North America Bee Products Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

3.19 Billion

USD

6.14 Billion

2024

2032

USD

3.19 Billion

USD

6.14 Billion

2024

2032

| 2025 –2032 | |

| USD 3.19 Billion | |

| USD 6.14 Billion | |

|

|

|

|

تجزئة سوق منتجات النحل في أمريكا الشمالية، حسب النوع (العسل، شمع العسل، البروبوليس، غذاء ملكات النحل، سم النحل، وغيرها)، والطبيعة (العضوية والتقليدية)، وقنوات التوزيع (المباشرة وغير المباشرة) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق منتجات النحل في أمريكا الشمالية

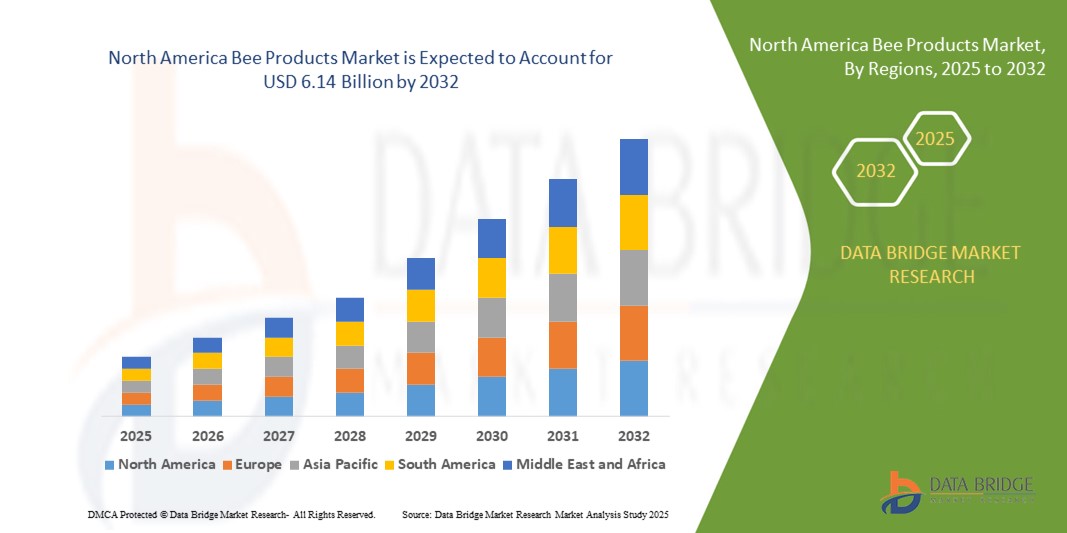

- تم تقييم حجم سوق منتجات النحل في أمريكا الشمالية بـ 3.19 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 6.14 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 8.53٪ خلال الفترة المتوقعة

- ينشأ نمو السوق إلى حد كبير من خلال الطلب المتزايد على المكملات الغذائية الطبيعية، وزيادة الوعي بالفوائد الطبية لمنتجات مشتقة من النحل، والاستخدام المتزايد للعسل، والبروبوليس، وغذاء الملكات في الأغذية الوظيفية، ومستحضرات التجميل، والأدوية.

- كما يدعم النمو الشعبية المتزايدة للعلاج بالنحل والاهتمام المتزايد من جانب المستهلكين بمنتجات تعزيز المناعة ومكافحة الشيخوخة المستمدة من مصادر طبيعية.

تحليل سوق منتجات النحل في أمريكا الشمالية

- يشهد سوق منتجات النحل في أمريكا الشمالية نموًا مطردًا بفضل تزايد تفضيل المستهلكين للمنتجات ذات العلامات التجارية النظيفة والمكونات الطبيعية. وتكتسب منتجات مثل العسل وحبوب لقاح النحل وغذاء الملكات وشمع العسل زخمًا بفضل خصائصها المضادة للأكسدة والبكتيريا والالتهابات.

- إن ازدياد الزراعة العضوية، ونمو قطاع العافية، ودمج منتجات النحل في تركيبات التغذية الرياضية والعناية بالبشرة، كلها عوامل تدفع عجلة نمو السوق. ومع تزايد الاستدامة والوعي البيئي، من المتوقع أن يزداد الطلب على منتجات النحل ذات المصادر الأخلاقية والقابلة للتتبع.

- استحوذ سوق منتجات النحل في الولايات المتحدة على أكبر حصة في أمريكا الشمالية في عام 2024، مدفوعًا بالطلب المتزايد على البدائل الطبيعية للأدوية التقليدية وزيادة الوعي بالمكونات الوظيفية القائمة على النحل

- من المتوقع أن تشهد كندا أعلى معدل نمو سنوي مركب (CAGR) في سوق منتجات النحل في أمريكا الشمالية بسبب زيادة الوعي بالفوائد الصحية للمنتجات المشتقة من النحل والمبادرات الحكومية الداعمة لتربية النحل المستدامة وفرص التصدير المتزايدة.

- استحوذ قطاع العسل على أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل استخدامه الواسع في الأغذية والمشروبات، والطب الطبيعي، والعناية بالبشرة. وقد ساهم مكانته كمُحلي طبيعي ومُعزز للمناعة بشكل كبير في تزايد استهلاكه في كل من الدول المتقدمة والنامية. خصائص العسل المتعددة تجعله عنصرًا أساسيًا في المطابخ المنزلية، ومنتجات العافية، والتطبيقات العلاجية، مما يُحافظ على هيمنته على السوق.

نطاق التقرير وتقسيم سوق منتجات النحل في أمريكا الشمالية

|

صفات |

رؤى رئيسية حول سوق منتجات النحل في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

• شركة عسل نيتشر نيت (الولايات المتحدة) • شركة سافانا بي (الولايات المتحدة) |

|

فرص السوق |

• توسع منتجات النحل في مجال التغذية الرياضية والمشروبات الوظيفية |

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق منتجات النحل في أمريكا الشمالية

زيادة الطلب على منتجات النحل الوظيفية والطبية

- يُعيد تفضيل المستهلكين المتزايد للحلول الصحية الطبيعية والوظيفية تشكيل سوق منتجات النحل، مع تزايد الاهتمام بالعسل، وغذاء الملكات، والبروبوليس، وحبوب لقاح النحل، نظرًا لخصائصها المضادة للأكسدة والبكتيريا، والمعززة للمناعة. تُستخدم هذه المنتجات بشكل متزايد في المكملات الغذائية والعلاجات الطبيعية للرعاية الصحية الوقائية.

- في كلٍّ من الأسواق المتقدمة والناشئة، تُدمج المكونات المشتقة من النحل في المستحضرات الغذائية، ومستحضرات العناية الشخصية، والتركيبات العلاجية. ويزداد الطلب بفضل حركة العافية والوعي المتزايد بالمنتجات النظيفة والخالية من المواد الكيميائية، والتي تُقدم فوائد شاملة.

- إن ازدياد استخدام منتجات النحل في العلاج يُحفّز الابتكار في قطاعي الأدوية والطب البديل. يلجأ المستهلكون إلى تركيبات النحل لعلاج حالات مثل الالتهابات والعدوى وتحسين صحة الجلد، مما يُسهم في تنويع استخدامات المنتجات.

- على سبيل المثال، في عام 2023، أطلقت العديد من العلامات التجارية المتخصصة في العافية في الولايات المتحدة بخاخات للحلق تعتمد على البروبوليس ومقويات للمناعة تستهدف الوقاية من الأمراض الموسمية، واكتسبت قوة جذب قوية في قطاعات المستهلكين المهتمين بالصحة.

- مع توسّع السوق، يعتمد النجاح على توحيد معايير المنتجات بشكل مستدام، وإمكانية تتبّعها، وضمان جودتها. يجب على الشركات التركيز على المصادر الأخلاقية ووضع ملصقات شفافة للحفاظ على ثقة المستهلك وتلبية الطلب المتزايد على منتجات النحل عالية الجودة والفعالة.

ديناميكيات سوق منتجات النحل في أمريكا الشمالية

سائق

تفضيل متزايد لمنتجات الصحة الطبيعية والعناية الشخصية

يُعزز التحول نحو الحلول الطبيعية الخالية من المواد الكيميائية اعتماد منتجات النحل بشكل كبير في قطاعات الأغذية ومستحضرات التجميل والأدوية. ويتزايد إقبال المستهلكين على المنتجات الآمنة والفعالة والمستدامة، والتي تتوافق مع الأصل الطبيعي والقيمة العلاجية لمكونات النحل، مثل العسل وشمع العسل وغذاء الملكات.

في صناعة التجميل والعناية الشخصية، يُستخدم شمع العسل والعسل على نطاق واسع في منتجات العناية العضوية بالبشرة والشفاه والشعر، نظرًا لفوائدهما المرطبة والمضادة للالتهابات والمضادة للميكروبات. ويتجلى هذا التوجه أيضًا في المكملات الغذائية التي تحتوي على البروبوليس وحبوب اللقاح لتعزيز المناعة والحيوية.

• يُعزز الدعم التنظيمي لأنظمة الطب التقليدي والطبيعي نطاق الوصول إلى السوق. كما أن تزايد إدراج المكونات المُستخلصة من النحل في قوائم المنتجات المعتمدة وفئات الأغذية الوظيفية يُتيح قبولًا وتوزيعًا أوسع.

على سبيل المثال، في عام ٢٠٢٢، طرحت العديد من شركات المُغذّيات الغذائية في أمريكا الشمالية كبسولات وبخاخات فموية مُدعّمة بالبروبوليس، استجابةً للطلب المتزايد من المستهلكين على مُعزّزات المناعة الطبيعية. وقد دُعمت هذه الإطلاقات بتفضيل متزايد للمكملات الغذائية ذات العلامات التجارية النظيفة، وتوسّع نطاق توزيعها بالتجزئة في الصيدليات ومتاجر العافية. وقد عزز هذا التطور حضور البروبوليس في سوق المُكمّلات الصحية الرئيسية في المنطقة.

• في حين أن التفضيلات الطبيعية تدفع السوق إلى الأمام، فإن ضمان الأصالة وإدارة مخاطر الغش سيكونان ضروريين للثقة طويلة الأجل والنمو المستدام

ضبط النفس/التحدي

التهديدات الناجمة عن انهيار المستعمرات وعدم الاستقرار البيئي

من أبرز المعوقات التي تواجه سوق منتجات النحل تزايد خطر انهيار مستعمرات النحل (CCD) والتدهور البيئي. يؤثر انخفاض أعداد النحل نتيجة استخدام المبيدات الحشرية، وفقدان الموائل، وتغير المناخ بشكل كبير على توافر المواد الخام واستدامة سلاسل التوريد المعتمدة على النحل.

تؤثر تقلبات الظروف المناخية على دورات الإزهار وتوافر الرحيق، مما يُقلل بدوره من إنتاج العسل ويُعطّل عمليات المناحل. يُحدّ هذا التقلب من ثبات جودة المنتج وحجمه، مما يُشكّل تحدياتٍ للمصنعين الذين يعتمدون على إمدادات مستقرة للإنتاج واسع النطاق.

يواجه مربي النحل، وخاصةً في المناطق النامية، تحدياتٍ تتعلق بإدارة الأمراض، والتعرض للمبيدات الحشرية، ومحدودية الوصول إلى ممارسات تربية النحل الحديثة. تؤثر هذه المشكلات على القدرة الإنتاجية وتحد من القدرة على تلبية الطلب الصناعي والاستهلاكي المتزايد.

على سبيل المثال، في عام ٢٠٢٣، أفادت عدة تعاونيات لمناحل النحل في أمريكا الشمالية بانخفاض حاد في إنتاج العسل بسبب ظروف الجفاف الشديد في أجزاء من الولايات المتحدة وكندا. أدى هذا الضغط البيئي إلى انخفاض توافر الرحيق، مما أثر بشكل مباشر على صحة المستعمرات وإنتاج العسل. وضغط هذا النقص على سلاسل توريد العسل العضوي والمتخصص، مما أدى إلى زيادة الواردات وتقلب الأسعار في قنوات البيع بالتجزئة والجملة.

• للتخفيف من هذه المخاطر، يجب على أصحاب المصلحة الاستثمار في ممارسات تربية النحل المستدامة، والبحث في سلالات النحل المقاومة للأمراض، وتحسين الحفاظ على النظام البيئي لحماية العرض واستقرار السوق على المدى الطويل.

نطاق سوق منتجات النحل في أمريكا الشمالية

يتم تقسيم السوق على أساس النوع والطبيعة وقناة التوزيع.

- حسب النوع

يُقسّم سوق منتجات النحل في أمريكا الشمالية، حسب نوعها، إلى العسل، وشمع العسل، والبروبوليس، وغذاء ملكات النحل، وسم النحل، وغيرها. وقد استحوذ قطاع العسل على أكبر حصة من إيرادات السوق في عام 2024، بفضل استخدامه الواسع في الأغذية والمشروبات، والطب الطبيعي، والعناية بالبشرة. وقد ساهم مكانته كمُحلي طبيعي ومُعزز للمناعة بشكل كبير في تزايد استهلاكه في كل من الدول المتقدمة والنامية. وتجعل خصائص العسل المتعددة من العسل عنصرًا أساسيًا في المطابخ المنزلية، ومنتجات العافية، والتطبيقات العلاجية، مما يُحافظ على هيمنته على السوق.

من المتوقع أن يشهد قطاع البروبوليس أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد استخدامه في المستحضرات الغذائية ومنتجات العناية الشخصية. وتؤدي فوائده المضادة للالتهابات والفيروسات والميكروبات إلى زيادة الطلب عليه بين المستهلكين المهتمين بالصحة والعلامات التجارية المتخصصة بالعافية. ومن المتوقع أن يُسهم النمو الكبير في تطوير المنتجات الوظيفية، وخاصةً تركيبات تعزيز المناعة ومنتجات العناية بالبشرة، في تسريع اعتماد البروبوليس في الأسواق العالمية.

- بالطبيعة

بناءً على طبيعة السوق، يُقسّم سوق منتجات النحل في أمريكا الشمالية إلى عضوي وتقليدي. وقد شكّل القطاع التقليدي أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل انتشاره الواسع وانخفاض سعره مقارنةً بنظيراته العضوية المعتمدة. وتُستورد منتجات النحل التقليدية بشكل رئيسي من قِبل شركات تصنيع الأغذية والأدوية ومستحضرات التجميل ذات السوق الواسعة، وذلك بفضل استقرار سلاسل التوريد وفعاليتها من حيث التكلفة.

من المتوقع أن يشهد قطاع المنتجات العضوية أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد وعي المستهلكين بالمنتجات الخالية من المواد الكيميائية والمصادر المستدامة. ويتزايد الطلب على العسل العضوي المعتمد، وشمع العسل، وغذاء الملكات في الأسواق التي تهتم بالصحة والبيئة. وتكتسب منتجات النحل العضوية زخمًا كبيرًا في قنوات البيع بالتجزئة الفاخرة والبيع المباشر للمستهلك، حيث يسعى المشترون بشكل متزايد إلى مكونات قابلة للتتبع وذات مصادر أخلاقية.

- حسب قناة التوزيع

بناءً على قنوات التوزيع، يُقسّم سوق منتجات النحل في أمريكا الشمالية إلى قنوات مباشرة وغير مباشرة. وقد هيمن القطاع غير المباشر على السوق في عام ٢٠٢٤ بفضل انتشاره الواسع في محلات السوبر ماركت والصيدليات ومتاجر الأغذية الصحية ومنصات التجارة الإلكترونية. تضمن هذه المنافذ وصولاً واسعاً للمستهلكين وتساهم في ارتفاع حجم المبيعات، لا سيما العسل المُعبأ وبخاخات العكبر والمكملات الغذائية المُستخلصة من النحل.

من المتوقع أن يشهد قطاع البيع المباشر أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد شعبية نماذج البيع من المزرعة إلى المستهلك وعلامات منتجات النحل الحرفية. ويعتمد مربو النحل والمنتجون المتخصصون بشكل متزايد على البيع المباشر عبر المنصات الإلكترونية وأسواق المزارعين ونماذج الاشتراك. وهذا يتيح شفافية أكبر للمنتجات، وأسعارًا مميزة، وتفاعلًا أقوى مع العملاء، مما يعزز نمو هذا القطاع.

تحليل إقليمي لسوق منتجات النحل في أمريكا الشمالية

- استحوذ سوق منتجات النحل في الولايات المتحدة على أكبر حصة في أمريكا الشمالية في عام 2024، مدفوعًا بالطلب المتزايد على البدائل الطبيعية للأدوية التقليدية وزيادة الوعي بالمكونات الوظيفية القائمة على النحل

- شجعت البنية التحتية القوية لتجارة التجزئة في البلاد والتفضيل للمنتجات المعتمدة عضويًا على التبني على نطاق واسع في قطاعات المكملات الغذائية والعناية الشخصية

- كما أدى اهتمام المستهلكين بالمصادر المستدامة وممارسات تربية النحل الأخلاقية إلى تعزيز التمييز بين المنتجات، مع تأكيد العلامات التجارية على إمكانية التتبع والنقاء

- علاوة على ذلك، تستمر الحملات التسويقية الاستراتيجية والابتكارات في المنتجات في مجال العسل المنكه، والمكملات الغذائية الغنية بحبوب لقاح النحل، وخطوط العناية بالبشرة في توسيع فرص السوق في الولايات المتحدة.

نظرة عامة على سوق منتجات النحل الكندية

من المتوقع أن يشهد سوق منتجات النحل في كندا أسرع معدل نمو بين عامي 2025 و2032، مدعومًا بتزايد توجه المستهلكين نحو المنتجات الصحية العضوية والطبيعية والمحلية المصدر. ويعتمد المستهلكون الكنديون على العسل والبروبوليس وغذاء الملكات كجزء من روتينهم الصحي اليومي، لا سيما لما له من فوائد في صحة المناعة والعناية بالبشرة. ويعزز القطاع الزراعي القوي في البلاد، إلى جانب تقاليد تربية النحل الراسخة، الإنتاج المحلي وتوفير منتجات نحل عالية الجودة. كما أن الطلب المتزايد على المنتجات ذات العلامات التجارية النظيفة والمستدامة يشجع العلامات التجارية المحلية على تقديم خيارات معالجة بأقل قدر من التعقيد وذات مصادر أخلاقية. وتعزز اللوائح الحكومية الداعمة وإمكانات التصدير المتزايدة إلى الأسواق الأمريكية والأوروبية مكانة كندا في سلسلة القيمة العالمية لمنتجات النحل.

حصة سوق منتجات النحل في أمريكا الشمالية

إن صناعة منتجات النحل في أمريكا الشمالية يقودها في المقام الأول شركات راسخة، بما في ذلك:

• شركة عسل نيتشر نيت (الولايات المتحدة)

• شركة بي ميد هوني المحدودة (كندا)

• كومفيتا يو إس إيه (الولايات المتحدة)

• بيوند ذا هايف (الولايات المتحدة)

• عسل داتش جولد (الولايات المتحدة)

• شركة سافانا بي (الولايات المتحدة)

• عسل ريلاي راو (الولايات المتحدة)

• ويدرسبون أورجانيك (الولايات المتحدة)

• شركة كروكيت هوني (الولايات المتحدة)

• جلوري بي (الولايات المتحدة)

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.