سوق التغليف المعبأ في الشرق الأوسط وأفريقيا ، حسب نوع المنتج (الأكياس والصواني والكرتون وغيرها)، المادة (PET، البولي بروبيلين، رقائق الألومنيوم، البولي أميد (PA)، الورق والكرتون المقوى، EVOH وغيرها)، قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت)، الاستخدام النهائي (الأغذية والمشروبات والأدوية وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والحجم

لقد أدت الصناعة والتحضر إلى تغيير تقنيات المعالجة وطرق شحن الوسائط أو السوائل، مما أدى إلى الحاجة إلى التغليف المعبأ في كل صناعة تقريبًا حيث تلعب السوائل دورًا رئيسيًا. لذلك، كان سوق التغليف المعبأ مدفوعًا بالحاجة إلى إنتاج أكثر أمانًا وبنية أساسية مناسبة.

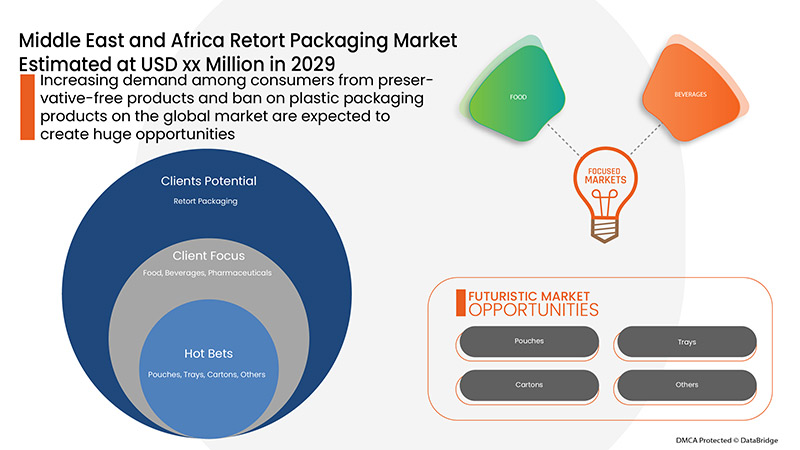

ومن بين العوامل التي تدفع السوق الطلب المتزايد بين المستهلكين على المنتجات الخالية من المواد الحافظة، والطلب المتزايد على حلول التغليف المستدامة والجمالية، والطلب المتزايد على التغليف الذكي لتجنب هدر الطعام. ومع ذلك، فإن التكلفة العالية المرتبطة بأنشطة البحث والتطوير هي العائق الذي يعيق نمو السوق.

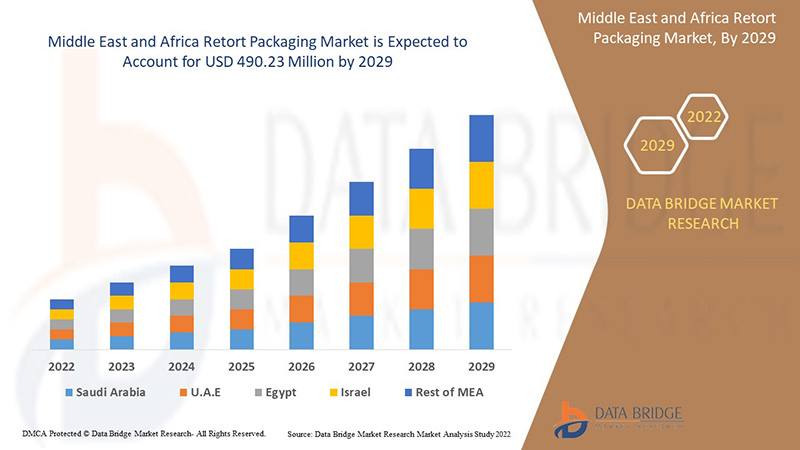

تحلل شركة Data Bridge Market Research أن سوق التغليف من المتوقع أن تصل قيمته إلى 490.23 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب بنسبة 4.6٪ خلال الفترة المتوقعة. تشكل "الأكياس" أكبر شريحة من أنواع المنتجات في سوق التغليف بسبب الأنماط الغذائية المتغيرة والتأثيرات الغربية المتزايدة التي أدت إلى تصعيد الطلب على المنتجات الغذائية المعبأة والمقدمة مرة واحدة. يغطي تقرير سوق التغليف أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع المنتج (الأكياس والصواني والكرتون وغيرها)، حسب المادة (PET، البولي بروبيلين، رقائق الألومنيوم، البولي أميد (PA)، الورق والكرتون المقوى، EVOH وغيرها)، حسب قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت)، حسب الاستخدام النهائي (الأغذية والمشروبات والأدوية وغيرها) |

|

الدول المغطاة |

جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل ومصر وبقية دول الشرق الأوسط وأفريقيا كجزء من الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

ProAmpac، Coveris، FLAIR Flexible Packaging Corporation، IMPAK CORPORATION، PORTCO PACKAGING، Constantia Flexibles، Mondi، Tetra Pak، وغيرها. |

تعريف السوق

التغليف بالتنقيط هو نوع من أنواع تغليف الأطعمة مصنوع من صفائح بلاستيكية مرنة ورقائق معدنية. وهو يسمح بالتغليف المعقم لمجموعة كبيرة ومتنوعة من الأطعمة والمشروبات التي يتم التعامل معها عن طريق المعالجة المعقمة، ويُستخدم كبديل لطرق التعليب الصناعية التقليدية. تتراوح الأطعمة المعبأة من الماء إلى الوجبات المطبوخة بالكامل والمستقرة حرارياً (المعالجة بالحرارة) والعالية السعرات الحرارية (1300 كيلو كالوري في المتوسط) مثل الوجبات الجاهزة للأكل (MREs)، والتي يمكن تناولها باردة أو دافئة عن طريق غمرها في الماء الساخن أو تسخينها باستخدام سخان حصص بدون لهب، وهو مكون للوجبة قدمه الجيش لأول مرة في عام 1992. تستخدم حصص الميدان، وطعام الفضاء، ومنتجات الأسماك، ووجبات التخييم، والمعكرونة السريعة، والشركات مثل Capri Sun وTasty Bite جميعها التغليف بالتنقيط.

في البداية، تم تطوير عبوات التعقيم للاستخدامات الصناعية وأعضاء الأنابيب. تدريجيًا، تم تكييف التصميم في صناعة الأدوية الحيوية لطرق التعقيم باستخدام مواد متوافقة. والآن يتم استخدامه في كل صناعة تقريبًا للإنتاج الآمن والبنية الأساسية الكافية، مثل الأغذية والمشروبات، والمعالجة الكيميائية وغيرها من القطاعات الرأسية.

ديناميكيات سوق التغليف

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

- تزايد الطلب بين المستهلكين على المنتجات الخالية من المواد الحافظة

تتم عملية التعبئة والتغليف عندما يتم غلق المنتجات غير المعقمة بإحكام، وهو ما يعني حرفيًا التغليف غير المعقم. يتم تحميل العبوة في وعاء ضغط معبأ وتعريضها للبخار المضغوط. كما يتعرض المنتج لدرجات حرارة عالية لفترة أطول بكثير من التعبئة الساخنة. يمكن أن يؤدي الوقت الإضافي إلى تدهور كبير في الجودة العامة والمحتوى الغذائي للمنتج.

إن الطلب المتزايد بين المستهلكين في جميع أنحاء العالم على المنتجات الخالية من المواد الحافظة هو المحرك الرئيسي لسوق التغليف في الشرق الأوسط وأفريقيا. ومع تزايد قلق المستهلكين بشأن الآثار الضارة للمواد الحافظة في مشروباتهم، فإن الطلب على المنتجات الخالية من المواد الحافظة بلغ ذروته.

- زيادة الطلب على التغليف المعبأ من قبل شركات الطيران

في الآونة الأخيرة، هناك تحول متزايد من جانب المستهلكين نحو خيارات التغليف المستدامة والصديقة للبيئة والتي أدت إلى إدخال المزيد من التغليف القابل لإعادة التدوير بالكامل والأكياس القابلة للوقوف بتصميمات مختلفة. بالإضافة إلى توفير المزايا البيئية، يمكن للتغليف المستدام أيضًا أن يساعد الشركات على زيادة الأرباح والتخلص من قطع الغيار غير الضرورية للتصنيع، وبالتالي تحسين سلامة خطوط الإنتاج، وتقليل تكاليف التخلص منها. الهدف الرئيسي للتغليف ليس فقط حماية المنتج من التلف أثناء النقل، ولكن أيضًا حماية المستودعات ومتاجر التجزئة قبل بيع المنتج. تُستخدم أنواع مختلفة من التغليف لأنواع مختلفة من المنتجات. كما تُستخدم عبوات التغليف المعبأة للمنتجات الغذائية الثقيلة والضخمة وتستخدم أيضًا لمنتجات أخرى.

- تزايد الطلب على التغليف الذكي لتجنب هدر الغذاء

توفر التغليفات الذكية حلولاً متنوعة للحد من هدر الطعام، حيث توفر مؤشرات مختلفة لتجنب تلف الطعام. وبالتالي، فإن هدر الطعام المتزايد يجذب المستهلكين لشراء الطعام باستخدام التغليفات الذكية.

تتضمن التغليف الذكي مؤشرات (مؤشرات الوقت والحرارة؛ ومؤشرات السلامة أو الغاز؛ ومؤشرات النضارة)؛ والرموز الشريطية وعلامات التعريف بالترددات الراديوية (RFID)؛ وأجهزة الاستشعار (أجهزة الاستشعار الحيوية؛ وأجهزة استشعار الغاز؛ وأجهزة استشعار الأكسجين القائمة على الفلورسنت)، من بين أمور أخرى. وبالتالي، يساعد التغليف الذكي مصنعي الأغذية على تتبع حالة منتجاتهم الغذائية في الوقت الفعلي، وبالتالي المساهمة في الحد من هدر الأغذية.

علاوة على ذلك، يمكن أن تعمل التغليف الذكي أيضًا كأداة أساسية للمستهلكين لاختيار منتجاتهم على مستوى البيع بالتجزئة، حيث يمكن لمفاهيم التغليف الذكي تمكين المستهلكين من الحكم على جودة المنتجات. ونتيجة لذلك، من المتوقع أن يلعب التغليف الذكي دورًا رئيسيًا في جذب المستهلكين.

- التكلفة العالية المرتبطة بأنشطة البحث والتطوير

ترتبط نفقات البحث والتطوير بشكل مباشر بالبحث والتطوير للسلع أو الخدمات التي تقدمها الشركة وأي ملكية فكرية يتم إنشاؤها في هذه العملية. تتكبد الشركة عمومًا نفقات البحث والتطوير في عملية العثور على منتجات أو خدمات جديدة وإنشائها.

تعتمد شركات التغليف بشكل كبير على قدراتها في البحث والتطوير؛ لذا يمكنها أن تتفوق نسبيًا على نفقات البحث والتطوير. على سبيل المثال، تغيير تفضيلات المستهلكين من التغليف العادي إلى التغليف الذكي والنشط، وزيادة وعي المستهلكين بسلامة الغذاء، من بين أمور أخرى. وبالتالي، يتعين على الشركات الاستثمار في أنشطة البحث والتطوير لتنويع أعمالها وإيجاد فرص نمو جديدة مع استمرار تطور التكنولوجيا.

- حظر منتجات التغليف البلاستيكية في أسواق الشرق الأوسط وأفريقيا

مع تزايد المخاوف البيئية في العديد من المناطق، اتخذت الحكومة خطوات صارمة نحو حظر المنتجات البلاستيكية التي تستخدم مرة واحدة ومنتجات التغليف غير القابلة للتحلل البيولوجي في السوق. وذلك لأن المنتجات البلاستيكية تستغرق وقتًا أطول للتحلل وتشكل خطورة على الحيوانات المائية والبرية.

على سبيل المثال،

تقدر منظمة البيئة الطبيعية أن ما يقرب من 100 ألف سلحفاة بحرية وحيوانات بحرية أخرى تموت كل عام بسبب اختناقها في الأكياس أو اعتقادها خطأً أنها طعام.

في أمريكا الشمالية، تم حظر استخدام الأكياس البلاستيكية التي تستخدم لمرة واحدة في تغليف المنتجات الغذائية والسلع الاستهلاكية. ونتيجة لهذا، يتزايد الطلب على التغليف بالورق المقوى والبلاستيك في المنطقة.

تُستخدم عدة أنواع من مواد التغليف في تطبيقات مختلفة، مما يؤدي إلى إنتاج النفايات وهي ضارة جدًا بالبيئة. تُستخدم مواد التغليف البلاستيكية لتغليف السلع الاستهلاكية، مما ينتج عنه نفايات تغليف بلاستيكية غير قابلة للتحلل البيولوجي، وتطلق غازات سامة في التربة، مما يشكل خطورة على الحيوانات والمياه الجوفية. ومن ثم، تم اتخاذ خطوات لحظر التغليف بالأكياس البلاستيكية لأنها ضارة بالبيئة.

- انقطاع سلسلة التوريد بسبب الوباء

لقد تسبب فيروس كورونا المستجد في تعطيل سلسلة التوريد وتراجع أسواق التغليف في جميع أنحاء العالم. وقد أدت الاضطرابات إلى تأخير مخزون المنتجات فضلاً عن انخفاض الوصول والإمدادات من المنتجات الغذائية والمشروبات. ومع استمرار تفشي فيروس كورونا المستجد، كانت هناك قيود على النقل واستيراد وتصدير المواد. كما تأثر تصنيع التغليف بسبب القيود المفروضة على حركة العمال، مما أدى إلى عدم تلبية الطلب من المستهلكين. كما أدى فرض القيود على الاستيراد والتصدير إلى صعوبة قيام الشركات المصنعة بتوريد المواد الخام ومنتجاتها النهائية عبر دول العالم مما أثر أيضًا على أسعار التغليف. وبالتالي، مع القيود المستمرة بسبب فيروس كورونا المستجد، تعطلت سلسلة التوريد للتغليف مما يخلق تحديًا كبيرًا للشركات المصنعة.

مع استمرار انتشار فيروس كورونا المستجد (كوفيد-19) والقيود المفروضة على الحركة، هناك اضطراب في سلسلة التوريد مما يشكل تحديًا كبيرًا لسوق التغليف في الشرق الأوسط وأفريقيا.

تأثير ما بعد كوفيد-19 على سوق التغليف المعبأ

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على سوق التغليف حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تتعامل مع إنتاج السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة مثل إغلاق إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. العمل الوحيد الذي يتعامل في هذا الوضع الوبائي هو الخدمات الأساسية المسموح لها بالفتح وتشغيل العمليات.

بسبب تفشي الوباء الناجم عن الفيروس، تم إغلاق العديد من القطاعات الصغيرة ومن ناحية أخرى قررت بعض القطاعات الاستغناء عن بعض الموظفين مما أدى إلى بطالة كبيرة. تُستخدم عبوات التغليف أيضًا في تغليف المنتجات وكذلك في الصناعات. وبسبب تفشي الوباء، ارتفع الطلب على مثل هذه المنتجات إلى حد ما خاصة في القطاع الطبي والرعاية الصحية والأدوية والبقالة والتجارة الإلكترونية ومختلف القطاعات الأخرى. لكن الطلب غير المتوقع، إلى جانب القدرات الإنتاجية المحدودة وانقطاعات سلسلة التوريد، لا يزال يسبب صعوبات في جميع هذه الصناعات.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا المستخدمة في التغليف. وبهذا، ستجلب الشركات أجهزة تحكم متقدمة ودقيقة إلى السوق. بالإضافة إلى ذلك، أدى استخدام السلطات الحكومية للتغليف في الأغذية والمشروبات إلى نمو السوق.

التطورات الأخيرة

- في فبراير 2021، أعلنت شركة SEE عن الاستحواذ على شركة Foxpak Flexibles Ltd. (Foxpak) تحت مظلة SEE Ventures، وهي مبادرتها للاستثمار في التقنيات المبتكرة ونماذج الأعمال لتسريع النمو. استفادت شركة Foxpak من قدرات الطباعة الرقمية للطباعة مباشرة على مواد التغليف المرنة الخاصة بها لتمكين العلامات التجارية لعملائها. يمكن توسيع نطاق حلولها بسرعة أو تقليصها لتلبية متطلبات الإنتاج للعملاء من أي حجم. سيساعد هذا الاستحواذ في تعزيز التدفقات النقدية والأرباح. كما يعمل على توسيع محفظة التغليف الخاصة بالشركة بشكل أكبر.

- في ديسمبر 2021، استحوذت شركة Sonoco على Ball Metalpack. يكمل هذا الاستحواذ أكبر امتياز لتغليف المستهلك لدى Sonoco. Ball Metalpack، الشركة الرائدة في تصنيع التغليف المعدني المستدام للأغذية والمنتجات المنزلية وأكبر منتج للهباء الجوي في أمريكا الشمالية. سيساعد هذا الاستحواذ في تعزيز التدفقات النقدية والأرباح. كما يعمل على توسيع محفظة التغليف الخاصة بالشركة بشكل أكبر.

نطاق سوق التغليف في الشرق الأوسط وأفريقيا

يتم تقسيم سوق التغليف المعبأ على أساس نوع المنتج والمادة وقناة التوزيع والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المنتج

- صواني

- الأكياس

- كرتون

- آحرون

على أساس نوع المنتج، يتم تقسيم سوق التغليف في الشرق الأوسط وأفريقيا إلى صواني وأكياس وكرتون وغيرها.

مادة

- حيوان أليف

- البولي بروبلين

- رقائق الألومنيوم

- بولي أميد (PA)

- الورق والكرتون

- إيفوه

- آحرون

على أساس المادة، تم تقسيم سوق التغليف المعوج في الشرق الأوسط وأفريقيا إلى PET، والبولي بروبيلين، ورقائق الألومنيوم، والبولي أميد (PA)، والورق والكرتون، وEVOH وغيرها.

قناة التوزيع

- غير متصل

- متصل

على أساس قناة التوزيع، تم تقسيم سوق التغليف في الشرق الأوسط وأفريقيا إلى سوق غير متصل بالإنترنت وسوق عبر الإنترنت.

الاستخدام النهائي

- طعام

- المشروبات

- المستحضرات الصيدلانية

- آحرون

على أساس الاستخدام النهائي، تم تقسيم سوق التغليف في الشرق الأوسط وأفريقيا إلى أغذية ومشروبات وأدوية وغيرها.

تحليل/رؤى إقليمية لسوق التغليف

يتم تحليل سوق التغليف المعبأ وتوفير رؤى حجم السوق والاتجاهات حسب نوع المنتج والمادة وقناة التوزيع وصناعة الاستخدام النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق التغليف المعبأ هي جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل ومصر وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA)

تهيمن جنوب أفريقيا على سوق التغليف في منطقة آسيا والمحيط الهادئ. ومن المتوقع أن يتزايد الطلب في هذه المنطقة نتيجة لزيادة الطلب على التغليف في قطاع الأغذية والمشروبات.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق التغليف

يقدم المشهد التنافسي لسوق التغليف المعبأ تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق التغليف المعبأ.

بعض اللاعبين الرئيسيين العاملين في سوق التغليف المعوج هم ProAmpac و Coveris و Berry Middle East and Africa Inc. و FLAIR Flexible Packaging Corporation و IMPAK CORPORATION و PORTCO PACKAGING و Constantia Flexibles و Mondi و Tetra Pak و Clifton Packaging Group Limited و DNP America، LLC. و Sonoco Products Company و Amcor plc وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE MIDDLE EAST & AFRICA MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 U.A.E.

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY MIDDLE EAST & AFRICA INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MIDDLE EAST AND AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 MIDDLE EAST AND AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 SOUTH AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 SOUTH AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 SAUDI ARABIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 SAUDI ARABIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 EGYPT POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 EGYPT FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 U.A.E. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 U.A.E. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 U.A.E. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 ISRAEL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 ISRAEL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.