North America Medical Device Warehouse And Logistics Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

20.55 Billion

USD

29.90 Billion

2024

2032

USD

20.55 Billion

USD

29.90 Billion

2024

2032

| 2025 –2032 | |

| USD 20.55 Billion | |

| USD 29.90 Billion | |

|

|

|

|

تجزئة سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية، حسب العروض (الخدمات، الأجهزة، والبرمجيات)، درجة الحرارة (المحيطة، المبردة/المبردة، المجمدة، وغيرها)، طريقة النقل (الشحن البحري، الشحن الجوي، والبري)، التطبيق (أجهزة التشخيص، الأجهزة العلاجية، أجهزة المراقبة، الأجهزة الجراحية، وغيرها)، الاستخدام النهائي (المستشفيات والعيادات، شركات الأجهزة الطبية، المعاهد الأكاديمية والبحثية، مختبرات التشخيص والمراجع، شركات خدمات الطوارئ الطبية، وغيرها)، قنوات التوزيع (الخدمات اللوجستية التقليدية والجهات الخارجية) - اتجاهات الصناعة والتوقعات حتى عام 2032

حجم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

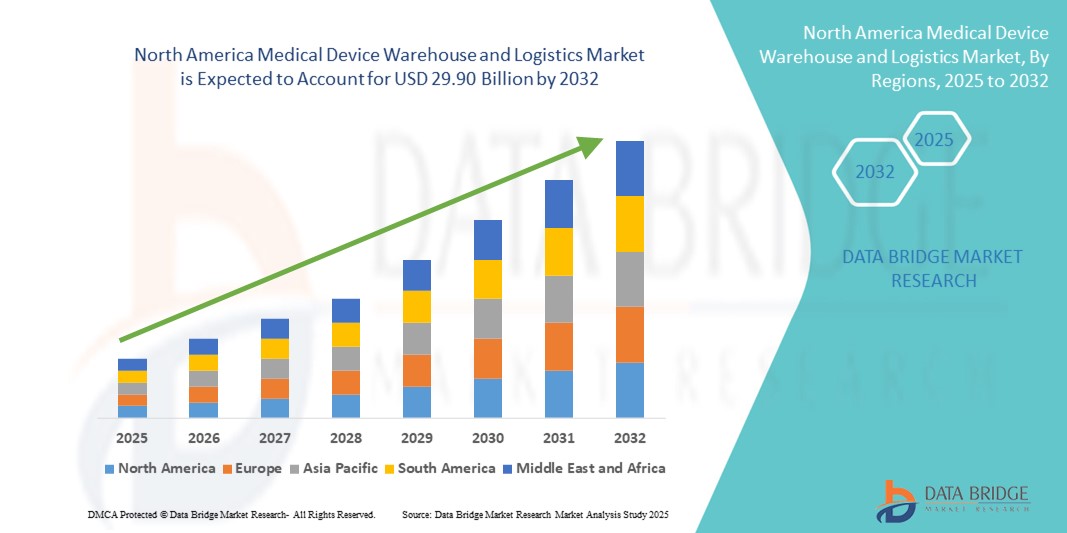

- تم تقييم حجم سوق المستودعات والخدمات اللوجستية للأجهزة الطبية في أمريكا الشمالية بـ 20.55 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 29.90 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 4.80٪ خلال الفترة المتوقعة.

- يتم دعم نمو السوق إلى حد كبير من خلال البنية التحتية المتوسعة للرعاية الصحية والطلب المتزايد على أنظمة سلسلة التوريد الطبية الفعالة في جميع أنحاء أمريكا الشمالية، مدفوعًا بارتفاع معدل انتشار الأمراض المزمنة ورقمنة الرعاية الصحية والحاجة المتزايدة إلى التوزيع في الوقت المناسب للأجهزة الطبية الحيوية.

- علاوة على ذلك، يُسهم الطلب المتزايد من المستهلكين والمؤسسات على حلول تخزين آمنة، مُتحكمة في درجة حرارتها، ومتكاملة تقنيًا، في ترسيخ دور الخدمات اللوجستية المتخصصة للأجهزة الطبية كركيزة أساسية لتقديم الرعاية الصحية في المنطقة. تُسرّع هذه العوامل المتقاربة من اعتماد خدمات التخزين والخدمات اللوجستية المتطورة للأجهزة الطبية، مما يُعزز بشكل كبير نمو هذه الصناعة في قطاعي الرعاية الصحية العام والخاص في أمريكا الشمالية.

تحليل سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

- تتزايد أهمية أنظمة مستودعات ولوجستيات الأجهزة الطبية في ضمان تسليم منتجات الرعاية الصحية في الوقت المناسب وبشكل آمن ومتوافق مع المعايير في جميع أنحاء أمريكا الشمالية. تدعم هذه الأنظمة التخزين الحساس لدرجة الحرارة، والتتبع الفوري، والتوزيع الفعال، وهي أمور أساسية للأجهزة والمعدات الطبية المنقذة للحياة.

- ينشأ الطلب المتزايد من خلال تطوير البنية التحتية للرعاية الصحية المتزايدة، وزيادة استيراد وتصدير التقنيات الطبية، والمتطلبات التنظيمية الصارمة لتتبع سلسلة التوريد وإدارة سلسلة التبريد.

- هيمنت الولايات المتحدة على سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية، محققةً أكبر حصة إيرادات بلغت 81.2% في عام 2024، مدفوعةً بمنظومة رعاية صحية متينة، واستهلاك مرتفع للأجهزة الطبية، واعتماد واسع النطاق لأتمتة المستودعات المتقدمة والخدمات اللوجستية المدعومة بإنترنت الأشياء. وتساهم الاستثمارات الاستراتيجية من قِبل كبار مزودي الخدمات اللوجستية في سلاسل التبريد ومراكز التوزيع في تعزيز النمو في البلاد.

- من المتوقع أن تكون كندا أسرع الدول نموًا في سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية، حيث يُتوقع أن تسجل معدل نمو سنوي مركب قدره 9.8% خلال الفترة 2025-2032. ويعزى هذا النمو إلى تزايد الاعتماد على الأجهزة الطبية المستوردة، وتنامي نشاط الصناعات الدوائية الحيوية، وتوسيع نطاق الوصول إلى الرعاية الصحية الإقليمية في المناطق النائية.

- سيطرت شريحة الخدمات اللوجستية البرية على سوق مستودعات الأجهزة الطبية والخدمات اللوجستية في أمريكا الشمالية بحصة سوقية بلغت 51.4% في عام 2024، مما يعكس استخدامها على نطاق واسع في عمليات تسليم الأجهزة الطبية قصيرة إلى متوسطة المدى في جميع أنحاء منطقة الشرق الأوسط وأفريقيا، بدعم من شبكة نقل بري واسعة النطاق تمكن التوزيع في الوقت المناسب وبتكلفة فعالة.

نطاق التقرير وتقسيم سوق مستودعات الأجهزة الطبية والخدمات اللوجستية في أمريكا الشمالية

|

صفات |

رؤى حول سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

" التكامل المتزايد بين اللوجستيات الذكية وتقنيات الامتثال في سوق مستودعات الأجهزة الطبية والخدمات اللوجستية في أمريكا الشمالية "

- من أهم الاتجاهات التي تُشكل سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية الطفرة في تقنيات الأتمتة والخدمات اللوجستية الذكية المُصممة لتبسيط تخزين ومناولة وتوزيع الأجهزة الطبية عالية القيمة. تُحسّن هذه الابتكارات الدقة وإمكانية التتبع والامتثال التنظيمي في قطاع تُعدّ فيه الدقة والسلامة من الأولويات القصوى.

- يتزايد استخدام أنظمة إدارة المخزون السحابية وأجهزة الاستشعار المدعومة بإنترنت الأشياء لمراقبة ظروف التخزين في الوقت الفعلي، مثل درجة الحرارة والرطوبة والتعرض للصدمات، وهو أمر بالغ الأهمية لأجهزة التشخيص الحساسة أو القابلة للزرع. تدعم هذه التقنيات الرؤية الشاملة والتنبيهات الفورية، مما يساعد على تقليل التلف والفقد.

- تُدمج كبرى الشركات في الولايات المتحدة وكندا الروبوتات والمركبات الموجهة آليًا (AGVs) في عمليات التخزين لتحسين الكفاءة وتقليل الأخطاء البشرية في اختيار الطلبات وتوزيعها. تُعدّ هذه الأنظمة مفيدة بشكل خاص لمراكز التوزيع ذات الكميات الكبيرة التي تتعامل مع مجموعة متنوعة ومعقدة من الأجهزة.

- يُعد تحسين سلسلة التبريد أيضًا مجال تركيز رئيسي. تستثمر الشركات في بنية تحتية ذكية لتخزين التبريد مزودة بأنظمة مراقبة عن بُعد وأنظمة طاقة احتياطية لحماية المنتجات الحساسة للحرارة، مثل الغرسات الجراحية والدعامات وأجهزة القلب والأوعية الدموية.

- يتيح التعاون بين مقدمي الخدمات اللوجستية ومصنعي الأجهزة الطبية تخصيصًا أكبر لسلاسل التوريد، مع خدمات لوجستية خارجية (3PL) تقدم حلولًا مخصصة للامتثال والتعبئة والتغليف والخدمات اللوجستية العكسية

- لا يزال الامتثال التنظيمي دافعًا للتحول الرقمي. وقد شجعت متطلبات إدارة الغذاء والدواء الأمريكية (FDA) الخاصة بالتعريف الفريد للجهاز (UDI) ولوائح الأجهزة الطبية الصادرة عن وزارة الصحة الكندية على اعتماد أدوات التسلسل والتتبع الفوري وإعداد التقارير الآلية لتعزيز المساءلة عبر سلسلة التوريد.

- إن هذا التقارب المتزايد بين ابتكارات الخدمات اللوجستية وأتمتة الامتثال وأنظمة التتبع في الوقت الفعلي يعيد تشكيل مشهد تخزين وتوزيع الأجهزة الطبية في جميع أنحاء أمريكا الشمالية، مما يضع السوق في وضع يسمح له بالنمو المستدام حتى عام 2032

ديناميكيات سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

سائق

"تزايد الطلب نتيجةً لتوسع البنية التحتية للرعاية الصحية واحتياجات سلسلة التبريد"

- يشهد سوق المستودعات والخدمات اللوجستية للأجهزة الطبية في أمريكا الشمالية نموًا كبيرًا بسبب زيادة الاستثمارات في البنية التحتية للرعاية الصحية، والطلب المتزايد على الأجهزة الطبية المتقدمة، والتركيز المتزايد على الخدمات اللوجستية للأدوية والأجهزة الحساسة لدرجة الحرارة.

- على سبيل المثال، في أبريل 2024، وسعت شركة CEVA Logistics نطاق خدماتها اللوجستية للرعاية الصحية في الشرق الأوسط من خلال إطلاق منشأة جديدة حاصلة على شهادة ممارسات التوزيع الجيد (GDP) في دبي، بهدف تقديم خدمات متخصصة للأجهزة الطبية والأدوية.

- مع النمو السريع للإجراءات التشخيصية والجراحة في المنطقة، يركز مزودو الخدمات اللوجستية بشكل متزايد على حلول التخزين والنقل المصممة خصيصًا والتي تضمن سلامة الأجهزة وسلامتها وامتثالها

- إن المبادرات الحكومية الرامية إلى تحسين فرص الحصول على الرعاية الصحية، وخاصة في دول مجلس التعاون الخليجي وجنوب أفريقيا، تدعم توسيع أنظمة التخزين المركزية ومراكز التوزيع للمعدات والمواد الاستهلاكية الطبية.

- أدى ارتفاع الأمراض المزمنة وزيادة استيراد الأجهزة الطبية المتطورة إلى زيادة الحاجة إلى خدمات لوجستية يتم التحكم في درجة حرارتها، وخاصة في الفئات المحيطة والمبردة والمجمدة، والتي أصبحت ضرورية لضمان فعالية المنتج وسلامته.

- علاوة على ذلك، فإن التبني المتزايد لتقنيات الرعاية الصحية الرقمية وأنظمة التتبع الذكية، مثل أجهزة الاستشعار القائمة على تقنية تحديد الهوية بموجات الراديو وإنترنت الأشياء، يعزز شفافية سلسلة التوريد والكفاءة التشغيلية، مما يدفع نمو السوق بشكل أكبر عبر قطاعي الرعاية الصحية الخاص والعام.

ضبط النفس/التحدي

" ارتفاع التكاليف وفجوات البنية التحتية في المناطق ذات الدخل المنخفض "

- على الرغم من الطلب القوي، يواجه السوق تحديات رئيسية مثل البنية التحتية اللوجستية المحدودة في العديد من بلدان أفريقيا جنوب الصحراء الكبرى، والبيئات التنظيمية غير المتسقة، والتكاليف التشغيلية المرتفعة المرتبطة بسلسلة التبريد ومرافق التخزين الآمنة.

- على سبيل المثال، في حين طورت جنوب أفريقيا والإمارات العربية المتحدة مراكز تخزين متقدمة، لا تزال البلدان ذات البنية التحتية الأقل نضجًا تواجه مشكلات مثل إمدادات الكهرباء غير المنتظمة، والوصول المحدود إلى حلول الشحن المتخصصة، وشبكات النقل المجزأة.

- تشكل التكاليف المرتفعة المرتبطة بإنشاء مرافق تخزين باردة متوافقة مع معايير التوزيع الجيد وتأمين تتبع الأجهزة من البداية إلى النهاية عوائق أمام الشركات اللوجستية الصغيرة والمتوسطة الحجم

- بالإضافة إلى ذلك، غالبًا ما تؤدي اللوائح الجمركية والاستيرادية الصارمة في مختلف البلدان في المنطقة إلى التأخير وانعدام الكفاءة، مما يؤثر على تسليم الأجهزة في الوقت المناسب ونتائج المرضى.

- وللتغلب على هذه القيود، تعد الشراكات بين القطاعين العام والخاص، والحوافز اللوجستية المدعومة من الحكومة، والتعاون الدولي ضرورية لتوحيد العمليات وتوسيع نطاق الوصول إلى الخدمات اللوجستية الموثوقة للأجهزة الطبية في المناطق النائية والنامية في المنطقة.

نطاق سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

يتم تقسيم السوق على أساس العروض ودرجة الحرارة وطريقة النقل والتطبيق والاستخدام النهائي وقناة التوزيع.

- حسب العروض

بناءً على العروض، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى خدمات وأجهزة وبرامج. وقد هيمن قطاع الأجهزة على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 42.8% في عام 2024، مدفوعًا بالحاجة المتزايدة إلى حلول تخزين متطورة، وبنية تحتية لسلسلة التبريد، وأنظمة تتبع تحديد الهوية بموجات الراديو (RFID). تُشكّل مكونات الأجهزة العمود الفقري لعمليات المستودعات الفعّالة، حيث تدعم تخزين ونقل الأجهزة الطبية في ظل ظروف مُنظّمة.

من المتوقع أن يشهد قطاع البرمجيات أسرع معدل نمو سنوي مركب بنسبة 12.9% من عام 2025 إلى عام 2032، مدفوعًا بالتحول الرقمي المتزايد في العمليات اللوجستية، والطلب المتزايد على أنظمة إدارة المستودعات المستندة إلى السحابة (WMS)، والحاجة إلى الرؤية في الوقت الفعلي وتتبع الامتثال.

- حسب درجة الحرارة

بناءً على درجة الحرارة، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى فئات: التخزين في درجات الحرارة المحيطة، والتبريد/التجميد، والتجميد، وغيرها. وقد هيمن قطاع التخزين في درجات الحرارة المحيطة على السوق بحصة إيرادات بلغت 47.3% في عام 2024، وذلك بفضل الحجم الكبير للأجهزة الطبية غير الحساسة للحرارة، مثل الأدوات الجراحية ومعدات التشخيص.

ومن المتوقع أن يشهد قطاع التبريد أسرع نمو، بمعدل نمو سنوي مركب نسبته 10.2% من عام 2025 إلى عام 2032، بسبب الطلب المتزايد على التخزين المتحكم في درجة حرارة اللقاحات، والكواشف التشخيصية، والأجهزة القابلة للزرع.

- حسب وسيلة النقل

بناءً على وسيلة النقل، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى لوجستيات برية، ولوجستيات شحن جوي، ولوجستيات شحن بحري. وقد استحوذ قطاع اللوجستيات البرية على أكبر حصة سوقية بنسبة 51.4% في عام 2024، مدفوعًا بالانتشار الواسع لشبكات النقل البري في منطقة الشرق الأوسط وأفريقيا لتوصيل الأجهزة الطبية قصيرة ومتوسطة المدى.

من المتوقع أن ينمو قطاع الخدمات اللوجستية للشحن الجوي بأسرع معدل نمو سنوي مركب بنسبة 11.7% من عام 2025 إلى عام 2032، حيث يتم استخدامه بشكل متزايد لشحنات الأجهزة العاجلة والحساسة لدرجة الحرارة، وخاصة في المناطق النائية أو التي تعاني من نقص الخدمات.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى أجهزة تشخيصية، وأجهزة علاجية، وأجهزة مراقبة، وأجهزة جراحية، وغيرها. وقد شكّل قطاع أجهزة التشخيص أكبر حصة من الإيرادات بنسبة 33.6% في عام 2024، مدفوعًا بزيادة حجم الاختبارات، وخاصةً بعد جائحة كوفيد-19، والحاجة إلى تخزين آمن لأدوات التشخيص الحساسة.

من المتوقع أن ينمو قطاع أجهزة المراقبة بأسرع معدل نمو سنوي مركب بنسبة 10.5% من عام 2025 إلى عام 2032، بدعم من الارتفاع الكبير في الطلب على تقنيات مراقبة الصحة القابلة للارتداء عن بعد.

- حسب الاستخدام النهائي

بناءً على الاستخدام النهائي، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى مستشفيات وعيادات، وشركات أجهزة طبية، ومعاهد أكاديمية وبحثية، ومختبرات مرجعية وتشخيصية، وشركات خدمات طبية طارئة، وغيرها. وقد استحوذ قطاع المستشفيات والعيادات على أعلى حصة سوقية بنسبة 38.9% في عام 2024، نظرًا لاحتياجات الشراء واسعة النطاق والطلب المستمر على الأجهزة الطبية في البيئات السريرية.

من المتوقع أن يشهد قطاع شركات الأجهزة الطبية أسرع معدل نمو سنوي مركب بنسبة 11.2% خلال الفترة من 2025 إلى 2032، حيث يقوم المزيد من المصنعين بالاستعانة بمصادر خارجية لعمليات الخدمات اللوجستية لمقدمي خدمات تابعين لجهات خارجية لتحقيق إمكانية التوسع وكفاءة التكلفة.

- حسب قناة التوزيع

بناءً على قنوات التوزيع، يُقسّم سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية إلى لوجستيات تقليدية ولوجستيات خارجية (3PL). وسيُهيمن قطاع لوجستيات الجهات الخارجية (3PL) على السوق بحصة سوقية تبلغ 62.4% في عام 2024، مدفوعًا بالاتجاه المتزايد نحو الاستعانة بمصادر خارجية لعمليات اللوجستيات، وخاصةً للأجهزة الطبية الحساسة لدرجة الحرارة والمتوافقة مع اللوائح التنظيمية.

من المتوقع أن يشهد قطاع الخدمات اللوجستية التقليدية أسرع معدل نمو سنوي مركب في الفترة من 2025 إلى 2032، مع استغلاله بشكل كبير من قبل المستشفيات والمؤسسات الصحية التي تديرها الحكومة ذات القدرات اللوجستية الداخلية.

تحليل إقليمي لسوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

- شكلت أمريكا الشمالية 18.4% من إيرادات سوق المستودعات والخدمات اللوجستية للأجهزة الطبية العالمية في عام 2024، مدفوعة بالنمو القوي في الرعاية الصحية في القطاع الخاص، وتبني الصحة الرقمية، والحاجة إلى أنظمة لوجستية عالية الأداء وموثوقة في كل من الولايات المتحدة وكندا.

- تلعب أنظمة مستودعات ولوجستيات الأجهزة الطبية دورًا حيويًا متزايدًا في ضمان تسليم معدات الرعاية الصحية الأساسية بأمان وفي الوقت المناسب، بما يتوافق مع اللوائح التنظيمية في جميع أنحاء أمريكا الشمالية. تُمكّن هذه الأنظمة من تخزين سلسلة التبريد، والتتبع الفوري، وتحسين عمليات التوزيع، وهي أمور أساسية للحفاظ على سلامة الأجهزة الطبية الحساسة والتشخيصات.

- الطلب في أمريكا الشمالية مدفوع بالتوسع السريع في البنية التحتية للرعاية الصحية، وارتفاع استيراد وتصدير التقنيات الطبية المتطورة، وتنفيذ لوائح صارمة لتتبع المنتجات والامتثال لسلسلة التبريد.

نظرة عامة على سوق مستودعات ولوجستيات الأجهزة الطبية في الولايات المتحدة

هيمنت الولايات المتحدة على سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية، مستحوذةً على أكبر حصة من الإيرادات بنسبة 81.2% في عام 2024، مدفوعةً بمنظومة رعاية صحية متينة، واستهلاك مرتفع للأجهزة الطبية، وانتشار واسع لأتمتة المستودعات المتقدمة والخدمات اللوجستية المدعومة بإنترنت الأشياء. وتُسهم الاستثمارات الاستراتيجية التي يضخها كبار مزودي الخدمات اللوجستية في سلاسل التبريد ومراكز التوزيع في دفع عجلة النمو في البلاد.

نظرة عامة على سوق مستودعات ولوجستيات الأجهزة الطبية في كندا

من المتوقع أن يكون سوق مستودعات ولوجستيات الأجهزة الطبية في كندا الأسرع نموًا في المنطقة، حيث يُتوقع أن يُسجل معدل نمو سنوي مركب قدره 9.8% خلال الفترة 2025-2032. ويعزى هذا النمو إلى تزايد الاعتماد على الأجهزة الطبية المستوردة، وتنامي نشاط الصناعات الدوائية الحيوية، وتوسيع نطاق الوصول إلى الرعاية الصحية إقليميًا في المناطق النائية. كما يشهد السوق الكندي زيادة في الاستثمار في تقنيات التخزين الذكية وممارسات اللوجستيات المستدامة.

نظرة عامة على سوق مستودعات الأجهزة الطبية والخدمات اللوجستية في المكسيك

يُعد سوق مستودعات ولوجستيات الأجهزة الطبية في المكسيك لاعبًا ناشئًا في سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية، مستفيدًا من قربه من الولايات المتحدة، وتوسع قطاع تصنيع الأجهزة الطبية، وتحسين بنيته التحتية للرعاية الصحية. تُعدّ المكسيك مركزًا رئيسيًا للتصنيع التعاقدي وتصدير الأجهزة الطبية، لا سيما على طول الحدود بين الولايات المتحدة والمكسيك. ويدعم هذا النمو أيضًا المبادرات الحكومية لتحديث لوجستيات سلسلة التبريد وزيادة التوافق التنظيمي مع المعايير الدولية. ومن المتوقع أن تشهد المكسيك معدل نمو سنوي مركب ثابتًا بنسبة 7.1% بين عامي 2025 و2032، مدفوعًا بتزايد السياحة العلاجية، والشراكات بين القطاعين العام والخاص في مجال الرعاية الصحية، وتزايد الطلب على حلول اللوجستيات المُتحكم في درجة حرارتها.

حصة سوق مستودعات ولوجستيات الأجهزة الطبية في أمريكا الشمالية

إن صناعة سوق المستودعات والخدمات اللوجستية للأجهزة الطبية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- شركة البريد الألماني (ألمانيا)

- فيديكس (الولايات المتحدة)

- كوينه+ناجل (المملكة المتحدة)

- شركة AWL الهندية الخاصة المحدودة (الهند)

- شركة سي إتش روبنسون العالمية (الولايات المتحدة)

- CEVA (فرنسا)

- ديمركو (تايوان)

- DSV (الدنمارك)

- هانزا الدولية (الصين)

- شركة هيلمان العالمية للخدمات اللوجستية المحدودة (ألمانيا)

- الإمبراطورية (جنوب أفريقيا)

- خدمات الأعمال ميركوري (الولايات المتحدة)

- منظمة OIA العالمية (الولايات المتحدة)

- شركة أومني لوجيستكس، ذ.م.م (الولايات المتحدة)

- مجموعة رينوس (ألمانيا)

- سيكو (الولايات المتحدة)

- تيبا (إسبانيا)

- تول هولدينجز المحدودة (أستراليا)

أحدث التطورات في سوق مستودعات الأجهزة الطبية والخدمات اللوجستية في أمريكا الشمالية

- في نوفمبر 2023، افتتحت شركة دي إتش إل إكسبريس رسميًا مركزها الموسّع في آسيا الوسطى في هونغ كونغ، مستثمرةً 562 مليون يورو لتعزيز قدراتها في ظلّ نموّ التجارة العالمية. وقد زاد هذا المركز، الذي يُعدّ محوريًا لربط آسيا بالعالم، من قدرته على مناولة الشحنات في أوقات الذروة بنسبة تقارب 70%، وأصبح قادرًا الآن على إدارة ستة أضعاف حجم الشحنات منذ إنشائه عام 2004. ويؤكد هذا التوسع التزام دي إتش إل بدعم نموّ عملائها وترسيخ مكانة هونغ كونغ كمركز طيران دولي رئيسي.

- في ديسمبر 2022، أعلنت سلسلة توريد دي إتش إل عن استثمار بقيمة 10.93 مليون دولار أمريكي لتوسيع قدراتها التخزينية في شمال تايوان، مع التركيز بشكل خاص على قطاعات أشباه الموصلات وعلوم الحياة والرعاية الصحية. يضيف مركز توزيع تاويوان - جيان غو، الذي افتُتح حديثًا، 10,000 متر مربع إلى إجمالي مساحة التخزين لشركة دي إتش إل في تاويوان، لتصل إلى 37,000 متر مربع. يُعزز هذا المرفق الاتصال لضمان كفاءة العمليات اللوجستية، ويدعم هدف الشركة المتمثل في الوصول إلى 200,000 متر مربع من إجمالي مساحة التخزين في تايوان بحلول عام 2027.

- في سبتمبر 2024، أطلقت فيديكس منصة fdx، وهي حل تجاري قائم على البيانات ومتاح الآن للشركات الأمريكية. تستفيد المنصة من شبكة فيديكس لتحسين تجارب العملاء من خلال تحسين نمو الطلب، ومعدلات التحويل، وتحسين استيفاء الطلبات. تشمل الميزات البارزة تقديرات التسليم التنبؤية، ورؤى الاستدامة، وتتبع الطلبات ذات العلامة التجارية، وتبسيط عمليات الإرجاع. وقد سلّط راج سوبرامانيام، الرئيس التنفيذي لشركة فيديكس، الضوء على دور المنصة في سلاسل التوريد الأكثر ذكاءً خلال فعالية Dreamforce 2024.

- في مارس 2024، أطلقت شركة UPS Healthcare منصة UPS Supply Chain Symphony R، وهي منصة سحابية مصممة لدمج وإدارة بيانات سلسلة توريد الرعاية الصحية من مختلف الأنظمة التشغيلية. توفر هذه الأداة لعملاء الرعاية الصحية رؤية شاملة للوجستياتهم، مما يُمكّنهم من اتخاذ قرارات مدروسة، وتحسين التخطيط، والتنبؤ بدقة. من خلال تعزيز التحكم والكفاءة والشفافية، تُلبي هذه المنصة الحاجة الماسة إلى سلاسل توريد مُبسطة في مجال الرعاية الصحية. وقد أكدت كيت غوتمان على إمكاناتها التحويلية في تحسين العمليات العالمية ورعاية المرضى.

- في سبتمبر 2024، افتتحت شركة Kuehne+Nagel، الرائدة في مجال توفير الخدمات اللوجستية، مركزًا جديدًا لتوزيع المنتجات مُتحكمًا بدرجة حرارته لشركة Medtronic في ميلتون، أونتاريو، على بُعد 50 كيلومترًا فقط من تورنتو. يمتد المركز على مساحة 25,000 متر مربع، وسيُوزّع الأجهزة الطبية على المستشفيات، ويضم مراكز خدمة وإصلاح وصيانة ميدترونيك الوقائية لمعداتها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.