Asia Pacific Uv Filter Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2024 –2031 | |

| USD 504.34 Million | |

| USD 684.74 Million | |

|

|

|

Asia-Pacific UV Filter Market, By Product (Organic, Inorganic, and Hybrid), Application (Personal Care and Cosmetics, Plastic, Packaging, Industrial Coatings, Construction, Optical Lenses, Textiles, Agriculture, Consumer Electronics, and Others) – Industry Trends and Forecast to 2031.

UV Filter Market Analysis

UV Filter has a rapid growth in expanding the skincare industry has responded to this heightened awareness by innovating and improving UV filter formulations. Companies are investing in research and development to create more effective, long-lasting, and user-friendly UV protection products. The cosmetic industry is rapidly evolving, with a strong focus on developing products that offer additional benefits beyond basic skincare. UV filters are now being incorporated into a wide range of products, including moisturizers, foundations, and lip balms, to provide comprehensive sun protection. This trend is particularly prominent in regions with high UV exposure, where consumers are more likely to seek out products with built-in UV protection. thereby driving market growth in Asia-Pacific.

UV Filter Market Size

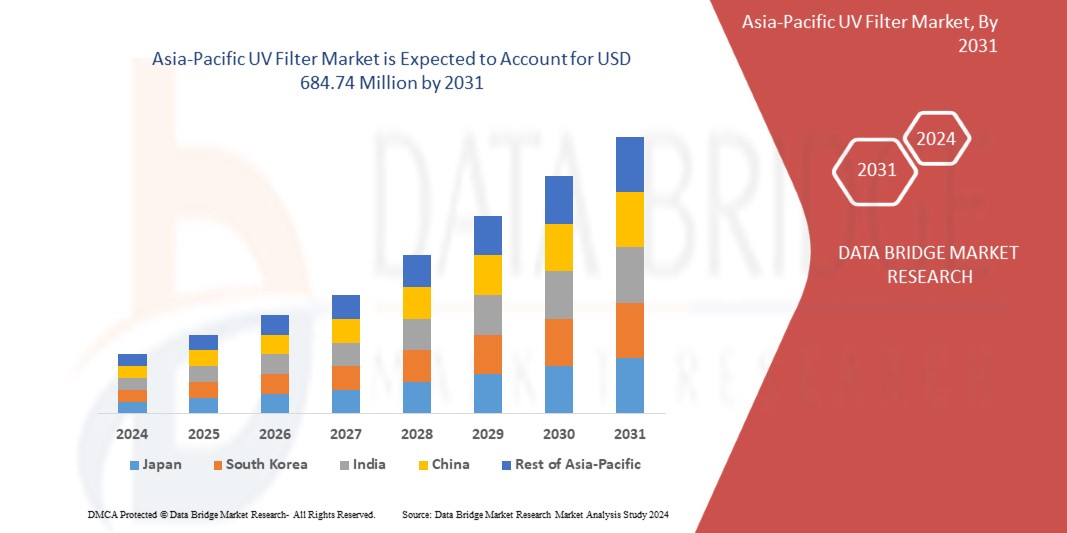

Asia-Pacific UV filter market size was valued at USD 504.34 million in 2023 and is projected to reach USD 684.74 million by 2031, with a CAGR of 3.95% during the forecast period of 2024 to 2031.

UV Filter Market Trends

“Rising Applications of UV Filters in Industrial Coatings”

UV filters are increasingly utilized in industrial coatings to protect surfaces from ultraviolet (UV) radiation, which can cause degradation, discoloration, and reduced lifespan of coatings. As industries seek to enhance the durability and longevity of their products, the demand for UV filters has surged. These filters are essential in providing a protective barrier that prevents UV-induced damage, making them a critical component in the formulation of high-performance coatings.

Examples of the construction industry also contributes to the growing demand for UV filters in coatings. Architectural coatings used on building exteriors are exposed to varying weather conditions, including intense UV radiation. By incorporating UV filters into these coatings, manufacturers can offer products that resist fading and maintain their protective qualities over extended periods. This application of UV filters is becoming increasingly crucial as building owners and developers prioritize long-lasting and low-maintenance solutions. In addition, the consumer goods sector, including electronics and household appliances, benefits from UV filters in coatings. Electronic devices and appliances often feature coatings that protect against UV damage, ensuring that their appearance and functionality remain intact. As the market for durable and aesthetically appealing consumer goods grows, the need for UV filters in these coatings expands. This demand is supported by technological advancements and increasing consumer expectations for high-quality products.

Report Scope and Market Segmentation

|

Attributes |

UV Filter Key Market Insights |

|

Segments Covered |

By Product: Organic, Inorganic and Hybrid By Application: Personal Care and Cosmetics, Plastic, Packaging, Industrial Coatings, Construction, Optical Lenses, Textiles, Agriculture, Consumer Electronics, and Others |

|

Countries Covered |

China, Japan, South Korea, India, Australia, Indonesia, Thailand, Malaysia, Vietnam, Philippines, Singapore, New Zealand, Taiwan, Rest of Asia-Pacific |

|

Key Market Players |

BASF SE (Germany), DSM (Netherlands), Ashland (U.S.), MFCI CO.,LTD (China), SUNJIN BEAUTY SCIENCE (South Korea), Sarex (India), UNIPROMA Hot Products (U.K), Omega Optical, LLC. (U.S.), and |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

UV Filter Market Definition

UV filters are compounds used to block or absorb ultraviolet (UV) radiation. They are commonly found in sunscreens, cosmetics, and various skincare products. These filters protect the skin from harmful UV rays, which can cause sunburn, premature aging, and skin cancer. UV filters are classified into two main types: chemical absorbers and physical blockers. Chemical absorbers absorb UV radiation and convert it into harmless heat. Physical blockers, like zinc oxide and titanium dioxide, reflect and scatter UV rays away from the skin. Their use is essential for maintaining skin health and preventing UV-induced damage.

UV Filter Market Dynamics

Drivers

- Rising Awareness of Skin Protection and Skin Conditions

The skincare industry has responded to this heightened awareness by innovating and improving UV filter formulations. Companies are investing in research and development to create more effective, long-lasting, and user-friendly UV protection products. These advancements are crucial as consumers look for products that not only provide high SPF protection but also cater to different skin types and preferences, such as water-resistant and non-greasy formulations. This innovation is driving the market forward, as more consumers integrate UV protection into their daily skincare routines. Moreover, regulatory bodies worldwide are implementing stricter guidelines for UV protection in skincare products, ensuring that products on the market are both safe and effective. These regulations are compelling manufacturers to enhance their UV filter offerings, thereby boosting market growth. The increasing scrutiny and demand for transparency in product formulations are pushing companies to use high-quality, compliant ingredients, which further fuels the expansion of the UV filter market.

For instance,

- In July 2024, in according to an article published by MJH Life Sciences, World Skin Health Day was inaugurated by the International League of Dermatological Societies (ILDS) and the International Society of Dermatology (ISD). The event aimed to promote "Skin Health for All" with Asia-Pacific activities. CeraVe, the first official corporate partner, supported initiatives worldwide to enhance skin health education and access. Events included free consultations in Malta, a skin cancer program in Tanzania, and educational sessions in Canada and Australia. The day marked a significant step towards addressing barriers to dermatological care Asia-Pacific

Growing Demand for Personal Care and Cosmetic Products

The cosmetic industry is rapidly evolving, with a strong focus on developing products that offer additional benefits beyond basic skincare. UV filters are now being incorporated into a wide range of products, including moisturizers, foundations, and lip balms, to provide comprehensive sun protection. This trend is particularly prominent in regions with high UV exposure, where consumers are more likely to seek out products with built-in UV protection. Advancements in UV filter technology are also playing a crucial role in market growth. Manufacturers are investing in research and development to create more efficient and stable UV filters that provide broad-spectrum protection. These innovations not only enhance the efficacy of personal care and cosmetic products but also address consumer concerns about potential side effects and environmental impact.

For instance,

- In July 2024, according to article published by Cision US Inc., A new study by Veylinx revealed consumer preferences for sunscreen, highlighting increased demand for products with added benefits like anti-aging (+49%), hydration (+33%), and vitamin C (+23%). Consumers showed a willingness to pay more for these enhanced features. The study also noted rising "sunxiety," with 38% feeling uneasy in the sun and a significant percentage burning easily. Usage trends indicated 30% applied sunscreen daily in summer, while 65% preferred SPF greater than 40

Opportunities

- Rising Demand for Natural and Organic UV Filter Products

Consumers are increasingly seeking products made with natural ingredients due to growing awareness about the potential health and environmental impacts of synthetic chemicals. This shift in consumer preference is driven by a desire for safer, eco-friendly, and sustainable products. Natural and organic UV filters often use plant-based or mineral ingredients like zinc oxide and titanium dioxide, which are perceived as safer and more environmentally friendly.

For instance,

- In July 2024, according to an article published by UL LLC, consumers are placing greater emphasis on transparency and clean beauty in their skincare products. In response, sunscreen brands are removing problematic ingredients such as oxybenzone and octinoxate, which have been associated with environmental and health issues. Clean formulations focus on natural and organic ingredients that are safe for both skin and the environment, in line with the clean beauty trend

- Advancements And Innovations In Formulation Technology

Improved formulation techniques enhance the effectiveness, stability, and sensory attributes of UV filters, making them more attractive to both manufacturers and consumers. New technologies enable the development of UV filters that offer better protection against a broader spectrum of UV radiation. Innovations such as encapsulation techniques help improve the stability and longevity of UV filters in various products, ensuring they remain effective throughout their intended use.

For instance,

- In July 2024, according to a blog published by Let's Make Beauty by Presperse, encapsulation technology offers excellent flexibility, enabling its use in various cosmetic products to improve their performance, stability, and user experience. Encapsulating UV filters can boost a product's photo stability and comfort, minimize potential skin irritation, and enhance protection against harmful sun exposure

Restraints/Challenges

- Potential Health and Environmental Concerns

Certain UV filters, such as oxybenzone and octocrylene, have raised concerns due to their potential health impacts. Research has indicated that these compounds may have endocrine-disrupting effects, which can interfere with hormonal systems in humans. This has led to increased scrutiny and regulation, as consumers become more aware of the potential risks associated with these chemicals. Consequently, the demand for UV filters is impacted by the growing preference for products with safer, more natural ingredients.

Environmental issues also contribute to the restraint on the UV filter market. Many UV filters have been found to have harmful effects on marine ecosystems. For example, some chemicals can contribute to coral reef bleaching and disrupt aquatic life, leading to adverse environmental impacts. This has led to stricter regulations and bans on certain UV filters in various regions, particularly in places with sensitive marine environments. These ecological concerns result in increased regulatory compliance costs and limit the market's ability to use certain UV filters, impacting overall market growth.

For instance,

- In September 2021, According to an article published by Environmental Working Group, the FDA proposed updating sunscreen regulations, determining only zinc oxide and titanium dioxide as “generally recognized as safe and effective” (GRASE). Other ingredients, including oxybenzone and octinoxate, faced scrutiny for safety and were not classified as GRASE due to insufficient data. Concerns arose over systemic absorption, hormone disruption, and potential health risks. European standards differed, proposing stricter limits for some non-mineral UV filters. The FDA requested more safety data for these ingredients while allowing their continued use in the U.S. market

High Cost of High-Quality UV Filters

For industrial applications, such as in automotive and architectural coatings, the cost of high-quality UV filters can be a significant barrier. These filters are crucial for enhancing the durability and performance of coatings by preventing UV-induced degradation. However, the high cost can lead to increased production costs for manufacturers, which might deter them from using premium filters. As a result, the market may see slower growth in sectors where cost constraints are a critical factor. Additionally, the high cost of advanced UV filters can restrict innovation and the development of new products within the market. Manufacturers might be hesitant to invest in research and development of novel UV filter technologies if the high costs make it challenging to achieve a return on investment. This reluctance can slow down the introduction of new and improved UV filters, further stalling market progress.

Climate Change Scenario

The Asia-Pacific UV filter market faces significant environmental concerns, particularly regarding the impact of certain UV filters on marine ecosystems. Ingredients such as oxybenzone and octocrylene have been linked to coral reef degradation, harming coral health and disrupting aquatic life due to their toxic effects. In response to environmental and health concerns, the Asia-Pacific UV filter market is undergoing significant changes. The industry is shifting towards safer, eco-friendly alternatives to traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage and other environmental issues. Governments play a pivotal role in shaping the Asia-Pacific UV filter market through regulation, policy-making, and enforcement. They establish regulations and safety standards for UV filters to protect consumers, setting limits on concentrations and defining efficacy and safety profiles, as seen with agencies like the U.S. FDA and the European Commission. Analysts recommend several strategic approaches for the Asia-Pacific UV filter market to address current challenges and leverage emerging opportunities. Firstly, shifting towards eco-friendly alternatives is crucial due to increasing environmental concerns about traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage. Adopting biodegradable and reef-safe ingredients can help companies align with regulatory trends and meet consumer demand for sustainable products.

Regulatory Framework content

Regulations play a crucial role in the UV Filter market, ensuring product quality, safety, and environmental compliance throughout the manufacturing process, For UV systems used in water treatment, adherence to Environmental Protection Agency (EPA) guidelines ensures that the UV systems effectively inactivate pathogens and meet safety standards. Regulations on waste disposal and recycling vary by region, requiring manufacturers to implement proper waste management practices to minimize environmental impact.

Below is a detailed coverage of regulations and standards affecting the APAC UV Filter market:

APAC

Regulation (EC) No 1223/2009

- UV filters used in cosmetics must be approved and listed in Annex VI of Regulation (EC) No 1223/2009. This annex specifies which UV filters can be used, their maximum allowable concentrations, and any specific conditions of use.

- Before a UV filter can be included in Annex VI, it must undergo rigorous safety evaluations. This includes toxicological testing to ensure it does not pose a risk to human health when used as intended.

- Products containing UV filters must demonstrate their effectiveness in protecting against UV radiation. This typically involves standardized testing methods for SPF (Sun Protection Factor) and UVA protection.

- Sunscreens and other products containing UV filters must include appropriate labeling, which includes:

SPF Value: Indicates the level of UVB protection.

UVA Protection: Must include a UVA logo or statement if the product offers UVA protection.

Directions for Use: Instructions on how to apply the product effectively.

Warnings: Any specific warnings related to sun exposure and use of the product.

United States

21 CFR Part 352 :

- It includes a list of UV filters that are generally recognized as safe and effective for use in sunscreens. These filters are categorized into two types:

Chemical UV Filters: These include ingredients like:

- Avobenzone (Butyl Methoxydibenzoylmethane): Provides broad-spectrum UVA protection.

- Octocrylene: Used to stabilize other UV filters and provides UVB protection.

- Octinoxate (Ethylhexyl Methoxycinnamate): Absorbs UVB rays.

- Oxybenzone: Provides UVB and some UVA protection.

- Homosalate: Absorbs UVB rays.

Physical (Mineral) UV Filters: These include ingredients like:

- Titanium Dioxide: Provides broad-spectrum protection, including UVA and UVB.

- Zinc Oxide: Also provides broad-spectrum protection.

The UV energy required to produce an MED on protected skin divided by the UV energy required to produce an MED on unprotected skin, which may also be defined by the following ratio: SPF value = MED (protected skin (PS))/MED (unprotected skin (US)), where MED (PS) is the minimal erythema dose for protected skin after application of 2 milligrams per square centimeter of the final formulation of the sunscreen product, and MED (US) is the minimal erythema dose for unprotected skin, e., skin to which no sunscreen product has been applied. In effect, the SPF value is the reciprocal of the effective transmission of the product viewed as a UV radiation filter

Production Cost Scenario

As per our analysis the average production of UV Filters is 29,544.27 Tons in the year 2023, and it is expected to reach 35,967.04 Tons in 2031. The average consumption is 27,148.23 Tons in the year 2023 and it is expected to reach 34,172.28 Tons in 2031.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Asia-Pacific UV Filter Market Scope

The market is segmented on the basis of product, application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Organic

- Avobenzone

- Octinoxate

- Octocrylene

- Oxybenzone

- Homosalate

- Octisalate

- Ensulizole

- Bis-Ethylhexyloxyphenol Methoxyphenyl Triazine (Bemotrizinol)

- Methylene Bis-Benzotriazolyl Tetramethylbutylphenol (Bisoctrizole)

- Drometrizole Trisiloxane

- Meradimate (Menthyl Anthranilate)

- Octyltriazone (Ethylhexyl Triazone)

- Polysilicone-15

- Aminobenzoic Acid

- Octyl Dimethyl Paba

- Others

- Inorganic

- Titanium Dioxide (TIO2)

- Zinc Oxide (ZNO)

- Iron Oxide (FE2O3)

- Silicone Oxide (SIO2)

- Tantalum Oxide

- Others

- Hybrid

Application

- Personal Care and Cosmetics

- Sunscreen

- BB and CC Cream

- Foundation

- Face Cream

- Lotion

- Lipbalm

- Lipstick

- Shampoos

- Conditioner

- Others

- Plastic, Packaging

- Food Packaging

- Pharmaceutical Packaging

- Industrial Coatings

- Protective Coatings

- Machinery

- Pipelines

- Industrial Equipment

- Others

- Automotive Coatings

- Clear Coat

- Paints

- Headlights

- Windows

- Windshield

- Bumpers

- Side Mirrors

- Trim

- Others

- Construction

- Optical Lenses

- Sunglasses

- Eyewear

- Contact Lenses

- Textiles

- Sportswear

- Swimwear

- Others

- Agriculture

- Greenhouse Films

- Shade Cloths

- Crop Covers

- Others

- Consumer Electronics

- Smartphones

- Monitors

- Televisions

- Others

- Others

- Protective Coatings

Asia-Pacific UV Filter Market Regional Analysis

The market is segmented on the basis of product and application.

The countries covered in the market are China, Japan, South Korea, India, Australia, Indonesia, Thailand, Malaysia, Vietnam, Philippines, Singapore, New Zealand, Taiwan, and rest of Asia-Pacific.

China is expected to dominate and fastest growing country in the market due to its large and growing population, increasing awareness about skin protection, and rising disposable incomes.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific UV Filter Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

UV Filter Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- DSM (Netherlands)

- Ashland (U.S.)

- MFCI CO.,LTD (China)

- SUNJIN BEAUTY SCIENCE (South Korea)

- Sarex (India)

- UNIPROMA Hot Products (U.K)

- Omega Optical, LLC. (U.S.)

Latest Developments in UV Filter Market

- In September 2023, BASF has further expanded its production footprint of its modern UV filter portfolio in the Asia-Pacific region. Uvinul A Plus is one of the few photostable UVA filters available in the market today that reliably filters the sun’s harmful UVA rays and provides protection from free radicals and skin damage

- In March 2023, DSM broadens the PARSOL portfolio with the launch of PARSOL DHHB. PARSOL DHHB offers flexibility to formulators to create multi-functional products with adequate UVA protection and high eco-class formulations (as per the DSM Sunscreen Optimizer™ 2.0). Its excellent solubility and wide formulation compatibility, makes PARSOL DHHB stand out of the crowd and suitable for a full range of application including sunscreens, facial care and color cosmetics

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRIAL RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST'S RECOMMENDATIONS

4.4 DETAILED INFORMATION FOR UV FILTERS MANUFACTURERS

4.5 ASIA-PACIFIC VS CHINA UV FILTER MARKET

4.5.1 OVERVIEW

4.5.2 ASIA-PACIFIC UV FILTER MARKET OVERVIEW

4.5.3 CHINA UV FILTER MARKET OVERVIEW

4.5.4 ASIA-PACIFIC VS CHINA UV FILTER MARKET

4.6 OVERVIEW OF HISTORICAL, PRESENT AND FUTURE OUTLOOK OF UV FILTER AT ASIA-PACIFIC LEVEL

4.6.1 HISTORICAL OVERVIEW

4.6.2 PRESENT SCENARIO

4.6.3 FUTURE OUTLOOK

4.7 PRODUCTION COST SCENARIO BY MANUFACTURERS

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING COSTS

4.7.3 REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION AND LOGISTICS

4.7.5 RESEARCH AND DEVELOPMENT

4.7.6 ENVIRONMENTAL AND SUSTAINABILITY INITIATIVES

4.8 RAW MATERIAL COVERAGE

4.8.1 TITANIUM DIOXIDE(TIO2)

4.8.2 ZINC OXIDE

4.8.3 AVOBENZONE

4.8.4 OCTINOXATE

4.8.5 OXYBENZONE

4.8.6 HOMOSALATE

4.8.7 OCTOCRYLENE

4.8.8 OCTISALATE

4.8.9 RAW MATERIAL SUPPLY CHAIN CONSIDERATIONS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 BROAD-SPECTRUM PROTECTION:

4.10.2 ENHANCED STABILITY AND EFFICACY:

4.10.3 MINERAL AND HYBRID FILTERS:

4.10.4 SKIN COMPATIBILITY:

4.10.5 SUSTAINABILITY:

4.11 VENDOR SELECTION CRITERIA

4.11.1 QUALITY AND CONSISTENCY OF SUPPLY

4.11.2 RELIABILITY AND TIMELINESS

4.11.3 COST COMPETITIVENESS

4.11.4 TECHNICAL CAPABILITY AND INNOVATION

4.11.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.11.6 FINANCIAL STABILITY

4.11.7 CUSTOMER SERVICE AND SUPPORT

4.12 PRICING ANALYSIS

4.12.1 RAW MATERIAL COSTS

4.12.2 MANUFACTURING PROCESSES

4.12.3 TECHNOLOGICAL ADVANCEMENTS

4.12.4 MARKET DEMAND

4.12.5 WHOLESALE MARGINS

4.12.5.1 RAW MATERIAL COSTS

4.12.5.2 PRODUCTION COSTS

4.12.5.3 REGULATORY COMPLIANCE

4.12.5.4 MARKET DEMAND

4.12.5.5 COMPETITION AND MARKET SATURATION

4.13 PRODUCTION CONSUMPTION ANALYSIS

4.14 TOP 10 COUNTRIES DATA

4.15 REGULATION COVERAGE

4.15.1 QUALITY STANDARDS AND CERTIFICATION

4.15.2 ENVIRONMENTAL REGULATIONS

4.15.3 OCCUPATIONAL HEALTH AND SAFETY

4.15.4 EXPORT CONTROLS AND INTERNATIONAL TRADE

4.15.5 INTELLECTUAL PROPERTY RIGHTS (IPR)

4.15.6 COMPLIANCE CHALLENGES AND CONSIDERATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS OF SKIN PROTECTION AND SKIN CONDITIONS

5.1.2 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS

5.1.3 INCREASING APPLICATION OF UV FILTERS IN POLYMER STABILIZATION AND DURABILITY

5.1.4 RISING APPLICATIONS OF UV FILTERS IN INDUSTRIAL COATINGS

5.2 RESTRAINTS

5.2.1 POTENTIAL HEALTH AND ENVIRONMENTAL CONCERNS

5.2.2 HIGH COST OF HIGH-QUALITY UV FILTERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR NATURAL AND ORGANIC UV FILTER PRODUCTS

5.3.2 ADVANCEMENTS AND INNOVATIONS IN FORMULATION TECHNOLOGY

5.3.3 STRINGENT REGULATIONS AND GUIDELINES FOR UV PROTECTION

5.4 CHALLENGES

5.4.1 HARMFUL ENVIRONMENTAL EFFECTS OF UV FILTERS IN VARIOUS PRODUCTS

5.4.2 COMPLEX REGULATORY LANDSCAPE AND COMPLIANCE WITH DIFFERENT STANDARDS

6 ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ORGANIC

6.3 INORGANIC

6.4 HYBRID

7 ASIA-PACIFIC UV FILTER MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PERSONAL CARE AND COSMETICS

7.3 PLASTIC

7.3.1 PACKAGING

7.3.2 INDUSTRIAL COATINGS

7.3.3 CONSTRUCTION

7.4 OPTICAL LENSES

7.4.1 TEXTILES

7.5 AGRICULTURE

7.6 CONSUMER ELECTRONICS

7.7 OTHERS

8 ASIA-PACIFIC UV FILTER MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 AUSTRALIA

8.1.6 INDONESIA

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 VIETNAM

8.1.10 PHILIPPINES

8.1.11 SINGAPORE

8.1.12 NEW ZEALAND

8.1.13 TAIWAN

8.1.14 REST OF ASIA-PACIFIC

9 ASIA-PACIFIC UV FILTER MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BASF SE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DSM

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ASHLAND

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 MFCI CO.,LTD

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 1.4.3 RECENT DEVELOPMENT

11.5 SUNJIN BEAUTY SCIENCE

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENT

11.6 EVERCARE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 IRA ISTITUTO RICERCHE APPLICATE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 OMEGA OPTICAL LLC.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 SAREX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 UNIPROMA HOT PRODUCTS

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Lista de Tablas

TABLE 1 LISTS OF TOP 10 MANUFACTURERS, AND THEIR ESTIMATED PRODUCTION COST AND AVERAGE SELLING PRICE ARE LISTED BELOW:

TABLE 2 ASIA-PACIFIC VS CHINA UV FILTER MARKET DEMAND ANALYSIS (USD THOUSAND)

TABLE 3 ASIA-PACIFIC UV FILTER MARKET, WHOLESALE MARGINS

TABLE 4 TOP 10 COUNTRIES DATA, (USD THOUSAND, TONS AND AVERAGE SELLIN GPRICE (USD/KG): ASIA-PACIFIC UV FILTER MARKET

TABLE 5 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 6 ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 8 ASIA-PACIFIC UV FILTER MARKET, AVERAGE SELLING PRICE, BY PRODUCT, 2022-2031 (USD/KG)

TABLE 9 ASIA-PACIFIC ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 11 ASIA-PACIFIC ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 14 ASIA-PACIFIC INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (TONS)

TABLE 17 ASIA-PACIFIC UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PLASTIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PACKAGING IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC INDUSTRIAL COATINGS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC CONSTRUCTION IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC OPTICAL LENSES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC TEXTILES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC AGRICULTURE IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC CONSUMER ELECTRONICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC OTHERS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC UV FILTER MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC UV FILTER MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 41 ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 43 ASIA-PACIFIC ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 CHINA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 CHINA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 59 CHINA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 60 CHINA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 CHINA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 62 CHINA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 CHINA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 CHINA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 CHINA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 CHINA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 67 CHINA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 68 CHINA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 CHINA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 CHINA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 CHINA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 CHINA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 JAPAN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 74 JAPAN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 75 JAPAN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 76 JAPAN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 77 JAPAN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 78 JAPAN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 JAPAN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 JAPAN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 JAPAN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 JAPAN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 JAPAN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 84 JAPAN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 JAPAN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 JAPAN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 JAPAN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 JAPAN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 SOUTH KOREA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 SOUTH KOREA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 91 SOUTH KOREA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 92 SOUTH KOREA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 SOUTH KOREA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 94 SOUTH KOREA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 SOUTH KOREA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 SOUTH KOREA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 SOUTH KOREA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 SOUTH KOREA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 99 SOUTH KOREA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 100 SOUTH KOREA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 SOUTH KOREA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 SOUTH KOREA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 SOUTH KOREA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 SOUTH KOREA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 INDIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 106 INDIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 107 INDIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 INDIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 109 INDIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 INDIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 INDIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 INDIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 INDIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 INDIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 115 INDIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 INDIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 INDIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 INDIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 INDIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 INDIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 AUSTRALIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 122 AUSTRALIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 123 AUSTRALIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 AUSTRALIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 125 AUSTRALIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 AUSTRALIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 AUSTRALIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 AUSTRALIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 AUSTRALIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 AUSTRALIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 131 AUSTRALIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 AUSTRALIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 AUSTRALIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 AUSTRALIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 AUSTRALIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 AUSTRALIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 INDONESIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 138 INDONESIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 139 INDONESIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 140 INDONESIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 141 INDONESIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 INDONESIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 INDONESIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 INDONESIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 INDONESIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 INDONESIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 147 INDONESIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 148 INDONESIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 INDONESIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 INDONESIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 INDONESIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 INDONESIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 THAILAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 154 THAILAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 155 THAILAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 156 THAILAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 157 THAILAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 158 THAILAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 THAILAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 THAILAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 THAILAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 THAILAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 THAILAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 164 THAILAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 THAILAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 THAILAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 THAILAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 THAILAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 MALAYSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 170 MALAYSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 171 MALAYSIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 172 MALAYSIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 173 MALAYSIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 174 MALAYSIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 175 MALAYSIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 MALAYSIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 MALAYSIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 MALAYSIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 179 MALAYSIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 180 MALAYSIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 MALAYSIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 MALAYSIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 MALAYSIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 MALAYSIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 VIETNAM UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 186 VIETNAM UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 187 VIETNAM ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 188 VIETNAM INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 189 VIETNAM UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 190 VIETNAM PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 VIETNAM PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 VIETNAM PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 VIETNAM INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 VIETNAM PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 195 VIETNAM AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 196 VIETNAM CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 VIETNAM OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 VIETNAM TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 VIETNAM AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 VIETNAM CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 PHILIPPINES UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 202 PHILIPPINES UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 203 PHILIPPINES ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 204 PHILIPPINES INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 205 PHILIPPINES UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 206 PHILIPPINES PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 PHILIPPINES PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 PHILIPPINES PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 PHILIPPINES INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 PHILIPPINES PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 211 PHILIPPINES AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 212 PHILIPPINES CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 PHILIPPINES OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 PHILIPPINES TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 PHILIPPINES AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 PHILIPPINES CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 SINGAPORE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 218 SINGAPORE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 219 SINGAPORE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 220 SINGAPORE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 221 SINGAPORE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 222 SINGAPORE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 SINGAPORE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 SINGAPORE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 SINGAPORE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 SINGAPORE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 SINGAPORE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 228 SINGAPORE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 SINGAPORE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 SINGAPORE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 SINGAPORE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 SINGAPORE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 NEW ZEALAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 234 NEW ZEALAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 235 NEW ZEALAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 236 NEW ZEALAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 237 NEW ZEALAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 238 NEW ZEALAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 NEW ZEALAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 NEW ZEALAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 NEW ZEALAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 NEW ZEALAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 NEW ZEALAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 244 NEW ZEALAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 245 NEW ZEALAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 NEW ZEALAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 NEW ZEALAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 NEW ZEALAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 TAIWAN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 250 TAIWAN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 251 TAIWAN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 252 TAIWAN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 253 TAIWAN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 254 TAIWAN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 255 TAIWAN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 256 TAIWAN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 TAIWAN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 TAIWAN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 259 TAIWAN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 260 TAIWAN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 TAIWAN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 TAIWAN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 263 TAIWAN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 264 TAIWAN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 265 REST OF ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 266 REST OF ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

Lista de figuras

FIGURE 1 ASIA-PACIFIC UV FILTER MARKET

FIGURE 2 ASIA-PACIFIC UV FILTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC UV FILTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC UV FILTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC UV FILTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC UV FILTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC UV FILTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC UV FILTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC UV FILTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC UV FILTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC UV FILTER MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE ASIA-PACIFIC UV FILTER MARKET, BY PRODUCT

FIGURE 13 ASIA-PACIFIC UV FILTER MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC UV FILTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC UV FILTER MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 ASIA-PACIFIC UV FILTER MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: ASIA-PACIFIC UV FILTER MARKET

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC UV FILTER MARKET

FIGURE 23 ASIA-PACIFIC UV FILTER MARKET: BY PRODUCT, 2023

FIGURE 24 ASIA-PACIFIC UV FILTER MARKET: BY APPLICATION, 2023

FIGURE 25 ASIA-PACIFIC UV FILTER MARKET: SNAPSHOT (2023)

FIGURE 26 ASIA-PACIFIC UV FILTER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.