Middle East And Africa Fraud Detection Transaction Monitoring Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

2.22 Billion

USD

10.00 Billion

2024

2032

USD

2.22 Billion

USD

10.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.22 Billion | |

| USD 10.00 Billion | |

|

|

|

|

تجزئة سوق مراقبة معاملات كشف الاحتيال في الشرق الأوسط وأفريقيا، حسب العرض (الحلول والخدمات)، الوظيفة (اعرف عميلك/انضم إلى الخدمة، إدارة الحالات، فحص قوائم المراقبة، لوحة المعلومات وإعداد التقارير، وغيرها)، النشر (داخليًا وسحابيًا)، حجم المؤسسة (المؤسسات الكبيرة والصغيرة والمتوسطة)، التطبيق (كشف الاحتيال في الدفع، كشف غسيل الأموال، حماية الحسابات، منع سرقة الهوية، وغيرها)، القطاع الرأسي (الخدمات المصرفية والمالية والتأمين، تجارة التجزئة، تكنولوجيا المعلومات والاتصالات، الحكومة والدفاع، الرعاية الصحية، التصنيع، الطاقة والمرافق، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

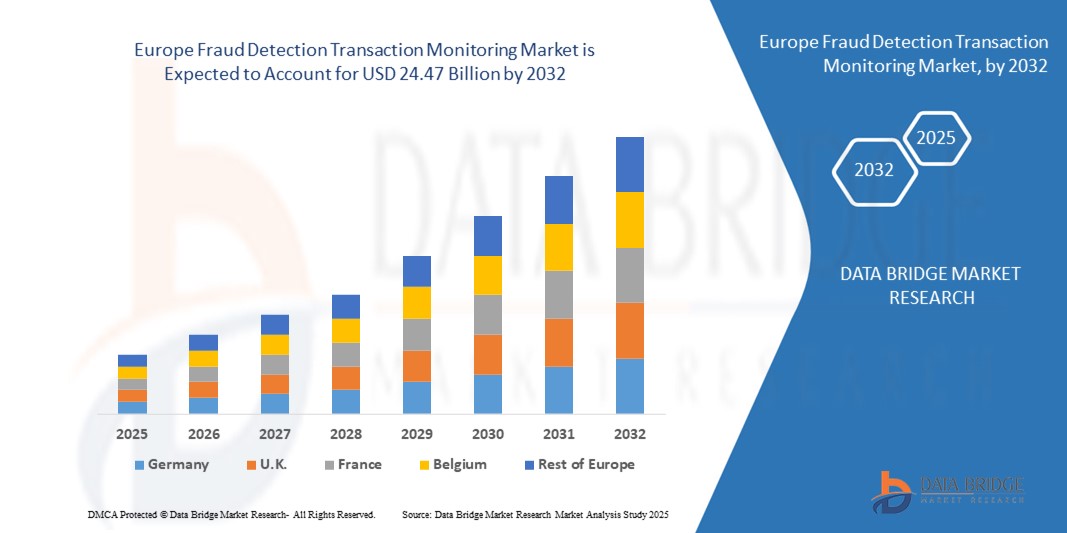

- تم تقييم حجم سوق مراقبة معاملات الكشف عن الاحتيال في الشرق الأوسط وأفريقيا بـ 2.22 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 10.00 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 20.7٪ خلال الفترة المتوقعة.

- يتم دعم نمو السوق إلى حد كبير من خلال الرقمنة المتزايدة للمعاملات المالية، والاعتماد المتزايد على الخدمات المصرفية عبر الإنترنت ومنصات الدفع الرقمية، ودمج تقنيات الذكاء الاصطناعي والتعلم الآلي للكشف عن الاحتيال في الوقت الفعلي عبر قطاعات الخدمات المصرفية والمالية والتأمين وتجارة التجزئة والتجارة الإلكترونية.

- علاوة على ذلك، فإن متطلبات الامتثال التنظيمي المتزايدة، بما في ذلك متطلبات معرفة العميل (KYC) ومكافحة غسل الأموال (AML) ومكافحة الاحتيال، إلى جانب الحاجة المتزايدة إلى أنظمة مراقبة معاملات آمنة وفعالة وآلية، تدفع المؤسسات إلى اعتماد حلول متطورة للكشف عن الاحتيال. تُسرّع هذه العوامل المتقاربة من نشر منصات المراقبة الشاملة، مما يُعزز نمو القطاع بشكل كبير.

تحليل سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

- تساعد حلول رصد معاملات كشف الاحتيال المؤسسات على تحديد الأنشطة الاحتيالية ومنعها والحد منها من خلال تحليل المعاملات آنيًا باستخدام الذكاء الاصطناعي والتعلم الآلي والتحليلات التنبؤية. توفر هذه الأنظمة تنبيهات وتسجيلًا آليًا للمخاطر وتقارير الامتثال لحماية الأصول المالية والتشغيلية.

- إن الطلب المتزايد على هذه الحلول مدفوع في المقام الأول بالزيادة الكبيرة في المعاملات عبر الإنترنت، وتزايد تعقيد مخططات الاحتيال الإلكتروني، والحاجة الملحة للمؤسسات لضمان الامتثال التنظيمي مع حماية بيانات العملاء والحفاظ على الثقة.

- سيطرت دولة الإمارات العربية المتحدة على سوق مراقبة معاملات الكشف عن الاحتيال في عام 2024، وذلك بفضل التحول الرقمي السريع للخدمات المصرفية والمالية في البلاد، والاعتماد الكبير على المدفوعات عبر الإنترنت والهاتف المحمول، والأطر التنظيمية القوية التي تفرض الامتثال لمعايير KYC ومكافحة غسل الأموال.

- من المتوقع أن تكون جنوب إفريقيا أسرع دولة نموًا في سوق مراقبة معاملات الكشف عن الاحتيال خلال فترة التنبؤ بسبب زيادة اعتماد المدفوعات الرقمية والخدمات المصرفية عبر الهاتف المحمول ومنصات الكشف عن الاحتيال التي تعمل بالذكاء الاصطناعي.

- هيمن قطاع الحلول على السوق بحصة سوقية بلغت 62.9% في عام 2024، وذلك بفضل الحاجة المتزايدة إلى برامج متطورة للكشف عن الاحتيال، تدمج الذكاء الاصطناعي والتعلم الآلي والتحليلات الفورية. وتعتمد المؤسسات في قطاعات الخدمات المصرفية والمالية والتأمين، وتجارة التجزئة، والاتصالات بشكل متزايد على منصات الكشف عن الاحتيال لحماية المعاملات، وتقليل الخسائر المالية، وضمان الامتثال للوائح التنظيمية. إن قابلية توسع الحلول، وقدرتها على توفير رؤى تنبؤية، وتكاملها السلس مع أنظمة المؤسسات، تجعلها الخيار الأمثل للمؤسسات التي تُولي الأولوية للأمن والكفاءة التشغيلية.

نطاق التقرير وتجزئة سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

|

صفات |

اكتشاف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا - رؤى السوق الرئيسية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الشرق الأوسط وأفريقيا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة. |

اتجاهات سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

استخدام الذكاء الاصطناعي للكشف عن الاحتيال في الوقت الفعلي

- يُحدث الاعتماد المتزايد على الذكاء الاصطناعي للكشف الفوري عن الاحتيال تغييرًا جذريًا في سوق مراقبة معاملات كشف الاحتيال. وتستفيد المؤسسات المالية والشركات من الأنظمة المدعومة بالذكاء الاصطناعي للكشف الفوري عن الأنشطة المشبوهة، وتقليل النتائج الإيجابية الخاطئة، وتحسين دقة الكشف بشكل عام في شبكات المعاملات المتزايدة التعقيد.

- على سبيل المثال، تستخدم ماستركارد أدوات كشف الاحتيال المدعومة بالذكاء الاصطناعي، والتي تُحلل أنماط المعاملات آنيًا لاعتراض الأنشطة الاحتيالية قبل اكتمالها. وبالمثل، تستخدم فيتشر سبيس تحليلات سلوكية تكيفية مدعومة بتقنيات التعلم الآلي لتمكين البنوك وشركات الدفع من تحديد أي خلل في المعاملات المالية واسعة النطاق بدقة أكبر.

- يُعزز استخدام الذكاء الاصطناعي بشكل كبير قدرات كشف الاحتيال من خلال تحليل كميات هائلة من البيانات المُهيكلة وغير المُهيكلة في ثوانٍ، وهو أمرٌ تعجز عنه الأنظمة التقليدية القائمة على القواعد. يُمكّن هذا المؤسسات من مواجهة أساليب الاحتيال المُتقدمة، مثل الهويات المُصطنعة، والاستيلاء على الحسابات، والاحتيال في المعاملات العابرة للحدود، بفعالية.

- تُساعد تقنيات الذكاء الاصطناعي أيضًا على تقليل معدل الرفض الكاذب الذي قد يؤثر سلبًا على تجربة العملاء في القطاع المالي. فمن خلال تحسين دقة الكشف، تحمي أنظمة الذكاء الاصطناعي الآنية المؤسسات من الخسائر المالية، كما تحافظ على ثقة العملاء وولائهم.

- أدى توسع أنظمة الدفع الرقمية، بما في ذلك المحافظ الإلكترونية ومنصات التجارة الإلكترونية والتحويلات بين الأقران، إلى زيادة الحاجة إلى منع الاحتيال الفوري. توفر أنظمة مراقبة المعاملات القائمة على الذكاء الاصطناعي إمكانيات تكيفية آنية تتيح التكامل السلس مع الشبكات المالية عالية السرعة.

- في الختام، يُسهم اعتماد الذكاء الاصطناعي للكشف الفوري عن الاحتيال في إحداث تحول سريع في هذا القطاع. ويُبرز هذا التوجه الحاجة المتزايدة لأطر مراقبة مرنة وذكية وتنبؤية، قادرة على التكيف مع أساليب الاحتيال المتطورة، وتوفير معاملات مالية آمنة وسلسة في جميع أنحاء العالم.

ديناميكيات سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

سائق

زيادة التركيز على التحقق من الهوية والمصادقة

- يُعدّ التركيز المتزايد على التحقق من الهوية والمصادقة عاملاً رئيسياً في تسريع اعتماد أنظمة مراقبة المعاملات. مع ازدياد المعاملات الرقمية، تُعطي المؤسسات المالية الأولوية لأساليب مصادقة الهوية المتقدمة لحماية المستخدمين من سرقة الهوية، والاحتيال في الاستيلاء على الحسابات، والوصول غير المصرح به.

- على سبيل المثال، دمجت شركة إكسبيريان أدوات متقدمة للتحقق من الهوية ضمن حلولها للكشف عن الاحتيال، مستخدمةً المصادقة البيومترية والتحقق متعدد العوامل لتعزيز أمان المعاملات. وبالمثل، تستخدم شركات مثل ليكسيس نيكسيس لحلول المخاطر الذكاء الاصطناعي والبيانات الضخمة لتمكين المؤسسات المالية من التحقق من هويات العملاء آنيًا مع تقليل الاحتكاك في تجربة المستخدم.

- يُعزز دمج العوامل البيومترية، مثل التعرف على الوجه وبصمات الأصابع والتحليلات السلوكية، من تخفيف المخاطر في الخدمات المصرفية والتجارة الإلكترونية والاتصالات. تُوفر هذه الإجراءات إمكانيات تحقق قوية تُكمّل مراقبة المعاملات وتُقلل من نقاط الضعف في حسابات المستخدمين.

- يُعزز المشهد التنظيمي، لا سيما مع وجود أطر عمل مثل متطلبات "اعرف عميلك" (KYC) ومكافحة غسل الأموال (AML)، الحاجة إلى أدوات قوية للتحقق من الهوية والمصادقة. يجب على المؤسسات المالية اعتماد حلول مراقبة متقدمة لضمان الامتثال وتقليل الغرامات التنظيمية.

- بشكل عام، يُعزز التركيز المتزايد على التحقق من الهوية والمصادقة الثقة العالمية بالقنوات الرقمية. ويضمن هذا المحرك استمرار تطور أنظمة رصد المعاملات وكشف الاحتيال كأدوات أساسية لتأمين الخدمات المالية وحماية علاقات العملاء.

ضبط النفس/التحدي

ارتفاع الاستثمار الأولي وتكاليف الصيانة المستمرة

- من التحديات الكبيرة في سوق مراقبة معاملات كشف الاحتيال الاستثمار المالي الكبير اللازم للتنفيذ والصيانة المستمرة. يتطلب نشر أنظمة مراقبة متطورة مدعومة بالذكاء الاصطناعي استثمارات رأسمالية ضخمة في منصات البرمجيات وتقنيات التكامل والكوادر المؤهلة، مما يُعيق عمل المؤسسات المالية والشركات الصغيرة.

- على سبيل المثال، تستطيع البنوك الكبيرة، مثل جي بي مورغان تشيس، تطبيق منصات رصد الاحتيال في الوقت الفعلي، مدعومة بالذكاء الاصطناعي، مع قدرات تنبؤية. ومع ذلك، غالبًا ما تواجه المؤسسات المتوسطة والإقليمية صعوبات في تكاليف التنفيذ المرتفعة، وتجد صعوبة في تبرير نفقاتها، لا سيما في الأسواق ذات هوامش الربح الضئيلة.

- يزيد تعقيد إدارة هذه الأنظمة وصيانتها من التكاليف طويلة الأجل. فالتحديثات المستمرة ضرورية للحفاظ على نماذج التهديدات، بينما تزيد النفقات التشغيلية، مثل ضبط النظام وسعة التخزين السحابي وأدوات التحليلات المتقدمة، من العبء المالي على المؤسسات.

- بالإضافة إلى ذلك، تنشأ تحديات التوسع مع تزايد أحجام المعاملات، مما يتطلب من المؤسسات الاستثمار بشكل أكبر في البنية التحتية وأنظمة الدعم. ويؤثر هذا على المؤسسات ذات الميزانيات المحدودة التي توازن بالفعل بين تكاليف الامتثال وضغوط الأرباح.

- نتيجةً لذلك، تُحدّ التكاليف الأولية المرتفعة، إلى جانب نفقات الصيانة المستمرة، من انتشار حلول رصد معاملات كشف الاحتيال. ويتطلب التغلب على هذا التحدي تطوير منصات فعّالة من حيث التكلفة، ونماذج اشتراك سحابية، وعروض خدمات مشتركة لتوسيع نطاق الوصول للمؤسسات من جميع الأحجام.

نطاق سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

يتم تقسيم السوق على أساس العرض والوظيفة والنشر وحجم المنظمة والتطبيق والعمودي.

- عن طريق العرض

بناءً على العرض، يُقسّم السوق إلى حلول وخدمات. وقد هيمن قطاع الحلول على أكبر حصة من إيرادات السوق بنسبة 62.9% في عام 2024، مدفوعًا بالحاجة المتزايدة إلى برامج متطورة للكشف عن الاحتيال تدمج الذكاء الاصطناعي والتعلم الآلي والتحليلات الفورية. وتعتمد المؤسسات في قطاعات الخدمات المصرفية والمالية والتأمين (BFSI) وتجارة التجزئة والاتصالات بشكل متزايد على منصات الكشف عن الاحتيال لحماية المعاملات وتقليل الخسائر المالية وضمان الامتثال للوائح التنظيمية. إن قابلية توسع الحلول، وقدرتها على توفير رؤى تنبؤية، وتكاملها السلس مع أنظمة المؤسسات، تجعلها الخيار الأمثل للمؤسسات التي تُولي الأولوية للأمن والكفاءة التشغيلية.

من المتوقع أن يشهد قطاع الخدمات أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالطلب المتزايد على الخدمات المُدارة والاستشارات والدعم الفني. وتلجأ الشركات بشكل متزايد إلى الاستعانة بمصادر خارجية لرصد الاحتيال من قِبل مُقدمي الخدمات نظرًا لنقص الخبرة الداخلية وصعوبة التعامل مع التهديدات السيبرانية المُتطورة. كما أن الطفرة في عروض كشف الاحتيال القائمة على الاشتراكات، وخدمات التدريب، ودعم المراقبة على مدار الساعة طوال أيام الأسبوع تُسرّع من وتيرة تبني هذه الخدمات. ويكتسب مُقدمو الخدمات الذين يُقدمون حلولًا استشارية مُصممة خصيصًا ومُركزة على الامتثال زخمًا متزايدًا، لا سيما بين الشركات الصغيرة والمتوسطة التي تسعى إلى حلول فعّالة من حيث التكلفة وقابلة للتطوير لمنع الاحتيال.

- حسب الوظيفة

بناءً على الوظيفة، يُقسّم السوق إلى: KYC/Customer Onboarding، وإدارة الحالات، وفحص قوائم المراقبة، ولوحة المعلومات وإعداد التقارير، وغيرها. وقد حقق قطاع KYC/Customer Onboarding أكبر حصة من إيرادات السوق في عام 2024، بفضل تزايد اللوائح التنظيمية ومتطلبات الامتثال في القطاع المالي. وتعتمد المؤسسات المالية وشركات التكنولوجيا المالية والبنوك الرقمية على حلول KYC فعّالة للتحقق من الهوية، ومنع فتح الحسابات الاحتيالية، وتعزيز ثقة العملاء. وقد عزز اعتماد التحقق البيومتري، وE-KYC، ومنصات التسجيل الرقمي، هيمنته، مما يضمن الكفاءة التشغيلية ويقلل من التعرض للمخاطر المالية.

من المتوقع أن يشهد قطاع فحص قوائم المراقبة أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد الضغط العالمي للامتثال للوائح مكافحة غسل الأموال وتمويل الإرهاب. وتنشر المؤسسات أدوات فحص متطورة لمراقبة المعاملات في ضوء العقوبات العالمية، وقواعد بيانات الأشخاص المعرضين سياسيًا، والإعلام السلبي. ويدفع ازدياد المدفوعات العابرة للحدود والتجارة الدولية الشركات إلى إعطاء الأولوية لحلول الفحص الآلية والفورية التي تقلل من مخاطر الامتثال والعقوبات التنظيمية.

- حسب النشر

بناءً على طريقة النشر، يُقسّم السوق إلى محلي وسحابي. وقد هيمن قطاع المحلي على أكبر حصة من إيرادات السوق في عام 2024، حيث تواصل الشركات الكبرى والهيئات الحكومية إعطاء الأولوية لأقصى قدر من التحكم في البيانات، وتخصيص الأنظمة، وتعزيز الأمان. ولا يزال النشر المحلي شائعًا في القطاعات شديدة التنظيم، مثل البنوك والدفاع، حيث تُطبّق متطلبات صارمة تتعلق بسيادة البيانات وسريتها. كما تُسهم القدرة على دمج أدوات مراقبة الاحتيال المحلية بدقة مع أنظمة تكنولوجيا المعلومات القديمة في انتشار استخدامه على نطاق واسع.

من المتوقع أن يشهد قطاع الحوسبة السحابية أسرع معدل نمو سنوي مركب بين عامي 2025 و2032، بفضل قابليته للتوسع، وفعاليته من حيث التكلفة، وقدرته على دعم المراقبة الفورية عبر الشبكات الموزعة. توفر حلول كشف الاحتيال السحابية للمؤسسات تحديثات فورية للبرامج، وتحليلات قائمة على الذكاء الاصطناعي، ومرونة في التكيف مع أنماط الاحتيال المتطورة. وقد أدى التبني السريع للمدفوعات الرقمية، والعمل عن بُعد، والخدمات المصرفية عبر الإنترنت إلى تسريع تبني الحوسبة السحابية، لا سيما بين الشركات الصغيرة والمتوسطة التي تبحث عن منصات آمنة لمراقبة الاحتيال قائمة على الاشتراكات بتكاليف بنية تحتية أولية منخفضة.

- حسب حجم المنظمة

بناءً على حجم المؤسسة، يُقسّم السوق إلى شركات كبيرة وشركات صغيرة ومتوسطة. وقد استحوذت الشركات الكبيرة على أكبر حصة سوقية في عام 2024، حيث تواجه الشركات العالمية مخاطر كبيرة ناجمة عن محاولات احتيال واسعة النطاق، ومخططات غسل الأموال، والهجمات الإلكترونية. وتستثمر هذه المؤسسات بكثافة في منصات رصد الاحتيال المدعومة بالذكاء الاصطناعي، والتحليلات المتقدمة، وأنظمة إدارة المخاطر على مستوى المؤسسة. ويضمن توافر الميزانيات الأعلى، والأولويات القائمة على الامتثال، والتكامل مع العمليات متعددة القنوات، بقاء الشركات الكبيرة في صدارة الشركات التي تتبنى حلول كشف الاحتيال.

من المتوقع أن ينمو قطاع الشركات الصغيرة والمتوسطة بأسرع وتيرة بين عامي 2025 و2032، مدفوعًا بتزايد تعرضها للاحتيال الإلكتروني والتصيد الاحتيالي والاستيلاء على الحسابات. وتعتمد الشركات الصغيرة والمتوسطة أدوات فعّالة من حيث التكلفة للكشف عن الاحتيال قائمة على السحابة، توفر حماية آلية دون الحاجة إلى بنية تحتية تقنية معلوماتية واسعة. ويدفع تزايد اعتماد حلول الدفع الرقمي، إلى جانب تنامي الوعي بالتزامات الامتثال، الشركات الصغيرة والمتوسطة إلى اعتماد منصات مراقبة الاحتيال. وتجعل نماذج التسعير القائمة على الاشتراك وخدمات الكشف عن الاحتيال المُدارة هذه الحلول جذابة للغاية للشركات الصغيرة.

- حسب الطلب

بناءً على التطبيق، يُقسّم السوق إلى: كشف الاحتيال في الدفع، وكشف غسل الأموال، وحماية الحسابات، ومنع سرقة الهوية، وغيرها. هيمن قطاع كشف الاحتيال في الدفع على السوق في عام 2024، بفضل النمو السريع للمدفوعات الرقمية، ومعاملات التجارة الإلكترونية، والخدمات المصرفية عبر الهاتف المحمول. دفع تزايد حالات المعاملات غير المصرح بها، والاحتيال على البطاقات، وهجمات التصيد الاحتيالي، البنوك وتجار التجزئة إلى اعتماد أنظمة كشف الاحتيال المدعومة بالذكاء الاصطناعي. وقد جعل تحليل المعاملات في الوقت الفعلي، وتسجيل الاحتيال التنبئي، والتكامل مع بوابات الدفع، هذا القطاع التطبيق الأكثر انتشارًا في مختلف القطاعات.

من المتوقع أن يُسجل قطاع حماية الحسابات من الاختراق أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالتطور المتزايد في سرقة بيانات الاعتماد، وعمليات التصيد الاحتيالي، وهجمات الهندسة الاجتماعية. يستهدف المحتالون حسابات المستخدمين في قطاعات الخدمات المصرفية، والتجزئة، والاتصالات، مما يجعل اختراق الحسابات مصدر قلق بالغ. وتعتمد الشركات على المصادقة متعددة العوامل، والقياسات الحيوية السلوكية، والمراقبة المدعومة بالذكاء الاصطناعي للكشف عن أي خلل في أنماط وصول المستخدمين. ويعزز الارتفاع الكبير في عدد الحسابات الإلكترونية، والمحافظ الرقمية، والخدمات السحابية، اعتماد حلول حماية الحسابات من الاختراق.

- بالعمودي

بناءً على القطاعات، يُقسّم السوق إلى قطاعات الخدمات المصرفية، والخدمات المالية والتأمين (BFSI)، وتجارة التجزئة، وتكنولوجيا المعلومات والاتصالات، والحكومة والدفاع، والرعاية الصحية، والتصنيع، والطاقة والمرافق، وغيرها. وقد هيمن قطاع الخدمات المصرفية والمالية والتأمين على أكبر حصة من إيرادات السوق في عام 2024، حيث لا تزال البنوك والمؤسسات المالية هي الأهداف الرئيسية للمحتالين. ويستثمر القطاع بكثافة في منصات كشف الاحتيال لتأمين المعاملات الرقمية، ومكافحة غسل الأموال، والامتثال للأطر التنظيمية الصارمة مثل مكافحة غسل الأموال (AML) و"اعرف عميلك" (KYC). ويواصل التوسع السريع في ابتكارات الخدمات المصرفية الإلكترونية والتكنولوجيا المالية تعزيز اعتماد حلول متقدمة لمراقبة الاحتيال في قطاع الخدمات المصرفية والمالية والتأمين.

من المتوقع أن يشهد قطاع الرعاية الصحية أسرع معدل نمو سنوي مركب بين عامي 2025 و2032، مدفوعًا بارتفاع حالات سرقة الهوية الطبية، والاحتيال في التأمين، واختراق البيانات. مع تزايد رقمنة السجلات الصحية وأنظمة فوترة المرضى، ينشر مقدمو الرعاية الصحية منصات كشف الاحتيال لحماية البيانات الحساسة. ويجري حاليًا اعتماد أنظمة تحليل ومراقبة قائمة على الذكاء الاصطناعي للكشف عن المطالبات الاحتيالية ومنع الوصول غير المصرح به إلى المعلومات الطبية. كما أن الجهود التنظيمية المتزايدة لتأمين بيانات المرضى تُسرّع من اعتماد مراقبة الاحتيال في هذا القطاع.

تحليل إقليمي لسوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

- سيطرت دولة الإمارات العربية المتحدة على سوق مراقبة معاملات الكشف عن الاحتيال بأكبر حصة من الإيرادات في عام 2024، مدفوعة بالتحول الرقمي السريع للخدمات المصرفية والمالية في البلاد، والاعتماد الكبير على المدفوعات عبر الإنترنت والهاتف المحمول، والأطر التنظيمية القوية التي تفرض الامتثال لمعايير اعرف عميلك ومكافحة غسل الأموال.

- تعززت قيادة الدولة باستثمارات كبيرة في أنظمة رصد الاحتيال القائمة على الذكاء الاصطناعي، وتحليلات المعاملات الفورية، والبنية التحتية للأمن السيبراني. كما أن وجود مؤسسات مالية كبرى، ومراكز ابتكار في مجال التكنولوجيا المالية، وأنظمة دفع رقمية متينة، يعزز مكانة الإمارات العربية المتحدة في السوق الإقليمية.

- إن الوعي المتزايد بين المستهلكين والشركات حول المعاملات الرقمية الآمنة، ودمج حلول الكشف الآلي عن الاحتيال عبر قطاعات التجزئة والخدمات المصرفية، والدعم الحكومي المستمر لمبادرات التمويل الرقمي، كلها عوامل تعزز نمو السوق.

نظرة عامة على سوق كشف الاحتيال ومراقبة المعاملات في جنوب أفريقيا

من المتوقع أن تُسجل جنوب أفريقيا أسرع معدل نمو سنوي مركب في سوق الشرق الأوسط وأفريقيا بين عامي 2025 و2032، مدعومةً بزيادة اعتماد المدفوعات الرقمية، والخدمات المصرفية عبر الهاتف المحمول، ومنصات كشف الاحتيال المدعومة بالذكاء الاصطناعي. ويساهم توسع التجارة الإلكترونية والخدمات المصرفية عبر الإنترنت، إلى جانب التركيز المتزايد على الامتثال لمتطلبات "اعرف عميلك" و"مكافحة غسل الأموال"، في تسريع تبني السوق. كما أن تزايد طلب المستهلكين على المعاملات المالية الآمنة، والاستثمارات في أنظمة المراقبة الآنية، والمبادرات الرامية إلى تعزيز الأمن السيبراني في قطاعي البنوك والتجزئة، تُعزز النمو. كما أن تركيز مزودي التكنولوجيا المحليين على حلول كشف الاحتيال بأسعار معقولة وقابلة للتطوير يُعزز إمكانية الوصول وتوسع السوق.

تحليل سوق كشف الاحتيال ومراقبة المعاملات في المملكة العربية السعودية

من المتوقع أن تشهد المملكة العربية السعودية نموًا مطردًا بين عامي 2025 و2032، مدفوعًا بالمبادرات الحكومية لتحديث الخدمات المصرفية والمالية، وتعزيز الشمول المالي، وتعزيز الامتثال التنظيمي لمكافحة الاحتيال. ويساهم تزايد استخدام منصات الدفع عبر الهاتف المحمول وعبر الإنترنت، وزيادة المعاملات الرقمية، وتنامي الوعي بتهديدات الأمن السيبراني، في توسع السوق. كما أن الاستثمار في تقنيات مراقبة الاحتيال المتقدمة، والتعاون مع مقدمي خدمات التكنولوجيا المالية، ودمج تحليلات المعاملات القائمة على الذكاء الاصطناعي والفورية، يدعم هذا التوجه. ويساهم التركيز المتزايد على الخدمات المالية الرقمية الآمنة والفعالة في تعزيز مكانة المملكة العربية السعودية كسوق متنامية باستمرار في المنطقة.

حصة سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

إن صناعة مراقبة معاملات الكشف عن الاحتيال يقودها في المقام الأول شركات راسخة، بما في ذلك:

- Amazon Web Services, Inc. (الولايات المتحدة)

- ليكسيس نيكسيس (الولايات المتحدة)

- ماستركارد (الولايات المتحدة)

- شركة تاتا للخدمات الاستشارية المحدودة (الهند)

- شركة فيسيرف (الولايات المتحدة)

- معهد SAS (الولايات المتحدة)

- ACI العالمية (الولايات المتحدة)

- أوراكل (الولايات المتحدة)

- نيس (إسرائيل)

- فيكو (الولايات المتحدة)

- سيمفوني ايه اي (الولايات المتحدة)

- أوبيكويتي (الولايات المتحدة)

- حلول فيرافين يو إل سي (كندا)

- مجموعة جي بي بي إل سي ('جي بي جي') (المملكة المتحدة)

- INFORM SOFTWARE (ألمانيا)

- كوانتيكسا (المملكة المتحدة)

- شركة سوم آند سابستانس المحدودة (المملكة المتحدة)

- شركة DataVisor، المحدودة (الولايات المتحدة)

- هوك (ألمانيا)

- شركة فيتشر سبيس المحدودة (إنجلترا)

- شركة INETCO Systems المحدودة (كندا)

- شركة أبرا للابتكارات (الولايات المتحدة)

- شركة سيون للتكنولوجيا المحدودة (المجر)

- فيدزاي (البرتغال)

- ماسح العقوبات (المملكة المتحدة)

أحدث التطورات في سوق كشف الاحتيال ومراقبة المعاملات في الشرق الأوسط وأفريقيا

- في يونيو 2024، عززت أمريكان إكسبريس الكشف عن الاحتيال باستخدام نماذج الذاكرة طويلة المدى (LSTM) المدعومة بالذكاء الاصطناعي. ومن خلال الاستفادة من الحوسبة المتوازية على وحدات معالجة الرسومات (GPU)، عالجت الشركة وحللت كميات هائلة من بيانات المعاملات بسرعة، مما أتاح الكشف الفوري عن الاحتيال. وقد ساعد هذا النهج أمريكان إكسبريس على التعامل مع التعقيدات الناجمة عن حجم معاملاتها الكبير. وقد عزز دمج الحوسبة المتسارعة والذكاء الاصطناعي قدرتها على الكشف عن الشذوذ بسرعة، مما حسّن الكفاءة التشغيلية وقلّل الخسائر المحتملة الناجمة عن الاحتيال.

- في يونيو 2024، عززت شركة DataVisor, Inc. قدراتها على تعدد المستأجرين لتوفير حلول قابلة للتطوير وآمنة ومرنة لمنع الاحتيال ومكافحة غسل الأموال. مكّن هذا التحديث المؤسسات من تخصيص استراتيجيات مكافحة الاحتيال وغسل الأموال ونشرها عبر المستأجرين الفرعيين مع ميزات مثل نماذج التعلم الآلي وقواعد العمل. دعمت هذه التحسينات البنوك الراعية في الامتثال، ومكّنت المؤسسات المالية الكبيرة من مركزية البيانات مع توفير إمكانية اتخاذ القرارات المتعلقة بالمستأجرين الفرعيين. أفاد هذا التطوير شركة DataVisor بتعزيز مكانتها في السوق وزيادة اعتماد حلولها بين المؤسسات المصرفية والمالية، مما عزز رضا العملاء واحتفاظهم بهم.

- في يونيو 2024، أطلقت ACI Worldwide وRS2 حلاً شاملاً للدفع في البرازيل، يجمع بين تقنياتهما في الاستحواذ والإصدار. أتاحت هذه المنصة السحابية للمؤسسات المالية ومقدمي خدمات الدفع طرح منتجات وخدمات جديدة بكفاءة، مما عزز الأمان وخفض التكاليف. وقد أفاد دمج إدارة الاحتيال المتقدمة والتحليلات الفورية الشركتين من خلال توسيع نطاق وصولهما إلى السوق وزيادة فرص تحقيق الإيرادات.

- في أكتوبر 2023، دخلت ACI Worldwide في شراكة مع Nymcard لتعزيز قدراتها في مجال مكافحة الاحتيال وغسيل الأموال. مكّنت هذه الشراكة Nymcard من الكشف عن الاحتيال المالي ومنعه بسرعة وكفاءة باستخدام تقنيات التعلم الآلي والتحليلات المتقدمة. وقد حسّن النشر عبر السحابة العامة لـ ACI قابلية التوسع والأمان والكفاءة التشغيلية، مما عزز بشكل كبير مكانة Nymcard في سوق منطقة الشرق الأوسط وشمال أفريقيا.

- في يوليو 2023، ووفقًا لمدونة بلو إنت، واجهت الشركات تحديات متزايدة في كشف الاحتيال نظرًا لضخامة حجم المعاملات. وتم اعتماد تقنيات متقدمة وأنظمة آلية لتحليل مجموعات البيانات الضخمة ورصد الاتجاهات والاختلالات عالية المخاطر. ورغم صعوبة إدارة البيانات غير المنظمة، حيث تحدث معظم عمليات الاحتيال، فقد مكّنت تحليلات بيانات الجرائم المالية من مراجعة البيانات المنظمة وغير المنظمة بفعالية. وساعد هذا النهج في منع الأنشطة الاحتيالية ودمج مصادر بيانات متنوعة لتحسين الكشف.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.