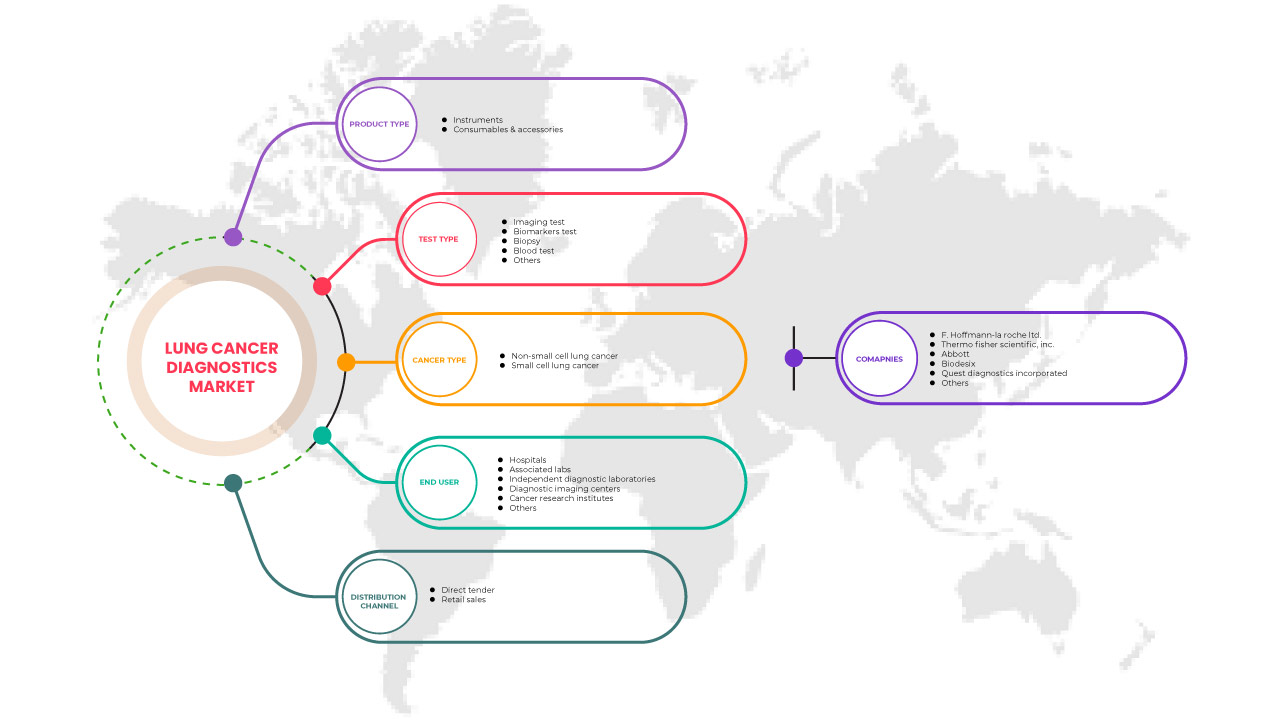

سوق تشخيص سرطان الرئة في أمريكا الشمالية، حسب نوع المنتج (الأدوات والمواد الاستهلاكية والملحقات)، نوع الاختبار (اختبار المؤشرات الحيوية، اختبار التصوير، الخزعة، اختبار الدم، وغيرها)، نوع السرطان ( سرطان الرئة ذو الخلايا غير الصغيرة ، سرطان الرئة ذو الخلايا الصغيرة)، المستخدم النهائي (المستشفى، المختبرات المرتبطة، مختبرات التشخيص المستقلة، مراكز التصوير التشخيصي، معاهد أبحاث السرطان وغيرها)، قناة التوزيع (العطاء المباشر، مبيعات التجزئة) - اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل ورؤى حول سوق تشخيص سرطان الرئة في أمريكا الشمالية

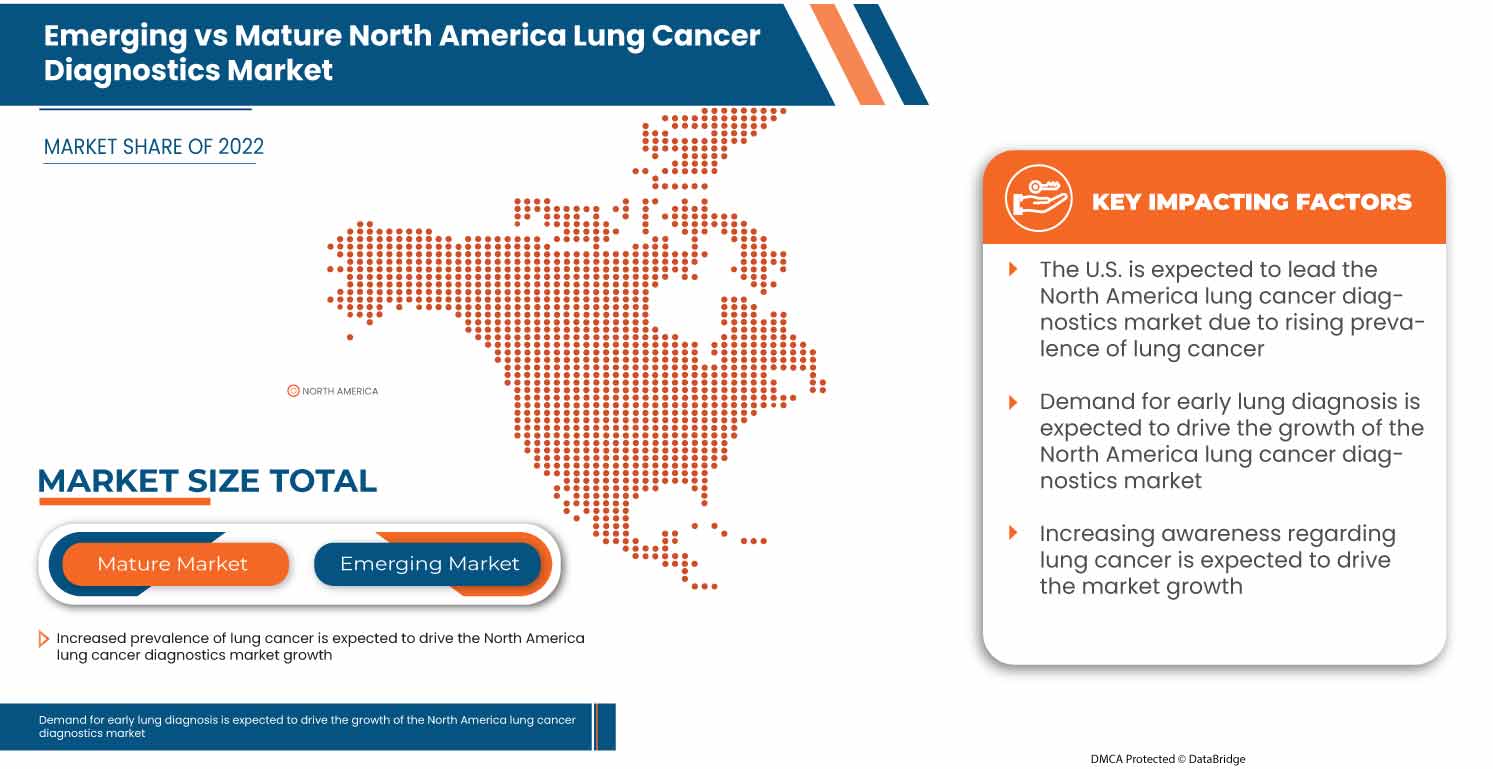

من المتوقع أن ينمو سوق تشخيص سرطان الرئة في أمريكا الشمالية في العام المتوقع بسبب زيادة عدد اللاعبين في السوق وتوافر الخدمات المتقدمة. إلى جانب ذلك، يشارك المصنعون في أنشطة البحث والتطوير لإطلاق خدمات جديدة في السوق. ومن المتوقع أن يؤدي زيادة تشخيص سرطان الرئة وأبحاث التطوير إلى تعزيز نمو السوق. ومع ذلك، فإن الصعوبات في تقنيات فحص سرطان الرئة قد تعيق نمو سوق تشخيص سرطان الرئة في أمريكا الشمالية في فترة التوقعات.

ومن المتوقع أن يؤدي ارتفاع الإنفاق الصحي على تشخيص وعلاج السرطان إلى إتاحة الفرص للسوق لتحسين العلاج. ومع ذلك، فإن التكلفة المرتفعة للاختبار واللوائح والمعايير الصارمة للموافقة على منتجات تشخيص السرطان وتسويقها قد تشكل تحديًا لنمو السوق.

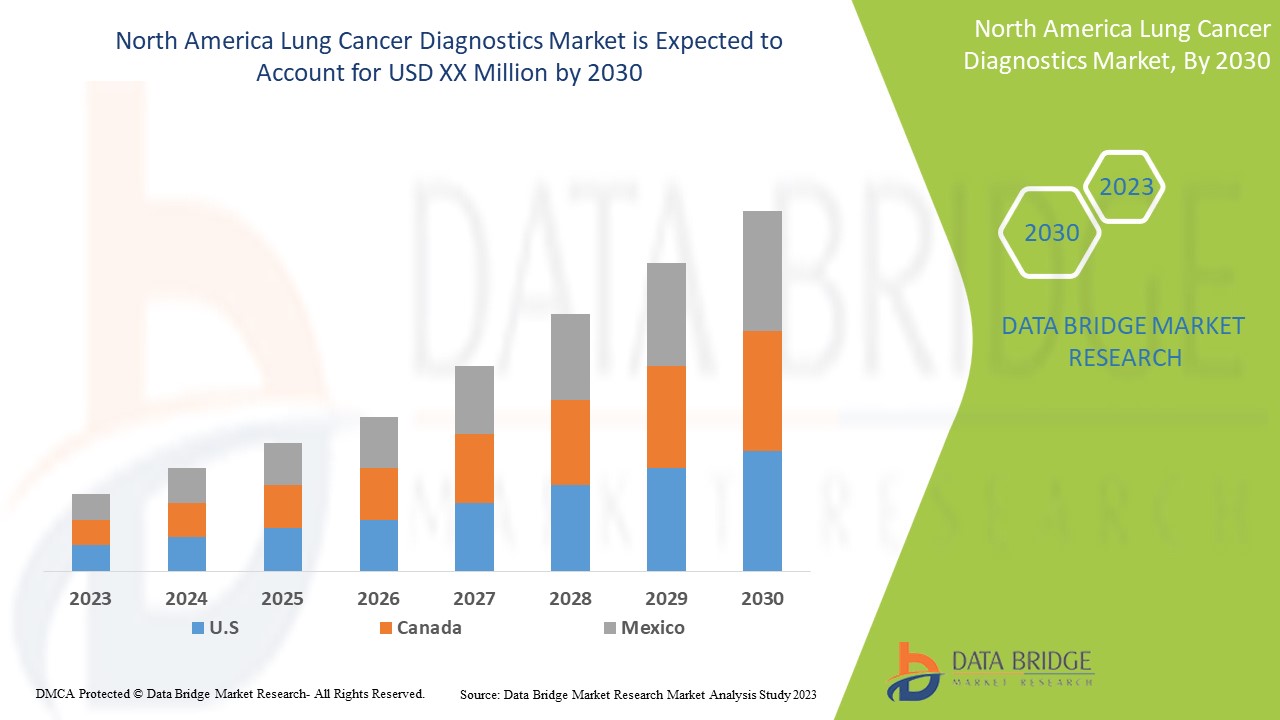

يعتبر سوق تشخيص سرطان الرئة في أمريكا الشمالية داعمًا ويهدف إلى الحد من تطور المرض. تحلل شركة Data Bridge Market Research أن سوق تشخيص سرطان الرئة في أمريكا الشمالية سينمو بمعدل نمو سنوي مركب يبلغ 14.6% خلال الفترة المتوقعة من 2023 إلى 2030.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

نوع المنتج (الأجهزة والمواد الاستهلاكية والملحقات)، نوع الاختبار (اختبار المؤشرات الحيوية، اختبار التصوير، الخزعة، اختبار الدم، وغيرها)، نوع السرطان (سرطان الرئة ذو الخلايا غير الصغيرة، سرطان الرئة ذو الخلايا الصغيرة)، المستخدم النهائي (المستشفى، المختبرات المرتبطة، مختبرات التشخيص المستقلة، مراكز التصوير التشخيصي، معاهد أبحاث السرطان وغيرها)، قناة التوزيع (العطاء المباشر، مبيعات التجزئة) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

F. Hoffmann-La Roche Ltd.، Thermo Fisher Scientific Inc.، Abbott، Quest Diagnostics Incorporated، Biodesix، Amoy Diagnostics Co.، Ltd.، Bio-Rad Laboratories, Inc.، Biocartis، Boditech Med Inc.، Danaher، Vela Diagnostics، DiaSorin SpA، Exact Sciences UK, Ltd. (شركة تابعة لشركة Exact Science Corporation)، 20/20 Gene Systems، Guardant Health, Inc.، Inivata Ltd.، LalPathLabs.com، LungLife AI, Inc.، MedGenome، Myriad Genetics, Inc.، NeoGenomics Laboratories، NanoString، Nanoentek، Oncocyte Corporation، PerkinElmer Inc.، PlexBio، QIAGEN، Siemens Healthcare GmbH، وVeracyte, Inc. وغيرها |

تعريف السوق

يبدأ السرطان في الرئتين ويحدث غالبًا لدى الأشخاص المدخنين. هناك نوعان رئيسيان من سرطان الرئة هما سرطان الرئة ذو الخلايا غير الصغيرة وسرطان الرئة ذو الخلايا الصغيرة . تشمل أسباب سرطان الرئة التدخين والتدخين السلبي والتعرض لبعض السموم والتاريخ العائلي.

تشمل الأعراض السعال (غالبًا مع وجود دم)، وألم في الصدر، وأزيز، وفقدان الوزن. لا تظهر هذه الأعراض غالبًا إلا بعد تقدم السرطان. تتنوع العلاجات ولكنها قد تشمل الجراحة، والعلاج الكيميائي، والعلاج الإشعاعي، والعلاج الدوائي المستهدف، والعلاج المناعي.

ديناميكيات سوق تشخيص سرطان الرئة في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

- زيادة التشخيص المبكر لسرطان الرئة

قد يحدث التعلم الآلي ثورة في التشخيص المبكر للسرطان، والذي يدرب أجهزة الكمبيوتر على رؤية الأنماط في البيانات المعقدة. تتضمن الأدوات تقييمات البيانات الصحية الشائعة والتصوير الطبي وعينات الخزعة واختبارات الدم للمساعدة في التشخيص المبكر وتصنيف المخاطر. في العديد من أنواع الأورام، تزداد احتمالية الخضوع للعلاج الناجح مع التشخيص المبكر للسرطان. تتمثل إحدى الاستراتيجيات المهمة في تقييم المرضى المعرضين للخطر والذين لا تظهر عليهم أعراض والاستجابة بسرعة وبشكل مناسب لأولئك الذين تظهر عليهم الأعراض.

تزداد احتمالات علاج السرطان بنجاح بشكل كبير من خلال الكشف المبكر. ويتمثل عنصرا الكشف المبكر عن السرطان في الفحص والتشخيص المبكر (أو تقليص مرحلة المرض). وفي حين يتألف الفحص من تقييم الأفراد الأصحاء للعثور على المصابين بالسرطان قبل ظهور أي أعراض، يركز التشخيص المبكر على تحديد المرضى الذين تظهر عليهم الأعراض في أقرب وقت ممكن.

- غالبًا ما يكون اكتشاف السرطانات في مراحلها المبكرة محدودًا بسبب ارتفاع نسبة الإيجابيات الكاذبة وضعف الحساسية

إن ابتكار اختبارات غير جراحية يمكنها تحديد ما إذا كان الشخص مصابًا بالسرطان في مرحلة مبكرة ومكانه في الجسم بسرعة وموثوقية هو أحد أكثر المجالات الواعدة في أبحاث الوقاية من السرطان. وليس سرطانًا واحدًا فقط بل مجموعة متنوعة من السرطانات. وعلى هذه الجبهة، تم تحقيق تقدم كبير في السنوات الأخيرة. هناك العديد من اختبارات الكشف المبكر عن السرطان المتعدد (MCED) قيد التطوير حاليًا، وهي مصممة لفحص أنواع متعددة من السرطان لدى الأفراد الأصحاء في وقت واحد. ومع ذلك، فإن اكتشاف السرطان في مرحلة مبكرة يمثل تحديًا لأنه يأتي مع العديد من الحواجز، مثل الإيجابيات الكاذبة العالية أو ضعف الحساسية. تؤدي العديد من حالات ضعف حساسية التشخيص إلى تعريض حياة المريض للخطر. كما أن الإيجابيات الكاذبة العالية هي أحد أسباب تقدم السرطان إلى مراحل متأخرة أو مراحل متقدمة.

وبالتالي، فإن الكشف عن السرطانات في مراحلها المبكرة غالباً ما يكون محدوداً بسبب ارتفاع نسبة الإيجابيات الكاذبة، وفي بعض الأحيان قد تعمل الحساسية الضعيفة كعامل تقييد رئيسي لنمو سوق تشخيص سرطان الرئة في أمريكا الشمالية.

- ارتفاع الإنفاق على الرعاية الصحية لتشخيص وعلاج السرطان

في جميع أنحاء العالم، تتزايد أنشطة البحث والتطوير بسبب الإنفاق على الصحة العامة مع الأداء الاقتصادي. في حين تحتل صناعة الرعاية الصحية المرتبة الثانية بين جميع الصناعات عندما يتعلق الأمر بالمبلغ الذي يتم إنفاقه على الرعاية الصحية. يمكن أن يؤدي ارتفاع الإنفاق على الرعاية الصحية إلى توفير فرص أفضل للبحث والتطوير. ومن المتوقع أن يزيد الطلب على تشخيص سرطان الرئة. كما تساعد زيادة الإنفاق على الرعاية الصحية لعلاج السرطان المريض على إجراء تشخيصات وعلاجات متقدمة خالية من المتاعب للتعافي السريع. يتكون الإنفاق على الرعاية الصحية من مزيج من المدفوعات من الجيب (الأشخاص الذين يدفعون مقابل رعايتهم) والإنفاق الحكومي والمصادر. ويشمل أيضًا التأمين الصحي والأنشطة التي تقوم بها المنظمات غير الحكومية. يعد هذا الإنفاق المتزايد على الرعاية الصحية لعلاج السرطان فرصة لزيادة الطلب في السوق.

- نقص المهنيين المهرة والمعتمدين

إن الحاجة إلى متخصصين ماهرين ومعتمدين تشكل عائقًا كبيرًا أمام تشخيص السرطان. ويزداد الطلب على تشخيص السرطان بسبب زيادة حالات الإصابة بالسرطان في العالم، ولكن قلة عدد المتخصصين المهرة الموجودين في مركز التشخيص تعوق نمو السوق.

لقد تطورت الأدوات والأساليب والإجراءات المستخدمة في تشخيص السرطان، ولكن هناك بعض الفجوات في التوحيد القياسي والمساواة والمعرفة. ويواجه الفنيون فجوات في التدريب الفني تتعلق بالمشكلات ويتكيفون مع الأساليب المتقدمة بأمان لإجراء العمليات بكفاءة. وفي تشخيص السرطان، هناك حاجة ماسة إلى متخصصين مهرة لتطوير الأساليب والتحقق منها وتشغيلها واستكشاف الأخطاء وإصلاحها.

يعد تشخيص السرطان مكونًا ديناميكيًا في وقتنا المعقد اليوم، حيث يوفر للمرضى معلومات أساسية لتشخيص مرض السرطان والوقاية منه وعلاجه وإدارته. إن الحاجة إلى موظفين مدربين تشكل مشكلة كبيرة في سوق تشخيص سرطان الرئة في أمريكا الشمالية. وبسبب نقص المهنيين المهرة والمعتمدين، لا يستطيع المستخدمون النهائيون تثبيت منتجات متقدمة لتشخيص السرطان؛ وقد يشكل هذا تحديًا لنمو سوق تشخيص سرطان الرئة في أمريكا الشمالية.

تأثير ما بعد كوفيد-19 على سوق تشخيص سرطان الرئة في أمريكا الشمالية

أثار العبء الثقيل الذي فرضه فيروس كورونا المستجد على أنظمة الرعاية الصحية في جميع أنحاء العالم مخاوف بين أطباء الأورام بشأن تأثير فيروس كورونا المستجد على تشخيص وعلاج سرطان الرئة. لقد بحثنا في تأثير فيروس كورونا المستجد على تشخيص وعلاج سرطان الرئة قبل وبعد عصر فيروس كورونا المستجد في دراسة الأقران الاستعادية هذه. خلال الوباء، انخفضت تشخيصات سرطان الرئة الجديدة بنسبة 34.7٪ مع مراحل أكثر تقدمًا قليلاً من المرض، وكان هناك زيادة كبيرة في الجراحة الإشعاعية كأول علاج نهائي وانخفاض في العلاج والجراحة الجهازية مقارنة بعصر ما قبل فيروس كورونا المستجد. وبالمقارنة بأوقات ما قبل فيروس كورونا المستجد، لم يكن هناك تأخير كبير في بدء العلاج الكيميائي والعلاج الإشعاعي أثناء الوباء.

ومع ذلك، لاحظنا أثناء الجائحة تأخيرًا في إجراء جراحات سرطان الرئة. ويبدو أن كوفيد-19 قد أثر بشكل كبير على تشخيص مرضى سرطان الرئة وأنماط العلاج في مركز سرطان الرئة لدينا. ويشعر العديد من أطباء الأورام بالقلق من ارتفاع عدد مرضى سرطان الرئة الذين تم تشخيصهم حديثًا في العام المقبل. ولا يزال هذا البحث جاريًا، وسيتم جمع المزيد من المعلومات وتحليلها لفهم التأثير الإجمالي لجائحة كوفيد-19 على مرضى سرطان الرئة لدينا بشكل أفضل.

التطورات الأخيرة

- في أكتوبر 2022، أعلنت Quest Diagnostics عن فصل جديد من الشراكة مع Decode Health. ساعدت هذه الشراكة الشركة في تقليل الوقت والتكاليف اللازمة لإنشاء اختبارات تشخيصية جديدة وإيجاد أهداف دوائية جديدة لمختلف أنواع السرطان وزيادة حضور الشركة في أمريكا الشمالية

- في أغسطس 2022، أعلنت شركة F. Hoffmann-La Roche Ltd. عن إطلاق نظام Digital LightCycler، وهو نظام تفاعل البوليميراز المتسلسل الرقمي من الجيل التالي الذي يساعد الباحثين السريريين على فهم طبيعة سرطان المريض أو مرضه الوراثي أو إصابته بشكل أفضل. تم تصميم هذا النظام للمختبرات التي تقوم بتحليل الحمض النووي الريبي والحمض النووي الريبي بدقة وحساسية عالية في علم الأورام والأمراض المعدية

نطاق سوق تشخيص سرطان الرئة في أمريكا الشمالية

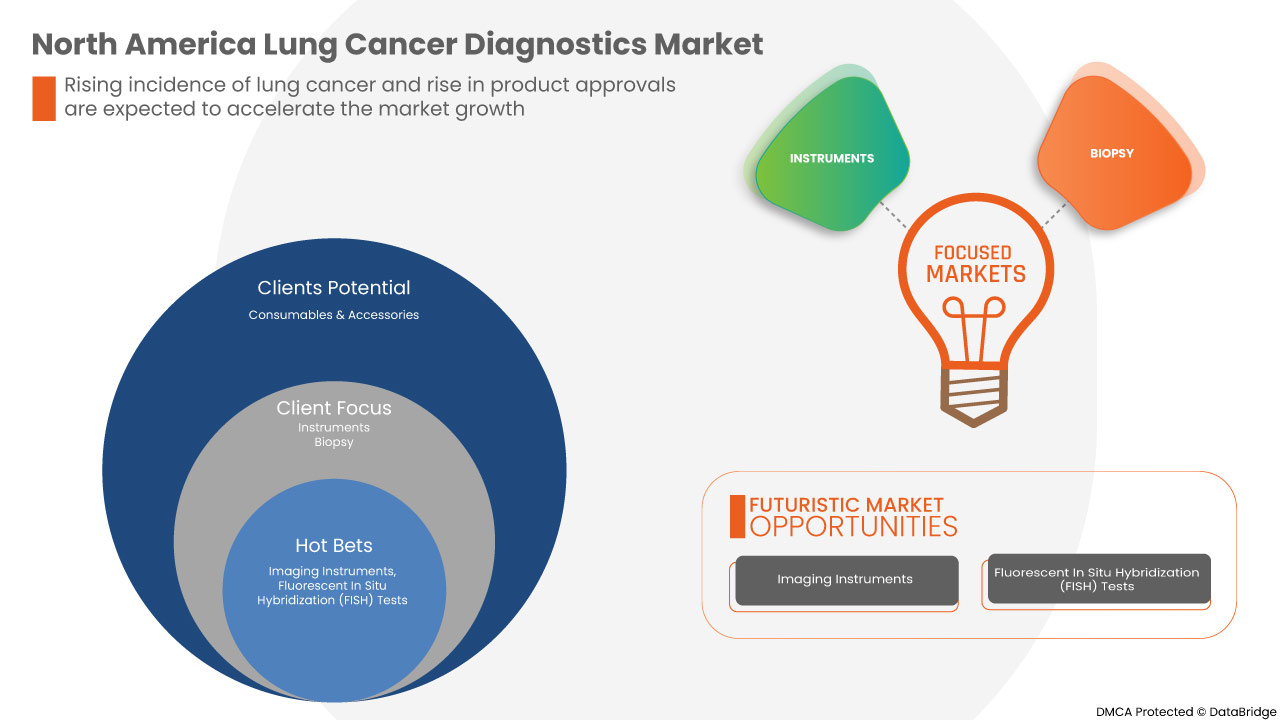

يتم تصنيف سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى خمسة قطاعات بارزة بناءً على نوع المنتج ونوع الاختبار ونوع السرطان والمستخدم النهائي وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المنتج

- الآلات الموسيقية

- المواد الاستهلاكية والملحقات

على أساس نوع المنتج، يتم تقسيم سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى أدوات ومواد استهلاكية وملحقات .

نوع الاختبار

- اختبارات المؤشرات الحيوية

- اختبار التصوير

- الخزعة

- فحص الدم

- آحرون

على أساس نوع الاختبار، يتم تقسيم سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى اختبار التصوير، واختبار المؤشرات الحيوية، والخزعة، واختبار الدم، وغيرها.

نوع السرطان

- سرطان الرئة ذو الخلايا غير الصغيرة

- سرطان الرئة ذو الخلايا الصغيرة

على أساس نوع السرطان، يتم تقسيم سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى سرطان الرئة ذو الخلايا غير الصغيرة وسرطان الرئة ذو الخلايا الصغيرة.

المستخدم النهائي

- مستشفى

- المختبرات المرتبطة

- مختبرات التشخيص المستقلة

- مراكز التصوير التشخيصي

- معاهد أبحاث السرطان

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى المستشفيات والمختبرات المرتبطة ومختبرات التشخيص المستقلة ومراكز التصوير التشخيصي ومعاهد أبحاث السرطان وغيرها.

قناة التوزيع

- العطاء المباشر

- مبيعات التجزئة

على أساس قناة التوزيع، يتم تقسيم سوق تشخيص سرطان الرئة في أمريكا الشمالية إلى العطاءات المباشرة ومبيعات التجزئة.

تحليل/رؤى إقليمية لسوق تشخيص سرطان الرئة في أمريكا الشمالية

يتم تحليل سوق تشخيص سرطان الرئة في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد ونوع المنتج ونوع الاختبار ونوع السرطان والمستخدم النهائي وقناة التوزيع، كما هو مذكور أعلاه.

بعض البلدان التي يغطيها سوق تشخيص سرطان الرئة في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

ومن المتوقع أن تهيمن الولايات المتحدة على منطقة أمريكا الشمالية بسبب الوعي المتزايد بتشخيص السرطان وخدمات الاستشارة.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق وتغييرات تنظيم السوق التي تؤثر على اتجاهات السوق الحالية والمستقبلية. نقاط البيانات مثل تحليل سلسلة القيمة في المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المنافسة وحصة سوق تشخيص سرطان الرئة في أمريكا الشمالية

يقدم المشهد التنافسي لسوق تشخيص سرطان الرئة في أمريكا الشمالية تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق تشخيص سرطان الرئة في أمريكا الشمالية.

بعض اللاعبين في سوق تشخيص سرطان الرئة في أمريكا الشمالية هم F. Hoffmann-La Roche Ltd. و Thermo Fisher Scientific Inc. و Abbott و Quest Diagnostics Incorporated و Biodesix و Amoy Diagnostics Co.، Ltd. و Bio-Rad Laboratories، Inc. و Biocartis و Boditech Med Inc. و Danaher و Vela Diagnostics و DiaSorin SpA و Exact Sciences UK، Ltd. (شركة تابعة لشركة Exact Science Corporation) و 20/20 Gene Systems و Guardant Health، Inc. و Inivata Ltd. و LalPathLabs.com و LungLife AI، Inc. و MedGenome و Myriad Genetics، Inc. و NeoGenomics Laboratories و NanoString و Nanoentek و Oncocyte Corporation و PerkinElmer Inc. و PlexBio و QIAGEN و Siemens Healthcare GmbH و Veracyte، Inc. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

5 EPIDERMIOLOGY

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 UNMET NEED FOR NON-INVASIVE, ACCURATE, AND RELIABLE DIAGNOSTIC TESTS FOR EARLIER CANCER DETECTION

7.1.2 INCREASING EARLY DIAGNOSIS OF LUNGS CANCER

7.1.3 INCREASING CASES OF LUNG CANCER

7.1.4 RISE IN PRODUCT APPROVALS

7.2 RESTRAINTS

7.2.1 POOR & LATE DIAGNOSIS OF LUNG CANCER

7.2.2 HIGH FALSE-POSITIVES AND POOR SENSITIVITY

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTICS

7.3.3 RISING AWARENESS OF LUNG CANCER

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY FRAMEWORK FOR THE APPROVAL AND COMMERCIALIZATION OF CANCER DIAGNOSTIC PRODUCTS

7.4.2 INCREASED COST, SAFETY, AND CONVENIENCE ISSUES

7.4.3 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 IMAGING INSTRUMENTS

8.2.1.1 CT SYSTEMS

8.2.1.2 ULTRASOUND SYSTEMS

8.2.1.3 MRI SYSTEMS

8.2.1.4 OTHERS

8.2.2 BIOPSY INSTRUMENTS

8.2.2.1 NEEDLE BIOPSY

8.2.2.2 ENDOSCOPIC BIOPSY

8.2.2.3 CORE BIOPSY

8.2.2.4 OTHERS

8.2.3 PATHOLOGY-BASED INSTRUMENTS

8.2.3.1 SLIDE STAINING SYSTEMS

8.2.3.2 TISSUE PROCESSING SYSTEMS

8.2.3.3 CELL PROCESSORS

8.2.3.4 PCR INSTRUMENTS

8.2.3.5 OTHERS PATHOLOGY-BASED INSTRUMENTS

8.3 CONSUMABLES AND ACCESSORIES

8.3.1 KITS

8.3.1.1 DNA POLYMERASE KITS

8.3.1.2 NUCLEIC ACID ISOLATION KITS

8.3.1.3 PCR KITS

8.3.1.4 OTHERS

8.3.2 REAGENTS

8.3.2.1 ASSAYS

8.3.2.2 BUFFERS

8.3.2.3 PRIMERS

8.3.2.4 OTHERS

8.3.3 PROBES

8.3.4 OTHER CONSUMABLES

9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 COMPUTED TOMOGRAPHY (CT) SCAN

9.2.2 POSITRON EMISSION TOMOGRAPHY (PET) SCAN

9.2.3 CHEST X-RAY

9.2.4 BONE SCAN

9.2.5 MRI

9.2.6 OTHERS

9.3 BIOMARKERS TEST

9.3.1 EGFR MUTATION TEST

9.3.2 KRAS MUTATION TEST

9.3.3 ALK TEST

9.3.4 HER2 TEST

9.3.5 OTHERS

9.4 BIOPSY

9.4.1 NEEDLE BIOPSY

9.4.2 BRONCHOSCOPY BIOPSY

9.4.3 CORE BIOPSY

9.4.4 OTHERS

9.5 BLOOD TEST

9.5.1 COMPLETE BLOOD COUNT (CBC)

9.5.2 BLOOD CHEMISTRY TESTS

9.5.3 OTHERS

9.6 OTHERS

10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 NON-SMALL CELL LUNG CANCER

10.3 SMALL CELL LUNG CANCER

11 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.3 ASSOCIATED LABS

11.4 INDEPENDENT DIAGNOSTIC LABORATORIES

11.5 DIAGNOSTIC IMAGING CENTERS

11.6 CANCER RESEARCH INSTITUTES

11.7 OTHERS

12 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 F. HOFFMANN-LA ROCHE LTD. (2022)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC. (2022)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ABBOTT (2022)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 QUEST DIAGNOSTICS INCORPORATED (2022)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 BIODESIX (2022)

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMOY DIAGNOSTICS CO., LTD. (2022)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BIO-RAD LABORATORIES, INC. (2022)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOCARTIS (2022)

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BODITECH MED INC.

16.9.1 COMPANY PROFILE

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DANAHER (2022)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIASORIN S.P.A. (2022)

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 EXACT SCIENCES UK, LTD. (SUBSIDIARY OF EXACT SCIENCE CORPORATION) (2022)

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 20/20 GENE SYSTEMS

16.13.1 COMPANY PROFILE

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GUARDANT HEALTH INC.

16.14.1 COMPANY PROFILE

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 INIVATA LTD.

16.15.1 COMPANY PROFILE

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 LALPATHLABS.COM (2022)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 LUNGLIFE AI, INC. (2022)

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MEDGENOME

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MYRIAD GENETICS, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 NEOGENOMICS LABORATORIES (2022)

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 NANOSTRING (2022)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

16.22 NANOENTEK

16.22.1 COMPANY PROFILE

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 ONCOCYTE CORPORATION

16.23.1 COMPANY PROFILE

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PERKINELMER INC

16.24.1 COMPANY PROFILE

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENTS

16.25 PLEXBIO

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 QIAGEN

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 SIEMENS HEALTHCARE GMBH

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENTS

16.28 VERACYTE, INC. (2022)

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 VELA DIAGNOSTICS

16.29.1 COMPANY PROFILE

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 DIFFERENT TYPES OF CANCER SCREENING TESTS FOR DIFFERENT TYPES OF CANCERS

TABLE 2 LUNG CANCER RATES

TABLE 3 APPROVED DIAGNOSTICS OF LUNGS CANCER

TABLE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA NON-SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITAL IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ASSOCIATED LABS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INDEPENDENT DIAGNOSTIC LABORATORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CANCER RESEARCH INSTITUTES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL SALES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 53 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.S. IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 68 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 69 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 CANADA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 CANADA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 84 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 85 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 MEXICO BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 100 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LUNGS CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LUNG CANCER DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT LUNG CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

FIGURE 14 THE NORTH AMERICA MORTALITY RATE DUE TO CANCER

FIGURE 15 THE DATA GIVEN BELOW SHOWS THE INCREASING NORTH AMERICA CANCER RATE IN 2020

FIGURE 16 BARRIERS TO EARLY CANCER DIAGNOSIS AND TREATMENT

FIGURE 17 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 18 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 22 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 30 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 34 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 35 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 38 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 39 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 42 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.