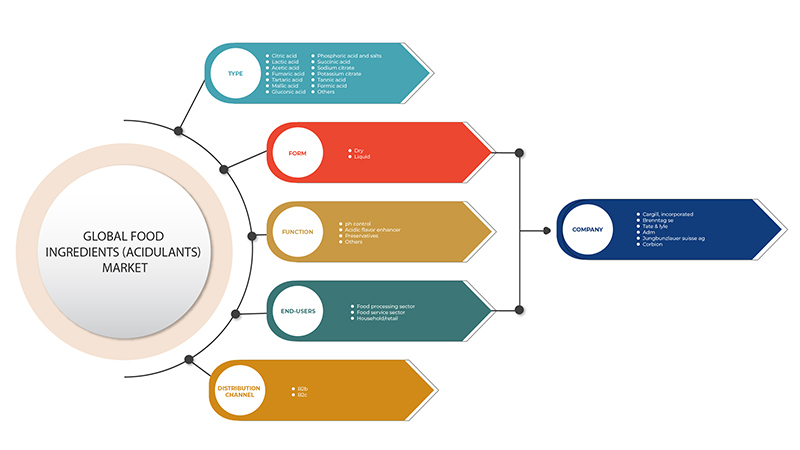

سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا، حسب النوع ( حمض الستريك ، حمض اللاكتيك، حمض الأسيتيك، حمض الفوماريك، حمض الطرطريك، حمض الماليك، حمض الجلوكونيك، حمض الفوسفوريك والأملاح، حمض السكسينيك، سترات الصوديوم، سترات البوتاسيوم، حمض التانيك، حمض الفورميك، وغيرها)، الشكل (جاف وسائل)، الوظيفة (التحكم في درجة الحموضة، معزز النكهة الحمضية، المواد الحافظة وغيرها)، قناة التوزيع (B2B، وB2C)، المستخدم النهائي (قطاع معالجة الأغذية، قطاع خدمات الأغذية، والأسر / التجزئة) اتجاهات الصناعة وتوقعاتها حتى عام 2029.

تحليل السوق والرؤى

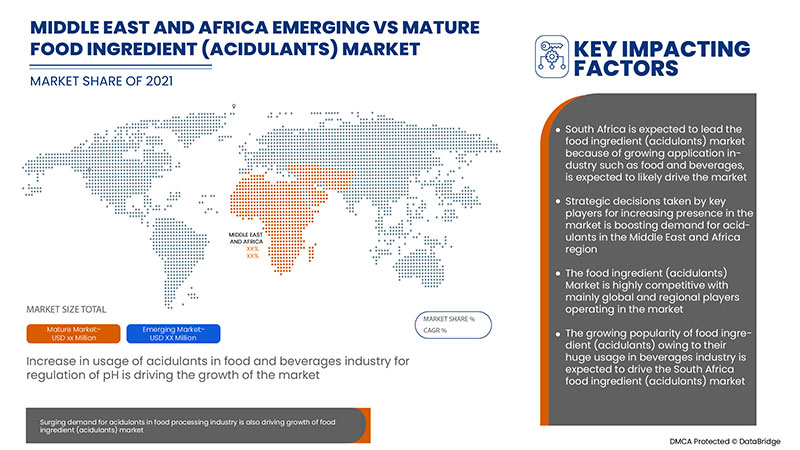

يشهد سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا نموًا كبيرًا بسبب نمو صناعة الأغذية والمشروبات وارتفاع الطلب على المشروبات المنكهة والأطعمة. كما أن زيادة الطلب على المواد الحمضية في المشروبات الكحولية مثل النبيذ تعزز أيضًا نمو سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا. ومع ذلك، من المتوقع أن تعمل اللوائح الحكومية الصارمة المرتبطة بالمواد الحمضية والمخاطر الصحية المرتبطة ببعض المواد الحمضية، مثل حمض الفوسفوريك، على كبح نمو السوق خلال فترة التوقعات.

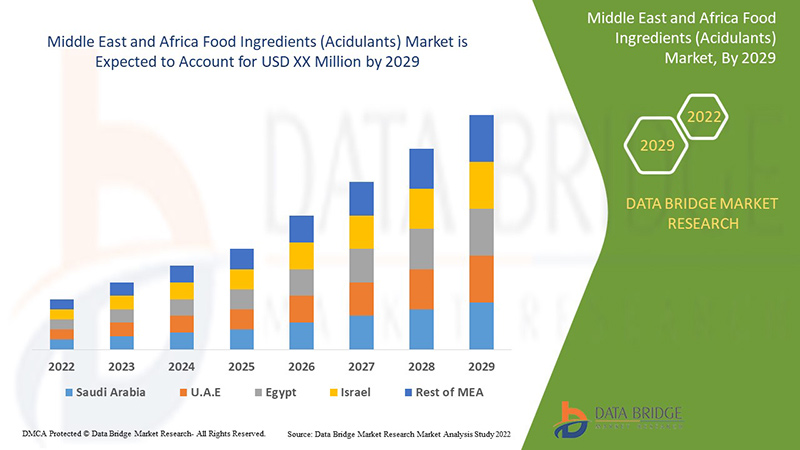

تشير تحليلات Data Bridge Market Research إلى أن سوق مكونات الأغذية (الأحماض) في منطقة الشرق الأوسط وأفريقيا من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 5.8٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (حمض الستريك، وحمض اللاكتيك، وحمض الأسيتيك، وحمض الفوماريك، وحمض الطرطريك، وحمض الماليك، وحمض الجلوكونيك، وحمض الفوسفوريك وأملاحه، وحمض السكسينيك، وسترات الصوديوم، وسترات البوتاسيوم، وحمض التانيك، وحمض الفورميك، وغيرها)، والشكل (جاف وسائل)، والوظيفة (التحكم في درجة الحموضة، ومعزز النكهة الحمضية، والمواد الحافظة، وغيرها)، وقناة التوزيع (B2B، وB2C)، والمستخدم النهائي (قطاع معالجة الأغذية، وقطاع خدمات الأغذية، والمنزلية/التجزئة) |

|

الدول المغطاة |

المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، الكويت، عمان، قطر، وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Brenntag SE، وBartek Ingredients Inc.، وCorbion، وCargill، Incorporated، وADM، وTate & Lyle، وFoodchem International Corporation، وRichest Group، وINDUSTRIAL TECNICA PECUARIA، SA، وغيرها |

تعريف السوق

المواد الحامضية هي مركبات كيميائية تعطي نكهة لاذعة أو حامضة أو حمضية للأطعمة أو تعزز الحلاوة المدركة للأطعمة. يمكن أن تعمل المواد الحامضية أيضًا كعوامل تخمير ومستحلبات في بعض أنواع الأطعمة المصنعة. على الرغم من أن المواد الحامضية يمكن أن تخفض الرقم الهيدروجيني، إلا أنها تختلف عن منظمات الحموضة، وهي إضافات غذائية مخصصة خصيصًا لتعديل استقرار الطعام أو الإنزيمات الموجودة فيه. المواد الحامضية النموذجية هي حمض الأسيتيك (على سبيل المثال، في المخللات) وحمض الستريك. تحتوي العديد من المشروبات، مثل الكولا، على حمض الفوسفوريك. غالبًا ما يتم تصنيع الحلوى الحامضة بحمض الماليك. تشمل المواد الحامضية الأخرى المستخدمة في إنتاج الأغذية حمض الفوماريك وحمض الطرطريك وحمض اللاكتيك وحمض الجلوكونيك.

ديناميكيات سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا

السائقين

- الاستخدام الواسع لحامض الستريك وحمض الماليك في تطبيقات المشروبات الكحولية وغير الكحولية الناشئة

في معظم المشروبات، يعتبر حمض الستريك هو الخيار الأول للاستخدام كمُحَمِّض. وهذا هو السبب وراء الحموضة المحددة التي تتراوح بين الخفيفة والحادة قليلاً والتأثير المنعش لمعظم نكهات الفاكهة. علاوة على ذلك، يستخدم حمض الماليك عندما يكون من المتوقع تعزيز النكهة القوية، غالبًا بالاشتراك مع حمض الستريك. بالإضافة إلى هذه المواد المُحَمِّضة، يستخدم حمض الفوسفوريك وحمض السكسينيك أيضًا في تطبيقات المشروبات. يستخدم حمض الفوسفوريك غالبًا في المشروبات الغازية مثل الكولا لإضفاء مذاق محدد وتأثير قوي على درجة الحموضة. يستخدم حمض الماليك عادةً في المشروبات الكحولية، غالبًا في المشروبات الباردة ذات النكهة الفاكهية والمشروبات منخفضة الكحول. يستخدم حمض السكسينيك فقط في المشروبات سريعة التحضير للتحضير المنزلي.

على سبيل المثال،

- في سبتمبر 2020، وفقًا لرابطة تجارة النبيذ والمشروبات الروحية، نمت فئة الروم المنكه والمتبل من أقل من 6 ملايين زجاجة في عام 2014 إلى أكثر من 10 ملايين زجاجة في عام 2019

- في سبتمبر 2021، أعلنت Svami عن إطلاق 2 Cal Cola، الكولا الفاخرة المزروعة محليًا في الهند، وSvami Salted Lemonade

ومن ثم، لتلبية طلب المستهلكين، يتزايد الطلب على المواد الحمضية في صناعة تصنيع المشروبات من قبل مصنعي المشروبات، مما يزيد من نمو السوق.

- ارتفاع الطلب على المواد الحامضية مثل حمض الماليك وحمض اللاكتيك ولاكتات الصوديوم في صناعة الحلويات

تتميز المواد الحامضية المستخدمة في صناعة الحلويات، مثل حمض الماليك وحمض اللاكتيك ولاكتات الصوديوم، بطعم ونكهة فريدة من نوعها. كما أنها تعزز تأثير بعض النكهات العطرية بسبب تقلبها. بالإضافة إلى ذلك، تُستخدم مجموعات المواد الحامضية بشكل شائع في صناعة الحلويات في الوقت الحاضر. علاوة على ذلك، يوفر حمض الماليك وحمض الفوماريك حموضة أكثر ثباتًا من أحماض الطعام الأخرى بنفس التركيز، ويعززان نكهات الفاكهة، ويعززان تأثير المحليات عالية الكثافة.

ومن ثم فإن الطلب المتزايد على منتجات الحلويات يؤدي إلى زيادة الطلب على المواد الحمضية مثل حمض الماليك وحمض اللاكتيك وحمض الفوماريك ولاكتات الصوديوم وغيرها من قبل مصنعي الأغذية لتلبية الطلبات.

فرص

- الإنتاج البيولوجي لحامض الستريك وحامض الخليك

يتجه المستهلكون نحو المنتجات المستدامة ويختارون المنتجات المصنعة بمساعدة مكونات مستدامة. ومن ثم، يتزايد الطلب على المكونات الغذائية المستدامة والفعّالة من حيث التكلفة والبيولوجية (المواد الحمضية) مثل حمض الستريك وحمض الأسيتيك بين الشركات المصنعة. ومع ذلك، فإن إنتاج حمض السكسينيك الحيوي صعب للغاية من خلال منتج مستدام يعتمد على التخمير الميكروبي، على الرغم من أنه فعال من حيث التكلفة.

وبالتالي، وبفضل توافر مجموعة واسعة من البكتيريا والفطريات والخميرة، يمكن زيادة الإنتاج البيولوجي للأحماض، ويمكن تقديم منتجات الأحماض الحيوية المستدامة لصناعة الأغذية والمشروبات العالمية، لأنها تتمتع بفرصة هائلة لمنتجات الأغذية والمشروبات التي تشمل مكونات مستدامة بيولوجيًا.

القيود/التحديات

- قواعد وتنظيم الهيئات التنظيمية الغذائية بشأن المنتجات الحامضية

إن القواعد واللوائح الخاصة بالموافقة على المواد الحامضية التي وضعتها الهيئات الحكومية تضمن عدم وجود آثار جانبية للمواد الحامضية، مما قد يحد من نمو سوق المكونات الغذائية العالمية (المواد الحامضية). وقد أجبر القلق المتزايد المتعلق بالآثار الجانبية للمواد الحامضية على الصحة الحكومة على وضع قواعد صارمة للموافقة على المنتج. قد تؤدي المواد الحامضية إلى ارتفاع ضغط الدم، واحمرار العين المؤقت، وغيرها. لذلك، يتم فحص كمية المادة الحامضية المستخدمة بشكل صحيح قبل استخدامها في أي منتج. وبالتالي، فإن اللوائح الصارمة لعملية الموافقة قد تعيق نمو السوق.

ومن ثم، فإن القواعد الصارمة للموافقة على المنتجات الحمضية وسحبها لتجنب المخاطر الصحية المرتبطة بها قد تحد من نمو السوق، حيث قد يجد المصنعون صعوبة في الوفاء بجميع القواعد التي تفرضها الحكومة بدقة.

- مخاوف صحية متزايدة بشأن المواد الحمضية

تُستخدم المواد الحمضية في العديد من تطبيقات الأغذية والمشروبات مثل المخبوزات والحلويات والمشروبات الكحولية وغير الكحولية لتعزيز المذاق والملمس والنكهة. ومع ذلك، فإن لها بعض الآثار الجانبية الضارة بجسم الإنسان.

ونتيجة لهذه الآثار الجانبية، فرضت الحكومة قواعد صارمة على استخدام المواد الحمضية التي قد تشكل تحدياً للمصنعين.

على سبيل المثال،

- تسمح لوائح الغذاء والدواء (B.01.090 وB.01.091 وB.01.092) بإضافة أملاح الفوسفات و/أو الماء إلى منتجات اللحوم. الأشكال المسموح بها من الفوسفات هي الحد الأقصى المسموح به للاستخدام وهو 0.5%، محسوبًا على أنه فوسفات ثنائي القاعدة من الصوديوم المضاف إلى المنتج.

وبالتالي، فإن الآثار الجانبية المرتبطة بالمواد الحمضية قد تشكل تحديًا لنمو السوق بسبب اللوائح الصارمة والمخاوف المتعلقة بالسلامة.

تأثير ما بعد كوفيد-19 على سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا

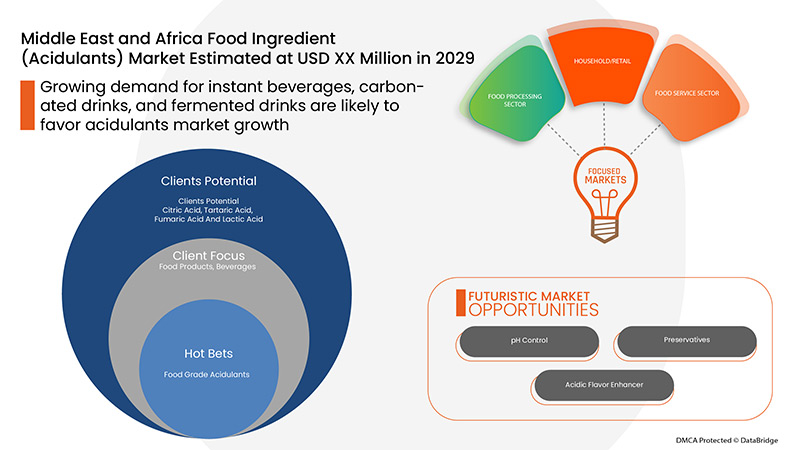

بعد جائحة كوفيد-19، زاد الطلب على المواد الحامضية بسبب أنماط الشراء لدى المستهلكين والتحول التدريجي نحو زيادة الطلب على المواد الحامضية بين مختلف المستخدمين النهائيين مثل الأغذية والمشروبات وغيرها. ونظرًا لإيقاف العديد من الأوامر والقيود الصارمة، يمكن للمصنعين والمنتجين تلبية الطلب على المواد الحامضية في المنطقة. بالإضافة إلى ذلك، فإن الاتجاه المتزايد لتجربة مطابخ جديدة ومشروبات غازية ومشروبات مخمرة بين الشباب من شأنه أن يدفع نمو السوق.

إن الطلب المتزايد على المشروبات المخمرة يمكّن الشركات المصنعة من إطلاق مشروبات مخمرة مبتكرة ومتنوعة، مما يؤدي في نهاية المطاف إلى زيادة الطلب على المواد الحامضية، مما ساعد على نمو السوق.

التطورات الأخيرة

- في مارس 2022، استحوذت شركة Brenntag SE على شركة توزيع المواد الكيميائية المتخصصة الإسرائيلية YS Ashkenazi Agencies Ltd، إلى جانب شركتها التابعة Biochem Trading. يمثل هذا الاستحواذ دخول Brenntag إلى السوق الإسرائيلية. سيعمل هذا الاستحواذ على زيادة سمعة الشركة

نطاق سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا

يتم تقسيم سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا إلى النوع والشكل والوظيفة وقناة التوزيع والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- حامض الستريك

- سترات الصوديوم

- سترات البوتاسيوم

- حمض الخليك

- حمض الفورميك

- حمض الجلوكونيك

- حمض الفوماريك

- حمض الماليك

- حمض الفوسفوريك وأملاحه

- حمض الطرطريك

- حمض اللاكتيك

- حمض التانيك

- حمض السكسينيك

- آحرون

على أساس النوع، يتم تقسيم سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا إلى حمض الستريك، سترات الصوديوم، سترات البوتاسيوم، حمض الأسيتيك، حمض الفورميك، حمض الجلوكونيك، حمض الماليك، حمض الفوسفوريك والأملاح، حمض الطرطريك، حمض اللاكتيك، التانيك، حمض الفوماريك، حمض السكسينيك، وغيرها.

استمارة

- جاف

- سائل

على أساس الشكل، يتم تقسيم سوق مكونات الأغذية (المواد الحمضية) في منطقة الشرق الأوسط وأفريقيا إلى جافة وسائلة.

وظيفة

- التحكم في درجة الحموضة

- معزز النكهة الحمضية

- المواد الحافظة

- آحرون

على أساس الوظيفة، يتم تقسيم سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا إلى التحكم في درجة الحموضة، ومعزز النكهة الحمضية، والمواد الحافظة، وغيرها.

قناة التوزيع

- ب2ب

- ب2م

على أساس قناة التوزيع، يتم تقسيم سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا إلى B2B و B2C.

المستخدم النهائي

- الأدوات المنزلية/التجزئة

- قطاع تصنيع الأغذية

- قطاع خدمات الأغذية

على أساس المستخدم النهائي، يتم تقسيم سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا إلى قطاع منزلي/تجزئة، وقطاع معالجة الأغذية، وقطاع خدمات الأغذية.

تحليل/رؤى إقليمية لسوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا

يتم تحليل سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والنوع والشكل والوظيفة والمستخدم النهائي وقناة التوزيع، كما هو مذكور أعلاه.

بعض الدول التي يغطيها تقرير سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا هي المملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا والكويت وعمان وقطر وبقية دول الشرق الأوسط وأفريقيا.

ومن المتوقع أن تهيمن المملكة العربية السعودية على سوق مكونات الأغذية (المواد الحمضية) في منطقة الشرق الأوسط وأفريقيا من حيث حصة السوق والإيرادات، وستواصل تعزيز هيمنتها خلال فترة التوقعات. ويرجع ذلك إلى الطلب المتزايد على المشروبات الغازية والمشروبات الأخرى، وتستخدم المواد الحمضية لأنها توفر طعمًا ونكهة أفضل للمنتجات.

كما يقدم قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في اللوائح في السوق والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات، مثل المبيعات الجديدة والاستبدالية، والتركيبة السكانية للدولة، وعلم الأوبئة المرضية، ورسوم الاستيراد والتصدير، من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. بالإضافة إلى ذلك، يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الشديدة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق مكونات الأغذية (الأحماض) في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين العاملين في سوق مكونات الأغذية (المواد الحمضية) في الشرق الأوسط وأفريقيا هم Brenntag SE و Bartek Ingredients Inc. و Corbion و Cargill، Incorporated و ADM و Tate & Lyle و Foodchem International Corporation و Richest Group و INDUSTRIAL TECNICA PECUARIA، SA وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي مثلث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، والشرق الأوسط وأفريقيا مقابل المنطقة، وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار إضافي.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 FACTORS INFLUENCING PURCHASING DECISION

4.2.1 PRICING OF FOOD INGREDIENTS (ACIDULANTS)

4.2.2 QUALITY AND PURITY OF ACIDULANTS

4.2.3 CERTIFIED FOOD INGREDIENTS (ACIDULANTS)

4.3 REGULATORY OR LEGAL RISK COVERAGE

4.4 NEW PRODUCT LAUNCH STRATEGIES

4.5 PATENT ANALYSIS

4.6 RAW MATERIAL ANALYSIS – TOP 10 ACIDULANTS

4.6.1 CITRIC ACID

4.6.2 ACETIC ACID

4.6.3 SODIUM CITRATE

4.6.4 LACTIC ACID

4.6.5 FUMARIC ACID

4.6.6 TARTARIC ACID

4.6.7 MALIC ACID

4.6.8 GLUCONIC ACID

4.6.9 PHOSPHORIC ACID AND SALT

4.7 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

4.8 RISK ANALYSIS OF ACIDULANTS

4.8.1 CITRIC ACID

4.8.2 SODIUM CITRATE

4.8.3 ACETIC ACID

4.8.4 SUCCINIC ACID

4.8.5 MALIC ACID

4.8.6 TARTARIC ACID

4.8.7 POTASSIUM CITRATE

4.8.8 GLUCONIC ACID

4.8.9 FUMARIC ACID

4.8.10 LACTIC ACID

4.8.11 TANNIC ACID

4.8.12 FORMIC ACID

4.8.13 PHOSPHORIC ACID AND SALTS

4.9 RUSSIA AND UKRAINE WAR IMPACT

4.9.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

4.9.2 RISK OF CIVIL UNREST

4.1 SUPPLY CHAIN OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 FOOD INGREDIENT (ACIDULANTS) PRODUCTION/PROCESSING

4.10.3 DISTRIBUTION

4.10.4 END-USERS

4.11 SUPPLIER DEEP DIVE – PART 1

4.12 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID-

4.13 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID-

4.14 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID-

4.15 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID-

4.16 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID-

4.17 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID-

4.18 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID-

4.19 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT-

4.2 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID-

4.21 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE –

4.22 SUPPLIERS DEEP DIVE – PART 2

4.22.1 PRODUCTION LOCATIONS

4.22.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.3 MARKETS THEY SELL TO

4.22.4 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.5 MARKETS THEY SELL TO

4.22.6 PRODUCTION LOCATIONS

4.23 ADM

4.23.1 PRODUCTION LOCATIONS

4.23.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.23.3 MARKETS THEY SELL TO

4.24 CORBION N.V

4.24.1 PRODUCTION LOCATIONS

4.24.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.24.3 MARKETS THEY SELL TO

4.25 TATE & LYLE

4.25.1 PRODUCTION LOCATIONS

4.25.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.25.3 MARKETS THEY SELL TO

4.26 JUNGBUNZLAUER SUISSE AG

4.26.1 PRODUCTION LOCATIONS

4.26.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.26.3 MARKETS THEY SELL TO

4.27 BARTEK INGREDIENTS INC.

4.27.1 PRODUCTION LOCATIONS

4.27.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.27.3 MARKETS THEY SELL TO

4.28 DAIRYCHEM

4.28.1 PRODUCTION LOCATIONS

4.28.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.28.3 MARKETS THEY SELL TO

4.29 WEIANG ENSIGN INDUSTRY CO.,LTD.

4.29.1 PRODUCTION LOCATIONS

4.29.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.29.3 MARKETS THEY SELL TO

4.3 INDUSTRIAL TECNICA PECUARIA, S.A.

4.30.1 PRODUCTION LOCATIONS

4.30.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.30.3 MARKETS THEY SELL TO

4.31 PRODUCTION CAPACITY – TOP FIVE PLAYERS

4.32 PRICING ANALYSIS FOR FOOD INGREDIENTS (ACIDULANTS)

4.33 SWOT ANALYSIS – TOP 10 ACIDULANTS

4.33.1 CITRIC ACID –

4.33.2 ACETIC ACID –

4.33.3 SODIUM CITRATE –

4.33.4 SUCCINIC ACID –

4.33.5 LACTIC ACID –

4.33.6 FUMARIC ACID –

4.33.7 TARTARIC ACID –

4.33.8 MALIC ACID –

4.33.9 GLUCONIC ACID –

4.33.10 PHOSPHORIC ACID AND SALTS -

5 REGULATIONS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH

6.1.2 WIDE USE OF CITRIC ACID AND MALIC ACID IN EMERGING ALCOHOLIC AS WELL AS NON-ALCOHOLIC BEVERAGE APPLICATIONS

6.1.3 RISE IN DEMAND FOR ACIDULANTS SUCH AS MALIC ACID, LACTIC ACID, AND SODIUM LACTATE IN THE CONFECTIONERY INDUSTRY

6.1.4 GROWING DEMAND FOR INSTANT BEVERAGES, CARBONATED DRINKS, AND FERMENTED DRINKS IS LIKELY TO FAVOR ACIDULANTS MARKET GROWTH

6.2 RESTRAINTS:

6.2.1 RULES AND REGULATION OF FOOD REGULATORY BODIES ON ACIDULANTS PRODUCTS

6.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR ACIDULANTS FROM THE RISING FOOD PROCESSING INDUSTRY IN EMERGING ECONOMIES SUCH AS INDIA AND CHINA

6.3.2 BIOLOGICAL PRODUCTION OF CITRIC ACID AND ACETIC ACID

6.4 CHALLENGES

6.4.1 GROWING HEALTH CONCERNS REGARDING ACIDULANTS

6.4.2 HIGH PRICES OF ACIDULANTS

7 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

7.1 IMPACT ON DEMAND AND SUPPLY CHAIN

7.2 IMPACT ON PRICE

7.3 CONCLUSION

8 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 LACTIC ACID

8.4 ACETIC ACID

8.5 FUMARIC ACID

8.6 TARTARIC ACID

8.7 MALLIC ACID

8.8 GLUCONIC ACID

8.9 PHOSPHORIC ACID

8.1 SUCCINIC ACID

8.11 SODIUM CITRATE AND SALT

8.12 POTASSIUM CITRATE AND SALT

8.13 TANNIC ACID AND SALT

8.14 FORMIC ACID AND SALT

8.15 OTHERS

9 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 PH CONTROL

10.3 ACIDIC FLAVOR ENHANCER

10.4 PRESERVATIVES

10.5 OTHERS

11 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.2.1 WHOLESALERS

11.2.2 ONLINE

11.3 B2C

11.3.1 SUPERMARKET

11.3.2 ONLINE

11.3.3 HYPERMARKET

11.3.4 DEPARTMENTAL STORES

11.3.5 SPECIALTY STORES

11.3.6 OTHERS

12 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD PROCESSING SECTOR

12.2.1 FOOD

12.2.1.1 PROCESSED MEAT PRODUCTS

12.2.1.1.1 POULTRY

12.2.1.1.2 PORK

12.2.1.1.3 BEEF

12.2.1.1.4 OTHERS

12.2.1.2 DAIRY PRODUCTS

12.2.1.2.1 CHEESE

12.2.1.2.2 MILK-POWDER

12.2.1.2.3 ICE CREAM

12.2.1.2.4 SPREADS

12.2.1.2.5 OTHERS

12.2.1.3 CONVENIENCE FOOD

12.2.1.3.1 READY TO EAT PRODUCTS

12.2.1.3.2 SOUPS & SAUCES

12.2.1.3.3 SEASONING & DRESSING

12.2.1.3.4 NOODLES & PASTA

12.2.1.3.5 OTHERS

12.2.1.4 BAKERY

12.2.1.4.1 CAKES & PASTRIES

12.2.1.4.2 BREAD

12.2.1.4.3 BISCUITS & COOKIES

12.2.1.4.4 MUFFINS

12.2.1.4.5 OTHERS

12.2.1.5 CONFECTIONERY

12.2.1.5.1 CHOCOLATE

12.2.1.5.2 GUMS & JELLY

12.2.1.5.3 HARD & SOFT CANDY

12.2.1.5.4 CREAM FILLINGS

12.2.1.5.5 OTHERS

12.2.1.5.6 SEAFOOD PRODUCTS

12.2.1.5.7 PROCESSED FOOD

12.2.1.5.8 SPORTS NUTRITION

12.2.1.5.9 DIETARY SUPPLEMENTS

12.2.1.5.10 INFANT FORMULA

12.2.1.6 BEVERAGES

12.2.1.6.1 NON-ALCOHOLIC BEVERAGES

12.2.1.6.1.1 RTD

12.2.1.6.1.2 FRUIT JUICES

12.2.1.6.1.3 SOFT DRINKS

12.2.1.6.1.4 DAIRY DRINKS

12.2.1.6.1.5 FLAVORED DRINKS

12.2.1.6.1.6 OTHERS

12.2.1.6.1.7 ALCOHOLIC BEVERAGES

12.3 FOOD SERVICE SECTOR

12.3.1 RESTAURANTS

12.3.2 CAFÉS

12.3.3 HOTELS

12.3.4 CANTEEN/CAFETERIA

12.3.5 CLOUD KITCHEN

12.4 HOUSEHOLD/RETAIL

13 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 SOUTH AFRICA

13.1.4 KUWAIT

13.1.5 OMAN

13.1.6 QATAR

13.1.7 REST OF MIDDLE-EAST & AFRICA

14 MIDDLE EAST & AFRICA FOOD INGREDIENT (ACIDULANTS) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TATE & LYLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ADM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 JUNGBUNZLAUER SUISSE AG

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BRENNTAG SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARIHANT CHEMICALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ARSHINE PHARMACEUTICAL CO.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BARTEK INGREDIENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHEMVERA SPECIALTY CHEMICALS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CORBION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 DAIRYCHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DIRECT FOOD INGREDIENTS LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FBC INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

1.13.3 RECENT DEVELOPMENTS 306

15.14 FOODCHEM INTERNATIONAL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HAWKINS WATTS LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INDUSTRIAL TECNICA PECUARIA, S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 INNOVA CORPORATE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICHEST GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SUNTRAN.CN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 WEIFANG ENSIGN INDUSTRY CO.,LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY OR LEGAL RISK COVERAGE FRAMEWORK

TABLE 2 MICROORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 3 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 4 CITRIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 5 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 6 ACETIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 7 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 8 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 9 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 10 SUCCINIC ACID APPLICATION IN THE FOOD AND BEVERAGES INDUSTRY

TABLE 11 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 12 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 13 LACTIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 14 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 15 FUMARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 16 TARTARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 17 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 18 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 19 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 20 RAW MATERIAL FOR DIFFERENT FOOD INGREDIENTS (ACIDULANTS)-

TABLE 21 MARKET SHARE OF CITRIC ACID

TABLE 22 MARKET SHARE OF LACTIC ACID

TABLE 23 MARKET SHARE OF FUMARIC ACID

TABLE 24 MARKET SHARE OF TARTARIC ACID

TABLE 25 MARKET SHARE OF MALIC ACID

TABLE 26 CATEGORY AND THEIR FUNCTIONALITY

TABLE 27 ACIDULANTS IN VARIOUS FOOD FUNCTIONALITY

TABLE 28 ACIDULANTS PRODUCTS AND THEIR APPLICATIONS

TABLE 29 MIDDLE EAST & AFRICA AVERAGE SELLING PRICES OF ACIDULANTS

TABLE 30 THE BELOW TABLE SHOWS THE ACIDULANTS AND THEIR APPLICATIONS IN BEVERAGES

TABLE 31 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 32 THE TABLE BELOW SHOWS CITRIC ACID-PRODUCING MICROORGANISMS AND THEIR SPECIES:

TABLE 33 BELOW TABLE SHOWS THE SIDE EFFECTS OF ACIDULANTS:

TABLE 34 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 36 MIDDLE EAST & AFRICA CITRIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA LACTIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ACETIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FUMARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA TARTARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA MALLIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA GLUCONIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHOSPHORIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SUCCINIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SODIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA POTASSIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA TANNIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FORMIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 THE TABLE BELOW SHOWS THE FUNCTIONS OF DIFFERENT ACIDULANTS IN SOLID FORM:

TABLE 52 MIDDLE EAST & AFRICA DRY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 THE BELOW TABLE SHOWS THE FUNCTIONS OF LIQUID ACIDULANTS IN THE FOOD PROCESSING INDUSTRY:

TABLE 54 MIDDLE EAST & AFRICA LIQUID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PH CONTROL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA ACIDIC FLAVOR ENHANCER IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PRESERVATIVES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 82 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SAUDI ARABIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 SAUDI ARABIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 117 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 U.A.E. B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.A.E. B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 122 U.A.E. FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 U.A.E. FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 U.A.E. FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.A.E. DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.A.E. BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 U.A.E. CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 U.A.E. PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.A.E. CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.A.E. BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.A.E. NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 152 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 KUWAIT B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 KUWAIT B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 KUWAIT FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 KUWAIT FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 KUWAIT FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 KUWAIT DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 KUWAIT BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 KUWAIT CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 KUWAIT PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 KUWAIT CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 KUWAIT BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 KUWAIT NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 OMAN B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 OMAN B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 173 OMAN FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 OMAN FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 OMAN FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 OMAN DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 OMAN BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 OMAN CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 OMAN PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 OMAN CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 OMAN BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 OMAN NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 185 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 186 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 187 QATAR B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 QATAR B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 190 QATAR FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 QATAR FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 QATAR FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 QATAR DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 QATAR BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 QATAR CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 QATAR PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 QATAR CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 QATAR BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 QATAR NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH WHICH IS DRIVING THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET IN THE FORECAST PERIOD

FIGURE 13 CITRIC ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET IN 2022 & 2029

FIGURE 14 UKRAINE AND RUSSIA’S SHARE OF MIDDLE EAST & AFRICA TRADE (2018-2020)-

FIGURE 15 SUPPLY CHAIN OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 17 THE BELOW GRAPH SHOWS THE MIDDLE EAST & AFRICA MARKET SIZE FOR BEVERAGES

FIGURE 18 THE BELOW GRAPH SHOWS THE SALES OF MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES FROM 2018 TO 2022:

FIGURE 19 THE BELOW GRAPH SHOWS THE SALES OF NON-ALCOHOLIC BEVERAGES IN U.S. FROM 2019 TO 2021-

FIGURE 20 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FUNCTION, 2021

FIGURE 23 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY END-USER, 2021

FIGURE 25 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA FOOD INGREDIENT (ACIDULANTS) MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.