سوق الطماطم في الشرق الأوسط وأفريقيا، حسب النوع (طماطم الكرز، طماطم العنب، طماطم روما، طماطم لحم البقر، طماطم موروثة، طماطم على الكرمة، طماطم خضراء، وغيرها)، نوع المنتج (طازج ومجمد ومجفف)، الفئة (تقليدي وعضوي)، المستخدم النهائي (صناعة خدمات الأغذية وصناعة الأسر / التجزئة)، قناة التوزيع (مباشرة وغير مباشرة) اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل وحجم سوق الطماطم في الشرق الأوسط وأفريقيا

إن سوق الطماطم في الشرق الأوسط وأفريقيا مدفوع بالعديد من الفوائد التي تقدمها للشركات والموظفين. كما أن سوق الطماطم مدفوع أيضًا بزيادة الطلب على الطماطم في صناعة تجهيز الأغذية. يحتاج سوق B2B إلى الطماطم حيث يتم استخدامها كمادة خام لصنع منتجات الطماطم المصنعة الأخرى. تُستخدم الطماطم بأشكال مختلفة، بما في ذلك العصير والمعجون والهريس والطماطم المقطعة/المقشرة والكاتشب والمخللات والصلصات والكاري الجاهز للأكل، والتي تعمل في النهاية كمحرك لنمو السوق. مع العدد المتزايد من مجموعات العمل وطلب جيل الألفية على الطماطم وأشكالها المختلفة زاد بشكل كبير. إن التقدم التكنولوجي المتزايد في إنتاج الطماطم يمثل فرصة لدخول هذه السوق المتوسعة. ومع ذلك، فإن التقلب في أسعار الطماطم هو أحد العوامل الرئيسية المقيدة التي تحد من نمو السوق.

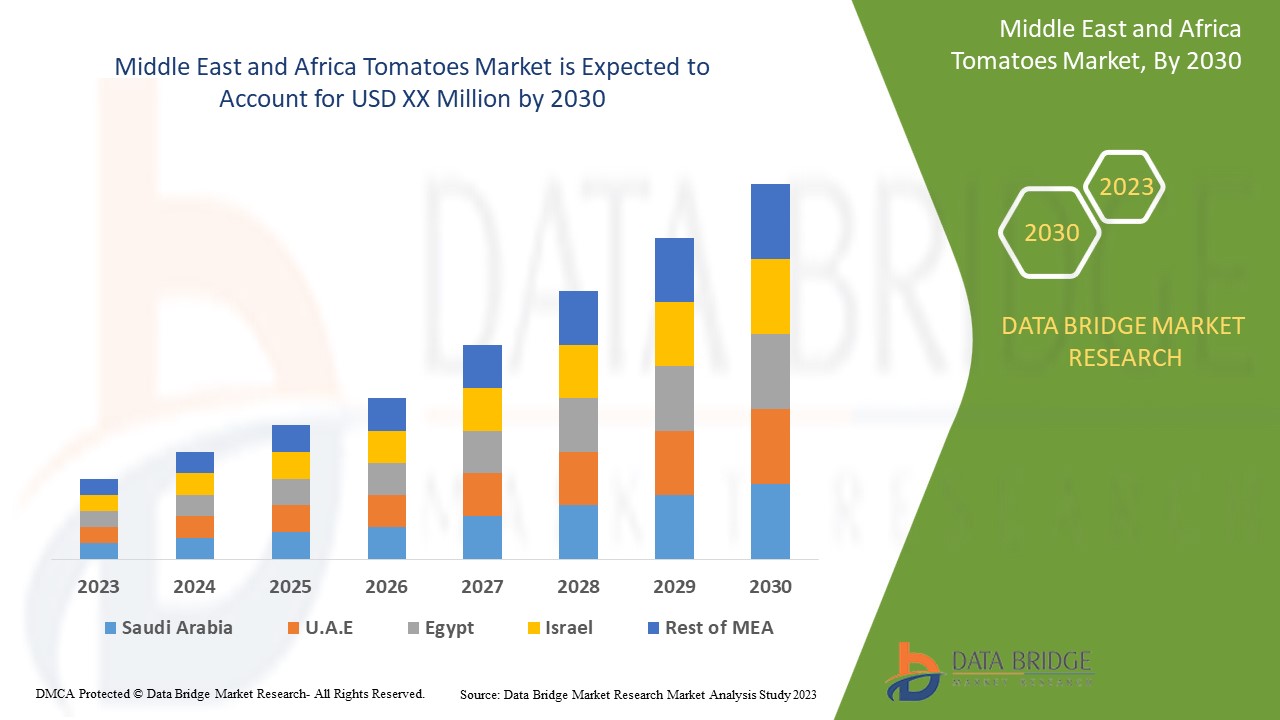

تشير تحليلات Data Bridge Market Research إلى أن سوق الطماطم في الشرق الأوسط وأفريقيا من المتوقع أن تصل قيمته إلى 22،263.48 مليون دولار أمريكي بحلول عام 2030، بمعدل نمو سنوي مركب قدره 2.8٪ خلال الفترة المتوقعة.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنة تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2016) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (طماطم الكرز، طماطم العنب، طماطم روما، طماطم لحم البقر، طماطم موروثة، طماطم على الكرمة، طماطم خضراء، وغيرها)، نوع المنتج (طازج، مجمد، ومجفف)، الفئة (تقليدي وعضوي)، المستخدم النهائي (صناعة خدمات الأغذية وصناعة السلع المنزلية/التجزئة)، قناة التوزيع (مباشرة وغير مباشرة) |

|

الدول المغطاة |

مصر وجنوب أفريقيا وإسرائيل والمملكة العربية السعودية والإمارات العربية المتحدة وبقية دول الشرق الأوسط وأفريقيا. |

|

الجهات الفاعلة في السوق المشمولة |

شركة ماستروناردي لإنتاج المحدودة، من بين شركات أخرى. |

تعريف السوق

الطماطم هي في الأساس خضروات مستديرة الشكل يمكن تناولها مطبوخة أو غير مطبوخة. وهي عبارة عن ثمار صالحة للأكل من عشبة Solanum lycoperscium. وهي تأتي بألوان عديدة مثل الأحمر والأصفر والبرتقالي وغيرها الكثير. وهي من أنواع عديدة ذات مذاق واستخدامات مختلفة.

تستخدم الطماطم على نطاق واسع في صناعة الأغذية والمشروبات، حيث تستخدم في إنتاج الحساء والصلصات والمهروسات والعصائر والكاتشب وغيرها. كما تستخدم أيضًا كخضروات نيئة في البرجر والسندويشات والسلطات والبيتزا وغير ذلك الكثير.

تعد الطماطم مصدرًا أساسيًا في صناعات تجهيز الأغذية ولها تطبيقات واسعة كما تحتوي أيضًا على مكونات أساسية مفيدة لجسم الإنسان. فهي تساعد في الحفاظ على ضغط الدم وصحة الجلد ولها أيضًا تأثير مضاد للالتهابات.

ديناميكيات سوق الطماطم في الشرق الأوسط وأفريقيا

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

سائق

- نمو متزايد للطماطم في صناعة تجهيز الأغذية

تحتاج سوق B2B إلى الطماطم لأنها تُستخدم كمادة خام لصنع منتجات الطماطم المصنعة الأخرى. تُستخدم الطماطم بأشكال مختلفة، بما في ذلك العصير والمعجون والهريس والطماطم المقطعة/المقشرة والكاتشب والمخللات والصلصات والكاري الجاهز للأكل. هناك العديد من الاستخدامات لمنتجات الطماطم المصنعة في قطاع الأغذية مثل الوجبات الخفيفة والمأكولات والفنادق والمطاعم وسلاسل بيع الوجبات السريعة. يمكن تناولها مطبوخة وغير مطبوخة ولها طلب مرتفع في سوق الشرق الأوسط وأفريقيا. بسبب التحضر السريع، ينجذب المستهلكون في البلدان الناشئة والمتقدمة إلى تناول الأطعمة الجاهزة ومنتجات الطماطم المصنعة. لتلبية الطلب المتزايد، يركز مصنعو الأطعمة المصنعة ومعالجو معجون الطماطم على المنتجات الجاهزة للأكل.

بالإضافة إلى ذلك، يتوسع نطاق الأطعمة المصنعة بالطماطم مع طرح منتجات الطماطم المتنوعة، بما في ذلك المنتجات القائمة على المسحوق. معجون الطماطم وهريس الطماطم هما المنتجان الرئيسيان للطماطم المصنعة. ويمكن تصنيع المنتجات المصنعة الثانوية للطماطم من خلال معالجة المنتجات الأولية. والسوق الرئيسية لمعجون الطماطم وهريسها هي قطاع الكاتشب والصلصة. وتعد صناعة المشروبات والأغذية ثاني أكبر مستخدم لمعجون الطماطم وهريسها.

مع العدد المتزايد من مجموعات العمل والسكان من جيل الألفية، زاد الطلب على الطماطم وأشكالها المختلفة بشكل كبير في قطاع الوجبات السريعة، مما أدى إلى صناعة المقاهي وقاعات الطعام الجامعية والفنادق والنزل والمطاعم وتجهيز الأغذية، مما يساهم في نهاية المطاف في نمو السوق.

ضبط النفس

- تقلبات أسعار الطماطم

إن الأسواق المتقلبة وغير المتوقعة لها عواقب بعيدة المدى على الشركات الصناعية. فالحواجز غير المتوقعة مثل ارتفاع تكاليف الطاقة والاختلافات غير المتوقعة في أسعار المواد الخام تعمل على تعطيل سلاسل التوريد وتجعل من الصعب على الشركات الحفاظ على الربحية. كما أن الاختلافات في أسعار المواد الخام اللازمة لصنع الصلصات والتوابل وتعبئة الزجاجات الساخنة تزيد من تكاليف سعر المنتج النهائي. ويمكن أن يؤدي الحصاد الوفير أو كارثة المحاصيل في منطقة إنتاج رئيسية إلى تغيير أسعار الطماطم بسرعة.

يجد المزارعون والموردون والشركات التي تتعامل في سوق الطماطم صعوبة في الحكم بشكل صحيح على مخاطر التقلبات الكبيرة في تكاليف الطماطم. يمكن أن تؤدي التكاليف المتقلبة للغاية وإدارة الأسعار غير الفعّالة إلى تعريض نجاح الشركات للخطر بشكل خطير. يستخدم المزارعون العديد من مرافق الدفيئات لزراعة الطماطم لتقليل تأثير الطقس على زراعة الطماطم وزيادة الغلة لكل فدان. تتطلب الطماطم المزروعة في الدفيئات بذورًا مختلفة عن تلك المزروعة في بيئتها الطبيعية. ونتيجة لذلك، تكون تكلفة البذور المستخدمة لزراعة الطماطم في الدفيئات أعلى من تلك المستخدمة لزراعة الطماطم في الظروف الطبيعية.

علاوة على ذلك، فإن زيادة التجارة في الشرق الأوسط وأفريقيا، والتحضر، واحتياجات النقل، والطلب على الطاقة، تفرض ضغوطًا إضافية على تكلفة الوسطاء المطلوبين للسوق. وبالتالي، فإن التغيرات في تكاليف الطماطم تؤثر على الطلب على المنتج، ومن المتوقع أن تعيق نمو السوق.

فرصة

- مجموعة واسعة من التطبيقات في قطاع الأغذية والمشروبات

في صناعة الأغذية والمشروبات، تُستخدم الطماطم في مجموعة متنوعة من الأشكال وكمكون طازج مثل المجمدة والمجففة والمهروسة والصلصات والمسحوقة وغيرها. إن مرونة هذه التطبيقات العديدة القائمة على الطماطم تتزايد يوميًا، مما يفتح في النهاية فرصًا لصناعات معالجة الأغذية لإنتاج مجموعة متنوعة من المنتجات القائمة على الطماطم. نظرًا لاعتياد العملاء على نكهة وطعم الطماطم، فقد زادت شعبية الطماطم بشكل كبير. بالإضافة إلى ذلك، يتم استخدام معجون الطماطم والمهروس والصلصات والمساحيق والمكونات الأخرى بشكل متكرر في الأطعمة المصنعة والوجبات الخفيفة. يساعد تطوير تقنيات إنتاج الأغذية الأكثر تخصصًا في اكتشاف تطبيقات جديدة للطماطم في صناعة الأغذية. ومن المتوقع أن تستمر هذه العوامل في خلق فرص عمل مربحة لكل من اللاعبين في السوق الراسخين ورجال الأعمال الجدد.

هناك طلب متزايد على المنتجات التي تحتوي على الطماطم بسبب قدرتها الواسعة على التكيف مع صناعة الأغذية، مما سيوفر فرصًا جديدة ويساعد في نمو السوق.

تحدي

- ارتفاع خسائر ما بعد الحصاد بسبب نقص مرافق التخزين

وعلى الرغم من العوامل المحركة والفرص المتاحة في السوق للطلب على الطماطم على مستوى العالم، إلا أن هناك تحديًا معينًا يواجهه المزارع والمورد من شأنه أن يؤثر على إمدادات الطماطم. ويتمثل التحدي في الخسائر بعد الحصاد بسبب طبيعة الطماطم القابلة للتلف ونقص مرافق التخزين بعد الحصاد وأثناء النقل. وتنجم الخسائر بعد الحصاد في المقام الأول عن التعفن والتلف الميكانيكي وسوء المناولة ودرجة الحرارة غير المناسبة وإدارة الرطوبة النسبية وقضايا النظافة أثناء المناولة. وتتسبب هذه الخسائر في انخفاض جودة المنتج، مما يؤدي في النهاية إلى خفض سعره والتأثير سلبًا على توسع السوق.

ومع ذلك، فإن الخسائر التي تحدث بعد الحصاد وغيرها من القضايا تمثل تحديًا خطيرًا لتوسيع السوق. ففي معظم الدول، تتفكك تجارة الطماطم بشكل مطرد بسبب مشاكل ما بعد الحصاد، سواء داخل المزرعة أو خارجها. ولا تستطيع معظم الدول الناشئة إنتاج ما يكفي من الطماطم بمفردها، كما يتضح من استيراد منتجات الطماطم المكتملة. وحتى في حين يوجد دائمًا فائض في السوق، فإن هذا مؤقت فقط لأن الطماطم غير المعالجة يصعب حفظها وقابلة للتلف بسرعة. وبسبب عدم الكفاءة في معالجة الطماطم بعد الحصاد، هناك فجوة في الطلب يتم سدها من خلال السلع المصنعة المستوردة. وتؤدي خسائر ما بعد الحصاد هذه إلى خفض القيمة السوقية للمنتج وتعمل كحاجز أمام توسيع السوق.

تشمل خسائر ما بعد الحصاد الأغذية المفقودة على طول سلسلة توريد الغذاء بأكملها، منذ حصاد المحصول حتى استهلاكه. وتنقسم الخسائر إلى عدة فئات: فقدان الوزن بسبب التعفن، وفقدان الجودة، والخسارة الغذائية، وفقدان صلاحية البذور، والخسارة التجارية. ويتسبب نقص مرافق التخزين في الغالب في حدوث هذه الخسائر بعد الحصاد داخل المزارع وخارجها، وهو ما سيشكل تحديًا رئيسيًا لتوسيع السوق.

تأثير ما بعد كوفيد-19 على سوق الطماطم في الشرق الأوسط وأفريقيا

بعد الوباء، زاد الطلب على الطماطم حيث لم تعد هناك قيود على الحركة مما أدى إلى سهولة توريد المنتجات. بالإضافة إلى ذلك، من المتوقع أن يؤدي الاتجاه المتزايد لمنتجات الأغذية المصنعة والطلب المتزايد على زراعة الطماطم بعد تفشي فيروس كورونا إلى دفع نمو السوق.

بعد الوباء، كان هناك طلب متزايد على الليكوبين المضاد للأكسدة والذي يوجد في الفواكه والخضروات. تعد الطماطم مصدرًا رائعًا للليكوبين بمنتجاتها المصنعة مثل المعجون واللب، مما ساعد على نمو السوق.

على سبيل المثال،

- في ديسمبر 2021، أعلنت شركة MASTRONARDI PRODUCE LTD. عن اتفاقية مع شركة AgriCapital Holdings Corp. سيكون هذا الاتفاق مفيدًا للشركة لتطوير الحديقة الزراعية في بنما.

التطورات الأخيرة

- في أكتوبر 2022، قدمت شركة MASTRONARDI PRODUCE LTD. عبوات جديدة للطماطم. عبوة التغليف بحجم نصف لتر قابلة لإعادة الاستخدام وإعادة التدوير. هذه العبوة مخصصة لطماطم العنب الخاصة بالشركة. هذه العبوة الجديدة ستفيد الشركة لأنها قابلة لإعادة الاستخدام ولن تسبب أي مخاوف بيئية في المستقبل. ستساعد ميزات التسمية المزدوجة فيها على عرض البضائع بشكل أفضل للعميل.

نطاق سوق الطماطم في الشرق الأوسط وأفريقيا

يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى خمسة قطاعات بارزة بناءً على النوع ونوع المنتج والفئة والمستخدم النهائي وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- طماطم الكرز

- طماطم العنب

- طماطم روما

- الطماطم على الكرمة

- طماطم لحم البقر

- طماطم موروثة

- الطماطم الخضراء

- آحرون

اعتمادًا على النوع، يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى طماطم الكرز، وطماطم العنب، وطماطم روما، وطماطم لحم البقر، والطماطم التراثية، والطماطم الخضراء، وغيرها.

نوع المنتج

- طازج

- مجمدة

- مجففة

اعتمادًا على نوع المنتج، يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى طماطم طازجة ومجمدة ومجففة.

فئة

- عادي

- عضوي

بحسب الفئة، يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى تقليدية وعضوية.

المستخدم النهائي

- صناعة خدمات الأغذية

- صناعة الأدوات المنزلية/التجزئة

اعتمادًا على المستخدم النهائي، يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى صناعة الخدمات الغذائية وصناعة المنازل/التجزئة.

قناة التوزيع

- مباشر

- غير مباشر

بناءً على قناة التوزيع، يتم تقسيم سوق الطماطم في الشرق الأوسط وأفريقيا إلى مباشرة وغير مباشرة.

تحليل/رؤى إقليمية لسوق الطماطم في الشرق الأوسط وأفريقيا

يتم تحليل سوق الطماطم في الشرق الأوسط وأفريقيا وتوفير رؤى حجم السوق والاتجاهات حسب البلد من حيث النوع ونوع المنتج والفئة والمستخدم النهائي وقناة التوزيع كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق الطماطم في الشرق الأوسط وأفريقيا هي مصر وجنوب أفريقيا وإسرائيل والمملكة العربية السعودية والإمارات العربية المتحدة وبقية دول الشرق الأوسط وأفريقيا.

تهيمن مصر على سوق الطماطم في الشرق الأوسط وأفريقيا. ويُعد الطلب المتزايد من صناعة تجهيز الأغذية على المنتجات المصنعة من الطماطم في جميع أنحاء العالم السبب الرئيسي وراء نمو هذه السوق. ومع ذلك، من المرجح أن تحد التكلفة المرتفعة للمواد الخام الممتازة من نمو السوق.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الطماطم في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق الطماطم في الشرق الأوسط وأفريقيا تفاصيل حسب المنافس. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات الجديدة في السوق، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف لدى الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على السوق.

ومن بين اللاعبين الرئيسيين العاملين في سوق الطماطم في منطقة الشرق الأوسط وأفريقيا شركة ماستروناردي لإنتاج المحدودة وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA Tomatoes Market

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTER OF TOMATOES MARKET

4.2 TOP IMPORTER OF TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 LAUNCHING OF DISEASE RESISTANT VARIETIES

4.3.2 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.3 AUNCHING ORGANIC PRODUCTS

4.3.4 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 MIDDLE EAST & AFRICA TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 MIDDLE EAST & AFRICA TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 MIDDLE EAST & AFRICA TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 MIDDLE EAST & AFRICA TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TPYE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 MIDDLE EAST & AFRICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 MIDDLE EAST & AFRICA TOMATOES MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 EGYPT

13.1.2 SOUTH AFRICA

13.1.3 ISRAEL

13.1.4 SAUDI ARABIA

13.1.5 UNITED ARAB EMIRATES

13.1.6 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 APPHARVEST

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MASTRONARDI PRODUCE LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HOUWELINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MUCCI INT’L MRKTG INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 REDSTAR SALES BV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AYLMER FAMILY FARM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DUIJVESTIJN TOMATEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EXETER PRODUCE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HNATIUK GARDENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MAGIC SUN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NATURE FRESH FARMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ONTARIO PROCESSING VEGETABLE GROWERS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PACIFIC RIM PRODUCE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 R&L HOLT LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROYALPRIDE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAHYADRI FARMS POST HARVEST CARE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STREEF PRODUCE LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOMATO GROWERS SUPPLY COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 WEST COAST TOMATO, LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 TOP EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 MIDDLE EAST & AFRICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CHERRY TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA GRAPE TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ROMA TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA TOMATOES ON THE VINE IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA BEEFSTEAK TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA HEIRLOOM TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA GREEN TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 COMPANIES PROVIDING FRESH TOMATOES

TABLE 15 MIDDLE EAST & AFRICA FRESH IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA FROZEN IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DRIED IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CONVENTIONAL IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA ORGANIC IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA DIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 EGYPT TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 EGYPT TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 EGYPT TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 EGYPT TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 EGYPT FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 EGYPT TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 SOUTH AFRICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 SOUTH AFRICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 SOUTH AFRICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 SOUTH AFRICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 SOUTH AFRICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SOUTH AFRICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 ISRAEL TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 ISRAEL TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 ISRAEL TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 ISRAEL TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 ISRAEL FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 ISRAEL TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 59 UNITED ARAB EMIRATES TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 60 UNITED ARAB EMIRATES TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 UNITED ARAB EMIRATES TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 62 UNITED ARAB EMIRATES TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 63 UNITED ARAB EMIRATES FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 UNITED ARAB EMIRATES TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 65 REST OF MIDDLE EAST & AFRICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA TOMATOES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TOMATOES MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TOMATOES MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TOMATOES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TOMATOES MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND OF TOMATO ON FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TOMATOES MARKET

FIGURE 14 THE AVERAGE CHANGE IN THE RETAIL PRICE OF TOMATO PER KG COMPARED TO THE LONG-TERM PRICE TREND

FIGURE 15 MIDDLE EAST & AFRICA TOMATOES MARKET, BY TYPE, 2022

FIGURE 16 MIDDLE EAST & AFRICA TOMATOES MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 MIDDLE EAST & AFRICA TOMATOES MARKET, BY CATEGORY, 2022

FIGURE 18 MIDDLE EAST & AFRICA TOMATOES MARKET, BY END USER, 2022

FIGURE 19 MIDDLE EAST & AFRICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 MIDDLE EAST AND AFRICA TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST AND AFRICA TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST AND AFRICA TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 MIDDLE EAST & AFRICA TOMATOES MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.