El Mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico está experimentando un crecimiento sustancial debido al creciente número de vehículos eléctricos, existe una demanda creciente de soluciones efectivas de reciclaje de baterías para gestionar las baterías al final de su vida útil de manera responsable. Para el reciclaje se emplean métodos pirometalúrgicos e hidrometalúrgicos. Las estrictas regulaciones medioambientales y las iniciativas de sostenibilidad impulsan aún más el mercado. Se espera que el creciente enfoque en la recuperación de recursos y la aparición de tecnologías de reciclaje innovadoras den forma a la trayectoria futura del mercado.

Acceder al informe completo @ https://www.databridgemarketresearch.com/reports/asia-pacific-electric-vehicle-lithium-ion-battery-recycling-market

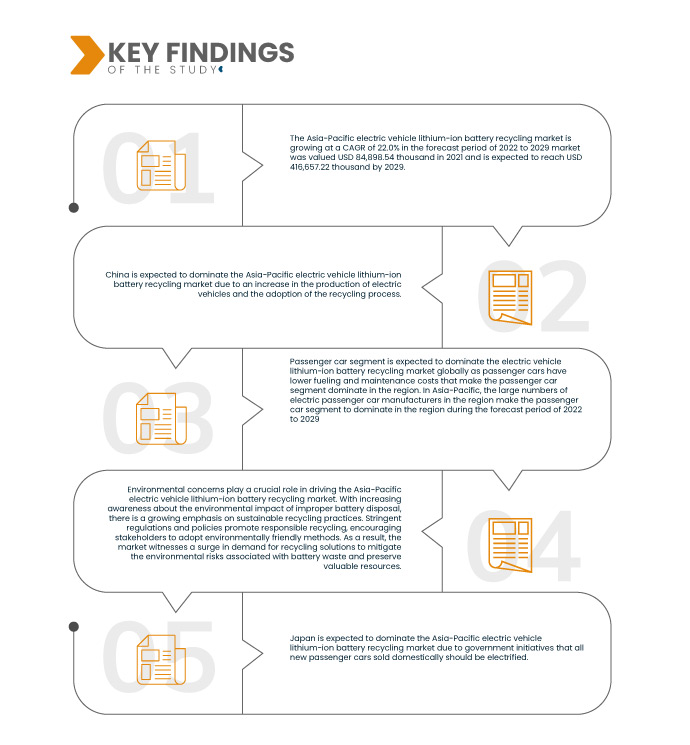

Data Bridge Market Research analiza que el mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico está creciendo a una tasa compuesta anual del 22,0% en el período previsto de 2022 a 2029. El mercado estaba valorado en 84.898,54 mil dólares en 2021 y se espera que alcance los 4 dólares. ,16.657,22 mil para 2029. La creciente adopción de vehículos eléctricos En Asia y el Pacífico aumenta el número de baterías de iones de litio al final de su vida útil, lo que impulsa la demanda de soluciones de reciclaje para gestionar los residuos de baterías de forma sostenible y recuperar materiales valiosos.

Hallazgos clave del estudio

Se espera que la necesidad crítica de conservación de recursos impulse la tasa de crecimiento del mercado.

El mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico está impulsado por la necesidad crítica de conservar los recursos. Litio, cobalto, el níquel y otros metales valiosos utilizados en las baterías de iones de litio son finitos y esenciales para la producción de baterías. El reciclaje de estas baterías permite la recuperación y reutilización de estos valiosos materiales, reduciendo la dependencia de nuevas actividades mineras y extracciones, que pueden ser perjudiciales para el medio ambiente. A medida que aumenta la adopción de vehículos eléctricos en la región, el reciclaje se vuelve imperativo para preservar estos recursos escasos, promover la sostenibilidad y garantizar un enfoque más responsable en la gestión de los residuos de baterías.

Alcance del informe y segmentación del mercado

|

Métrica de informe

|

Detalles

|

|

Período de pronóstico

|

2022 a 2029

|

|

Año base

|

2021

|

|

Años históricos

|

2020 (Personalizable para 2014-2019)

|

|

Unidades Cuantitativas

|

Ingresos en miles de USD, volúmenes en unidades, precios en USD

|

|

Segmentos cubiertos

|

Proceso (Pirometalúrgico, Hidrometalúrgico, Otros), Aplicación (Turismo, Vehículo Comercial),

|

|

Países cubiertos

|

China, India, Corea del Sur, Japón, Australia, Nueva Zelanda, Singapur, Tailandia, Malasia, Filipinas, Indonesia, Resto de Asia-Pacífico

|

|

Actores del mercado cubiertos

|

Neometals (Australia), Glencore (Suiza), FORTUM (Finlandia) Gem Co. Ltd. (China), Brunp Recycle Technology Co. Ltd. (una filial de CATL) (China), Tata Chemicals Ltd. (India), Ganfeng Lithium (China), Umicore (Bélgica)

|

|

Puntos de datos cubiertos en el informe

|

Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundos de expertos, epidemiología de pacientes, análisis de tuberías, análisis de precios, y marco regulatorio.

|

Análisis de segmentos:

El mercado de reciclaje de baterías de iones de litio de vehículos eléctricos de Asia y el Pacífico está segmentado según el proceso y la aplicación.

- Sobre la base del proceso, el mercado de reciclaje de baterías de iones de litio de vehículos eléctricos de Asia y el Pacífico se segmenta en pirometalúrgicos, hidrometalúrgicos y otros. En 2022, se espera que el segmento pirometalúrgico domine el mercado mundial de reciclaje de baterías de iones de litio para vehículos eléctricos, ya que el proceso pirometalúrgico permite una cadena de proceso corta y un menor impacto ambiental, lo que aumenta su demanda a nivel mundial en el período previsto de 2022 a 2029.

En 2022, se espera que el segmento pirometalúrgico domine el mercado de reciclaje de baterías de iones de litio para vehículos eléctricos.

En 2022, se espera que el segmento pirometalúrgico domine el mercado de reciclaje de baterías de iones de litio para vehículos eléctricos debido a su cadena de proceso corta y su menor impacto ambiental, lo que impulsará su demanda global. En la región de Asia y el Pacífico, particularmente en China e India, el aumento de la producción de vehículos eléctricos y la adopción del reciclaje ha aumentado aún más la demanda de reciclaje pirometalúrgico, convirtiéndolo en el método dominante en la región. Su eficiencia y beneficios medioambientales lo convierten en una opción atractiva para gestionar baterías de iones de litio al final de su vida útil en el período previsto de 2022 a 2029.

- Según la aplicación, el mercado de reciclaje de baterías de iones de litio de vehículos eléctricos de Asia y el Pacífico se segmenta en vehículos de pasajeros y vehículos comerciales. En 2022, se espera que el segmento de automóviles de pasajeros domine el mercado mundial de reciclaje de baterías de iones de litio para vehículos eléctricos, ya que los automóviles de pasajeros tienen costos de combustible y mantenimiento más bajos, lo que hace que el segmento de automóviles de pasajeros domine en la región. En Asia-Pacífico, la gran cantidad de fabricantes de automóviles de pasajeros eléctricos en la región hace que el segmento de automóviles de pasajeros domine la región durante el período previsto de 2022 a 2029.

En 2022, se espera que el segmento de turismos domine el mercado de reciclaje de baterías de iones de litio de vehículos eléctricos.

En 2022, se espera que el segmento de turismos domine el mercado de reciclaje de baterías de iones de litio de vehículos eléctricos debido a los menores costes de combustible y mantenimiento, lo que hará que los turismos eléctricos sean más populares. En la región de Asia y el Pacífico, el dominio del segmento de turismos se ve reforzado aún más por la presencia de numerosos fabricantes de turismos eléctricos. A medida que más consumidores optan por turismos eléctricos, aumenta la demanda de reciclaje de baterías en este segmento, consolidando su dominio en la región en el período previsto de 2022 a 2029.

Principales actores

Data Bridge Market Research reconoce que las siguientes empresas como los principales actores del mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico son Neometals (Australia), Glencore (Suiza), FORTUM (Finlandia) Gem Co. Ltd. (China), Brunp Recycle Technology Co. Ltd. (una filial de CATL) (China), Tata Chemicals Ltd. (India)

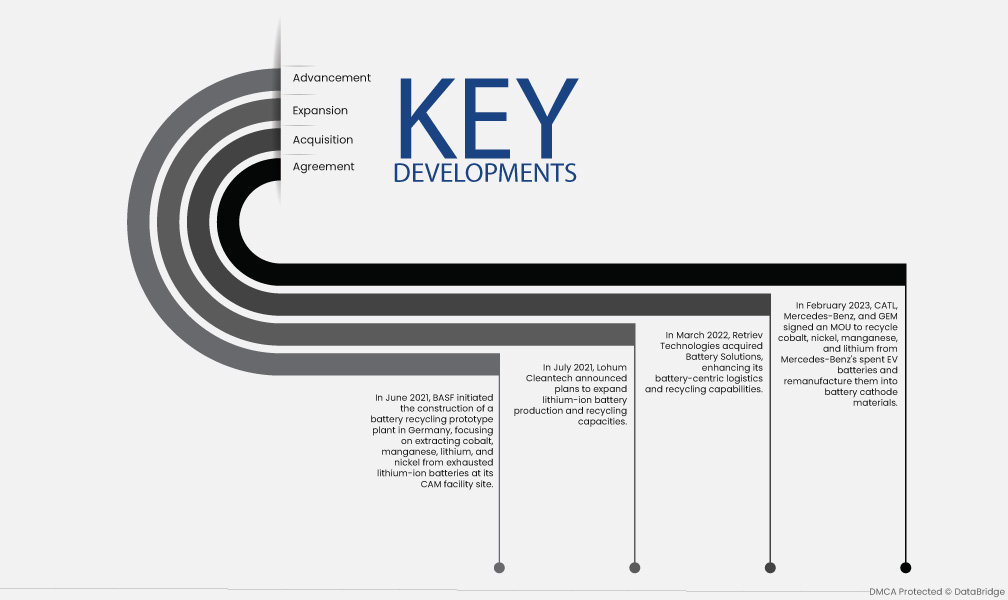

Desarrollos del mercado

- En febrero de 2023, CATL, Mercedes-Benz y GEM firmaron un memorando de entendimiento para reciclar cobalto, níquel, manganeso y litio de las baterías gastadas de vehículos eléctricos de Mercedes-Benz y remanufacturarlos en materiales catódicos para baterías.

- En marzo de 2022, Retriev Technologies adquirió Battery Solutions, mejorando sus capacidades de reciclaje y logística centradas en baterías.

- En julio de 2021, Lohum Cleantech anunció planes para ampliar las capacidades de producción y reciclaje de baterías de iones de litio.

- En junio de 2021, BASF inició la construcción de una planta prototipo de reciclaje de baterías en Alemania, centrándose en la extracción de cobalto, manganeso, litio y níquel de baterías de iones de litio agotadas en sus instalaciones CAM.

Análisis Regional

Geográficamente, los países cubiertos en el informe del mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico son EE. UU., Japón, China, Corea del Sur, Australia, India, Singapur, Tailandia, Malasia, Indonesia, Filipinas y el resto de Asia y el Pacífico. .

Según el análisis de investigación de mercado de Data Bridge:

China es la región dominante en Mercado de reciclaje de baterías de iones de litio de vehículos eléctricos de Asia y el Pacífico durante el período de pronóstico 2022 - 2029

China domina el mercado debido a su importante aumento en la producción de vehículos eléctricos y la adopción del proceso de reciclaje. Como mercado de vehículos eléctricos más grande del mundo, China genera un volumen sustancial de baterías de iones de litio al final de su vida útil, lo que crea una necesidad apremiante de soluciones de reciclaje. El énfasis del gobierno chino en la sostenibilidad ambiental y la conservación de recursos ha llevado a políticas de apoyo e incentivos para iniciativas de reciclaje de baterías. Además, las sólidas capacidades de fabricación del país y la inversión en infraestructura de reciclaje fortalecen aún más su posición en el mercado.

Se estima que Japón es la región de más rápido crecimiento en el mercado de reciclaje de baterías de iones de litio de vehículos eléctricos de Asia y el Pacífico en el período de pronóstico 2022 - 2029

Se espera que Japón domine el mercado gracias a las ambiciosas iniciativas gubernamentales destinadas a electrificar la industria automotriz. El gobierno japonés se ha fijado el objetivo de que todos los turismos nuevos vendidos en el país sean electrificados, lo que ha impulsado un rápido aumento en la adopción de vehículos eléctricos. A medida que aumenta la demanda de vehículos eléctricos, también aumenta la necesidad de un reciclaje sostenible de baterías. El compromiso de Japón con la tecnología verde y los principios de la economía circular ha impulsado el desarrollo de tecnologías de reciclaje avanzadas y un fuerte apoyo regulatorio para los esfuerzos de reciclaje de baterías, solidificando su liderazgo en la región de Asia y el Pacífico.

Para obtener información más detallada sobre el mercado de reciclaje de baterías de iones de litio para vehículos eléctricos de Asia y el Pacífico informe, haga clic aquí - https://www.databridgemarketresearch.com/reports/asia-pacific-electric-vehicle-lithium-ion-battery-recycling-market