La importancia del material de la suela del calzado está estrechamente ligada a la salud y la ortopedia. La elección del material de la suela es fundamental para la salud del pie, ya que una suela con buen soporte y amortiguación es fundamental para minimizar la tensión en el pie. Una suela cuidadosamente seleccionada contribuye al bienestar ortopédico al proporcionar un soporte y una amortiguación adecuados, reduciendo así el riesgo de lesiones y las molestias asociadas con el uso prolongado. Ya sea en calzado deportivo o de uso diario, el material de suela adecuado puede mejorar la salud del pie, promoviendo un entorno cómodo y con buen soporte.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/south-america-footwear-sole-material-market

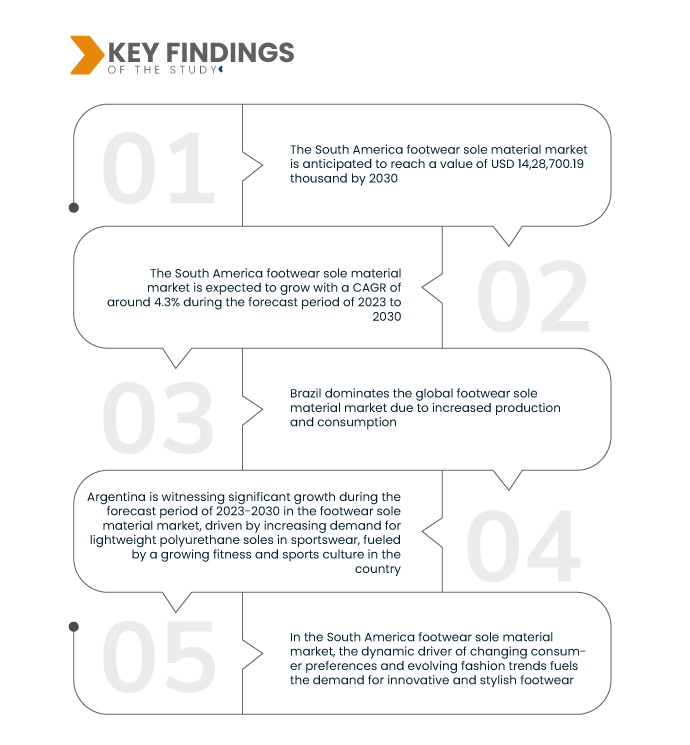

Data Bridge Market Research analiza el mercado sudamericano de materiales para suelas de calzado , que alcanzó los USD 10.20.156,11 mil en 2022 y se espera que alcance los USD 14.28.700,19 mil para 2030, con una tasa de crecimiento anual compuesta (TCAC) del 4,3 % durante el período de pronóstico de 2023 a 2030. La creciente cultura del deporte y el fitness en Sudamérica es un factor clave para el mercado de materiales para suelas de calzado. El aumento de la participación en actividades deportivas impulsa la demanda de calzado deportivo especializado, lo que impulsa la necesidad de materiales avanzados para suelas que ofrezcan comodidad, soporte y rendimiento superiores, lo que influye en el crecimiento del mercado.

Principales hallazgos del estudio

Se espera que la creciente demanda impulsada por el creciente énfasis de los consumidores impulse la tasa de crecimiento del mercado.

Un factor clave en el mercado sudamericano de materiales para suelas de calzado es la creciente demanda, impulsada por la creciente importancia que los consumidores dan a la comodidad y el rendimiento en sus selecciones de calzado. Los consumidores modernos priorizan una amortiguación superior, absorción de impactos y durabilidad en sus zapatos. Esta tendencia impulsa una mayor demanda de materiales avanzados para suelas que satisfagan estas expectativas. Los fabricantes están respondiendo desarrollando e incorporando materiales y tecnologías innovadores en las suelas de calzado, con el objetivo de brindar una experiencia cómoda y de alto rendimiento.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2023 a 2030

|

Año base

|

2022

|

Años históricos

|

2021 (personalizable para 2015-2020)

|

Unidades cuantitativas

|

Ingresos en miles de USD, volúmenes en unidades, precios en USD

|

Segmentos cubiertos

|

Material de la suela (suelas de plástico, suelas de goma, suelas de cuero, biocompuestos, madera talada, otros materiales), componente de la suela (suela, plantilla, entresuela, suela unitaria), producto (suela de calzado deportivo, suela de calzado no deportivo, otros), canal de distribución (en línea, fuera de línea, otros), usuario final (hombre, mujer, niño), tipo de suela (suelas nuevas, suelas de reparación), industria (agricultura, química, construcción, metalurgia, alimentaria, transporte, seguridad, minería, farmacéutica, electrónica, etc.)

|

Países cubiertos

|

Brasil, Argentina y el resto de Sudamérica como parte de Sudamérica

|

Actores del mercado cubiertos

|

Lubrizol Corporation (EE. UU.), Wanhua (China), Huntsman International LLC (EE. UU.), Coim Group (Italia), Solvay (Bélgica), BASF SE (EE. UU.), Dow (EE. UU.), Covestro AG (Alemania), ASAHI KASEI CORPORATION (Japón), Era Polymers Pty Ltd (Australia), Braskem (Estados Unidos), INOAC CORPORATION (Japón), INGOM SPA (Italia), Vibram Commerce LLC (Italia), Allbirds, Inc. (EE. UU.), Soles by MICHELIN (China), Arkema (Francia), Evonik Industries AG (Alemania).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos:

El mercado de materiales para suelas de calzado de América del Sur está segmentado en función del material de la suela, el componente de la suela, el producto, el canal de distribución, el usuario final, el tipo de suela y la industria.

- Sobre la base del material de la suela, el mercado de suelas de calzado de América del Sur se segmenta en suelas de calzado de plástico, suelas de calzado de caucho, suelas de calzado de cuero, biocompuestos, madera talada y otros materiales.

- Sobre la base del componente de la suela, el mercado de material para suelas de calzado de América del Sur se segmenta en suela exterior, plantilla interior, entresuela y suela unitaria.

- Sobre la base del producto, el mercado de materiales para suelas de calzado de América del Sur se segmenta en materiales para suelas de calzado deportivo, materiales para suelas de calzado no deportivo y otros.

- Sobre la base del canal de distribución, el mercado de materiales para suelas de calzado de América del Sur está segmentado en en línea, fuera de línea y otros.

- Sobre la base del usuario final, el mercado de materiales para suelas de calzado de América del Sur se segmenta en hombres, mujeres y niños.

- Sobre la base del tipo de suela, el mercado de materiales para suelas de calzado de América del Sur se segmenta en suelas nuevas y suelas de reparación.

- Sobre la base de la industria, el mercado de materiales para suelas de calzado de América del Sur está segmentado en industria agrícola, industria química, industria de la construcción, industria metalúrgica, industria alimentaria, industria del transporte, industria de la seguridad, industria minera, industria farmacéutica, industria electrónica y otras.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado de materiales para suelas de calzado en Sudamérica: Lubrizol Corporation (EE. UU.), Wanhua (China), Huntsman International LLC (EE. UU.), Coim Group (Italia), Solvay (Bélgica), BASF SE (EE. UU.), Dow (EE. UU.), Covestro AG (Alemania) y ASAHI KASEI CORPORATION (Japón).

Desarrollos del mercado

- En 2021, las Universidades de Aveiro, Oporto y Minho colaboraron en el proyecto Materiales de Seguridad para Calzado (SM4S), liderado por un equipo de académicos portugueses. El objetivo principal de esta colaboración fue desarrollar una suela de zapato con propiedades antivirales, específicamente enfocada en la lucha contra el coronavirus y otros virus. El proyecto pretendía incorporar materiales y tecnología avanzados para mejorar las características de seguridad del calzado, contribuyendo así a la salud pública durante la pandemia mundial en curso.

- En 2021, BASF, una importante empresa química, colaboró con Hotter para mejorar la comodidad y el rendimiento de su calzado casual. La colaboración implicó la incorporación de Infinergy, un tipo de poliuretano termoplástico expandido (E-TPU) desarrollado por BASF SE, en los diseños de Hotter. La sinergia entre la tecnología de amortiguación de Hotter y la de Infinergy de BASF buscaba ofrecer una comodidad excepcional al calzado clásico. Se esperaba que esta colaboración atrajera a un público más amplio que buscaba opciones de calzado más cómodas y tecnológicamente avanzadas.

- En 2020, Puma fue noticia con el lanzamiento de sus zapatillas Puma Fi, anunciando un innovador sistema de cordones. Las zapatillas incorporaban una tecnología que permitía apretar los cordones con un simple movimiento del dedo. Este desarrollo representó un gran avance en la tecnología del calzado, ofreciendo una solución práctica y futurista al atado tradicional de cordones. Las zapatillas Puma Fi estaban dirigidas a los consumidores que buscaban estilo y funcionalidad en su calzado deportivo.

- En 2020, Puma dio un paso significativo hacia la sostenibilidad con el lanzamiento de una nueva línea de calzado fabricado con plástico reciclado. En colaboración con First Mile, una empresa de reciclaje, Puma buscó abordar las preocupaciones ambientales utilizando materiales plásticos reciclados para la fabricación de su calzado. Esta iniciativa ecológica se diseñó para responder a la creciente demanda de productos sostenibles y respetuosos con el medio ambiente. La colaboración con First Mile reflejó el compromiso de Puma de reducir su impacto ambiental y contribuir a un futuro más sostenible.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado de materiales para suelas de calzado de América del Sur son Brasil, Argentina y el resto de América del Sur como parte de América del Sur.

Según el análisis de investigación de mercado de Data Bridge:

Brasil es el país dominante en el mercado de materiales para suelas de calzado en América del Sur durante el período de pronóstico 2023-2030

El dominio de Brasil en el mercado mundial de materiales para suelas de calzado se debe al considerable aumento tanto en la producción como en el consumo de estos materiales. La industria del calzado ha experimentado un crecimiento significativo, satisfaciendo la creciente demanda nacional e internacional. La preferencia por las suelas blandas en el calzado de uso diario, que refleja la importancia de la comodidad por parte del consumidor, ha impulsado la expansión del mercado. La capacidad manufacturera de Brasil, caracterizada por una infraestructura de producción eficiente y rentable, consolida aún más su dominio.

Se estima que Argentina será el país de más rápido crecimiento en el mercado de materiales para suelas de calzado de América del Sur para el período de pronóstico 2023-2030.

Se espera que Argentina experimente un crecimiento significativo durante el período de pronóstico 2023-2023 en el mercado de suelas para calzado, impulsado por la creciente demanda de suelas ligeras, especialmente en ropa deportiva, con especial énfasis en los materiales de poliuretano. Esta tendencia refleja un cambio en las preferencias de los consumidores hacia calzado cómodo y de alto rendimiento. El auge de la actividad deportiva en el país impulsa aún más el crecimiento del mercado, lo que indica una creciente cultura del fitness y el deporte. La combinación de la preferencia por las suelas ligeras de poliuretano y un floreciente panorama deportivo posiciona a Argentina como un actor clave en la trayectoria del mercado de suelas para calzado, con potencial de expansión sostenida a medida que el deporte continúa ganando protagonismo.

Para obtener información más detallada sobre el informe del mercado de materiales para suelas de calzado de América del Sur, haga clic aquí: https://www.databridgemarketresearch.com/reports/south-america-footwear-sole-material-market