, the rigorous compliance requirements may also extend the time-to-market for new injectable drugs. Despite these challenges, the commitment to maintaining high quality is imperative to safeguard patient safety and uphold the integrity of healthcare practices.

Despite the challenges posed by quality assurance constraints, it stands out as a pivotal aspect that underscores the industry's unwavering commitment to providing injectable drugs that are both safe and effective. This commitment plays a fundamental role in securing the trust and well-being of patients on a global scale.

- Logistics Arising from Specialized Storage and Transportation Requirements

Generic drugs are frequently made by several manufacturers, resulting in different formulations and packaging. Although generic medications come in various formulations, they may be more vulnerable to changes in humidity and temperature while being stored and transported. The problem arises from the possibility that some generic drugs, particularly those with specific stability requirements, may require specific storage settings to preserve their effectiveness and safety.

Certain complex formulations and generic drugs may be susceptible to changes in temperature and exposure to light. The integrity of these medications may be compromised by inadequate storage, which could result in decreased therapeutic efficacy or even safety issues when administered. Furthermore, wholesalers and distributors are just two of the numerous intermediaries frequently involved in the worldwide distribution networks for generic medications. Exposure to unfavorable storage conditions poses a risk at every stage of the supply chain. This becomes especially important in areas with less developed infrastructure or uneven transportation temperature regulation.

Recent Developments

- In January 2024, Sun Pharmaceutical Industries Limited and Taro Pharmaceutical Industries Ltd. officially entered into a definitive merger agreement. Under this agreement, Sun Pharma, as the controlling shareholder of Taro, will acquire all outstanding ordinary shares of Taro, excluding those already held by Sun Pharma or its affiliates. The acquisition will be at a cash price of USD 43.00 per share without interest. This merger is anticipated to create a more robust and competitive entity, driving potential benefits such as increased market presence, operational efficiency, and expanded capabilities for Sun Pharma and Taro Pharmaceutical Industries Ltd

- In November 2023, Fresenius Kabi introduced Tyenne, its biosimilar of tocilizumab referencing RoActemra (tocilizumab), in the European Union. Tyenne marks the inaugural tocilizumab biosimilar in Europe for addressing various inflammatory and immune diseases. It will expand its product range

- In August 2023, Aurobindo Pharma secured final approval from the U.S. Food and Drug Administration (USFDA) for the production and commercialization of Vancomycin Hydrochloride for Injection USP in Single-Dose Vials with strengths of 1.25 g/vial and 1.5 g/vial. These formulations are bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Vancomycin Hydrochloride for Injection USP, manufactured by Mylan Laboratories Ltd

- In June 2023, Dr. Reddy's Laboratories Ltd. announced the opening of its new, dedicated division "RGenX," marking its entry into the Indian commercial generics market. Dr. Reddy believes this will give patients more affordable and more access to a greater selection of products. The new venture will advance the company's objective of serving more than 1.5 billion patients by 2030. This has helped the company to expand its business with product availability

- In December 2023, Hikma Pharmaceuticals PLC introduced Phenylephrine HCl Injection, USP, available in 500mcg/5mL and 1,000mcg/10mL doses. This product is now available in the United States in ready-to-use vials. Its intended use is to elevate blood pressure in adults experiencing clinically significant hypotension primarily caused by vasodilation during anesthesia. This helped the company to expand its market.

India and Europe Generic Injectable Market Scope

The India and Europe generic injectable market is segmented into three notable segments, which are based on therapeutic application, end user, biosimilar drugs and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Therapeutic Application

- Oncology

- Cardiovascular Disorders

- Infectious Diseases

- Pain Management

- Metabolic Disorder (Diabetes)

- Immunology Disorders

On the basis of therapeutic application, the market is segmented into oncology, cardiovascular disorders, infectious diseases, pain management, metabolic disorder (diabetes), and immunology disorders.

Biosimilar Drugs

- Semaglutide

- Ibutidlide Fumarate

- Evolocumab

- Alirocumab

- Anidulafungin

- Exenatide

- Lixisenatide

- Dulaglutide

- Adalimumab

On the basis of biosimilar drugs, the market is segmented into semaglutide, ibutilide fumarate, evolocumab, alirocumab, anidulafungin, exenatide, lixisenatide, dulaglutide, and adalimumab.

End User

- Direct Sales Distributors

- Pharmaceutical Wholesalers

- Drug Stores

- Pharmacy

- Group Purchasing Organizations (GPOs)

- Others

On the basis of end user, the market is segmented into direct sales distributors, pharmaceutical wholesalers, drug stores, pharmacy, group purchasing organizations (GPOs), and others.

Distribution Channel

- Pharmaceutical Wholesalers

- Contract Manufacturers

- Pharmacy Chains

- Group Purchasing Organizations (GPOs)

- Others

On the basis of distribution channel, the market is segmented into pharmaceutical wholesalers, contract manufacturers, pharmacy chains, Group Purchasing Organizations (GPOs), and others.

The India and Europe Generic Injectable Market Regional Analysis/Insights

The India and Europe generic injectable market is analyzed and market size insights and trends are provided by therapeutic application, end user, biosimilar drugs and distribution channel.

The country/region covered in this market report are India and Europe.

Europe is expected to dominate the India and Europe generic injectable market owing to technological advancements in injectable generic drug molecules in the region

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional/country brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

India and Europe Generic Injectable Market: Competitive Landscape and Share Analysis

The India and Europe generic injectable market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the India and Europe generic injectable market are Cipla Inc., Dr. Reddy’s Laboratories Ltd, Sanofi, Viatris Inc., Fresenius Kabi AG, Sandoz Group AG, GLENMARK PHARMACEUTICALS LTD, Gland Pharma Limited, Par Pharmaceutical, and Sun Pharmaceutical Industries Ltd., among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA AND EUROPE GENERIC INJECTABLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 INDIA MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.1.1 EUROPE

4.1.2 INDIA

4.2 PORTER FIVE FORCED

4.2.1 EUROPE

4.2.2 INDIA

4.3 EPIDEMIOLOGY

5 EUROPE GENERIC INJECATBLE MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE

5.1.2 PIONEERING PROGRESS FUELED BY TECHNOLOGICAL ADVANCEMENTS IN DRUG MOLECULES

5.1.3 SURGE OF GENERIC INJECTABLE MARKET AMIDST THE ESCALATING PREVALENCE OF CHRONIC DISEASES

5.2 RESTRAINTS

5.2.1 ENSURING AND MAINTAINING HIGH-QUALITY STANDARDS

5.2.2 ENSURING THE QUALIFICATION AND ETHICAL STANDARDS OF A CONTRACT MANUFACTURING ORGANIZATION (CMO)

5.2.3 NAVIGATING MARKET CHALLENGES IN THE DEVELOPMENT COSTS OF GENERIC INJECTABLE

5.3 OPPORTUNITIES

5.3.1 ASCENDANCE OF MARKET GROWTH THROUGH INCREASED EMPHASIS ON CONTRACT RESEARCH MANUFACTURING

5.3.2 SYNERGIZING INNOVATION THROUGH COLLABORATIVE DRUG RESEARCH AND DEVELOPMENT

5.3.3 EXPANSION IN MARKET GROWTH FUELED BY RISING PREFERENCE FOR GENERIC DRUGS OVER NOVEL ALTERNATIVES

5.3.4 EXPANDING HORIZONS PROPELLED BY GROWING PIPELINE OF INNOVATIVE PRODUCTS

5.4 CHALLENGES

5.4.1 LOGISTICAL CHALLENGES DUE TO SPECIALIZED STORAGE AND TRANSPORTATION NEEDS

6 INDIA GENERIC INJECATBLE MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ESCALATING INCIDENCE OF CHRONIC DISEASES

6.1.2 DEPENDENCE ON THE INDIAN MANUFACTURERS FOR GENERIC VERSION

6.1.3 AVAILABILITY OF A WIDE VARIETY OF DISTRIBUTION CHANNELS

6.2 RESTRAINTS

6.2.1 ELEVATED STANDARDS OF QUALITY ASSURANCE IN GENERIC INJECTABLE

6.3 OPPORTUNITIES

6.3.1 MARKET EXPANSION SURGING WITH A HEIGHTENED FOCUS ON CONTRACT RESEARCH MANUFACTURING ORGANIZATION

6.3.2 HARMONIZING INNOVATION BY COLLABORATIVE EFFORTS IN DRUG RESEARCH AND DEVELOPMENT

6.3.3 MARKET GROWTH EXPANDS DUE TO INCREASING FAVOR FOR GENERIC DRUGS INSTEAD OF NOVEL ALTERNATIVES

6.3.4 GOVERNMENT DRIVE AND ADVOCACY FOR GENERIC MEDICATIONS

6.4 CHALLENGES

6.4.1 CHALLENGES IN LOGISTICS ARISING FROM SPECIALIZED STORAGE AND TRANSPORTATION REQUIREMENTS

7 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY THERAPEUTIC APPLICATION

7.1 OVERVIEW

7.2 ONCOLOGY

7.3 CARDIOVASCULAR DISORDERS

7.4 INFECTIOUS DISEASES

7.5 PAIN MANAGEMENT

7.6 METABOLIC DISORDERS (DIABETES)

7.7 IMMUNOLOGY DISORDERS

8 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY BIOSIMILAR DRUGS

8.1 OVERVIEW

8.2 SEMAGLUTIDE

8.3 IBUTILIDE FUMARATE

8.4 EVOLOCUMAB

8.5 ALIROCUMAB

8.6 ANIDULAFUNGIN

8.7 DULAGLUTIDE

8.8 LIXISENATIDE

8.9 EXENATIDE

8.1 LIRAGLUTIDE

8.11 ADALIMUMAB

9 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY END USER

9.1 OVERVIEW

9.2 DIRECT SALES DISTRIBUTORS

9.3 PHARMACEUTICAL WHOLESALERS

9.4 DRUG STORES

9.5 PHARMACY

9.6 GROUP PURCHASING ORGANIZATIONS (GPOS)

9.7 OTHERS

10 INDIA & EUROPE INJECTABLE DRUG DELIVERY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 CONTRACT MANUFACTURERS

10.3 PHARMACEUTICAL WHOLESALERS

10.4 PHARMACY CHAINS

10.5 GROUP PURCHASING ORGANIZATIONS (GPOS)

10.6 OTHERS

11 INDIA AND EUROPE GENERIC INJECTABLE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 COMPANY SHARE ANALYSIS: INDIA

12 SWOT ANALYSIS

12.1 CONTRACT MANUFACTURERS

12.2 MANUFACTURERS

12.3 DISTRIBUTORS

13 COMPANY PROFILE (CONTRACT MANUFACTURERS)

13.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 CARDINAL HEALTH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 DIVI'S LABORATORIES LIMITED.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 DR. REDDY’S LABORATORIES LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 FAREVA

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 HIKMA PHARMACEUTICALS PLC

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 INNOVEXIA LIFESCIENCES PVT LTD

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 MEDLOCK HEALTHCARE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 RECIPHARM AB.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 SWISSCHEM

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 TEVA PHARMACEUTICAL INDUSTRIES LTD

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 VENUS PHARMA GMBH.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ZYDUS GROUP

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

14 COMPANY PROFILES (DISTRIBUTORS)

14.1 AAH PHARMACEUTICALS LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT DESCRIPTION

14.1.3 RECENT DEVELOPMENT

14.2 HENRY SCHEIN, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 MAWDSLEYS – BROOKS & CO. LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT DESCRIPTION

14.3.3 RECENT DEVELOPMENT

14.4 MEDLINE INDUSTRIES, LP.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

15 COMPANY PROFILES (GENERIC MANUFACTURERS)

15.1 FRESENIUS SE & CO. KGAA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 AMNEAL PHARMACEUTICALS LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 LUPIN.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ZYDUS GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AUROBINDO PHARMA.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CIPLA INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONCORD BIOTECH.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DR. REDDY’S LABORATORIES LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 GLAND PHARMA LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 SOURCE: COMPANY WEBSITE, ANNUAL REPORTS, AND SEC FILING

15.10.3 REVENUE ANALYSIS

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 GLENMARK PHARMACEUTICALS LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 HIKMA PHARMACEUTICALS PLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 INTAS PHARMACEUTICALS LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PAR PHARMACEUTICAL.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDOZ GROUP AG

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SANOFI

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VIATRIS INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

18 REFERENCES

Lista de Tablas

TABLE 1 INDIA GENERIC INJECTABLE MARKET, BY THERAPEUTIC APPLICATION, 2022-2035 (USD MILLION)

TABLE 2 EUROPE GENERIC INJECTABLE MARKET, BY THERAPEUTIC APPLICATION, 2022-2035 (USD MILLION)

TABLE 3 EUROPE ONCOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 4 EUROPE ONCOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 5 EUROPE CARDIOVASCULAR DISORDERS IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 6 INDIA CARDIOVASCULAR DISORDERS IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 7 EUROPE INFECTIOUS DISEASES IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 8 INDIA INFECTIOUS DISEASES IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 9 EUROPE PAIN MANAGEMENT IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 10 INDIA PAIN MANAGEMENT IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 11 EUROPE METABOLIC DISORDERS (DIABETES) IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 12 INDIA METABOLIC DISORDERS (DIABETES) IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 13 EUROPE IMMUNOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 14 INDIA IMMUNOLOGY IN GENERIC INJECTABLE MARKET, BY DRUGS, 2022-2035 (USD MILLION)

TABLE 15 EUROPE GENERIC INJECTABLE MARKET, BY BIOSIMILAR DRUGS, 2022-2035 (USD MILLION)

TABLE 16 INDIA GENERIC INJECTABLE MARKET, BY BIOSIMILAR DRUGS, 2022-2035 (USD MILLION)

TABLE 17 EUROPE GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 18 INDIA GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 19 EUROPE GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 20 INDIA GENERIC INJECTABLE MARKET, BY END USER, 2022-2035 (USD MILLION)

TABLE 21 EUROPE GENERIC INJECTABLE MARKET, BY DISTRIBUTION CHANNEL, 2022-2035 (USD MILLION)

TABLE 22 INDIA GENERIC INJECTABLE MARKET, BY DISTRIBUTION CHANNEL, 2022-2035 (USD MILLION)

Lista de figuras

FIGURE 1 INDIA AND EUROPE GENERIC INJECTABLE MARKET: SEGMENTATION

FIGURE 2 INDIA AND EUROPE GENERIC INJECTABLE MARKET: DATA TRIANGULATION

FIGURE 3 INDIA GENERIC INJECTABLE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GENERIC INJECTABLE MARKET: DROC ANALYSIS

FIGURE 5 INDIA GENERIC INJECTABLE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 EUROPE GENERIC INJECTABLE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 INDIA AND EUROPE GENERIC INJECTABLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 EUROPE MULTIVARIATE MODELLING

FIGURE 9 INDIA AND EUROPE GENERIC INJECTABLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 INDIA AND EUROPE GENERIC INJECTABLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 INDIA AND EUROPE GENERIC INJECTABLE MARKET: SEGMENTATION

FIGURE 12 ESCALATING INCIDENCE OF CHRONIC DISEASES AND SURGE IN THE DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE IS DRIVING THE GROWTH OF THE INDIA GENERIC INJECTABLE MARKET IN THE FORECAST PERIOD OF 2024 TO 2035

FIGURE 13 SURGE IN DEVELOPMENT AND PRODUCTION OF GENERIC INJECTABLE DRUGS IS EXPECTED TO DRIVE THE EUROPEAN GENERIC INJECTABLE MARKET IN THE FORECAST PERIOD OF 2024 TO 2035

FIGURE 14 ONCOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA GENERIC INJECTABLE MARKET IN 2024 AND 2035

FIGURE 15 ONCOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GENERIC INJECTABLE MARKET IN 2024 AND 2035

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE GENERIC INJECATBLE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDIA GENERIC INJECATBLE MARKET

FIGURE 18 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2023

FIGURE 19 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2024-2035 (USD MILLION)

FIGURE 20 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, CAGR (2024-2035)

FIGURE 21 EUROPE GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, LIFELINE CURVE

FIGURE 22 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2023

FIGURE 23 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, 2024-2035 (USD MILLION)

FIGURE 24 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, CAGR (2024-2035)

FIGURE 25 INDIA GENERIC INJECTABLE MARKET: BY THERAPEUTIC APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2023

FIGURE 27 EUROPE GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2024-2035 (USD MILLION)

FIGURE 28 INDIA GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2023

FIGURE 29 INDIA GENERIC INJECTABLE MARKET: BY BIOSIMILAR DRUGS, 2024-2035 (USD MILLION)

FIGURE 30 EUROPE GENERIC INJECTABLE MARKET: BY END USER, 2023

FIGURE 31 EUROPE GENERIC INJECTABLE MARKET: BY END USER, 2024-2035 (USD MILLION)

FIGURE 32 EUROPE GENERIC INJECTABLE MARKET: BY END USER, CAGR (2024-2035)

FIGURE 33 EUROPE GENERIC INJECTABLE MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 INDIA GENERIC INJECTABLE MARKET: BY END USER, 2023

FIGURE 35 INDIA GENERIC INJECTABLE MARKET: BY END USER, 2024-2035 (USD MILLION)

FIGURE 36 INDIA GENERIC INJECTABLE MARKET: BY END USER, CAGR (2024-2035)

FIGURE 37 INDIA GENERIC INJECTABLE MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 39 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2024-2035 (USD MILLION)

FIGURE 40 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2035)

FIGURE 41 EUROPE GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 43 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, 2024-2035 (USD MILLION)

FIGURE 44 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2035)

FIGURE 45 INDIA GENERIC INJECTABLE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 EUROPE GENERIC INJECTABLE MARKET: COMPANY SHARE 2023 (%)

FIGURE 47 INDIA GENERIC INJECTABLE MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.