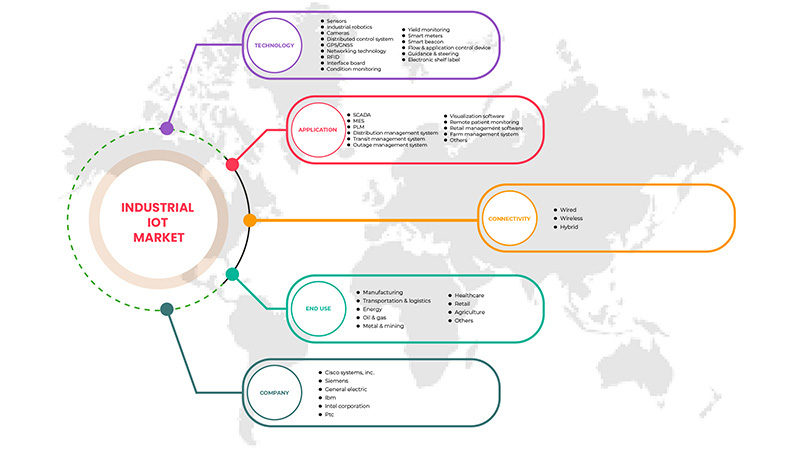

سوق إنترنت الأشياء الصناعي في الشرق الأوسط وأفريقيا، حسب التكنولوجيا (أجهزة الاستشعار، والروبوتات الصناعية، والكاميرات، ونظام التحكم الموزع، ونظام تحديد المواقع العالمي/نظام الملاحة العالمي عبر الأقمار الصناعية، وتكنولوجيا الشبكات، وتقنية تحديد الهوية بموجات الراديو، ولوحة الواجهة، ومراقبة الحالة، ومراقبة العائد، والعدادات الذكية، والمنارات الذكية، وجهاز التحكم في التدفق والتطبيق، والتوجيه والتوجيه، وعلامة الرف الإلكترونية )، والتطبيق (نظام إدارة التحكم الإشرافي وتحصيل البيانات، ونظام إدارة النقل، ونظام إدارة الانقطاعات، وبرامج التصور، ومراقبة المرضى عن بعد، وبرامج إدارة التجزئة، ونظام إدارة المزارع، وغيرها)، والاتصال (السلكي واللاسلكي والهجين)، والاستخدام النهائي (التصنيع، والنقل والخدمات اللوجستية، والطاقة، والنفط والغاز، والمعادن والتعدين، والرعاية الصحية، والتجزئة، والزراعة، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل وحجم سوق إنترنت الأشياء الصناعي في الشرق الأوسط وأفريقيا

كما أن الاستخدام المتزايد لسوق إنترنت الأشياء الصناعي بسبب اعتماد الذكاء الاصطناعي والتعلم الآلي في صناعة المستخدم النهائي يدفع نمو السوق. ومن المتوقع أن يؤدي ارتفاع احتمال سرقة الأجهزة وانتهاكات البيانات إلى تقييد سوق إنترنت الأشياء الصناعي. إن انتشار الإنترنت المتزايد والرقمنة في جميع أنحاء العالم يمثلان فرصة لسوق إنترنت الأشياء الصناعي. تشكل تكاليف التثبيت المرتفعة والصعوبات في دمج أجهزة إنترنت الأشياء تحديًا لسوق إنترنت الأشياء الصناعي في الشرق الأوسط وأفريقيا.

تحلل شركة Data Bridge Market Research أن سوق إنترنت الأشياء الصناعي في الشرق الأوسط وأفريقيا من المتوقع أن يصل إلى 26,096.82 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 8.5٪ خلال الفترة المتوقعة. تشكل "أجهزة الاستشعار" قطاع التكنولوجيا الأبرز حيث أن هذا النوع من التكنولوجيا مطلوب وهو الخيار الأفضل لاستخراج المعلومات من المكونات الصناعية. يغطي تقرير سوق إنترنت الأشياء الصناعي أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

By Technology (Sensors, Industrial Robotics, Cameras, Distributed Control System, GPS/GNSS, Networking Technology, RFID, Interface Board, Condition Monitoring, Yield Monitoring, Smart Meters, Smart Beacon, Flow & Application Control Device, Guidance & Steering, and Electronic Shelf Label), Application (SCADA, MES, PLM, Distribution Management System, Transit Management System, Outage Management System, Visualization Software, Remote Patient Monitoring, Retail Management Software, Farm Management System, and Others), Connectivity (Wired, Wireless, and Hybrid), End Use (Manufacturing, Transportation & Logistics, Energy, Oil & Gas, Metal & Mining, Healthcare, Retail, Agriculture, and Others)– Industry Trends and Forecast to 2029 |

|

Countries Covered |

Saudi Arabia, South Africa, Egypt, Israel, the Rest of the Middle East, and Africa |

|

Market Players Covered |

Cisco Systems, Inc., Siemens. General Electric, IBM Corporation, Intel Corporation, PTC, Honeywell International Inc., NEC Corporation, Rockwell Automation, ABB, SAP SE, Texas Instruments Incorporated, Robert Bosch GmbH, Emerson Electric Co., Microsoft, KUKA AG, Sigfox Network Limited (a subsidiary of UnaBiz), Wipro, Arm Limited (a subsidiary of Softbank Group Corp.) and Huawei Technologies Co., Ltd., among others |

Market Definition

The extension and application of the internet of things (IoT) in industrial sectors and applications are referred to as the industrial internet of things (IIoT). The Machine-to-Machine (M2M) Internet of Things (IIoT) enables businesses and industries to operate more efficiently and reliably because of its strong emphasis on M2M connectivity, big data, and machine learning. Industrial applications such as robotics, medical technology, and software-defined production processes are all included in the IIoT.

Industrial IoT Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increase in adoption of artificial intelligence (AI) and machine learning (ML) in end user industry

The popularity of AI and ML is increasing year over year in various industries such as manufacturing, healthcare, energy, oil & gas, and many others. Most of these industries adopt the technology to increase working efficiency, automate the service delivery process and modernize the offerings which has gained an important role in competing with competitors in the market. Thus, the rising trend of AI & ML adoption is a major driver for the growth of the Middle East and Africa industrial IoT market.

- Surge in implementation of sensors and distributed control systems in business operations

The adoption of sensors and distributed control system will help control and manage the work process and automate the management process for all industrial processes. Thus, the demand for implementing sensors and DCS in various business operations will increase yearly. Thus, globally, the need for sensors and DCS is rising due to various advantages associated with the implementation. And promotes the growth of the Middle East and Africa industrial IoT market and acts as a driver for the market's growth.

- Increase in the need for real-time data solutions and services

The real-time data solutions require a wide range of electronic devices, and majorly the demand for IoT devices is expected to increase because to support the real-time data analysis in business operations to support the quick understanding of data and guide the decisions to deliver products or services to customers. Thus, there is high demand for the adoption of real-time solutions, which directly involve the usage of IoT devices for industries. Therefore, it is expected to be a major driver of market growth.

Restraints/Challenges

- Lack of skilled labor and training sessions

Adopting IoT solutions for industries is not quick and easy; it involves detailed visualization and an adequate method of automating the sector. Therefore, end users need more time and labor to adopt the solutions and train the employees to understand the operation and maintenance.

- Higher probability of device theft and data breaches

The dependability of the IT climate suggests getting the plant's resources, organization, and information created by these associated gadgets. Reliability is more responsible for adopting digitalization in business operations; however, there is a high probability of safety disadvantages.

- Rise in the technical complexities due to day-by-day technological advancement

Flexible security is one thought for giving medical care, instruction, and lodging help, whether somebody is officially utilized. Furthermore, action records can back deep-rooted training and laborer retraining. Regardless of how individuals decide to invest energy, there should be ways for individuals to live satisfying lives irrespective of whether society needs fewer specialists. Thus, continuous technological advancement will lead to constant employee training and hinder the market growth.

Post COVID-19 Impact on Industrial IoT Market

COVID-19 significantly impacted the industrial IoT market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

The growth of the industrial IoT market is rising due to the digitalization of production processes and supply chains across agriculture, electrical utilities, mining, oil and gas, and transportation. Moreover, the IoT adoption in industries had huge progress from 2020 to 2021 as the pandemic demonstrated the importance of IoT in all types of businesses. The surge in demand for automation to avoid the involvement of a maximum workforce has driven the adoption of IoT in industries. This replicates the positive impact of COVID-19 on the IIoT market, which has further catalyzed the business through adopting industry 4.0 technologies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology in the industrial IoT market. The companies will bring advanced and accurate solutions to the market.

Recent Development

- In March 2022, Cisco Systems, Inc. developed an advanced IoT Control Center platform to help improve service reliability and reduce operational costs. This development will help the company diversify its solution portfolio and offers better quality solutions

- In April 2022, Arm Limited introduced two new solutions, Arm Cortex-M85 and Cortex-A. These new products and solutions will help the company offer better solutions to customers, attracting new customers and accelerating revenue growth

Middle East and Africa Industrial IoT Market Scope

The industrial IoT market is segmented based on technology, application, connectivity, and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Technology

- Sensors

- Industrial Robotics

- Cameras

- Distributed Control System

- GPS/GNSS

- Networking Technology

- RFID

- Interface Board

- Condition Monitoring

- Yield Monitoring

- Smart Meters

- Smart Beacon

- Flow & Application Control Device

- Guidance & Steering

- Electronic Shelf Label

On the basis of technology, the Middle East and Africa industrial IoT market is segmented into sensors, industrial robotics, cameras, distributed control system, GPS/GNSS, networking technology, RFID, interface board, condition monitoring, yield monitoring, smart meters, smart beacon, flow & application control device, guidance & steering, and electronic shelf label.

By Application

- SCADA

- MES

- PLM

- Distribution Management System

- Transit Management System

- Outage Management System

- Visualization Software

- Remote Patient Monitoring

- Retail Management Software

- Farm Management System

- Others

On the basis of application, the Middle East and Africa industrial IoT market has been segmented into SCADA, MES, PLM, distribution management system, transit management system, outage management system, visualization software, remote patient monitoring, retail management software, farm management system, and others.

By Connectivity

- Wired

- Wireless

- Hybrid

On the basis of connectivity, the Middle East and Africa industrial IoT market has been segmented into wired, wireless, and hybrid.

By End-Use

- Manufacturing

- Transportation & Logistics

- Energy

- Oil & Gas

- Metal & Mining

- Healthcare

- Retail

- Agriculture

- Others

Based on End-Use, the Middle East and Africa industrial IoT market has been segmented into manufacturing, transportation & logistics, energy, oil & gas, metal & mining, healthcare, retail, agriculture, and others.

Industrial IoT Market Regional Analysis/Insights

The industrial IoT market is analyzed, and market size insights and trends are provided by technology, application, connectivity, and end-use, as referenced above.

The countries covered in the internet of things (IoT) devices market report are Saudi Arabia, South Africa, Egypt, Israel, the Rest of the Middle East and Africa

Saudi Arabia dominates the Middle East and Africa industrial IoT market. Saudi Arabia is likely to be the fastest-growing industrial IoT market. Saudi Arabia develops cloud-based solutions and services designed to improve security and contribute new levels of operational intelligence for governments, enterprises, transport, and communities. This will boost industrial IoT products in the Middle East and Africa.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Industrial IoT Market Share Analysis

The industrial IoT market competitive landscape provides details about a competitor. Components included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the industrial IoT market.

Some of the major players operating in the industrial IoT market are:

- Cisco Systems, Inc.

- Siemens

- General Electric

- IBM Corporation

- Intel Corporation

- PTC

- Honeywell International Inc.

- NEC Corporation

- Rockwell Automation, Inc.

- ABB

- SAP SE

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Emerson Electric Co.

- Microsoft

- KUKA AG

- Sigfox Partner Network (a subsidiary of UnaBiz)

- Wipro

- Arm Limited (a subsidiary of Softbank Group Corp.)

- شركة هواوي للتكنولوجيا المحدودة

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 SOUTH AFRICA

10.1.3 EGYPT

10.1.4 ISRAEL

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 56 EGYPT INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 EGYPT INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 EGYPT INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 59 EGYPT INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 64 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

FIGURE 14 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 15 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 16 GROWING INTERNET USERS WORLDWIDE

FIGURE 17 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 18 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 19 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 20 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 21 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 23 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 24 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.