North America Ai In Bioinformatics Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

1,000.00 Million

USD

19,677.40 Million

2021

2029

USD

1,000.00 Million

USD

19,677.40 Million

2021

2029

| 2022 –2029 | |

| USD 1,000.00 Million | |

| USD 19,677.40 Million | |

|

|

|

سوق المعلوماتية الحيوية للذكاء الاصطناعي في أمريكا الشمالية، حسب العرض (الخدمات والبرامج وغيرها)، النوع (التعلم الآلي، والتعلم العميق وغيرها)، المنتج والخدمات (خدمات المعلوماتية الحيوية، ومنصات المعلوماتية الحيوية، وأدوات إدارة المعرفة)، التطبيق ( علم الجينوم ، وعلم المعلومات الكيميائية وتصميم الأدوية، والبروتينات، وتسلسل الحمض النووي، وعلم الأحياء النظامي، والنسخ الجيني، واستخراج النصوص، والمصفوفات الدقيقة، وعلم الأيض وغيرها)، القطاع (التكنولوجيا الحيوية الطبية، والتكنولوجيا الحيوية الحيوانية، والتكنولوجيا الحيوية النباتية، والتكنولوجيا الحيوية البيئية، والتكنولوجيا الحيوية الشرعية وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2029.

تحليل وحجم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

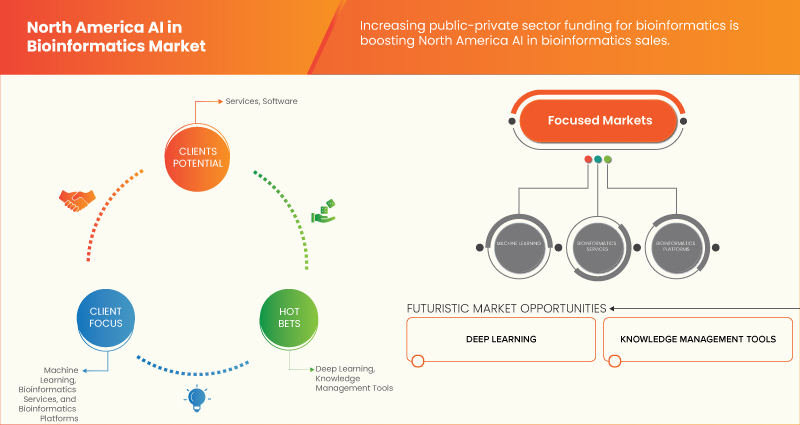

أدى خفض تكلفة التسلسل الجيني إلى تعزيز الطلب في السوق. كما يساهم ارتفاع الإنفاق على الرعاية الصحية لتحسين الخدمات الصحية في نمو السوق. يركز اللاعبون الرئيسيون في السوق على إطلاق خدمات مختلفة والموافقة عليها خلال هذه الفترة الحاسمة. بالإضافة إلى ذلك، يساهم الطلب المتزايد على المعلوماتية الحيوية وزيادة تمويل القطاعين العام والخاص للمعلوماتية الحيوية أيضًا في زيادة الطلب على السوق.

يشهد سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية نموًا في عام التوقعات بسبب زيادة عدد اللاعبين في السوق وتوافر الخدمات المتقدمة. إلى جانب ذلك، يشارك المصنعون في أنشطة البحث والتطوير لإطلاق خدمات جديدة في السوق. تعمل التطورات المتزايدة في تكنولوجيا المعلوماتية الحيوية على تعزيز نمو السوق. ومع ذلك، فإن التكلفة العالية للأجهزة ومخاوف الأمن السيبراني في المعلوماتية الحيوية قد تعيق نمو سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية في فترة التوقعات.

إن التقدم التقني المتزايد والتحديث والمبادرات الاستراتيجية من قبل اللاعبين في السوق توفر فرصًا للسوق. ومع ذلك، فإن الافتقار إلى المتخصصين المهرة لأداء تكنولوجيا المعلومات الحيوية القائمة على الذكاء الاصطناعي والتحديات في تنفيذ تكنولوجيا المعلومات الحيوية في المختبرات السريرية تشكل تحديات رئيسية لنمو السوق.

تحلل شركة Data Bridge Market Research أن سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 19,677.40 مليون دولار أمريكي بحلول عام 2030، بمعدل نمو سنوي مركب يبلغ 45.2% خلال الفترة المتوقعة. يغطي تقرير سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بشكل شامل.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

العرض (الخدمات والبرامج وغيرها)، النوع (التعلم الآلي والتعلم العميق وغيرها)، المنتج والخدمات (خدمات المعلوماتية الحيوية ومنصات المعلوماتية الحيوية وأدوات إدارة المعرفة)، التطبيق (علم الجينوم وعلم المعلومات الكيميائية وتصميم الأدوية والبروتينات وتسلسل الحمض النووي وعلم الأحياء النظامي وعلم النسخ واستخراج النصوص والمصفوفات الدقيقة وعلم الأيض وغيرها)، القطاع (التكنولوجيا الحيوية الطبية والتكنولوجيا الحيوية الحيوانية والتكنولوجيا الحيوية النباتية والتكنولوجيا الحيوية البيئية والتكنولوجيا الحيوية الشرعية وغيرها) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

تحليل بيانات JADBio & Gnosis، SOPHiA GENETICS، Biomax Informatics AG، DNASTAR، Ardigen، QIAGEN، Source BioScience.، NeoGenomics Laboratories، Eurofins Scientific، Illumina, Inc.، Thermo Fisher Scientific Inc.، CelbridgeScience.، Dassault Systemes، Fios Genomics، Insilico Medicine، Strand Life Sciences، Paige AI, Inc.، SomaLogic Operating Co., Inc.، و iNDX. Ai. Elucidata. |

تعريف السوق

يشير سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى القطاع داخل منطقة أمريكا الشمالية حيث يتم تطبيق تقنيات الذكاء الاصطناعي في مجال المعلوماتية الحيوية. تتضمن المعلوماتية الحيوية استخدام الأساليب والتقنيات الحسابية لتحليل وتفسير البيانات البيولوجية، مثل التسلسلات الجينومية وهياكل البروتين والتجارب البيولوجية واسعة النطاق.

يجمع علم المعلومات الحيوية بين البرمجة الحاسوبية والبيانات الضخمة وعلم الأحياء الجزيئي، مما يمكّن العلماء من فهم وتحديد الأنماط في البيانات البيولوجية. وهو مفيد بشكل خاص في دراسة الجينومات وتسلسل الحمض النووي، لأنه يسمح للعلماء بتنظيم كميات كبيرة من البيانات.

هناك العديد من فروع علم الأحياء التي يمكن التخصص فيها، من علم الوراثة وعلم السموم وعلم الفطريات وعلم الأحياء الإشعاعي. ومن بين العديد من هذه الفروع، تعد المعلوماتية الحيوية واحدة من المجالات المثيرة للاهتمام التي تمكن من تحديد المعلومات البيولوجية وتقييمها وتخزينها واسترجاعها. وباعتبارها مجال دراسة متعدد التخصصات، فإنها تتضمن تطبيقات مختلفة لعلوم الكمبيوتر والإحصاء وعلم الأحياء لتطوير تطبيقات برمجية لفهم البيانات البيولوجية مثل تسلسل الحمض النووي وتحليل البروتين وعلم الوراثة التطوري وغيرها.

ديناميكيات سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- خفض تكلفة التسلسل الجيني

لقد ساهم الطلب القوي على خفض تكلفة الجينوم والتنبؤ بالعلامات الحيوية في إنشاء تسلسل الجينوم عالي الإنتاجية، والذي يُعرف غالبًا باسم تسلسل الجيل التالي (NGS). يتم إنشاء الآلاف أو الملايين من التسلسلات في دورة واحدة من المعلومات الحيوية في وقت واحد. وقد أدت الترقيات الجذرية لتقنيات تسلسل الجيل التالي الصناعية إلى تخفيضات كبيرة في تكلفة تسلسل الحمض النووي لكل قاعدة. وبالتالي، أصبحت تقنيات التسلسل الرئيسية مؤخرًا موضوعًا رئيسيًا للبحث، مع تولي تحسين تصميم العينات وظيفة ثانوية.

بفضل قدرتها الموازية على التعامل مع مئات الملايين من قوالب الحمض النووي، نجحت تقنية تسلسل الجيل التالي في تحسين كفاءة التسلسل وخفض تكاليفه بشكل كبير. وعلاوة على ذلك، انخفضت تكلفة المعلوماتية الحيوية بشكل كبير منذ اكتمال مشروع الجينوم البشري، متجاوزة قانون مور. وقد ساعدت شركة Illumina في خفض تكلفة أجهزة المعلوماتية الحيوية من خلال الابتكار المستمر، مما سمح باستخراج الجينوم البشري بتكلفة 1000 دولار أمريكي.

- الطلب المتزايد على المعلوماتية الحيوية

مع استمرار علم الأدوية الذي يركز على الجينوم في لعب دور أكبر في علاج العديد من الأمراض المزمنة، وخاصة السرطان، يتطور التسلسل الجيني للجيل التالي (NGS) كأداة قوية لتوفير نظرة أعمق وأكثر دقة للأسس الجزيئية للأورام الفردية والمستقبلات المحددة. تعد المعلوماتية ضرورية في البحث البيولوجي الذي يشمل علماء الأحياء الذين يتعلمون البرمجة، ومبرمجي الكمبيوتر، وعلماء الرياضيات، أو مديري قواعد البيانات الذين يتعلمون أساسيات علم الأحياء.

تقدم تقنية NGS مزايا في الدقة والحساسية والسرعة مقارنة بالطرق التقليدية التي لديها القدرة على إحداث تأثير كبير في مجال علم الأورام. ولأن تقنية NGS يمكنها تقييم جينات متعددة في اختبار واحد، فإن الحاجة إلى طلب اختبارات متعددة لتحديد الطفرة المسببة يتم التخلص منها. يعد الذكاء الاصطناعي في المعلوماتية الحيوية مهمًا لإدارة البيانات في علم الأحياء والطب الحديث.

إن الاستخدام المتزايد لعلم المعلومات الحيوية مدفوع بالطفرة في البيانات البيولوجية، والحاجة إلى دمج البيانات وتحليلها، وتطبيقاتها في اكتشاف الأدوية والطب الشخصي، ومساهمتها في فهم الأنظمة البيولوجية المعقدة، ودورها في علم الأحياء التطوري وعلم الوراثة. يلعب علم المعلومات الحيوية دورًا مهمًا في تطوير البحوث البيولوجية، وتحسين الرعاية الصحية، ومعالجة التحديات المختلفة في علوم الحياة.

فرصة

- ارتفاع الإنفاق على الرعاية الصحية

لوحظ ارتفاع الإنفاق الحكومي على الرعاية الصحية في العديد من البلدان حول العالم. زاد الإنفاق على الرعاية الصحية في جميع أنحاء العالم مع زيادة الدخل المتاح للأشخاص في مختلف البلدان. علاوة على ذلك، لتحقيق متطلبات السكان، تتخذ الهيئات الحكومية ومنظمات الرعاية الصحية زمام المبادرة من خلال تسريع الإنفاق على الرعاية الصحية. مع تقدم السكان في السن، يزداد الطلب على خدمات الرعاية الصحية، بما في ذلك إدارة الأمراض المزمنة والرعاية طويلة الأجل ورعاية نهاية الحياة. يميل كبار السن إلى طلب المزيد من موارد وخدمات الرعاية الصحية، مما يؤدي إلى ارتفاع نفقات الرعاية الصحية. هناك بعض الحالات التي حسنت فيها العديد من المنظمات الحكومية التمويل القوي للرعاية الصحية مما عزز سوق الرعاية الصحية وأتاح فرصة كبيرة لأمريكا الشمالية للذكاء الاصطناعي في سوق المعلوماتية الحيوية.

ضبط النفس/التحدي

- مخاوف الأمن السيبراني في مجال المعلوماتية الحيوية

تحتوي مجموعات بيانات المعلومات الحيوية على معلومات حساسة، بما في ذلك البيانات الجينية، ومعلومات الصحة الشخصية، وبيانات البحث. وإذا تمكن أفراد غير مصرح لهم من الوصول إلى هذه البيانات من خلال خروقات في دفاعات الأمن السيبراني، فقد يؤدي ذلك إلى انتهاكات الخصوصية، أو سرقة الهوية، أو إساءة استخدام البيانات.

ولكن تزايد استخدام تكنولوجيا الحمض النووي والتكنولوجيا الحيوية على نطاق أوسع يثير مخاوف جديدة تتعلق بالأمن السيبراني الحيوي. فقد أصبحت الثغرات المرتبطة عادة بأنظمة الكمبيوتر التقليدية ــ مثل معالجة المدخلات غير الموثوقة، وتسريب القنوات الجانبية، وضعف المصادقة، والبيانات المزيفة، والثغرات في الأنظمة السيبرانية الفيزيائية ــ موجودة الآن في التكنولوجيا الحيوية. وقد هددت التهديدات الأمنية السيبرانية الحيوية الناشئة أنظمة المعلومات المرتبطة بالحمض النووي في مجال المعلوماتية الحيوية.

تأثير ما بعد كوفيد-19 على سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

وقد لاحظت صناعة الذكاء الاصطناعي في المعلوماتية الحيوية انخفاضًا في الطلب بسبب الإغلاق وكوفيد-19. القوانين الحكومية، حيث تم إغلاق مرافق التصنيع والخدمات. أحدث كوفيد-19 تأثيرًا كبيرًا على العديد من الصناعات حيث اختارت كل دولة تقريبًا إغلاق كل منشأة باستثناء تلك التي تتعامل في قطاع السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة مثل إغلاق المرافق وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. وقد عزز هذا سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية، حيث كان المستهلكون يستفيدون من التأمين لتجنب المدفوعات الرأسمالية الضخمة في المستشفيات في حالة الاحتياجات الطبية. وبالتالي، أثر كوفيد-19 بشكل إيجابي على سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية.

التطورات الأخيرة

- في سبتمبر 2022، نجحت شركة Elucidata، وهي شركة تابعة لشركة TechBio، في جمع 16 مليون دولار أمريكي في جولة تمويل من الفئة A. وقد قادت التمويل شركة Eight Roads Ventures. وتخطط الشركة لاستخدام رأس المال المكتسب حديثًا لتعزيز قدرات المنتج في أبحاث الأدوية الانتقالية والأسواق ذات الصلة. بالإضافة إلى ذلك، ستدعم الأموال توسيع مبادرات طرح المنتجات في السوق وتمكين الشركة من تنمية عملياتها عالميًا.

- في يناير 2022، أبرمت شركة شنغهاي فوسون للأدوية المحدودة، وهي مجموعة رائدة في مجال الرعاية الصحية الدولية القائمة على الابتكار في الصين، وشركة إنسيليكو ميديسين، وهي شركة اكتشاف وتطوير أدوية تعتمد على الذكاء الاصطناعي. أبرمت الشركة اتفاقية تعاون لتعزيز اكتشاف وتطوير الأدوية التي تستهدف عدة أهداف على مستوى العالم من خلال تقنية الذكاء الاصطناعي. وقد ساعد هذا الشركة على توسيع محفظة منتجاتها في السوق وزيادة حضورها العالمي.

نطاق سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

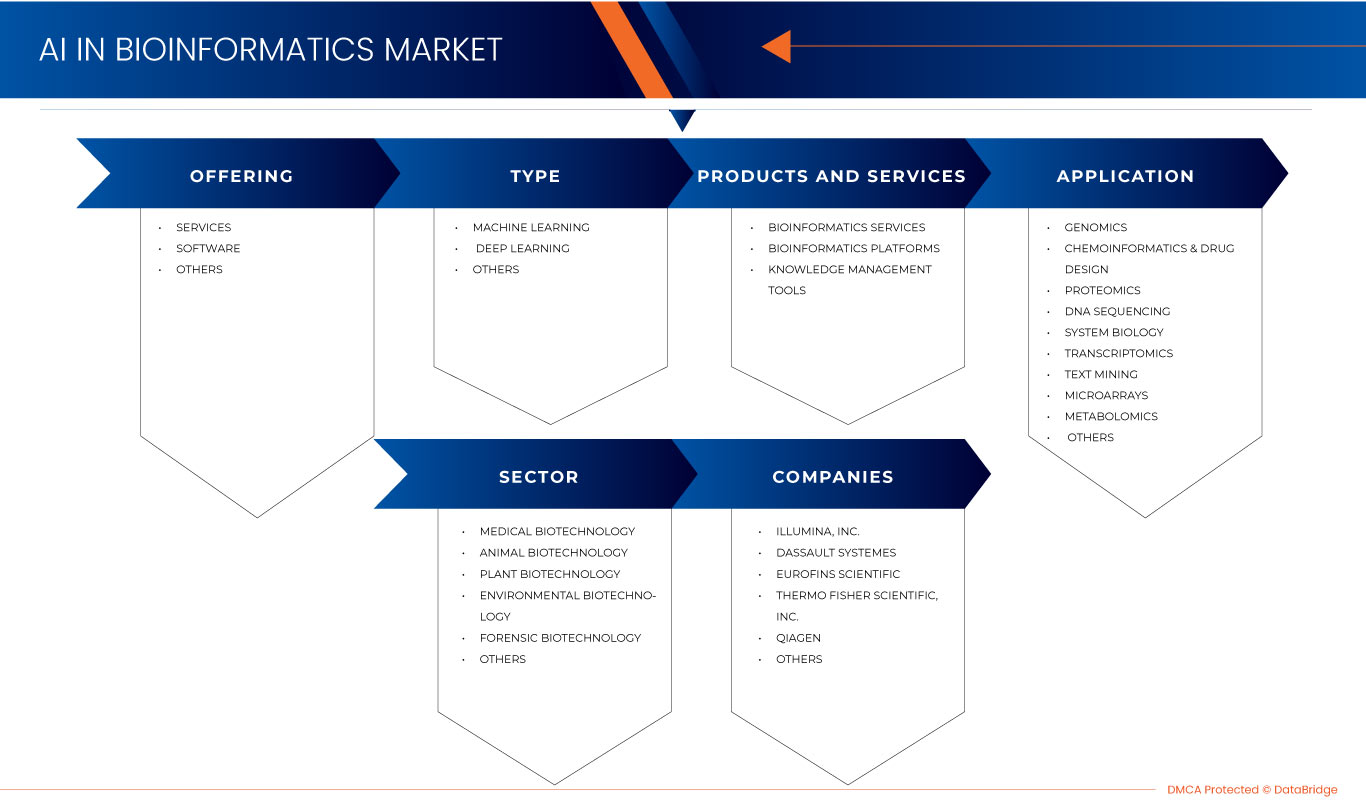

يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية على أساس العرض والنوع والمنتج والخدمات والتطبيق والقطاع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

عرض

- خدمات

- برمجة

- آحرون

على أساس العرض، يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى خدمات وبرامج وغيرها.

يكتب

- التعلم الآلي

- التعلم العميق

- آحرون

على أساس النوع، يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى التعلم الآلي، والتعلم العميق، وغيرها.

المنتجات والخدمات

- خدمات المعلوماتية الحيوية

- منصات المعلوماتية الحيوية

- أدوات إدارة المعرفة

على أساس المنتج والخدمات، يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى خدمات المعلوماتية الحيوية ومنصات المعلوماتية الحيوية وأدوات إدارة المعرفة.

طلب

- علم الجينوميات

- المعلوماتية الكيميائية وتصميم الأدوية

- تحليل البروتينات

- تسلسل الحمض النووي

- علم الأحياء النظامي

- النسخ الجيني

- استخراج النصوص

- المصفوفات الدقيقة

- علم الأيض

- آحرون

على أساس التطبيق، يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى علم الجينوم، وعلم المعلومات الكيميائية وتصميم الأدوية، والبروتينات، وتسلسل الحمض النووي، وعلم الأحياء النظامي، وعلم النسخ، واستخراج النصوص، والمصفوفات الدقيقة، وعلم الأيض وغيرها.

قطاع

- التكنولوجيا الحيوية الطبية

- التكنولوجيا الحيوية الحيوانية

- التكنولوجيا الحيوية النباتية

- التكنولوجيا الحيوية البيئية

- التكنولوجيا الحيوية الشرعية

- آحرون

على أساس القطاع، يتم تقسيم سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية إلى التكنولوجيا الحيوية الطبية، والتكنولوجيا الحيوية الحيوانية، والتكنولوجيا الحيوية النباتية، والتكنولوجيا الحيوية البيئية، والتكنولوجيا الحيوية الشرعية، وغيرها.

تحليل/رؤى إقليمية لسوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

يتم تحليل سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والعرض والنوع والمنتجات والخدمات والتطبيق والقطاع كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك. تهيمن الولايات المتحدة على منطقة أمريكا الشمالية بسبب الطلب المرتفع على الذكاء الاصطناعي في أجهزة المعلوماتية الحيوية. بالإضافة إلى ذلك، تتمتع الولايات المتحدة بنظام بيئي قوي للبحث والتطوير مع استثمار كبير في البحث العلمي. قدمت الجامعات والمؤسسات البحثية الرائدة في البلاد مساهمات كبيرة في مجال المعلوماتية الحيوية، بما في ذلك تطبيق تقنيات الذكاء الاصطناعي.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل بورتر للقوى الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية

يقدم المشهد التنافسي لسوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والمالية، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق الذكاء الاصطناعي في المعلوماتية الحيوية في أمريكا الشمالية هم JADBio & Gnosis Data Analysis و SOPHiA GENETICS و Biomax Informatics AG و DNASTAR و Ardigen و QIAGEN و Source BioScience. و NeoGenomics Laboratories و Eurofins Scientific و Illumina، Inc. و Thermo Fisher Scientific Inc. و CelbridgeScience. و Dassault Systemes Fios Genomics و Insilico Medicine و Strand Life Sciences و Paige AI، Inc. و SomaLogic Operating Co.، Inc. و iNDX. Ai. و Elucidata وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AI IN BIOINFORMATICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERING LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET SECTOR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AI IN BIOINFORMATICS MARKET :MARKET OVERVIEW

5.1 DRIVERS

5.1.1 REDUCTION IN THE GENETIC SEQUENCING COST

5.1.2 GROWING DEMAND FOR BIOINFORMATICS

5.1.3 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTRUMENTATION

5.2.2 CYBERSECURITY CONCERNS IN BIOINFORMATICS

5.3 OPPORTUNITIES

5.3.1 RISE IN HEALTHCARE EXPENDITURE

5.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

5.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM AI-BASED BIOINFORMATICS TECHNOLOGY

5.4.2 CHALLENGES OF IMPLEMENTING BIOINFORMATIC TECHNOLOGY IN THE CLINICAL LAB

6 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.3 SOFTWARE

6.4 OTHERS

7 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 MACHINE LEARNING

7.3 DEEP LEARNING

7.4 OTHERS

8 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES

8.1 OVERVIEW

8.2 BIOINFORMATICS SERVICES

8.2.1 DATA ANALYSIS

8.2.2 SEQUENCING SERVICES

8.2.3 DATABASE MANAGEMENT

8.2.4 OTHERS

8.3 BIOINFORMATICS PLATFORMS

8.3.1 SEQUENCE ANALYSIS PLATFORMS

8.3.2 SEQUENCE ALIGNMENT PLATFORMS

8.3.3 STRUCTURAL ANALYSIS PLATFORMS

8.3.4 SEQUENCE MANIPULATION PLATFORMS

8.3.5 OTHERS

8.4 KNOWLEDGE MANAGEMENT TOOLS

8.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

8.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

9 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS

9.3 CHEMOINFORMATICS & DRUG DESIGN

9.4 PROTEOMICS

9.5 DNA SEQUENCING

9.6 SYSTEM BIOLOGY

9.7 TRANSCRIPTOMICS

9.8 TEXT MINING

9.9 MICROARRAYS

9.1 METABOLOMICS

9.11 OTHERS

10 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY SECTOR

10.1 OVERVIEW

10.2 MEDICAL BIOTECHNOLOGY

10.3 ANIMAL BIOTECHNOLOGY

10.4 PLANT BIOTECHNOLOGY

10.5 ENVIRONMENTAL BIOTECHNOLOGY

10.6 FORENSIC BIOTECHNOLOGY

10.7 OTHERS

11 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY COUNTRY

11.1 U.S.

11.2 CANADA

11.3 MEXICO

12 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ILLUMINA, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 DASSAULT SYSTEMES

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 EUROFINS SCIENTIFIC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 QIAGEN

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 ARDIGEN

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BIOMAX INFORMATICS AG

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CELBRIDGESCIENCE.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 DNASTAR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ELUCIDATA

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INDX. AI.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 INSILICO MEDICINE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 JADBIO & GNOSIS DATA ANALYSIS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 NEOGENOMICS LABORATORIES

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 PAIGE AI, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SOMALOGIC OPERATING CO., INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOPHIA GENETICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SOURCE BIOSCIENCE.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 BIOINFORMATICS COST PER SAMPLE

TABLE 2 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA AI IN BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 11 U.S. AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 12 U.S. AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 14 U.S. BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 15 U.S. BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 16 U.S. KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 17 U.S. AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 U.S. AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 19 CANADA AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 20 CANADA AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 CANADA AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 22 CANADA BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 23 CANADA BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 24 CANADA KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 25 CANADA AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 CANADA AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 27 MEXICO AI IN BIOINFORMATICS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 28 MEXICO AI IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MEXICO AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 30 MEXICO BIOINFORMATICS SERVICES IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 31 MEXICO BIOINFORMATICS PLATFORMS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 32 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN AI IN BIOINFORMATICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 33 MEXICO AI IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 MEXICO AI IN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AI IN BIOINFORMATICS MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AI IN BIOINFORMATICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA AI IN BIOINFORMATICS MARKET: OFFERING LIFELINE CURVE

FIGURE 8 NORTH AMERICA AI IN BIOINFORMATICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AI IN BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AI IN BIOINFORMATICS MARKET: MARKET SECTOR COVERAGE GRID

FIGURE 11 NORTH AMERICA AI IN BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 13 THE REDUCTION IN THE GENETIC SEQUENCING COST AND GROWING DEMAND FOR BIOINFORMATICS ARE EXPECTED TO DRIVE THE NORTH AMERICA AI IN BIOINFORMATICS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AI IN BIOINFORMATICS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AI IN BIOINFORMATICS MARKET

FIGURE 16 COST OF GENETIC SEQUENCING IN USD (YEAR WISE)

FIGURE 17 POSSIBLE IMPACT OF CYBER ATTACKS ON BIOINFORMATICS

FIGURE 18 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, 2021

FIGURE 19 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 23 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 27 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 31 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 35 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 38 NORTH AMERICA AI IN BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA AI IN BIOINFORMATICS MARKET: BY OFFERING (2022-2029)

FIGURE 43 NORTH AMERICA AI IN BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.