سوق الحليب النباتي في أمريكا الشمالية، حسب النوع (حليب اللوز، حليب جوز الهند، حليب الكاجو، حليب الجوز، حليب البندق، حليب الصويا، حليب الشوفان، حليب الأرز، حليب الكتان، وغيرها)، نوع المنتج (الحليب المبرد والحليب المستقر على الرف)، الفئة (العضوي والتقليدي)، التركيبة (المحلاة وغير المحلاة)، النكهة (الأصلية / غير المنكهة، الفانيليا، الشوكولاتة، العسل، مزيج جوز الهند، مزيج البندق، الكراميل، القيقب، القهوة، وغيرها)، التحصين (العادي والمحصن)، الطبيعة (المعدلة وراثيا وغير المعدلة وراثيا)، الادعاء (العادي، الخالي من الغلوتين، الخالي من المكسرات، الخالي من الصويا، المواد الحافظة الاصطناعية والألوان، وغيرها)، حجم العبوة (أقل من 100 مل، 110 مل، 250 مل، 500 مل، 1000 مل، وأكثر من 1000 مل)، نوع العبوة (عبوات رباعية، زجاجات، وعلب)، وقناة التوزيع (تجار التجزئة المعتمدين على المتاجر وتجار التجزئة غير المعتمدين على المتاجر) - اتجاهات الصناعة وتوقعاتها حتى عام 2030.

تحليل وحجم سوق الحليب النباتي في أمريكا الشمالية

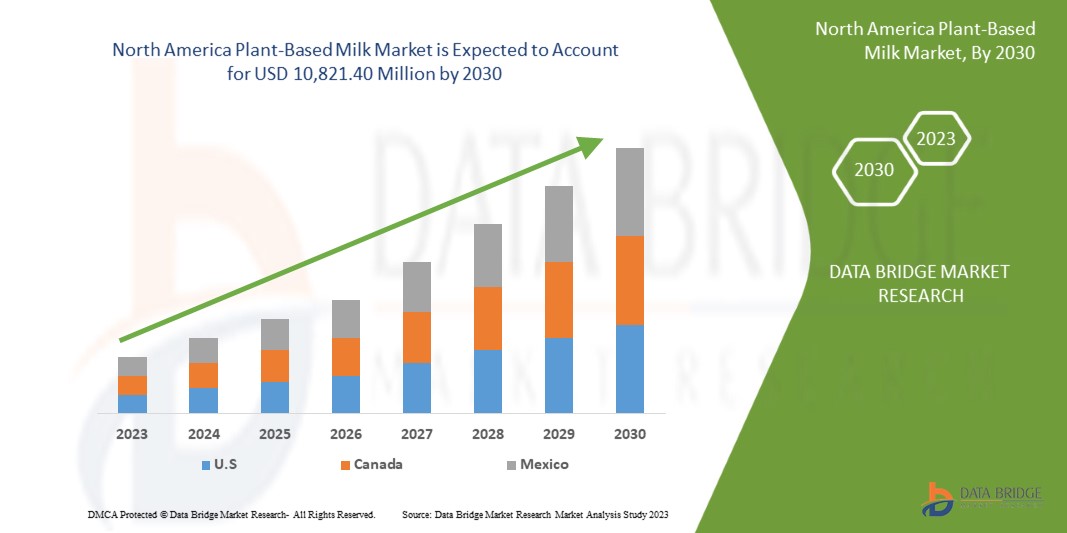

من المتوقع أن ينمو سوق الحليب النباتي في أمريكا الشمالية بشكل كبير في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 12.0٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 10،821.40 مليون دولار أمريكي بحلول عام 2030. الزيادة في عدد السكان النباتيين في جميع أنحاء العالم هي العامل الرئيسي الذي يغذي توسع سوق الحليب النباتي.

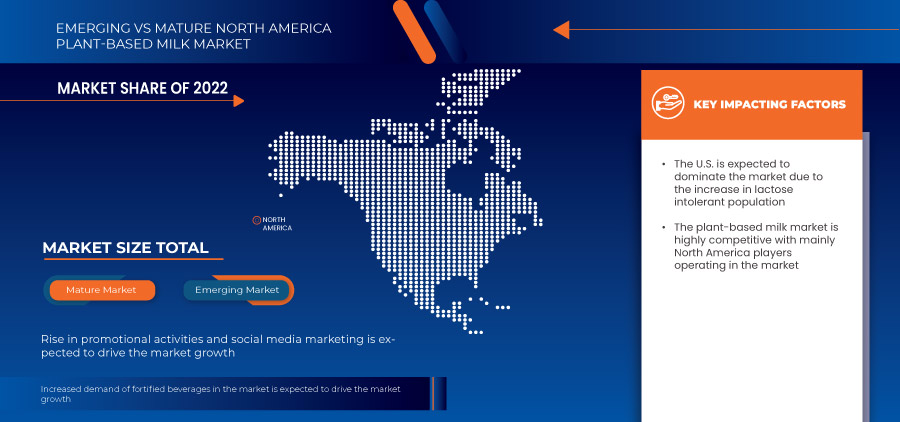

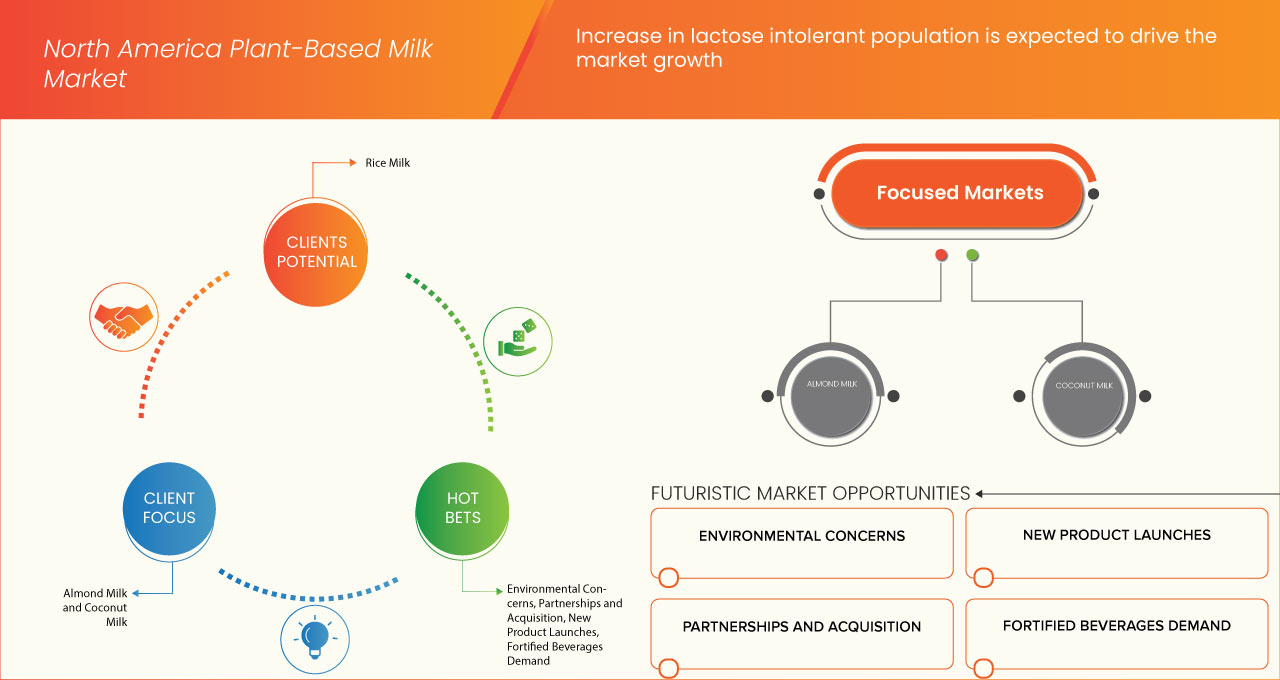

إن توافر مجموعة أوسع من منتجات الحليب النباتية هو المحرك لتوسع السوق. بالإضافة إلى ذلك، يتأثر السوق أيضًا بزيادة عدد السكان الذين يعانون من عدم تحمل اللاكتوز. علاوة على ذلك، أدى ارتفاع الأنشطة الترويجية والتسويق عبر وسائل التواصل الاجتماعي للحليب النباتي إلى تعزيز السوق. بالإضافة إلى التوسعات، فتح البحث والتطوير وتحديث المنتجات النباتية في السوق المزيد من إمكانات الأعمال للحليب النباتي.

يقدم تقرير سوق الحليب النباتي في أمريكا الشمالية تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب النوع ( حليب اللوز ، حليب جوز الهند، حليب الكاجو ، حليب الجوز، حليب البندق، حليب الصويا ، حليب الشوفان ، حليب الأرز، حليب الكتان، وغيرها)، نوع المنتج (حليب مبرد وحليب صالح للتخزين على الرف)، الفئة (عضوي وتقليدي)، التركيبة (محلية وغير محلاة)، النكهة (أصلية/غير منكهة، فانيليا، شوكولاتة، عسل، مزيج جوز الهند، مزيج البندق، كراميل، القيقب، قهوة، وغيرها)، التحصين (عادي ومحصن)، الطبيعة (معدلة وراثيًا وغير معدلة وراثيًا)، الادعاء (عادي، خالٍ من الغلوتين، خالٍ من المكسرات، خالٍ من الصويا، مواد حافظة صناعية وخالية من الألوان، وغيرها)، حجم العبوة (أقل من 100 مل، 110 مل، 250 مل، 500 مل، 1000 مل، وأكثر من 1000 مل)، نوع العبوة (عبوات رباعية، زجاجات، وعلب)، وقناة التوزيع (على أساس المتجر) تجار التجزئة وتجار التجزئة غير المعتمدين على المتاجر) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

Silk، وAlpro، وTHE HAIN CELESTIAL GROUP، INC.، وSUNOPTA GRAINS AND FOODS INC.، وCalifia Farms، LLC، وNotCo، وYEO HIAP SENG LTD.، وnatur-a، وOatly Inc.، وElmhurst Milked Direct LLC، وManitoba Milling Company، وHP Hood LLC، وغيرها |

تعريف السوق

الحليب النباتي هو مشروب مصنوع من نباتات تشبه الحليب في مظهرها. الحليب النباتي هو مشروب غير ألباني منكه ومعطر بمستخلصات نباتية مائية. يتم استهلاك الحليب النباتي كبديل نباتي لحليب الألبان. يتميز الحليب النباتي بقوام كريمي عند مقارنته بحليب الألبان. لإنتاج الحليب النباتي، يتم استخدام نباتات مختلفة. من بين أكثر أنواع الحليب النباتي شيوعًا على مستوى العالم حليب اللوز والشوفان وفول الصويا وجوز الهند والكاجو. منذ العصور القديمة، شرب الناس المشروبات المصنوعة من النباتات.

ديناميكيات سوق الحليب النباتي في أمريكا الشمالية

سائق

- زيادة في عدد السكان النباتيين حول العالم

لقد زاد سوق النباتيين بشكل كبير على مدى السنوات العشر الماضية، مما جعل المزيد من الناس يتجهون إلى الأنظمة الغذائية القائمة على النباتات كل عام. وقد أدى الوعي الصحي المتزايد إلى زيادة الطلب على الأطعمة الطبيعية والعضوية. وقد دفع هذا جزءًا كبيرًا من السكان إلى تغيير نمط حياتهم ونظامهم الغذائي بشكل جذري. يركز مجتمع النباتيين على تناول الأطعمة التي تحتوي على مكونات أو مكونات أخرى تأتي من النباتات. يتم تقليل خطر الإصابة بالعديد من الأمراض، مثل أمراض القلب ومرض السكري من النوع 2 وارتفاع ضغط الدم وأنواع معينة من السرطان والسمنة، من خلال اتباع أنظمة غذائية نباتية مخططة بشكل صحيح، وفقًا لأكاديمية التغذية وعلم التغذية. ونتيجة لذلك، بدأ بعض هؤلاء العملاء النباتيين أو النباتيين الصرف في الاهتمام بالحليب النباتي في نظامهم الغذائي اليومي

وبالتالي، فإن النمو السريع لعدد النباتيين في مختلف أنحاء العالم واعتماد المستهلكين على المزيد من الأنظمة الغذائية النباتية أو المرنة من شأنه أن يزيد من سوق الأطعمة والمشروبات النباتية. وهذا بدوره سيساعد أيضًا في دفع نمو سوق الحليب النباتي في أمريكا الشمالية.

فرصة

- زيادة إطلاق المنتجات الجديدة والشراكات الجديدة والاستحواذ بين اللاعبين الرئيسيين

يتخذ المستهلكون ومصنعو الأغذية والمشروبات العديد من التطورات والقرارات الاستراتيجية لتنمية أعمالهم لمواكبة الطلب المتزايد على الأغذية النباتية مثل الحليب النباتي. من إطلاق منتجات جديدة إلى الاستثمارات إلى عمليات الاستحواذ، يعمل كبار اللاعبين في السوق على تطوير ممارساتهم التجارية وتوسيع محافظ منتجاتهم.

وبالتالي، فإن مثل هذه التطورات سوف تعمل على جذب المزيد من فرص النمو لسوق الحليب النباتي في أمريكا الشمالية، وسوف تجذب المزيد والمزيد من المستهلكين إلى سوق الحليب المصنوع من المكسرات.

ضبط النفس/التحدي

- ارتفاع حالات حساسية المكسرات بين المستهلكين

حساسية المكسرات هي نوع من حساسية الطعام التي يمكن أن تسبب ردود فعل شديدة وربما تهدد الحياة، مثل الحساسية المفرطة. تعد المكسرات المختلفة سببًا محددًا جيدًا لحساسية الطعام. ويبدو أن هناك اختلافات في تواتر حساسية المكسرات بين البلدان بسبب العادات الغذائية الأخرى وإجراءات الطهي. حساسية المكسرات شائعة جدًا، خاصة بين الأطفال والبالغين، ويتزايد هذا العدد يوميًا. انخفض نمو المبيعات منذ أن أصبح المستهلكون على دراية بخياراتهم الصحية.

علاوة على ذلك، تعد المكسرات والبذور من أكثر الأطعمة المسببة لردود الفعل التحسسية الشديدة التي تهدد الحياة. في أوروبا، تعد حساسية المكسرات شائعة، حيث تعد حساسية البندق هي أكثر حساسية للمكسرات انتشارًا. الكاجو هو ثاني أكثر المكسرات المسببة للحساسية ومشكلة صحية كبيرة في الولايات المتحدة. بخلاف تجنب المكسرات والأطعمة التي تحتوي عليها، لا يوجد علاج لحساسية المكسرات. ونتيجة لذلك، فقد أثر هذا بشكل كبير على صناعة المكسرات ومن المتوقع أن يستمر.

تأثير ما بعد كوفيد-19 على سوق الحليب النباتي في أمريكا الشمالية

ومع ذلك، واجهت سوق الحليب النباتي في أمريكا الشمالية اتجاهًا متزايدًا. فقد زاد استخدام الحليب النباتي، مثل حليب اللوز وحليب الكاجو وحليب البندق، بين المستهلكين. والسبب وراء هذا الطلب المتزايد هو الوعي الصحي المتزايد بين المستهلكين، وأيضًا، خلال هذه الأوقات العصيبة، أبدى المستهلكون اهتمامًا كبيرًا بالحفاظ على البيئة.

بالنظر إلى الانخفاضات الكبيرة في العديد من الصناعات، يجب على الحكومة وقادة الأعمال والمستهلكين العمل معًا لهزيمة كوفيد-19. في هذا الموقف، يكون تأثير جائحة كوفيد-19 على سوق حليب الألبان النباتي في أمريكا الشمالية مفيدًا إلى حد ما. تلتزم الحكومات في جميع أنحاء العالم عن كثب بتدابير الصحة العامة، والتي تشمل زيادة الوعي بالسمنة والأطعمة والمشروبات ذات القيمة الغذائية المضافة. أصبحت معرفة المستهلك بالمناعة العالية مصدر قلق مشروع أثناء الوباء. يقوم العملاء بشكل متزايد بجعل مشترياتهم أكثر صحة بدلاً من أن تكون ألذ من حيث الطعام. في هذا السيناريو، تم تعزيز استخدام حليب النبات بين المستهلكين بسبب فوائده. سبب آخر لازدهار السوق في عصر الوباء هو تنوعه. على سبيل المثال، تتوفر أنواع مختلفة من النكهات والأصول والصيغ والتحصينات في السوق. علاوة على ذلك، في عصر ما بعد الوباء هذا، كان الوضع أفضل بسبب زيادة الطلب من المستهلكين والتحول نحو المنتجات النباتية بدلاً من المنتجات الحيوانية.

التطورات الأخيرة

- في يناير 2023، أعلنت شركة Reitan، وهي شركة تجزئة كبرى في منطقة الشمال والبلطيق، وشركة Oatly Inc. مؤخرًا عن توسيع علاقتهما. تمتلك شركة Reitan وتدير حوالي 300 متجر Pressbyrn و90 متجرًا صغيرًا من 7-Eleven في جميع أنحاء السويد. ستساعد هذه الشراكة الشركة على تعزيز أعمالها وجذب قاعدة مستهلكين جديدة

- في عام 2021، أعلنت شركة Silk عن إطلاق منتجها الجديد Silk Oat. وقد منح هذا الإطلاق الشركة محفظة أكبر، مما أدى إلى جذب قاعدة أكبر من المستهلكين

نطاق سوق الحليب النباتي في أمريكا الشمالية

يتم تقسيم سوق الحليب النباتي في أمريكا الشمالية إلى أحد عشر قطاعًا بارزًا بناءً على النوع ونوع المنتج والفئة والتركيبة والنكهة والتحصين والطبيعة والمطالبة وحجم العبوة ونوع العبوة وقناة التوزيع. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب النوع

- حليب الشوفان

- حليب الصويا

- حليب اللوز

- حليب جوز الهند

- حليب الأرز

- حليب الكاجو

- حليب الجوز

- حليب البندق

- حليب الكتان

- آحرون

على أساس النوع، يتم تقسيم سوق الحليب النباتي في أمريكا الشمالية إلى حليب اللوز، وحليب جوز الهند، وحليب الكاجو، وحليب الجوز، وحليب البندق، وحليب الصويا، وحليب الشوفان، وحليب الأرز، وحليب الكتان، وغيرها.

حسب نوع المنتج

- الحليب المبرد

- حليب صالح للتخزين

على أساس نوع المنتج، يتم تقسيم سوق الحليب النباتي في أمريكا الشمالية إلى حليب مبرد وحليب صالح للتخزين.

حسب الفئة

- عادي

- عضوي

على أساس الفئة، يتم تقسيم سوق الحليب النباتي في أمريكا الشمالية إلى حليب عضوي وحليب تقليدي.

حسب الصياغة

- غير محلى

- محلى

على أساس التركيبة، يتم تقسيم سوق الحليب النباتي في أمريكا الشمالية إلى محلى وغير محلى.

حسب النكهة

- أصلي/غير منكه

- الفانيليا

- الشوكولاتة

- قهوة

- مزيج جوز الهند

- كراميل

- عسل

- مزيج البندق

- القيقب

- آحرون

On the basis of flavor, the North America plant-based milk market is segmented into original/unflavored, vanilla, chocolate, honey, coconut blend, hazelnut blend, caramel, maple, coffee, and others.

BY FORTIFICATION

- Regular

- Fortified

On the basis of fortification, the North America plant-based milk market is segmented into regular and fortified.

BY NATURE

- Non-GMO

- GMO

On the basis of nature, the North America plant-based milk market is segmented into GMO and non-GMO.

BY CLAIM

- Regular

- Gluten Free

- Artificial Preservatives & Color Free

- Soy Free

- Nut Free

- Others

On the basis of claim, the North America plant-based milk market is segmented into regular, gluten free, nut free, soy free, artificial preservatives, color free, and others.

BY PACKAGING SIZE

- 1000 ML

- 250 ML

- 500 ML

- 110 ML

- More Than 1000 ML

- Less Than 100 ML

On the basis of packaging size, the North America plant-based milk market is segmented into less than 100 ml, 110 ml, 250 ml, 500 ml, 1000 ml, and more than 1000 ml.

BY PACKAGING TYPE

- Tetra Packs

- Bottles

- Can

On the basis of packaging type, the North America plant-based milk market is segmented into tetra packs, bottles, and can.

BY DISTRIBUTION CHANNEL

- Non-Store Retailers

- Store Based Retailers

On the basis of distribution channel, the North America plant-based milk market is segmented into store based retailers and non-store based retailers.

North America Plant-Based Milk Market Regional Analysis/Insights

North America plant-based milk market is segmented on the basis of type, product type, category, formulation, flavor, fortification, nature, claim, packaging size, packaging type, and distribution channel.

Some countries in North America plant-based milk market are the U.S., Canada, and Mexico.

The U.S. is expected to dominate North America plant-based milk market due to the high preference for plant-based milk among consumers.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Plant-Based Milk Market Share Analysis

يقدم المشهد التنافسي لسوق الحليب النباتي في أمريكا الشمالية تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والمالية، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الحليب النباتي في أمريكا الشمالية.

بعض المشاركين البارزين العاملين في سوق الحليب النباتي في أمريكا الشمالية هم Silk و Alpro و THE HAIN CELESTIAL GROUP, INC. و SUNOPTA GRAINS AND FOODS INC. و Califia Farms, LLC و NotCo و YEO HIAP SENG LTD. و natur-a و Oatly Inc. و Elmhurst Milked Direct LLC و Manitoba Milling Company و HP Hood LLC وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SHOPPING BEHAVIOR AND DYNAMICS

4.1.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.1.2 RESEARCH

4.1.3 IMPULSIVE

4.1.4 ADVERTISEMENT

4.1.4.1 TELEVISION ADVERTISEMENT

4.1.4.2 ONLINE ADVERTISEMENT

4.1.4.3 IN-STORE ADVERTISEMENT

4.1.4.4 OUTDOOR ADVERTISEMENT

4.2 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.3 CONCLUSION

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 LARGE PRODUCT RANGE

4.4.2 PRODUCT PRICING

4.4.3 AUTHENTICITY OF PRODUCT

5 NORTH AMERICA PLANT-BASED MILK MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.1 OVERVIEW

5.2 SOCIAL FACTORS

5.3 CULTURAL FACTORS

5.4 PSYCHOLOGICAL FACTORS

5.5 PERSONAL FACTORS

5.6 ECONOMIC FACTORS

5.7 PRODUCT TRAITS

5.8 MARKET ATTRIBUTES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN VEGAN POPULATION AROUND THE NORTH AMERICA

6.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

6.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

6.1.4 AVAILABILITY AND ACCESSIBILITY OF A WIDER RANGE OF PLANT-BASED MILK PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

6.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

6.2.3 FLUCTUATING RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING ENVIRONMENTAL CONCERNS IS FUELING THE MARKET GROWTH

6.3.2 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS, ACQUISITION AMONG KEY PLAYERS

6.3.3 INCREASED DEMAND FOR FORTIFIED BEVERAGES IN THE MARKET

6.4 CHALLENGES

6.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

6.4.2 STRINGENT GOVERNMENT REGULATIONS

6.4.3 RISE IN THE NUMBER OF PLANT-BASED MILK PRODUCERS IN THE MARKET

7 NORTH AMERICA PLANT-BASED MILK MARKET, BY FLAVOR

7.1 OVERVIEW

7.2 ORIGINAL/UNFLAVORED

7.2.1 ALMOND MILK

7.2.2 OAT MILK

7.2.3 SOY MILK

7.2.4 COCONUT MILK

7.2.5 RICE MILK

7.2.6 CASHEW NUT MILK

7.2.7 FLAX MILK

7.2.8 WALNUT MILK

7.2.9 HAZELNUT MILK

7.2.10 OTHERS

7.3 VANILLA

7.3.1 ALMOND MILK

7.3.2 OAT MILK

7.3.3 SOY MILK

7.3.4 COCONUT MILK

7.3.5 RICE MILK

7.3.6 CASHEW NUT MILK

7.3.7 FLAX MILK

7.3.8 WALNUT MILK

7.3.9 HAZELNUT MILK

7.3.10 OTHERS

7.4 CHOCOLATE

7.4.1 ALMOND MILK

7.4.2 OAT MILK

7.4.3 SOY MILK

7.4.4 COCONUT MILK

7.4.5 RICE MILK

7.4.6 CASHEW NUT MILK

7.4.7 FLAX MILK

7.4.8 WALNUT MILK

7.4.9 HAZELNUT MILK

7.4.10 OTHERS

7.5 COFFEE

7.5.1 ALMOND MILK

7.5.2 OAT MILK

7.5.3 SOY MILK

7.5.4 COCONUT MILK

7.5.5 RICE MILK

7.5.6 CASHEW NUT MILK

7.5.7 FLAX MILK

7.5.8 WALNUT MILK

7.5.9 HAZELNUT MILK

7.5.10 OTHERS

7.6 COCONUT BLEND

7.6.1 ALMOND MILK

7.6.2 OAT MILK

7.6.3 SOY MILK

7.6.4 COCONUT MILK

7.6.5 RICE MILK

7.6.6 CASHEW NUT MILK

7.6.7 FLAX MILK

7.6.8 WALNUT MILK

7.6.9 HAZELNUT MILK

7.6.10 OTHERS

7.7 CARAMEL

7.7.1 ALMOND MILK

7.7.2 OAT MILK

7.7.3 SOY MILK

7.7.4 COCONUT MILK

7.7.5 RICE MILK

7.7.6 CASHEW NUT MILK

7.7.7 FLAX MILK

7.7.8 WALNUT MILK

7.7.9 HAZELNUT MILK

7.7.10 OTHERS

7.8 HONEY

7.8.1 ALMOND MILK

7.8.2 OAT MILK

7.8.3 SOY MILK

7.8.4 COCONUT MILK

7.8.5 RICE MILK

7.8.6 CASHEW NUT MILK

7.8.7 FLAX MILK

7.8.8 WALNUT MILK

7.8.9 HAZELNUT MILK

7.8.10 OTHERS

7.9 HAZELNUT BLEND

7.9.1 ALMOND MILK

7.9.2 OAT MILK

7.9.3 SOY MILK

7.9.4 COCONUT MILK

7.9.5 RICE MILK

7.9.6 CASHEW NUT MILK

7.9.7 FLAX MILK

7.9.8 WALNUT MILK

7.9.9 HAZELNUT MILK

7.9.10 OTHERS

7.1 MAPLE

7.10.1 ALMOND MILK

7.10.2 OAT MILK

7.10.3 SOY MILK

7.10.4 COCONUT MILK

7.10.5 RICE MILK

7.10.6 CASHEW NUT MILK

7.10.7 FLAX MILK

7.10.8 WALNUT MILK

7.10.9 HAZELNUT MILK

7.10.10 OTHERS

7.11 OTHERS

7.11.1 ALMOND MILK

7.11.2 OAT MILK

7.11.3 SOY MILK

7.11.4 COCONUT MILK

7.11.5 RICE MILK

7.11.6 CASHEW NUT MILK

7.11.7 FLAX MILK

7.11.8 WALNUT MILK

7.11.9 HAZELNUT MILK

7.11.10 OTHERS

8 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORTIFICATION

8.1 OVERVIEW

8.2 REGULAR

8.3 FORTIFIED

9 NORTH AMERICA PLANT-BASED MILK MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 NORTH AMERICA PLANT-BASED MILK MARKET, BY CLAIM

10.1 OVERVIEW

10.2 REGULAR

10.3 GLUTEN FREE

10.4 ARTIFICIAL PRESERVATIVES & COLOR FREE

10.5 SOY FREE

10.6 NUT FREE

10.7 OTHERS

11 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE

11.1 OVERVIEW

11.2 1000 ML

11.3 250 ML

11.4 500 ML

11.5 110 ML

11.6 MORE THAN 1000 ML

11.7 LESS THAN 100 ML

12 NORTH AMERICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 REFRIGERATED MILK

12.3 SHELF STABLE MILK

13 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORMULATION

13.1 OVERVIEW

13.2 UNSWEETENED

13.3 SWEETENED

14 NORTH AMERICA PLANT-BASED MILK MARKET, BY CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 NORTH AMERICA PLANT-BASED MILK MARKET, BY TYPE

15.1 OVERVIEW

15.2 ALMOND MILK

15.2.1 UNSWEETENED

15.2.2 SWEETENED

15.3 OAT MILK

15.3.1 UNSWEETENED

15.3.2 SWEETENED

15.4 SOY MILK

15.4.1 UNSWEETENED

15.4.2 SWEETENED

15.5 COCONUT MILK

15.5.1 UNSWEETENED

15.5.2 SWEETENED

15.6 RICE MILK

15.6.1 UNSWEETENED

15.6.2 SWEETENED

15.7 CASHEW NUT MILK

15.7.1 UNSWEETENED

15.7.2 SWEETENED

15.8 FLAX MILK

15.8.1 UNSWEETENED

15.8.2 SWEETENED

15.9 WALNUT MILK

15.9.1 UNSWEETENED

15.9.2 SWEETENED

15.1 HAZELNUT MILK

15.10.1 UNSWEETENED

15.10.2 SWEETENED

15.11 OTHERS

15.11.1 UNSWEETENED

15.11.2 SWEETENED

16 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 TETRA PACKS

16.3 BOTTLES

16.3.1 GLASS

16.3.2 PLASTICS

16.3.3 OTHERS

16.4 CAN

17 NORTH AMERICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 NON-STORE RETAILERS

17.2.1 ONLINE RETAILERS

17.2.2 COMPANY WEBSITES

17.2.3 VENDING

17.3 STORE BASED RETAILERS

17.3.1 SUPERMARKETS/HYPERMARKETS

17.3.2 CONVENIENCE STORES

17.3.3 GROCERY STORES

17.3.4 SPECIALTY STORES

17.3.5 OTHERS

18 NORTH AMERICA PLANT-BASED MILK MARKET BY COUNTRY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 THE HAIN CELESTIAL GROUP, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 ALPRO

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 RECENT DEVELOPMENT

21.3 OATLY AB

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 CALIFIA FARMS, LLC

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 NATURA FOODS

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 RECENT DEVELOPMENTS

21.6 ELMHURST MILKED DIRECT LLC

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 HP HOOD LLC.

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 MANITOBA MILLING COMPANY

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENT

21.9 NOTCO

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENT

21.1 SUNOPTA

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 WHITEWAVE SERVICES, INC.

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 YEO HIAP SENG LTD.

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 LACTOSE INTOLERANT POPULATION IN THE YEAR 2023

TABLE 2 PRICES FOR PLANT-BASED MILK

TABLE 3 PRICES FOR ANIMAL MILK

TABLE 4 SOYBEAN PRICES OVER THE YEARS (2019-2023)

TABLE 5 OAT PRICES OVER THE YEARS (2019-2023)

TABLE 6 NORTH AMERICA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA PLANT-BASED MILK MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 U.S. PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 45 U.S. COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 46 U.S. RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 48 U.S. FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 49 U.S. WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 50 U.S. HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 51 U.S. OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 52 U.S. PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 54 U.S. PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 55 U.S. PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 56 U.S. ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. CARAMEL BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. HAZELNUT IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 67 U.S. PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 68 U.S. PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 69 U.S. PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 70 U.S. PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 72 U.S. PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 U.S. STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 U.S. NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 CANADA PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 77 CANADA OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 78 CANADA SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 79 CANADA COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 80 CANADA RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 81 CANADA CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 82 CANADA FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 83 CANADA WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 84 CANADA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 85 CANADA OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 86 CANADA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 CANADA PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 88 CANADA PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 89 CANADA PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 90 CANADA ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 CANADA CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 CANADA HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA OTHERS IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 CANADA PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 101 CANADA PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 102 CANADA PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 103 CANADA PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 104 CANADA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 105 CANADA BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 106 CANADA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 CANADA STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 108 CANADA NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 109 MEXICO PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 MEXICO ALMOND MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 111 MEXICO OAT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 112 MEXICO SOY MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 113 MEXICO COCONUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 114 MEXICO RICE MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 115 MEXICO CASHEW NUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 116 MEXICO FLAX MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 117 MEXICO WALNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 118 MEXICO HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 119 MEXICO OTHERS IN PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 120 MEXICO PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO PLANT-BASED MILK MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 122 MEXICO PLANT-BASED MILK MARKET, BY FORMULATION, 2021-2030 (USD MILLION)

TABLE 123 MEXICO PLANT-BASED MILK MARKET, BY FLAVOR, 2021-2030 (USD MILLION)

TABLE 124 MEXICO ORIGINAL/UNFLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 MEXICO VANILLA IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 MEXICO CHOCOLATE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 MEXICO COFFEE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO COCONUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO CARAMEL IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 MEXICO HONEY IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 MEXICO HAZELNUT BLEND IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO MAPLE IN PLANT-BASED MILK MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 MEXICO PLANT-BASED MILK MARKET, BY FORTIFICATION, 2021-2030 (USD MILLION)

TABLE 134 MEXICO PLANT-BASED MILK MARKET, BY NATURE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO PLANT-BASED MILK MARKET, BY CLAIM, 2021-2030 (USD MILLION)

TABLE 136 MEXICO PLANT-BASED MILK MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 137 MEXICO PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 138 MEXICO BOTTLES PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 139 MEXICO PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 140 MEXICO STORE BASED RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 141 MEXICO NON-STORE RETAILERS IN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT-BASED MILK MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT-BASED MILK MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT-BASED MILK MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT-BASED MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT-BASED MILK MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PLANT-BASED MILK MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PLANT-BASED MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PLANT-BASED MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PLANT-BASED MILK MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PLANT-BASED MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA PLANT-BASED MILK MARKET: SEGMENTATION

FIGURE 13 INCREASE IN VEGAN POPULATION AROUND THE NORTH AMERICA IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA PLANT-BASED MILK MARKET IN THE FORECAST PERIOD

FIGURE 14 ALMOND MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT-BASED MILK MARKET IN 2023 AND 2030

FIGURE 15 NORTH AMERICA PLANT-BASED MILK MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPENDING DYNAMICS OF THE CONSUMERS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA PLANT-BASED MILK MARKET

FIGURE 17 NORTH AMERICA PLANT-BASED MILK MARKET: BY FLAVOR, 2022

FIGURE 18 NORTH AMERICA PLANT-BASED MILK MARKET: BY FORTIFICATION, 2022

FIGURE 19 NORTH AMERICA PLANT-BASED MILK MARKET: BY NATURE, 2022

FIGURE 20 NORTH AMERICA PLANT-BASED MILK MARKET: BY CLAIM, 2022

FIGURE 21 NORTH AMERICA PLANT-BASED MILK MARKET: BY PACKAGING SIZE, 2022

FIGURE 22 NORTH AMERICA PLANT-BASED MILK MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 NORTH AMERICA PLANT-BASED MILK MARKET: BY FORMULATION, 2022

FIGURE 24 NORTH AMERICA PLANT-BASED MILK MARKET: BY CATEGORY, 2022

FIGURE 25 NORTH AMERICA PLANT-BASED MILK MARKET: BY TYPE, 2022

FIGURE 26 NORTH AMERICA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2022

FIGURE 27 NORTH AMERICA PLANT-BASED MILK MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 28 NORTH AMERICA PLANT-BASED MILK MARKET: SNAPSHOT (2022)

FIGURE 29 NORTH AMERICA PLANT-BASED MILK MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.