North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

366.03 Billion

USD

437.01 Billion

2024

2032

USD

366.03 Billion

USD

437.01 Billion

2024

2032

| 2025 –2032 | |

| USD 366.03 Billion | |

| USD 437.01 Billion | |

|

|

|

|

تجزئة سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا، حسب النوع (سكر طبيعي ومحليات)، شكل المنتج (سائل، بلوري، ومسحوق)، المصدر (فواكه، ألبان، ونباتي)، الاستخدام (مخابز، حلويات، حلويات مجمدة، أغذية مصنعة، حليب أطفال، مشروبات، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق السكر والمحليات الصناعية في ولايات كارولينا الشمالية وكارولينا الجنوبية وفيرجينيا

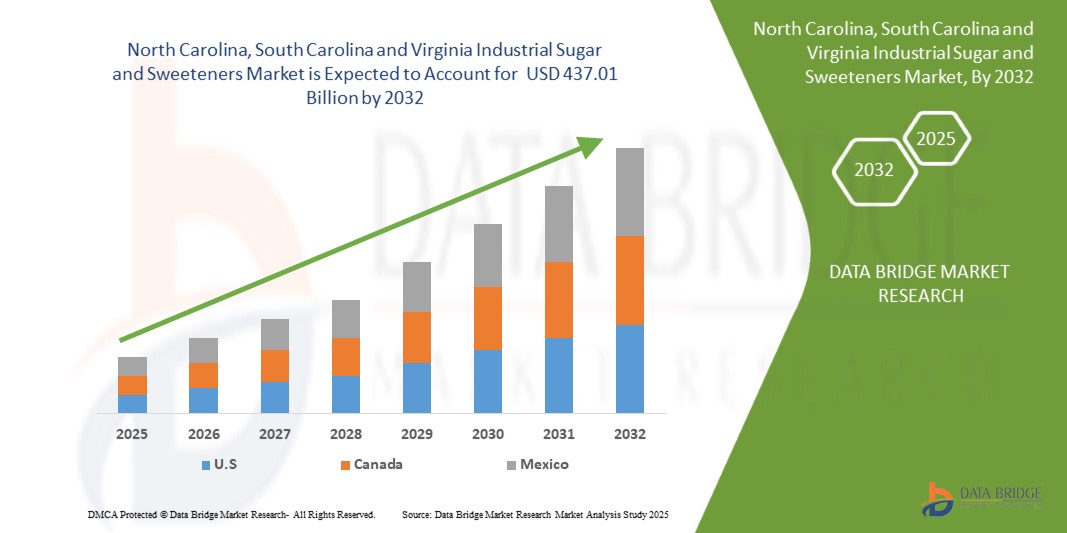

- تم تقييم حجم سوق السكر والمحليات الصناعية في ولاية كارولينا الشمالية وكارولينا الجنوبية وفيرجينيا بـ 366.03 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 437.01 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 2.24٪ خلال الفترة المتوقعة

- يُعزى نمو السوق بشكل كبير إلى تفضيل المستهلكين المتزايد للمحليات الصحية منخفضة السعرات الحرارية والطبيعية، بالإضافة إلى تزايد الوعي بالآثار الصحية للإفراط في استهلاك السكر. يبتكر المصنعون بدائل نباتية وطبيعية للسكر، مما يُتيح تنويع المنتجات في تطبيقات المخابز والمشروبات والحلويات والأطعمة المصنعة.

- علاوة على ذلك، يُسهم الطلب المتزايد على المنتجات ذات العلامات التجارية النظيفة والدعم التنظيمي للمُحليات الطبيعية في تعزيز اعتمادها في الأسواق العالمية. تُسرّع هذه العوامل المتقاربة من استخدام السكر والمُحليات الصناعية، مما يُعزز نمو هذه الصناعة بشكل كبير.

تحليل سوق السكر والمحليات الصناعية في ولايات كارولينا الشمالية وكارولينا الجنوبية وفيرجينيا

- يشمل السكر والمحليات الصناعية مجموعة متنوعة من المكونات الطبيعية والصناعية المستخدمة لإضفاء الحلاوة والملمس والخصائص الوظيفية على منتجات الأغذية والمشروبات. وتشمل هذه المنتجات أشكالاً سائلة وبلورية ومسحوقة، مستخلصة من الفواكه ومنتجات الألبان والنباتات، وتُستخدم في تطبيقات متنوعة مثل المخبوزات والمشروبات والحلويات والحلويات المجمدة وحليب الأطفال والأطعمة المصنعة.

- يُعزى الطلب المتزايد على السكر والمُحليات الصناعية بشكل رئيسي إلى التحول نحو أنظمة غذائية صحية، والابتكار في بدائل السكر، وتزايد استهلاك الأطعمة الجاهزة والمصنعة عالميًا. ويعتمد المصنعون بشكل متزايد على تقنيات معالجة متقدمة لتحسين المذاق، وقابلية الذوبان، والوظائف، لتلبية الاحتياجات المتطورة للمستهلكين وصناعة الأغذية.

- هيمن قطاع السكر الطبيعي على السوق بحصة سوقية بلغت 62.5% في عام 2024، وذلك بفضل تفضيل المستهلكين المتزايد للمكونات النظيفة والصحية. ويستفيد المصنعون من السكريات الطبيعية لتلبية الطلب المتزايد على المنتجات قليلة الإضافات الصناعية، كما أن الدعم التنظيمي للمحليات الطبيعية يعزز من اعتمادها. تُستخدم السكريات الطبيعية على نطاق واسع في تطبيقات المخابز والحلويات والمشروبات نظرًا لفوائدها الغذائية الملحوظة، وتعدد استخداماتها، وتوافقها مع عمليات الإنتاج الحالية. كما يستفيد هذا القطاع من الاستثمارات القوية في ابتكار المنتجات، والوعي المتزايد بالآثار الصحية السلبية للمحليات الصناعية، مما يعزز هيمنته على السوق.

نطاق التقرير وتقسيم سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية وكارولاينا الجنوبية وفرجينيا

|

صفات |

رؤى رئيسية حول سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية وكارولاينا الجنوبية وفيرجينيا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية وكارولاينا الجنوبية وفيرجينيا

صناعة الأغذية والمشروبات سريعة النمو

- يُعد التوسع القوي في صناعة الأغذية والمشروبات اتجاهًا رئيسيًا يُغذي الطلب على السكر والمُحليات الصناعية. ومع توجه المستهلكين المتزايد نحو المنتجات الغذائية المُعبأة والجاهزة للأكل والوظيفية، يُعد السكر والمُحليات مكونات أساسية لتحسين الطعم وإطالة مدة الصلاحية واستقرار التركيبة في فئات مُتعددة.

- على سبيل المثال، تواصل شركة كارغيل توسيع محفظة مُحلياتها لتلبية احتياجات شركات المشروبات ومُصنّعي الحلويات. وبالمثل، تُقدّم شركة تيت آند لايل مجموعة من السكريات التقليدية والمُحليات المتخصصة التي تُلبّي الحاجة المُتزايدة لتوازن النكهات والتحكم في السعرات الحرارية في مُختلف منتجات الأطعمة والمشروبات.

- يُبرز الاستخدام الواسع للسكر والمُحليات الصناعية في المخابز والحلويات والمشروبات الغازية ومنتجات الألبان والأغذية المُصنّعة دورها كمُضافات غذائية أساسية. فقدرتها على توفير مذاق وملمس وكثافة مُتناسقة تجعلها جزءًا لا يتجزأ من احتياجات الإنتاج الضخم لمُصنّعي الأغذية العالميين.

- يُسهم نمو الأسواق الناشئة ذات الكثافة السكانية المتسارعة في هذا الاتجاه. فارتفاع مستويات الدخل المتاح وتغير العادات الغذائية يُعززان استهلاك الوجبات الخفيفة وحبوب الإفطار والمشروبات الغازية والأطعمة المجمدة، مما يُؤدي إلى زيادة الاعتماد على السكر والمُحليات.

- يُنوّع المُصنّعون أيضًا عروضهم لمواكبة تفضيلات المستهلكين المُتغيّرة والضغوط التنظيمية. يُعيد الطلب المتزايد على البدائل غير الغذائية، مثل ستيفيا ومستخلصات فاكهة الراهب والبوليولات، تشكيل السوق إلى جانب السكر التقليدي، مما يضمن توافر الحلول للمستهلكين العاديين والمهتمين بالصحة على حدٍ سواء.

- في الختام، يُسهم النمو السريع لصناعة الأغذية والمشروبات بشكل مباشر في توسع سوق السكر والمُحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا. ويؤكد هذا التوجه الدور الأساسي لهذه المكونات في ضمان الطعم والجودة والابتكار عبر مجموعة واسعة من تطبيقات الأغذية عالميًا.

ديناميكيات سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية وكارولاينا الجنوبية وفيرجينيا

سائق

تزايد الطلب على الأغذية المصنعة المعبأة والمنتجات المتخصصة

- يُعدّ تفضيل المستهلكين المتزايد للأطعمة المُعالَجة المُصنّعة والمنتجات الغذائية المُتخصصة عاملاً رئيسياً في سوق السكر والمُحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا. تُشجّع أنماط الحياة المُزدحمة والتوسّع الحضري المُتزايد على الاعتماد بشكل أكبر على الأطعمة الجاهزة المُعالَجة التي تعتمد على السكر والمُحليات من أجل النكهة والثبات والحفظ.

- على سبيل المثال، تُوفر شركة آرتشر دانيلز ميدلاند (ADM) مجموعة واسعة من مكونات السكر والمُحليات لكبار مُصنّعي الوجبات الخفيفة والمشروبات، مما يدعم إنتاج الأغذية المُعبأة على نطاق واسع. يُبرز تطوير منتجات الشركة العلاقة الوثيقة بين الأطعمة المُصنّعة والطلب المُستمر على المُحليات.

- يلعب السكر والمحليات الصناعية دورًا محوريًا في تعزيز جاذبية المنتجات في المخبوزات والحلويات والمشروبات الغازية ومشروبات الطاقة والحبوب سريعة التحضير. كما تعتمد المنتجات المتخصصة، مثل مخفوقات البروتين والمكملات الغذائية والمشروبات الوظيفية، بشكل كبير على المحليات البديلة لتحقيق التوازن في الطعم دون الإفراط في تناول السعرات الحرارية.

- لقد عزز الابتكار المستمر في فئات الأغذية المعبأة، بما في ذلك الأطعمة النباتية والوجبات الخفيفة المدعمة والمشروبات الخالية من السكر، الحاجة إلى حلول مُحليات متعددة الاستخدامات. ويضمن هذا المحرك بقاء السكر والمحليات البديلة جزءًا لا يتجزأ من خطط البحث والتطوير في شركات الأغذية والمشروبات العالمية.

- في الختام، يُعزز الارتفاع المطرد في الطلب على المنتجات المُصنّعة والمتخصصة صناعة السكر والمُحليات الصناعية كحلقة وصل حيوية في دعم شرائح المستهلكين المتنوعة. ويضمن هذا المحرك استمرار توسع الطلب على فئات الأغذية التقليدية والناشئة حول العالم.

ضبط النفس/التحدي

المخاطر الصحية للإفراط في تناول السكر

- من أبرز التحديات التي تواجه سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا تزايد الوعي بالمخاطر الصحية المرتبطة بالإفراط في استهلاك السكر. فالأنظمة الغذائية الغنية بالسكريات المكررة ترتبط ارتباطًا وثيقًا بمشكلات صحية، بما في ذلك السمنة، وداء السكري من النوع الثاني، وأمراض القلب والأوعية الدموية، ومشاكل الأسنان، مما يخلق مقاومة متزايدة بين المستهلكين والجهات التنظيمية.

- على سبيل المثال، فرضت حكومات في مناطق مثل المملكة المتحدة والمكسيك ضرائب على السكر في المشروبات المُحلاة للحد من الاستهلاك المفرط وتشجيع عادات غذائية صحية. وخفضت شركات المشروبات الكبرى، مثل كوكاكولا وبيبسيكو، نسبة السكر في العديد من منتجاتها تماشيًا مع سياسات الصحة العامة وتغير توقعات المستهلكين.

- يؤثر التحول نحو الأنظمة الغذائية الصحية سلبًا على استهلاك الأطعمة المصنعة عالية السكر، مما يؤدي إلى انخفاض الطلب على بعض الفئات، مثل المشروبات الغازية والحلويات التقليدية. في الوقت نفسه، يتجه المستهلكون بشكل متزايد إلى بدائل المُحليات الطبيعية منخفضة السعرات الحرارية، مما يزيد من الضغوط التنافسية على مُصنّعي السكر التقليديين.

- تُشكّل القيود التنظيمية ومتطلبات وضع العلامات الإلزامية تحدياتٍ لشركات الأغذية والمشروبات. فالإفصاح الشفاف عن محتوى السكر، وقلق المستهلكين بشأن السكريات المخفية في الأطعمة المعبأة، يُعيدان تشكيل سلوك الشراء، ويضغطان على الشركات لإعادة صياغة منتجاتها.

- نتيجةً لذلك، لا تزال المخاطر الصحية المرتبطة بالإفراط في استهلاك السكر تُشكّل عائقًا كبيرًا أمام هذه الصناعة. ويعتمد التغلب على هذا التحدي على الابتكار الاستراتيجي في تقنيات تقليل استهلاك السكر، وزيادة استخدام المُحليات الطبيعية، وتحقيق التوازن بين طلب المستهلكين على المذاق والاعتبارات التنظيمية والصحية.

نطاق سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية وكارولاينا الجنوبية وفيرجينيا

يتم تقسيم السوق على أساس النوع وشكل المنتج والمصدر والتطبيق.

• حسب النوع

بناءً على النوع، يُقسّم سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا إلى سكر طبيعي ومحليات. وقد هيمن قطاع السكر الطبيعي على أكبر حصة من إيرادات السوق بنسبة 62.5% في عام 2024، مدفوعًا بتزايد تفضيل المستهلكين للمكونات النظيفة والصحية. ويستفيد المصنعون من السكريات الطبيعية لتلبية الطلب المتزايد على المنتجات قليلة الإضافات الصناعية، كما أن الدعم التنظيمي للمحليات الطبيعية يعزز من اعتمادها. تُستخدم السكريات الطبيعية على نطاق واسع في تطبيقات المخابز والحلويات والمشروبات نظرًا لفوائدها الغذائية الملحوظة، وتعدد استخداماتها، وتوافقها مع عمليات الإنتاج الحالية. كما يستفيد هذا القطاع من الاستثمارات القوية في ابتكار المنتجات والوعي المتزايد بالآثار الصحية السلبية للمحليات الصناعية، مما يعزز هيمنته على السوق.

من المتوقع أن يشهد قطاع المُحليات أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد الطلب على البدائل منخفضة السعرات الحرارية والمناسبة لمرضى السكري. وتُسهم الابتكارات في المُحليات الطبيعية والنباتية، إلى جانب دمجها في الأطعمة والمشروبات الوظيفية، في زيادة الإقبال عليها. ويتزايد بحث المستهلكين عن بدائل تُضفي حلاوةً دون إضافة سعرات حرارية زائدة أو التأثير على مستويات السكر في الدم. ويدعم نمو هذا القطاع البحث والتطوير المستمر في تحسين النكهة واستقرار التركيبة، مما يُمكّن المُصنّعين من استبدال السكريات التقليدية دون المساس بجودة المنتج.

• حسب شكل المنتج

بناءً على شكل المنتج، يُقسّم سوق السكر والمُحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا إلى أنواع سائلة، وبلورية، ومسحوقة. وقد استحوذ قطاع السكر البلوري على أكبر حصة من إيرادات السوق في عام 2024، نظرًا لاستخدامه الواسع في منتجات المخابز والحلويات والأغذية المصنعة. يتميز السكر البلوري بثبات حلاوته، وسهولة التعامل معه، وطول مدة صلاحيته، مما يجعله مثاليًا للتطبيقات الصناعية واسعة النطاق. كما يُفضل المُصنّعون الأشكال البلورية نظرًا لتوافقها مع معدات المعالجة الآلية، مما يُقلل من التحديات التشغيلية. وقد عزز الطلب القوي من الأسواق التقليدية والناشئة، إلى جانب تزايد وعي المستهلكين بخيارات السكر البلوري الطبيعي، هيمنة هذا القطاع.

من المتوقع أن يشهد قطاع السوائل أسرع معدل نمو سنوي مركب بين عامي 2025 و2032، مدفوعًا باعتماده المتزايد في تطبيقات المشروبات والصلصات والأطعمة المصنعة. تتميز السكريات والمحليات السائلة بسهولة المزج، وتوزيع الحلاوة بشكل متساوٍ، وذوبان أفضل، مما يجعلها جذابة للغاية للاستخدام الصناعي. ويساهم الطلب المتزايد على المشروبات الجاهزة للشرب والمشروبات الوظيفية، إلى جانب الابتكارات في مجال المحليات الطبيعية السائلة، في دفع عجلة النمو. بالإضافة إلى ذلك، تساعد المحليات السائلة المصنّعين على تقليل وقت المعالجة وتكاليف الطاقة، مما يعزز شعبيتها.

• حسب المصدر

بناءً على المصدر، يُقسّم سوق السكر والمحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا إلى فواكه، ومنتجات ألبان، ونباتية. وقد هيمن قطاع المنتجات النباتية على السوق في عام 2024، مدفوعًا بالطلب المتزايد على المكونات النباتية المستدامة والصحية. وتُفضّل المحليات النباتية، مثل ستيفيا، وأغاف، وفاكهة الراهب، نظرًا لأصلها الطبيعي، وانخفاض مؤشرها الجلايسيمي، وتوافقها مع مختلف التطبيقات. ويركز المصنعون على دمج المصادر النباتية في منتجات المخابز والحلويات والمشروبات لتلبية توجّه المستهلكين المتزايد نحو المنتجات النظيفة والمستدامة بيئيًا. ويدعم نمو هذا القطاع الموافقات التنظيمية والاستثمارات القوية في ابتكار المنتجات النباتية.

من المتوقع أن يشهد قطاع منتجات الألبان أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد الطلب على المُحليات الوظيفية القائمة على اللاكتوز في حليب الأطفال، والحلويات المجمدة، والأطعمة المصنعة المتخصصة. تتميز السكريات المصنوعة من الألبان بخصائص وظيفية فريدة، مثل التسمير، والاحتفاظ بالرطوبة، وتحسين الملمس، مما يجعلها مناسبة جدًا للتطبيقات الصناعية. ويساهم التطور في تقنيات تصنيع الألبان، وتزايد تفضيل المستهلكين للمكونات الطبيعية، في تسريع تبني هذا القطاع.

• حسب الطلب

بناءً على التطبيق، يُقسّم سوق السكر والمُحليات الصناعية في ولايات كارولاينا الشمالية والجنوبية وفرجينيا إلى المخابز، والحلويات، والحلويات المجمدة، والأغذية المُصنّعة، وحليب الأطفال، والمشروبات، وغيرها. وقد هيمن قطاع المخابز على أكبر حصة من إيرادات السوق في عام 2024، مدفوعًا بالطلب المستمر على الخبز والكعك والمعجنات. يُعدّ السكر والمُحليات الصناعية عنصرًا أساسيًا في تحسين قوام ونكهة ومدة صلاحية منتجات المخابز، ويزداد تفضيل المُصنّعين للمُحليات الطبيعية والوظيفية لتلبية احتياجات المستهلكين المهتمين بالصحة. كما يستفيد هذا القطاع من التوسع الحضري المتزايد، وارتفاع الدخل المتاح، وتوسع سلاسل المخابز، مما يُسرّع من اعتماد منتجات السكر والمُحليات عالية الجودة.

من المتوقع أن يشهد قطاع المشروبات أسرع معدل نمو سنوي مركب بين عامي 2025 و2032، مدفوعًا بتزايد استهلاك المشروبات الجاهزة للشرب، ومشروبات الطاقة، والمياه المنكهة، والمشروبات الوظيفية. ويتزايد استخدام مُصنّعي المشروبات للمُحليات الطبيعية منخفضة السعرات الحرارية لمعالجة المشاكل الصحية مع الحفاظ على مذاق وجاذبية المنتج. وتُعدّ الابتكارات في المُحليات السائلة، وسهولة تركيبها، وتزايد طلب المستهلكين على بدائل السكر في المشروبات الباردة والساخنة، عوامل رئيسية تُسهم في النمو السريع لهذا القطاع.

حصة سوق السكر والمحليات الصناعية في ولايات كارولينا الشمالية وكارولينا الجنوبية وفيرجينيا

وتقود صناعة السكر والمحليات الصناعية في المقام الأول شركات راسخة، بما في ذلك:

- ADM (الولايات المتحدة)

- شركة سودزوكر أيه جي (ألمانيا)

- شركة كارغيل، المحدودة (الولايات المتحدة)

- شركة النكهات والعطور الدولية (الولايات المتحدة)

- إنجريديون (الولايات المتحدة)

- شركة ويلمار الدولية المحدودة (سنغافورة)

- مكونات طبيعية من شركة Layn (الصين)

- شركة سويجين (الولايات المتحدة)

- إمبريال شوجر (الولايات المتحدة)

- هاوتيان (الصين)

- بيور (الولايات المتحدة)

أحدث التطورات في سوق السكر والمحليات الصناعية في ولايات كارولينا الشمالية والجنوبية وفرجينيا

- في أبريل 2024، طرحت إنجريديون مُحلّي ستيفيا رائدًا تفوّق على المنتجات المنافسة في اختبارات تذوق المستهلكين. يُوفّر هذا المُحلّي الجديد لمُصنّعي الأغذية والمشروبات خيارًا مُتميّزًا لتقليل السكر، مما يُمكّنهم من تلبية الطلب المُتزايد من المستهلكين على منتجات صحية أقلّ سكرًا. من خلال الحفاظ على مذاق ممتاز وعلامة تجارية نظيفة، يُعزّز ابتكار إنجريديون مكانتها في سوق المُحلّيات الطبيعية، ويدعم نموّ تطبيقاتها في المخابز والمشروبات والأطعمة المُصنّعة. يُعزّز هذا التطوير توجّهات الصناعة نحو استخدام مُكوّنات وظيفية وصحية.

- في يناير 2024، أطلقت شركة كارغيل مُحلي ستيفيا "إيفر سويت"، مستفيدةً من عملية تخمير خاصة لتحسين المذاق مع الحفاظ على أصله الطبيعي. يُعالج هذا التطور تحديًا رئيسيًا في قطاع ستيفيا، وهو الطعم المر، مما يُمكّن المُصنّعين من تقديم منتجات حلوة بنكهة أنقى. من خلال تعزيز تنوع المنتجات في تطبيقات الأغذية والمشروبات، يُمكّن "إيفر سويت" كارغيل من الاستفادة من الطلب المتزايد على المُحليات الطبيعية منخفضة السعرات الحرارية، مما يُوسّع نطاق نفوذها في السوق.

- في أغسطس 2024، حصلت شركة ADM على جائزة الريادة في الاستدامة لعام 2024 من مجموعة Business Intelligence Group. يُبرز هذا التكريم التزام ADM الاستراتيجي بالممارسات والابتكارات المستدامة، مما يعزز سمعتها كشركة رائدة في سوق إنتاج السكر والمُحليات المسؤولة بيئيًا واجتماعيًا. ومن المرجح أن يُعزز هذا التكريم قيمة علامة ADM التجارية وتأثيرها، لا سيما بين المستهلكين المهتمين بالصحة والاستدامة، مما يُعزز اعتماد منتجاتها في الأسواق العالمية.

- في أبريل 2023، كشفت شركة SweeGen, Inc. عن نكهات Sweetensify، وهي أداة جديدة لمصنعي الأغذية والمشروبات مصممة لإنتاج منتجات صحية قليلة السكر. بفضل تقنية بروتينات حلوة جديدة، بما في ذلك البرازين والثوماتين II، يُحسّن Sweetensify الحلاوة ويُعدّلها لمحاكاة مذاق السكر. يُوسّع هذا الابتكار آفاق سوق المُحليات الوظيفية والطبيعية، مما يسمح للمصنعين بتطوير منتجات تُلبي طلب المستهلكين على خيارات صحية دون المساس بالنكهة.

- في مارس 2022، أطلقت شركة كارغيل منصة EverSweet ClearFlo، وهي خط مُحليات قائم على ستيفيا، مُصمم خصيصًا لمذاق أنقى وتعدد استخدامات مُحسّن في تطبيقات الأغذية والمشروبات. باستخدام عملية تخمير خاصة لتحسين جليكوسيدات ستيفيول، تُقدم المنصة للمُصنّعين حلاً عمليًا لتقليل السكر مع الحفاظ على الحلاوة وجاذبية المذاق. عزز هذا التطور مكانة كارغيل التنافسية في سوق المُحليات الطبيعية، مُلبيًا بذلك التحول العالمي المُتزايد نحو المنتجات منخفضة السعرات الحرارية والمُوجهة نحو الصحة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.