North America Medical Automation Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

35.34 Billion

USD

75.75 Billion

2025

2033

USD

35.34 Billion

USD

75.75 Billion

2025

2033

| 2026 –2033 | |

| USD 35.34 Billion | |

| USD 75.75 Billion | |

|

|

|

|

تقسيم سوق الأتمتة الطبية في أمريكا الشمالية، حسب المكونات (المعدات والبرمجيات والخدمات)، والنوع (صياغة وتوزيع الوصفات الطبية آليًا، والتقييم والمراقبة الصحية آليًا، والتصوير وتحليل الصور آليًا، والخدمات اللوجستية للرعاية الصحية آليًا، وتتبع الموارد والموظفين، والروبوتات الطبية والأجهزة الجراحية بمساعدة الحاسوب، والإجراءات العلاجية (غير الجراحية) الآلية، والاختبارات والتحليلات المخبرية الآلية)، والتطبيق (التشخيص والمراقبة، والعلاجات، وأتمتة المختبرات والصيدليات، والخدمات اللوجستية الطبية والتدريب، وغيرها)، والاتصال (سلكي ولاسلكي)، والمستخدم النهائي (المستشفيات، ومراكز التشخيص، والصيدليات، ومختبرات ومعاهد الأبحاث، والرعاية المنزلية، والعيادات المتخصصة، ومراكز الجراحة الخارجية ، وغيرها)، وقناة التوزيع (المناقصات المباشرة، ومبيعات التجزئة، والمبيعات عبر الإنترنت، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2033

حجم سوق الأتمتة الطبية في أمريكا الشمالية

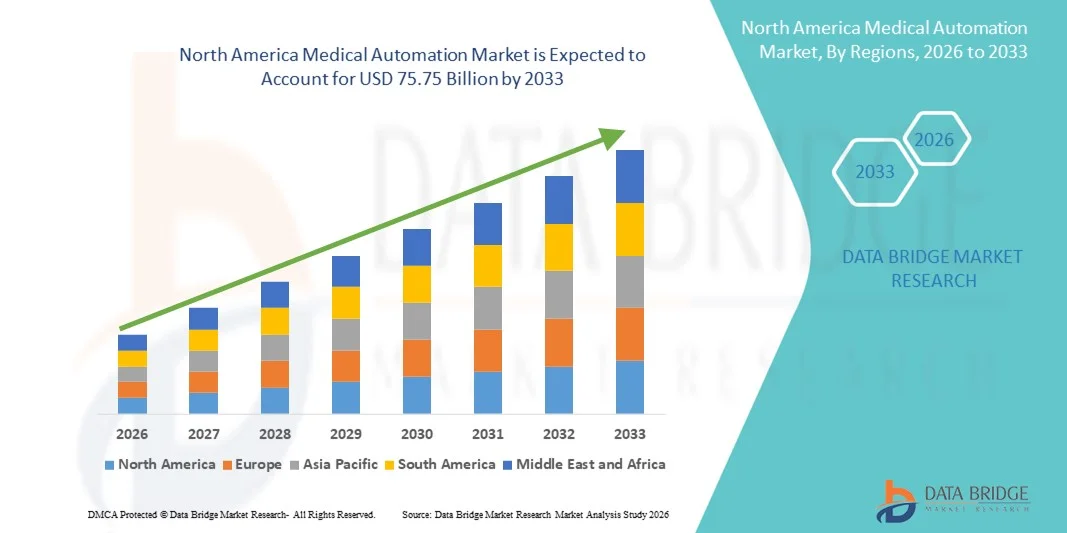

- بلغت قيمة سوق الأتمتة الطبية في أمريكا الشمالية 35.34 مليار دولار أمريكي في عام 2025، ومن المتوقع أن تصل إلى 75.75 مليار دولار أمريكي بحلول عام 2033 ، بمعدل نمو سنوي مركب قدره 10.00% خلال فترة التوقعات.

- يعود نمو السوق إلى حد كبير إلى التبني السريع لأنظمة تكنولوجيا المعلومات المتقدمة في مجال الرعاية الصحية، والروبوتات، والذكاء الاصطناعي في المستشفيات ومختبرات التشخيص، مما يؤدي إلى زيادة أتمتة سير العمل السريري والإداري والتشغيلي في كل من أقسام المرضى الداخليين والخارجيين.

- علاوة على ذلك، فإن الطلب المتزايد على تحسين الكفاءة التشغيلية، والحد من الأخطاء البشرية، وضبط التكاليف، وتعزيز سلامة المرضى، يُرسخ مكانة الأتمتة الطبية كعنصر أساسي في تقديم الرعاية الصحية الحديثة. وتُسهم هذه العوامل المتضافرة في تسريع تبني حلول الأتمتة الطبية، مما يُعزز نمو القطاع بشكل ملحوظ.

تحليل سوق الأتمتة الطبية في أمريكا الشمالية

- أصبحت الأتمتة الطبية، التي تشمل الروبوتات والبرمجيات المدعومة بالذكاء الاصطناعي والتشخيص الآلي وحلول سير العمل الرقمي، ضرورية بشكل متزايد في المستشفيات والمختبرات ومرافق العيادات الخارجية، حيث يسعى مقدمو الرعاية الصحية إلى تحسين الكفاءة التشغيلية والدقة السريرية وسلامة المرضى.

- يرجع الطلب المتزايد على الأتمتة الطبية في المقام الأول إلى زيادة أعداد المرضى، والضغط المتزايد لخفض التكاليف التشغيلية، ونقص المتخصصين المهرة في مجال الرعاية الصحية، والاعتماد السريع للتقنيات الرقمية والذكاء الاصطناعي والروبوتات في العمليات السريرية والإدارية.

- هيمنت الولايات المتحدة على سوق الأتمتة الطبية في أمريكا الشمالية بحصة إيرادات بلغت حوالي 38.6% في عام 2025، مدعومة ببنية تحتية راسخة للرعاية الصحية، واعتماد مبكر لحلول الأتمتة المتقدمة في مجال الرعاية الصحية، وانتشار واسع النطاق للتشخيص المدعوم بالذكاء الاصطناعي، والجراحة الروبوتية، وأتمتة المستشفيات، إلى جانب استثمارات قوية من شركات التكنولوجيا الطبية الرائدة.

- من المتوقع أن تكون كندا أسرع الدول نموًا في سوق الأتمتة الطبية خلال الفترة المتوقعة، بمعدل نمو سنوي مركب قوي يبلغ 11.8%، مدفوعًا بتحديث مرافق الرعاية الصحية المتزايد، والمبادرات الحكومية القوية الداعمة لرقمنة الرعاية الصحية، وزيادة استخدام الروبوتات الطبية، وتزايد الاستثمارات في حلول المستشفيات الذكية من قبل الشركات المحلية والدولية.

- هيمن قطاع الاتصالات السلكية على السوق بحصة إيرادات بلغت حوالي 58.2% في عام 2025، ويعود ذلك بشكل أساسي إلى موثوقيته الفائقة، واستقرار نقل البيانات، وأدائه منخفض زمن الاستجابة في بيئات الرعاية الصحية الحرجة.

نطاق التقرير وتجزئة سوق الأتمتة الطبية

|

صفات |

رؤى رئيسية حول سوق الأتمتة الطبية |

|

القطاعات التي تم تغطيتها |

|

|

الدول المشمولة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

• سيمنز هيلثينيرز (ألمانيا) |

|

فرص السوق |

|

|

مجموعات بيانات القيمة المضافة |

بالإضافة إلى المعلومات المتعلقة بسيناريوهات السوق مثل قيمة السوق ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليلًا متعمقًا من قبل الخبراء، وعلم الأوبئة الخاص بالمرضى، وتحليل خطوط الإنتاج، وتحليل التسعير، والإطار التنظيمي. |

اتجاهات سوق الأتمتة الطبية في أمريكا الشمالية

تزايد اعتماد سير العمل السريري والمختبري الآلي

- يُعدّ التوسع في استخدام الأنظمة الآلية في المستشفيات ومختبرات التشخيص ومرافق تصنيع الأدوية ومراكز الرعاية الخارجية اتجاهاً هاماً ومتسارعاً في سوق الأتمتة الطبية العالمية، وذلك بهدف تحسين الكفاءة والدقة وسلامة المرضى.

- فعلى سبيل المثال، في عام 2024، وسّعت شركة سيمنز هيلثينيرز نطاق نشر منصات أتمتة المختبرات الخاصة بها في جميع أنحاء أمريكا الشمالية وآسيا والمحيط الهادئ، لدعم التشخيص عالي الإنتاجية وسير العمل الموحد للاختبارات على نطاق عالمي.

- تُستخدم حلول الأتمتة الطبية بشكل متزايد لتبسيط المهام السريرية والإدارية المتكررة مثل تحضير العينات، وصرف الأدوية، ومراقبة المرضى، وإدارة البيانات، مما يقلل بشكل كبير من التدخل اليدوي ومعدلات الخطأ.

- إن الطلب العالمي المتزايد على التشخيص الأسرع، والنتائج السريرية المتسقة، وإجراء الاختبارات بكميات كبيرة، يُسرّع من تبني الأتمتة في أسواق الرعاية الصحية المتقدمة والناشئة على حد سواء.

- تُتيح التطورات في مجال الروبوتات، ومنصات البرمجيات المتكاملة، والأنظمة المُجهزة بأجهزة استشعار، تنسيقًا سلسًا بين مختلف وظائف الرعاية الصحية، مما يُحسّن استمرارية سير العمل في بيئات الرعاية المعقدة.

- يُحدث هذا التحول نحو أنظمة الرعاية الصحية الآلية والقابلة للتطوير والتوافق تحولاً جذرياً في نماذج تقديم الرعاية الصحية العالمية، ويعزز دور الأتمتة الطبية في جميع أنحاء العالم.

ديناميكيات سوق الأتمتة الطبية في أمريكا الشمالية

السائق

تزايد الطلب العالمي على الرعاية الصحية ومتطلبات الكفاءة التشغيلية

- يُعدّ تزايد العبء العالمي للأمراض المزمنة، وشيخوخة السكان، وارتفاع أعداد المرضى، من العوامل الرئيسية التي تدعم نمو سوق الأتمتة الطبية العالمية.

- فعلى سبيل المثال، أعلنت شركة فريزينيوس ميديكال كير في أبريل 2025 عن إطلاق عالمي لحلول إدارة ومراقبة العلاج الآلية في عيادات غسيل الكلى التابعة لها في مناطق متعددة، بهدف تحسين اتساق الرعاية والكفاءة التشغيلية.

- يتزايد اعتماد مقدمي الرعاية الصحية في جميع أنحاء العالم على تقنيات الأتمتة لمعالجة نقص القوى العاملة، وخفض التكاليف التشغيلية، وتعزيز الاتساق في العمليات السريرية.

- إن توسع المختبرات المركزية ومراكز تصنيع الأدوية ومرافق الرعاية الخارجية في مناطق مثل آسيا والمحيط الهادئ وأمريكا اللاتينية والشرق الأوسط يزيد من الطلب على الأنظمة الطبية الآلية

- بالإضافة إلى ذلك، تعمل مبادرات تحديث الرعاية الصحية العالمية والاستثمارات في البنية التحتية الرقمية والآلية على تسريع دمج حلول الأتمتة في مرافق الرعاية الصحية العامة والخاصة.

- تُسهم هذه العوامل مجتمعةً في خلق زخم قوي لنمو مستدام في سوق الأتمتة الطبية العالمية خلال الفترة المتوقعة.

ضبط النفس/التحدي

ارتفاع تكاليف رأس المال وتعقيد التنفيذ

- لا يزال الاستثمار الأولي المرتفع المطلوب لأنظمة الأتمتة الطبية المتقدمة يمثل تحديًا كبيرًا لمقدمي الرعاية الصحية، لا سيما في المناطق الحساسة للتكاليف والمحدودة الموارد.

- فعلى سبيل المثال، في عام 2024، أجلت العديد من المستشفيات في الأسواق الناشئة في آسيا وأمريكا اللاتينية مشاريع أتمتة المختبرات واسعة النطاق بسبب قيود التمويل وتحديات جاهزية البنية التحتية، مما يسلط الضوء على عوائق التبني المتعلقة بالتكلفة

- قد يؤدي تعقيد تكامل النظام، بما في ذلك التوافق مع البنية التحتية القديمة الحالية وأنظمة معلومات المستشفى، إلى إطالة جداول التنفيذ وزيادة تكاليف الملكية الإجمالية.

- بالإضافة إلى ذلك، فإن التحديات مثل متطلبات تدريب الموظفين، وإعادة تصميم سير العمل، والاضطرابات التشغيلية المؤقتة أثناء النشر، يمكن أن تزيد من تباطؤ عملية التبني.

- قد يؤدي التباين التنظيمي بين البلدان والمناطق إلى تعقيد نشر حلول الأتمتة الموحدة، مما يزيد من التكاليف المتعلقة بالامتثال.

- يُعدّ التغلب على هذه القيود من خلال تصميم أنظمة قابلة للتطوير، ونماذج تمويل مرنة، واستراتيجيات تنفيذ مدعومة من الموردين، أمراً ضرورياً للنمو طويل الأجل لسوق الأتمتة الطبية العالمي.

نطاق سوق الأتمتة الطبية في أمريكا الشمالية

يتم تقسيم السوق على أساس المكون والنوع والتطبيق والاتصال والمستخدم النهائي وقناة التوزيع.

- حسب المكون

استنادًا إلى المكونات، ينقسم سوق الأتمتة الطبية إلى ثلاثة قطاعات رئيسية: المعدات، والبرمجيات، والخدمات. وقد استحوذ قطاع المعدات على الحصة الأكبر من إيرادات السوق، بنسبة تقارب 46.1% في عام 2025، مدفوعًا بالانتشار الواسع لأنظمة الأجهزة الآلية في المستشفيات، ومختبرات التشخيص، والعيادات المتخصصة. وتشكل معدات مثل أنظمة التصوير الآلي، ومنصات الجراحة الروبوتية، ووحدات التوزيع الآلية، وروبوتات المختبرات، الركيزة الأساسية للبنية التحتية للأتمتة الطبية. وتواصل المستشفيات إعطاء الأولوية للاستثمار الرأسمالي في معدات الأتمتة للحد من الأخطاء السريرية، وتعزيز دقة الإجراءات، وإدارة الأعداد المتزايدة من المرضى. ويدعم الطلب القوي من المستشفيات الجامعية والمراكز الطبية الأكاديمية هذه الهيمنة. كما تتميز حلول المعدات بدورة استبدال أطول وقيمة شراء أولية عالية. ويساهم دمج أجهزة الاستشعار المدعومة بالذكاء الاصطناعي، والروبوتات، ووحدات التحكم الذكية في زيادة الإقبال عليها. وتتصدر الأسواق المتقدمة، مثل الولايات المتحدة وألمانيا واليابان وفرنسا، نشر المعدات. ويحافظ التحديث المستمر وتوسيع المرافق المجهزة بالأتمتة على ريادة الإيرادات.

من المتوقع أن يشهد قطاع البرمجيات أسرع معدل نمو سنوي مركب بنسبة 22.4% خلال الفترة من 2026 إلى 2033، وذلك بفضل التحول الرقمي السريع لعمليات الرعاية الصحية والاعتماد المتزايد على الأتمتة القائمة على البيانات. تُمكّن منصات البرمجيات من التحكم المركزي، والمراقبة الآنية، والصيانة التنبؤية، ودعم اتخاذ القرارات باستخدام الذكاء الاصطناعي في جميع الأنظمة المؤتمتة. كما يُسهم التوسع في استخدام الحلول السحابية، وخوارزميات الذكاء الاصطناعي، والبرمجيات المتوافقة مع السجلات الصحية الإلكترونية في تسريع هذا النمو. ويلجأ مقدمو الرعاية الصحية بشكل متزايد إلى استخدام برمجيات الأتمتة لتحسين استخدام المعدات وخفض التكاليف التشغيلية. وتُعزز نماذج الاشتراك ونماذج البرمجيات كخدمة (SaaS) من هذا التوجه. كما يُساهم توسع خدمات التطبيب عن بُعد والتشخيص عن بُعد في زيادة الطلب. وتستثمر الاقتصادات الناشئة بكثافة في برمجيات الأتمتة نظرًا لانخفاض تكاليفها الأولية مقارنةً بالأجهزة. ويُعزز التركيز التنظيمي على التتبع والامتثال نمو قطاع البرمجيات.

- حسب النوع

استنادًا إلى نوع الخدمة، يُقسّم السوق إلى أربعة قطاعات رئيسية: تركيب وصرف الوصفات الطبية آليًا، والتقييم والمراقبة الصحية آليًا، والتصوير وتحليل الصور آليًا، والخدمات اللوجستية للرعاية الصحية آليًا، وتتبع الموارد والموظفين، والروبوتات الطبية والأجهزة الجراحية بمساعدة الحاسوب، والإجراءات العلاجية (غير الجراحية) آليًا، والفحوصات والتحاليل المخبرية آليًا. وقد استحوذ قطاع التصوير وتحليل الصور آليًا على الحصة الأكبر من إيرادات السوق بنسبة 35.6% تقريبًا في عام 2025، مدفوعًا بالطلب المتزايد على التصوير التشخيصي السريع والدقيق وعالي الإنتاجية. يُحسّن التشغيل الآلي كفاءة سير العمل في أقسام الأشعة ويقلل من تباين التشخيص. وتساعد أدوات التصوير المدعومة بالذكاء الاصطناعي الأطباء في الكشف المبكر عن الأمراض واتخاذ القرارات السريرية. ويُعزز الاستخدام الواسع لهذه الأدوات في مجالات الأورام وأمراض القلب والأعصاب من تبنيها. وتعتمد سلاسل التشخيص والمستشفيات الكبيرة اعتمادًا كبيرًا على التصوير الآلي لإدارة أحجام المسح المتزايدة. كما تُعزز الموافقات التنظيمية لحلول التصوير القائمة على الذكاء الاصطناعي من هيمنتها في السوق. يعزز التكامل مع أنظمة أرشفة الصور والاتصالات (PACS) وأنظمة تكنولوجيا المعلومات في المستشفيات القيمة المضافة. وتسيطر المناطق المتقدمة على تبني هذه التقنية بفضل بنيتها التحتية المتطورة.

من المتوقع أن يشهد قطاع الروبوتات الطبية والأجهزة الجراحية بمساعدة الحاسوب أسرع معدل نمو سنوي مركب بنسبة 24.1% خلال الفترة من 2026 إلى 2033، مدفوعًا بتزايد الإقبال على الجراحات طفيفة التوغل والدقيقة. تُحسّن الأنظمة الروبوتية دقة العمليات الجراحية، وتقلل من فقدان الدم، وتُقصّر مدة الإقامة في المستشفى. كما تدعم برامج تدريب الجراحين المتنامية وتوسع نطاق استخدام هذه الأنظمة في مجالات جراحة العظام والمسالك البولية وأمراض النساء وجراحة الأعصاب، تبنيها. وتُسهم التطورات التكنولوجية، مثل الملاحة المدعومة بالذكاء الاصطناعي والوظائف المستقلة، في تسريع النمو. تستثمر المستشفيات في الروبوتات لتمييز خدماتها وتحسين نتائجها. ويُعزز التوسع في أسواق آسيا والمحيط الهادئ والشرق الأوسط معدل النمو السنوي المركب. كما تُعزز اتجاهات التعويضات المواتية وطلب المرضى على الرعاية المتقدمة زخم النمو.

- عن طريق التقديم

استنادًا إلى التطبيقات، يُقسّم السوق إلى التشخيص والمراقبة، والعلاجات، وأتمتة المختبرات والصيدليات، والخدمات اللوجستية الطبية والتدريب، وغيرها. استحوذ قطاع التشخيص والمراقبة على الحصة الأكبر من إيرادات السوق بنسبة 41.3% تقريبًا في عام 2025، مدفوعًا بارتفاع معدلات انتشار الأمراض المزمنة والحاجة إلى مراقبة المرضى بشكل مستمر. تُحسّن أنظمة التشخيص الآلية الدقة وتُقلّل من وقت الاستجابة. وقد لاقت حلول المراقبة عن بُعد رواجًا كبيرًا بعد الجائحة. وتُوظّف المستشفيات بشكل متزايد أنظمة التشخيص الآلية لإدارة تدفق المرضى الكبير. كما يُعزّز التكامل مع الأجهزة القابلة للارتداء ومنصات إنترنت الأشياء من هيمنتها. وتُساهم المبادرات الحكومية الداعمة للتشخيص الرقمي أيضًا في هذا النمو. ولا تزال أتمتة التشخيص عنصرًا أساسيًا في استراتيجيات الرعاية الصحية الوقائية.

من المتوقع أن يسجل قطاع أتمتة المختبرات والصيدليات أسرع معدل نمو سنوي مركب بنسبة 23.0% خلال الفترة من 2026 إلى 2033، مدفوعًا بارتفاع حجم الاختبارات والطلب المتزايد على صرف الأدوية بدقة متناهية. تُحسّن الأتمتة إنتاجية المختبرات، وتقلل من مخاطر التلوث، وتضمن الامتثال للوائح التنظيمية. كما تُقلل أتمتة الصيدليات من أخطاء الأدوية وتُحسّن إدارة المخزون. ويدعم الإقبال الكبير على استخدامها في صيدليات المستشفيات والمختبرات المركزية هذا النمو. ويزيد توسع مرافق الرعاية الصحية الأولية والخارجية من الطلب. كما يُساهم التركيز المتزايد على الطب الشخصي في تسريع وتيرة تبني هذه التقنية.

- عن طريق الاتصال

استنادًا إلى الاتصال، ينقسم السوق إلى قسمين: سلكي ولاسلكي. هيمنت الشبكات السلكية على السوق بحصة إيرادات بلغت حوالي 58.2% في عام 2025، ويعود ذلك بشكل أساسي إلى موثوقيتها العالية، واستقرار نقل البيانات، وانخفاض زمن الاستجابة في بيئات الرعاية الصحية الحساسة. يُفضل استخدام الاتصال السلكي على نطاق واسع لأنظمة الأتمتة المستخدمة في غرف العمليات، ووحدات العناية المركزة، والتصوير التشخيصي، وأتمتة المختبرات، حيث يُعد الأداء المتواصل أمرًا بالغ الأهمية. تعتمد المستشفيات على الشبكات السلكية لضمان استمرارية عمل النظام وتقليل مخاطر الأمن السيبراني المرتبطة بنقل البيانات اللاسلكي. صُممت البنية التحتية الحالية للمستشفيات بشكل كبير حول الاتصال السلكي، مما يقلل من تكاليف الاستثمار الإضافية. كما تدعم الأنظمة السلكية أحمال البيانات العالية الناتجة عن أنظمة التصوير والروبوتات. وتُعزز متطلبات الامتثال التنظيمي وحماية البيانات من تفضيل الحلول السلكية. تُعطي مرافق الرعاية الصحية الكبيرة الأولوية للأتمتة السلكية للتطبيقات بالغة الأهمية. ويساهم المتانة طويلة الأمد والأداء المتوقع في استمرار هيمنتها.

من المتوقع أن يشهد قطاع الاتصالات اللاسلكية أسرع نمو سنوي مركب بنسبة 21.2% خلال الفترة من 2026 إلى 2033، مدفوعًا بالتوسع السريع للأجهزة الطبية التي تدعم تقنية إنترنت الأشياء وحلول مراقبة المرضى عن بُعد. تتيح الاتصالات اللاسلكية مرونةً وحركةً أكبر للعاملين في مجال الرعاية الصحية والمرضى على حدٍ سواء. كما يدعم التوسع المتزايد في استخدام خدمات التطبيب عن بُعد والرعاية المنزلية بقوة نشر أنظمة التشغيل الآلي اللاسلكية. تُقلل الأنظمة اللاسلكية من تعقيد عملية التركيب وتُمكّن من التوسع القابل للتطبيق في مختلف المرافق. ويُساهم نمو مراكز الجراحة النهارية والعيادات الخارجية في تسريع هذا التبني. تُحسّن التطورات في تقنية الجيل الخامس (5G) بشكل كبير من عرض النطاق الترددي والسرعة والموثوقية. كما تُعد الاتصالات اللاسلكية ضرورية للأجهزة القابلة للارتداء وأجهزة الاستشعار الذكية. وتعتمد الاقتصادات الناشئة بشكل متزايد على الأنظمة اللاسلكية نظرًا لانخفاض متطلبات البنية التحتية. ويُعزز الابتكار المستمر آفاق النمو على المدى الطويل.

- بواسطة المستخدم النهائي

استنادًا إلى المستخدم النهائي، يُقسّم السوق إلى المستشفيات، ومراكز التشخيص، والصيدليات، ومختبرات ومعاهد الأبحاث، والرعاية المنزلية، والعيادات التخصصية، ومراكز الجراحة النهارية، وغيرها. هيمن قطاع المستشفيات على السوق بحصة إيرادات بلغت حوالي 49.4% في عام 2025، مدفوعًا بالتوسع الكبير في استخدام الأتمتة في مختلف الأقسام. تستثمر المستشفيات بكثافة في التشخيص الآلي، والجراحة بمساعدة الروبوت، وأتمتة الصيدليات، وأنظمة مراقبة المرضى لتحسين الكفاءة ونتائج العلاج. تتطلب أعداد المرضى الكبيرة تبسيط إجراءات العمل وتقليل الأخطاء البشرية. كما تستفيد المستشفيات من ميزانيات رأسمالية أعلى وإمكانية الوصول إلى التمويل الحكومي أو الخاص. يُعزز دمج الأتمتة مع أنظمة معلومات المستشفيات من تبنيها. تُعد المستشفيات التعليمية والتخصصية من أوائل المتبنين لتقنيات الأتمتة المتقدمة. يدعم الضغط التنظيمي لتحسين جودة الرعاية استمرار الاستثمار. كما تُعطي المستشفيات الأولوية للأتمتة لمعالجة نقص القوى العاملة. يُحافظ التخطيط طويل الأجل للبنية التحتية على ريادة السوق.

من المتوقع أن يشهد قطاع الرعاية المنزلية أسرع معدل نمو سنوي مركب بنسبة 22.6% خلال الفترة من 2026 إلى 2033، مدفوعًا بالتوجه المتزايد نحو تقديم رعاية صحية لامركزية تتمحور حول المريض. ويُسهم ارتفاع نسبة كبار السن وانتشار الأمراض المزمنة بشكل كبير في زيادة الطلب على حلول الأتمتة المنزلية. وتُمكّن أجهزة المراقبة الآلية من المتابعة المستمرة للحالة الصحية للمرضى. كما يُعزز التشخيص عن بُعد وتكامل خدمات التطبيب عن بُعد إمكانية الوصول إلى الرعاية. وتُقلل أتمتة الرعاية المنزلية من حالات إعادة دخول المستشفى وتكاليف الرعاية الصحية الإجمالية. وقد أدت التطورات التكنولوجية إلى ظهور أجهزة أتمتة صغيرة الحجم وسهلة الاستخدام وقابلة للنقل. كما يُساهم تزايد إقبال المرضى على العلاج المنزلي في دعم النمو. ويُعزز توسع نطاق الاتصال اللاسلكي من جدوى هذه الحلول. وتُسرّع سياسات السداد المواتية في المناطق المتقدمة من تبني هذه الحلول. كما تُظهر الأسواق الناشئة إمكانات قوية لنمو أتمتة الرعاية المنزلية.

- عن طريق قناة التوزيع

استنادًا إلى قنوات التوزيع، يُقسّم السوق إلى المناقصات المباشرة، ومبيعات التجزئة، والمبيعات عبر الإنترنت، وقنوات أخرى. استحوذت المناقصات المباشرة على الحصة الأكبر من الإيرادات بنسبة 53.7% تقريبًا في عام 2025، مدعومةً بعقود شراء واسعة النطاق من المستشفيات، وأنظمة الرعاية الصحية الحكومية، والمؤسسات العامة. تُمكّن المناقصات المباشرة من شراء معدات وأنظمة أتمتة عالية القيمة بكميات كبيرة. تضمن هذه القناة النشر الموحد والامتثال للمتطلبات التنظيمية. تُفضّل الحكومات وشبكات المستشفيات الكبيرة المناقصات المباشرة لما توفره من شفافية وكفاءة في التكلفة. كما تُعزّز اتفاقيات الخدمة والصيانة طويلة الأجل هذه القناة. تدعم المناقصات المباشرة أيضًا التخصيص وتكامل الأنظمة. ولا تزال هي الخيار المهيمن لحلول الأتمتة كثيفة رأس المال. تُساهم استثمارات الرعاية الصحية العامة بشكل كبير في دعم الطلب.

من المتوقع أن يسجل قطاع المبيعات عبر الإنترنت أسرع معدل نمو سنوي مركب بنسبة 21.8% خلال الفترة من 2026 إلى 2033، مدفوعًا بتزايد رقمنة عمليات الشراء. وتُفضل العيادات الصغيرة والصيدليات ومقدمو خدمات الرعاية المنزلية بشكل متزايد المنصات الإلكترونية لشراء أجهزة التشغيل الآلي. توفر المبيعات عبر الإنترنت شفافية أكبر في الأسعار وتوافرًا أوسع للمنتجات، كما أن سهولة الطلب وسرعة التسليم تُعزز من الإقبال عليها. ويدعم نمو منصات التجارة الإلكترونية المتخصصة في الأجهزة الطبية هذا التوسع. وتُعد البرامج القائمة على الاشتراك وأدوات التشغيل الآلي المعيارية مناسبة تمامًا للتوزيع عبر الإنترنت. كما يُساهم ارتفاع معدل انتشار الإنترنت في الأسواق الناشئة في تسريع النمو. وتُمكّن القنوات الإلكترونية أيضًا من التواصل المباشر بين المُصنِّع والعميل. ويدعم الابتكار المستمر في المنصات قابلية التوسع على المدى الطويل.

تحليل إقليمي لسوق الأتمتة الطبية في أمريكا الشمالية

- من المتوقع أن يشهد سوق الأتمتة الطبية في أمريكا الشمالية نموًا كبيرًا بمعدل نمو سنوي مركب خلال فترة التوقعات، مدفوعًا بشكل أساسي بتزايد الضغط لتحسين كفاءة الرعاية الصحية، وخفض التكاليف التشغيلية، ومعالجة نقص القوى العاملة في المستشفيات ومراكز التشخيص.

- يُسهم الإطار التنظيمي القوي في المنطقة، الداعم لتبني الصحة الرقمية، إلى جانب تزايد الاستثمارات في أنظمة المختبرات الآلية، والجراحة بمساعدة الروبوت، وسير العمل السريري المدعوم بالذكاء الاصطناعي، في تسريع نمو السوق. ويتزايد اعتماد مقدمي الرعاية الصحية في أمريكا الشمالية لحلول الأتمتة الطبية لتعزيز سلامة المرضى، وتحسين دقة التشخيص، وتبسيط العمليات في المستشفيات.

- يشهد قطاع الرعاية الصحية نمواً ملحوظاً في المرافق الصحية العامة والخاصة، حيث يتم دمج تقنيات الأتمتة في كل من المستشفيات المبنية حديثاً ومبادرات تحديث البنية التحتية للرعاية الصحية القائمة.

نظرة عامة على سوق الأتمتة الطبية في الولايات المتحدة:

هيمنت الولايات المتحدة على سوق الأتمتة الطبية في أمريكا الشمالية، محققةً أعلى حصة من الإيرادات بنسبة تقارب 38.6% في عام 2025، مدعومةً ببنية تحتية متطورة للرعاية الصحية، واعتماد مبكر لحلول الأتمتة المتقدمة، وانتشار واسع النطاق للتشخيص المدعوم بالذكاء الاصطناعي، والجراحة الروبوتية، وأتمتة المستشفيات، إلى جانب استثمارات ضخمة من شركات التكنولوجيا الطبية الرائدة. وتشهد البلاد استمراراً في التوسع السريع في استخدام الروبوتات الطبية، وأنظمة المختبرات الآلية، وسير العمل السريري المدعوم بالذكاء الاصطناعي، مما يعزز نمو السوق بشكل عام.

نظرة عامة على سوق الأتمتة الطبية في كندا:

من المتوقع أن يكون سوق الأتمتة الطبية في كندا الأسرع نموًا في أمريكا الشمالية خلال الفترة المتوقعة، بمعدل نمو سنوي مركب قوي يبلغ 11.8%، مدفوعًا بتحديث مرافق الرعاية الصحية، والمبادرات الحكومية الداعمة لرقمنة الرعاية الصحية، وتزايد استخدام الروبوتات الطبية، والاستثمارات المتنامية في حلول المستشفيات الذكية من قبل الشركات المحلية والدولية. وتسعى المستشفيات، سواء الجديدة منها أو القائمة، إلى دمج حلول الأتمتة بشكل متزايد لتحسين رعاية المرضى، وكفاءة العمليات، والنتائج السريرية.

حصة سوق الأتمتة الطبية في أمريكا الشمالية

تتصدر شركات راسخة صناعة الأتمتة الطبية، بما في ذلك:

• سيمنز هيلثينيرز (ألمانيا)

• جي إي هيلث كير (الولايات المتحدة)

• فيليبس هيلث كير (هولندا)

• أبوت (الولايات المتحدة)

• روش دياجنوستيكس (سويسرا)

• ميدترونيك (أيرلندا)

• بي دي (الولايات المتحدة)

• سترايكر كوربوريشن (الولايات المتحدة)

• بوسطن ساينتيفيك (الولايات المتحدة)

• أوليمبوس كوربوريشن (اليابان)

• إنتويتيف سيرجيكال (الولايات المتحدة)

• داناهر كوربوريشن (الولايات المتحدة)

• ثيرمو فيشر ساينتيفيك (الولايات المتحدة)

• أجيلنت تكنولوجيز (الولايات المتحدة)

• جونسون آند جونسون (الولايات المتحدة)

• فريزينيوس ميديكال كير (ألمانيا)

• سميث آند نيفيو (المملكة المتحدة)

• جيتينج إيه بي (السويد)

• زيمر بايوميت (الولايات المتحدة)

• أومنيسيل (الولايات المتحدة)

آخر التطورات في سوق الأتمتة الطبية في أمريكا الشمالية

- في مارس 2025، أطلقت مستشفيات براشانث في الهند معهد الجراحة الروبوتية، إلى جانب نظام جراحي روبوتي متخصص لإجراء عمليات جراحية طفيفة التوغل، مما يمثل توسعًا كبيرًا في استخدام الأتمتة الطبية في الممارسة السريرية في جنوب آسيا. وسلط المستشفى الضوء على فوائد الروبوت في تقليل فترة النقاهة، وفقدان الدم، ودرجة التدخل الجراحي، مع دعمه لعمليات الجراحة العامة، والمسالك البولية، وأمراض النساء - وهو إنجاز هام في تبني الأتمتة على مستوى المنطقة.

- في أبريل 2025، أعلنت شركة IMA Automation عن إطلاق قسم IMA Med-Tech التابع لها، والذي يركز على خطوط التجميع والتعبئة الآلية المخصصة للأجهزة الطبية، مثل الحقن، وأجهزة الاستنشاق، ومنصات التشخيص، ومنتجات الرعاية الصحية القابلة للارتداء. وتعكس هذه المبادرة التوجه الأوسع نحو الأتمتة في عمليات تصنيع وتجميع الأجهزة عبر سلسلة التوريد في قطاع الرعاية الصحية.

- في مارس 2025، أعلنت شركة UiPath عن اتفاقية استشارية عالمية مع مزود رئيسي لأنظمة السجلات الطبية الإلكترونية (EMR) لتسريع خدمات الأتمتة لمؤسسات الرعاية الصحية في 16 دولة، مما يسهل التكامل السلس بين أنظمة السجلات الطبية الإلكترونية وسير العمل الآلي، ويوسع نطاق استخدام أدوات الأتمتة في العمليات السريرية والإدارية.

- في أكتوبر 2024، أطلقت مايكروسوفت مجموعة من أدوات الذكاء الاصطناعي والأتمتة الجديدة في مجال الرعاية الصحية، والتي تركز على نماذج التصوير الطبي، والتوثيق السريري الآلي، ومساعدة الممرضات في سير العمل، بهدف تقليل العبء الإداري وتحسين تقديم الرعاية من خلال الأتمتة الذكية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.