Las pruebas no destructivas (NDT) son una técnica de prueba y análisis utilizada por la industria para evaluar las propiedades de un material, componente, estructura o sistema en busca de diferencias características o defectos y discontinuidades de soldadura sin causar daños a la pieza original. El END también se conoce como examen no destructivo (NDE), inspección no destructiva (NDI) y evaluación no destructiva (NDE). Estos métodos se utilizan ampliamente en industrias como la aeroespacial, la automotriz y la manufacturera para garantizar la calidad y seguridad del producto. Por lo tanto, se estima que el mercado mundial de sistemas de inspección por rayos X aumentará rápidamente en el futuro próximo.

Acceder al informe completo @https://www.databridgemarketresearch.com/reports/global-x-ray-inspection-system-market

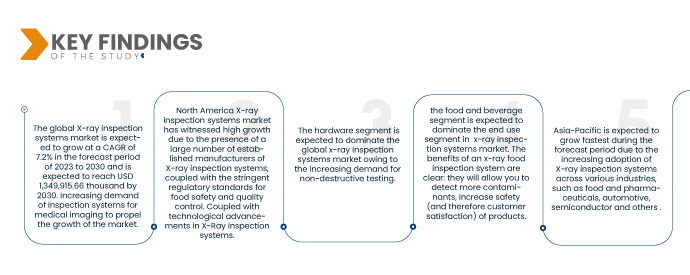

Data Bridge Market Research analiza que el Mercado mundial de sistemas de inspección por rayos X Se espera que crezca a una tasa compuesta anual del 7,2% en el período previsto de 2023 a 2030 y se espera que alcance los 1.349.915,66 mil dólares estadounidenses para 2030. Aumento de la demanda de sistemas de inspección para imágenes médicas para impulsar el crecimiento del mercado.

Hallazgos clave del estudio

Normas de seguridad y estándares de calidad cada vez mayores en relación con los sistemas de inspección por rayos X

El objetivo de las normas de seguridad es garantizar que un producto, evento o material sea seguro y no peligroso, y todas las industrias en todo el mundo siguen diversas normas de seguridad gubernamentales y organizativas para el producto comercializado. Además, los estándares de calidad son documentos que proporcionan requisitos, especificaciones, pautas o características que pueden usarse de manera consistente para garantizar que los materiales, productos, procesos y servicios sean adecuados para su propósito. En estas industrias se adoptan cada vez más sistemas de inspección por rayos X para cumplir con los requisitos reglamentarios y garantizar la seguridad y calidad de sus productos.

Alcance del informe y segmentación del mercado

|

Métrica de informe

|

Detalles

|

|

Período de pronóstico

|

2023 a 2030

|

|

Año base

|

2022

|

|

Años históricos

|

2021 (Personalizable para 2020-2016)

|

|

Unidades Cuantitativas

|

Ingresos en miles, volúmenes en unidades, precios en USD

|

|

Segmentos cubiertos

|

Por oferta (hardware, software y servicios), técnica de imagen (imagen basada en película e imagen digital), dimensión (2D y 3D), tipo de producto (productos empaquetados, productos no empaquetados, bombeados y otros), tecnología de escaneo (tecnología HD, Tecnología Ultra-HD y otros), número de carriles (carril único, carril múltiple y carril doble), uso final (petróleo y gas, generación de energía, infraestructura gubernamental, alimentos y bebidas, aeroespacial, automotriz, productos farmacéuticos y nutracéuticos, semiconductores y Otros).

|

|

País cubierto

|

EE.UU., Canadá, México, Reino Unido, Alemania, Francia, Italia, Países Bajos, España, Suiza, Rusia, Suecia, Dinamarca, Bélgica, Turquía, Polonia, Noruega, Finlandia, resto de Europa, China, Japón, India, Filipinas, Sur Corea, Australia, Nueva Zelanda, Singapur, Tailandia, Indonesia, Malasia, Vietnam, Taiwán, el resto de Asia-Pacífico, Brasil, Argentina, el resto de América del Sur, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel, Sudáfrica, Omán, Bahréin, Kuwait, Qatar y el resto de Oriente Medio y África.

|

|

Actores del mercado cubiertos

|

SHIMADZU CORPORATION (Japón), METTLER TOLEDO (EE.UU.), Nordson Corporation (EE.UU.), SmithsDetection Group Ltd (Reino Unido), ANRITSU CORPORATION (Japón), ZEISS (Alemania), A&D Company (EE.UU.), Sesotec GmbH (Alemania), Nikon Metrology Inc. (Japón), Comet Group (EE. UU.), North Star Imaging In (EE. UU.), Viscom AG (Alemania), ISHIDA CO.,LTD (Reino Unido), MEKITEC GROUP (EE. UU.), MATSUSADA PRECISION Inc (EE. UU.), Scienscope (EE.UU.), SYSTEM SQUARE INC. (Japón), MAHA X-RAY EQUIPMENTS PVT. LTD (India), Sapphire Inspection (EE.UU.), VJElectronix, Inc. (EE.UU.), Loma Systems (Armenia), Minebea Intec GMbH (Alemania), TDI PACKSYS (EE.UU.)

|

|

Puntos de datos cubiertos en el informe

|

Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundos de expertos, epidemiología de pacientes, análisis de tuberías, análisis de precios, y marco regulatorio.

|

Análisis de segmentos:

El mercado mundial de sistemas de inspección por rayos X se divide en siete segmentos notables, que se basan en la oferta, la técnica de imágenes, la dimensión, el tipo de producto, la tecnología de escaneo, el número de carriles y el uso final.

- Según la oferta, el mercado mundial de sistemas de inspección por rayos X se segmenta en hardware, software y servicios. En 2023, se espera que el segmento de hardware domine el mercado mundial de sistemas de inspección por rayos X debido a la creciente demanda de pruebas no destructivas.

- Sobre la base de la técnica de imágenes, el mercado mundial de sistemas de inspección por rayos X se segmenta en imágenes basadas en películas e imágenes digitales. En 2023, se espera que las imágenes digitales dominen el mercado de sistemas de inspección por rayos X como la mayor parte de la forma avanzada de inspección por rayos X que produce una imagen radiográfica digital instantáneamente en una computadora.

- Según la dimensión, el mercado mundial de sistemas de inspección por rayos X se segmenta en 2D y 3D. En 2023, se espera que el segmento 2D domine el mercado mundial de sistemas de inspección por rayos X, ya que la mayoría de los usuarios no pueden soportar el precio del 3D porque es costoso en comparación con el 2D.

- Según el tipo de producto, el mercado mundial de sistemas de inspección por rayos X se segmenta en productos envasados, productos no envasados, bombeados y otros. El bombeo se segmenta aún más en semisólidos y fluidos. En 2023, se espera que el segmento de productos empaquetados domine el mercado de sistemas de inspección por rayos X debido a que el embalaje sirve como protección para el producto en su interior. Simplifica el envío y el transporte y garantiza una vida útil decente para su producto.

- Sobre la base de la tecnología de escaneo, el mercado global de sistemas de inspección por rayos X se segmenta en tecnología HD, tecnología Ultra HD y otras. En 2023, se espera que el segmento de tecnología HD domine el mercado de sistemas de inspección por rayos X debido a sus bajos costos y disponibilidad.

- Según el número de carriles, el mercado mundial de sistemas de inspección por rayos X se segmenta en carril único, carril múltiple y carril doble. En 2023, se espera que el segmento de carril único domine el mercado de sistemas de inspección por rayos X debido a la presencia de diferentes tecnologías de escaneo para los sistemas de inspección por rayos X.

- Según el uso final, el mercado mundial de sistemas de inspección por rayos X se segmenta en alimentos y bebidas, semiconductores, productos farmacéuticos y nutracéuticos, automoción, petróleo y gas, aeroespacial, generación de energía, infraestructura gubernamental y otros. En 2023, se espera que el segmento de alimentos y bebidas domine el mercado de sistemas de inspección por rayos X. Los beneficios de un sistema de inspección de alimentos por rayos X son claros: le permitirán detectar más contaminantes, aumentar la seguridad (y por lo tanto la satisfacción del cliente) de sus productos, reducir los costos comerciales y aumentar la reputación de su negocio.

En 2023, se espera que el segmento de hardware del segmento de oferta domine el mercado mundial de sistemas de inspección por rayos X

En 2023, se espera que el segmento de hardware de este mercado domine el mercado mundial de sistemas de inspección por rayos X debido a los avances tecnológicos en los sistemas de inspección por rayos X. Se espera que el segmento de hardware alcance una tasa compuesta anual del 7,5% en el período previsto de 2023-2030.

- Sobre la base de la técnica de imágenes, el mercado mundial de sistemas de inspección por rayos X se segmenta en imágenes digitales e imágenes basadas en películas. En 2023, se espera que el segmento de imágenes digitales domine el mercado mundial de sistemas de inspección por rayos X con una participación del 67,52% y se espera que alcance los 925.918,16 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 7,5% en el período previsto de 2023 a 2030.

- Según la dimensión, el mercado mundial de sistemas de inspección por rayos X se segmenta en 2D y 3D. En 2023, se espera que 2D domine el mercado mundial de sistemas de inspección por rayos X con una participación del 58,23% y se espera que alcance los 766.357,77 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 6,8% en el período previsto de 2023 a 2030.

- Según el tipo de producto, el mercado mundial de sistemas de inspección por rayos X se segmenta en productos envasados, productos no envasados, bombeados y otros. En 2023, se espera que los sistemas de inspección de productos envasados dominen el mercado mundial de sistemas de inspección por rayos X con una participación del 46,32% y se espera que alcance los 651.347,24 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 7,9% en el período previsto de 2023 a 2030.

- Sobre la base de la tecnología de escaneo, el mercado mundial de sistemas de inspección por rayos X se segmenta en tecnología HD, tecnología Ultra-HD y otras. En 2023, se espera que la tecnología HD domine el mercado mundial de sistemas de inspección por rayos X con una participación del 53,16% y se espera que alcance los 711.891,06 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 7,1% en el período previsto de 2023 a 2030.

- Según el número de carriles, el mercado mundial de sistemas de inspección por rayos X se segmenta en carril único, carril doble y carril múltiple. En 2023, se espera que un solo carril domine el mercado mundial de sistemas de inspección por rayos X con una participación del 42,02% y se espera que alcance los 554.454,57 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 6,9% en el período previsto de 2023 a 2030.

En 2023, se proyecta que el segmento de alimentos y bebidas tendrá la mayor participación del segmento de uso final en el mercado mundial de sistemas de inspección por rayos X.

En 2023, se espera que los alimentos y bebidas dominen el mercado mundial de sistemas de inspección por rayos X con una participación del 23,57% y se espera que alcance los 340.674,35 mil dólares estadounidenses para 2030, creciendo con una tasa compuesta anual del 8,3% en el período previsto de 2023 a 2030.

Principales actores

Data Bridge Market Research reconoce a las siguientes empresas como los principales sistemas de inspección por rayos X a nivel mundial Los actores del mercado de sistemas de inspección por rayos X son SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, SmithsDetection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging In, Viscom AG. , ISHIDA CO., LTD, MEKITEC GROUP, MATSUSADA PRECISION Inc, Scienscope, sistemas SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJElectronix, Inc., Loma Systems, Minebea Intec GMbH, TDI PACKSYS.

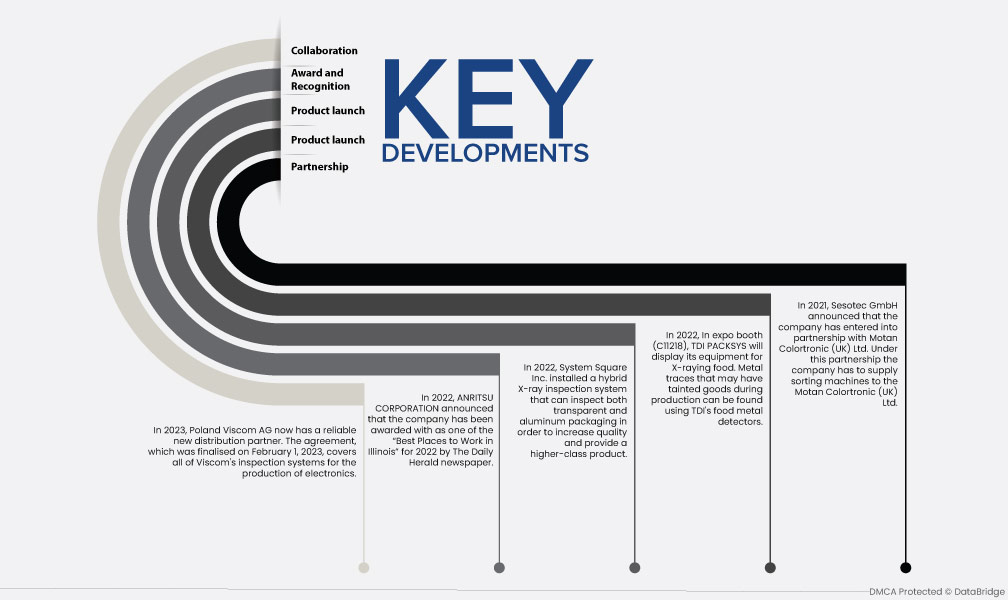

El desarrollo del mercado

- En noviembre de 2022, MATSUSADA PRECISION Inc. presentó un nuevo sistema compacto de inspección por rayos X de mesa "precisión µB4500" que permite la tomografía de radiación horizontal para observar muestras líquidas o en polvo.

- En agosto de 2022, ANRITSU CORPORATION anunció que la empresa había sido galardonada como uno de los “Mejores lugares para trabajar en Illinois” para 2022 por el periódico The Daily Herald. La empresa recibió este reconocimiento y lo utilizó para promover su cultura empresarial y su cartera de productos en toda la región de EE. UU. Esto ha permitido a la empresa obtener ingresos al aumentar las ventas de sus productos en el mercado global de sistemas de inspección por rayos X.

- En septiembre de 2021, Loma Systems anunció que la compañía asistió a Pack Expo en Las Vegas. A través de esta exposición, la empresa ha mostrado sus últimos avances en el sistema de detección y en el sistema de inspección. La empresa ha atraído a nuevos consumidores hacia su oferta de productos y ha ganado reconocimiento en el mercado mundial de sistemas de inspección por rayos X.

- En julio de 2021, Sesotec GmbH anunció que la empresa se había asociado con Motan Colortronic (UK) Ltd. En virtud de esta asociación, la empresa debe suministrar máquinas clasificadoras a Motan Colortronic (UK) Ltd. La empresa pretende ampliar esta asociación y Además, obtenga un contrato para los sistemas de inspección que la empresa ofrece en el mercado global de sistemas de inspección por rayos X.

- En noviembre de 2020, el grupo Mekitec anunció en su sitio web oficial que la empresa se había asociado con International Packaging Machinery Pty Ltd (IPM). En virtud de esto, la empresa ha proporcionado sus sistemas de inspección por rayos X de alimentos a International Packaging Machinery Pty Ltd. Esto ha permitido a la empresa expandir su negocio y avanzar en el mercado global de sistemas de inspección por rayos X.

Análisis Regional

Geográficamente, los países cubiertos en el informe del mercado global de Sistemas de inspección por rayos X son EE. UU., Canadá, México, Reino Unido, Alemania, Francia, Italia, Países Bajos, España, Suiza, Rusia, Suecia, Dinamarca, Bélgica, Turquía, Polonia, Noruega. Finlandia, resto de Europa, China, Japón, India, Filipinas, Corea del Sur, Australia, Nueva Zelanda, Singapur, Tailandia, Indonesia, Malasia, Vietnam, Taiwán, resto de Asia-Pacífico, Brasil, Argentina, resto de Sur América, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel, Sudáfrica, Omán, Bahrein, Kuwait, Qatar y el resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge:

América del Norte es la región dominante en el mercado mundial de sistemas de inspección por rayos X durante el período de pronóstico 2023-2030

En 2022, el mercado de sistemas de inspección por rayos X de América del Norte ha experimentado un gran crecimiento y tiene la mayor participación debido a la presencia de una gran cantidad de fabricantes establecidos de sistemas de inspección por rayos X, junto con los estrictos estándares regulatorios para la seguridad alimentaria y el control de calidad. . Junto con los avances tecnológicos en los sistemas de inspección por rayos X.

Se estima que Asia-Pacífico es la región de más rápido crecimiento en el mercado mundial de sistemas de inspección por rayos X el período de previsión 2023 - 2030

En 2023, se espera que Asia-Pacífico crezca durante el período de pronóstico debido a la creciente adopción de sistemas de inspección por rayos X en diversas industrias, como la alimentaria y farmacéutica, automotriz, de semiconductores y otras, así como a la creciente población y la creciente demanda de Los productos alimenticios envasados en la región están impulsando el crecimiento del mercado. Varios actores importantes del mercado de sistemas de inspección por rayos X de Asia y el Pacífico operan en esta región, lo que lleva a varios planes estratégicos y lanzamientos de productos.

Análisis de impacto de COVID-19

La pandemia interrumpió las cadenas de suministro y los procesos de fabricación en diversas industrias, incluida la industria de sistemas de inspección por rayos X. Además, la desaceleración económica mundial resultante de la pandemia afectó la demanda de sistemas de inspección por rayos X, ya que las empresas redujeron su gasto de capital en equipos y tecnología.

Sin embargo, a pesar del impacto negativo de la pandemia, el mercado de sistemas de inspección por rayos X también ha experimentado algunos efectos positivos. La necesidad de métodos de inspección sin contacto aumentó durante la pandemia, y los sistemas de inspección por rayos X demostraron ser una forma confiable y eficaz de inspeccionar y detectar defectos en productos sin contacto físico. Como resultado, algunas industrias, como la de alimentos y bebidas, la farmacéutica y la de dispositivos médicos, han aumentado la adopción de sistemas de inspección por rayos X para garantizar la seguridad y la calidad de sus productos.

Para obtener información más detallada sobre el mercado de sistemas de inspección por rayos X informe, haga clic aquí –https://www.databridgemarketresearch.com/reports/global-x-ray-inspection-system-market