Mexico Rfid And Electronic Article Surveillance Systems Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2024 –2031 | |

| USD 408,499.95 Thousand | |

| USD 775,431.35 Thousand | |

|

|

|

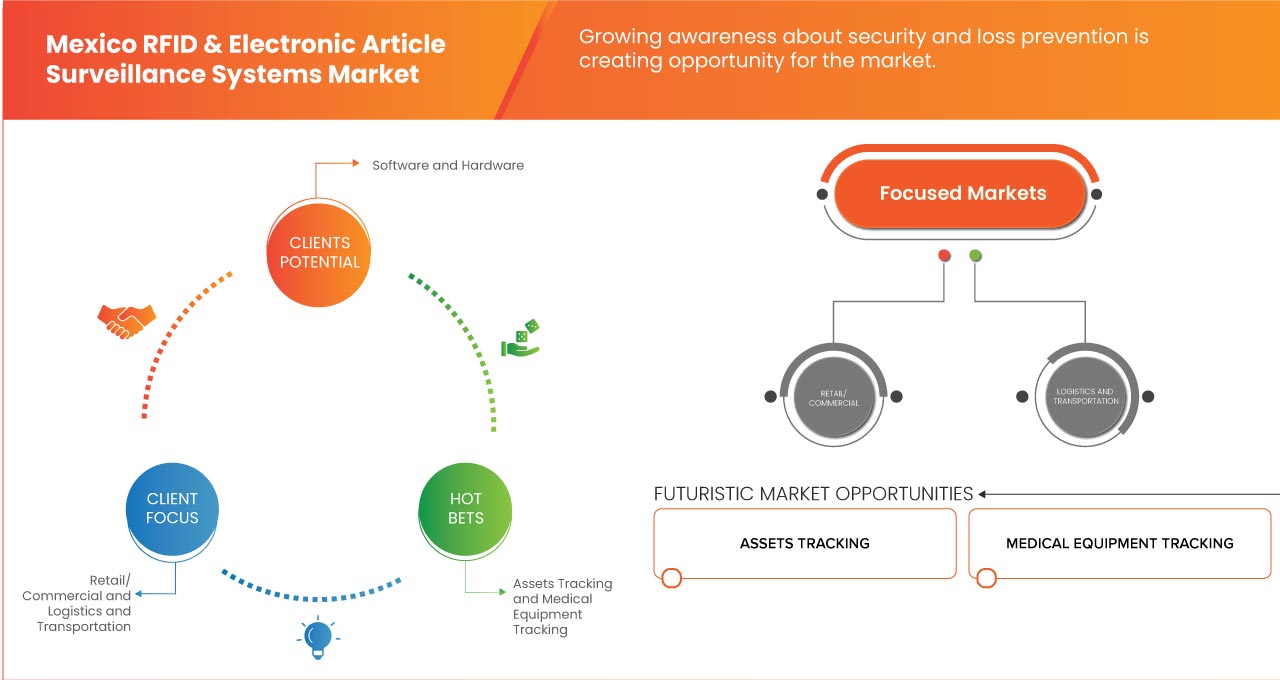

|

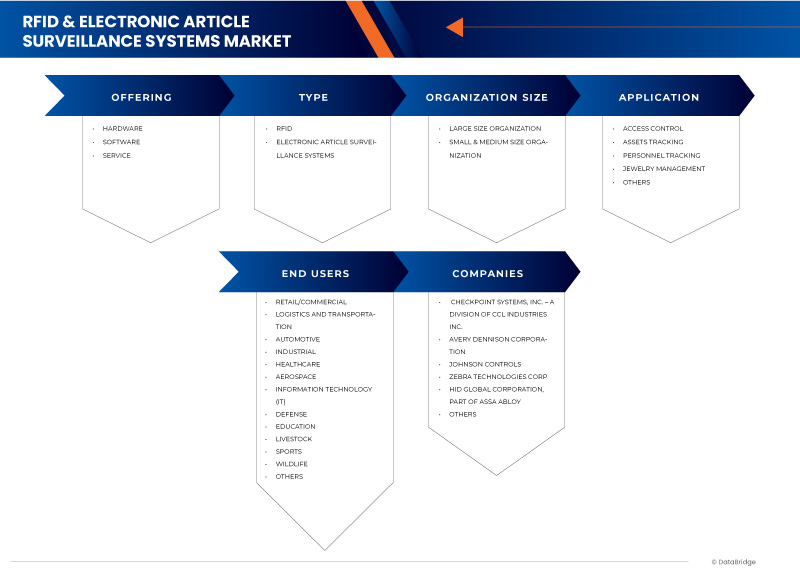

Mexico RFID & Electronic Article Surveillance Systems Market, By Offerings (Hardware, Software, and Service), Type (RFID and Electronic Article Surveillance Systems), Organization Size (Large Size Organization and Small & Medium Size Organization), Application (Access Control, Assets Tracking, Personnel Tracking, Jewelry Management, and Others), End Users (Retail/Commercial, Logistics and Transportation, Automotive, Industrial, Healthcare, Aerospace, Information Technology (IT), Defense, Education, Livestock, Sports, Wildlife, and Others), Sales Channel (Indirect and Direct) - Industry Trends and Forecast to 2031.

Mexico RFID and Electronic Article Surveillance Systems Market Analysis and Size

RFID (Radio Frequency Identification) and Electronic Article Surveillance (EAS) Systems represent cutting-edge technological solutions that have revolutionized the retail and logistics industries. RFID systems utilize radio waves to identify and track items in real-time, offering unmatched visibility into supply chain operations. By attaching RFID tags to products, companies can monitor their movement throughout the entire supply chain, from manufacturing to point of sale, enabling accurate inventory management and efficient logistics operations. On the other hand, EAS systems employ various technologies, such as tags and antennas, to deter theft and prevent unauthorized removal of items from retail premises. These systems act as a powerful deterrent against shoplifting and help retailers minimize losses due to theft. Combined, RFID and EAS systems provide comprehensive oversight of assets, enhance inventory accuracy, optimize supply chain processes, and ensure heightened security across retail and logistics operations. With their ability to streamline operations, reduce costs, and enhance security, RFID and EAS systems continue to play a pivotal role in driving efficiency and profitability in the retail and logistics sectors.

Data Bridge Market Research analyses that Mexico RFID & electronic article surveillance systems market is expected to reach a value of USD 775,431.35 thousand by 2031 from 408,499.95 thousand in 2023, growing at a CAGR of 8.5% during the forecast period 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Offerings (Hardware, Software, and Service), Type (RFID and Electronic Article Surveillance Systems), Organization Size (Large Size Organization and Small & Medium Size Organization), Application (Access Control, Assets Tracking, Personnel Tracking, Jewelry Management, and Others), End Users (Retail/Commercial, Logistics and Transportation, Automotive, Industrial, Healthcare, Aerospace, Information Technology (IT), Defense, Education, Livestock, Sports, Wildlife, and Others), Sales Channel (Indirect and Direct) |

|

States Covered |

Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas, and Rest of Mexico |

|

Market Players Covered |

Checkpoint Systems, Inc, AVERY DENNISON CORPORATION, Johnson Controls, Zebra Technologies Corp, HID Global Corporation, part of ASSA ABLOY, Honeywell International Inc., Dahua Technology, Amersec s.r.o, Datalogic S.p.A, and Gunnebo AB |

Market Definition

RFID (Radio Frequency Identification) and Electronic Article Surveillance (EAS) Systems refer to advanced technological solutions employed primarily in retail and logistics sectors for enhanced inventory management, theft prevention, and supply chain optimization. RFID systems utilize radio waves to identify and track items in real-time, offering unparalleled visibility into supply chain operations. On the other hand, EAS systems employ various technologies such as tags and antennas to deter theft and prevent unauthorized removal of items from retail premises. Together, these systems provide comprehensive oversight of assets, improve inventory accuracy, and ensure enhanced security across the retail and logistics sectors.

Mexico RFID & Electronic Article Surveillance Systems Market

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Retail Sector Expansion Necessitates RFID and EAS System Integration

The expansion of the retail sector underscores the crucial need for integrating Radio-Frequency Identification (RFID) and Electronic Article Surveillance (EAS) systems. Combining RFID, which facilitates real-time inventory management and enhances operational efficiency, with EAS, which provides anti-theft protection, ensures comprehensive asset tracking and security solutions. This integration optimizes inventory visibility, reduces out-of-stock occurrences, minimizes theft losses, and streamlines checkout processes. By leveraging RFID for accurate inventory tracking and EAS for theft prevention, retailers can enhance customer satisfaction, increase sales, and maintain competitive advantage in the dynamic retail landscape.

- Rising Demand for Improved Supply Chain Visibility Which Leads to Better Logistics and Reduced Costs

The rising demand for improved supply chain visibility is driving retailers to adopt advanced technologies like RFID. Enhanced visibility enables real-time tracking of inventory, allowing for more precise logistics management and reducing operational costs. This granular insight into the movement of goods from source to sale helps identify inefficiencies and streamline processes, resulting in faster and more accurate fulfilment. As a result, retailers can reduce excess stock, minimize waste, and improve overall supply chain responsiveness. The adoption of RFID technology thus not only enhances logistical efficiency but also significantly lowers costs, contributing to better profitability and competitiveness in the market.

Opportunities

- Technological Advancements in RFID and EAS Systems

Technological advancements in Radio-Frequency Identification (RFID) and Electronic Article Surveillance (EAS) systems have opened up significant opportunities for the market. With the integration of advanced sensors, data analytics, and machine learning algorithms, modern RFID and EAS systems offer enhanced capabilities in inventory management, loss prevention, and customer experience optimization. These advancements allow retailers and logistics companies to efficiently track and manage their inventory in real-time, leading to improved operational efficiency and reduced costs.

Furthermore, the convergence of RFID and EAS systems with other emerging technologies such as IoT (Internet of Things) and cloud computing has expanded their potential applications across various industries beyond retail, including healthcare, manufacturing, and logistics. The ability to collect and analyze large volumes of data generated by RFID and EAS systems facilitates predictive analytics, enabling businesses to make data-driven decisions, optimize processes, and improve overall performance. As these technologies continue to evolve, the RFID and EAS systems market is poised for sustained growth, driven by the increasing demand for efficient inventory management, enhanced security, and seamless customer experiences.

- Increasing Demand for Medical Equipment Tracking in Healthcare Sector

The increasing demand for medical equipment tracking in the healthcare sector presents a significant opportunity for the RFID and Electronic Article Surveillance (EAS) Systems Market. As hospitals and healthcare facilities strive to enhance efficiency and patient care, the need for accurate and real-time tracking of medical equipment becomes paramount. RFID technology offers a robust solution by enabling the automatic identification and tracking of medical devices, instruments, and supplies throughout their lifecycle. By implementing RFID systems, healthcare providers can improve asset utilization, reduce equipment loss or theft, streamline inventory management, and ensure regulatory compliance.

Restraints/Challenges

- Initial Investment Costs May Hinder RFID and EAS Adoption

The initial investment costs associated with implementing Radio-Frequency Identification (RFID) and Electronic Article Surveillance (EAS) systems may pose a significant barrier to adoption for retailers. These technologies require upfront expenditures for equipment, software, and training, which can strain limited budgets. Additionally, the complexity of integrating RFID and EAS into existing infrastructure adds to the financial burden. Retailers may hesitate to commit resources without a clear understanding of the return on investment and long-term benefits. Consequently, despite recognizing the potential advantages in terms of inventory management and loss prevention, many businesses may delay or forego adoption due to financial constraints.

- Integrating RFID and EAS Systems With Existing it Infrastructure and Processes can be Complex and Time-Consuming

The integration of RFID (Radio Frequency Identification) and EAS (Electronic Article Surveillance) systems with existing IT infrastructure and processes poses a significant challenge for the RFID & Electronic Article Surveillance Systems Market. One of the primary complexities arises from the diverse range of IT systems already in place across different industries and organizations. Each business may have unique software applications, databases, and network configurations, making it challenging to seamlessly integrate RFID and EAS technologies without disruptions to existing operations.

Moreover, the integration process can be time-consuming due to the need for thorough planning, customization, and testing to ensure compatibility and functionality with existing IT infrastructure. This often involves coordinating with multiple stakeholders, including IT teams, system administrators, and end-users, to address potential conflicts and optimize system performance. As a result, the lengthy integration timeline can deter organizations from adopting RFID and EAS solutions, especially those with urgent security or inventory management needs.

Moreover, any delays or disruptions during integration can impact productivity and revenue, potentially resulting in additional expenses. Therefore, simplifying the integration process and offering cost-effective solutions tailored to diverse IT environments are critical factors for RFID and EAS system providers to overcome this challenge and drive market growth.

Recent Developments

- In April 2023, Checkpoint Systems, Inc. has teamed up with Partner Tech Europe to create a next-generation RFID-based Self-Service Checkout (SCO) solution aimed at improving customer convenience and in-store security. This collaboration bolsters Checkpoint Systems, Inc.'s presence in the RFID market by embedding their technology into advanced SCO systems. The new solution enhances customer experience, increases loss prevention, and delivers precise purchase data, thereby boosting sales and operational efficiency for retailers

- In February 2024, Zebra Technologies debuted "The Modern Store" at NRF'24 Retail's Big Show, introducing a groundbreaking retail approach with RFID technology. This innovation boosts inventory management, personalizes customer interactions, and streamlines store operations with features like self-checkout and personalized user profiles. By embedding RFID into retail settings, Zebra solidifies its reputation for delivering advanced solutions that enhance operational efficiency, accuracy, and customer experience. The success of "The Modern Store" strengthens Zebra's market position and broadens its impact in the retail technology industry

- In January 2022, Johnson Controls’ Sensormatic Solutions released its 2021 Sustainability Story white paper, detailing its commitment to sustainability through innovative RFID technology. Their Electronic Article Surveillance (EAS) systems now consume 50% less power, and the Inventory Intelligence solution, leveraging RFID, reduces waste and carbon emissions in the supply chain. This focus on sustainability benefits both retailers and shoppers, ensuring efficient operations, reduced energy use, and seamless shopping experiences

- In February 2023, HID Global Corporation has expanded its healthcare offering with the acquisition of GuardRFID, a real-time location services company. This move enhances HID's presence in the active RFID and RTLS space, allowing them to offer innovative solutions for infant security, staff duress, asset tracking, and wandering patients. The acquisition strengthens HID's ability to protect patients and staff in healthcare facilities, positioning them as a leader in the industry

- In August 2020, Datalogic S.p.A has unveiled the 2128P UHF RFID Reader, tailored for the Memor 10 PDA, to bolster inventory accuracy with rapid and precise RFID tag scanning. This advancement amplifies Datalogic SPA's RFID capabilities, enabling superior performance in tag reading. With the introduction of the 2128P UHF RFID Reader, Datalogic elevates inventory accuracy and efficiency for its clientele. Key features like maximum output power, extended read range, and tag de-duplication software streamline inventory management processes, positioning Datalogic as a leading provider of cutting-edge RFID solutions across industries including retail, transportation and logistics, manufacturing, and healthcare

Mexico RFID & Electronic Article Surveillance Systems Market Scope

The Mexico RFID & electronic article surveillance systems market is categorized into six notable segments based on offerings, type, organization size, application, end users, sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offerings

- Hardware

- Software

- Service

On the basis of offerings, the market is segmented into hardware, software, and service.

Type

- RFID

- Electronic Article Surveillance Systems

On the basis of type, the market is segmented into RFID and electronic article surveillance systems

Organization Size

- Large Size Organization

- Small & Medium Size Organization

On the basis of organization size, the market is segmented into large size organization and small & medium size organization.

Application

- Access Control

- Assets Tracking

- Personnel Tracking

- Jewelry Management

- Others

On the basis of application, the market is segmented into access control, assets tracking, personnel tracking, jewelry management, and others.

End Users

- Retail/Commercial

- Logistics and Transportation

- Automotive

- Industrial

- Healthcare

- Aerospace

- Information Technology (IT)

- Defense

- Education

- Livestock

- Sports

- Wildlife

- Others

On the basis of end users, the market is segmented into retail/commercial, logistics and transportation, automotive, industrial, healthcare, aerospace, Information Technology (IT), defense, education, livestock, sports, wildlife, and others.

Sales Channel

- Indirect

- Direct

On the basis of sales channel, the market is segmented into indirect and direct.

Mexico RFID & Electronic Article Surveillance Systems Market Regional Analysis/Insights

The Mexico RFID & electronic article surveillance systems market is analyzed and market size insights and trends are provided by offerings, type, organization size, application, end users, and sales channel.

The states covered in the Mexico RFID & electronic article surveillance systems market Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas, and rest of Mexico.

The Jalisco is expected to dominate the Mexico RFID & electronic article surveillance systems market due to its robust industrial base and strong retail sector.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of country brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mexico RFID & Electronic Article Surveillance Systems Market Share Analysis

Mexico RFID & electronic article surveillance systems market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Mexico RFID & electronic article surveillance systems market.

Some of the major players operating in the Mexico RFID & electronic article surveillance systems market are Checkpoint Systems, Inc, AVERY DENNISON CORPORATION, Johnson Controls, Zebra Technologies Corp, HID Global Corporation, part of ASSA ABLOY, Honeywell International Inc., Dahua Technology, Amersec s.r.o, Datalogic S.p.A, and Gunnebo AB.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERINGS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 CASE STUDY

4.5 PATENT ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.8 INDSUTRY WISE RFID IMPLEMENTATION

4.9 LIST OF THE COMPANIES ALONG WITH THEIR PROSPECT INDUSTRIES, POTENTIAL CLIENTS/CUSTOMERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RETAIL SECTOR EXPANSION NECESSITATES RFID AND EAS SYSTEM INTEGRATION

5.1.2 RISING DEMAND FOR IMPROVED SUPPLY CHAIN VISIBILITY WHICH LEADS TO BETTER LOGISTICS AND REDUCED COSTS

5.1.3 INDUSTRY 4.0 FOSTERS IOT AND RFID ASSET TRACKING ADOPTION

5.1.4 HEIGHTENED SECURITY CONCERNS DRIVE EAS SYSTEM INSTALLATIONS

5.2 RESTRAINTS

5.2.1 INITIAL INVESTMENT COSTS MAY HINDER RFID AND EAS ADOPTION

5.2.2 CONCERNS OVER DATA SECURITY AND PRIVACY IMPEDE TECHNOLOGY ADOPTION

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS IN RFID AND EAS SYSTEMS

5.3.2 INCREASING DEMAND FOR MEDICAL EQUIPMENT TRACKING IN HEALTHCARE SECTOR

5.3.3 GROWING AWARENESS ABOUT SECURITY AND LOSS PREVENTION

5.4 CHALLENGE

5.4.1 INTEGRATING RFID AND EAS SYSTEMS WITH EXISTING IT INFRASTRUCTURE AND PROCESSES CAN BE COMPLEX AND TIME-CONSUMING

6 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 ANTENNA

6.2.1.1 RFID ANTENNA

6.2.1.2 EAS SECURITY ANTENNA

6.2.2 TAGS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 RFID TAG

6.2.2.1.2 EAS TAG

6.2.2.2 BY TYPE

6.2.2.2.1 PASSIVE TAG

6.2.2.2.2 ACTIVE TAG

6.2.2.2.3 BATTERY-ASSISTED PASSIVE(BAP) RFID

6.2.2.3 BY FORM FACTOR

6.2.2.3.1 INLAY

6.2.2.3.2 LABEL

6.2.2.3.3 CARD

6.2.2.3.4 WRISTBANDS

6.2.2.3.5 OTHERS

6.2.2.4 BY MATERIAL

6.2.2.4.1 CERAMIC

6.2.2.4.2 PLASTICS

6.2.2.4.3 TEFLON

6.2.2.4.4 OTHERS

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 WINDOWS

6.3.1.2 ANDROID

6.3.1.3 iOS

6.3.1.4 OTHERS

6.3.2 DEPLOYMENT MODE

6.3.2.1 CLOUD

6.3.2.2 ON-PREMISE

6.4 SERVICES

6.4.1 SUPPORT & MAINTENANCE

6.4.2 SYSTEM INTEGRATION

6.4.3 CONSULTING

7 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 RFID

7.2.1 HIGH FREQUENCY RFID SYSTEMS

7.2.2 LOW FREQUENCY RFID SYSTEMS

7.2.3 ULTRA-HIGH FREQUENCY RFID SYSTEMS

7.2.4 MICROWAVE RFID SYSTEMS

7.3 ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS

7.3.1 ACOUSTIC MAGNETIC (AM) SYSTEMS

7.3.2 RADIO FREQUENCY (RF) SYSTEMS & RFID

7.3.3 ELECTRO MAGNETIC (EM) SYSTEMS

7.3.4 MICROWAVE

7.3.5 OTHERS

8 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ACCESS CONTROL

8.3 ASSETS TRACKING

8.4 PERSONNEL TRACKING

8.5 JEWELRY MANAGEMENT

8.6 OTHERS

9 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE SIZE ORGANIZATION

9.3 SMALL & MEDIUM SIZE ORGANIZATION

10 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 INDIRECT

10.2.1 BY TYPE

10.2.1.1 DISTRIBUTOR/WHOLESALER

10.2.1.2 SPECIALTY STORE

10.2.1.3 OTHERS

10.3 DIRECT

11 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS

11.1 OVERVIEW

11.2 RETAIL/COMMERCIAL

11.2.1 BY TYPE

11.2.1.1 APPAREL

11.2.1.2 CONSUMER PACKAGED GOODS

11.2.1.3 KIOSK

11.2.1.4 JEWELLERY TRACKING

11.2.1.5 LAUNDRY

11.2.1.6 ADVERTISING

11.2.1.7 OTHERS

11.2.2 BY OFFERING

11.2.2.1 HARDWARE

11.2.2.2 SOFTWARE

11.2.2.3 SERVICE

11.3 LOGISTICS AND TRANSPORTATION

11.3.1 BY OFFERING

11.3.1.1 HARDWARE

11.3.1.2 SOFTWARE

11.3.1.3 SERVICE

11.4 AUTOMOTIVE

11.4.1 BY OFFERING

11.4.1.1 HARDWARE

11.4.1.2 SOFTWARE

11.4.1.3 SERVICE

11.5 INDUSTRIAL

11.5.1 BY OFFERING

11.5.1.1 HARDWARE

11.5.1.2 SOFTWARE

11.5.1.3 SERVICE

11.6 HEALTHCARE

11.6.1 BY TYPE

11.6.1.1 EQUIPMENT MANAGEMENT

11.6.1.2 DRUGS MANAGEMENT

11.6.1.3 PATIENTS MANAGEMENT

11.6.1.4 LABORATORY MANAGEMENT

11.6.1.5 WASTE MANAGEMENT

11.6.1.6 OTHERS

11.6.2 BY OFFERING

11.6.2.1 HARDWARE

11.6.2.2 SOFTWARE

11.6.2.3 SERVICE

11.7 AEROSPACE

11.7.1 BY TYPE

11.7.1.1 BAGGAGE TRACKING

11.7.1.2 MATERIALS MANAGEMENT

11.7.1.3 MRO

11.7.1.4 LIFETIME TRACEABILITY

11.7.1.5 FLYABLE PARTS TRACKING

11.7.1.6 OTHERS

11.7.2 BY OFFERING

11.7.2.1 HARDWARE

11.7.2.2 SOFTWARE

11.7.2.3 SERVICE

11.8 INFORMATION TECHNOLOGY (IT)

11.8.1 BY OFFERING

11.8.1.1 HARDWARE

11.8.1.2 SOFTWARE

11.8.1.3 SERVICE

11.9 DEFENCE

11.9.1 BY OFFERING

11.9.1.1 WEAPON MANAGEMENT TRACKING

11.9.1.2 BORDER SECURITY

11.9.1.3 SOLDIER MOVEMENT TRACKING

11.9.1.4 OTHERS

11.9.2 BY TYPE

11.9.2.1 HARDWARE

11.9.2.2 SOFTWARE

11.9.2.3 SERVICE

11.1 EDUCATION

11.10.1 BY OFFERING

11.10.1.1 HARDWARE

11.10.1.2 SOFTWARE

11.10.1.3 SERVICE

11.11 LIVESTOCK

11.11.1 BY OFFERING

11.11.1.1 HARDWARE

11.11.1.2 SOFTWARE

11.11.1.3 SERVICE

11.12 SPORTS

11.12.1 BY OFFERING

11.12.1.1 HARDWARE

11.12.1.2 SOFTWARE

11.12.1.3 SERVICE

11.13 WILDLIFE

11.13.1 BY OFFERING

11.13.1.1 HARDWARE

11.13.1.2 SOFTWARE

11.13.1.3 SERVICE

11.14 OTHERS

11.14.1 BY OFFERING

11.14.1.1 HARDWARE

11.14.1.2 SOFTWARE

11.14.1.3 SERVICE

12 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY STATE

12.1 MEXICO

12.1.1 JALISCO

12.1.2 OAXACA

12.1.3 CHIHUAHUA

12.1.4 COAHUILA DE ZARAGOZA

12.1.5 SONORA

12.1.6 ZACATECAS

12.1.7 REST OF MEXICO

13 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CHECKPOINT SYSTEMS, INC. – A DIVISION OF CCL INDUSTRIES INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 AVERY DENNISON CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ZEBRA TECHNOLOGIES CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 JOHNSON CONTROLS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AMERSEC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DAHUA TECHNOLOGY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DATALOGIC S.P.A.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 HONEYWELL INTERNATIONAL INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 GUNNEBO AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 GAO REPORT (GAO-05-551): RFID TECHNOLOGY STANDARDS

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 LIST OF THE COMPANIES ALONG WITH THEIR PROSPECT INDUSTRIES, POTENTIAL CLIENTS

TABLE 4 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 5 MEXICO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 MEXICO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY RODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 10 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 11 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 12 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 13 MEXICO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 MEXICO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 16 MEXICO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 17 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 19 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 20 MEXICO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 22 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 24 MEXICO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 25 MEXICO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 26 MEXICO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 27 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 29 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 31 MEXICO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 32 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 34 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKE: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 35 MEXICO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 36 MEXICO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 37 MEXICO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 38 MEXICO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 39 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY STATES, 2022-2031 (USD THOUSAND)

TABLE 40 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 41 MEXICO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 MEXICO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 43 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 46 MEXICO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 47 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 48 MEXICO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 49 MEXICO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 MEXICO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 52 MEXICO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 53 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 54 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 55 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 56 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 MEXICO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 58 MEXICO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 59 MEXICO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 60 MEXICO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 61 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 MEXICO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 63 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 MEXICO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 65 MEXICO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 68 MEXICO EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 69 MEXICO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 70 MEXICO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 71 MEXICO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 72 MEXICO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 73 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 74 MEXICO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 TABLE-37: JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 76 JALISCO HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 JALISCO ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 81 JALISCO TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 82 JALISCO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 83 JALISCO SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 84 JALISCO SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 JALISCO RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 87 JALISCO ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 88 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 89 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 90 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 91 JALISCO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 JALISCO RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 93 JALISCO LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 94 JALISCO AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 95 JALISCO INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 96 JALISCO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 JALISCO HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 98 JALISCO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 JALISCO AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 100 JALISCO INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 101 JALISCO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 JALISCO DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 103 JALISCO EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 104 JALISCO LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 105 JALISCO SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 JALISCO WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 107 JALISCO OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 108 JALISCO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 109 JALISCO INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 111 OAXACA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 OAXACA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 116 OAXACA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 117 OAXACA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 118 OAXACA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 119 OAXACA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 OAXACA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 122 OAXACA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 123 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 124 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 125 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 126 OAXACA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 OAXACA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 128 OAXACA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 129 OAXACA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 130 OAXACA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 131 OAXACA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 OAXACA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 133 OAXACA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 OAXACA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 135 OAXACA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 136 OAXACA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 OAXACA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 138 OAXACA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 139 OAXACA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 140 OAXACA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 141 OAXACA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 142 OAXACA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 143 OAXACA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 144 OAXACA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 CHIHUAHUA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 CHIHUAHUA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 151 CHIHUAHUA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 152 CHIHUAHUA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 153 CHIHUAHUA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 154 CHIHUAHUA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 CHIHUAHUA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 157 CHIHUAHUA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 158 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 159 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 160 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 161 CHIHUAHUA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 CHIHUAHUA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 163 CHIHUAHUA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 164 CHIHUAHUA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 165 CHIHUAHUA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 CHIHUAHUA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 CHIHUAHUA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 168 CHIHUAHUA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 CHIHUAHUA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 170 CHIHUAHUA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 171 CHIHUAHUA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 CHIHUAHUA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 173 CHIHUAHUA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 174 CHIHUAHUA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 175 CHIHUAHUA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 176 CHIHUAHUA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 177 CHIHUAHUA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 178 CHIHUAHUA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 179 CHIHUAHUA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 181 COAHUILA DE ZARAGOZA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 COAHUILA DE ZARAGOZA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 186 COAHUILA DE ZARAGOZA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 187 COAHUILA DE ZARAGOZA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 188 COAHUILA DE ZARAGOZA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 189 COAHUILA DE ZARAGOZA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 COAHUILA DE ZARAGOZA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 192 COAHUILA DE ZARAGOZA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 193 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 194 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 195 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 196 COAHUILA DE ZARAGOZA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 COAHUILA DE ZARAGOZA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 198 COAHUILA DE ZARAGOZA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 199 COAHUILA DE ZARAGOZA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 200 COAHUILA DE ZARAGOZA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 201 COAHUILA DE ZARAGOZA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 COAHUILA DE ZARAGOZA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 203 COAHUILA DE ZARAGOZA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 204 COAHUILA DE ZARAGOZA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 205 COAHUILA DE ZARAGOZA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 COAHUILA DE ZARAGOZA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 COAHUILA DE ZARAGOZA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 208 COAHUILA DE ZARAGOZA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 209 COAHUILA DE ZARAGOZA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 210 COAHUILA DE ZARAGOZA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 211 COAHUILA DE ZARAGOZA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 212 COAHUILA DE ZARAGOZA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 213 COAHUILA DE ZARAGOZA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 214 COAHUILA DE ZARAGOZA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 216 SONORA HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 SONORA ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 221 SONORA TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 222 SONORA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 223 SONORA SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 224 SONORA SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 SONORA RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 227 SONORA ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 228 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 229 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 230 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 231 SONORA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 SONORA RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 233 SONORA LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 234 SONORA AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 235 SONORA INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 236 SONORA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 SONORA HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 238 SONORA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 SONORA AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 240 SONORA INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 241 SONORA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 SONORA DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 243 SONORA EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 244 SONORA LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 245 SONORA SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 SONORA WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 247 SONORA OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 248 SONORA RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 249 SONORA INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 251 ZACATECAS HARDWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 ZACATECAS ANTENNA IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 255 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FORM FACTOR, 2022-2031 (USD THOUSAND)

TABLE 256 ZACATECAS TAGS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY MATERIAL, 2022-2031 (USD THOUSAND)

TABLE 257 ZACATECAS SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OPERATING SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 258 ZACATECAS SOFTWARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE, 2022-2031 (USD THOUSAND)

TABLE 259 ZACATECAS SERVICES IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 ZACATECAS RFID IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY FREQUENCY RANGE, 2022-2031 (USD THOUSAND)

TABLE 262 ZACATECAS ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 263 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE, 2022-2031 (USD THOUSAND)

TABLE 264 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 265 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY END USERS, 2022-2031 (USD THOUSAND)

TABLE 266 ZACATECAS RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 ZACATECAS RETAIL/COMMERCIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 268 ZACATECAS LOGISTICS AND TRANSPORTATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 269 ZACATECAS AUTOMOTIVE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 270 ZACATECAS INDUSTRIAL IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 271 ZACATECAS HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 ZACATECAS HEALTHCARE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 273 ZACATECAS AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 ZACATECAS AEROSPACE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 275 ZACATECAS INFORMATION TECHNOLOGY (IT) IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 276 ZACATECAS DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 ZACATECAS DEFENSE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 278 ZACATECAS EDUCATION IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 279 ZACATECAS LIVESTOCK IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 280 ZACATECAS SPORTS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 281 ZACATECAS WILDLIFE IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 282 ZACATECAS OTHERS IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 283 ZACATECAS RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY SALES CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 284 ZACATECAS INDIRECT IN RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 285 REST OF MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

Lista de figuras

FIGURE 1 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: SEGMENTATION

FIGURE 10 RETAIL SECTOR EXPANSION NECESSITATES RFID AND EAS SYSTEM INTEGRATION ARE EXPECTED TO DRIVE THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET IN THE FORECAST PERIOD

FIGURE 11 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET IN 2024 & 2031

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL ARTIFICIAL TURF MARKET

FIGURE 13 MEXICO RETAIL SALES YOY (%)

FIGURE 14 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY OFFERINGS, 2023

FIGURE 15 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2023

FIGURE 16 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY APPLICATION, 2023

FIGURE 17 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY ORGANIZATION SIZE, 2023

FIGURE 18 FIGURE 1: MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY SALES CHANNEL, 2023

FIGURE 19 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: BY END USERS, 2023

FIGURE 20 MEXICO RFID & ELECTRONIC ARTICLE SURVEILLANCE SYSTEMS MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.