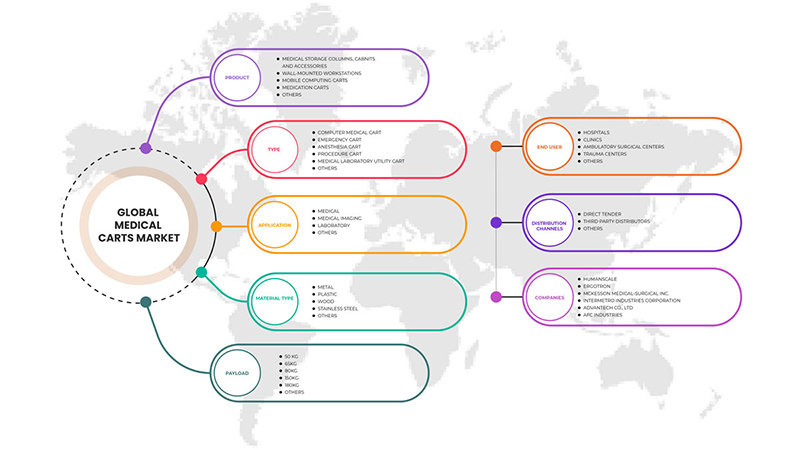

سوق عربات الطبية في الشرق الأوسط وأفريقيا، حسب المنتج (عربات الحوسبة المتنقلة، أعمدة التخزين الطبية، الخزائن والملحقات، عربات الأدوية، محطات العمل المثبتة على الحائط وغيرها)، النوع (عربة طبية حاسوبية، عربة طوارئ، عربة إجراءات، عربة تخدير، عربة مرافق مختبر طبي وغيرها)، التطبيق (الطبي، التصوير الطبي، المختبر وغيرها)، نوع المادة (البلاستيك، الخشب، الفولاذ المقاوم للصدأ، المعادن وغيرها)، الحمولة (50 كجم، 65 كجم، 80 كجم، 150 كجم، 180 كجم وغيرها)، المستخدم النهائي (المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز الصدمات وغيرها)، قناة التوزيع (العطاء المباشر، الموزعون التابعون لجهات خارجية وغيرهم) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق عربات النقل الطبية في الشرق الأوسط وأفريقيا

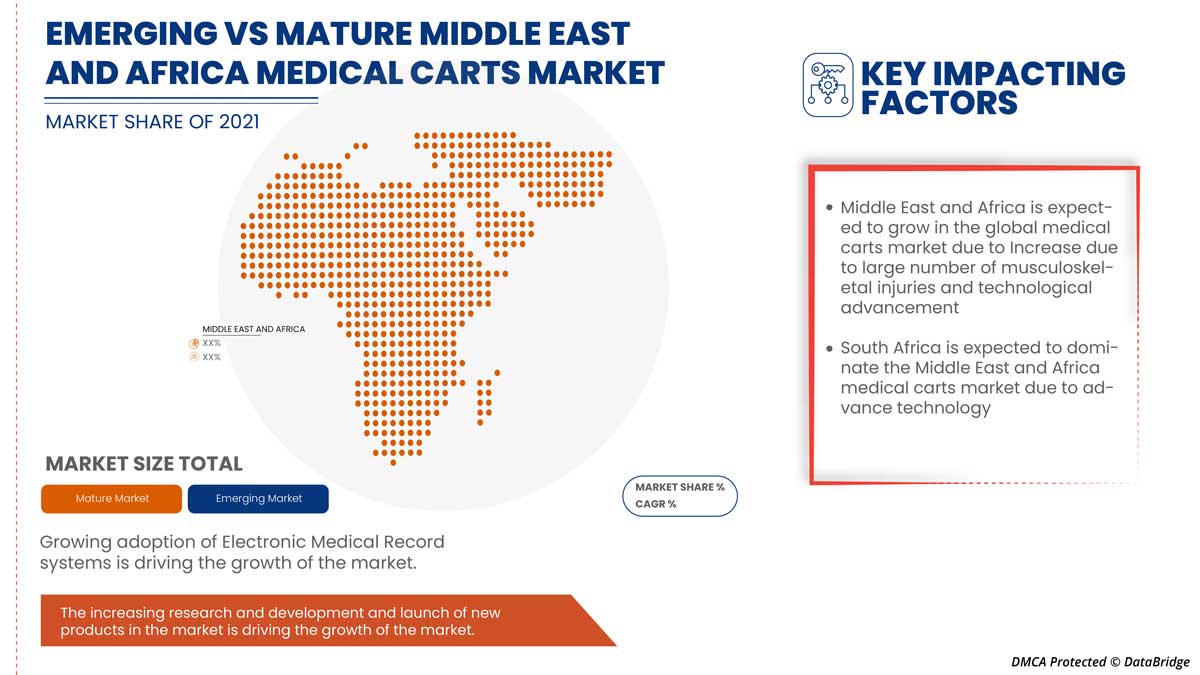

من المتوقع أن ينمو سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا بسبب تحسين مرافق الرعاية الصحية والبنية الأساسية وتبني السجلات الطبية الإلكترونية في المستشفيات، مما قد يدفع نمو السوق. ومن بين العوامل الأخرى التي من المتوقع أن تدفع نمو سوق عربات الرعاية الطبية ارتفاع حالات الإصابات والعمليات الجراحية في الجهاز العضلي الهيكلي .

وتعوق العوامل الأخرى، مثل نقص المتخصصين المهرة والتكلفة المرتفعة لعربات الرعاية الطبية المخصصة، نمو سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا. ومن ناحية أخرى، فإن زيادة الإنفاق على الرعاية الصحية وظهور دول ناشئة ذات مستشفيات متطورة تشكل فرصة لنمو سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا.

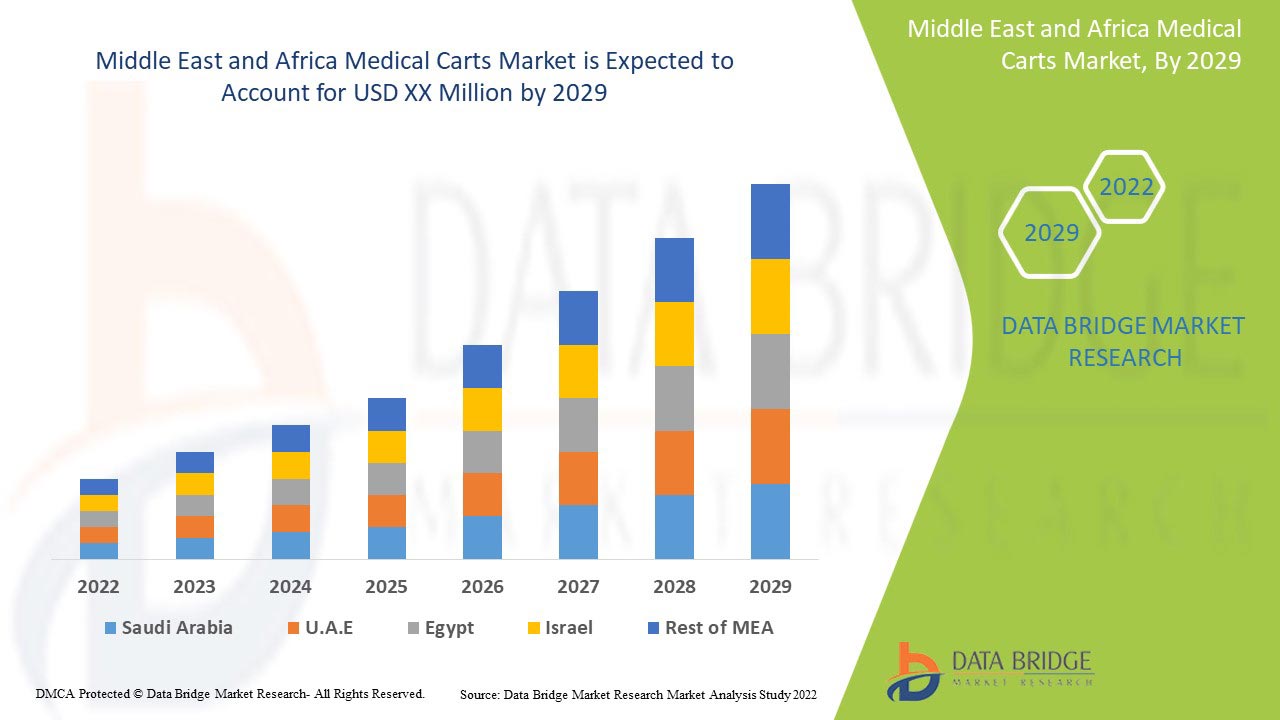

تحلل شركة Data Bridge Market Research أن سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا سينمو بمعدل نمو سنوي مركب نسبته 5.6٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب المنتج (عربات الحوسبة المتنقلة، وأعمدة التخزين الطبية، والخزائن والملحقات، وعربات الأدوية، ومحطات العمل المثبتة على الحائط وغيرها)، والنوع (عربة طبية حاسوبية، وعربة طوارئ، وعربة إجراءات، وعربة تخدير، وعربة مرافق مختبر طبي، وغيرها)، والتطبيق (الطب، والتصوير الطبي، والمختبر، وغيرها)، ونوع المادة (البلاستيك، والخشب، والفولاذ المقاوم للصدأ، والمعادن وغيرها)، والحمولة (50 كجم، و65 كجم، و80 كجم، و150 كجم، و180 كجم وغيرها)، والمستخدم النهائي (المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز الصدمات وغيرها)، وقناة التوزيع (العطاء المباشر، والموزعون من جهات خارجية وغيرها) |

|

الدول المغطاة |

جنوب أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، مصر، إسرائيل وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

شركة ITD Gmbh، وشركة Omnicell Inc.، وشركة Midmark Corporation، وشركة Herman Miller, Inc.، وشركة AMD Telemedicine، وغيرها. |

تعريف سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا

العربات الطبية هي عربات خفيفة الوزن متنقلة تستخدم في المرافق الطبية لتطبيقات مختلفة. وهي تستخدم على نطاق واسع لتخزين ونقل الأدوية ومعدات الطوارئ والإمدادات الطبية. عادة ما تكون عربات الأدوية عبارة عن وحدات مستطيلة أو مربعة ذات عجلات دوارة وحجرات محددة لحمل العديد من الإمدادات الطبية. وهي مصنوعة لتكون ملائمة للممرضات والأطباء والعاملين في مجال الرعاية الصحية لإدارة روتين الأدوية للمرضى باستمرار أثناء إقامتهم في المستشفى. يتكون إطارها في الغالب من الفولاذ المقاوم للصدأ أو سبائك الصلب. يتم وضع عربات الطوارئ في جميع أنحاء المستشفيات، مما يتيح الوصول إليها في أي وقت من أوقات الطوارئ. يتم وضع علامة على كل درج عربة بشكل صحيح لموظفي الرعاية الصحية للعثور على المعدات بسهولة في عجلة من أمرهم. تشمل بعض العربات الطبية الأخرى عربات التخدير وعربات المرافق الطبية وعربات الإجراءات والعربات المثبتة على الحائط. تتميز بعض العربات الطبية، مثل عربات أجهزة الموجات فوق الصوتية المحمولة، بتقنيات متقدمة مثل الرافعة الهوائية لضبط الارتفاع بسهولة. وهي مزودة بحاملات لمجسات الموجات فوق الصوتية ومناديل طبية وموزعات جل الموجات فوق الصوتية وموزع قفازات صحية وتأتي مع عجلة ثقيلة التحمل.

ديناميكيات سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا

السائقين

- تحسين المرافق والبنية التحتية للرعاية الصحية

تتزايد المرافق الصحية والمستشفيات والعيادات ومراكز الرعاية الخارجية ومراكز الرعاية المتخصصة ومراكز الولادة ومراكز الرعاية النفسية في الشرق الأوسط وأفريقيا بسبب ارتفاع حالات الأمراض المزمنة والأمراض المعدية ومتطلبات دخول المستشفيات والإقامة فيها. وقد أدت حالة الوباء إلى زيادة الطلب بشكل كبير على عربات الإسعاف ووحدات العناية المركزة لعلاج المرضى. وتتخذ العديد من البلدان النامية حلولاً واستراتيجيات مختلفة لتحسين المرافق الصحية في بلدانها.

- اعتماد السجلات الطبية الإلكترونية في المستشفيات

تم إخطار العديد من قطاعات الرعاية الصحية بضرورة إعداد السجلات الطبية الإلكترونية في مستشفياتها أو عياداتها لتحويل جميع السجلات الطبية إلى تنسيق رقمي، ويتم دمجها بشكل أساسي في عربات طبية لسهولة الوصول إليها. سيتم اعتبار أي مستشفى لا يتيح السجلات الطبية الإلكترونية غير قابل للقراءة وغير مكتمل.

- تطبيق عربات طبية متقدمة

تم دمج عربات الرعاية الطبية المصنعة حديثًا مع العديد من حلول تكنولوجيا المعلومات لتمكين التخزين الطبي والوصول إليه بسهولة. تأتي معظم الأجهزة مع لوحات لمس بتصميمات نحيفة لسهولة الاستخدام. إنها خفيفة الوزن مع عجلات ناعمة تتيح سهولة الحركة مع ضغط ضئيل بشكل كبير من قبل الممرضات لمنع آلام العضلات. يمكن لهذه اللوحات اللمسية تحسين جودة الرعاية والقضاء على العواقب البشرية الكارثية، والتي يمكن أن تسبب خطأ في جرعة العلاج والإمداد. يحاول العديد من المصنعين ابتكار تطورات جديدة في عرباتهم الطبية.

فرص

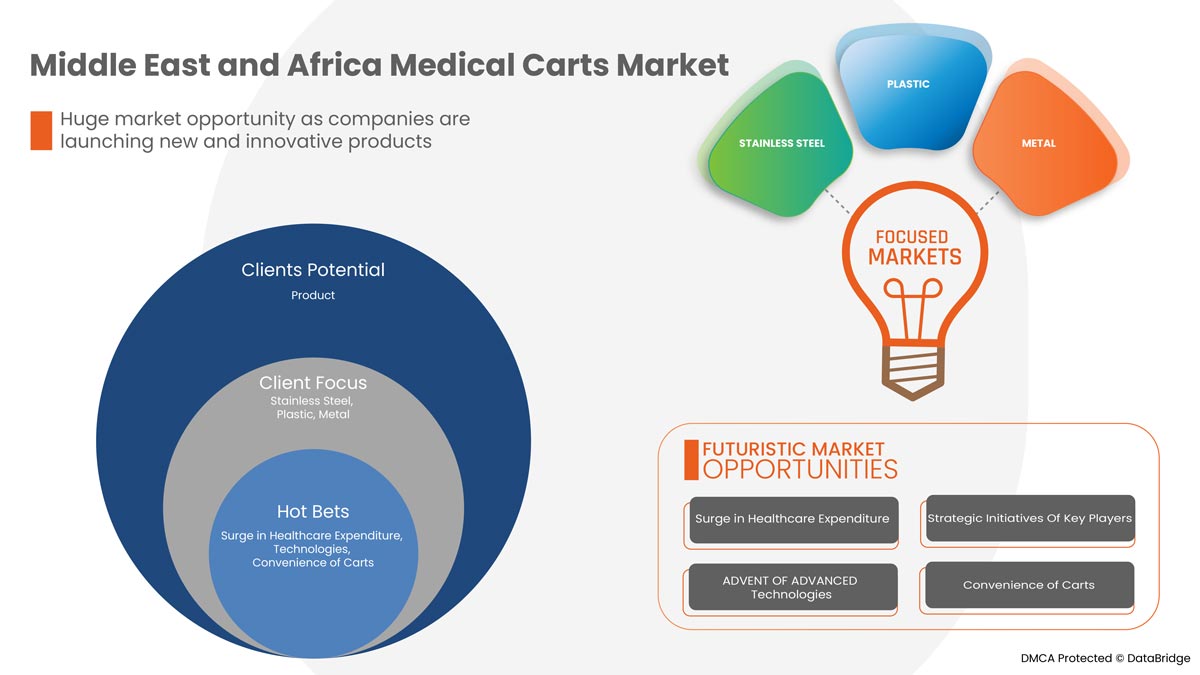

- ارتفاع في الإنفاق على الرعاية الصحية

إن حجم الأموال التي تنفقها دولة ما على الرعاية الصحية ومعدل نموها بمرور الوقت يتأثر بمجموعة واسعة من العوامل الاقتصادية والاجتماعية، بما في ذلك ترتيبات التمويل وهيكل تنظيم النظام الصحي. وعلى وجه الخصوص، هناك ارتباط قوي بين مستوى الدخل الإجمالي ومقدار ما ينفقه سكان تلك الدولة على الرعاية الصحية.

لقد زادت نفقات الرعاية الصحية في الدول المتقدمة والاقتصادات الناشئة مع نمو الدخل المتاح للأفراد. وعلاوة على ذلك، ولتلبية متطلبات السكان، تتخذ الهيئات الحكومية ومنظمات الرعاية الصحية في مناطق مختلفة زمام المبادرة من خلال تسريع الإنفاق على الرعاية الصحية. ويساعد ارتفاع الإنفاق على الرعاية الصحية منظمات الرعاية الصحية على تحسين مرافقها ومعداتها، بما في ذلك عربات الرعاية الطبية.

- المبادرات الاستراتيجية التي اتخذها اللاعبون الرئيسيون في السوق

إن المبادرات الاستراتيجية مثل الاستحواذ والشراكة واتفاقية العقد والمشاركة في المؤتمرات توفر فرصاً لتنمية قاعدة عملائها. وعلاوة على ذلك، من خلال مثل هذه الاستراتيجيات المبادرة، تعمل كلتا الشركتين على توسيع نطاق وصولهما من خلال أسواق جغرافية أو صناعية جديدة، أو الوصول إلى منتجات أو خدمات جديدة، أو أنواع جديدة من العملاء. يفتح كلا اللاعبين في السوق الباب أمام موارد إضافية أو جديدة مثل التكنولوجيا والمواهب.

- راحة العربات

تساعد عربات الرعاية الطبية الطاقم الطبي والجراحي على التخلص من المتاعب بفضل التطبيق المريح. وقد تحول العديد من مقدمي الرعاية الصحية إلى عربات طبية مزودة بأنظمة السجلات الطبية الإلكترونية لتخزين البيانات الطبية والحفاظ عليها في الموقع للحصول على رؤية مستمرة لتقدم العلاج. وقد ساعدت هذه العربات مقدمي الرعاية الصحية على التخلص من جبل الأعمال الورقية للبيانات الطبية. وقد تم تقليل العبء من خلال لوحة تعمل باللمس لتخزين بيانات متعددة والوصول إليها على عربات الرعاية الطبية الإلكترونية. وفي حالات الطوارئ، تسمح هذه العربات المزودة بأنظمة السجلات الطبية الإلكترونية بالبحث السريع وتصور السجلات على الفور.

- الدول الناشئة ذات المستشفيات المتطورة

وتعمل البلدان النامية مثل الهند والصين والأرجنتين، وغيرها، على تحسين مرافق الرعاية الصحية في بلدانها. وتتطلب الحالات المتزايدة من الأمراض المزمنة غير المعدية، والنوبات القلبية، والسكري، وغيرها، متطلبات عالية لمرافق المستشفيات مع ارتفاع معدلات القبول في المستشفيات والعلاج. كما تعمل معدلات الأمراض المرتفعة في البلدان النامية على تعزيز الفرصة أمام اللاعبين في السوق لتوزيع منتجاتهم بوتيرة جيدة. والسبب الجذري وراء عبء الأمراض هو عواقب الفقر، مثل سوء التغذية، وتلوث الهواء، وعادات الأكل وأسلوب الحياة غير الصحية. وبالتالي، فإن هذا يزيد من الحاجة إلى المستشفيات ذات المرافق العالية في هذه البلدان النامية.

القيود/التحديات

- محطة عمل ثقيلة على عجلات

يجب أن تكون معظم العربات الطبية المستخدمة في المستشفيات أو الأقسام الطبية مصممة هندسيًا لتجنب مشاكل الوزن لأي متخصص في الرعاية الصحية يستخدمها. دائمًا ما يكون لمحطة العمل الثقيلة ذات العجلات تأثير سلبي على الممرضات اللاتي يدفعن العربة.

- إطار تنظيمي صارم

يتزايد استخدام عربات الرعاية الطبية مع العديد من التخصصات والتطورات في المستشفيات بسرعة، مع نمو عدد السكان المسنين والعديد من الأمراض المسرطنة التي تتطلب إقامات طويلة في المستشفى وصيانة طبية روتينية. في الوقت نفسه، يتعين على لاعبي مصنعي عربات الرعاية الطبية في السوق اتباع لوائح محددة للحصول على موافقة السلطات العليا لإطلاق المنتج في السوق. يجب اتباع هذه الإرشادات الصارمة، وهذه واحدة من أصعب المهام بين جميع الخطوات. تختلف الموافقة المسبقة على الأجهزة الطبية المختلفة من دولة إلى أخرى. تنظم إدارة الغذاء والدواء الأمريكية عربات الرعاية الطبية في الولايات المتحدة، ويحتفظ الاتحاد الأوروبي بأوروبا. ومع ذلك، يتم إجراء التطوير السريع لسياسات الخصوصية واللوائح في منطقة آسيا والمحيط الهادئ وأوروبا والشرق الأوسط وأفريقيا، بما في ذلك الهند وروسيا والصين وكوريا الجنوبية وسنغافورة وهونج كونج وأستراليا.

تأثير ما بعد كوفيد-19 على سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على سوق عربات المرضى في الشرق الأوسط وأفريقيا. لم تؤثر جائحة كوفيد-19 بشكل ضار على سعر وطلب منتجات عربات المرضى على مستوى أعلى بسبب المبيعات عبر الإنترنت التقدمية وبدائل التوصيل المبتكرة المتاحة مع أقصى قدر من المخاوف الأمنية لمراكز الرعاية الصحية الكبرى والمستشفيات والعيادات ومراكز الجراحة الخارجية. ومع ذلك، فإن الأمراض المزمنة المتزايدة والحالات الجراحية والقبول في المستشفيات أدت إلى زيادة كبيرة في استخدام عربات المرضى في الشرق الأوسط وأفريقيا. أثناء وبعد جائحة كوفيد-19، زاد الطلب على عربات المرضى بسبب متطلبات المستشفيات المتزايدة في مناطق مختلفة والتقدم في البحث والتطوير في المعدات الطبية مما أدى إلى تسريع نمو السوق في الشرق الأوسط وأفريقيا. ارتفع الطلب على عربات المرضى في السنوات القليلة الماضية مع نمو عربات المرضى في المستشفيات والعيادات ومراكز الصدمات ومراكز الجراحة الخارجية. وبالتالي، ظل الطلب على عربات المرضى مرتفعًا دائمًا حيث زاد عدد المستشفيات مع الحاجة إلى مرافق معدات أفضل. أثر تفشي جائحة كوفيد-19 بشكل إيجابي على نمو السوق بسبب الطلب المرتفع على عربات الإسعاف، وخاصة في المستشفيات المختلفة، ولكن تعطيل سلسلة التوريد كان تحديًا. ومع ذلك، يتم توفير العديد من عربات الإسعاف الأخرى المستخدمة في العمليات الجراحية وأجنحة وحدة العناية المركزة الطارئة للمستشفيات باستخدام وسائل النقل المبتكرة والمبيعات عبر الإنترنت. تُعطى الأولوية الحالية في معظم المستشفيات لعلاجات كوفيد-19 حيث لا يزال ارتفاع حالات كوفيد-19 مستمرًا، مما يزيد أيضًا من استخدام عربات الإسعاف للعديد من إمدادات الأدوية. علاوة على ذلك، دعمت العديد من الحكومات والمنظمات الصحية الدولية توريد هذه المنتجات نظرًا لأولويتها العالية في الحالات الحرجة.

التطورات الأخيرة

- في سبتمبر 2021، أعلنت شركة Omnicell, Inc. أنها أكملت عملية الاستحواذ المعلنة سابقًا على شركة FDS Amplicare. يضيف الاستحواذ مجموعة شاملة ومتكاملة من حلول إدارة الشؤون المالية والتحليلات وصحة السكان SaaS إلى قسم EnlivenHealth التابع لشركة Omnicell، مما يؤثر على نمو السوق للشركة

- في سبتمبر 2020، أعلنت شركة Midmark Corp أنها استحوذت على شركة Schroer Manufacturing Company ("Shor-Line")، وهي شركة تصنيع معدات صحة الحيوان ومقرها مدينة كانساس سيتي بولاية كانساس. يضيف هذا الاستحواذ إلى محفظة Midmark ويضع الشركة في مكانة الشريك التصميمي المفضل لمحترفي رعاية الحيوان

نطاق سوق عربات النقل الطبية في الشرق الأوسط وأفريقيا

يتم تصنيف سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا إلى سبعة قطاعات بارزة بناءً على المنتج والنوع والتطبيق ونوع المادة والحمولة والمستخدم النهائي وقناة التوزيع. سيساعد النمو بين هذه القطاعات في تحليل قطاعات نمو السوق في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

منتج

- عربات الحوسبة المتنقلة

- أعمدة التخزين الطبية

- الخزائن والملحقات

- عربات الأدوية

- محطات العمل المثبتة على الحائط

- آخر

وفقًا للمنتج، يتم تقسيم سوق العربات الطبية إلى عربات الحوسبة المتنقلة، وأعمدة التخزين الطبية، والخزائن والملحقات، وعربات الأدوية، ومحطات العمل المثبتة على الحائط، وغيرها.

يكتب

- عربة طبية بالكمبيوتر

- عربة الطوارئ

- عربة الإجراءات

- عربة التخدير

- عربة أدوات المختبر الطبي

- آحرون

اعتمادًا على النوع، يتم تقسيم سوق العربات الطبية إلى عربة طبية حاسوبية، وعربة طوارئ، وعربة إجراءات، وعربة تخدير، وعربات مرافق المختبرات الطبية، وغيرها.

طلب

- طبي

- التصوير الطبي

- معمل

- آحرون

بناءً على التطبيق، يتم تقسيم سوق العربات الطبية إلى عربات طبية وتصوير طبي ومختبرية وغيرها.

نوع المادة

- بلاستيك

- خشب

- الفولاذ المقاوم للصدأ

- معدن

- آحرون

بناءً على نوع المادة، يتم تقسيم سوق العربات الطبية إلى البلاستيك والخشب والفولاذ المقاوم للصدأ والمعادن وغيرها .

الحمولة

- 50 كجم

- 65 كجم

- 80 كجم

- 150 كجم

- 180 كجم

- آحرون

بناءً على الحمولة، يتم تقسيم سوق العربات الطبية إلى 50 كجم، و65 كجم، و80 كجم، و150 كجم، و180 كجم، وغيرها.

المستخدم النهائي

- المستشفيات

- العيادات

- مراكز الجراحة الخارجية

- مراكز الصدمات

- آحرون.

بناءً على المستخدم النهائي، يتم تقسيم سوق العربات الطبية إلى المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز الصدمات وغيرها.

قناة التوزيع

- العطاء المباشر

- الموزعون التابعون لجهات خارجية

- آحرون

بناءً على قناة التوزيع، يتم تقسيم سوق العربات الطبية إلى عطاءات مباشرة وموزعين تابعين لجهات خارجية وآخرين.

تحليل/رؤى إقليمية لسوق عربات النقل الطبية في الشرق الأوسط وأفريقيا

تم تحليل سوق عربات النقل الطبية في الشرق الأوسط وأفريقيا. تعتمد رؤى حجم السوق واتجاهاته على المنتج والنوع والتطبيق ونوع المادة والحمولة والمستخدم النهائي وقناة التوزيع.

الدول التي يغطيها تقرير سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا هي جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تهيمن جنوب أفريقيا على سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا بمعدل نمو سنوي مركب يبلغ حوالي 7.4% من حيث حصة السوق وإيرادات السوق. وستواصل ازدهار هيمنتها خلال فترة التوقعات. ويرجع هذا إلى ارتفاع حالات إصابات الجهاز العضلي الهيكلي والجراحات واعتماد السجلات الطبية الإلكترونية في المستشفى.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود العلامات التجارية وتوافرها والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا تفاصيل حول المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، والمبادئ التوجيهية التنظيمية، وتحليل العلامة التجارية، وموافقات المنتج، وحمولة المنتج، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين العاملين في سوق عربات الرعاية الطبية في الشرق الأوسط وأفريقيا هم ITD Gmbh، و Omnicell Inc.، و Midmark Corporation، و Herman Miller، Inc.، و AMD Telemedicine، وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.1 PRODUCT LIFELINE CURVE

2.2 DBMR MARKET POSITION GRID

2.3 VENDOR SHARE ANALYSIS

2.4 MARKET APPLICATION COVERAGE GRID

2.5 SECONDARY SOURCES

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: REGULATIONS

5.1 REGULATION IN THE U.S.

5.2 REGULATIONS IN EUROPE:

5.3 REGULATIONS IN CHINA:

5.4 REGULATIONS IN JAPAN:

5.5 REGULATION IN INDIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE

6.1.2 ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITALS

6.1.3 ADVANCED MEDICAL CARTS APPLICATION

6.1.4 DURING COVID-19, MEDICAL CARTS SUPPLIED BY THE VENDORS, RISING THE MARKET GROWTH

6.2 RESTRAINTS

6.2.1 HIGH COST OF PRODUCT CUSTOMIZED MEDICAL CARTS

6.2.2 POTENTIAL PROBLEMS WITH BATTERY-OPERATED CARTS

6.2.3 LACK OF SKILLED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 SURGE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.3 CONVENIENCE OF CARTS

6.3.4 EMERGING COUNTRIES WITH DEVELOPED HOSPITALS

6.4 CHALLENGES

6.4.1 HEAVY WORKSTATION ON WHEELS

6.4.2 STRINGENT REGULATORY FRAMEWORK

7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 MOBILE COMPUTING CARTS

7.2.1 BY APPLICATION

7.2.1.1 TELEHEALTH WORKSTATION

7.2.1.2 DOCUMENTATION

7.2.1.3 MEDICATION DELIVERY

7.2.1.4 EQUIPMENT

7.2.1.5 OTHERS

7.2.2 BY ENERGY SOURCE

7.2.2.1 NON-POWERED

7.2.2.2 POWERED

7.2.3 BY DISPLAY TYPE

7.2.3.1 1 MONITOR

7.2.3.2 LAPTOP

7.2.3.3 TABLET

7.2.3.4 2 MONITORS

7.3 MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES

7.3.1 STORAGE CABINETS

7.3.2 SUPPLY CABINETS

7.3.3 STERILIZATION CABINETS

7.3.4 DRYING CABINETS

7.3.5 TRANSFER CABINETS

7.3.6 DISPENSING CABINETS

7.3.7 OTHERS

7.4 MEDICATION CARTS

7.4.1 PUNCH-CARD CARTS

7.4.2 BOX-BIN-PUNCH CARD CARTS

7.4.3 BOX CARTS

7.4.4 BIN CARTS

7.5 WALL-MOUNTED WORKSTATIONS

7.5.1 SIT-STAND COMBO SYSTEM

7.5.2 WALL-MOUNT SYSTEM

7.5.3 OTHERS

7.6 OTHERS

8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 COMPUTER MEDICAL CART

8.2.1 TELEMEDICINE CART

8.2.2 POINT OF CARE PC CART

8.3 EMERGENCY CART

8.4 ANESTHESIA CART

8.5 PROCEDURE CART

8.6 MEDICAL LABORATORY UTILITY CART

8.7 OTHERS

9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL

9.2.1 TELEMEDICINE

9.2.2 SURGERY

9.3 LABORATORY

9.4 MEDICAL IMAGING

9.5 OTHERS

10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE

10.1 OVERVIEW

10.2 PLASTIC

10.3 STAINLESS STEEL

10.4 METAL

10.5 WOOD

10.6 OTHERS

11 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 80 KG

11.3 65 KG

11.4 50 KG

11.5 150 KG

11.6 180 KG

11.7 OTHERS

12 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 LONG-TERM CARE HOSPITALS

12.2.2 ACUTE CARE HOSPITALS

12.2.3 NURSING FACILITIES

12.2.4 REHABILITATION CENTERS

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 TRAUMA CENTERS

12.6 OTHERS

13 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 THIRD PARTY DISTRIBUTORS

13.3 DIRECT TENDER

13.4 OTHERS

14 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 HUMANSCALE

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.1.5 PARTNERSHIP

17.1.6 ACQUISITION

17.2 MCKESSON MEDICAL-SURGICAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 ERGOTRON, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.3.4.1 PRODUCT PORTFOLIO

17.3.5 PARTNERSHIP

17.3.5.1 PRODUCT PORTFOLIO

17.4 HERMAN MILLER, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 INTERMETRO INDUSTRIES CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ADVANTECH CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AFC INDUSTRIES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 ACQUISITION

17.8 AMD MIDDLE EAST & AFRICA TELEMEDICINE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.8.3.1 PARTNERSHIP

17.9 ALTUS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.9.3.1 EXPANSION

17.9.3.2 PARTNERSHIP

17.9.3.3 PRODUCT PORTFOLIO

17.1 BAILIDA MEDICAL.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BERGMANN GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIHEALTHCARE (ZHANGJIAGANG BRAUN INDUSTRY CO., LTD.)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.12.3.1 THE COMPANY’S WEBSITE HAS NO RECENT DEVELOPMENT RELATED TO THE MARKET

17.13 BYTEC HEALTHCARE LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 CAPSA HEALTHCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.14.3.1 ACQUISITION

17.15 CHANG GUNG MEDICAL TECHNOLOGY CO., LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 ENOVATE MEDICAL.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.16.3.1 PRODUCT LAUNCH

17.17 HARLOFF MANUFACTURING COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 HI-LIFE TECHNOLOGY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 HUA SHUO PLASTIC CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ITD GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.20.3.1 ACQUISITION

17.20.3.2 MODIFICATION

17.21 JACO INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.21.3.1 PRODUCT LAUNCH

17.22 JEGNA (XIAMEN) INFO&TECH CO., LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 JOSON-CARE ENTERPRISE CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS

17.24 MEDICAL MASTER CO., LTD.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MIDMARK CORPORATION

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.25.3.1 ACQUISITION

17.26 OMNICELL INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.27 PEDIGO PRODUCTS

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PERFORMANCE HEALTH

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 VILLARD

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 ZHANGJIAGANG BESTRAN TECHNOLOGY CO.,LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 3 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 6 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 8 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 13 MIDDLE EAST & AFRICA MEDICATI0N CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 16 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 22 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 25 MIDDLE EAST & AFRICA EMERGENCY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANESTHESIA CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PROCEDURE CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA MEDICAL LABORATORY UTILITY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LABORATORY IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEDICAL IMAGING IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 38 MIDDLE EAST & AFRICA PLASTIC IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA STAINLESS STEEL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA METAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA WOOD IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA 80 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA 65 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA 50 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA 150 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA 180 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CLINICS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA TRAUMA CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA DIRECT TENDER IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 64 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 66 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 68 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 70 MIDDLE EAST AND AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 74 MIDDLE EAST AND AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 76 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 78 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 80 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 84 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 90 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 91 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 93 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 94 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 96 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 97 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 99 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 100 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 102 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 103 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 105 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 106 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 108 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 109 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 112 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 114 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 SOUTH AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 119 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 120 SOUTH AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 121 SOUTH AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 SOUTH AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 SOUTH AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 126 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 127 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 129 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 130 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 132 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 133 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 135 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 136 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 139 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 141 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 142 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 144 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 145 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 147 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 148 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 150 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 151 SAUDI ARABIA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 SAUDI ARABIA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 155 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 156 SAUDI ARABIA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 157 SAUDI ARABIA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SAUDI ARABIA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 SAUDI ARABIA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 160 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 162 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 163 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 165 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 166 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 167 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 168 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 169 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 171 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 172 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 174 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 175 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 176 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 177 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 178 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 180 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 181 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 183 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 184 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 186 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 187 U.A.E MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 U.A.E MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 191 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 192 U.A.E MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 193 U.A.E MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 U.A.E HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 195 U.A.E MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 196 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 198 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 199 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 201 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 202 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 203 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 204 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 205 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 206 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 207 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 208 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 209 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 210 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 211 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 213 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 214 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 216 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 217 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 219 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 220 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 222 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 223 EGYPT MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 EGYPT MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 225 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 226 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 227 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 228 EGYPT MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 229 EGYPT MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 EGYPT HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 231 EGYPT MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 232 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 234 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 235 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 237 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 238 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 239 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 240 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 241 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 242 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 243 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 244 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 245 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 246 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 247 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 248 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 249 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 250 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 252 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 253 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 256 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 258 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 259 ISRAEL MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 260 ISRAEL MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 261 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 262 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 263 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 264 ISRAEL MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 265 ISRAEL MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 ISRAEL HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 ISRAEL MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 269 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 270 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 11 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE AND ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITAL IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MOBILE COMPUTING CARTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2020-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2020-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2021

FIGURE 40 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2020-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, LIFELINE CURVE

FIGURE 43 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY PRODUCT (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.