سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا، حسب المواد الخام (الكرتون المموج والوسائط)، النمط (الصندوق المشقوق، التلسكوبات، المجلدات، الصواني، الأوراق، المراوح القابلة للطي، القوالب المقطوعة بالقطع، والديكورات الداخلية المقطوعة بالقطع)، الدرجة (بطانة الاختبار غير المبيضة، بطانة الاختبار ذات السطح الأبيض، بطانة كرافت غير المبيضة، بطانة كرافت ذات السطح الأبيض، التغليف القائم على النفايات والتغليف شبه الكيميائي)، الاستخدام النهائي (الأغذية المصنعة، الرعاية الصحية، المشروبات، المواد الكيميائية، المنسوجات، العناية الشخصية، السلع الكهربائية، أجزاء المركبات، الأواني الزجاجية والسيراميك، منتجات الأخشاب والأخشاب، العناية المنزلية، الفواكه والخضروات، المنتجات الورقية، التبغ وغيرها)، الدولة (جنوب أفريقيا، إسرائيل، الإمارات العربية المتحدة، المملكة العربية السعودية، مصر، بقية الشرق الأوسط وأفريقيا) اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى: سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا

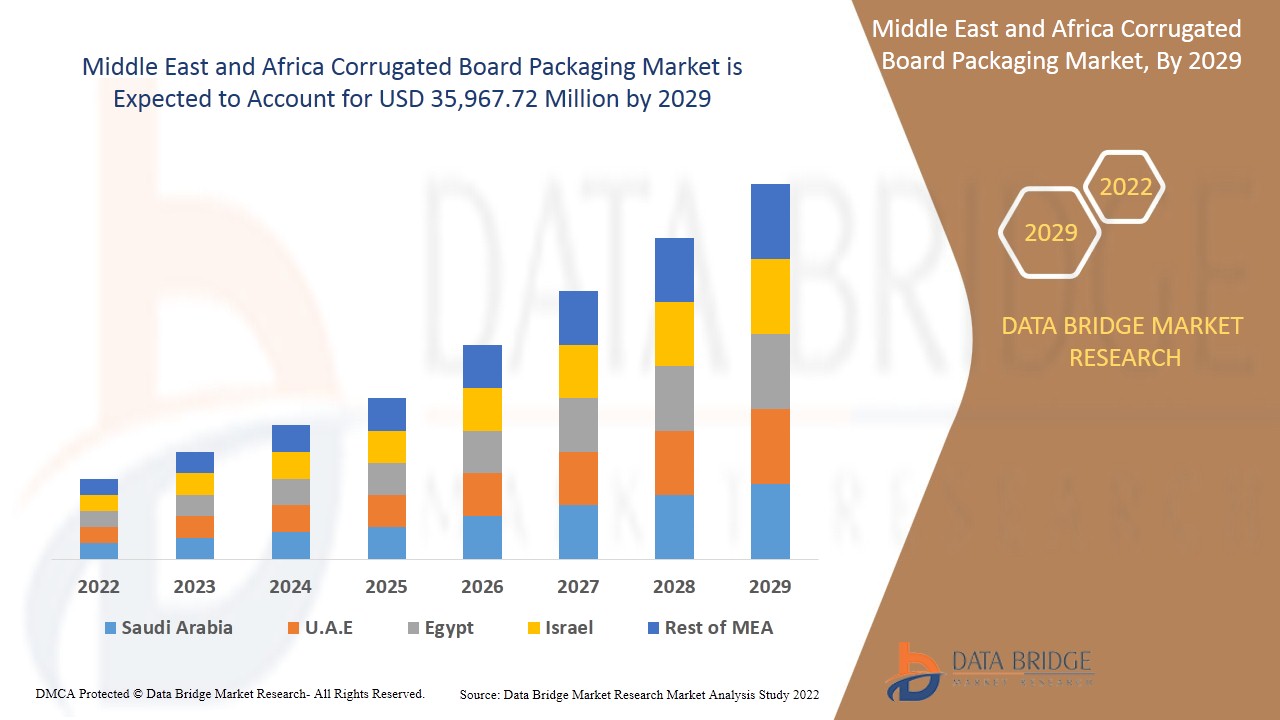

من المتوقع أن يكتسب سوق التغليف المموج في الشرق الأوسط وأفريقيا نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 4.7٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 35،967.72 مليون دولار أمريكي بحلول عام 2029. نمو عبوات الورق المقوى المموج الصغيرة والمتوسطة الحجم في صناعة تغليف الأطعمة والمشروبات وزيادة التفضيلات للمنتجات المموجة المعاد تدويرها في صناعة التغليف. من أجل تلبية الطلب المتزايد على منتجات التغليف المموج في صناعة البناء والتشييد والإلكترونيات، تعمل بعض الشركات على توسيع قدراتها الإنتاجية من خلال الدخول في عمليات استحواذ ومشاريع مشتركة وإطلاق منتجات عبر مناطق مختلفة.

تم تصميم منتجات التغليف المصنوعة من الورق المقوى المموج لتوفير حماية قصوى للمنتجات الهشة أو الثقيلة أو الضخمة أو عالية القيمة أثناء التخزين والعبور. توفر عبوات الورق المقوى المموج ذات الطبقات المتعددة القوة لمنتج التغليف وتجعله أقوى من الورق المقوى العادي. تُستخدم أنواع مختلفة من البطانات في الورق المقوى المموج لتوفير القوة مثل بطانات الكرافت وبطانات الاختبار وبطانات الرقائق الخطية. يعمل الورق المقوى المموج أيضًا كوسادة للمنتج أثناء النقل. منتجات التغليف المموج قابلة للتجديد بنسبة 100٪ وفعالة من حيث التكلفة وتستخدم لتحل محل التغليف الخشبي والمعدني. هناك عدة أنواع من عبوات الورق المقوى المموج مثل الطور الواحد والجدار الواحد والجدار المزدوج والجدار الثلاثي وغيرها. تتضمن عبوات الورق المقوى المموج أحادية الطور شقًا واحدًا وواحدة أو اثنتين من اللوح الخطي. تتضمن عبوات الورق المقوى المموجة ذات الجدار الواحد ورقة واحدة من الوسط المموج يتم لصقها ووضعها بين ورقتين من اللوح المبطن. يشير اللوح المزدوج إلى ذلك النوع من تغليف الورق المقوى المموج الذي يتكون من طبقتين من الوسط المموج الملتصق بين ثلاث طبقات من لوح البطانة. يشير اللوح الثلاثي إلى ذلك النوع من تغليف الورق المقوى المموج، والذي يعتبر الأقوى بين جميع أنواع تغليف الورق المقوى المموج لأنه يتكون من ثلاث طبقات من الوسط المموج وأربع طبقات من لوح البطانة.

من المتوقع أن يؤدي زيادة عمليات الشراء نحو الصناديق المموجة خفيفة الوزن عبر الصناعات إلى تعزيز نمو السوق، ومع ذلك، من المتوقع أن تعمل اللوائح الحكومية الصارمة لتغليف المنتجات على تقييد سوق التغليف المموج في الشرق الأوسط وأفريقيا. ومن المتوقع أن يؤدي ارتفاع عمليات الاستحواذ والتعاون بين الشركات إلى خلق فرصة لنمو السوق، ولكن الافتقار إلى الوعي بشأن استدامة التغليف يسبب تحديًا كبيرًا لنمو السوق.

يقدم تقرير سوق التغليف بالكرتون المموج تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق التغليف بالكرتون المموج، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق التغليف بالكرتون المموج وحجم السوق

تنقسم سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا إلى أربعة قطاعات بارزة تعتمد على الدرجة والمواد الخام والأسلوب والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو المتخصصة والاستراتيجيات اللازمة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس المواد الخام، يتم تقسيم سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا إلى لوح مبطن ومتوسط. في عام 2022، من المتوقع أن تهيمن شريحة التغليف بالكرتون المموج على سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا بسبب تقنيات المعالجة السهلة والكفاءات المحسنة فضلاً عن سهولة الاستخدام. ومع ذلك، فإن كمية القوة المحدودة تحد من الاستهلاك في السوق.

- على أساس شريحة الأسلوب، يتم تقسيم سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا إلى صناديق مشقوقة، وتلسكوبات، ومجلدات، وصواني، وصناديق مقطوعة بالقالب، وتصاميم داخلية مقطوعة بالقالب، وصفائح، وصناديق قابلة للطي. في عام 2022، من المتوقع أن تهيمن شريحة الصناديق المشقوقة على السوق نظرًا لتطبيقها المتزايد في صناعة الأغذية والمشروبات في سوق الشرق الأوسط وأفريقيا. إن التوافر السهل في السوق يدفع شريحة الصناديق المشقوقة في سوق الشرق الأوسط وأفريقيا.

- على أساس شريحة الدرجة، يتم تقسيم سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا إلى كرافتلاينر أبيض، كرافتلاينر غير مبيض، اختبار أبيض، اختبار غير مبيض، فلوتينغ قائم على النفايات، و فلوتينغ شبه كيميائي. في عام 2022، من المتوقع أن تهيمن شريحة اختبار اللاينر غير المبيض على السوق بسبب التوافر بكثرة، مما يزيد من الاستهلاك في سوق الشرق الأوسط وأفريقيا. تعمل خصائص مقاومة القوة على تعظيم التطبيق في مختلف المجالات التي تدفع شريحة اختبار اللاينر غير المبيض في سوق الشرق الأوسط وأفريقيا.

- على أساس شريحة الاستخدام النهائي، يتم تقسيم سوق التغليف بالكرتون المموج في الشرق الأوسط وأفريقيا إلى الأطعمة المصنعة والفواكه والخضروات والمشروبات والعناية الشخصية والرعاية الصحية والعناية المنزلية والمواد الكيميائية والمنتجات الورقية والسلع الكهربائية والأواني الزجاجية والسيراميك والخشب ومنتجات الأخشاب والمنسوجات والتبغ وأجزاء المركبات وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الأغذية المصنعة على السوق بسبب الطلب المتزايد على الأغذية المعبأة في البلدان النامية. تعمل خصائص الحمل السهل على دفع شريحة الأغذية والمشروبات في سوق الشرق الأوسط وأفريقيا.

تحليل سوق التغليف بالكرتون المموج على مستوى الدولة

يتم تحليل سوق التغليف بالكرتون المموج وتوفير معلومات حجم السوق حسب البلد والمواد الخام والأسلوب والدرجة والاستخدام النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق التغليف بالكرتون المموج هي جنوب أفريقيا وإسرائيل والإمارات العربية المتحدة والمملكة العربية السعودية ومصر وبقية دول الشرق الأوسط وأفريقيا. تهيمن الإمارات العربية المتحدة على منطقة الشرق الأوسط وأفريقيا بسبب زيادة الوعي البيئي بين السكان، والطلب على حلول التغليف المستدامة، والتغليف المريح (الذي يقابله قيود جديدة على الاستخدام الفردي في بعض البلدان)، وسوق التجارة الإلكترونية المتنامية، والارتفاع في الحاجة إلى السلع الإلكترونية ومنتجات العناية المنزلية والشخصية، إلى جانب التنمية الاقتصادية وزيادة دخل الفرد.

كما يقدم قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

من المتوقع أن يؤدي الميل المتزايد للشراء نحو الصناديق المموجة خفيفة الوزن في جميع أنحاء الصناعة إلى دفع نمو السوق

كما يوفر لك سوق التغليف بالكرتون المموج تحليلاً تفصيلياً للسوق لكل نمو في سوق معين. بالإضافة إلى ذلك، يوفر معلومات تفصيلية حول استراتيجية اللاعبين في السوق ووجودهم الجغرافي. البيانات متاحة للفترة التاريخية 2020.

تحليل المشهد التنافسي وحصة سوق التغليف بالكرتون المموج

يوفر المشهد التنافسي لسوق التغليف بالكرتون المموج تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج واتساعه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق التغليف بالكرتون المموج.

بعض اللاعبين الرئيسيين العاملين في سوق التغليف بالكرتون المموج هم International Paper وMondi وSmurfit Kappa وKlabin SA وSealed Air وغيرها.

كما يتم إبرام العديد من العقود والاتفاقيات من قبل الشركات في الشرق الأوسط وأفريقيا والتي تعمل أيضًا على تسريع سوق التغليف بالكرتون المموج.

على سبيل المثال،

- في مايو 2019، أعلنت شركة Sealed Air عن استحواذها على شركة Automated Packaging System Inc.، الشركة المعروفة بنظام التعبئة والتغليف. ولتحقيق الهدف في هذا العمل، قررت الشركة الاستحواذ على الشركة بسبب العمل التعاوني الذي تقوم به القوى العاملة في الشركة. إن الابتكار التكنولوجي هو النتيجة لكل من السوقين.

- في يونيو 2021، استحوذت شركة Smurfit Kappa على عمليات تصنيع الورق المموج EI Salvador في بيرو. تم إجراء عملية الاستحواذ لتوسيع أعمالها في أمريكا اللاتينية. كانت السوق المغطاة أكبر، ومن أجل زيادة قاعدة المستهلكين، اتخذت الشركة هذا القرار.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 RAW MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY

5.1.2 CONTINUED INDUSTRIALIZATION ACROSS MIDDLE EAST & AFRICALY FOR UNIQUE CARTONS AND MATERIALS

5.1.3 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING IN THE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGHER COST OF CORRUGATED BOARD FOR PACKAGING

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR PACKAGING OF PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE ACQUISITIONS & COLLABORATIONS BETWEEN THE COMPANIES

5.3.2 BAN ON PLASTIC PACKAGING PRODUCTS ON THE MIDDLE EAST & AFRICA MARKET

5.3.3 SURGING E-COMMERCE & COURIER SECTOR ACROSS DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARNESS ABOUT SUSTAINABLE PACKAGING

5.4.2 IMPACT OF HUMID AND MOIST WEATHER ON THE FIRMNESS OF CORRUGATED BOX

6 ANALYSIS ON IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE & DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 LINERBOARD

7.2.1 RECYCLED RESOURCES

7.2.1.1 OCC

7.2.1.2 RECOVERY PAPER

7.2.1.3 MIXED PAPER

7.2.1.4 OFFICE PAPER

7.2.2 NATURAL RESOURCES

7.3 MEDIUM

7.3.1 RECYCLED RESOURCES

7.3.1.1 OCC

7.3.1.2 RECOVERY PAPER

7.3.1.3 MIXED PAPER

7.3.1.4 OFFICE PAPER

7.3.2 NATURAL RESOURCES

8 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE

8.1 OVERVIEW

8.2 SLOTTED BOX

8.3 TELESCOPES

8.4 FOLDERS

8.5 TRAYS

8.6 SHEETS

8.7 FANFOLD

8.8 DIE CUT BLISS

8.9 DIE CUT INTERIORS

9 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE

9.1 OVERVIEW

9.2 UNBLEACHED TESTILINER

9.3 WHITE-TOP TESTILINER

9.4 UNBLEACHED KRAFTLINER

9.5 WHITE-TOP KRAFTLINER

9.6 WASTE-BASED FLUTING

9.7 SEMI-CHEMICAL FLUTING

10 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE

10.1 OVERVIEW

10.2 PROCESSED FOODS

10.3 HEALTHCARE

10.4 BEVERAGES

10.5 CHEMICALS

10.6 TEXTILES

10.7 PERSONAL CARE

10.8 ELECTRICAL GOODS

10.9 VEHICLE PARTS

10.1 GLASSWARE AND CERAMICS

10.11 WOOD AND TIMBER PRODUCTS

10.12 HOUSEHOLD CARE

10.13 FRUITS AND VEGETABLES

10.14 PAPER PRODUCTS

10.15 TOBACCO

10.16 OTHER

11 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 UNITED ARAB EMIRATES

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY SHARE ANALYSIS

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 INTERNATIONAL PAPER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 PACKAGING CORPORATION OF AMERICA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 DS SMITH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 RENGO CO, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ARABIAN PACKAGING CO, LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 B SMITH PACKAGING LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CASCADE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 GEORGIA PACIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 JONSAC AB

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 KLABIN S.A.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 KLINGELE PAPIERWERKE GMBH & CO.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 NEFAB GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NEWAY PACKAGING

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 NIPPON

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 OJI HOLDING CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SMURFIT KAPPA

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SEALED AIR

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 WERTHEIMER BOX CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 BASIC RULES TO CONSIDER FOR SINGLE WALL CORRUGATED FIBERBOARD BOXES:

TABLE 2 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SLOTTED BOX IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA TELESCOPE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA FOLDERS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA TRAYS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SHEETS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA FANFOLD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DIE CUT BLISS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DIE CUT INTERIORS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA UNBLEACHED TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA WHITE-TOP TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA UNBLEACHED KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA WHITE-TOP KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA WASTE-BASED FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SEMI-CHEMICAL FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PROCESSED FOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HEALTHCARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA BEVERAGES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CHEMICALS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TEXTILES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PERSONAL CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ELECTRICAL GOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA VEHICLE PARTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA GLASSWARE AND CERAMICS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA WOOD AND TIMBER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA HOUSEHOLD CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FRUITS AND VEGETABLES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PAPER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA TOBACCO IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 50 UNITED ARAB EMIRATES CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 UNITED ARAB EMIRATES LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 UNITED ARAB EMIRATES RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 UNITED ARAB EMIRATES MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 UNITED ARAB EMIRATES RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 UNITED ARAB EMIRATES CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 56 UNITED ARAB EMIRATES CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 57 UNITED ARAB EMIRATES CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 83 EGYPT LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 EGYPT CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 88 EGYPT CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 90 REST OF MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 11 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RAW MATERIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND ALSO THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVER, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET

FIGURE 15 BELOW FIGURE DEPICTS THE EARNING REVENUE FROM DIFFERENT TYPE OF PACKAGING IN U.S. PACKAGING INDUSTRY IN 2016 (IN %)

FIGURE 16 U.S RETAIL SALES VIA E-COMMERCE IN 2019

FIGURE 17 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: BY STYLE, 2021

FIGURE 19 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: BY GRADE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: BY END-USE, 2021

FIGURE 21 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CORRUGATED BOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.