North America Heat Shrinkable Film For Sleeve Labels Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

2.74 Billion

USD

3.61 Billion

2024

2032

USD

2.74 Billion

USD

3.61 Billion

2024

2032

| 2025 –2032 | |

| USD 2.74 Billion | |

| USD 3.61 Billion | |

|

|

|

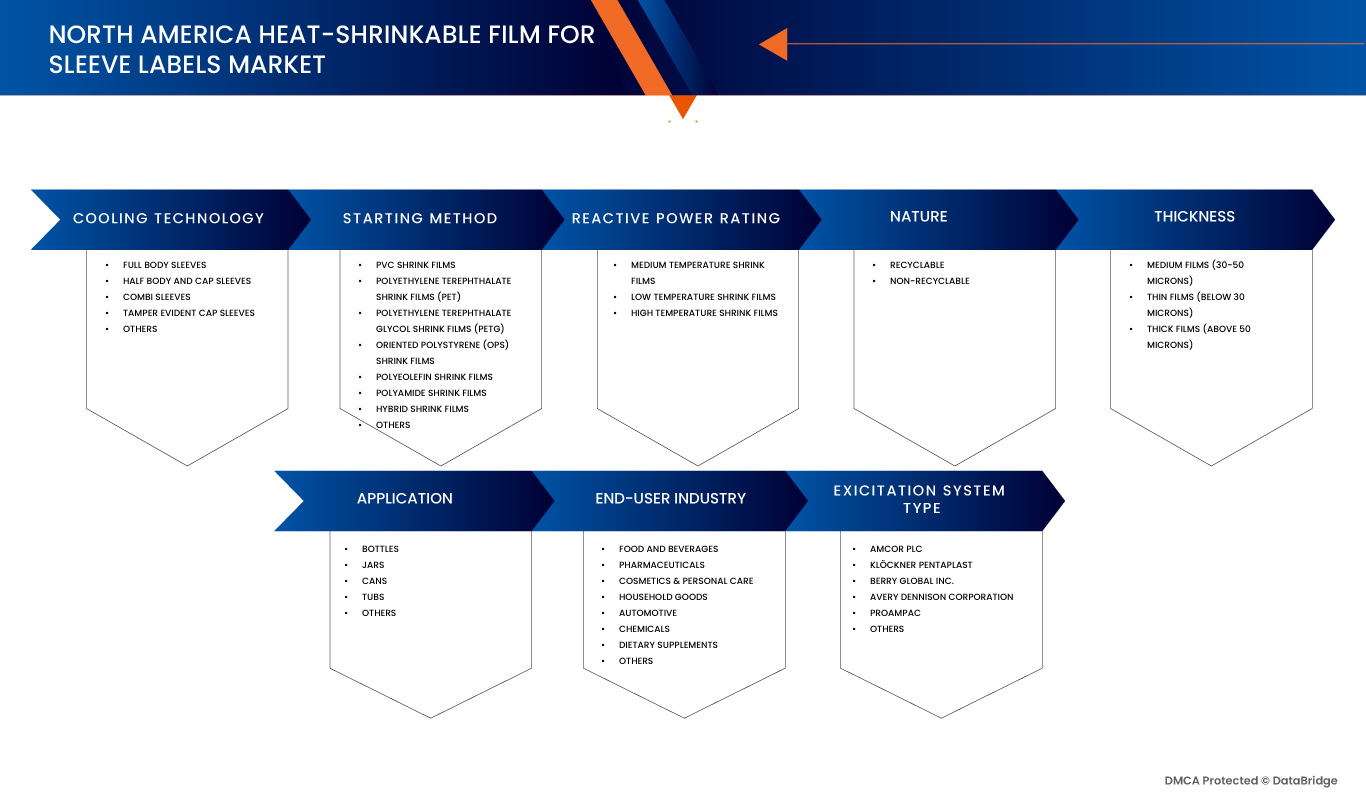

تجزئة سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية لملصقات الأكمام، حسب الأكمام (الأكمام الكاملة، والأكمام نصف الجسم وأكمام القبعة، والأكمام المركبة، وأكمام القبعة المقاومة للتلاعب، وغيرها)، والمواد (أغشية الانكماش المصنوعة من البولي فينيل كلوريد، وأغشية الانكماش المصنوعة من البولي إيثيلين تيريفثالات (PET)، وأغشية الانكماش المصنوعة من البولي إيثيلين تيريفثالات جليكول (PETG)، وأغشية الانكماش المصنوعة من البوليسترين الموجه (OPS)، وأغشية الانكماش المصنوعة من البولي أوليفين، وأغشية الانكماش المصنوعة من البولي أميد، وأغشية الانكماش الهجينة، وغيرها)، ودرجة الحرارة (أغشية الانكماش متوسطة الحرارة، وأغشية الانكماش منخفضة الحرارة، وأغشية الانكماش عالية الحرارة)، والطبيعة (قابلة لإعادة التدوير وغير قابلة لإعادة التدوير)، والسمك (أغشية متوسطة (30-50 ميكرون)، والأغشية الرقيقة (أقل من 30 ميكرون)، والأغشية السميكة (أعلى من 50 ميكرون))، والتطبيق (الزجاجات، والبرطمانات، والعلب، والأحواض، وغيرها)، صناعة المستخدم النهائي (الأغذية والمشروبات، والأدوية، ومستحضرات التجميل والعناية الشخصية، والسلع المنزلية، والسيارات، والمواد الكيميائية، والمكملات الغذائية، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2032

تحليل سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

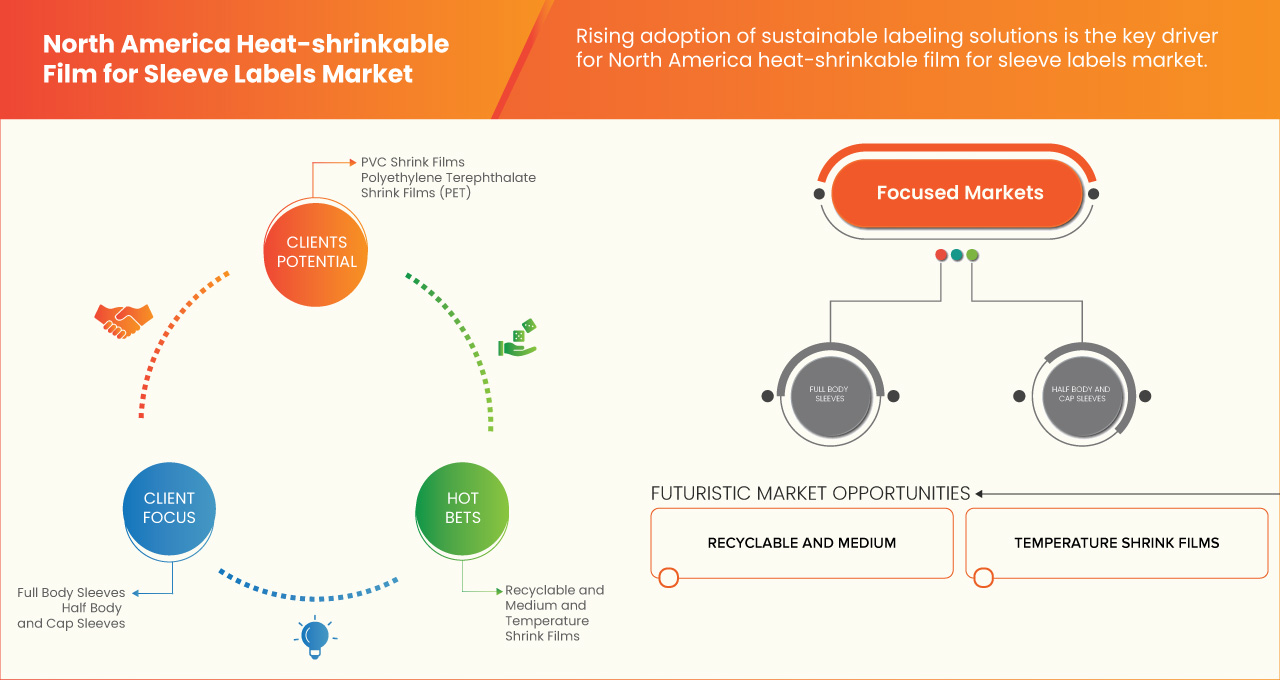

يشهد سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام طلبًا متزايدًا على حلول الملصقات المستدامة، حيث تتحرك الحكومات نحو الاقتصاد الدائري سعياً إلى تقليل توليد النفايات مع ضمان احتياجات المستهلكين، ومرة أخرى تساعد التطورات والابتكارات في مواد الأغشية القابلة للانكماش وتقنيات الطباعة في جذب فئات مختلفة من المستهلكين لاختيار المنتجات وفقًا للاحتياجات وبالتالي دفع نمو السوق في منطقة أمريكا الشمالية.

حجم سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

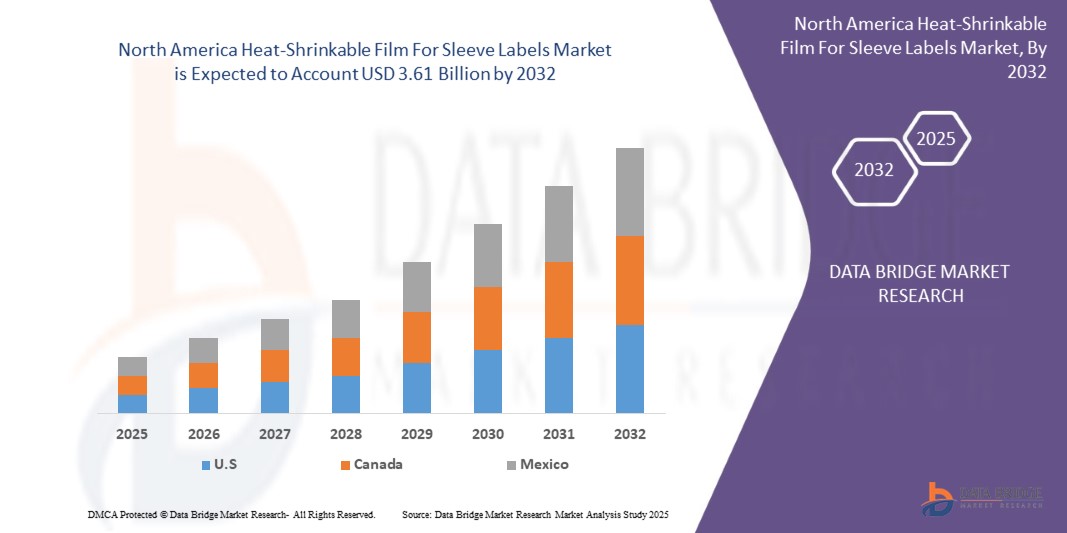

من المتوقع أن يصل سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية لملصقات الأكمام إلى 3.61 مليار دولار أمريكي بحلول عام 2032 من 2.74 مليار دولار أمريكي في عام 2024، مع نمو بمعدل نمو سنوي مركب كبير بنسبة 3.7٪ في الفترة المتوقعة من 2025 إلى 2032. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا للخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي.

اتجاهات سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

"تزايد اعتماد حلول وضع العلامات المستدامة"

إن التركيز المتزايد على الاستدامة هو محرك مهم يشكل سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية. ومع إعطاء الشركات والمستهلكين الأولوية للممارسات الصديقة للبيئة، اكتسب الطلب على حلول الملصقات المستدامة، مثل الأغشية القابلة للانكماش بالحرارة القابلة لإعادة التدوير والقابلة للتحلل البيولوجي، زخمًا في جميع أنحاء المنطقة. يتماشى هذا الاتجاه مع الوعي المتزايد بالقضايا البيئية، بما في ذلك النفايات البلاستيكية وانبعاثات الكربون، مما دفع الصناعات إلى تبني حلول تغليف أكثر مسؤولية بيئيًا. تكتسب ملصقات الأكمام القابلة للانكماش بالحرارة المصنوعة من مواد مستدامة، مثل بولي إيثيلين تيريفثالات جليكول (PETG) وحمض البوليكتيك (PLA) ، شعبية بسبب قابليتها لإعادة التدوير وتأثيرها البيئي المنخفض. تتبنى الشركات في قطاعات مثل الأغذية والمشروبات والعناية الشخصية والمنتجات المنزلية هذه الملصقات بشكل متزايد لتحقيق أهداف الاستدامة للشركات، والامتثال للوائح، وتلبية احتياجات المستهلكين المهتمين بالبيئة. على سبيل المثال، تحولت العلامات التجارية الرائدة في أمريكا الشمالية نحو استخدام الملصقات القابلة للانكماش بالحرارة مع تقليل استخدام المواد ومتطلبات الطاقة المنخفضة أثناء التطبيق. وعلاوة على ذلك، تعمل اللوائح الحكومية ومبادرات الصناعة التي تدعم ممارسات التغليف المستدامة على تضخيم هذا الاتجاه. وتشجع السياسات التي تشجع استخدام المواد القابلة لإعادة التدوير وفرض القيود على البلاستيك الذي يستخدم مرة واحدة الشركات المصنعة على الابتكار في حلول الملصقات المستدامة. كما أصبحت الشهادات والملصقات البيئية أدوات تسويقية بالغة الأهمية للعلامات التجارية، مما يزيد من اعتماد ملصقات الأكمام الصديقة للبيئة.

نطاق التقرير وتقسيم السوق

|

صفات |

رؤى أساسية حول سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام |

|

القطاعات المغطاة |

حسب صناعة المستخدم النهائي : الأغذية والمشروبات، والأدوية ، ومستحضرات التجميل والعناية الشخصية، والسلع المنزلية، والسيارات، والمواد الكيميائية، والمكملات الغذائية ، وغيرها |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

اللاعبون الرئيسيون في السوق |

Amcor plc (الولايات المتحدة)، Klöckner Pentaplast (المملكة المتحدة)، Berry Global Inc. (الولايات المتحدة)، Avery Dennison Corporation (الولايات المتحدة)، ProAmpac (الولايات المتحدة)، Taghleef Industries (الإمارات العربية المتحدة)، Bonset America Corporation (الولايات المتحدة)، Cosmo Films (الهند)، Clysar (الولايات المتحدة)، وPlastic Suppliers, Inc. (الولايات المتحدة) وغيرها |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء، وتحليل التسعير، وتحليل حصة العلامة التجارية، واستطلاع رأي المستهلكين، وتحليل التركيبة السكانية، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

الفيلم القابل للانكماش بالحرارة هو مادة تغليف متعددة الاستخدامات تنكمش بإحكام حول المنتجات عند تعرضها للحرارة، مما يضمن تغليفًا آمنًا وواقيًا. مصنوع من البوليمرات مثل البولي أوليفينات أو كلوريد البوليفينيل أو البولي إيثيلين، يوفر هذا الفيلم المتانة والوضوح والقدرة على التكيف لمجموعة واسعة من التطبيقات. يُستخدم عادةً لتغليف العناصر وحماية البضائع أثناء الشحن وإنشاء أختام مقاومة للتلاعب. الفيلم القابل للانكماش بالحرارة مثالي للصناعات مثل الأغذية والمشروبات وتجارة التجزئة والتغليف الصناعي، حيث يوفر فوائد مثل تقليل استخدام المواد ورؤية المنتج والاستدامة في المتغيرات القابلة لإعادة التدوير.

ديناميكيات سوق الأغشية القابلة للانكماش بالحرارة المستخدمة في ملصقات الأكمام في أمريكا الشمالية

السائقين

- التخصيص والجاذبية الجمالية للأفلام القابلة للانكماش بالحرارة

الطلب المتزايد على حلول التغليف الجذابة بصريًا والقابلة للتخصيص بدرجة كبيرة هو المحرك الرئيسي لسوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام في أمريكا الشمالية. توفر الأغشية القابلة للانكماش بالحرارة تنوعًا لا مثيل له في التصميم، مما يسمح للعلامات التجارية بإنشاء ملصقات جذابة وحيوية ومصممة خصيصًا تعمل على تعزيز جاذبية الرفوف وتعزيز هوية العلامة التجارية القوية. في مشهد المستهلك التنافسي، أصبحت القدرة على التمييز بين المنتجات من خلال جماليات التغليف عامل نجاح حاسم، مما يجعل الأغشية القابلة للانكماش بالحرارة خيارًا مفضلًا عبر الصناعات. يمتد التخصيص أيضًا إلى الجوانب العملية للتغليف. يمكن تصميم الأغشية القابلة للانكماش بالحرارة لتناسب أشكال الحاويات المختلفة، من الزجاجات والبرطمانات إلى العلب وأشكال التغليف الفريدة، مما يضمن التطبيق السلس واللمسة النهائية الاحترافية. تجعلها هذه القدرة على التكيف مثالية للعلامات التجارية التي تتطلع إلى التميز مع الحفاظ على سلامة التغليف الوظيفية. مع استمرار العلامات التجارية في إعطاء الأولوية للتغليف كأداة تسويقية رئيسية، يلعب التخصيص والجاذبية الجمالية للأغشية القابلة للانكماش بالحرارة دورًا محوريًا في دفع نمو السوق في جميع أنحاء أمريكا الشمالية. ومن المتوقع أن يتسارع هذا الاتجاه بشكل أكبر مع استمرار ارتفاع توقعات المستهلكين للتغليف الجذاب بصريًا والمتميز.

على سبيل المثال،

- في أبريل 2024، وفقًا لمدونة نُشرت على موقع شركة كوكا كولا، يجمع تعاون كوكا كولا مع مارفل بين التغليف ذي الإصدار المحدود ورواية القصص الغامرة، حيث يضم 30 شخصية من مارفل على الزجاجات والعلب المعززة برموز QR القابلة للمسح لتجارب الواقع المعزز. تُبرز هذه الحملة قوة التخصيص والجاذبية الجمالية لملصقات الأكمام المنكمشة، والتي توفر صورًا عالية الجودة وملاءمة دقيقة. تعمل مثل هذه الاستراتيجية التسويقية على تغذية النمو في التغليف من خلال تعزيز المشاركة وقيمة العلامة التجارية.

الطلب المتزايد على السلع الاستهلاكية والمشروبات

إن الطلب المتزايد على السلع الاستهلاكية والمشروبات في أمريكا الشمالية هو محرك مهم لسوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام. ومع استمرار نمو سكان المنطقة وتسارع التحضر، يرتفع استهلاك المنتجات المعبأة، مما يخلق طلبًا قويًا على حلول التغليف المبتكرة والجذابة بصريًا مثل ملصقات الأكمام القابلة للانكماش بالحرارة. وتعد صناعة المشروبات، على وجه الخصوص، مساهمًا بارزًا في هذا الطلب. مع الشعبية المتزايدة للمياه المعبأة، ومشروبات الطاقة، والمشروبات الغازية، والشاي الجاهز للشرب، والمشروبات الكحولية، يبحث المصنعون عن خيارات تغليف فعالة ومتعددة الاستخدامات لتمييز منتجاتهم على أرفف البيع بالتجزئة المزدحمة. توفر ملصقات الأكمام القابلة للانكماش بالحرارة فرصة للعلامة التجارية بزاوية 360 درجة، مما يتيح للشركات عرض التصميمات النابضة بالحياة، ومعلومات المنتج التفصيلية، والمحتوى الترويجي، وتعزيز جاذبية منتجاتها على الرفوف وتفاعل المستهلك. وبالمثل، يستفيد قطاع السلع الاستهلاكية، الذي يشمل العناية الشخصية، والمنتجات المنزلية، والأطعمة، من الأغشية القابلة للانكماش بالحرارة لتلبية التوقعات المتطورة للمستهلكين المعاصرين. لا تقدم هذه الملصقات خيارات تخصيص فائقة فحسب، بل تلبي أيضًا الطلب على التغليف المقاوم للتلاعب والمتين، وهي عوامل حاسمة للمنتجات في هذه الفئات.

على سبيل المثال،

- في يوليو 2024، وفقًا لمقال نُشر على Alibaba.com، تزدهر سوق السلع الاستهلاكية في أمريكا الشمالية، التي تقدر قيمتها بأكثر من 2 تريليون دولار أمريكي، بالابتكار والعلامات التجارية وتفضيلات المستهلكين المتطورة. تعمل التجارة الإلكترونية، بقيادة منصات مثل أمازون، على دفع النمو، في حين تؤثر الاستدامة والأخلاق بشكل متزايد على خيارات الشراء. مع الطلب القوي والقدرة على التكيف، توفر السوق فرصًا واسعة للشركات المصنعة لتلبية احتياجات المستهلكين المتنوعة عبر الأغذية والإلكترونيات والملابس والمزيد.

فرص

- الابتكارات والتطورات التكنولوجية في مواد الأغشية المنكمشة وتقنيات الطباعة

من المتوقع أن يستفيد سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية بشكل كبير من التطورات التكنولوجية المستمرة في مواد الأغشية القابلة للانكماش وتقنيات الطباعة. نظرًا لأن الصناعات تتطلب حلول تغليف أكثر تنوعًا ومتانة واستدامة، فإن الابتكارات في هذا المجال تخلق فرص نمو كبيرة. يكمن أحد مجالات الابتكار الرئيسية في تطوير مواد الأغشية القابلة للانكماش الصديقة للبيئة، مثل البوليمرات القائمة على المواد الحيوية والقابلة لإعادة التدوير. تلبي هذه المواد متطلبات المستهلكين والجهات التنظيمية المتزايدة للتغليف المستدام مع الحفاظ على خصائص الأداء المطلوبة للأغشية القابلة للانكماش، مثل المتانة والوضوح والقدرة على الانكماش. على سبيل المثال، اكتسبت أفلام البولي إيثيلين تيريفثالات جليكول (PETG) زخمًا بسبب ملفها البيئي المتفوق وقابليتها لإعادة التدوير مقارنة بأفلام البولي فينيل كلوريد التقليدية. تمكن مثل هذه التطورات الشركات المصنعة من التوافق مع أهداف الاستدامة مع جذب المستهلكين المهتمين بالبيئة. بالتوازي مع ذلك، تعمل التطورات في تقنيات الطباعة على تحويل كيفية استخدام الأغشية القابلة للانكماش في العلامات التجارية والتسويق. تسمح تقنيات الطباعة الرقمية عالية الدقة الآن بتصميمات أكثر وضوحًا وحيوية مباشرة على الأغشية القابلة للانكماش، مما يعزز الجاذبية الجمالية للمنتجات المعبأة. وتتيح هذه الابتكارات للعلامات التجارية تنفيذ تصميمات فريدة وتغليف مخصص ومحتوى ترويجي، مما يمنحها ميزة تنافسية على أرفف البيع بالتجزئة. وتعتمد الشركات العاملة في قطاعات المشروبات والأغذية والعناية الشخصية بشكل متزايد على هذه القدرات لتعزيز التمييز بين المنتجات وإشراك المستهلكين.

على سبيل المثال،

- في نوفمبر 2024، وفقًا لمقال نُشر على موقع Verdict Media Limited، فإن التطورات في تكنولوجيا الأغشية المنكمشة، مثل التحول إلى البولي أوليفينات متعددة الاستخدامات وصديقة للبيئة، والبولي إيثيلين القابل لإعادة التدوير، والأغشية القائمة على المواد الحيوية، تخلق فرصًا كبيرة في سوق التغليف. تتيح وضوح المواد المحسّن وقابلية الطباعة إنشاء علامات تجارية مخصصة وتحسين جاذبية المنتج، بينما تعالج الحلول المستدامة المخاوف البيئية المتزايدة. تضع هذه الابتكارات الأغشية المنكمشة كمكون رئيسي للتغليف الآمن والجذاب بصريًا والمسؤول بيئيًا، مما يدفع نمو السوق وإشراك المستهلكين

تفتح هذه التطورات الأبواب أمام الشركات المصنعة لتلبية احتياجات شرائح المنتجات المتميزة، ومعالجة مخاوف الاستدامة، وتقديم حلول مخصصة لأصحاب العلامات التجارية. ومن خلال تبني هذه الابتكارات، يمكن للشركات فتح فرص جديدة، وتوسيع حصتها في السوق، والاستفادة من الطلب المتزايد على حلول التغليف المتقدمة في أمريكا الشمالية.

- تزايد شعبية التغليف الذكي والتفاعلي

تتمتع سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية بمكانة جيدة للاستفادة من الطلب المتزايد على التغليف الذكي والتفاعلي ، وهو الاتجاه الذي يحركه التقدم في التكنولوجيا الرقمية وتوقعات المستهلكين المتغيرة. تسعى العلامات التجارية بشكل متزايد إلى حلول تغليف مبتكرة لتعزيز مشاركة المنتج وتقديم تجارب ذات قيمة مضافة للمستهلك، مما يخلق فرصًا كبيرة لمصنعي الأغشية القابلة للانكماش بالحرارة.

يتم دمج حلول التغليف الذكية والتفاعلية، مثل رموز الاستجابة السريعة والواقع المعزز وتكنولوجيا الاتصالات القريبة المدى، بسلاسة في تصميمات الأغشية المنكمشة. تمكن هذه التقنيات المستهلكين من الوصول إلى معلومات المنتج أو العروض الترويجية أو تجارب العلامة التجارية الغامرة من خلال هواتفهم الذكية. تعمل الأغشية القابلة للانكماش بالحرارة، مع قدرتها على التوافق تمامًا مع أشكال الحاويات المختلفة وقابليتها للطباعة عالية الجودة، كوسيلة مثالية لمثل هذه التطبيقات. على سبيل المثال، تستفيد العلامات التجارية للأغذية والمشروبات من التغليف التفاعلي للتواصل بشفافية حول المصادر والمعلومات الغذائية وجهود الاستدامة. وبالمثل، في صناعات العناية الشخصية ومستحضرات التجميل، تسمح الأغشية المنكمشة ذات الميزات الذكية للعلامات التجارية بعرض البرامج التعليمية والتوصيات الشخصية ومراجعات العملاء، مما يعزز ثقة المستهلك وولائه.

على سبيل المثال،

- في سبتمبر 2023، وفقًا لمقال نُشر على موقع Axies Digital، نفذت شركة كوكاكولا أكواد QR الذكية على عبوات التغليف البلاستيكية في أمريكا الشمالية كجزء من استراتيجيتها التسويقية التفاعلية. يمكن للمستهلكين مسح الرموز للوصول إلى محتوى حصري، بما في ذلك الرسائل الشخصية والعروض الترويجية ومعلومات الاستدامة حول مبادرات كوكاكولا الصديقة للبيئة.

مع استمرار تحول سلوك المستهلك نحو المشاركة الرقمية، من المتوقع أن يتسارع اعتماد الأغشية القابلة للانكماش بالحرارة في التغليف الذكي والتفاعلي. يوفر هذا الابتكار ميزة تنافسية كبيرة للعلامات التجارية، مما يمكنها من التمييز بين منتجاتها وتلبية الطلب المتزايد على تجارب المستهلك التفاعلية. يمكن للشركات المصنعة في سوق الأغشية القابلة للانكماش بالحرارة التي تستثمر في هذا الاتجاه توسيع حصتها في السوق، وتلبية احتياجات شرائح المنتجات الفاخرة، ووضع نفسها كقادة في ابتكار التغليف.

القيود/التحديات

- منافسة شرسة من حلول وضع العلامات البديلة

تواجه سوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية تحديات كبيرة بسبب المنافسة الشديدة من حلول وضع العلامات البديلة مثل الملصقات الحساسة للضغط والملصقات داخل القالب والملصقات الملفوفة. توفر هذه البدائل مزايا فريدة تجذب الشركات المصنعة عبر مختلف الصناعات، مما يخلق بيئة تنافسية لمقدمي الأغشية القابلة للانكماش بالحرارة.

على سبيل المثال، اكتسبت الملصقات الحساسة للضغط شعبية كبيرة بسبب تنوعها وسهولة تطبيقها وقدرتها على الالتصاق بالأسطح المتنوعة. وهي تستخدم على نطاق واسع في صناعات المشروبات والأغذية والأدوية، وغالبًا ما توفر جاذبية بصرية مماثلة دون الحاجة إلى تطبيق الحرارة. بالإضافة إلى ذلك، فإن الملصقات الحساسة للضغط متوافقة مع معدات التطبيق عالية السرعة، مما يجذب الشركات التي تسعى إلى الكفاءة في خطوط الإنتاج. تقدم الملصقات داخل القالب (IML) بديلاً هائلاً آخر، وخاصة في صناعة الأغذية والمشروبات. تدمج IML الملصق مباشرة في الحاوية أثناء عملية الصب، مما ينتج عنه تشطيب سلس ودائم. تلغي هذه الطريقة الحاجة إلى عمليات وضع العلامات المنفصلة وتوفر مقاومة ممتازة للرطوبة وتغيرات درجة الحرارة، مما يجعلها جذابة للغاية لتطبيقات محددة.

كما تشكل الملصقات التي تغطي الأسطح المحيطة بالمنتجات تحديًا كبيرًا للأفلام القابلة للانكماش بالحرارة، وخاصة في الأسواق ذات الحجم الكبير مثل المشروبات. توفر هذه الملصقات تغطية بزاوية 360 درجة تشبه الأفلام القابلة للانكماش ولكن غالبًا بتكلفة أقل. ولا يتطلب تطبيقها الحرارة، مما يقلل من الحاجة إلى معدات متخصصة واستهلاك الطاقة. وعلاوة على ذلك، أدى تركيز العديد من الشركات على الاستدامة إلى تحول التفضيلات نحو خيارات الملصقات القابلة لإعادة التدوير والصديقة للبيئة. وفي حين تتطور الأفلام القابلة للانكماش بالحرارة لمعالجة هذه المخاوف، يُنظر إلى البدائل الأخرى على أنها أكثر ملاءمة للبيئة، مما يمنحها ميزة في سوق تتأثر بشكل متزايد باتجاهات الاستدامة.

على سبيل المثال،

- وفقًا لمقال نُشر على Wildpack Beverage، فإن الملصقات الحساسة للضغط تمثل بديلاً قويًا لملصقات الانكماش الحراري نظرًا لمرونتها وفعاليتها من حيث التكلفة وسهولة التطبيق. هذه الملصقات، المصنوعة غالبًا من الورق أو البلاستيك أو الفينيل، مثالية للعمليات الصغيرة أو العلامات التجارية التي تتطلع إلى توفير استثمارات المعدات. كما أنها تدعم التخصيص السريع وتسمح بالتطبيق الداخلي دون الحاجة إلى آلات انكماش حراري متخصصة. بالإضافة إلى ذلك، فإن خيارات الورق الصديقة للبيئة ومجموعة متنوعة من خيارات المواد تجعلها متعددة الاستخدامات لمنتجات مختلفة، من علب البيرة إلى برطمانات الطعام

التقلبات في أسعار المواد الخام

تشكل التقلبات في أسعار المواد الخام تحديًا كبيرًا لسوق الأغشية القابلة للانكماش بالحرارة في أمريكا الشمالية، حيث تؤثر بشكل مباشر على تكاليف الإنتاج والربحية واستقرار سلسلة التوريد. تُصنع الأغشية القابلة للانكماش بالحرارة في المقام الأول من مواد مثل كلوريد البولي فينيل (PVC) وبولي إيثيلين تيريفثالات (PET) وراتنجات البوليمر الأخرى، وكلها تخضع لتقلبات أسعار السلع الأساسية العالمية.

وتؤثر عوامل مختلفة، بما في ذلك التوترات الجيوسياسية، وانقطاعات سلسلة التوريد، والكوارث الطبيعية، والتغيرات في الطلب عبر الصناعات المختلفة، على أسعار هذه المواد الخام. على سبيل المثال، يمكن أن تتسبب التقلبات في أسعار النفط الخام، وهو المحرك الرئيسي للبلاستيك القائم على البتروكيماويات، في زيادة تكلفة البوليمرات المستخدمة في الأغشية القابلة للانكماش بالحرارة. ويشكل هذا التقلب تحديًا للمصنعين الذين يعتمدون على التسعير المستقر للتخطيط لإنتاجهم وإدارة تكاليف التشغيل. وعلاوة على ذلك، يجب على صناعة الأغشية القابلة للانكماش بالحرارة أيضًا التعامل مع تأثير زيادات أسعار المواد الخام على استراتيجيات الشراء. بالنسبة للمصنعين، قد يؤدي ارتفاع تكاليف المواد الخام إلى ارتفاع الأسعار للمستخدمين النهائيين، مما قد يقلل الطلب على منتجاتهم. وفي سوق شديدة التنافسية، يمكن أن تؤدي هذه الزيادات في التكلفة إلى انخفاض هوامش الربح أو الحاجة إلى تعديلات الأسعار، والتي قد لا يقبلها العملاء دائمًا، خاصة إذا كانت حلول وضع العلامات البديلة متاحة بأسعار أكثر استقرارًا.

على سبيل المثال،

- في سبتمبر 2024، وفقًا لمقال نُشر على موقع openPR، شهدت أسعار البولي فينيل كلوريد تقلبات كبيرة بسبب عوامل متعددة. تسبب جائحة كوفيد-19 في تعطيل الإنتاج، تلاه ارتفاع في الطلب، وخاصة في مجال البناء، مما أدى إلى اختلال التوازن بين العرض والطلب. ساهمت الاضطرابات المستمرة في سلسلة التوريد وتأخيرات الشحن في تقلبات الأسعار. بالإضافة إلى ذلك، تسببت أسعار النفط الخام المرتفعة، والتي تؤثر على تكلفة الإيثيلين المستخدم في إنتاج البولي فينيل كلوريد، في زيادة أسعار البولي فينيل كلوريد بشكل أكبر، مما أضاف إلى عدم القدرة على التنبؤ بها.

تأثير وسيناريو السوق الحالي لنقص المواد الخام وتأخيرات الشحن

تقدم Data Bridge Market Research تحليلاً عالي المستوى للسوق وتقدم معلومات من خلال مراعاة تأثير وبيئة السوق الحالية لنقص المواد الخام وتأخيرات الشحن. ويترجم هذا إلى تقييم الاحتمالات الاستراتيجية وإنشاء خطط عمل فعالة ومساعدة الشركات في اتخاذ القرارات المهمة.

بالإضافة إلى التقرير القياسي، فإننا نقدم أيضًا تحليلًا متعمقًا لمستوى المشتريات من تأخيرات الشحن المتوقعة، ورسم خريطة الموزع حسب المنطقة، وتحليل السلع، وتحليل الإنتاج، واتجاهات رسم الخرائط السعرية، والتوريد، وتحليل أداء الفئة، وحلول إدارة مخاطر سلسلة التوريد، والمقارنة المتقدمة، وغيرها من الخدمات للشراء والدعم الاستراتيجي.

التأثير المتوقع للتباطؤ الاقتصادي على تسعير المنتجات وتوافرها

عندما يتباطأ النشاط الاقتصادي، تبدأ الصناعات في المعاناة. يتم أخذ التأثيرات المتوقعة للركود الاقتصادي على تسعير المنتجات وإمكانية الوصول إليها في الاعتبار في تقارير رؤى السوق وخدمات الاستخبارات التي تقدمها DBMR. بفضل هذا، يمكن لعملائنا عادةً أن يظلوا متقدمين بخطوة واحدة على منافسيهم، وأن يتوقعوا مبيعاتهم وإيراداتهم، وأن يقدروا نفقاتهم على الأرباح والخسائر.

نطاق سوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

يتم تقسيم السوق على أساس الأكمام والمواد ودرجة الحرارة والطبيعة والسمك والتطبيق وصناعة المستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

كم

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

مادة

- أفلام الانكماش البلاستيكية

- أغشية الانكماش المصنوعة من البولي إيثيلين تيريفثاليت (PET)

- أغشية الانكماش المصنوعة من البولي إيثيلين تيريفثاليت جليكول (PETG)

- أغشية الانكماش الموجهة المصنوعة من البوليسترين (OPS)

- أفلام الانكماش المصنوعة من البولي أوليفين

- أفلام الانكماش المصنوعة من مادة البولي أميد

- أفلام الانكماش الهجينة

- آحرون

درجة حرارة

- أفلام الانكماش ذات درجة الحرارة المتوسطة

- أفلام الانكماش ذات درجات الحرارة المنخفضة

- أفلام الانكماش ذات درجات الحرارة العالية

طبيعة

- قابلة لإعادة التدوير

- غير قابلة لإعادة التدوير

سماكة

- الأفلام المتوسطة (30-50 ميكرون)

- الأغشية الرقيقة (أقل من 30 ميكرون)

- الأغشية السميكة (أكثر من 50 ميكرون)

طلب

- زجاجات

- الجرار

- علب

- أحواض الاستحمام

- آحرون

صناعة المستخدم النهائي

- الأطعمة والمشروبات

- الأطعمة والمشروبات حسب النوع

- المشروبات

- المشروبات حسب النوع

- المشروبات الكحولية

- المشروبات الكحولية حسب النوع

- جعة

- خمر

- المشروبات الروحية

- تكيلا

- آحرون

- المشروبات الكحولية حسب النوع

- المشروبات المدعمة

- المشروبات المدعمة حسب النوع

- فول الصويا

- لوز

- جوزة الهند

- شوفان نباتة

- آحرون

- المشروبات المدعمة حسب النوع

- المشروبات النباتية

- المشروبات الغازية

- العصائر

- مياه شرب/مياه معدنية معبأة

- آحرون

- المشروبات الكحولية

- المشروبات حسب النوع

- المشروبات حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- المشروبات

- الأطعمة والمشروبات حسب النوع

- المواد الغذائية المعبأة

- المواد الغذائية المعبأة، حسب النوع

- الصلصات والتوابل

- الزيوت والدهون

- الحلوى والحلويات

- مخللات

- مربى

- خضروات

- منتجات الألبان

- منتجات الألبان حسب النوع

- لبن

- الحليب حسب النوع

- بدون نكهة

- منكه

- الحليب حسب النوع

- كريم

- الزبادي

- آحرون

- لبن

- منتجات الألبان حسب النوع

- آحرون

- المواد الغذائية المعبأة، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- المواد الغذائية المعبأة، حسب النوع

- المستحضرات الصيدلانية

- المستحضرات الصيدلانية حسب النوع

- زجاجات الدواء

- شراب

- التعليق

- قطرات

- آحرون

- المستحضرات الصيدلانية، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- المستحضرات الصيدلانية حسب النوع

- مستحضرات التجميل والعناية الشخصية

- مستحضرات التجميل والعناية الشخصية، حسب النوع

- شامبو/بلسم

- المستحضرات

- كريم

- البلسم

- الأمصال/الهلام

- مرهم

- آحرون

- مستحضرات التجميل والعناية الشخصية، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- مستحضرات التجميل والعناية الشخصية، حسب النوع

- السلع المنزلية

- السلع المنزلية، حسب النوع

- حاويات تخزين منزلية بلاستيكية

- منتجات التنظيف

- منتجات الغسيل

- معطرات الجو

- الشموع

- طارد البعوض

- أدوات وأواني المطبخ

- آحرون

- السلع المنزلية، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- السلع المنزلية، حسب النوع

- السيارات

- السيارات، حسب نوع الأكمام

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- السيارات، حسب نوع الأكمام

- المواد الكيميائية

- المواد الكيميائية، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- المواد الكيميائية، حسب نوع الغلاف

- المكملات الغذائية

- المكملات الغذائية، حسب نوع الغلاف

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- المكملات الغذائية، حسب نوع الغلاف

- آحرون

- أخرى، حسب نوع الكم

- أكمام الجسم الكاملة

- نصف الجسم وأكمام الكاب

- أكمام كومبي

- أكمام واقية من العبث

- آحرون

- أخرى، حسب نوع الكم

تحليل إقليمي لسوق الأغشية القابلة للانكماش بالحرارة لملصقات الأكمام

يتم تحليل السوق وتوفير رؤى حجم السوق والاتجاهات حسب الأكمام، والمادة، ودرجة الحرارة، والطبيعة، والسمك، والتطبيق، والصناعة للمستخدم النهائي.

الدول التي يغطيها السوق هي الولايات المتحدة وكندا والمكسيك

من المتوقع أن تهيمن الولايات المتحدة على سوق الأغشية القابلة للانكماش بالحرارة المستخدمة في ملصقات الأكمام في أمريكا الشمالية بسبب البنية التحتية المتقدمة للتصنيع، والطلب المرتفع على حلول التغليف المبتكرة، ووجود صناعات رئيسية للأغذية والمشروبات والعناية الشخصية مما يدفع إلى اعتماد ملصقات الأكمام القابلة للانكماش.

U.S. is expected to be the fastest growing due to strong demand from key industries such as food and beverage, pharmaceuticals, and personal care. The rapid adoption of advanced packaging technologies, increasing consumption of packaged goods, and the presence of major market players further fuel growth. Additionally, sustainability initiatives, such as the use of recyclable shrink films, align with consumer preferences and regulatory support, driving innovation and market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Heat-Shrinkable Film for Sleeve Labels Market Sha re

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Heat-shrinkable Film for Sleeve Labels Market Leaders Operating in the Market Are:

- Amcor plc (U.S)

- Klöckner Pentaplast (U.K)

- Berry Global Inc. (U.S)

- Avery Dennison Corporation (U.S)

- ProAmpac (U.S)

- Taghleef Industries (UAE)

- Bonset America Corporation (U.S)

- Cosmo Films (India), Clysar (U.S)

- Plastic Suppliers, Inc. (U.S)

Latest Developments in Heat-Shrinkable Film for Sleeve Labels Market

- In November 2024, Amcor plc announced a strategic partnership with South Korea's Kolon Industries to co-develop and commercialize sustainable polyester materials for flexible packaging. The collaboration focuses on chemically recycled PET (crPET) and polyethylene furanoate (PEF), supporting Amcor's goals of incorporating 30% post-consumer recycled materials by 2030 and achieving net-zero emissions by 2050. This partnership aims to advance circular economy initiatives and reduce carbon footprints in global packaging solutions

- في أغسطس 2024، حصلت ProAmpac على جائزتين فضيتين في حفل توزيع جوائز التميز في الطباعة الفليكسوغرافية لعام 2024 الذي استضافته جمعية التقنيات الفليكسوغرافية (FTA). وقد تم تكريم الشركة لتصميم عبوة الشاي TAZO Wild Sweet Orange Tea Packet، والتي اشتهرت بـ "نغمتها الممتازة"، وتصميم Econosource Paper Wrap، والذي تم الإشادة به لـ "تسجيل الألوان الدقيق والنص الحاد". يسلط هذا الإنجاز الضوء على تفاني ProAmpac في تطوير الطباعة الفليكسوغرافية وتقديم جودة استثنائية

- في فبراير 2023، قدمت شركة Taghleef Industries أفلام ملصقات التغليف القابلة للانكماش المبتكرة لقطاع الألبان، مما يوفر مظهرًا جديدًا ومذهلًا على الأرفف. تعمل أفلام SHAPE360 القابلة لإعادة التدوير هذه على تعزيز العلامة التجارية بتصميمات حاويات كاملة مع دعم الاستدامة من خلال التوافق مع أنظمة إعادة التدوير الحديثة، مما يعزز التزام Taghleef بحلول الاقتصاد الدائري

- في مارس 2022، أعلنت شركة Cosmo Films Limited، وهي شركة رائدة عالميًا في مجال التعبئة والتغليف والوسم والتصفيح والورق الصناعي، عن إنشاء خط إنتاج أفلام CPP في أورنجاباد بطاقة إنتاجية سنوية تبلغ 25000 طن متري. سيتم تمويل المشروع الذي تبلغ تكلفته 140 كرور روبية من خلال الاستحقاقات الداخلية والديون، واستهداف الإنتاج في غضون عامين

- في أكتوبر 2018، أعلنت شركة Bonset America Corporation عن خطط لزيادة قدرتها على إنتاج أفلام PETG بنسبة 30%، بدءًا من أوائل عام 2020، لتلبية الطلب المتزايد في سوق الأفلام القابلة للانكماش بالحرارة العالمية. وأكد الرئيس التنفيذي ميتسوهيرو إيواتا التزام الشركة بتوفير أفلام عالية الجودة وزيادة الإنتاجية، مما يعزز مكانتها في صناعة الأفلام القابلة للانكماش بالحرارة. تصنع Bonset America، وهي جزء من CI Takiron، أفلامًا لوضع العلامات على الجسم بالكامل، وتغليف الحزم، والتطبيقات المقاومة للتلاعب

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 BRAND OUTLOOK

4.6.1 BRANDS

4.6.1.1 BODYARMOR

4.6.1.2 FAIRLIFE

4.6.1.3 DOWNEY

4.6.1.4 FEBREZE

4.6.1.5 GILLETTE

4.6.1.6 GATORADE

4.6.1.7 BAI

4.6.1.8 PRIME

4.6.1.9 OTHERS

4.6.2 BRAND OWNERS

4.6.2.1 COCA-COLA

4.6.2.2 PEPSI

4.6.2.3 NESTLÉ

4.6.2.4 P&G (PROCTER & GAMBLE)

4.6.2.5 KRAFT HEINZ

4.6.2.6 UNILEVER

4.6.2.7 ABBOTT & DANONE

4.6.2.8 WALMART

4.6.2.9 COSTCO

4.6.2.10 OTHERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT'S ROLE

4.7.4 ANALYST RECOMMENDATION

4.8 BRAND OUTLOOK

4.8.1 CCL

4.8.1.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.1.2 SALES QUANTITIES

4.8.1.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.2 MCC/FORT DEARBORN

4.8.2.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.2.2 SALES QUANTITIES

4.8.2.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.3 AMERICAN FUJI SEAL

4.8.3.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.3.2 SALES QUANTITIES

4.8.3.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.4 FORTIS

4.8.4.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.4.2 SALES QUANTITIES

4.8.4.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.5 BROOK & WHITTLE

4.8.5.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.5.2 SALES QUANTITIES

4.8.5.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.6 RB DWYER

4.8.6.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.6.2 SALES QUANTITIES

4.8.6.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.7 EXIMPRO (MEXICO)

4.8.7.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.7.2 SALES QUANTITIES

4.8.7.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.8 VINS (CANADA)

4.8.8.1 PROCUREMENT SOURCES (WITH LOCATION-SPECIFIC DETAILS AND QUANTITIES)

4.8.8.2 SALES QUANTITIES

4.8.8.3 IMPORT DATA (QUANTITATIVE DATA ON IMPORTED HSF VOLUMES)

4.8.9 OTHERS

4.9 SCENARIO: ACTUAL PRICE AND VOLUME

4.1 PRODUCTION CAPACITY OVERVIEW

4.10.1 MANUFACTURING INFRASTRUCTURE

4.10.2 REGIONAL DEMAND IMPACT

4.10.3 SUSTAINABILITY-DRIVEN ADJUSTMENTS

4.10.4 RAW MATERIAL AVAILABILITY AND CONSTRAINTS

4.10.5 COMPETITIVE LANDSCAPE

4.10.6 OUTLOOK AND RECOMMENDATIONS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.13 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ADOPTION OF SUSTAINABLE LABELING SOLUTIONS

6.1.2 CUSTOMIZATION AND AESTHETIC APPEAL OF HEAT-SHRINKABLE FILMS

6.1.3 GROWING DEMAND FOR CONSUMER GOODS AND BEVERAGES

6.1.4 REGULATORY COMPLIANCE AND SAFETY OF HEAT-SHRINKABLE FILMS

6.2 RESTRAINTS

6.2.1 DEPENDENCE ON SPECIFIC MACHINERY FOR THE APPLICATION OF HEAT-SHRINKABLE FILMS

6.2.2 ENVIRONMENTAL CONCERN REGARDING RECYCLING OF HEAT-SHRINKABLE FILM

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATIONS AND ADVANCEMENTS IN SHRINK FILM MATERIALS AND PRINTING TECHNIQUES

6.3.2 RISING POPULARITY OF SMART AND INTERACTIVE PACKAGING

6.4 CHALLENGES

6.4.1 STIFF COMPETITION FROM ALTERNATIVE LABELING SOLUTIONS

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

7 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE

7.1 OVERVIEW

7.2 FULL BODY SLEEVES

7.3 HALF BODY AND CAP SLEEVES

7.4 COMBI SLEEVES

7.5 TAMPER EVIDENT CAP SLEEVES

7.6 OTHERS

8 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PVC SHRINK FILMS

8.3 POLYETHYLENE TEREPHTHALATE SHRINK FILMS (PET)

8.4 POLYETHYLENE TEREPHTHALATE GLYCOL SHRINK FILMS (PETG)

8.5 ORIENTED POLYSTYRENE (OPS) SHRINK FILMS

8.6 POLYEOLEFIN SHRINK FILMS

8.7 POLYAMIDE SHRINK FILMS

8.8 HYBRID SHRINK FILMS

8.9 OTHERS

9 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE

9.1 OVERVIEW

9.2 MEDIUM TEMPERATURE SHRINK FILMS

9.3 LOW TEMPERATURE SHRINK FILMS

9.4 HIGH TEMPERATURE SHRINK FILMS

10 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE

10.1 OVERVIEW

10.2 RECYCLABLE

10.3 NON-RECYCLABLE

11 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 MEDIUM FILMS (30-50 MICRONS)

11.3 THIN FILMS (BELOW 30 MICRONS)

11.4 THICK FILMS (ABOVE 50 MICRONS)

12 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BOTTLES

12.3 JARS

12.4 CANS

12.5 TUBS

12.6 OTHERS

13 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY

13.1 OVERVIEW

13.2 FOOD AND BEVERAGES

13.2.1 FOOD AND BEVERAGES, BY TYPE

13.2.2 BEVERAGES, BY TYPE

13.2.3 ALCOHOLIC BEVERAGES, BY TYPE

13.2.4 FORTIFIED BEVERAGES, BY TYPE

13.2.5 BEVERAGES, BY SLEEVE TYPE

13.2.6 PACKED FOOD ITEMS, BY TYPE

13.2.7 DAIRY PRODUCTS, BY TYPE

13.2.8 MILK, BY TYPE

13.2.9 PACKED FOOD ITEMS, BY SLEEVE TYPE

13.3 PHARMACEUTICALS

13.3.1 PHARMACEUTICALS, BY TYPE

13.3.2 PHARMACEUTICALS, BY SLEEVE TYPE

13.4 COSMETICS & PERSONAL CARE

13.4.1 COSMETICS & PERSONAL CARE, BY TYPE

13.4.2 COSMETICS & PERSONAL CARE, BY SLEEVE TYPE

13.5 HOUSEHOLD GOODS

13.5.1 HOUSEHOLD GOODS, BY TYPE

13.5.2 HOUSEHOLD GOODS, BY SLEEVE TYPE

13.6 AUTOMOTIVE

13.6.1 AUTOMOTIVE, BY SLEEVE TYPE

13.7 CHEMICALS

13.7.1 CHEMICALS, BY SLEEVE TYPE

13.8 DIETARY SUPPLEMENTS

13.8.1 DIETARY SUPPLEMENTS, BY SLEEVE TYPE

13.9 OTHERS

13.9.1 OTHERS, BY SLEEVE TYPE

14 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY COUNTRY

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 AMCOR PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 KLÖCKNER PENTAPLAST

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT UPDATES

17.3 BERRY GLOBAL INC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 AVERY DENNISON CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 PROAMPAC

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 BONSET AMERICA CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 CLYSAR

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COSMO FILMS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 TAGHLEEF INDUSTRIES

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATES

17.1 PLASTIC SUPPLIERS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 ESTIMATED PRICE AND VOLUME OF HEAT-SHRINKABLE FILM FOR SLEEVE LABELS ACROSS THE SUPPLY CHAIN:

TABLE 2 REGULATION COVERAGE

TABLE 3 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (TONS)

TABLE 5 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (TONS)

TABLE 7 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (TONS)

TABLE 9 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (THOUSAND TONS)

TABLE 11 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (THOUSAND TONS)

TABLE 13 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 15 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 17 NORTH AMERICA FOOD AND BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA ALCOHOL BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA FORTIFIED BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA PACKED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA DAIRY PRODUCTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA MILK IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA PACKED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA CHEMICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA DIETARY SUPPLEMENTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 38 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (USD MILLION)

TABLE 39 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (THOUSAND TONS)

TABLE 40 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 41 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (THOUSAND TONS)

TABLE 42 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (USD MILLION)

TABLE 43 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (THOUSAND TONS)

TABLE 44 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 45 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (THOUSAND TONS)

TABLE 46 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 47 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (THOUSAND TONS)

TABLE 48 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 49 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 50 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (USD MILLION)

TABLE 51 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (THOUSAND TONS)

TABLE 52 U.S. FOOD AND BEVERAGE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 U.S. BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 U.S. ALCOHOLIC BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 55 U.S. FORTIFIED BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 56 U.S. HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 57 U.S. PACKED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 U.S. DAIRY PRODUCTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 U.S. MILK IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 60 U.S. PACKAGED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 61 U.S. PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 U.S. PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 63 U.S. COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 U.S. COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 65 U.S. HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 66 U.S. HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 67 U.S. AUTOMOTIVE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 68 U.S. CHEMICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 69 U.S. DIETARY SUPPLEMENTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 70 U.S. OTHERS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 71 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (USD MILLION)

TABLE 72 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (THOUSAND TONS)

TABLE 73 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 74 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (THOUSAND TONS)

TABLE 75 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (USD MILLION)

TABLE 76 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (THOUSAND TONS)

TABLE 77 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 78 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (THOUSAND TONS)

TABLE 79 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 80 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (THOUSAND TONS)

TABLE 81 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 83 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (USD MILLION)

TABLE 84 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (THOUSAND TONS)

TABLE 85 CANADA FOOD AND BEVERAGE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 CANADA BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 87 CANADA ALCOHOLIC BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 88 CANADA FORTIFIED BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 CANADA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 90 CANADA PACKED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 CANADA DAIRY PRODUCTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 CANADA MILK IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 CANADA PACKAGED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 94 CANADA PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 CANADA PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 96 CANADA COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 CANADA COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 98 CANADA HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 CANADA HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 100 CANADA AUTOMOTIVE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 101 CANADA CHEMICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 102 CANADA DIETARY SUPPLEMENTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 103 CANADA OTHERS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 104 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (USD MILLION)

TABLE 105 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE, 2018-2032 (THOUSAND TONS)

TABLE 106 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 107 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY MATERIAL, 2018-2032 (THOUSAND TONS)

TABLE 108 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (USD MILLION)

TABLE 109 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TEMPERATURE, 2018-2032 (THOUSAND TONS)

TABLE 110 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 111 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY NATURE, 2018-2032 (THOUSAND TONS)

TABLE 112 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 113 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY THICKNESS, 2018-2032 (THOUSAND TONS)

TABLE 114 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 115 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 116 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (USD MILLION)

TABLE 117 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY END-USER INDUSTRY, 2018-2032 (THOUSAND TONS)

TABLE 118 MEXICO FOOD AND BEVERAGE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 119 MEXICO BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 MEXICO ALCOHOLIC BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 MEXICO FORTIFIED BEVERAGES IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 MEXICO HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 123 MEXICO PACKED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 MEXICO DAIRY PRODUCTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 MEXICO MILK IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 MEXICO PACKAGED FOOD ITEMS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 127 MEXICO PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 128 MEXICO PHARMACEUTICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 129 MEXICO COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 MEXICO COSMETICS & PERSONAL CARE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 131 MEXICO HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 MEXICO HOUSEHOLD GOODS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 133 MEXICO AUTOMOTIVE IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 134 MEXICO CHEMICALS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 135 MEXICO DIETARY SUPPLEMENTS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

TABLE 136 MEXICO OTHERS IN HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE TYPE, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET

FIGURE 2 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET, BY SLEEVE (2024)

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING ADOPTION OF SUSTAINABLE LABELING SOLUTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE FULL BODY SLEEVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET

FIGURE 22 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY SLEEVE, 2024

FIGURE 23 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY MATERIAL, 2024

FIGURE 24 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY TEMPERATURE, 2024

FIGURE 25 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY NATURE, 2024

FIGURE 26 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY THICKNESS, 2024

FIGURE 27 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: BY END-USER INDUSTRY, 2024

FIGURE 29 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: SNAPSHOT (2024)

FIGURE 30 NORTH AMERICA HEAT-SHRINKABLE FILM FOR SLEEVE LABELS MARKET: COMPANY SHARE 2024 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.