Global Amino Acids Premix For Feed Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2022 –2029 | |

| USD 1.20 Billion | |

| USD 3.01 Billion | |

|

|

|

Global Amino Acids Premix for Feed Market By Source (Plant Based, Animal Based), Type (L-lysine, L-taurine) End-Use (Ruminant, Poultry, Swine, Aqua, Equine, Healthcare, Animal Feed, Food Industry and Others), Distribution Channel (Hypermarket, Pharmacy Stores, Supermarket, Online Stores) – Industry Trends and Forecast to 2029

Market Analysis and Size

Feed Premix plays an essential role in improving feed additives and feed properties. Feed Premix also benefits the animals by boosting their immune and reproductive systems and increasing their metabolism. The term "premix" refers to vitamins, trace minerals, antibiotics, feed supplements, and diluents.

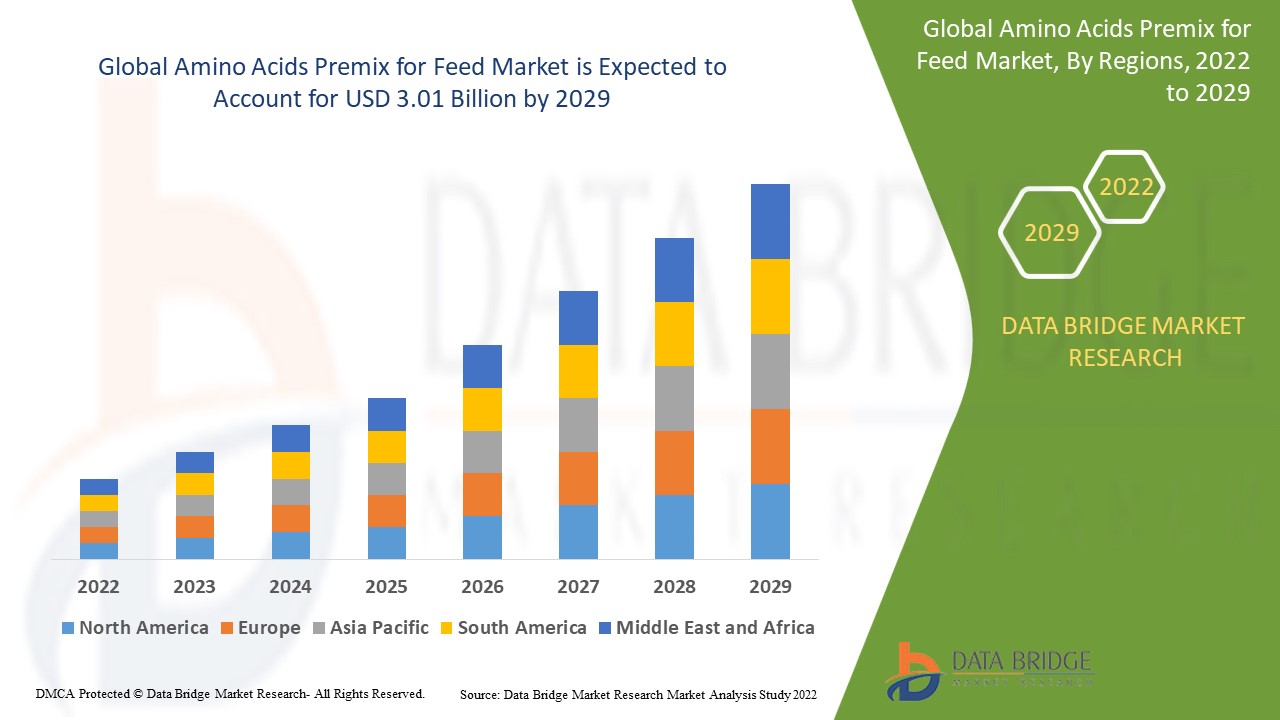

Data Bridge Market Research analyses that the amino acids premix for feed market which was valued USD 1.20 billion in 2021 and is expected to reach the value of USD 3.01 billion by 2029, at a CAGR of 12.2% during the forecast period of 2022 to 2029.

Market Definition

Amino acids are important in health nutrition, particularly parenteral nutrition. Amino acids are frequently used in animal feed as dietary supplements. Amino acids are used as animal feed to increase metabolic rate and provide nutrition to animals such as cattle, broilers, and pigs. Furthermore, feed amino acids aid in animals' health, reproduction, and lactation.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Source (Plant Based, Animal Based), Type (L-lysine, L-taurine) End-Use (Ruminant, Poultry, Swine, Aqua, Equine, Healthcare, Animal Feed and Others), Distribution Channel (Hypermarket, Pharmacy Stores, Supermarket, Online Stores) |

|

Countries Covered |

U.S., Canada, Mexico in North America, Germany, Poland, Ireland, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Chile, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Egypt, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Dow (US), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (US), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (USA), Alltech (US), Associated British Foods plc (UK), Charoen Pokphand Foods PCL (Thailand), Cargill, Incorporated (US), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (US), Kent Nutrition Group (US), J. D. HEISKELL & CO. (US), Perdue Farms (US), SunOpta (Canada), Scratch and Peck Feeds (US), De Heus Animal Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary) |

|

Opportunities |

|

Amino Acids Premix for Feed Market Dynamics

Drivers

- Growing focus on the animal health

Increased emphasis on animal health will also drive market growth. Increased cattle farming is likely to increase demand for amino acids premix for feed. Humans' increasing demand for animal-based products will drive up market demand. Proponents of natural growth are expected to be active in the market as their momentum grows. Increasing consumer responsiveness of the benefits of using feed additives to reduce disease has fuelled the market's demand.

- Increasing demand for organic meat

Food safety concerns have increased the demand for high-quality amino acids premix for feed to ensure meat safety. Another factor driving the growth of the amino acids premix for feed market is the growing awareness among farm owners of maintaining a healthy animal-based diet. As a result, they are transitioning from standard amino acids premix for feed to functional and premium variants that help improve the animals' immunity against enzootic diseases while also lowering the risk of metabolic disorders, acidosis, injuries, and infections.

Furthermore, an increase in demand for organic meat from developed-country consumers and the implementation of new animal rearing practises and the maintenance of high farming standards have created a positive outlook for the industry.

Opportunity

Increasing meat consumption in developing economies such as China, India, and Brazil is expected to drive global demand for the product. Australia is a major pork exporting region and is expected to drive product demand over the forecast period.

Restraints

High raw material prices and a rising number of restrictions and regulatory bans will serve as market restraints on the expansion of amino acids premix for feed. Less product awareness will restrain further challenging the growth of the amino acids premix for feed market during the forecast period.

This amino acids premix for feed market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the amino acids premix for feed market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Amino Acids Premix for Feed Market

Agriculture and food production have been identified as critical sectors during the COVID-19 situation. As a result, farmers have continued to ensure that farm animals receive high-quality nutrition in order to feed an increasing number of global consumers. However, the supply chain disruption has become the most significant factor affecting the amino acids premix for feed market. China is a major producer and exporter of amino acids premix for feed, and it stockpiled significant amounts of product during the emergence of the COVID-19 situation while businesses were closed for the lunar new year, which was enough for 2-3 months’ supply. Furthermore, logistics issues have hampered the supply of containers and vessels and the transport of certain micro-ingredients.

Recent Development

- De Heus acquired Coppens Diervoeding, a feed manufacturing company based in the Netherlands that specializes in the pig farming sector, in July 2021. This acquisition enabled the company to double its production capacity and strengthen its regional presence by 400k.

- ADM opened a new livestock feed plant in Ha Nam province, Vietnam, in November 2019. The new facility adds to ADM's growing list of investments in Vietnam, becoming the company's fifth plant dedicated to animal nutrition in the country.

- In October 2021, Cargill and BASF announced a partnership in the animal nutrition business, bringing additional markets and research and development capabilities to the companies' current feed enzymes distribution agreements. This partnership contributed in the development, manufacture, marketing, and sale of customer-focused enzyme products and solutions for animals, especially pigs.

Global Amino Acids Premix for Feed Market Scope

The amino acids premix for feed market is segmented on the basis of source, type, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Plant Based

- Animal Based

Type

- L-lysine

- L-taurine

- Others

End-User

- Animal Feed

- Swine

- Poultry

- Cattle

- Food Industry

- Healthcare

Distribution channel

- Hypermarket

- Pharmacy Stores

- Supermarket

- Online Stores

Amino Acids Premix for Feed Market Regional Analysis/Insights

The amino acids premix for feed market is analysed and market size insights and trends are provided by country, source, type, end user and distribution channel as referenced above.

The countries covered in the amino acids premix for feed market report are U.S., Canada, Mexico in North America, Germany, Poland, Ireland, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Chile, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Egypt, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is the most important pork consumption and production market, accounting for roughly half of global output. The global region is the largest market for amino acids premix for feed products due to the high consumption of pork meat. South East Asia is the world's largest pork producer and exporter. Since ancient times, pork meat has been consumed in the region and is the most popular meat due to its high fat content and flavour. China is the largest pork producer's market, followed by Vietnam, Thailand, South Korea, Japan, and the Philippines. Japan, South Korea, and Taiwan are saturated pork consumption markets, while Vietnam and the Philippines are emerging markets.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Amino Acids Premix for Feed Market Share Analysis

The amino acids premix for feed market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to amino acids premix for feed market.

Some of the major players operating in the amino acids premix for feed market are:

- Cargill, Incorporated (U.S)

- Dow (US)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (US)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (US)

- Alltech (US)

- Associated British Foods plc (UK)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (US)

- Kent Nutrition Group (US)

- J. D. HEISKELL & CO. (US)

- Perdue Farms (US)

- SunOpta (Canada)

- Scratch Peck Feeds (US)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.