El mercado español de sistemas de monitorización de emisiones está experimentando un crecimiento sustancial en diversos sectores, como el petroquímico, el del petróleo y el gas, el de la generación de energía y el químico. La adopción de software para sistemas de monitorización de emisiones es generalizada, lo que permite la medición precisa de las emisiones según las normas aplicables. La expansión de este mercado se debe a las estrictas normativas ambientales, la prioridad en la sostenibilidad y la necesidad de cumplir con los límites de emisiones. La trayectoria del mercado en España refleja la creciente importancia de la monitorización y el control de las emisiones en todos los sectores.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/spain-emission-monitoring-system-market

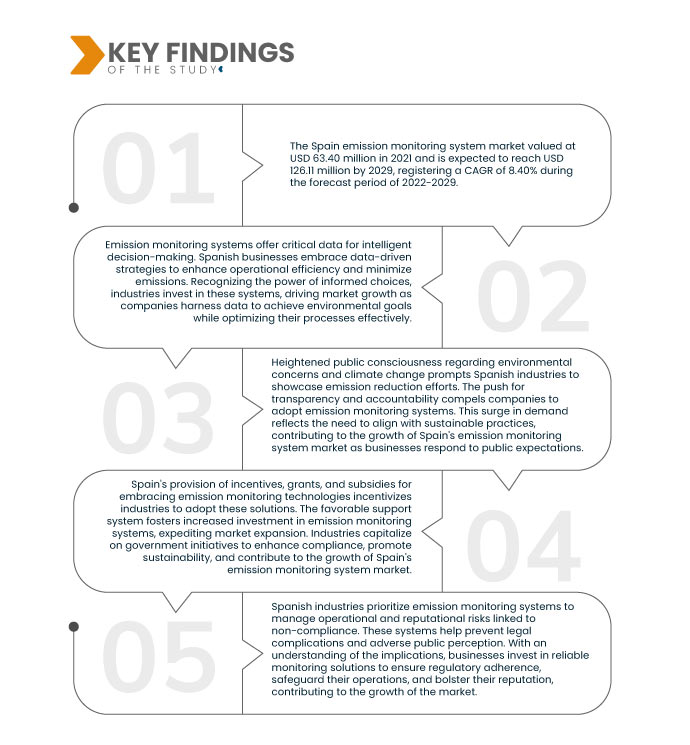

Data Bridge Market Research analiza que el mercado español de sistemas de monitorización de emisiones se valoró en 63,40 millones de dólares en 2021 y se espera que alcance los 126,11 millones de dólares en 2029, registrando una tasa de crecimiento anual compuesta (TCAC) del 8,40 % durante el período de pronóstico 2022-2029. Las empresas españolas que utilizan sistemas de monitorización de emisiones para demostrar prácticas respetuosas con el medio ambiente obtienen una ventaja competitiva. Esto motiva a sus competidores a adoptar medidas similares, impulsando el crecimiento del mercado a medida que las industrias reconocen los beneficios de alinearse con las tendencias sostenibles.

Principales hallazgos del estudio

Se espera que la evolución de las tecnologías de software de monitorización de emisiones en España impulse la tasa de crecimiento del mercado

Las tecnologías de software de monitorización de emisiones en evolución en España ofrecen mayor precisión, eficiencia y facilidad de uso. Las empresas españolas adoptan estas innovaciones para mejorar su capacidad de monitorización y simplificar los procedimientos de cumplimiento normativo. A medida que las industrias buscan soluciones eficaces para cumplir con la normativa y optimizar sus operaciones, la adopción de sistemas avanzados de monitorización de emisiones impulsa el crecimiento del mercado al permitir capacidades de monitorización mejoradas y procesos optimizados.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2022 a 2029

|

Año base

|

2021

|

Años históricos

|

2020 (personalizable para 2014-2019)

|

Unidades cuantitativas

|

Ingresos en millones de USD, volúmenes en unidades, precios en USD

|

Segmentos cubiertos

|

Tipo de sistema (Sistema de Monitoreo Continuo de Emisiones (CEMS), Sistema de Monitoreo Predictivo de Emisiones (PEMS)), Tipo de emisión (Dióxido de Carbono, Monóxido de Carbono, Óxido de Nitrógeno, Dióxido de Azufre, Amoníaco , Sulfuro de Hidrógeno, Hidrocarburos , Ácido Fluorhídrico , Oxígeno, Otros), Tipo de Alimentación (Menos de 200 V, De 200 a 300 V, Más de 300 V), Tipo de Instalación (Nueva, Modernización), Canal de Ventas (Directo a Clientes, Directo a Distribuidores), Aplicación (Caldera de Potencia, Caldera de Recuperación, Cogeneración, Turbina, Horno de Cemento, Incinerador de Residuos), Oferta (Hardware, Software, Servicios), Industria (Farmacéutica, Metalmecánica, Centrales Eléctricas y Combustión, Petróleo y Gas, Química, Petroquímica y Refinerías, Materiales de Construcción, Marina y Transporte Marítimo, Minería, Incineración de Residuos, Pulpa y Papel)

|

Actores del mercado cubiertos

|

Ems Security Group Ltd (Reino Unido), Electro Detectors Ltd (Reino Unido), Sterling Safety Systems (Reino Unido), Honeywell International, Inc. (EE. UU.), Siemens AG (Alemania), Wagner Group GmbH (Alemania), Hochiki Corporation (Japón), Halma Plc. (Reino Unido), Apollo Fire Detectors Limited (Reino Unido), Robert Bosch GmbH (Alemania), EUROFYRE LTD. (Reino Unido), Detectomat GmbH (Alemania), Ceasefire Industries Pvt. Ltd (India), Johnson Controls (Irlanda), Napco Security Technologies, Inc. (EE. UU.), Def Nederland, Zeta Alarm Ltd (Reino Unido), Libelium Comunicaciones Distribuidas SL (España), Attentis (Australia) y Vigilys, Inc. (EE. UU.), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos:

El mercado de sistemas de monitorización de emisiones de España está segmentado en función del tipo de sistema, tipo de emisión, tipo de potencia, tipo de instalación, canal de venta, aplicación, oferta e industria.

- Según el tipo de sistema, el mercado de sistemas de monitoreo de emisiones se segmenta en sistema de monitoreo de emisiones continuo (CEMS) y sistema de monitoreo de emisiones predictivo (PEMS).

- Según el tipo de emisión, el mercado de sistemas de monitoreo de emisiones se segmenta en dióxido de carbono, monóxido de carbono, óxido de nitrógeno, dióxido de azufre, amoníaco, sulfuro de hidrógeno, hidrocarburos, ácido fluorhídrico, oxígeno y otros.

- Según el tipo de energía, el mercado del sistema de monitoreo de emisiones se segmenta en menos de 200 V, de 200 a 300 V y más de 300 V.

- Según el tipo de instalación, el mercado de sistemas de monitoreo de emisiones se segmenta en nuevos y modernizados.

- Sobre la base del canal de ventas, el mercado de sistemas de monitoreo de emisiones se segmenta en directo a clientes y directo a distribuidores.

- Sobre la base de la aplicación, el mercado de sistemas de monitoreo de emisiones se segmenta en calderas de energía, calderas de recuperación, cogeneración, turbinas, hornos de cemento e incineradores de residuos.

- Sobre la base de la oferta, el mercado de sistemas de monitoreo de emisiones está segmentado en hardware, software y servicios.

- Sobre la base de la industria, el mercado de sistemas de monitoreo de emisiones está segmentado en productos farmacéuticos, metalurgia, plantas de energía y combustión, petróleo y gas, productos químicos, petroquímicos y refinerías, materiales de construcción, marítimo y envío, minería, incineración de residuos, pulpa y papel.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado de sistemas de monitoreo de emisiones en España: Ems Security Group Ltd (Reino Unido), Electro Detectors Ltd (Reino Unido), Sterling Safety Systems (Reino Unido), Honeywell International, Inc. (EE. UU.), Siemens AG (Alemania), Wagner Group Gmbh (Alemania), Hochiki Corporation (Japón), Halma Plc. (Reino Unido),

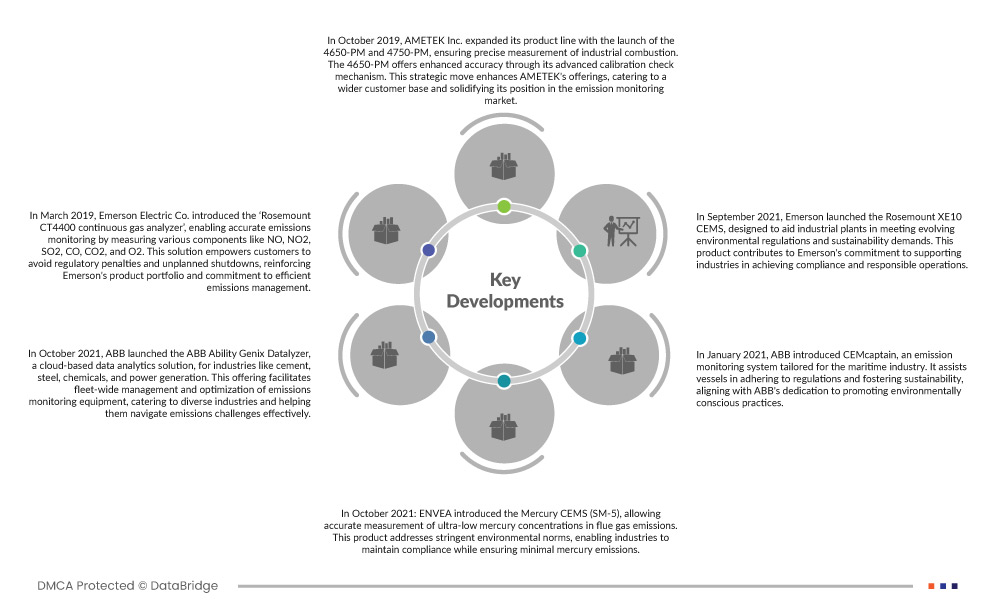

Desarrollos del mercado

- En octubre de 2019, AMETEK Inc. amplió su línea de productos con el lanzamiento de los modelos 4650-PM y 4750-PM, lo que garantiza una medición precisa de la combustión industrial. El 4650-PM ofrece mayor precisión gracias a su avanzado mecanismo de verificación de calibración. Esta estrategia amplía la oferta de AMETEK, atendiendo a una base de clientes más amplia y consolidando su posición en el mercado de la monitorización de emisiones.

- En marzo de 2019, Emerson Electric Co. presentó el analizador de gases continuo Rosemount CT4400, que permite una monitorización precisa de emisiones mediante la medición de diversos componentes como NO, NO₂, SO₂, CO, CO₂ y O₂. Esta solución permite a los clientes evitar sanciones regulatorias y paradas imprevistas, lo que refuerza la cartera de productos de Emerson y su compromiso con la gestión eficiente de emisiones.

- En octubre de 2021, ABB lanzó ABB Ability Genix Datalyzer, una solución de análisis de datos en la nube para industrias como la cementera, la siderúrgica, la química y la de generación de energía. Esta solución facilita la gestión y optimización de toda la flota de equipos de monitorización de emisiones, atendiendo a diversas industrias y ayudándolas a afrontar eficazmente los retos de las emisiones.

- En octubre de 2021, ENVEA presentó el CEMS de mercurio (SM-5), que permite la medición precisa de concentraciones ultrabajas de mercurio en las emisiones de gases de combustión. Este producto cumple con las estrictas normas ambientales, lo que permite a las industrias mantener el cumplimiento normativo y, al mismo tiempo, garantizar emisiones mínimas de mercurio.

- En septiembre de 2021, Emerson lanzó el Rosemount XE10 CEMS, diseñado para ayudar a las plantas industriales a cumplir con las cambiantes normativas ambientales y las exigencias de sostenibilidad. Este producto contribuye al compromiso de Emerson de apoyar a las industrias para lograr el cumplimiento normativo y operaciones responsables.

- En enero de 2021, ABB presentó CEMcaptain, un sistema de monitorización de emisiones diseñado específicamente para la industria marítima. Este sistema ayuda a los buques a cumplir con la normativa y a fomentar la sostenibilidad, en consonancia con el compromiso de ABB de promover prácticas respetuosas con el medio ambiente.

- En febrero de 2020, Baker Hughes presentó el Sistema 1 de Monitoreo Predictivo de Emisiones (PEMS), que anticipa las emisiones de la chimenea en función de las condiciones ambientales, la composición del combustible y el funcionamiento de la maquinaria. Este enfoque predictivo se alinea con el compromiso de Baker Hughes con soluciones innovadoras de gestión de emisiones, contribuyendo a operaciones más eficientes y ecológicas.

Para obtener información más detallada sobre el informe del mercado del sistema de monitorización de emisiones de España, haga clic aquí: https://www.databridgemarketresearch.com/reports/spain-emission-monitoring-system-market