Overview

The semiconductor industry, renowned for its pivotal role in powering modern technology, is encountering a transformative era characterized by both unprecedented opportunities and formidable challenges. Amidst dynamic market landscapes and disruptive forces, semiconductor companies are compelled to reevaluate their operational paradigms. In this context, the imperative of cultivating resilience and fostering inter-industry collaboration emerges as a strategic imperative for semiconductor manufacturers. This essay explores the critical necessity for semiconductor firms to fortify their resilience and embrace cross-industry partnerships, delineating strategies and implications within a rapidly evolving ecosystem.

Navigating Market Dynamics

Semiconductor companies are inherently susceptible to cyclical market dynamics, influenced by factors ranging from technological obsolescence to geopolitical tensions. The COVID-19 pandemic served as a stark reminder of the fragility inherent in global supply chains, amplifying existing vulnerabilities within the semiconductor industry. Supply shortages, fluctuating demand patterns, and geopolitical uncertainties underscore the need for semiconductor manufacturers to fortify their operational resilience against unforeseen disruptions.

Building Resilience through Strategic Partnerships

Strategic partnerships represent a cornerstone in fortifying the resilience of semiconductor companies. By forging collaborative alliances with partners across diverse industries, semiconductor firms can diversify their revenue streams, mitigate risks, and enhance operational agility. These partnerships extend beyond conventional supplier-customer relationships, encompassing joint ventures, research consortia, and ecosystem collaborations. Through strategic alliances, semiconductor companies can harness synergies, access novel markets, and augment their competitive edge amidst market turbulence.

Cultivating Process Maturity and Adaptability

Achieving resilience necessitates a steadfast commitment to process maturity and adaptability within semiconductor operations. Robust quality control measures, streamlined supply chain management, and technological innovation are paramount in enhancing operational efficiency and mitigating risks. Moreover, cultivating a culture of continuous improvement and agility enables semiconductor companies to swiftly pivot in response to evolving market dynamics. Embracing digital transformation initiatives and talent development programs further augments the adaptive capacity of semiconductor firms, ensuring sustained competitiveness in a dynamic environment.

Facilitating Seamless Industry Transitions

The strategic imperative for semiconductor companies extends beyond resilience-building to encompass seamless transitions between industries. Traditionally entrenched within sectors such as consumer electronics and automotive, semiconductor manufacturers are increasingly diversifying their market presence across burgeoning domains such as IoT, AI, and renewable energy. Inter-industry collaborations enable semiconductor firms to leverage their technological prowess in addressing evolving market demands and emergent trends. By fostering partnerships with companies in adjacent sectors, semiconductor manufacturers can catalyze innovation, expand market reach, and unlock new avenues for growth.

Strategies for Inter-Industry Collaboration

To capitalize on the opportunities presented by inter-industry collaboration, semiconductor companies must adopt a proactive stance toward partnership development. Strategic imperatives include:

-

Market Analysis and Opportunity Assessment: Conducting comprehensive market analyses to identify industries with high growth potential and unmet technological needs

-

Relationship Building and Networking: Cultivating robust relationships with potential partners through industry forums, collaborative platforms, and networking events

-

Co-Innovation and Co-Creation: Engaging in collaborative initiatives to co-develop innovative solutions tailored to specific market segments and customer requirements

-

Intellectual Property Management: Establishing clear frameworks for IP management and technology transfer to facilitate equitable collaboration and foster trust among partners

-

Long-Term Vision and Commitment: Formulating a coherent strategic vision for inter-industry partnerships, underpinned by a commitment to mutual success and sustained collaboration

Implications and Future Outlook

The pursuit of resilience and inter-industry collaboration holds profound implications for the future trajectory of the semiconductor industry. By embracing strategic partnerships and fostering collaborative ecosystems, semiconductor companies can position themselves as catalysts for innovation and drivers of collective growth. Moreover, inter-industry collaboration augments the adaptive capacity of semiconductor firms, enabling them to thrive amidst evolving market dynamics and emerging technologies. Looking ahead, the strategic imperative of resilience-building and cross-industry collaboration will remain central to the sustained competitiveness and relevance of semiconductor companies within an increasingly interconnected global landscape.

Evolution of Semiconductor Industry Participants

The semiconductor industry has undergone a remarkable evolution since its inception, transitioning from solitary players to collaborative innovators in a dynamic global landscape. From the early days of isolated research labs to the present era of strategic partnerships and ecosystem collaborations, semiconductor manufacturers have continually adapted their operational paradigms to navigate market dynamics and technological advancements. This essay traces the history and evolution of semiconductor manufacturers, exploring the pivotal role of collaborations in driving innovation, competitiveness, and industry growth.

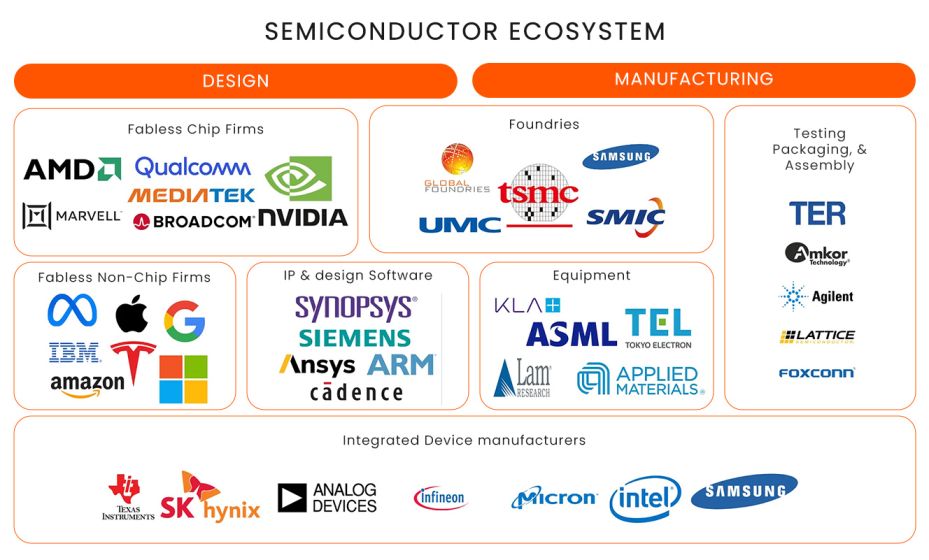

Figure 1: Semiconductor Ecosystem

Source: Generative Value

Origins and Early Innovations:

The roots of the semiconductor industry can be traced back to the mid-20th century, marked by seminal discoveries and technological breakthroughs. The invention of the transistor in 1947 by Bell Labs researchers heralded a new era of electronic miniaturization, laying the foundation for modern semiconductor devices. In the following decades, pioneers such as Fairchild Semiconductor and Texas Instruments emerged as trailblazers in semiconductor manufacturing, pioneering advancements in integrated circuits (ICs) and semiconductor materials.

Rise of Integrated Circuits and Foundries:

The advent of integrated circuits in the 1960s revolutionized semiconductor manufacturing, enabling the consolidation of multiple electronic components onto a single chip. This paradigm shift facilitated the mass production of semiconductor devices and fueled the rapid expansion of the electronics industry. Concurrently, the rise of semiconductor foundries emerged as a pivotal development, offering specialized manufacturing services to fabless semiconductor companies. Foundry collaborations enabled semiconductor firms to focus on design and innovation while leveraging the manufacturing expertise of specialized foundry partners.

Globalization and Market Consolidation:

The late 20th century witnessed the globalization of the semiconductor industry, driven by advances in technology, trade liberalization, and shifting market dynamics. Semiconductor manufacturers expanded their global footprint, establishing manufacturing facilities and R&D centers in diverse regions to capitalize on market opportunities and access talent pools. Moreover, market consolidation emerged as a prevailing trend, characterized by mergers, acquisitions, and strategic alliances aimed at enhancing competitiveness and market share.

Strategic Partnerships and Ecosystem Collaborations:

In the 21st century, semiconductor manufacturers have increasingly embraced strategic partnerships and ecosystem collaborations to foster innovation and drive industry growth. Collaborative ventures encompass a spectrum of initiatives, including joint development projects, research consortia, and ecosystem alliances. These partnerships enable semiconductor companies to pool resources, share expertise, and accelerate time-to-market for innovative technologies. Furthermore, collaborations with customers, suppliers, and academic institutions foster an environment of open innovation, driving collective progress and addressing complex industry challenges.

Diversification and Industry Convergence:

A trend towards diversification and industry convergence characterizes the evolution of semiconductor manufacturers. Traditional semiconductor companies have expanded their product portfolios beyond silicon chips, venturing into adjacent markets such as software, services, and systems integration. Moreover, industry convergence between the semiconductor, telecommunications, and consumer electronics sectors has blurred traditional boundaries, fostering cross-industry collaborations and ecosystem synergies.

Emerging Trends and Future Outlook

Semiconductor manufacturers are poised to navigate a rapidly evolving landscape shaped by emerging trends such as AI, IoT, and automotive electrification in coming years. Collaborative partnerships will play a pivotal role in driving innovation and addressing emerging market opportunities. Moreover, semiconductor manufacturers will continue to embrace digital transformation initiatives, leveraging technologies such as artificial intelligence, advanced analytics, and digital twins to optimize manufacturing processes and enhance operational efficiency.

Facts and Figures

-

The Semiconductor Industry Association (SIA) reported that global semiconductor sales in February 2024 reached USD46.2 billion, marking a significant 16.3% increase compared to February 2023's USD 39.7 billion. However, there was a slight decrease of 3.1% from January 2024'sUSD 47.6 billion. Despite the month-to-month decline, this February's sales demonstrated robust year-to-year growth, the highest since May 2022. John Neuffer, SIA's president and CEO, highlighted this trend, emphasizing the market's resilience and projecting continued growth throughout the year.

Regionally, year-to-year sales showed increases in China (28.8%), the Americas (22.0%), and Asia Pacific/All Other (15.4%), while Europe (-3.4%) and Japan (-8.5%) experienced declines. Month-to-month sales decreased across all regions: Asia Pacific/All Other (-1.3%), Europe (-2.3%), Japan (-2.5%), the Americas (-3.9%), and China (-4.3%).

Manufacturers can contribute to semiconductor industry growth by investing in research and development, enhancing production efficiency, and fostering innovation to meet increasing global demand for semiconductors, driving technological advancement and economic growth.

The semiconductor industry, according to SEMI, is poised for a slight contraction in 2023 before rebounding in 2024 and reaching a record $124 billion in sales by 2025. This forecast is attributed to various factors, such as cyclical market trends, capacity expansions, and high demand for advanced technologies.

-

In 2023, global semiconductor manufacturing equipment sales are projected to reach $100 billion, reflecting a 6.1% decline from the previous year's record of $107.4 billion. This contraction is primarily due to cyclical market dynamics. However, the industry is expected to experience growth in 2024, reaching $124 billion in sales by 2025.

The wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, is forecasted to decline by 3.7% in 2023, reaching $90.6 billion. This is an improvement from the previously projected 18.8% decline, mainly driven by strong equipment spending in China. In 2024, the segment is expected to grow modestly by 3% due to limited memory capacity addition and a pause in mature capacity expansion. However, a significant 18% expansion is anticipated in 2025, driven by new fab projects and technology migrations.

On the other hand, the back-end equipment segment experienced a decline in 2022 and is projected to continue this trend in 2023 due to challenging macroeconomic conditions. Semiconductor test equipment market sales are expected to contract by 15.9% to $6.3 billion, while assembly and packaging equipment sales are forecasted to drop by 31% to $4.0 billion. However, both segments are anticipated to rebound in 2024 and continue growing in 2025.

In terms of regional spending, China, Taiwan, and Korea are expected to remain the top three destinations for equipment spending through 2025. China is projected to maintain its lead, with equipment shipments surpassing USD 30 billion in 2023. Despite a mild contraction in 2024 after heavy investments in 2023, China's equipment spending is expected to continue growing.

Manufacturers should pay attention to these forecasts, especially regarding capacity expansions, new fab projects, and technological advancements driving investments in the semiconductor industry, particularly in regions such as China, Taiwan, and Korea. These trends can inform strategic decisions and resource allocations for manufacturers aiming to capitalize on the projected growth in the coming years.

Future of the Semiconductor Industry

The global semiconductor industry is amidst a transformative period marked by a convergence of challenges and opportunities that demand innovation and adaptability. In this article, we delve into seven pivotal trends shaping the trajectory of the semiconductor landscape, as identified by Capgemini. From supply chain resilience to the burgeoning influence of generative AI, each trend underscores the industry's imperative to evolve and thrive in an ever-changing world.

In the ever-evolving landscape of the semiconductor industry, building supply chain resilience emerges as a critical imperative to navigate through uncertainty and mitigate the impact of disruptions. Supply chain resilience entails the ability of semiconductor companies to anticipate, adapt to, and recover from unforeseen events while maintaining operational continuity and meeting customer demands.

- Understanding the Challenges

The semiconductor supply chain is intricate and global, involving numerous stakeholders across multiple stages of production and distribution. From raw material suppliers to semiconductor manufacturers and end-users, each link in the chain is susceptible to disruptions, whether due to natural disasters, geopolitical tensions, or unforeseen shifts in demand.

- Enhancing Transparency and Collaboration

To bolster supply chain resilience, semiconductor manufacturers must prioritize transparency and collaboration across the value chain. This entails fostering open lines of communication with suppliers, customers, and partners to facilitate real-time visibility into inventory levels, production capacities, and potential risks.

One avenue for semiconductor manufacturers to enhance supply chain resilience is through strategic partnerships and alliances. By forging collaborative relationships with key suppliers and customers, semiconductor companies can streamline communication channels, share insights, and jointly develop contingency plans to mitigate risks.

- Dual Sourcing and Diversification

Another strategy to enhance supply chain resilience involves dual sourcing and diversification. Semiconductor manufacturers can mitigate the risk of disruptions by sourcing critical components and materials from multiple suppliers or diversifying production facilities across different geographic regions. This approach reduces dependence on a single source and enhances flexibility to adapt to changing market conditions.

- Investing in Technology and Automation

Investing in technology and automation also plays a pivotal role in enhancing supply chain resilience. Leveraging advanced analytics, artificial intelligence, and predictive modeling enables semiconductor companies to proactively identify potential bottlenecks, optimize inventory management, and streamline production processes. Automation further enhances agility and responsiveness, allowing manufacturers to rapidly adjust production levels in response to fluctuating demand or supply chain disruptions.

- Risk Management and Contingency Planning

Effective risk management and contingency planning are essential components of supply chain resilience. Semiconductor manufacturers must conduct thorough risk assessments, identify potential vulnerabilities, and develop robust contingency plans to mitigate the impact of disruptions. This includes establishing alternative sourcing strategies, maintaining safety stock levels, and implementing agile supply chain processes to enable rapid response to unforeseen events.

- The Role of Collaboration in Supply Chain Resilience

Collaboration emerges as a cornerstone of supply chain resilience, enabling semiconductor manufacturers to leverage the collective expertise and resources of industry partners to navigate through challenges collectively. By fostering a culture of collaboration and information sharing, semiconductor companies can build agile and adaptive supply chains capable of withstanding disruptions and driving long-term sustainability and success in an increasingly dynamic and complex operating environment.

The semiconductor industry is undergoing a transformative shift towards sustainability, spurred by mounting environmental concerns and a recognition of the need for responsible business practices. This paradigm shift reflects a broader commitment to address pressing environmental challenges while driving innovation and growth.

- Charting Ambitious Sustainability Strategies

Semiconductor manufacturers are responding to these imperatives by developing and implementing ambitious sustainability strategies. These strategies encompass a range of initiatives aimed at reducing environmental impact and fostering sustainable innovation.

- Energy Efficiency and Carbon Reduction

Energy efficiency is a cornerstone of sustainability efforts within the semiconductor industry. Manufacturers are investing in renewable energy sources and optimizing manufacturing processes to minimize carbon emissions. By embracing renewable energy technologies such as solar and wind power, semiconductor companies are not only reducing their carbon footprint but also contributing to a more sustainable energy future.

- Product Innovation for Sustainability

Innovation plays a key role in driving sustainability within the semiconductor industry. Manufacturers are developing products that prioritize energy efficiency, reduce power consumption, and minimize carbon footprints. This includes the development of energy-efficient chips, power management solutions, and eco-friendly materials to meet the growing demand for sustainable electronics.

- Circular Economy Practices

Semiconductor companies are embracing the principles of the circular economy to minimize waste and maximize resource efficiency. This involves implementing recycling and reuse programs, designing products for disassembly and recyclability, and adopting closed-loop manufacturing processes. By promoting waste reduction and resource optimization, semiconductor manufacturers are contributing to a more sustainable and circular economy.

- Sustainable Supply Chain Management

Collaboration with suppliers is essential to promote sustainability throughout the semiconductor supply chain. Manufacturers are establishing sustainable procurement practices, assessing supplier sustainability performance, and sourcing materials from ethical and environmentally responsible suppliers. By fostering collaboration and transparency, semiconductor companies are driving positive environmental impact across the industry value chain.

- How Semiconductor Manufacturers Can Contribute

Semiconductor manufacturers play a crucial role in driving sustainability across the industry. They can contribute to sustainability efforts by investing in research and development, collaborating with industry partners, advocating for policy change, and promoting transparency and accountability. By embracing sustainability as a core business principle, semiconductor companies can drive positive environmental impact, foster responsible practices, and contribute to a more sustainable future for the industry and society as a whole.

Generative AI emerges as a transformative force with far-reaching implications across industries, promising to redefine traditional paradigms and unlock new avenues of innovation. Positioned at the forefront of this revolution, the semiconductor industry assumes a pivotal role in enabling the proliferation of generative AI applications. From optimizing manufacturing processes to enhancing design capabilities, the integration of AI promises to reshape industry dynamics and drive unprecedented levels of efficiency and productivity.

Digital twin technology stands poised to revolutionize the semiconductor landscape, offering a simulation-driven approach to enhance operational efficiency and accelerate innovation. By creating virtual replicas of fabrication facilities and processes, semiconductor companies can harness the power of data-driven insights to optimize performance and mitigate risks. From device-scale twins to process-scale simulations, the integration of digital twin technology heralds a new era of scalability and agility within the industry.

The digital twin market has witnessed substantial growth in recent years owing to the rising adoption of developing technologies such as IoT and cloud. Adding to this, the growing adoption of Industry 4.0 will further accelerate the growth of the market. According to the Data Bridge Market Research analysis, the digital twin market is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2029.

To learn more about the study, visit: https://www.databridgemarketresearch.com/reports/global-digital-twin-market

The automotive sector emerges as a pivotal driver of change within the semiconductor industry, characterized by burgeoning demand and evolving priorities. Against the backdrop of past chip shortages, semiconductor manufacturers are compelled to recalibrate their strategies to align with the dynamic automotive ecosystem. Collaborative endeavors between semiconductor and automotive entities are essential to foster innovation and ensure the seamless integration of advanced technologies into next-generation vehicles.

The automotive semiconductor market has witnessed a substantial growth in recent years owing to growing road fatalities is creating a need for advanced safety features. Adding to this, electric and hybrid vehicles are becoming increasingly popular around the world which will further accelerate the growth of the market. According to the Data Bridge Market Research analysis, the automotive semiconductor market is projected to grow at a compound annual growth rate (CAGR) of 11.93% from 2022 to 2029.

To learn more about the study, visit: https://www.databridgemarketresearch.com/reports/global-automotive-semiconductor-market

Geo-political tensions cast a shadow of uncertainty over the semiconductor landscape, accentuating the need for strategic foresight and resilience. With a significant proportion of chip production concentrated in geopolitically sensitive regions, industry players must navigate divergent national approaches and mitigate associated risks. Initiatives such as the US CHIPS Act and the European Chips Act underscore governments' recognition of the semiconductor industry's strategic importance, signaling a concerted effort to bolster domestic production capabilities and diversify supply chains.

Diversity and inclusion emerge as paramount considerations within the semiconductor industry, with a growing consensus on the imperative of nurturing a diverse workforce. Initiatives aimed at fostering inclusivity and expanding access to opportunities resonate across industry stakeholders, underscoring the importance of equitable representation and leadership diversity. By cultivating partnerships with educational institutions and prioritizing workforce development programs, semiconductor companies are poised to usher in a new era of inclusivity and innovation.

Conclusion

The semiconductor industry stands at a pivotal juncture where strategic partnerships and enhanced process maturity are imperative for fostering resilience and facilitating seamless transitions between industries. This white paper has elucidated the critical importance of adaptability and collaboration in navigating the complexities and uncertainties inherent in the semiconductor landscape.

By forging strategic partnerships, semiconductor companies can leverage synergies, pool resources, and access complementary expertise to strengthen their competitive position. Collaborative ventures enable the sharing of risks and rewards, facilitating innovation, and accelerating time-to-market for new products and technologies. Moreover, partnerships foster resilience by diversifying revenue streams and mitigating the impact of market fluctuations and disruptions.

Process maturity plays a central role in enhancing operational efficiency, product quality, and customer satisfaction. By implementing robust processes and best practices, semiconductor manufacturers can streamline operations, minimize waste, and optimize resource utilization. A mature process framework enables proactive risk management, agility, and scalability, thereby enabling companies to adapt swiftly to changing market dynamics and customer requirements.

The ability to pivot between industries is becoming increasingly crucial in todays interconnected and rapidly evolving global economy. Semiconductor companies can capitalize on their core competencies and technological prowess to serve diverse markets beyond traditional electronics, including automotive, healthcare, aerospace, and renewable energy. By fostering a culture of innovation and cross-disciplinary collaboration, manufacturers can identify new opportunities, address emerging challenges, and drive sustainable growth across multiple sectors.

Inter-industry cooperation holds immense potential for driving collective progress and addressing shared challenges such as supply chain disruptions, geopolitical tensions, and environmental sustainability. By fostering open dialogue, knowledge sharing, and pre-competitive collaboration, semiconductor companies can drive industry-wide standards, promote interoperability, and accelerate the adoption of transformative technologies such as artificial intelligence, the Internet of Things, and 5G.

The semiconductor industry must embrace a paradigm shift towards collaboration, resilience, and process maturity to thrive in an increasingly complex and volatile business environment. By cultivating strategic partnerships, enhancing process maturity, and embracing inter-industry cooperation, manufacturers can position themselves for sustained success and unlock new avenues for growth and innovation. The journey toward resilience and industry leadership requires a collective commitment to continuous improvement, agility, and collaboration across the semiconductor ecosystem.