El mercado mundial de rayos X industriales es una industria automotriz importante y dinámica. Las pruebas no destructivas (NDT) son una técnica de prueba y análisis utilizada por la industria para evaluar las propiedades de un material, componente, estructura o sistema en busca de diferencias características o defectos y discontinuidades de soldadura sin causar daños a la pieza original. Los sistemas de inspección por rayos X son un componente crucial de los END, ya que proporcionan una detección precisa y confiable de defectos y contaminantes que pueden comprometer la calidad y seguridad del producto. Las pruebas no destructivas modernas se utilizan en la fabricación, la fabricación y las inspecciones en servicio para garantizar la integridad y confiabilidad del producto, controlar los procesos de fabricación, reducir los costos de producción y mantener un nivel de calidad uniforme.

Acceder al informe completo @https://www.databridgemarketresearch.com/reports/global-industrial-x-ray-market

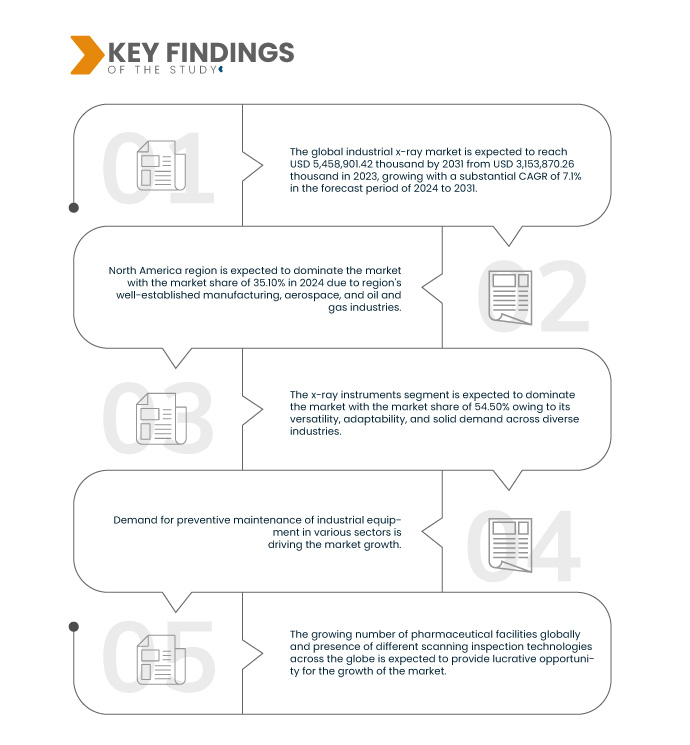

Data Bridge Market Research analiza que el Mercado mundial de rayos X industriales Se espera que alcance los 5.458.901,42 mil dólares en 2031 desde los 3.153.870,26 mil dólares en 2023, creciendo con una tasa compuesta anual del 7,1% en el período previsto de 2024 a 2031.

Hallazgos clave del estudio

Desarrollo de Sistemas de Inspección Portátiles y Móviles

Los sistemas de inspección por rayos X portátiles y móviles ofrecen varias ventajas, como ser compactos, livianos y fáciles de transportar, lo que los hace ideales para su uso en ubicaciones remotas o de difícil acceso. Por lo tanto, los sistemas de inspección por rayos X portátiles y móviles pueden realizar END en ubicaciones remotas o de difícil acceso y pueden configurar y desmontar el sistema según sea necesario rápidamente. La demanda de estos sistemas está aumentando en diversas industrias, incluidas las de petróleo y gas, automotriz, aeroespacial y de construcción, donde las END son fundamentales para garantizar la seguridad y confiabilidad del producto. El sistema de inspección por rayos X portátil y móvil está diseñado para su uso en diversas aplicaciones industriales, como inspección de tuberías, aeroespacial y petroquímicos. Las empresas están reaccionando a la creciente demanda de sistemas portátiles y móviles ampliando su oferta de productos y sistemas. Se espera que esto aumente la adopción de sistemas de inspección por rayos X portátiles y móviles en diversas industrias. Por lo tanto, el desarrollo de nuevos sistemas de inspección por rayos X portátiles y móviles está impulsando el crecimiento del mercado.

Alcance del informe y segmentación del mercado

|

Métrica de informe

|

Detalles

|

|

Período de pronóstico

|

2024 a 2031

|

|

Año base

|

2023

|

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

|

Unidades Cuantitativas

|

Ingresos en miles de dólares

|

|

Segmentos cubiertos

|

Técnica de imágenes (radiografía digital y radiografía basada en películas), aplicación (industrias aeroespaciales, defensa y militares, industria de generación de energía, industria automotriz, industria manufacturera, industria de alimentos y bebidas, y otras), modalidad (2D, 3D e híbrida), Rango (rayos X Micro Focus, rayos X de alta energía y otros), fuente (cobalto-59, iridio-192 y otros), canal de distribución (canal indirecto y canal directo), tipo de producto (consumibles de rayos X, Instrumentos de rayos X y servicios de rayos X)

|

|

Países cubiertos

|

EE.UU., Canadá, México, Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Turquía, Noruega, Finlandia, Dinamarca, Suecia, Polonia, Resto de Europa, Japón, China, Corea del Sur, India, Australia & Nueva Zelanda, Singapur, Tailandia, Indonesia, Malasia, Taiwán, Vietnam, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Resto de América del Sur, Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait, Egipto, Qatar, Baréin, Israel , Omán y resto de Oriente Medio y África

|

|

Actores del mercado cubiertos

|

Teledyne Digital Imaging Inc. (Canadá), Hamamatsu Photonics KK (Japón), GENERAL ELECTRIC (EE.UU.), Comet Group (Suiza), Varex Imaging (EE.UU.), Carestream Health (EE.UU.), Carl Zeiss Group (Alemania), Eastman Kodak Company (EE.UU.), North Star Imaging Inc. (EE.UU.), Ixar (India), VJ X-Ray (EE.UU.), Rigaku Corporation (Japón), Minebea Intec GmbH (Alemania), Lohmann X-Ray GmbH (Alemania), PROTEC GmbH & Co. KG (Alemania), OR Technology (Alemania), FUJIFILM Corporation (Japón), Shimadzu Corporation (Japón), Krystalvision Image Systems Pvt. Limitado. Ltd. (India), Lucky Healthcare Co., Ltd. (China), Canon Electron Tubes & Devices Co., Ltd. (Japón), Applus+ (España), Hitachi High-Tech Analytical Science (Japón), Avonix Imaging (EE. UU. ), y Nordson Corporation (EE.UU.), entre otros

|

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos de mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye análisis de expertos en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis de mortero

|

Análisis de segmentos

El mercado mundial de rayos X industriales se divide en siete segmentos notables que se basan en el tipo de producto, técnica de imagen, modalidad, rango, fuente, aplicación y canal de distribución.

- Según el tipo de producto, el mercado mundial de rayos X industriales se segmenta en instrumentos de rayos X, consumibles de rayos X y servicios de rayos X.

En 2024, se espera que el segmento de instrumentos de rayos X domine el mercado mundial de rayos X industriales.

En 2024, se espera que el segmento de instrumentos de rayos X domine el mercado con una cuota de mercado del 54,50% debido a su versatilidad, rentabilidad y capacidad para realizar misiones críticas con un riesgo reducido para vidas humanas.

- Sobre la base de la técnica de imágenes, el mercado mundial de rayos X industriales se segmenta en radiografía digital y radiografía basada en películas.

En 2024, se espera que el segmento de radiografía digital domine el mercado mundial de rayos X industriales.

En 2024, se espera que el segmento de radiografía digital domine el mercado con una participación de mercado del 66,00% debido a sus aplicaciones en una amplia gama de industrias, incluidas la seguridad, vigilancia, industrial, médica, automotriz y aeroespacial.

- Según la modalidad, el mercado mundial de rayos X industriales se segmenta en 2D, 3D e híbrido. En 2024, se espera que el segmento 2D domine el mercado con una cuota de mercado del 59,58%.

- Según el alcance, el mercado mundial de rayos X industriales se segmenta en rayos X de microfoco, rayos X de alta energía y otros. En 2024, se espera que el segmento de rayos X de microenfoque domine el mercado con una cuota de mercado del 65,39%

- Según su fuente, el mercado mundial de rayos X industriales se segmenta en cobalto-59, iridio-192 y otros. En 2024, se espera que el segmento de cobalto-59 domine el mercado con una cuota de mercado del 3,60%.

- Según la aplicación, el mercado mundial de rayos X industriales se segmenta en industrias aeroespaciales, defensa y militares, industria de generación de energía, industria automotriz, industria manufacturera, industria de alimentos y bebidas, y otras. En 2024, se espera que el segmento de industrias aeroespaciales domine el mercado con una cuota de mercado del 33,21%.

- Según el canal de distribución, el mercado mundial de rayos X industriales se segmenta en canal indirecto y canal directo. En 2024, se espera que el segmento del canal indirecto domine el mercado con una cuota de mercado del 66,09%.

Principales actores

Data Bridge Market Research analiza Teledyne Digital Imaging Inc. (Canadá), Hamamatsu Photonics KK (Japón), Carl Zeiss Group (Alemania), Comet Group (Suiza), Applus+ (España) como principales actores del mercado global de rayos X industriales. .

El desarrollo del mercado

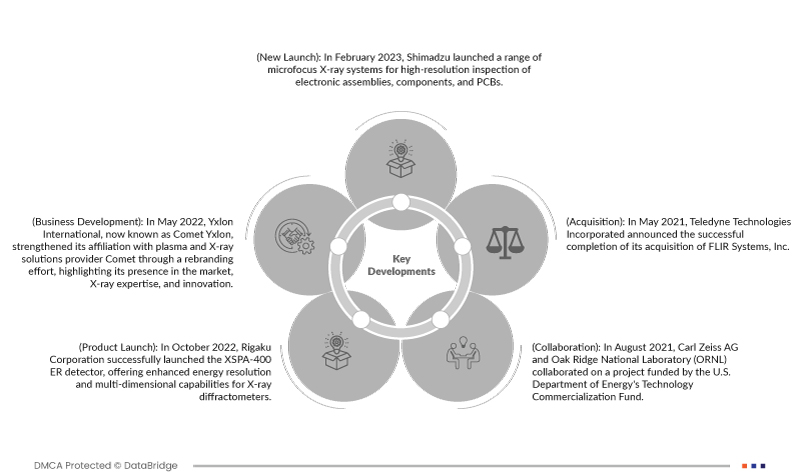

- En octubre de 2022, Rigaku Corporation lanzó con éxito el detector ER XSPA-400, que ofrece resolución de energía mejorada y capacidades multidimensionales para difractómetros de rayos X. Esta innovación atendió a sectores exigentes como baterías, acero y cerámica, lo que permite mediciones precisas de muestras que contienen metales de transición, fomenta aplicaciones ampliadas y refuerza la posición de Rigaku en soluciones XRD avanzadas.

- En agosto de 2021, Carl Zeiss AG y el Laboratorio Nacional Oak Ridge (ORNL) colaboraron en un proyecto financiado por el Fondo de Comercialización de Tecnología del Departamento de Energía de EE. UU. El proyecto pretendía aprovechar inteligencia artificial(AI) y tecnología CT de rayos X para permitir una caracterización confiable y no destructiva de piezas fabricadas aditivamente (AM). La fabricación aditiva (AM) es un método de fabricación que crea una forma 3D mediante la acumulación de materiales. La asociación desarrollará una metodología integral de caracterización de polvo a pieza para la fabricación aditiva, mejorando la calidad y precisión de las mediciones y potencialmente cambiando las pruebas y la metrología no destructivas más allá de la industria de fabricación aditiva (AM).

- En febrero de 2023, Shimadzu lanzó una gama de sistemas de rayos X de microenfoque para la inspección de alta resolución de conjuntos, componentes y PCB electrónicos. Su línea incluye el Xslicer SMX-1010/1020, con calidad de imagen y flujo de trabajo mejorados, y el Xslicer SMX-6010, que proporciona imágenes de alta precisión con un amplio rango dinámico para una observación detallada de estructuras y defectos internos.

- En mayo de 2022, Yxlon International, ahora conocida como Comet Yxlon, reforzó su afiliación con el proveedor de soluciones de plasma y rayos X Comet mediante un esfuerzo de cambio de marca, destacando su presencia en el mercado, su experiencia en rayos X y su innovación. La empresa ofrece soluciones de sistemas de tomografía computarizada y rayos X de alta gama para entornos industriales, respaldadas por servicios integrados que utilizan inteligencia artificial y análisis de datos bajo el paraguas de Comet Group. El cambio de marca de Yxlon International a Comet Yxlon fortalece la afiliación con la empresa matriz, Comet Group. Refuerza la posición del grupo como proveedor de soluciones de plasma y rayos X

- En mayo de 2021, Teledyne Technologies Incorporated anunció la finalización exitosa de la adquisición de FLIR Systems, Inc. La adquisición condujo a la formación de Teledyne FLIR, una entidad combinada que ofrece un espectro completo de tecnologías y productos de imágenes, ampliando su gama de sistemas no tripulados y carga útil de imágenes. Este movimiento estratégico tiene como objetivo mejorar la posición de Teledyne en la industria, brindando soluciones innovadoras en múltiples dominios.

Análisis Regional

Geográficamente, los países cubiertos en el informe del mercado mundial de rayos X industriales son EE. UU., Canadá, México, Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Turquía, Noruega, Finlandia, Dinamarca, Suecia, Polonia. , Resto de Europa, Japón, China, Corea del Sur, India, Australia y Nueva Zelanda, Singapur, Tailandia, Indonesia, Malasia, Taiwán, Vietnam, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Resto de América del Sur, Sudáfrica , Emiratos Árabes Unidos, Arabia Saudita, Kuwait, Egipto, Qatar, Bahrein, Israel, Omán y resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge:

América del Norte es la región dominante y de más rápido crecimiento región en el mercado mundial de rayos X industriales

Se espera que la región de América del Norte domine el mercado con un fuerte liderazgo tecnológico, presupuestos de defensa sustanciales, una industria de defensa sólida y condiciones regulatorias favorables. Estos factores contribuyen colectivamente a la posición de América del Norte como actor dominante en esta industria. Se espera que América del Norte sea la región de más rápido crecimiento, ya que existe una gran demanda de productos de rayos X y varias empresas también están lanzando nuevos productos. Además, ha logrado avances significativos en tecnología e innovación, centrándose en el desarrollo y la adopción de tecnologías avanzadas de rayos X.

Para obtener información más detallada sobre el informe del mercado global de rayos X industriales, haga clic aquí:https://www.databridgemarketresearch.com/reports/global-industrial-x-ray-market