El moldeo por inyección de metal (MIM) en la industria médica produce piezas metálicas complejas con alta precisión. Utiliza polvos metálicos finos y aglutinantes , moldeados y sinterizados para lograr las formas finales. El MIM permite diseños complejos en instrumental quirúrgico e implantes . El proceso garantiza alta resistencia y biocompatibilidad, mejorando la eficiencia y la calidad de la fabricación de dispositivos médicos.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-metal-injection-molding-mim-in-medical-application-market

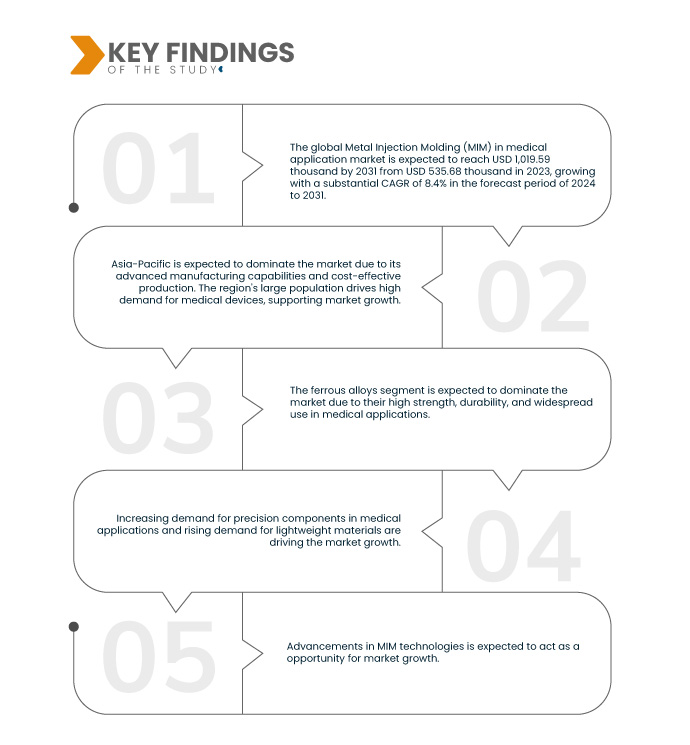

Data Bridge Market Research analiza que se espera que el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas alcance los USD 1.030 millones para 2031 desde USD 535,45 millones en 2023, creciendo con una CAGR sustancial de 8,45% en el período de pronóstico de 2024 a 2031.

Principales hallazgos del estudio

Creciente demanda de componentes de precisión en aplicaciones médicas

Los componentes de precisión son fundamentales en los dispositivos médicos , ya que garantizan fiabilidad y un alto rendimiento. El moldeo por inyección de metal, con su capacidad para producir piezas complejas y de alta precisión, se ha convertido en la solución ideal para los exigentes requisitos de la industria médica. Este método permite la producción de componentes pequeños y complejos con excelentes propiedades mecánicas, esenciales para instrumentos e implantes médicos .

Las aplicaciones médicas, como instrumental quirúrgico, aparatos de ortodoncia e implantes ortopédicos , se benefician de la precisión y consistencia de la MIM. La capacidad de fabricar componentes con tolerancias estrictas y acabados superficiales superiores convierte a la MIM en una opción atractiva para la producción de piezas médicas. Además, la eficiencia del proceso para crear piezas de gran volumen y calidad constante se alinea con la necesidad de la industria médica de soluciones de fabricación rentables. Esta convergencia impulsa la adopción de la tecnología MIM en el sector médico, impulsando así el crecimiento del mercado.

En conclusión, la creciente demanda de componentes de precisión en aplicaciones médicas impulsa significativamente el crecimiento del mercado del moldeo por inyección de metal. La capacidad de MIM para producir piezas complejas de alta precisión con eficiencia se ajusta a la perfección a los exigentes requisitos de la industria médica. A medida que el sector médico continúa evolucionando, con las tendencias hacia la miniaturización y los estándares regulatorios más estrictos, el papel de MIM se vuelve aún más crucial. Esta sinergia entre las capacidades de MIM y las necesidades de la industria médica subraya el sólido crecimiento del mercado de la tecnología de moldeo por inyección de metal.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024-2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Material (aleaciones ferrosas, aleaciones de tungsteno, metales duros, materiales especiales, otros), categoría (implantes, coronas dentales, endoscopios, dispositivos laparoscópicos, mangos para tijeras quirúrgicas, mandíbulas y otros)

|

Países cubiertos

|

EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Taiwán, Singapur, Vietnam, Malasia, Resto de Asia-Pacífico, Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Bélgica, Países Bajos, Resto de Europa, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Israel y Resto de Oriente Medio y África.

|

Actores del mercado cubiertos

|

GKN Powder Metallurgy (EE. UU.), Molex (EE. UU.), Seiko Epson Corporation (Japón), INDO-MIM (India), ARC Group Worldwide (EE. UU.), Jiangsu Gian MIM Parts (China), MPP (EE. UU.), Reich MIM GmbH (Alemania), SZS Co., Ltd. (Taiwán), Alpha Precision Group (EE. UU.), Optimim (EE. UU.), ASH INDUSTRIES (EE. UU.), Parmaco Metal Injection Molding AG (Suiza), Advanced Powder Products, Inc. (EE. UU.), AMT Pte Ltd (Singapur), Shilpan Steelcast Pvt. Ltd. (India), VDR Metals Inc. (India), Smith Metal Products (EE. UU.), Taiwan Kodai Co., Ltd. (Taiwán) y ABIS MOLD Technology Co., Ltd. (China).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado de moldeo por inyección de metal (MIM) en aplicaciones médicas está segmentado en dos segmentos notables según el material y la categoría.

- Según el material, el mercado está segmentado en aleaciones ferrosas, aleaciones de tungsteno, metales duros, materiales especiales y otros.

Se espera que en 2024, el segmento de aleaciones ferrosas domine el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas.

Se espera que en 2024, el segmento de aleaciones ferrosas domine el mercado con una participación de mercado del 36,11% debido a su alta resistencia, durabilidad y uso generalizado en aplicaciones médicas.

- Según la categoría, el mercado está segmentado en implantes, coronas dentales, endoscopios, dispositivos laparoscópicos, mangos para tijeras quirúrgicas, mandíbula y otros.

Se espera que en 2024, el segmento de implantes domine el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas.

Se espera que en 2024, el segmento de implantes domine el mercado con un 31,81% debido a la alta precisión y las geometrías complejas requeridas para los implantes médicos.

Actores principales

Data Bridge Market Research analiza a GKN Powder Metallurgy (EE. UU.), Molex (EE. UU.), Seiko Epson Corporation (Japón), INDO-MIM (India) y ARC Group Worldwide (EE. UU.) como los principales actores en el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas.

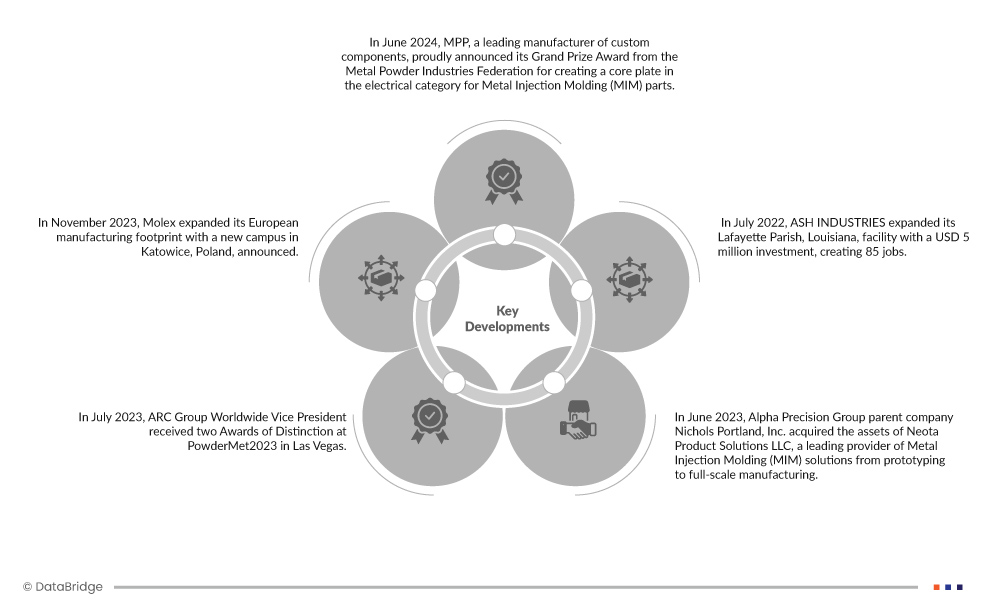

Desarrollos del mercado

- En junio de 2024, MPP, fabricante líder de componentes personalizados, anunció con orgullo su Gran Premio de la Federación de Industrias de Polvo Metálico por la creación de una placa de núcleo en la categoría eléctrica para piezas de Moldeo por Inyección de Metal (MIM). Esta placa de núcleo es crucial en la tableta Cadence, el primer dispositivo capaz de mostrar gráficos táctiles en movimiento. Este reconocimiento atraerá nuevos clientes, fortalecerá su confianza y abrirá nuevas oportunidades en industrias avanzadas como la electrónica y la tecnología táctil.

- En noviembre de 2023, Molex amplió su presencia de fabricación europea con el anuncio de un nuevo campus en Katowice, Polonia. Las instalaciones iniciales de 23.000 metros cuadrados albergaban dispositivos médicos avanzados y soluciones de electrificación, con planes de expansión futuros de hasta 85.000 metros cuadrados. Molex invirtió 110 millones de dólares en el emplazamiento, que proporcionó capacidades de vanguardia y creó aproximadamente 350 empleos cualificados. El campus estaba previsto para obtener las certificaciones LEED Oro e ISO 13485.

- En julio de 2023, el vicepresidente mundial de ARC Group recibió dos Premios de Distinción en PowderMet2023 en Las Vegas. Los premios reconocieron la innovación en componentes de moldeo por inyección de metal (MIM) para armas de fuego, incluyendo un bloque de bloqueo de acero para herramientas S-7 y un retén de corredera para pistola. La obtención de los Premios de Distinción fortalece la reputación de ARC Group Worldwide en la industria y fomenta nuevas oportunidades de negocio al demostrar su liderazgo en tecnología MIM de precisión para componentes de armas de fuego.

- En junio de 2023, Nichols Portland, Inc., empresa matriz de Alpha Precision Group, adquirió los activos de Neota Product Solutions LLC, proveedor líder de soluciones de moldeo por inyección de metal (MIM), desde la creación de prototipos hasta la fabricación a gran escala. Esta adquisición, anunciada por el presidente y director ejecutivo de Nichols, Thomas K. Houck, refuerza las capacidades de MIM de Nichols. Jason Osborne, presidente de Neota, y su equipo se unirán a Nichols, lo que enriquecerá la experiencia de la compañía en diseño y fabricación de productos. Heidi Goldstein, de Altus Capital Partners, propietaria de Nichols, destacó el potencial de la alianza para impulsar los servicios integrales de Nichols centrados en el cliente. No se revelaron los términos financieros.

- En julio de 2022, ASH INDUSTRIES amplió sus instalaciones en la parroquia de Lafayette, Luisiana, con una inversión de 5 millones de dólares, lo que generó 85 empleos. El proyecto duplicó la superficie de la planta de fabricación al añadir 1800 metros cuadrados. Durante el lanzamiento, la empresa destacó la importancia del espacio de fabricación, una sólida plantilla y equipos de vanguardia, incluyendo el moldeo por inyección de metal en planta.

Análisis regional

Geográficamente, las regiones cubiertas por el informe global del mercado de Moldeo por Inyección de Metal (MIM) en aplicaciones médicas son Asia Pacífico, Norteamérica, Europa, Sudamérica, Oriente Medio y África. Estas regiones se segmentan a su vez por países: EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Rusia, Suiza, Turquía, Bélgica, Resto de Europa, China, Japón, India, Corea del Sur, Tailandia, Indonesia, Singapur, Australia y Nueva Zelanda, Malasia, Filipinas, Resto de Asia Pacífico, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel, Resto de Oriente Medio y África.

Según el análisis de investigación de mercado de Data Bridge:

Asia-Pacífico es la región dominante en el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas.

En 2024, se prevé que Asia-Pacífico domine el mercado gracias a sus avanzadas capacidades de fabricación y su producción rentable. La gran población de la región impulsa una alta demanda de dispositivos médicos, lo que impulsa el crecimiento del mercado.

Se estima que América del Norte es la región de más rápido crecimiento en el mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas.

Se espera que América del Norte crezca durante el período de pronóstico de 2024 a 2031 a medida que aumenta la demanda de componentes de precisión en aplicaciones médicas.

Para obtener información más detallada sobre el informe de mercado global de moldeo por inyección de metal (MIM) en aplicaciones médicas, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-metal-injection-molding-mim-in-medical-application-market