South East Asia Air Maintenance Repair And Operations Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2024 –2031 | |

| USD 5.87 Billion | |

| USD 8.03 Billion | |

|

|

|

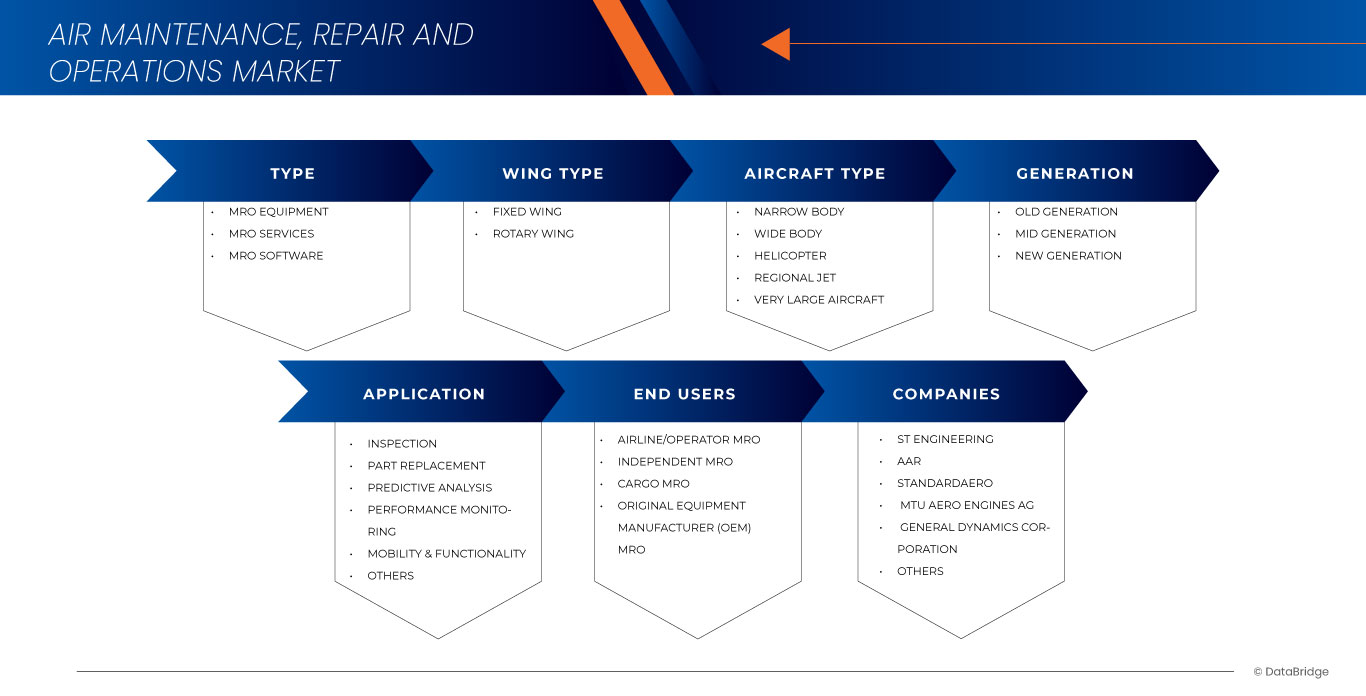

South East Asia Air Maintenance market, By Type (MRO Equipment, MRO Services, MRO Software), Wing Type (Fixed Wing, Rotary Wing), Aircraft Type (Narrow Body, Wide Body, Helicopter, Regional Jet and Very Large Aircraft), Generation (Old Generation, Mid Generation, and New Generation Aircraft), Application (Inspection, Part Replacement, Predictive Analysis, Performance Monitoring, Mobility & Functionality), End User (Airline/Operator MRO, Independent MRO, Cargo MRO, Original Equipment Manufacturer (OEM) (MRO)], Aviation Type (Civilian Aviation, Military Aviation, and Training Aviation), Countries (Indonesia, Thailand, Malaysia, Vietnam, Singapore, Philippines, Myanmar, Cambodia, Laos, and Rest of South East Asia) - Industry Trends and Forecast to 2031.

South East Asia Air Maintenance Repair and Operations Market Analysis and Size

South East Asia air maintenance, repair and operations market is fragmented in nature, as it consists of many regional players such as ST Engineering, AAR, StandardAero, MTU Aero Engines AG, General Dynamics Corporation, PT GMF AEROASIA TBK., Rolls-Royce plc, Safran, Textron Inc., ExecuJet MRO Services., Lufthansa Group, Sepang Aircraft Engineering Sdn Bhd, AIROD SDN BHD, Asia Aerotechnics Sdn Bhd., FL Technics, Lion Air., Malaysia Airlines Berhad, PT. Dirgantara Indonesia, PT. KALIMASADA PUSAKA and among others. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer services with different specifications and characteristics for all budgets. As the global fleet of aircraft ages, the need for regular maintenance and overhauls increases, Regulatory requirements mandate regular maintenance checks, driving demand for MRO services, Airlines are prioritizing fuel efficiency and performance, driving demand for regular maintenance and upgrades, and Increasing focus on aftermarket services by OEMs and independent providers supports MRO market expansion is driving the South East Asia air maintenance, repair and operations market. Additionally, Rapid growth in air travel in emerging Southeast Asian economies presents new opportunities for MRO services, Strategic partnerships and collaborations with airlines and OEMs can open up new business avenues, Integrating advanced technologies like AI, IoT, will improve efficiency and reduce downtime is expected to provide opportunity for the growth of the South East Asia air maintenance, repair and operations market. However, fluctuations in global economic conditions can impact airline profitability and MRO spending is estimated to act as a restraint for the market.

Moreover, ensuring ongoing safety and reliability amid complex maintenance operations, and managing high costs associated with parts, labour, and equipment are estimated to be as challenges for the growth of the South East Asia air maintenance, repair and operations market. Data Bridge Market Research analyses that Mexico RFID & electronic article surveillance systems market is expected to reach a value of USD 8.03 billion by 2031 from USD 5.87 billion in 2023, growing at a CAGR of 4.1 % during the forecast period 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Type (MRO Equipment, MRO Services, MRO Software), Wing Type (Fixed Wing, Rotary Wing), Aircraft type (Narrow Body, Wide Body, Helicopter, Regional Jet and Very Large Aircraft), Generation (Old Generation, Mid Generation and New Generation Aircraft), Application (Inspection, Part Replacement, Predictive Analysis, Performance Monitoring, Mobility & Functionality), End User [Airline/Operator MRO, Independent MRO, Cargo MRO, Original Equipment Manufacturer (OEM)], Aviation Type (Civilian Aviation, Military Aviation, and Training Aviation) |

|

Countries Covered |

Indonesia, Thailand, Malaysia, Vietnam, Singapore, Philippines, Myanmar, Cambodia, Laos, and rest of South East Asia |

|

Market Players Covered |

ST Engineering, AAR, StandardAero, MTU Aero Engines AG, General Dynamics Corporation, PT GMF AEROASIA TBK., Rolls-Royce plc, Safran, Textron Aviation Inc., ExecuJet MRO Services., Lufthansa Technik, Sepang Aircraft Engineering Sdn Bhd, AIROD SDN BHD, Asia Aerotechnics Sdn Bhd., FL Technics, Lion Airs, Malaysia Airlines Berhad, PT. Dirgantara Indonesia, and PT. KALIMASADA PUSAKA among others |

Market Definition

The South East Asia air maintenance, repair, and operations market encompasses a comprehensive range of activities and services aimed at ensuring the safety, efficiency, and airworthiness of aircraft operating within the region. This market includes MRO equipment, services, and software used for the maintenance, repair, and overhaul of fixed-wing and rotary-wing aircraft across various types, such as narrow body, wide body, helicopters, regional jets, and very large aircraft. It addresses the needs of different generations of aircraft, from old to new, and covers applications such as inspection, part replacement, predictive analysis, performance monitoring, and mobility & functionality enhancements. The market serves a diverse clientele, including airline operators, independent MRO providers, cargo operators, and original equipment manufacturers (OEMs), across civilian, military, and training aviation sectors.

South East Asia Air Maintenance, Repair, and Operations Market

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

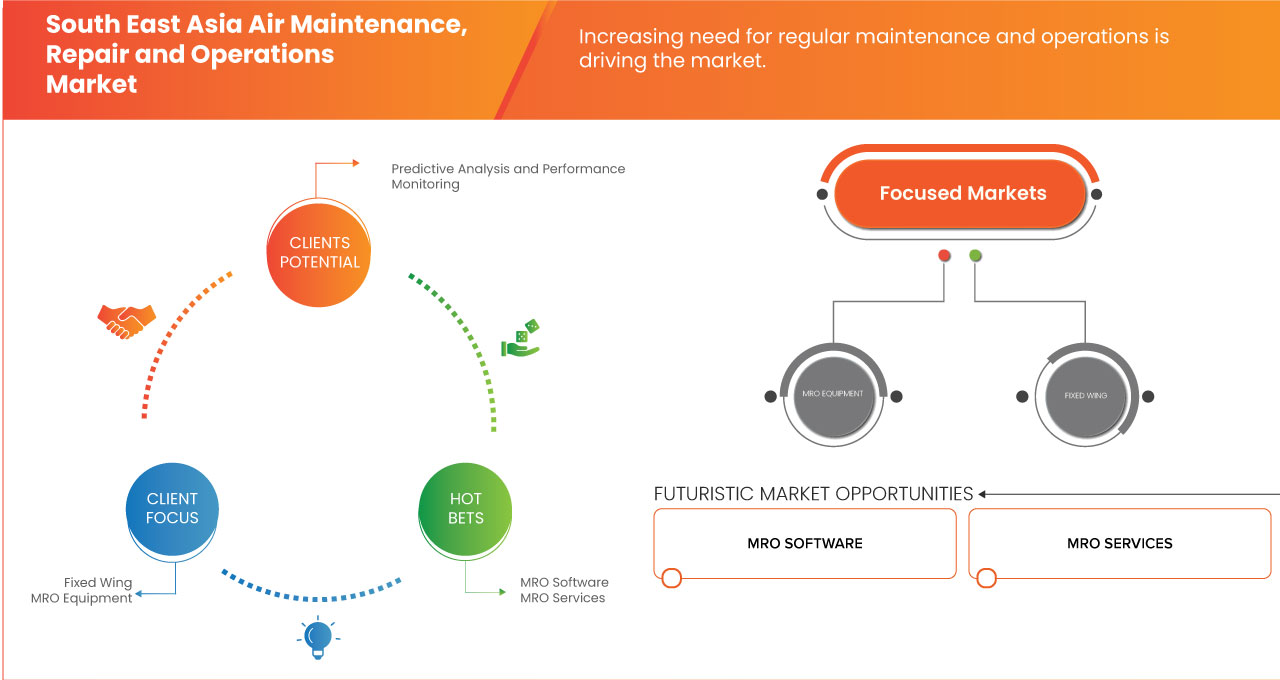

- Increasing the Need for Regular Maintenance and Operations

The demand for regular maintenance, repair, and operations (MRO) services intensifies. Aircraft require more frequent inspections and updates to ensure that they meet safety and performance standards. This increases the need for comprehensive MRO solutions, including periodic maintenance, structural repairs, and major overhauls. Regular MRO services help in extending the lifespan of aircraft, preventing potential issues, and maintaining operational efficiency. As aircraft fleets grow older, the importance of reliable MRO providers becomes crucial for sustaining safe and efficient aviation operations.

- Regulatory Requirements Increases the Demand for MRO Services

Regulatory requirements mandate regular maintenance checks to ensure the safety and reliability of aircraft. These stringent regulations necessitate periodic inspections, overhauls, and repairs, which drive the demand for maintenance, repair, and overhaul (MRO) services. Compliance with these standards is crucial for maintaining operational safety and preventing equipment failures, thus reinforcing the need for comprehensive MRO solutions.

As a result, the MRO sector is expanding to meet these regulatory demands. The increased frequency of required maintenance tasks and the complexity of modern aircraft have led to a rise in specialized MRO services and facilities. This growth supports the aviation industry's commitment to safety and efficiency while fostering advancements in maintenance technologies and practices.

Opportunities

- Expanding Air Travel in Southeast Asia Creates New Opportunities for MRO Services

The expansion of air travel in Southeast Asia is creating new opportunities for maintenance, repair, and operations (MRO) services in the region. As the demand for air travel increases, airlines are expanding their fleets and operating more flights, which in turn also boosts the need for regular maintenance and timely repairs. This growth presents a significant opportunity for MRO providers to cater to the rising number of aircraft and support airlines in maintaining optimal operational efficiency and safety.

- Strategic Partnerships and Collaborations Between Airlines and OEMs

Strategic partnerships and collaborations between airlines and OEMs are increasingly shaping the aviation industry's landscape. By forming these alliances, airlines and original equipment manufacturers can leverage each other's strengths to enhance operational efficiency, reduce costs, and improve service quality. Such partnerships facilitate the sharing of advanced technologies and insights, leading to better maintenance practices, streamlined supply chains, and more responsive support services. As the aviation sector evolves, these collaborations will play a crucial role in optimizing fleet performance, accelerating innovation, and meeting the growing demands of the global air travel market.

Restraints/Challenges

- Fluctuations in Economic Conditions Impact Airline Profitability and MRO Spending

Fluctuations in global economic conditions impact airline profitability and MRO spending. Economic downturns and uncertainties often lead to reduced revenue for airlines, prompting cost-cutting measures that include scaling back on maintenance, repair, and overhaul (MRO) services. This can result in deferred maintenance programs, affecting aircraft performance and safety. Consequently, MRO providers face difficulty in adapting to fluctuating budgets and demand while maintaining high service standards and operational efficiency.

- Ensuring Ongoing Safety and Reliability Amid Complex Maintenance Operations

Ensuring ongoing safety and reliability amidst complex maintenance operations presents a significant challenge in the air maintenance, repair, and operations (MRO) market. Aircraft maintenance involves intricate procedures and adherence to stringent regulatory standards to uphold safety and operational reliability. The complexity arises from the diverse fleet of aircraft types, each requiring tailored maintenance schedules and procedures. MRO providers must navigate these complexities while ensuring that maintenance activities do not compromise flight safety or operational efficiency. Moreover, advancements in aircraft technology and regulatory updates continually evolve, necessitating MRO providers to stay updated with the latest protocols and equipment capabilities to maintain high standards of safety and reliability.

Recent Developments

- In July 2024, ST Engineering entered a two-year agreement with SAFRAN Aircraft Engines, extendable to handle module repairs for LEAP 1A and LEAP-1B engines, including high-pressure turbine components. This partnership strengthened ST Engineering's role in the LEAP engine MRO sector, meets rising demand, and enhanced its position and collaboration with SAFRAN, boosting both capabilities and market presence

- In February 2024, ST Engineering renewed its partnership with Honeywell to maintain, repair, and overhaul Honeywell's mechanical, avionics, and LEAP engine components. This extension strengthened ST Engineering’s position as a leading MRO provider in the Asia-Pacific region, boosted its access to cutting-edge technology, and enhanced its component servicing operations across Asia and Europe

- In February 2023, ST Engineering opened a new aircraft maintenance hangar at Pensacola International Airport, enhancing its U.S. expansion and customer support efforts. This facility doubled the company's capacity in Pensacola, boosted its wide body aircraft service capabilities, and strengthened its Airbus A300 program, positioning ST Engineering to capture new opportunities in the Americas and drive growth in the air maintenance repair and operations sector

- In July, LOT Polish Airlines and Lufthansa Technik expanded their partnership with a new Engine Maintenance Services (EMS) contract for the CFM56-7B engines of LOT's Boeing 737NG fleet. This agreement included eleven engine overhauls and the provision of two lease engines to ensure operational stability. This contract reinforced Lufthansa Technik's position as a leading provider of engine MRO services, enhancing its operational scope and deepening its relationship with LOT Polish Airlines. The successful execution of these services bolstered Lufthansa Technik's reputation for reliability and technical expertise in engine maintenance

South East Asia Air Maintenance, Repair and Operations Market Scope

The South East Asia air maintenance, repair and operations market is segmented into seven notable segments which are based the type, wing type, aircraft type, generation, application, end user, and aviation type.

Type

- MRO Equipment

- MRO Services

- MRO Software

On the basis of type, the South East Asia air maintenance, repair and operations market is segmented into MRO equipment, MRO services, and MRO software.

Wing Type

- Fixed Wing

- Rotary Wing

On the basis of wing type, the South East Asia air maintenance, repair and operations market is segmented into fixed wing, and rotary wing.

Aircraft Type

- Narrow Body

- Wide Body

- Helicopter

- Regional Jet

- Very Large Aircraft

On the basis of aircraft type, the South East Asia air maintenance, repair and operations market is segmented narrow body, wide body, helicopter, regional jet, and very large aircraft.

Generation

- Old Generation

- Mid Generation

- New Generation

On the basis of generation, the South East Asia air maintenance, repair and operations market is segmented into old generation, mid generation, and new generation.

Application

- Inspection

- Part Replacement

- Predictive Analysis

- Performance Monitoring

- Mobility & Functionality

- Others

On the basis of application, the South East Asia air maintenance, repair and operations market is segmented into inspection, part replacement, predictive analysis, performance monitoring, mobility & functionality, and others.

End User

- Airline/Operator MRO

- Independent MRO

- Cargo MRO

- Original Equipment Manufacturer (OEM) MRO

On the basis of end user, the South East Asia air maintenance, repair and operations market is segmented into Airline/Operator MRO, Independent MRO, Cargo MRO, and Original Equipment Manufacturer (OEM) MRO.

Aviation Type

- Civilian Aviation

- Military Aviation

- Training Aviation

South East Asia Air Maintenance Repair and Operations Market Regional Analysis/Insights

South East Asia air maintenance, repair and operations market is segmented into seven notable segments which are based the type, wing type, aircraft type, generation, application, end user, and aviation type.

The counties in the South East Asia air maintenance, repair and operations market are Indonesia, Thailand, Malaysia, Vietnam, Singapore, Philippines, Myanmar, Cambodia, Laos, and Rest of South East Asia

South East Asia air maintenance, repair and operations market is fragmented in nature, as it consists of many regional players such as ST Engineering, AAR, StandardAero, MTU Aero Engines AG, General Dynamics Corporation, PT GMF AEROASIA TBK., Rolls-Royce plc, Safran, Textron Inc., ExecuJet MRO Services., Lufthansa Group, Sepang Aircraft Engineering Sdn Bhd, AIROD SDN BHD, Asia Aerotechnics Sdn Bhd., FL Technics, Lion Air., Malaysia Airlines Berhad, PT. Dirgantara Indonesia, PT. KALIMASADA PUSAKA and among others. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer services with different specifications and characteristics for all budgets. As the global fleet of aircraft ages, the need for regular maintenance and overhauls increases, Regulatory requirements mandate regular maintenance checks, driving demand for MRO services, Airlines are prioritizing fuel efficiency and performance, driving demand for regular maintenance and upgrades, and Increasing focus on aftermarket services by OEMs and independent providers supports MRO market expansion is driving the South East Asia air maintenance, repair and operations market.

Competitive Landscape and South East Asia Air Maintenance, Repair and Operations Market Share Analysis

South East Asia Air Maintenance, Repair and Operations Market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global industrial automation market.

Some of the major players operating in the South East Asia Air Maintenance, Repair and Operations Market are ST Engineering, AAR, StandardAero, MTU Aero Engines AG, General Dynamics Corporation, PT GMF AEROASIA TBK., Rolls-Royce plc, Safran, Textron Aviation Inc., ExecuJet MRO Services., Lufthansa Group, Sepang Aircraft Engineering Sdn Bhd, AIROD SDN BHD, Asia Aerotechnics Sdn Bhd., FL Technics, Lion Air., Malaysia Airlines Berhad, PT. Dirgantara Indonesia and PT. KALIMASADA PUSAKA among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELLING

2.8 TYPE TIMELINE CURVE

2.9 END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 REGULATORY STANDARDS

4.4 TECHNOLOGICAL TRENDS

4.5 VALUE CHAIN ANALYSIS

4.6 COMPANY COMPARATIVE ANALYSIS

4.7 GOVERNMENT/LOCAL STRATEGY IN RELATION WITH MRO FOR DIFFERENT COUNTRIES

4.8 EMPLOYEE DETAILS (DESIGNATION & QUALIFICATION) DEALING IN MRO SERVICES (VIETNAM)

4.9 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET

4.1 DATA ON MRO HANGARS AND ITS RELATED COMPANIES

4.10.1 INFORMATION ON THE CONSTRUCTION AND ITS COST IN VIETNAM OF MRO HANGARS

4.10.2 IDENTIFICATION OF MRO COMPANIES AND AIRLINES THAT MAY BE INTERESTED IN SETTING UP IN THE TARGETED AIRPORT IN VIETNAM

4.10.3 EVALUATION OF THE QUANTITY OF HANGARS THAT CAN MEET DEMAND OVER TIME

4.11 LIST OF CUSTOMERS FOR DIFFERENT MRO COMPANIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING THE NEED FOR REGULAR MAINTENANCE AND OPERATIONS

5.1.2 REGULATORY REQUIREMENTS INCREASES THE DEMAND FOR MRO SERVICES

5.1.3 INCREASING FUEL EFFICIENCY AND AIR-CRAFT PERFORMANCE

5.1.4 RISING FOCUS ON AFTERMARKET SERVICES BY OEM SUPPLIER

5.2 RESTRAINT

5.2.1 FLUCTUATIONS IN ECONOMIC CONDITIONS IMPACT AIRLINE PROFITABILITY AND MRO SPENDING

5.3 OPPORTUNITIES

5.3.1 EXPANDING AIR TRAVEL IN SOUTH EAST ASIA CREATES NEW OPPORTUNITIES FOR MRO SERVICES

5.3.2 STRATEGIC PARTNERSHIPS AND COLLABORATIONS BETWEEN AIRLINES AND OEMS

5.3.3 INTEGRATING ADVANCED TECHNOLOGIES NAMELY AI AND IOT FOR ENHANCING OVERALL EFFICIENCY

5.4 CHALLENGE

5.4.1 ENSURING ONGOING SAFETY AND RELIABILITY AMID COMPLEX MAINTENANCE OPERATIONS

6 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE

6.1 OVERVIEW

6.2 MRO EQUIPMENT

6.2.1 AIRCRAFT EQUIPMENT

6.2.1.1 ENGINE

6.2.1.2 AIRFRAME

6.2.1.3 AVIONICS

6.2.1.4 LANDING GEAR

6.2.1.5 INTERIORS

6.2.1.6 OTHERS

6.2.2 GSE EQUIPMENT

6.2.2.1 CARGO/CONTAINER LOADERS

6.2.2.2 PASSENGER BOARDING BRIDGES

6.2.2.3 BULK LOADERS/CONVEYORS

6.2.2.4 BOARDING STAIRS

6.2.2.5 CABIN SERVICE VEHICLES

6.2.2.6 LAVATORY SERVICE VEHICLES

6.2.2.7 PASSENGER BUSES

6.2.2.8 OTHERS

6.2.3 REPAIR TOOLS

6.2.3.1 SCREWDRIVER

6.2.3.2 WRENCHES (INCLUDING TORQUE WRENCHES)

6.2.3.3 PLIERS

6.2.3.4 HAMMERS AND MALLETS

6.2.3.5 FILES

6.2.3.6 DRILL

6.2.3.7 CHISELS

6.2.3.8 MICROMETER

6.2.3.9 HACKSAW

6.2.3.10 PUNCHES

6.2.3.11 SCRIBER

6.2.3.12 METAL CUTTING TOOLS

6.2.3.13 STRAP WRENCHES

6.2.3.14 OTHERS

6.3 MRO SERVICES

6.3.1 MAINTENANCE SERVICES

6.3.1.1 ENGINE MAINTENANCE

6.3.1.1.1 INTEGRATED SERVICES (ENGINE HEALTH MONITORING, FLEET MANAGEMENT, OTHERS)

6.3.1.1.2 IN-HOUSE REPAIR CAPABILITIES (OEM PROPRIETARY REPAIRS, PAINTING, OTHERS)

6.3.1.1.3 ENGINE WASH

6.3.1.1.4 OTHERS

6.3.1.2 AIRFRAME MAINTENANCE

6.3.1.2.1 STRUCTURAL REPAIR AND MODIFICATION

6.3.1.2.2 WORK MODERNIZATION AND CABIN RECONFIGURATION

6.3.1.2.3 TRANSIT/TURNAROUND SERVICING AND CHECKS

6.3.1.2.4 OTHERS

6.3.1.3 COMPONENT MAINTENANCE

6.3.1.3.1 COMMUNICATION AND NAVIGATION SYSTEMS

6.3.1.3.2 AIRBORNE COMPUTERS, INSTRUMENTS AND CONTROL DISPLAY UNITS

6.3.1.3.3 ELECTRICAL AND HYDRAULIC ACCESSORIES

6.3.1.3.4 FUEL CONTROLLER

6.3.1.3.5 EMERGENCY EQUIPMENT

6.3.1.3.6 OTHERS

6.3.1.4 LINE MAINTENANCE

6.3.2 ENGINES OVERHAUL

6.3.3 REVERSE ENGINEERING AND MODIFICATIONS/DESIGNING

6.3.4 INVENTORY MANAGEMENT

6.3.5 TECHNICAL TRAINING

6.3.6 OTHERS

6.4 MRO SOFTWARE

6.4.1 ERP SOLUTIONS

6.4.2 POINT SOLUTIONS

7 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE

7.1 OVERVIEW

7.2 CIVILIAN AVIATION

7.2.1 BY USAGE

7.2.1.1 COMMERCIAL AIRCRAFT

7.2.1.1.1 PASSENGER AIRCRAFT

7.2.1.1.2 CARGO AIRCRAFT

7.2.1.1.3 COMBINATION

7.2.1.2 PRIVATE AIRCRAFT

7.2.2 BY TYPE

7.2.2.1 MRO EQUIPMENT

7.2.2.2 MRO SERVICES

7.2.2.3 MRO SOFTWARE

7.3 MILITARY AVIATION

7.3.1 BY TYPE

7.3.1.1 MRO EQUIPMENT

7.3.1.2 MRO SERVICES

7.3.1.3 MRO SOFTWARE

7.4 TRAINING AVIATION

7.4.1 BY TYPE

7.4.1.1 MRO EQUIPMENT

7.4.1.2 MRO SERVICES

7.4.1.3 MRO SOFTWARE

8 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE

8.1 OVERVIEW

8.2 FIXED WING

8.3 ROTARY WING

9 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE

9.1 OVERVIEW

9.2 NARROW BODY

9.3 WIDE BODY

9.4 HELICOPTER

9.5 REGIONAL JET

9.6 VERY LARGE AIRCRAFT

10 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION

10.1 OVERVIEW

10.2 OLD GENERATION

10.3 MID GENERATION

10.4 NEW GENERATION

11 SOUTH EAST ASIA AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 INSPECTION

11.3 PART REPLACEMENT

11.4 PREDICTIVE ANALYSIS

11.5 PERFORMANCE MONITORING

11.6 MOBILITY & FUNCTIONALITY

11.7 OTHERS

12 SOUTH EAST ASIA AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY END USER

12.1 OVERVIEW

12.2 AIRLINE/OPERATOR MRO

12.3 INDEPENDENT MRO

12.4 CARGO MRO

12.5 ORIGINAL EQUIPMENT MANUFACTURER (OEM) MRO

13 SOUTH EAST ASIA AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY COUNTRY

13.1 OVERVIEW

13.2 INDONESIA

13.3 THAILAND

13.4 MALAYSIA

13.5 VIETNAM

13.6 SINGAPORE

13.7 PHILIPPINES

13.8 MYANMAR

13.9 CAMBODIA

13.1 LAOS

13.11 REST OF SOUTH EAST ASIA

14 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: SOUTH EAST ASIA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ST ENGINEERING

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 SOLUTION PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 LUFTHANSA TECHNIK

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 STANDARDAERO

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 SAFRAN

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ROLLS-ROYCE PLC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AAR

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 AIROD SDN BHD

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 ASIA AEROTECHNICS SDN BHD.

16.8.1 COMPANY SNAPSHOT

16.8.2 SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EXECUJET MRO SERVICES

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 FL TECHNICS

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 JET AVIATION INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 LION AIR

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 MAB ENGINEERING SERVICES SDN. BHD.

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MTU AERO ENGINES AG

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 PT GMF AEROASIA TBK

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SERVICE PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 PT. DIRGANTARA INDONESIA (PERSERO)

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 PT. KALIMASADA PUSAKA

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SEPANG AIRCRAFT ENGINEERING SDN BHD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 TEXTRON AVIATION INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 CERTIFICATE/LICENSE RELATED AIR MAINTENANCE REPAIR AND OPERATIONS

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 EMPLOYEES DETAILS (DESIGNATION & QUALIFICATION) DEALING IN MRO SERVICES (VIETNAM)

TABLE 4 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 SOUTH EAST ASIA MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 SOUTH EAST ASIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 SOUTH EAST ASIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 SOUTH EAST ASIA REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 SOUTH EAST ASIA MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 SOUTH EAST ASIA MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 SOUTH EAST ASIA ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 SOUTH EAST ASIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 SOUTH EAST ASIA COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 SOUTH EAST ASIA MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 LIST OF CUSTOMERS

TABLE 16 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 SOUTH EAST ASIA MRO EQUIPMENT IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 SOUTH EAST ASIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 SOUTH EAST ASIA GSE EQUIPMENT IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 SOUTH EAST ASIA REPAIR TOOLS IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 SOUTH EAST ASIA MRO SERVICES IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 SOUTH EAST ASIA MAINTENANCE SERVICES IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 SOUTH EAST ASIA ENGINE MAINTENANCE IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 SOUTH EAST ASIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 SOUTH EAST ASIA COMPONENT MAINTENANCE IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 SOUTH EAST ASIA MRO SOFTWARE IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 27 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 SOUTH EAST ASIA CIVILIAN AVIATION IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 29 SOUTH EAST ASIA COMMERCIAL AIRCRAFT IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 SOUTH EAST ASIA CIVILIAN AVIATION IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 SOUTH EAST ASIA MILITARY AVIATION IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 32 SOUTH EAST ASIA TRAINING AVIATION IN AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 35 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 36 SOUTH EAST ASIA AIR MAINTENANCE REPAIR AND OPERATIONS MARKET, BY OFFERING, 2020-2031 (USD THOUSAND)

TABLE 37 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 38 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY COUNTRY, (USD THOUSAND)

TABLE 39 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 SOUTH EAST ASIA MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 SOUTH EAST ASIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 SOUTH EAST ASIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 43 SOUTH EAST ASIA REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 SOUTH EAST ASIA MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 SOUTH EAST ASIA MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 SOUTH EAST ASIA ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 SOUTH EAST ASIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 SOUTH EAST ASIA COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 SOUTH EAST ASIA MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 53 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 54 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 55 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 SOUTH EAST ASIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 57 SOUTH EAST ASIA COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 SOUTH EAST ASIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 SOUTH EAST ASIA MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 SOUTH EAST ASIA TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 INDONESIA MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 INDONESIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 INDONESIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 INDONESIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 INDONESIA MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 INDONESIA MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 INDONESIA ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 INDONESIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 INDONESIA COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 INDONESIA MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 75 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 76 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 77 INDONESIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 INDONESIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 79 INDONESIA COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 INDONESIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 INDONESIA MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 INDONESIA TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 83 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 THAILAND MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 THAILAND AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 THAILAND GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 THAILAND REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 THAILAND MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 THAILAND MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 THAILAND ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 THAILAND AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 THAILAND COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 THAILAND MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 98 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 99 THAILAND AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 THAILAND CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 101 THAILAND COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 THAILAND CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 THAILAND MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 THAILAND TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 MALAYSIA MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 MALAYSIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 MALAYSIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 MALAYSIA REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 MALAYSIA MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 MALAYSIA MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 MALAYSIA ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 MALAYSIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 MALAYSIA COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 MALAYSIA MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 119 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 120 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 121 MALAYSIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 MALAYSIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 123 MALAYSIA COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 MALAYSIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 MALAYSIA MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 MALAYSIA TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 VIETNAM MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 VIETNAM AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 VIETNAM GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 VIETNAM REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 VIETNAM MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 VIETNAM MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 VIETNAM ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 VIETNAM AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 VIETNAM COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 VIETNAM MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 141 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 143 VIETNAM AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 VIETNAM CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 145 VIETNAM COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 VIETNAM CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 VIETNAM MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 VIETNAM TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SINGAPORE MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SINGAPORE AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SINGAPORE GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SINGAPORE REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SINGAPORE MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 155 SINGAPORE MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 SINGAPORE ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SINGAPORE AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 SINGAPORE COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SINGAPORE MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 163 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 164 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 165 SINGAPORE AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 SINGAPORE CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 167 SINGAPORE COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 SINGAPORE CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 SINGAPORE MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 SINGAPORE TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 PHILIPPINES MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 PHILIPPINES AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 PHILIPPINES GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 175 PHILIPPINES REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 PHILIPPINES MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 PHILIPPINES MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 PHILIPPINES ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 PHILIPPINES AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 PHILIPPINES COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 PHILIPPINES MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 185 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 186 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 187 PHILIPPINES AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 PHILIPPINES CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 189 PHILIPPINES COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 PHILIPPINES CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 PHILIPPINES MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 PHILIPPINES TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 MYANMAR MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 195 MYANMAR AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 196 MYANMAR GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 MYANMAR REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 MYANMAR MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 MYANMAR MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 MYANMAR ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 MYANMAR AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 MYANMAR COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 203 MYANMAR MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 204 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 205 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 206 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 207 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 208 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 209 MYANMAR AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 MYANMAR CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 211 MYANMAR COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 MYANMAR CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 MYANMAR MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 MYANMAR TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 CAMBODIA MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 CAMBODIA AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 CAMBODIA GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 CAMBODIA REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 CAMBODIA MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 CAMBODIA MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 CAMBODIA ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 CAMBODIA AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 CAMBODIA COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 CAMBODIA MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 227 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 229 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 230 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 231 CAMBODIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 CAMBODIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 233 CAMBODIA COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 CAMBODIA CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 235 CAMBODIA MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 236 CAMBODIA TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 LAOS MRO EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 LAOS AIRCRAFT EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 LAOS GSE EQUIPMENT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 LAOS REPAIR TOOLS IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 LAOS MRO SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 243 LAOS MAINTENANCE SERVICES IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 244 LAOS ENGINE MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 245 LAOS AIRFRAME MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 LAOS COMPONENT MAINTENANCE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 LAOS MRO SOFTWARE IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY WING TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AIRCRAFT TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY GENERATION, 2022-2031 (USD THOUSAND)

TABLE 251 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 252 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 253 LAOS AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY AVIATION TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 LAOS CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY USAGE, 2022-2031 (USD THOUSAND)

TABLE 255 LAOS COMMERCIAL AIRCRAFT IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 256 LAOS CIVILIAN AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 LAOS MILITARY AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 LAOS TRAINING AVIATION IN AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 259 REST OF SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

Lista de figuras

FIGURE 1 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: SEGMENTATION

FIGURE 2 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: DROC ANALYSIS

FIGURE 4 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: MULTIVARIATE MODELLING

FIGURE 9 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: TYPE TIMELINE CURVE

FIGURE 10 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: END USER COVERAGE GRID

FIGURE 11 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET:

FIGURE 13 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: EXECUTIVE SUMMARY

FIGURE 14 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: STRATEGIC DECISIONS

FIGURE 15 REGULATORY REQUIREMENTS MANDATE REGULAR MAINTENANCE CHECKS IS EXPECTED TO BE KEY DRIVERS FOR SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 16 MRO EQUIPMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET IN 2024 TO 2031

FIGURE 17 PESTLE ANALYSIS

FIGURE 18 PORTERS FIVE FORCES ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET

FIGURE 21 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY TYPE, 2023

FIGURE 22 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY AVIATION TYPE, 2023

FIGURE 23 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY WING TYPE, 2023

FIGURE 24 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY AIRCRAFT TYPE, 2023

FIGURE 25 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY GENERATION, 2023

FIGURE 26 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY APPLICATION, 2023

FIGURE 27 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: BY END USER, 2023

FIGURE 28 SOUTH EAST ASIA AIR MAINTENANCE REPAIR, AND OPERATIONS MARKET: SNAPSHOT (2023)

FIGURE 29 SOUTH EAST ASIA AIR MAINTENANCE, REPAIR AND OPERATIONS MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.