El Cribado de Alto Contenido (HCS, también conocido como Análisis de Alto Contenido o HCA) es un enfoque de la biología celular que combina la obtención automatizada de imágenes y el análisis cuantitativo de datos en un formato de alto rendimiento, ideal para aplicaciones a gran escala como el descubrimiento de fármacos y la biología de sistemas. Este mercado se refiere al sector de las ciencias de la vida que se centra en el uso de técnicas avanzadas de imagen y análisis para estudiar y analizar procesos celulares y fenómenos biológicos a gran escala. El HCS implica la obtención automatizada de imágenes y el análisis cuantitativo de células u organismos mediante tecnologías como la microscopía de fluorescencia, sistemas automatizados de manejo de líquidos y un sofisticado software de análisis de imágenes.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-high-content-screening-market

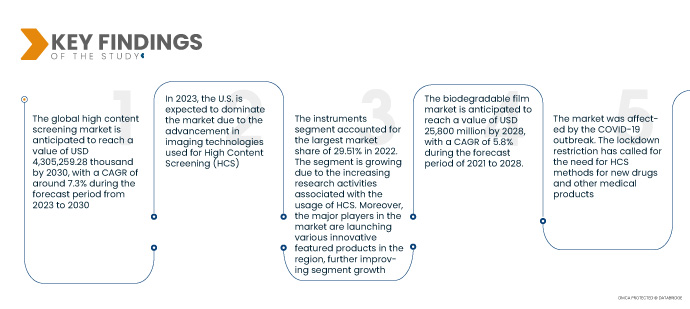

Data Bridge Market Research analiza que se espera que el mercado global de cribado de alto contenido crezca a una tasa de crecimiento anual compuesta (CAGR) del 7,3 % entre 2023 y 2030, alcanzando los 4 305 259,28 USD para 2030. Se prevé que el creciente número de CRO que ofrecen servicios de HCS impulse el crecimiento del mercado.

Principales hallazgos del estudio

Avances en las tecnologías de imágenes utilizadas para el cribado de alto contenido

Las tecnologías de imagen han estado a la vanguardia del Cribado de Alto Contenido (HCS), permitiendo a los investigadores visualizar y analizar procesos celulares con un detalle y una precisión sin precedentes. Además de la obtención de imágenes de alta resolución, se han logrado mejoras significativas en la velocidad y el rendimiento de las imágenes. El HCS facilita el análisis de un gran número de muestras, a menudo en formatos de alto rendimiento. Las tecnologías de imagen han evolucionado para ofrecer tiempos de adquisición más rápidos, lo que permite a los investigadores analizar grandes conjuntos de datos en menos tiempo. Las técnicas de imagen de alta velocidad, como la microscopía confocal de disco giratorio y la microscopía de lámina de luz, permiten una adquisición rápida de imágenes sin comprometer la calidad de la imagen, lo que facilita la eficiencia de los flujos de trabajo de cribado y el análisis de datos.

A lo largo de los años, se han logrado avances significativos en las modalidades de imágenes, técnicas de microscopía y herramientas de análisis de imágenes, transformando el panorama de HCS e impulsando su expansión en el mercado.

Por ejemplo,

- En enero de 2023, Axion BioSystems anunció la incorporación del Omni Pro 12 a la familia de productos Omni para la obtención de imágenes de células vivas. La nueva plataforma, que incorpora robótica integrada y múltiples diseños compatibles con cualquier incubadora estándar, ofrece mayor flexibilidad y eficiencia a científicos y desarrolladores de fármacos que realizan experimentos de obtención de imágenes de células vivas. Este avance en la técnica de obtención de imágenes contribuiría a la eficiencia del descubrimiento de fármacos mediante la realización de experimentos de obtención de imágenes de células vivas.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2023 a 2030

|

Año base

|

2022

|

Años históricos

|

2021 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en USD, precios en USD

|

Segmentos cubiertos

|

Por tipo de producto (instrumentos, consumibles, software, servicios y accesorios), aplicación (cribado primario y secundario, identificación y validación de objetivos, estudios de toxicidad, elaboración de perfiles de compuestos y otros), tecnología (microscopía, citometría de flujo , espectrometría de masas , Western blot, ELISA, inmunohistoquímica y otros), usuario final (empresas farmacéuticas y biotecnológicas, institutos académicos y gubernamentales, organizaciones de investigación por contrato, laboratorios y otros), canal de distribución (licitaciones directas y ventas minoristas)

|

Países cubiertos

|

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Dinamarca, Países Bajos, Suiza, Suecia, Polonia, Noruega, Finlandia, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Nueva Zelanda, Singapur, Tailandia, Malasia, Vietnam, Taiwán, Indonesia, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Baréin, Emiratos Árabes Unidos, Kuwait, Omán, Catar, Egipto, Israel y Resto de Oriente Medio y África.

|

Actores del mercado cubiertos

|

BD., Merck KGaA, Corning Incorporated, Carl Zeiss AG, Sartorius AG, EVIDENT, Zifo RnD Solutions, Axxam SpA, Molecular Devices, LLC. (subsidiaria de Danaher Corporation), Thermo Fisher Scientific Inc., PerkinElmer Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Yokogawa Electric Corporation, Sysmex Corporation, Genedata AG, De Novo Software, Araceli Biosciences, Miltenyi Biotec y Aligned Genetics, Inc., entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, análisis de canalización, análisis de precios y marco regulatorio.

|

Análisis de segmentos

El mercado global de cribado de alto contenido está segmentado en cinco segmentos notables según el tipo de producto, la aplicación, la tecnología, el usuario final y el canal de distribución.

- Según el tipo de producto, el mercado se segmenta en instrumentos, consumibles, software, servicios y accesorios.

En 2023, se proyecta que el segmento de instrumentos tendrá la mayor participación de mercado del segmento de tipo de producto en el mercado global de cribado de alto contenido.

En 2023, se espera que el segmento de instrumentos domine el mercado con una participación de mercado del 30,04%, creciendo a una CAGR del 9,0% en el período de pronóstico de 2023 a 2030.

- Sobre la base de la aplicación, el mercado está segmentado en detección primaria y secundaria, identificación y validación de objetivos, estudios de toxicidad, perfiles de compuestos y otros.

En 2023, se espera que el segmento de cribado primario y secundario del segmento de aplicaciones domine el mercado global de cribado de alto contenido.

Se espera que en 2023, el segmento de detección primaria y secundaria domine el mercado debido a su capacidad para permitir la identificación y validación de medicamentos potenciales que contribuyan al proceso de descubrimiento de fármacos.

- En función de la tecnología, el mercado se segmenta en microscopía , citometría de flujo, espectrometría de masas, Western blot , ELISA, inmunohistoquímica, entre otros. En 2023, se prevé que el segmento de microscopía domine el mercado con una cuota de mercado del 26,45 %, con una tasa de crecimiento anual compuesta (TCAC) del 10,2 % durante el período de pronóstico de 2023 a 2030.

- En función del usuario final, el mercado se segmenta en empresas farmacéuticas y biotecnológicas, institutos académicos y gubernamentales, organizaciones de investigación por contrato, laboratorios, entre otros. En 2023, se prevé que el segmento de empresas farmacéuticas y biotecnológicas domine el mercado con una cuota de mercado del 37,15 %, con una tasa de crecimiento anual compuesta (TCAC) del 8,6 % durante el período de pronóstico de 2023 a 2030.

- Según el canal de distribución, el mercado se segmenta en licitaciones directas y ventas minoristas. En 2023, se prevé que el segmento de licitaciones directas domine el mercado con una cuota de mercado del 63,97 %, con una tasa de crecimiento anual compuesta (TCAC) del 7,7 % durante el período de pronóstico de 2023 a 2030.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado en el mercado global de detección de alto contenido que incluyen a BD., Merck KGaA, Corning Incorporated, Carl Zeiss AG, Sartorius AG, EVIDENT, Zifo RnD Solutions, Axxam SpA, Molecular Devices, LLC. (Subsidiaria de Danaher Corporation), Thermo Fisher Scientific Inc., PerkinElmer Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Yokogawa Electric Corporation, Sysmex Corporation, Genedata AG, De Novo Software, Araceli Biosciences, Miltenyi Biotec y Aligned Genetics, Inc. entre otros.

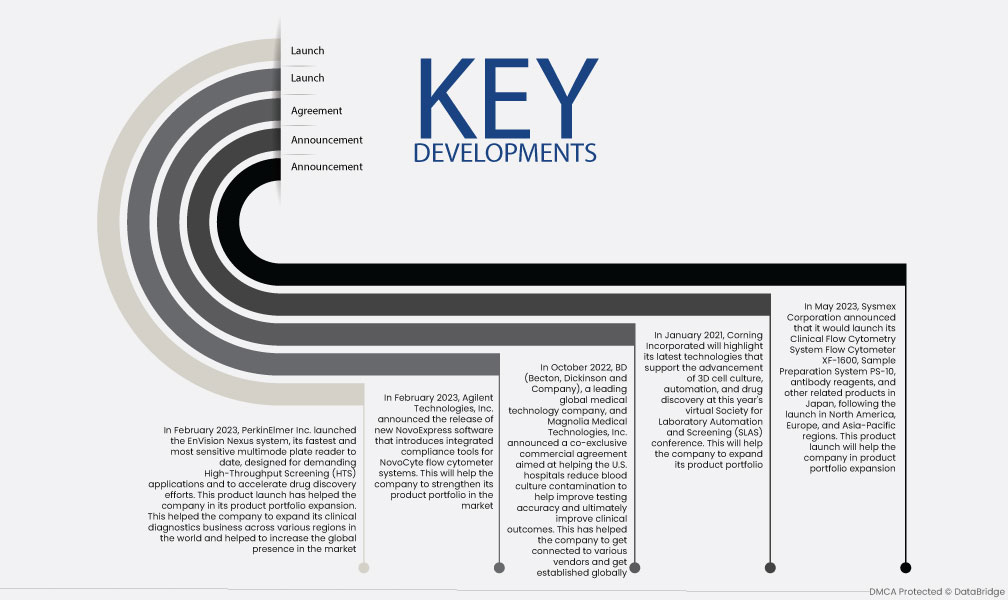

Desarrollos del mercado

- En febrero de 2023, PerkinElmer Inc. lanzó el sistema EnVision Nexus, su lector de placas multimodo más rápido y sensible hasta la fecha, diseñado para aplicaciones exigentes de cribado de alto rendimiento (HTS) y para acelerar el desarrollo de fármacos. Este lanzamiento ha ayudado a la compañía a ampliar su cartera de productos. Esto le ha permitido expandir su negocio de diagnóstico clínico a diversas regiones del mundo y fortalecer su presencia global en el mercado.

- En febrero de 2023, Agilent Technologies, Inc. anunció el lanzamiento del nuevo software NovoExpress, que incorpora herramientas de cumplimiento integradas para los sistemas de citómetros de flujo NovoCyte. Esto ayudará a la compañía a fortalecer su cartera de productos en el mercado.

- En octubre de 2022, BD (Becton, Dickinson and Company), empresa líder mundial en tecnología médica, y Magnolia Medical Technologies, Inc. anunciaron un acuerdo comercial de coexclusividad para ayudar a los hospitales estadounidenses a reducir la contaminación de los hemocultivos, mejorar la precisión de las pruebas y, en última instancia, los resultados clínicos. Esto ha permitido a la empresa conectar con diversos proveedores y consolidarse a nivel mundial.

- En enero de 2021, Corning Incorporated presentará sus últimas tecnologías que impulsan el avance del cultivo celular 3D, la automatización y el descubrimiento de fármacos en la conferencia virtual de la Sociedad para la Automatización y el Cribado de Laboratorios (SLAS) de este año. Esto ayudará a la empresa a ampliar su cartera de productos.

- En mayo de 2023, Sysmex Corporation anunció el lanzamiento en Japón de su sistema de citometría de flujo clínica, el citómetro de flujo XF-1600, el sistema de preparación de muestras PS-10, reactivos de anticuerpos y otros productos relacionados, tras su lanzamiento en Norteamérica, Europa y Asia-Pacífico. Este lanzamiento contribuirá a la expansión de la cartera de productos de la empresa.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado global de detección de alto contenido son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Dinamarca, Países Bajos, Suiza, Suecia, Polonia, Noruega, Finlandia, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Nueva Zelanda, Singapur, Tailandia, Malasia, Vietnam, Taiwán, Indonesia, Filipinas, Resto de Asia-Pacífico, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Baréin, Emiratos Árabes Unidos, Kuwait, Omán, Qatar, Egipto, Israel y Resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge

Se espera que el mercado global de cribado de alto contenido crezca a una CAGR del 7,3% debido a las crecientes iniciativas estratégicas adoptadas por los actores del mercado.

Para obtener información más detallada sobre el mercado global de cribado de alto contenido, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-high-content-screening-market