>سوق التغليف الورقي والكرتوني في أمريكا الشمالية، حسب المنتج (أكواب ورقية، ألواح ورق كرافت، كرتون مقوى، صناديق وعلب قابلة للطي، أكياس ورقية وغيرها)، النوع (ملصقات، متسوق، طلاء، تغليف، دعوات / مظاريف / ورق ملاحظات، ملصقات، أغلفة، كتالوجات وطباعة رقمية)، الخاصية (ملونة، طبيعية، مطلية، لؤلؤية، ملمس، معاد تدويره، قطن وغيرها)، الوزن (70 جم / م 2 إلى 100 جم / م 2، 101 جم / م 2 إلى 150 جم / م 2، 151 جم / م 2 إلى 200 جم / م 2، 201 جم / م 2 إلى 250 جم / م 2 وأكثر من 250 جم / م 2)، المستخدم النهائي (العناية الشخصية ومستحضرات التجميل، الأغذية والمشروبات، الرعاية الصحية، السلع الاستهلاكية، التعليم والقرطاسية وغيرها)، الدولة (الولايات المتحدة وكندا والمكسيك) اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى : سوق التغليف الورقي والكرتوني في أمريكا الشمالية

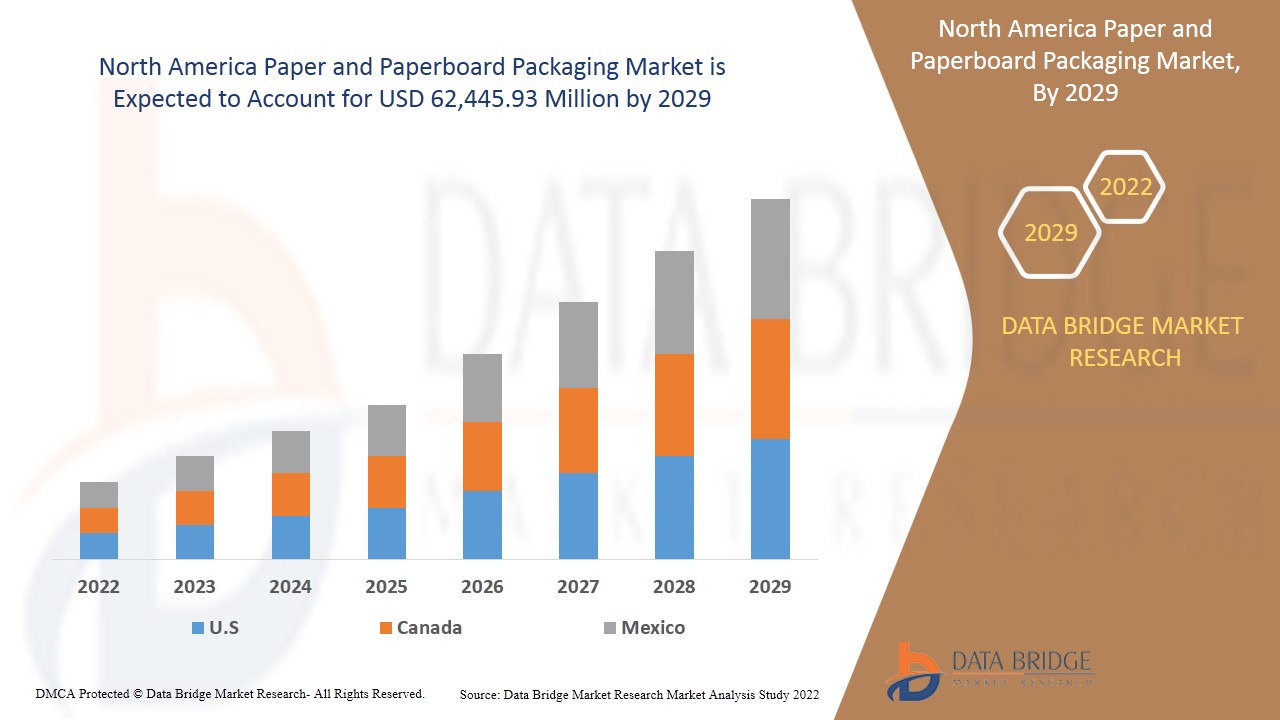

من المتوقع أن يكتسب سوق التغليف الورقي والكرتون في أمريكا الشمالية نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 4.9٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 62445.93 مليون دولار أمريكي بحلول عام 2029. الورق مصنوع من ألياف السليلوز، والتي يتم الحصول عليها من الأشجار والأوراق المستردة وألياف النباتات السنوية مثل قش الحبوب. اليوم، يتم تصنيع حوالي 97 في المائة من الورق والكرتون في العالم من لب الخشب، وحوالي 85 في المائة من لب الخشب المستخدم من أشجار التنوب والتنوب والصنوبر. أيضًا، يمكن استخدام الورق والكرتون في ملامسة الطعام بعدة طرق مختلفة، إما بشكل مباشر أو غير مباشر، وإما بشكل منفرد أو مغلف بمواد أخرى مثل البلاستيك أو رقائق معدنية.

يؤثر الطلب المتزايد على صناديق التغليف المصنوعة من الورق المقوى من صناعة الرعاية الصحية بشكل كبير على توسع سوق التغليف المصنوع من الورق والكرتون. وتماشياً مع هذا، فإن الوعي المتزايد فيما يتعلق بتبني مواد التغليف المستدامة للتغليف الصديق للبيئة، والطلب المتزايد من صناعة التجارة الإلكترونية على حاويات الورق والكرتون، هي عوامل رئيسية تدعم نمو سوق التغليف المصنوع من الورق والكرتون خلال الفترة المتوقعة.

ومع ذلك، فإن اللوائح التي تفرضها الحكومات فيما يتعلق باستخدام مواد التعبئة والتغليف، قد تعمل كقيود رئيسية على معدل نمو سوق التغليف الورقي والكرتوني، في حين أن الحفاظ على جودة منتجات التغليف الورقية أمر صعب للغاية، إلا أن هذا من شأنه أن يتحدى نمو سوق التغليف الورقي والكرتوني خلال فترة التنبؤ.

This Paper and Paperboard Packaging Market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Paper and Paperboard Packaging Market Scope and Market Size

North America paper and paperboard packaging market is segmented into five notable segments which are based on the type, product, property, weight and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the global paper and paperboard packaging market is segmented into stickers, shopper, coating, packaging, invitations / envelopes / notepaper, labels, covers, catalogs and digital print. In 2022, packaging segment is expected to dominate the market due to the growing demand for paper boxes from e-commerce industry.

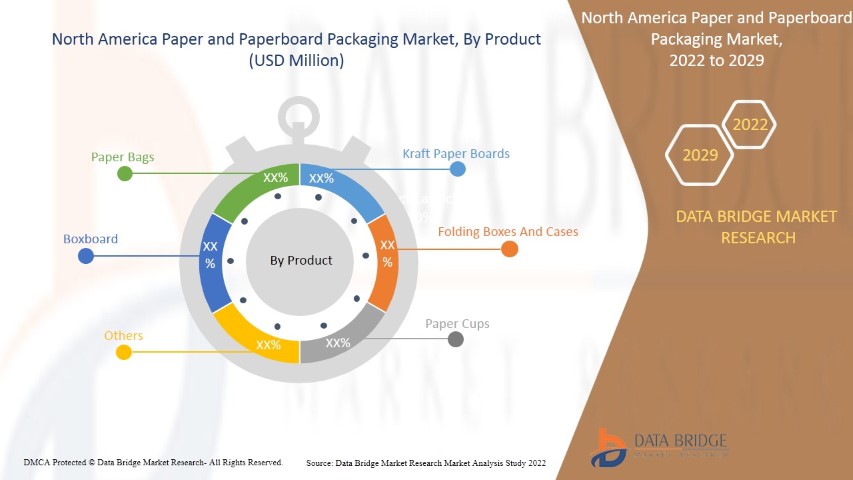

- On the basis of product, the global paper and paperboard packaging market is segmented into paper cups, kraft paper boards, boxboard, folding boxes and cases, paper bags and others. In 2022, the kraft paper boards segment is expected to dominate the market as kraft paper boards have high durability, which increases its demand in North America.

- On the basis of property, the global paper and paperboard packaging market is segmented into colored, natural, coated, pearlescent, texture, recycle, cotton and others. In 2022, the recycle segment is expected to dominate the market as recycling property helps to reduce pollution, which increases its demand in North America.

- On the basis of weight, the global paper and paperboard packaging market is segmented into 70 G/M2 TO 100 G/M2, 101 G/M2 TO 150 G/M2, 151 G/M2 TO 200 G/M2, 201 G/M2 TO 250 G/M2 and more than 250 G/M2. In 2022, the 151 G/M2 To 200 G/M2 segment is expected to dominate the market as this weight is easier to carry, which increases its demand in North America.

- On the basis of end user, the global paper and paperboard packaging market is segmented into personal care and cosmetics, food and beverages, healthcare, consumer goods, education and stationary and others. In 2022, the food and beverages segment is expected to dominate the market as paper and paperboard packaging has good flexibity to store different types of food products, which increases its demand in North America.

North America Paper and Paperboard Packaging Market Country Level Analysis

North America paper and paperboard packaging market is segmented into four notable segments which are based on the basis of type, product, property, weight and end user.

The countries covered in North America Paper and paperboard packaging market report are U.S., Canada and Mexico . U.S. is dominating the North America market due to the growing demand for paperboard packaging boxes from healthcare industry which increases the demand for Paper and Paperboard Packaging in the region

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Demand For Paperboard Packaging Boxes From Healthcare Industry

Paper and paperboard packaging materials play an important role for packaging and displays for the medicine & pharmaceuticals sector. Enclosing the product is the most basic function of packaging medicines. The design of high quality packages must take into account product needs and manufacturing and distribution systems. This requires that the package does not leak, does not allow the product to spread or penetrate, and is strong enough to hold the contents under normal handling.

The health sector is contributing to increasing demand for packaging. Cardboard boxes are required to transport health products and medicines to various locations of distribution. The package must protect the product from all external adverse effects that could compromise quality or effectiveness, such as light, moisture, oxygen, biological contamination, mechanical damage, counterfeiting or counterfeiting.

Therefore, pharmaceutical manufacturers must take packaging into careful consideration as medication safety is important to prevent devastating errors, ineffective storage and the risk of medication tampering and falsified products. This in turn rises the demand for paperboard boxes and hence contributing to the growth of the global paper and paperboard packaging market.

Competitive Landscape and Paper and Paperboard Packaging Market Share Analysis

يوفر المشهد التنافسي لسوق التغليف بالورق والكرتون في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والمالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب التجارب السريرية، وتحليل العلامة التجارية، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج والتنفس، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق التغليف بالورق والكرتون في أمريكا الشمالية.

اللاعبون الرئيسيون في السوق المنخرطون في سوق التغليف الورقي والكرتون في أمريكا الشمالية هم Amcor plc و Cascades inc. و Packaging Corporation of America و DS Smith و Fedrigoni SPA Atlantic Packaging و International Paper و Smurfit Kappa و Svenska Cellulosa Aktiebolaget SCA و Mondi و Nippon Paper Industries Co.، Ltd. و Stora Enso و METSÄ GROUP و Georgia-Pacific و Oji Holdings Corporation و Mayr-Melnhof Karton AG و UPM و Rengo Co.، Ltd. و WestRock Company وغيرها.

على سبيل المثال،

- في نوفمبر 2021، أعلنت شركة نيبون للصناعات الورقية المحدودة عن تعديلات أسعار ورق الطباعة وورق الاتصالات والورق الصناعي في السوق المحلية لجميع وكالاتها. وقد ساعد هذا بدوره الشركة على زيادة إيراداتها على المدى الطويل.

- في نوفمبر 2021، أعلنت شركة Oji Holdings Corporation عن إنشاء مصنع جديد للحاويات المموجة في فيتنام. وقد ساعد ذلك الشركة على زيادة حجم إنتاجها من الصناديق المموجة في منطقة آسيا والمحيط الهادئ.

- في ديسمبر 2021، حصلت شركة Stora Enso على جائزة أفضل حل دائري المقدمة من شركة Tetra Pak لإنجازاتها الكبيرة في مجال ابتكار إعادة تدوير علب المشروبات. وقد ساعد ذلك الشركة على تعزيز مكانتها عالميًا.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY OVERVIEW

4.1.1 CORRUGATED SHEET

4.1.2 BUTTER PAPER

4.1.3 CARDBOARD

4.1.4 VIRGIN PAPER

4.1.5 KRAFT LINER

4.1.6 TESTLINER

4.1.7 SBS (SOLID BLEACHED SULFATE) BOARD

4.1.8 CCNB (CLAY COATED NEWS BACKBOARD)

4.2 MANUFACTURING INSIGHTS

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 THE MIDDLE EAST AND AFRICA

5.4 ASIA-PACIFIC

5.5 NORTH AMERICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR PAPERBOARD PACKAGING BOXES FROM THE HEALTHCARE INDUSTRY

6.1.2 INCREASING AWARENESS ABOUT SUSTAINABLE PACKAGING MATERIAL AND ADOPTION OF ECO-FRIENDLY PACKAGING

6.1.3 INCREASING ADOPTION OF PAPER-BASED PACKAGING IN THE FOOD INDUSTRY

6.1.4 MOUNTING REQUIREMENT FOR LIGHTWEIGHT PACKAGING BOARDS

6.1.5 INCREASING USE OF PAPERBOARD PACKAGING BY E-COMMERCE INDUSTRIES

6.2 RESTRAINTS

6.2.1 REGULATIONS IMPOSED BY GOVERNMENTS REGARDING THE USE OF PACKAGING MATERIALS

6.2.2 INCREASING COMPETITION FROM FLEXIBLE PLASTIC PACKAGING

6.3 OPPORTUNITIES

6.3.1 ENVIRONMENTAL BENEFITS ASSOCIATED WITH PAPER AND PAPERBOARD PACKAGING

6.3.2 STRONG EMPHASIS ON PAPER RECYCLING INITIATIVES IN SEVERAL COUNTRIES

6.3.3 SURGE IN INNOVATIVE PACKAGING SOLUTIONS WITH DIGITAL PRINTING

6.3.4 INCREASING USAGE OF COMPOSITE CARDBOARD PACKAGING IN THE PERSONAL CARE INDUSTRY

6.4 CHALLENGES

6.4.1 DIFFICULTY IN MAINTAINING QUALITY OF PAPER-BASED PACKAGING PRODUCTS

6.4.2 TEMPERATURE FLUCTUATIONS MAY AFFECT STRENGTH OF THE PAPERBOARD BOXES

7 IMPACT OF COVID-19 ON NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST NORTH AMERICA PAPER AND PAPERBOARD MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 KRAFT PAPER BOARDS

8.3 FOLDING BOXES AND CASES

8.4 PAPER CUPS

8.4.1 COLD PAPER CUPS

8.4.1.1 Serving Cups

8.4.1.2 Portion Cups

8.4.1.3 OTHERS

8.4.2 HOT PAPER CUPS

8.4.2.1 Serving Cups

8.4.2.2 Portion Cups

8.4.2.3 OTHERS

8.5 PAPER BAGS

8.6 BOXBOARD

8.7 OTHERS

9 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACKAGING

9.3 SHOPPER

9.4 LABELS

9.5 COATING

9.6 CATALOGS

9.7 COVERS

9.8 DIGITAL PRINT

9.9 STICKERS

9.1 INVITATIONS/ENVELOPES/NOTEPAPER

10 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY

10.1 OVERVIEW

10.2 RECYCLE

10.3 COLORED

10.4 NATURAL

10.5 COATED

10.6 PEARLESCENT

10.7 TEXTURE

10.8 COTTON

10.9 OTHERS

11 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT

11.1 OVERVIEW

11.2 G/M2 TO 200 G/M2

11.3 G/M2 TO 150 G/M2

11.4 G/M2 TO 100 G/M2

11.5 G/M2 TO 250 G/M2

11.6 MORE THAN 250 G/M2

12 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES, BY END-USER

12.2.1.1 FRUITS & VEGETABLES

12.2.1.2 BAKERY & CONFECTIONERY

12.2.1.3 PROCESSED FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 MEAT & POULTRY PRODUCTS

12.2.1.6 DAIRY PRODUCTS

12.2.1.7 MILK & MILK DERIVED PRODUCTS

12.2.1.8 JUICES

12.2.1.9 OTHERS

12.2.2 FOOD & BEVERAGES, BY TYPE

12.2.2.1 PACKAGING

12.2.2.2 SHOPPER

12.2.2.3 LABELS

12.2.2.4 COATING

12.2.2.5 CATALOGS

12.2.2.6 COVERS

12.2.2.7 DIGITAL PRINT

12.2.2.8 STICKERS

12.2.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY TYPE

12.3.1.1 PACKAGING

12.3.1.2 SHOPPER

12.3.1.3 LABELS

12.3.1.4 COATING

12.3.1.5 CATALOGS

12.3.1.6 COVERS

12.3.1.7 DIGITAL PRINT

12.3.1.8 STICKERS

12.3.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.4 PERSONAL CARE & COSMETICS

12.4.1 PERSONAL CARE & COSMETICS, BY END-USER

12.4.1.1 SKIN CARE

12.4.1.2 HAIR CARE

12.4.1.3 NAIL CARE

12.4.1.4 OTHERS

12.4.2 PERSONAL CARE & COSMETICS, BY TYPE

12.4.2.1 PACKAGING

12.4.2.2 SHOPPER

12.4.2.3 LABELS

12.4.2.4 COATING

12.4.2.5 CATALOGS

12.4.2.6 COVERS

12.4.2.7 DIGITAL PRINT

12.4.2.8 STICKERS

12.4.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.5 CONSUMER GOODS

12.5.1 CONSUMER GOODS, BY TYPE

12.5.1.1 PACKAGING

12.5.1.2 SHOPPER

12.5.1.3 LABELS

12.5.1.4 COATING

12.5.1.5 CATALOGS

12.5.1.6 COVERS

12.5.1.7 DIGITAL PRINT

12.5.1.8 STICKERS

12.5.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.6 EDUCATION & STATIONERY

12.6.1 EDUCATION & STATIONERY, BY TYPE

12.6.1.1 PACKAGING

12.6.1.2 SHOPPER

12.6.1.3 LABELS

12.6.1.4 COATING

12.6.1.5 CATALOGS

12.6.1.6 COVERS

12.6.1.7 DIGITAL PRINT

12.6.1.8 STICKERS

12.6.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 PACKAGING

12.7.1.2 SHOPPER

12.7.1.3 LABELS

12.7.1.4 COATING

12.7.1.5 CATALOGS

12.7.1.6 COVERS

12.7.1.7 DIGITAL PRINT

12.7.1.8 STICKERS

12.7.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

13 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INTERNATIONAL PAPER

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 WESTROCK COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 OJI HOLDINGS CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 AMCOR PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 PACKAGING CORPORATION OF AMERICA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ATLANTIC PACKAGING

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CASCADES INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DS SMITH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 FEDRIGONI S.P.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GEORGIA-PACIFIC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 MAYR-MELNHOF KARTON AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 METSÄ GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 MONDI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NIPPON PAPER INDUSTRIES CO., LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 RENGO CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 SMURFIT KAPPA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SONOCO PRODUCTS COMPANY

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 STORA ENSO

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 UPM

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

List of Table

TABLE 1 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 2 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 3 TYPES OF RAW MATERIALS USED IN PHARMACEUTICAL PACKAGING

TABLE 4 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 NORTH AMERICA KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 NORTH AMERICA FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 10 NORTH AMERICA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 12 NORTH AMERICA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA COLD PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HOT PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 17 NORTH AMERICA BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 19 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 21 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PACKAGING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SHOPPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LABELS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA COATING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CATALOGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA COVERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIGITAL PRINT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA STICKERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INVITATIONS/ENVELOPES/NOTEPAPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RECYCLE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA COLORED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA NATURAL IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COATED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA PEARLESCENT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TEXTURE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COTTON IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA 151 G/M2 TO 200 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA 101 G/M2 TO 150 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA 70 G/M2 TO 100 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA 201 G/M2 TO 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA MORE THAN 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 63 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 65 NORTH AMERICA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 U.S. PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 U.S. COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.S. HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 87 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 88 U.S. PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 89 U.S. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 90 U.S. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 93 U.S. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.S. EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 99 CANADA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 CANADA COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 CANADA HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 104 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 105 CANADA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 106 CANADA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 107 CANADA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 110 CANADA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 MEXICO PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 MEXICO COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 MEXICO HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 121 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 122 MEXICO PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 123 MEXICO FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 MEXICO FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 MEXICO PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: THE TYPE LINE CURVE

FIGURE 7 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FROM THE E-COMMERCE INDUSTRY FOR PAPER AND PAPERBOARD CONTAINERS IS EXPECTED TO DRIVE THE NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 KRAFT PAPER BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 16 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET

FIGURE 18 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 19 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2021

FIGURE 21 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2021

FIGURE 22 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2021

FIGURE 23 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 28 NORTH AMERICA PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.