سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا، حسب النوع (الهيدروكولويدات، البروتين ، النشا، البكتين ، وغيرها)، الشكل ( مسحوق ، حبيبات، هلام ، وغيرها)، الطبيعة (غير المعدلة وراثيا والمعدلة وراثيا )، المصدر (نباتي، حيواني، بحري، وميكروبي)، التطبيق ( الأغذية والمشروبات)، الدولة (جنوب أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، الكويت، وبقية دول الشرق الأوسط وأفريقيا) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى : سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا

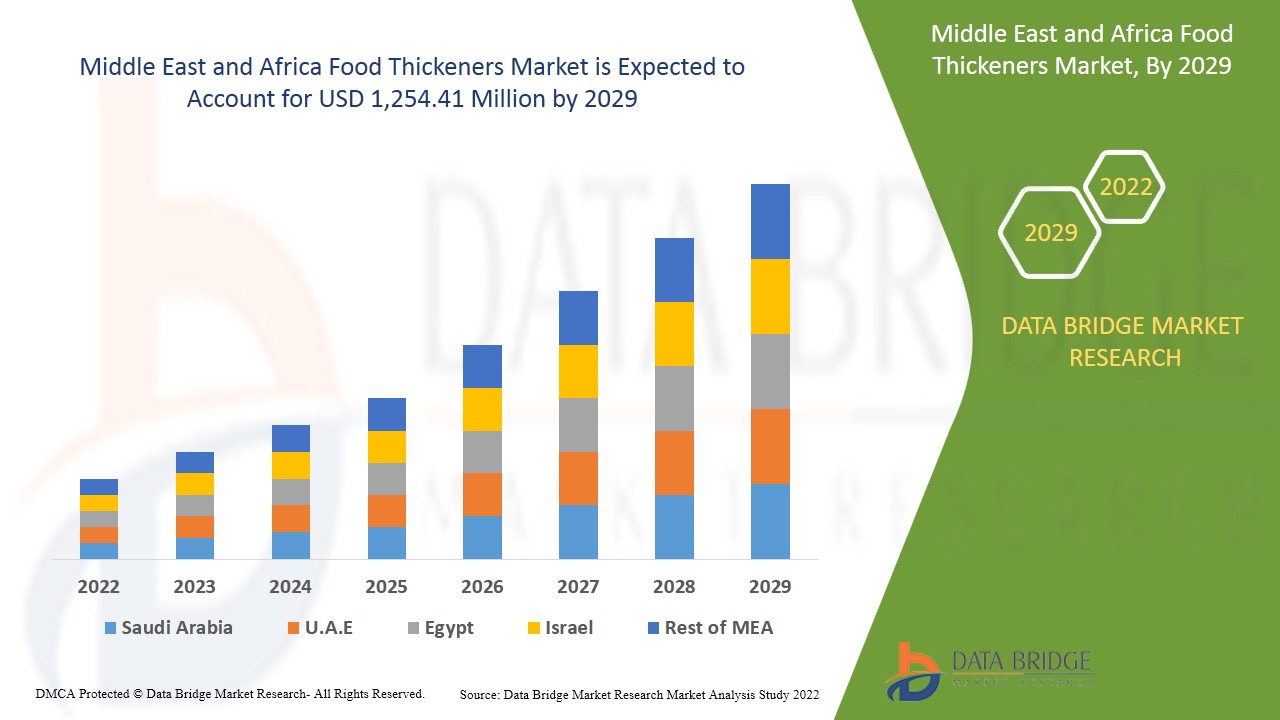

من المتوقع أن ينمو سوق الشرق الأوسط وأفريقيا في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 4.7٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 1،254.41 مليون دولار أمريكي بحلول عام 2029. من المتوقع أن يؤدي الطلب المتزايد على المشروبات غير الكحولية، بما في ذلك عصائر الفاكهة ومشروبات الطاقة، إلى دفع نمو سوق مكثفات الطعام في الشرق الأوسط وأفريقيا.

تُعرَّف مثخنات الطعام بأنها عوامل تعديل الطعام التي تُستخدم لتعديل بنية نسيج الطعام والمشروبات. وتُستخدم لزيادة سمك الطعام والمشروبات، مما يساعد على امتصاص محتوى الماء في الأطعمة بمجرد دمجها في المنتجات. تُستخدم هذه المنتجات بشكل أساسي لتعديل لزوجة هذه المنتجات، مما يمنحها بنية عامة متسقة. مثخنات الطعام الأكثر استخدامًا في السوق هي النشويات، تليها الهيدروكولويدات والبروتينات. تُستخدم مثخنات الطعام في تطبيقات الطعام مثل منتجات المخابز ومنتجات الحلويات والصلصات والتتبيلات والمرق والمشروبات ومنتجات الألبان والحلويات المجمدة والأطعمة المصنعة وغيرها.

إن الزيادة في التغيير في نمط حياة المستهلكين مما يؤدي إلى زيادة التركيز على نظامهم الغذائي هو عامل حيوي في تصعيد نمو السوق. كما أن زيادة فوائد المنتج التي تقدم أكثر من مجرد قدرات التثخين بتكلفة منخفضة قد تغذي سوق مكثفات الطعام العالمية. ومع ذلك، فإن زيادة تكاليف البحث والتطوير المرتبطة بتطوير وتصنيع مكثفات الطعام والتقلبات المستمرة في أسعار المواد الخام للهيدروكولويدات هي العوامل الرئيسية، من بين أمور أخرى، المتوقع أن تحد من سوق مكثفات الطعام العالمية في فترة التوقعات.

إن زيادة ابتكار المنتجات الجديدة وزيادة أنشطة البحث والتطوير في السوق من شأنها أن تخلق فرصًا جديدة لسوق مكثفات الأغذية العالمية. من ناحية أخرى، قد تشكل المخاوف الصحية المحتملة فيما يتعلق بصمغ الزانثان والكاراجينان تحديًا لنمو سوق مكثفات الأغذية العالمية.

يقدم تقرير سوق مكثفات الطعام في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق مكثفات الطعام العالمية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق وحجم سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا

يتم تقسيم سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا إلى خمسة قطاعات بارزة بناءً على النوع والشكل والطبيعة والمصدر والتطبيق. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس النوع، يتم تقسيم سوق مكثفات الطعام في الشرق الأوسط وأفريقيا إلى بروتين ونشا ومركبات هيدروكولويدية وبكتين وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة مكثفات الطعام الهيدروكولويدية على السوق بسبب الاستخدام المتزايد للمركبات الهيدروكولويدية في منتجات الحلويات التي تشمل بشكل أساسي المربى والهلام والمربى والعلكة والمواد الهلامية منخفضة السكر/السعرات الحرارية.

- على أساس الشكل، يتم تقسيم سوق مكثفات الطعام في الشرق الأوسط وأفريقيا إلى هلام ومسحوق وحبيبات وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة المسحوق على السوق بسبب طبيعة شكل المسحوق السهلة الاستخدام والصيانة مقارنة بمكثفات الطعام الأخرى.

- على أساس الطبيعة، يتم تقسيم سوق المواد المثخنة للأغذية في الشرق الأوسط وأفريقيا إلى مواد معدلة وراثيًا وغير معدلة وراثيًا. في عام 2022، من المتوقع أن تهيمن شريحة المواد غير المعدلة وراثيًا على السوق بسبب الطلب المتزايد على الأغذية العضوية المزروعة بشكل طبيعي.

- على أساس المصدر، يتم تقسيم سوق مكثفات الطعام في الشرق الأوسط وأفريقيا إلى نباتية وحيوانية وبحرية وميكروبية. في عام 2022، من المتوقع أن تهيمن شريحة المواد النباتية على السوق بسبب الشعبية المتزايدة لمكثفات الطعام النباتية مثل النشا المستخرج من الحبوب مثل الذرة أو القمح أو الأرز والخضروات الجذرية مثل البطاطس والكسافا والأرو مارت.

- على أساس التطبيق، يتم تقسيم سوق مكثفات الطعام في الشرق الأوسط وأفريقيا إلى الأغذية والمشروبات. في عام 2022، من المتوقع أن يهيمن قطاع الأغذية على السوق بسبب ارتفاع الفوائد المرتبطة بالمنتج الذي يقدم أكثر من مجرد قدرات التثخين.

تحليل سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا على مستوى الدولة

يتم تحليل سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا، ويتم توفير معلومات حجم السوق حسب النوع والشكل والطبيعة والمصدر والتطبيق كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا هي جنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة والكويت وبقية دول الشرق الأوسط وأفريقيا.

من المتوقع أن تهيمن جنوب أفريقيا على سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا بسبب ارتفاع الدخول المتاحة إلى جانب أنماط الحياة المتغيرة بسبب التحضر السريع.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

إن الأنشطة الاستراتيجية المتنامية التي يقوم بها كبار اللاعبين في السوق لتعزيز الوعي بمكثفات الأغذية تعزز نمو سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا

كما يوفر لك سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا تحليلاً تفصيلياً للسوق لنمو كل دولة في سوق معينة. بالإضافة إلى ذلك، يوفر معلومات تفصيلية بشأن استراتيجية اللاعبين في السوق وتواجدهم الجغرافي. تتوفر البيانات للفترة التاريخية من 2010 إلى 2019.

تحليل المشهد التنافسي وحصة سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق مكثفات الطعام في الشرق الأوسط وأفريقيا تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج، ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق مكثفات الطعام في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين الذين يعملون في سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا هم Ingredion Incorporated و Cargill Incorporated و CP Kelco US، Inc. و Tate & Lyle و DuPont Nutrition Bioscience ApS و Ashland و ADM و Jungbunzlauer Suisse AG و Deosen Biochemical (Ordos) Ltd. و GELITA AG و Solvay و VIKAS WSP LTD. و DSM و Medline Industries، LP و Kent Precision Foods Group، Inc. و HL Agro Products Pvt. Ltd. و Emsland Group، من بين اللاعبين المحليين الآخرين.

يفهم محللو DBMR نقاط القوة التنافسية ويوفرون تحليلاً تنافسيًا لكل منافس على حدة.

كما تقوم الشركات في جميع أنحاء العالم بإطلاق العديد من المنتجات، الأمر الذي يعمل أيضًا على تسريع سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا.

على سبيل المثال،

- في يناير 2021، وسعت شركة Tate & Lyle خط إنتاجها من النشويات القائمة على التابيوكا. ويشمل التوسع إطلاق نشويات REZISTA MAX الجديدة لتكثيف القوام ونشويات BRIOGEL لتجميد القوام. وقد ساعد هذا الشركة على توسيع مجموعة منتجاتها

- في مايو 2019، قدمت شركة Bioriginal منتجًا جديدًا يسمى XanFlax، وهو عامل تكثيف طبيعي يمكن استخدامه كبديل غير معدّل وراثيًا لصمغ الزانثان في مجموعة متنوعة من تطبيقات الأغذية

يساهم التعاون وإطلاق المنتج وتوسيع الأعمال والجوائز والتقدير والمشاريع المشتركة وغيرها من الاستراتيجيات التي يتبعها اللاعب في السوق في تعزيز بصمات الشركة في سوق مكثفات الأغذية في الشرق الأوسط وأفريقيا، مما يفيد أيضًا نمو أرباح المنظمة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIENTS CUSTOMIZATION:

4.1.1 WHAT IS THE MAJOR FOOD THICKENER, AND WHAT IS EACH FOOD THICKENER'S ISSUE (OR REQUIREMENT) TO SOLVE?

4.1.2 STARCH

4.1.3 HYDROCOLLOIDS

4.1.4 PECTIN

4.1.5 PROTEIN:

4.2 ANALYSIS OF MAJOR FOOD THICKENERS:

4.3 PRICING ANALYSIS OF FOOD THICKENERS

4.4 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: NEW PRODUCT LAUNCH STRATEGIES

4.4.1 GROWING DEMAND FOR PLANT-BASED SOURCED FOOD THICKENERS

4.4.2 LAUNCHING ORGANIC, CLEAN, AND SUSTAINABLE FOOD THICKENERS

4.4.3 PROMOTING BY HIGHLIGHTING GLUTEN-FREE THICKENERS

4.4.4 LAUNCHES-

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.5.1 VARIETY OF APPLICATIONS CATERED BY FOOD THICKENERS PRODUCTS:

4.5.2 AVAILABILITY OF A VARIETY OF PRODUCT TYPES:

4.5.3 QUALITY OF THE PRODUCTS:

4.6 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: REGULATORY FRAMEWORK

4.6.1 FOOD STANDARDS AUSTRALIA, NEW ZEALAND

4.7 SUPPLY CHAIN ANALYSIS

4.8 VALUE CHAIN ANALYSIS OF MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR FRUIT JUICES

5.1.2 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

5.1.3 ADVANTAGES AND SEVERAL FUNCTIONS ASSOCIATED WITH THE USE OF FOOD THICKENERS

5.1.4 RISING DEMAND FOR THICKENING AGENTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.2 RESTRAINTS

5.2.1 POSSIBLE HEALTH CONCERNS REGARDING XANTHAN GUM AND CARRAGEENAN

5.2.2 HIGH R&D COSTS ASSOCIATED WITH THE DEVELOPMENT AND MANUFACTURING OF FOOD THICKENERS

5.2.3 FLUCTUATIONS IN RAW MATERIAL PRICES OF HYDROCOLLOIDS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC DECISIONS BY KEY PLAYERS

5.3.2 ADVANCEMENTS IN THE EXTRACTION AND PROCESSING OF FOOD THICKENERS

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS

5.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6 COVID-19 IMPACT ON THE MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROCOLLOIDS

7.2.1 HYDROCOLLOIDS, BY TYPE

7.2.1.1 XANTHAN GUM

7.2.1.2 SODIUM ALGINATE

7.2.1.3 LOCUST BEAN GUM

7.2.1.4 GUM ARABIC

7.2.1.5 GAUR GUM

7.2.1.6 GUM KARAYA

7.2.1.7 GUM TRAGACANTH

7.2.1.8 OTHERS

7.2.2 HYDROCOLLOIDS, BY FORM

7.2.2.1 POWDER

7.2.2.2 GRANULES

7.2.2.3 GEL

7.2.2.4 OTHERS

7.3 PROTEIN

7.3.1 PROTEIN, BY TYPE

7.3.1.1 GELATIN

7.3.1.2 COLLAGEN

7.3.1.3 EGG PROTEIN

7.3.2 PROTEIN, BY FORM

7.3.2.1 POWDER

7.3.2.2 GRANULES

7.3.2.3 GEL

7.3.2.4 OTHERS

7.4 STARCH

7.4.1 STARCH, BY TYPE

7.4.1.1 CORN STARCH

7.4.1.2 WHEAT STARCH

7.4.1.3 ARROWROOT STARCH

7.4.1.4 POTATO STARCH

7.4.1.5 RICE STARCH

7.4.1.6 PEA STARCH

7.4.1.7 OTHERS

7.4.2 STARCH, BY FORM

7.4.2.1 POWDER

7.4.2.2 GRANULES

7.4.2.3 GEL

7.4.2.4 OTHERS

7.5 PECTIN

7.5.1 PECTIN, BY FORM

7.5.1.1 POWDER

7.5.1.2 GRANULES

7.5.1.3 GEL

7.5.1.4 OTHERS

7.6 OTHERS

8 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 GRANULES

8.4 GEL

8.5 OTHERS

9 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PLANT

10.3 ANIMAL

10.4 MARINE

10.5 MICROBIAL

10.5.1 BACTERIA

10.5.2 YEAST

10.5.3 FUNGI

11 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FROZEN DESSERTS

11.2.2 DAIRY PRODUCTS

11.2.3 FRUIT PREPARATIONS

11.2.4 BAKERY

11.2.5 CONFECTIONERY

11.2.6 MEAT PRODUCTS

11.2.7 CONVENIENCE FOOD

11.2.8 PROCESSED FOOD

11.2.9 DAIRY ALTERNATIVE PRODUCTS

11.2.10 FUNCTIONAL FOOD

11.2.11 SEAFOOD PRODUCTS

11.2.12 SPORTS NUTRITION

11.2.13 MEAT ALTERNATIVE PRODUCTS

11.3 BEVERAGES

11.3.1 JUICES

11.3.2 DAIRY BASED DRINKS

11.3.3 CARBONATED SOFT DRINKS

11.3.4 SMOOTHIES

11.3.5 RTD TEA & COFFEE

11.3.6 SPORTS DRINKS

11.3.7 ENERGY DRINKS

11.3.8 OTHERS

12 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UAE

12.1.4 KUWAIT

12.1.5 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 INGREDION INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARGILL, INCORPORATED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATE & LYLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 REVENUE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CP KELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DSM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 SOLVAY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DUPONT NUTRITION BIOSCIENCE APS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 CHIMIQUE (INDIA) LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DEOSEN BIOCHEMICAL (ORDOS) LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EMSLAND GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 FOODING GROUP LIMITED

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 GELITA AG

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GUAR RESOURCES, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 HL AGRO PRODUCTS PVT. LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 JUNGBUNZLAUER SUISSE AG

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KENT PRECISION FOODS GROUP, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VIKAS WSP LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATIONS BY HEALTH CANADA-

TABLE 2 HEALTH CANADA REGULATIONS-

TABLE 3 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 5 MIDDLE EAST AND AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 8 MIDDLE EAST AND AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 10 MIDDLE EAST AND AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 13 MIDDLE EAST AND AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 15 MIDDLE EAST AND AFRICA STARCH IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 18 MIDDLE EAST AND AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 20 MIDDLE EAST AND AFRICA PECTIN IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 23 MIDDLE EAST AND AFRICA OTHERS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA POWDER IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA GRANULES IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA GEL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA OTHERS IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA NON-GMO IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA GMO IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA PLANT IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA ANIMAL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA MARINE IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MICROBIAL IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA FOOD IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD THICKENERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONS)

TABLE 45 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 47 MIDDLE EAST & AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 49 MIDDLE EAST & AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 51 MIDDLE EAST & AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 53 MIDDLE EAST & AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 55 MIDDLE EAST & AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 57 MIDDLE EAST & AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 59 MIDDLE EAST & AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 61 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 70 SOUTH AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 72 SOUTH AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 74 SOUTH AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 76 SOUTH AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 78 SOUTH AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 80 SOUTH AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 82 SOUTH AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 84 SOUTH AFRICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 93 SAUDI ARABIA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 95 SAUDI ARABIA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 97 SAUDI ARABIA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 99 SAUDI ARABIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 101 SAUDI ARABIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 103 SAUDI ARABIA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 105 SAUDI ARABIA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 107 SAUDI ARABIA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 UAE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 UAE FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 116 UAE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 UAE STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 118 UAE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 UAE STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 120 UAE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 UAE PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 122 UAE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 UAE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 124 UAE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 125 UAE HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 126 UAE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 UAE PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 128 UAE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 129 UAE PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 130 UAE FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 131 UAE FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 132 UAE FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 133 UAE MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 134 UAE FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 UAE FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 UAE BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 KUWAIT FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 KUWAIT FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 139 KUWAIT STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 KUWAIT STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 141 KUWAIT STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 KUWAIT STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 143 KUWAIT PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 KUWAIT PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 145 KUWAIT HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 KUWAIT HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 147 KUWAIT HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 148 KUWAIT HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 149 KUWAIT PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 KUWAIT PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 151 KUWAIT PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 152 KUWAIT PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 153 KUWAIT FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 154 KUWAIT FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 155 KUWAIT FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 156 KUWAIT MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 157 KUWAIT FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 KUWAIT FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 KUWAIT BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET : DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND FOR FRUIT JUICES IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET IN THE FORECAST PERIOD

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET

FIGURE 13 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: BY TYPE, 2021

FIGURE 14 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: BY FORM, 2021

FIGURE 15 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: BY NATURE, 2021

FIGURE 16 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET, BY SOURCE, 2021

FIGURE 17 MIDDLE EAST AND AFRICA FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 18 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET: SNAPSHOT (2021)

FIGURE 19 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET: BY COUNTRY (2021)

FIGURE 20 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA FOOD THICKENERS MARKET: BY TYPE (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA FOOD THICKENERS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.