سوق شاشات العرض الصناعية في الشرق الأوسط وأفريقيا، حسب النوع (شاشات متينة، شاشات مفتوحة الإطار، شاشات متعددة اللمس (P-Cap)، شاشات أمامية، شاشات USB Type-C، شاشات SDI، شاشات خلفية، شاشات مثبتة على لوحة، شاشات بحرية، جدران فيديو، أخرى)، حجم اللوحة (حتى 14 بوصة، من 14 بوصة إلى 21 بوصة، من 21 إلى 40 بوصة، 40 بوصة وما فوق)، التكنولوجيا (LCD، LED، OLED، شاشات E-Paper)، نوع الاتصال (تسلسلي، إيثرنت، شبكة محمولة، اتصالات صناعية، RF/Zigbee/IR، Jason/MQTT، أخرى)، التطبيق (HMI، تطبيق عن بعد، شاشات تفاعلية، لافتات رقمية، تصوير)، عمودي (التصنيع، الطاقة والكهرباء، العسكرية والإلكترونيات الجوية، النفط والغاز، المعادن والتعدين، النقل، أخرى)، الدولة (جنوب أفريقيا ومصر والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل وبقية دول الشرق الأوسط وأفريقيا) اتجاهات الصناعة والتوقعات حتى عام 2028

تحليل السوق والرؤى: سوق العرض الصناعي في الشرق الأوسط وأفريقيا

تحليل السوق والرؤى: سوق العرض الصناعي في الشرق الأوسط وأفريقيا

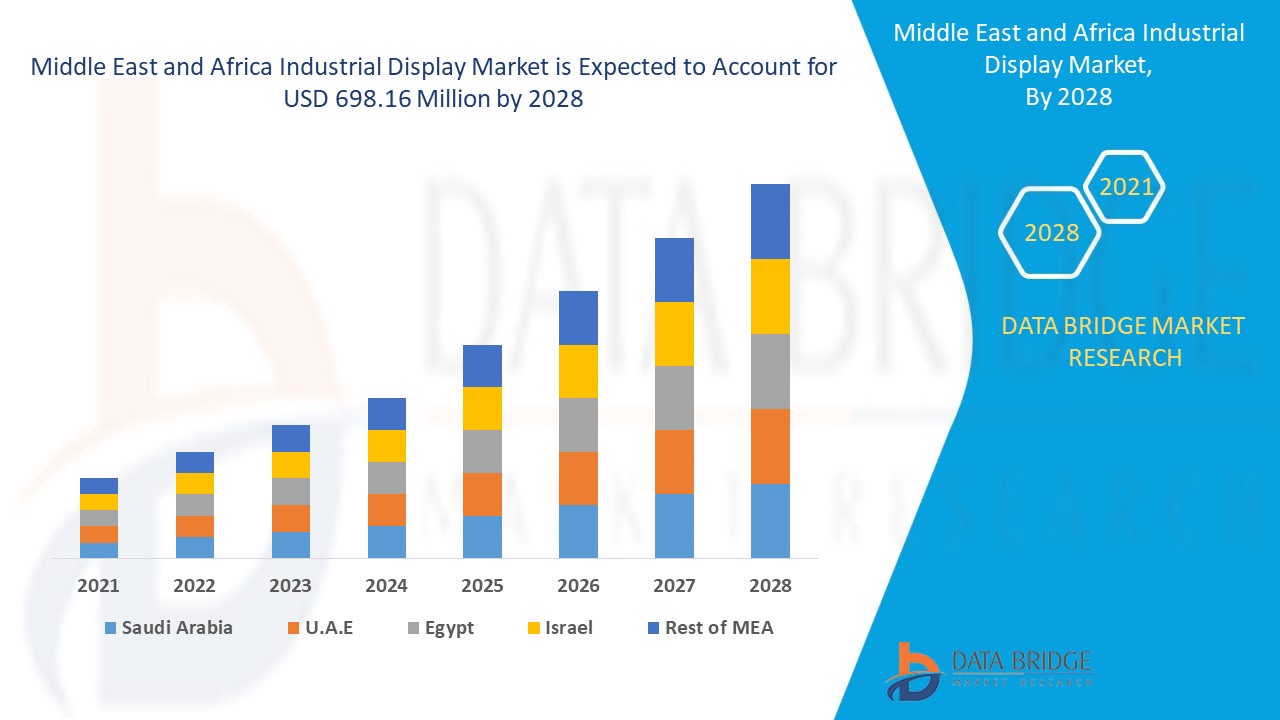

من المتوقع أن يحقق سوق العرض الصناعي نموًا في السوق في الفترة المتوقعة من 2021 إلى 2028. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 2.9٪ في الفترة المتوقعة من 2021 إلى 2028 ومن المتوقع أن يصل إلى 698.16 مليون دولار أمريكي بحلول عام 2028. ظهور التطورات التكنولوجية المختلفة والعمليات الآلية في الصناعات هي العوامل الرئيسية التي تدفع نمو سوق العرض الصناعي.

نظام العرض الصناعي عبارة عن مجموعة من الآلات المستخدمة لعرض الناتج الرقمي. تتضمن هذه الآلات أنواعًا مختلفة من شاشات العرض TFT والشاشات واللافتات الرقمية والمعدات المماثلة. تم تصميم الشاشات الصناعية لزيادة المتانة وتحمل الظروف البيئية القاسية مثل درجات الحرارة الشديدة والرطوبة والغبار والأوساخ وغيرها في التطبيقات الصناعية والتجارية.

إن الطلب المتزايد على تطبيقات واجهة الإنسان والآلة (HMI) في صناعات التصنيع والعمليات يدفع نمو سوق شاشات العرض الصناعية. الاستثمارات الكبيرة المطلوبة لتثبيت شاشات / لوحات صناعية قد تعيق نمو سوق شاشات العرض الصناعية. إن الطلب المتزايد على تطبيقات اللافتات الرقمية في الصناعات لعرض المعلومات الضرورية يخلق فرصة لسوق شاشات العرض الصناعية. إن اعتماد الشركات المصنعة على الموردين المختلفين لتوفير المعدات والمكونات هو أحد أكبر التحديات التي تواجه سوق شاشات العرض الصناعية.

يقدم تقرير سوق شاشات العرض الصناعية هذا تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق شاشات العرض الصناعية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق شاشات العرض الصناعية وحجم السوق

نطاق سوق شاشات العرض الصناعية وحجم السوق

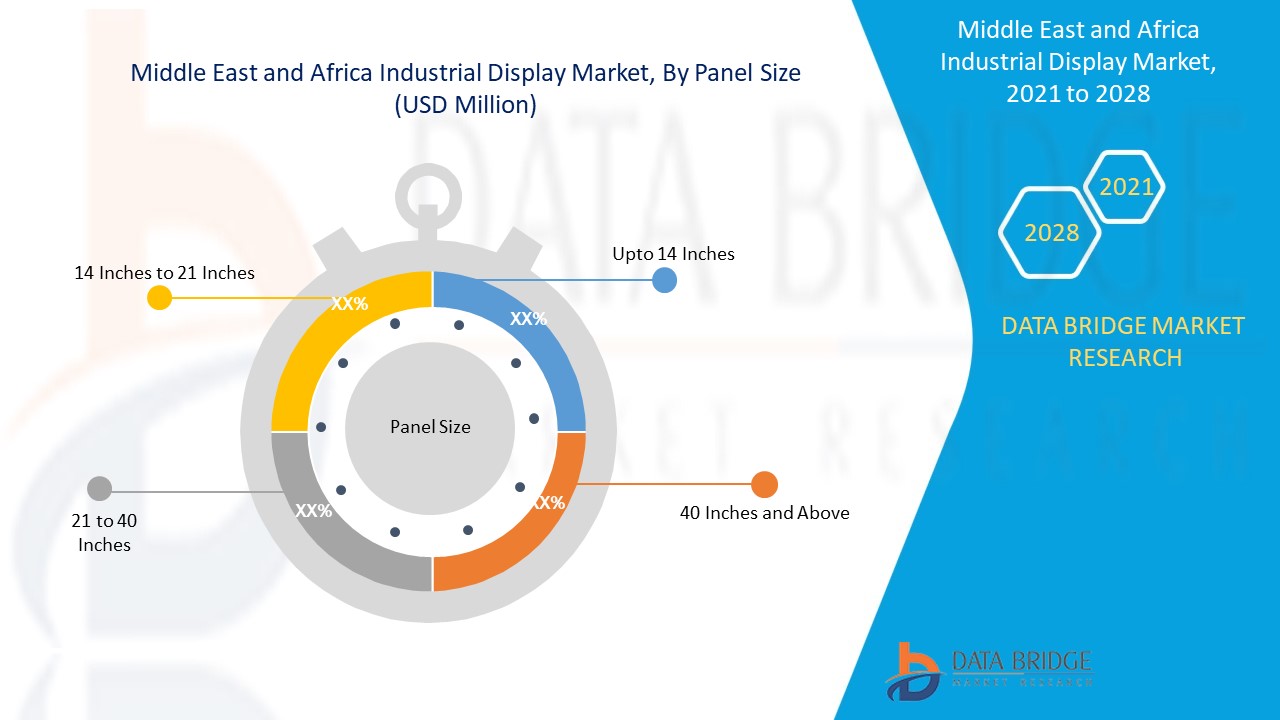

يتم تقسيم سوق العرض الصناعي على أساس النوع وحجم اللوحة والتكنولوجيا ونوع الاتصال والتطبيق والقطاع الرأسي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس النوع، يتم تقسيم سوق شاشات العرض الصناعية إلى شاشات متينة، وشاشات ذات إطار مفتوح، وشاشات متعددة اللمس (P-cap)، وشاشات أمامية، وشاشات USB من النوع C، وشاشات SDI، وشاشات مثبتة في الخلف، وشاشات مثبتة على لوحة، وشاشات بحرية، وجدران فيديو وغيرها. في عام 2021، احتلت شريحة شاشات العرض المتينة أكبر حصة سوقية في سوق شاشات العرض الصناعية حيث تقدم العديد من الحلول المختلفة لبيئات العمل القاسية للغاية والظروف التي يكون فيها الاستخدام القاسي للتكنولوجيا هو القاعدة.

- على أساس حجم اللوحة، يتم تقسيم سوق شاشات العرض الصناعية إلى ما يصل إلى 14 بوصة، ومن 14 بوصة إلى 21 بوصة، ومن 21 إلى 40 بوصة، و40 بوصة وما فوق. في عام 2021، تحتل شريحة ما يصل إلى 14 بوصة أكبر حصة سوقية في سوق شاشات العرض الصناعية حيث من المتوقع استخدام هذه المكونات بشكل متزايد في الأجهزة الإلكترونية الصغيرة مثل الساعات الذكية والأجهزة اللوحية وأجهزة الكمبيوتر المحمولة.

- على أساس التكنولوجيا، يتم تقسيم سوق شاشات العرض الصناعية إلى شاشات LCD وLED وOLED وe-paper. في عام 2021، استحوذت تقنية LCD على أكبر حصة سوقية في سوق شاشات العرض الصناعية حيث اكتسبت شاشات LCD قبولًا نظرًا لخصائصها المتقدمة التي تشمل استهلاكًا أقل للطاقة وحجمًا صغيرًا وسعرًا منخفضًا.

- على أساس نوع الاتصال، يتم تقسيم سوق شاشات العرض الصناعية إلى تسلسلي، إيثرنت، شبكة محمولة، اتصالات صناعية ، RF/Zigbee/IR، Jason/MQTT وغيرها. في عام 2021، احتلت شريحة المسلسل أكبر حصة سوقية في سوق شاشات العرض الصناعية حيث أن الاتصال التسلسلي هو طريقة اتصال تستخدم خط نقل واحد أو خطين لإرسال واستقبال البيانات ويتم إرسال واستقبال هذه البيانات باستمرار بت واحد في كل مرة.

- على أساس التطبيق، يتم تقسيم سوق شاشات العرض الصناعية إلى ما يصل إلى HMI، والتطبيق عن بعد، والعرض التفاعلي، واللافتات الرقمية والتصوير. في عام 2021، احتل قطاع HMI أكبر حصة سوقية في سوق شاشات العرض الصناعية بسبب زيادة اعتماد الأتمتة الصناعية في صناعات التصنيع والنفط والغاز والعمليات.

- على أساس عمودي، يتم تقسيم سوق العرض الصناعي إلى التصنيع والطاقة والقوة والعسكرية والإلكترونيات الجوية والنفط والغاز والمعادن والتعدين والنقل وغيرها. في عام 2021، احتل قطاع التصنيع أكبر حصة سوقية في سوق العرض الصناعي بسبب الاستخدام المتزايد للعرض في الصناعات والتحول التكنولوجي وعملية أتمتة المصانع.

تحليل سوق العرض الصناعي على مستوى الدولة

يتم تحليل سوق العرض الصناعي وتوفير معلومات حجم السوق حسب البلد والنوع وحجم اللوحة والتكنولوجيا ونوع الاتصال والتطبيق والعمودي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق العرض الصناعي هي جنوب أفريقيا والإمارات العربية المتحدة والمملكة العربية السعودية وإسرائيل ومصر وبقية دول الشرق الأوسط وأفريقيا كجزء من الشرق الأوسط وأفريقيا.

استحوذت دولة الإمارات العربية المتحدة على أكبر حصة في السوق بسبب زيادة اعتماد تطبيقات واجهة الإنسان والآلة في الصناعات لزيادة الإنتاجية والكفاءة.

كما يقدم قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

الطلب المتزايد على تطبيقات HMI

يوفر لك سوق العرض الصناعي أيضًا تحليلًا تفصيليًا للسوق لكل بلد من حيث نمو الصناعة مع المبيعات ومبيعات المكونات وتأثير التطور التكنولوجي في العرض الصناعي والتغييرات في السيناريوهات التنظيمية مع دعمها لسوق العرض الصناعي. تتوفر البيانات للفترة التاريخية من 2010 إلى 2019.

تحليل حصة السوق التنافسية للمناظر الطبيعية والعرض الصناعي

يقدم المشهد التنافسي لسوق شاشات العرض الصناعية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج واتساعه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق شاشات العرض الصناعية في الشرق الأوسط وأفريقيا.

اللاعبون الرئيسيون الذين يغطيهم التقرير هم SAMSUNG ELECTRONICS CO, LTD. وRockwell Automation, Inc. وPanasonic Corporation وSharp NEC Display Solutions, Ltd (شركة تابعة لشركة NEC Corporation) وSchneider Electric وSiemens وGeneral Electric وEmerson Electric Co. وAdvantech Co., Ltd. وInnolux Corporation من بين اللاعبين المحليين الآخرين. يفهم محللو DBMR نقاط القوة التنافسية ويقدمون تحليلاً تنافسيًا لكل منافس على حدة.

يتم المبادرة بالعديد من عمليات تطوير واستحواذ المنتجات من قبل الشركات في جميع أنحاء العالم والتي تعمل أيضًا على تسريع نمو سوق العرض الصناعي.

على سبيل المثال،

- في نوفمبر 2020، أطلقت شركة Rockwell Automation, Inc.، الشركة الرائدة عالميًا في مجال الأتمتة الصناعية والتحول الرقمي، أجهزة الكمبيوتر الصناعية الجديدة Allen-Bradley VersaView 6300 وبرامجها لتحسين موثوقية التصور وتطبيقات الأمان بشكل ملحوظ. ومع إطلاق هذا المنتج الجديد، زادت الشركة من خط منتجاتها.

إن توسيع الإنتاج وتطوير منتجات جديدة واستراتيجيات أخرى تعمل على تعزيز حصة الشركة في السوق من خلال زيادة التغطية والحضور. كما أنها توفر للمؤسسة فرصة تحسين عروضها للعرض الصناعي.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF INDUSTRIAL DISPLAY MARKET

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAY MARKET

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRICAL MANUFACTURERS ASSOCIATION (NEMA) RATINGS:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES THE RISK OF EYE DAMAGE

5.1.3 RISING DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN MANUFACTURING AND PROCESS INDUSTRIES

5.1.4 INCREASING MANUFACTURING FACILITIES WORLDWIDE IS LEADING THE ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.2 RESTRAINT

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS / PANELS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASING DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISING ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 COMPANIES ARE TRANSFORMING THEIR PROCESS FROM MANUAL TO DIGITAL

5.3.5 VARIOUS PARTNERSHIPS AND ACQUISITION IS LEADING FOR NEW PRODUCT DEVELOPMENTS AND BUSINESS EXPANSION

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCE OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT ROLE

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TYPE

7.1 OVERVIEW

7.2 RUGGED DISPLAY

7.2.1 TYPE

7.2.1.1 smartphone & handheld computer

7.2.1.2 tablet

7.2.1.3 laptop

7.2.1.4 mission critical display

7.2.1.5 avionic display

7.2.1.6 vehicle-mounted display

7.2.2 LEVEL OF RUGEDNESS

7.2.2.1 ultra-rugged

7.2.2.2 fully rugged

7.2.2.3 semi rugged

7.3 PANEL MOUNT MONITOR

7.4 VIDEO WALLS

7.5 OPEN FRAME MONITOR

7.6 FRONT DISPLAY

7.7 REAR MOUNT DISPLAY

7.8 MARINE DISPLAY

7.8.1 APPLICATION

7.8.1.1 hmi

7.8.1.2 digital signage

7.8.1.3 interactive display

7.8.1.4 remote monitoring

7.8.1.5 imaging

7.9 SDI DISPLAY

7.1 MULTI-TOUCH (P-CAP) DISPLAY

7.11 USB TYPE-C DISPLAY

7.12 OTHERS

8 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 UP TO 14 INCHES

8.3 14 INCHES TO 21 INCHES

8.4 21 TO 40 INCHES

8.5 40 INCHES AND ABOVE

9 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 LCD

9.3 LED

9.3.1 FULL ARRAY

9.3.2 EDGE LIT

9.3.3 DIRECT LIT

9.4 OLED

9.4.1 AMOLED

9.4.2 PMOLED

9.5 E-PAPER DISPLAY

10 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE

10.1 OVERVIEW

10.2 SERIAL

10.3 ETHERNET

10.4 MOBILE NETWORK

10.5 INDUSTRIAL COMMUNICATION

10.6 RF/ZIGBEE/IR

10.7 JASON/MQTT

10.8 OTHERS

11 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 HMI

11.3 DIGITAL SIGNAGE

11.4 INTERACTIVE DISPLAY

11.5 REMOTE MONITORING

11.6 IMAGING

12 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 MANUFACTURING

12.2.1 LCD

12.2.2 LED

12.2.2.1 FULL ARRAY

12.2.2.2 EDGE LIT

12.2.2.3 DIRECT LIT

12.2.3 OLED

12.2.3.1 AMOLED

12.2.3.2 PMOLED

12.2.4 E-PAPER DISPLAY

12.3 ENERGY & POWER

12.3.1 LCD

12.3.2 LED

12.3.2.1 FULL ARRAY

12.3.2.2 EDGE LIT

12.3.2.3 DIRECT LIT

12.3.3 OLED

12.3.3.1 AMOLED

12.3.3.2 PMOLED

12.3.4 E-PAPER DISPLAY

12.4 MILITARY AND AVIONICS

12.4.1 LCD

12.4.2 LED

12.4.2.1 FULL ARRAY

12.4.2.2 EDGE LIT

12.4.2.3 DIRECT LIT

12.4.3 OLED

12.4.3.1 AMOLED

12.4.3.2 PMOLED

12.4.4 E-PAPER DISPLAY

12.5 OIL & GAS

12.5.1 LCD

12.5.2 LED

12.5.2.1 FULL ARRAY

12.5.2.2 EDGE LIT

12.5.2.3 DIRECT LIT

12.5.3 OLED

12.5.3.1 AMOLED

12.5.3.2 PMOLED

12.5.4 E-PAPER DISPLAY

12.6 TRANSPORTATION

12.6.1 LCD

12.6.2 LED

12.6.2.1 FULL ARRAY

12.6.2.2 EDGE LIT

12.6.2.3 DIRECT LIT

12.6.3 OLED

12.6.3.1 AMOLED

12.6.3.2 PMOLED

12.6.4 E-PAPER DISPLAY

12.7 METAL & MINING

12.7.1 LCD

12.7.2 LED

12.7.2.1 FULL ARRAY

12.7.2.2 EDGE LIT

12.7.2.3 DIRECT LIT

12.7.3 OLED

12.7.3.1 AMOLED

12.7.3.2 PMOLED

12.7.4 E-PAPER DISPLAY

12.8 OTHERS

12.8.1 LCD

12.8.2 LED

12.8.2.1 FULL ARRAY

12.8.2.2 EDGE LIT

12.8.2.3 DIRECT LIT

12.8.3 OLED

12.8.3.1 AMOLED

12.8.3.2 PMOLED

12.8.4 E-PAPER DISPLAY

13 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY REGION

13.1 OVERVIEW

13.2 MIDDLE EAST AND AFRICA

13.2.1 U.A.E

13.2.2 SAUDI ARABIA

13.2.3 SOUTH AFRICA

13.2.4 EGYPT

13.2.5 ISRAEL

13.2.6 REST OF MIDDLE EAST AND AFRICA

14 COMPANY LAND SCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AU OPTRONICS CORP.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BOE TECHNOLOGY UK LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 INNOLUX CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SAMSUNG ELECTRONICS CO., LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 LG DISPLAY CO., LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 TIANMA MICROELECTRONICS CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADVANTECH CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 PANASONIC CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 EMERSON ELECTRIC CO.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 GENERAL DIGITAL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 JAPAN DISPLAY INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PEPPERL+FUCHS SE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 PLANAR

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 ROCKWELL AUTOMATION, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 SCHNEIDER ELECTRIC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 SHARP NEC DISPLAY SOLUTIONS, LTD. (A SUBSIDIARY OF NEC CORPORATION)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SHENZHEN TOPWAY TECHNOLOGY CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SIEMENS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 TRICOMTEK CO., LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA PANEL MOUNT MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA VIDEO WALLS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA OPEN FRAME MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA FRONT DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA REAR MOUNT MONITOR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA SDI DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA MULTI-TOUCH (P-CAP) DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA USB TYPE-C DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA UP TO 14 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA 14 INCHES TO 21 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA 21 TO 40 INCHES IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA 40 INCHES AND ABOVE IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA LCD IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA LED IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA OLED IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA E-PAPER DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SERIAL IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA ETHERNET IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA MOBILE NETWORK IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA INDUSTRIAL COMMUNICATION IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA RF/ZIGBEE/IR IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA JASON/MQTT IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA HMI IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA DIGITAL SIGNAGE IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA INTERACTIVE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA REMOTE MONITORING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA IMAGING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA ENERGY AND POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA ENERGY AND POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA MILITARY AND AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MILITARY AND AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA MILITARY AND AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA MILITARY AND AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.A.E INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.A.E RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 107 U.A.E RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 108 U.A.E MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 U.A.E INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 U.A.E LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 111 U.A.E OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 112 U.A.E INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 113 U.A.E INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 114 U.A.E INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 U.A.E INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 116 U.A.E MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 117 U.A.E MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 118 U.A.E MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 119 U.A.E ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 120 U.A.E ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 121 U.A.E ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 122 U.A.E MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 123 U.A.E MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 124 U.A.E MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 125 U.A.E OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 126 U.A.E OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 127 U.A.E OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 U.A.E TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 129 U.A.E TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 130 U.A.E TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 131 U.A.E METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 U.A.E METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 133 U.A.E METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 134 U.A.E OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 U.A.E OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 136 U.A.E OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 137 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 138 SAUDI ARABIA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 SAUDI ARABIA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 140 SAUDI ARABIA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 141 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 142 SAUDI ARABIA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 143 SAUDI ARABIA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 144 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 145 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 146 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 147 SAUDI ARABIA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 148 SAUDI ARABIA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 149 SAUDI ARABIA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 150 SAUDI ARABIA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 151 SAUDI ARABIA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 152 SAUDI ARABIA ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 153 SAUDI ARABIA ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 154 SAUDI ARABIA MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 SAUDI ARABIA MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 156 SAUDI ARABIA MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 SAUDI ARABIA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 SAUDI ARABIA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 159 SAUDI ARABIA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 160 SAUDI ARABIA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 SAUDI ARABIA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 SAUDI ARABIA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 SAUDI ARABIA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 164 SAUDI ARABIA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 165 SAUDI ARABIA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 166 SAUDI ARABIA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 167 SAUDI ARABIA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 168 SAUDI ARABIA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 169 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 170 SOUTH AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 171 SOUTH AFRICA RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 172 SOUTH AFRICA MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 173 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 174 SOUTH AFRICA LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 175 SOUTH AFRICA OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 176 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 177 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 178 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 179 SOUTH AFRICA INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 180 SOUTH AFRICA MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 SOUTH AFRICA MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 182 SOUTH AFRICA MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 183 SOUTH AFRICA ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 SOUTH AFRICA ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 SOUTH AFRICA ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 SOUTH AFRICA MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 187 SOUTH AFRICA MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 188 SOUTH AFRICA MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 189 SOUTH AFRICA OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 190 SOUTH AFRICA OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 191 SOUTH AFRICA OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 192 SOUTH AFRICA TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 193 SOUTH AFRICA TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 194 SOUTH AFRICA TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 195 SOUTH AFRICA METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 196 SOUTH AFRICA METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 197 SOUTH AFRICA METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 198 SOUTH AFRICA OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 199 SOUTH AFRICA OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 200 SOUTH AFRICA OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 201 EGYPT INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 202 EGYPT RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 203 EGYPT RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 204 EGYPT MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 205 EGYPT INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 206 EGYPT LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 207 EGYPT OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 208 EGYPT INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 209 EGYPT INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 210 EGYPT INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 211 EGYPT INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 212 EGYPT MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 213 EGYPT MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 214 EGYPT MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 215 EGYPT ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 216 EGYPT ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 217 EGYPT ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 218 EGYPT MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 219 EGYPT MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 220 EGYPT MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 221 EGYPT OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 222 EGYPT OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 223 EGYPT OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 224 EGYPT TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 225 EGYPT TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 226 EGYPT TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 227 EGYPT METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 228 EGYPT METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 229 EGYPT METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 230 EGYPT OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 231 EGYPT OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 232 EGYPT OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 233 ISRAEL INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 234 ISRAEL RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 235 ISRAEL RUGGED DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY LEVEL OF RUGGEDNESS, 2019-2028 (USD MILLION)

TABLE 236 ISRAEL MARINE DISPLAY IN INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 237 ISRAEL INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 238 ISRAEL LED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 239 ISRAEL OLED IN INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 240 ISRAEL INDUSTRIAL DISPLAY MARKET, BY COMMUNICATION TYPE, 2019-2028 (USD MILLION)

TABLE 241 ISRAEL INDUSTRIAL DISPLAY MARKET, BY PANEL SIZE, 2019-2028 (USD MILLION)

TABLE 242 ISRAEL INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 243 ISRAEL INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 244 ISRAEL MANUFACTURING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 245 ISRAEL MANUFACTURING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 246 ISRAEL MANUFACTURING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 247 ISRAEL ENERGY & POWER IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 248 ISRAEL ENERGY & POWER IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 249 ISRAEL ENERGY & POWER IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 250 ISRAEL MILITARY & AVIONICS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 251 ISRAEL MILITARY & AVIONICS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 252 ISRAEL MILITARY & AVIONICS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 253 ISRAEL OIL & GAS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 254 ISRAEL OIL & GAS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 255 ISRAEL OIL & GAS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 256 ISRAEL TRANSPORTATION IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 257 ISRAEL TRANSPORTATION IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 258 ISRAEL TRANSPORTATION IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 259 ISRAEL METAL & MINING IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 260 ISRAEL METAL & MINING IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 261 ISRAEL METAL & MINING IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 262 ISRAEL OTHERS IN INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 263 ISRAEL OTHERS IN LED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 264 ISRAEL OTHERS IN OLED FOR INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 265 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN MANUFACTURING AND PROCESS INDUSTRIES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 RUGGED DISPLAYS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 15 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET

FIGURE 16 SHIPMENTS PROJECTION OF INSTALLATION BASED DIGITAL SIGNAGE DISPLAYS

FIGURE 17 OLED SMARTPHONE PANEL SHIPMENT

FIGURE 1 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY TYPE, 2020

FIGURE 2 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY PANEL SIZE, 2020

FIGURE 3 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 4 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY COMMUNICATION TYPE, 2020

FIGURE 5 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 6 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 7 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 8 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY REGION (2020)

FIGURE 9 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY REGION (2021 & 2028)

FIGURE 10 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY REGION (2020 & 2028)

FIGURE 11 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY TYPE (2021-2028)

FIGURE 12 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 13 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 14 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 15 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 16 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: BY TYPE (2021-2028)

FIGURE 17 MIDDLE EAST AND AFRICA INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.