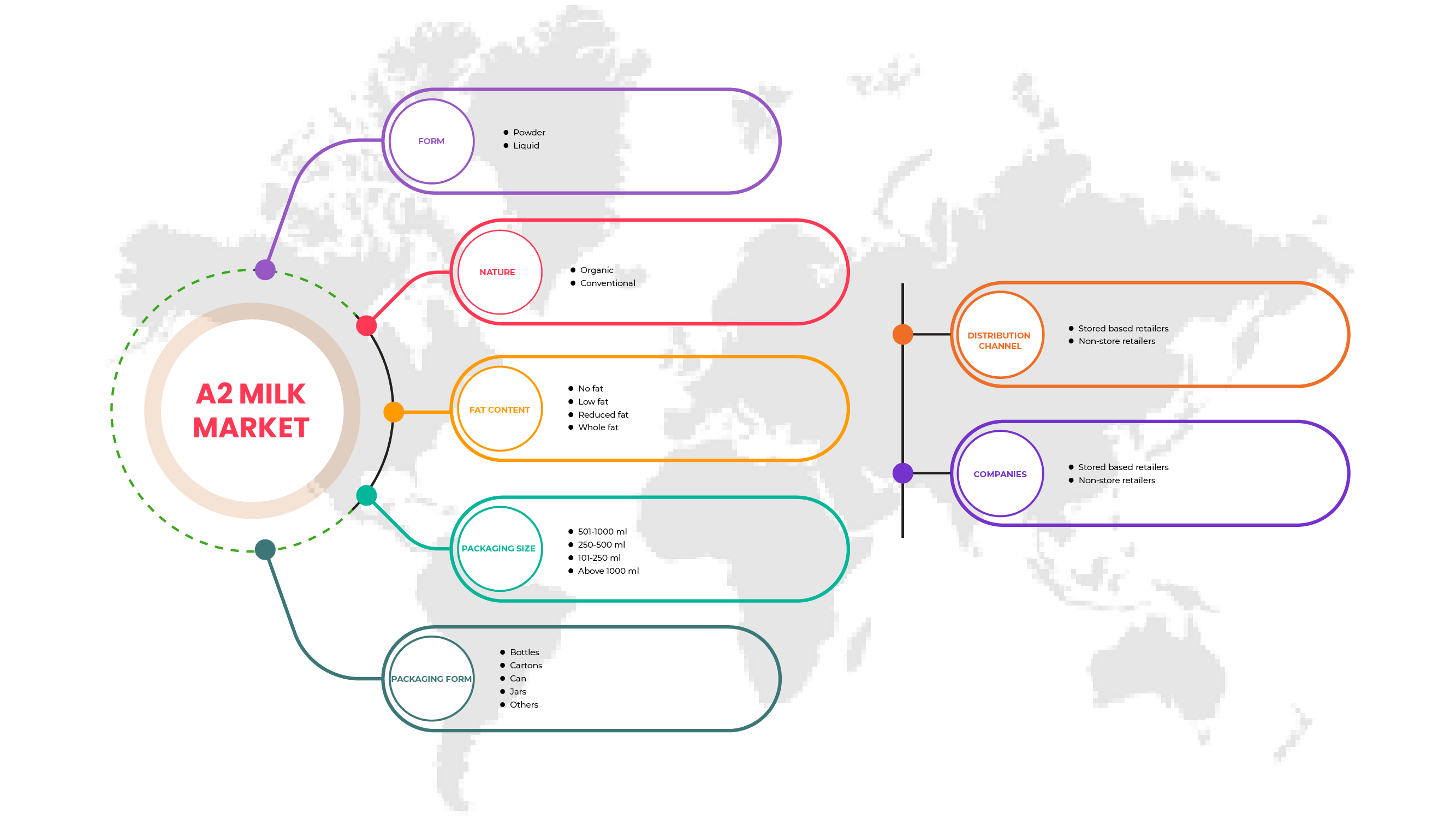

سوق الحليب A2 في الشرق الأوسط وأفريقيا، حسب الشكل (المسحوق والسائل)، الطبيعة (العضوي والتقليدي)، محتوى الدهون (بدون دهون، قليل الدسم، قليل الدسم، وكامل الدسم)، حجم التعبئة والتغليف (101-250 مل / جم، 250-500 مل / جم، 501-1000 مل / جم وفوق 1000 مل / جم)، شكل التعبئة والتغليف (الزجاجات والكرتون والعلب والبرطمانات وغيرها) قناة التوزيع (تجار التجزئة في المتاجر وتجار التجزئة خارج المتاجر) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق الحليب A2 في الشرق الأوسط وأفريقيا

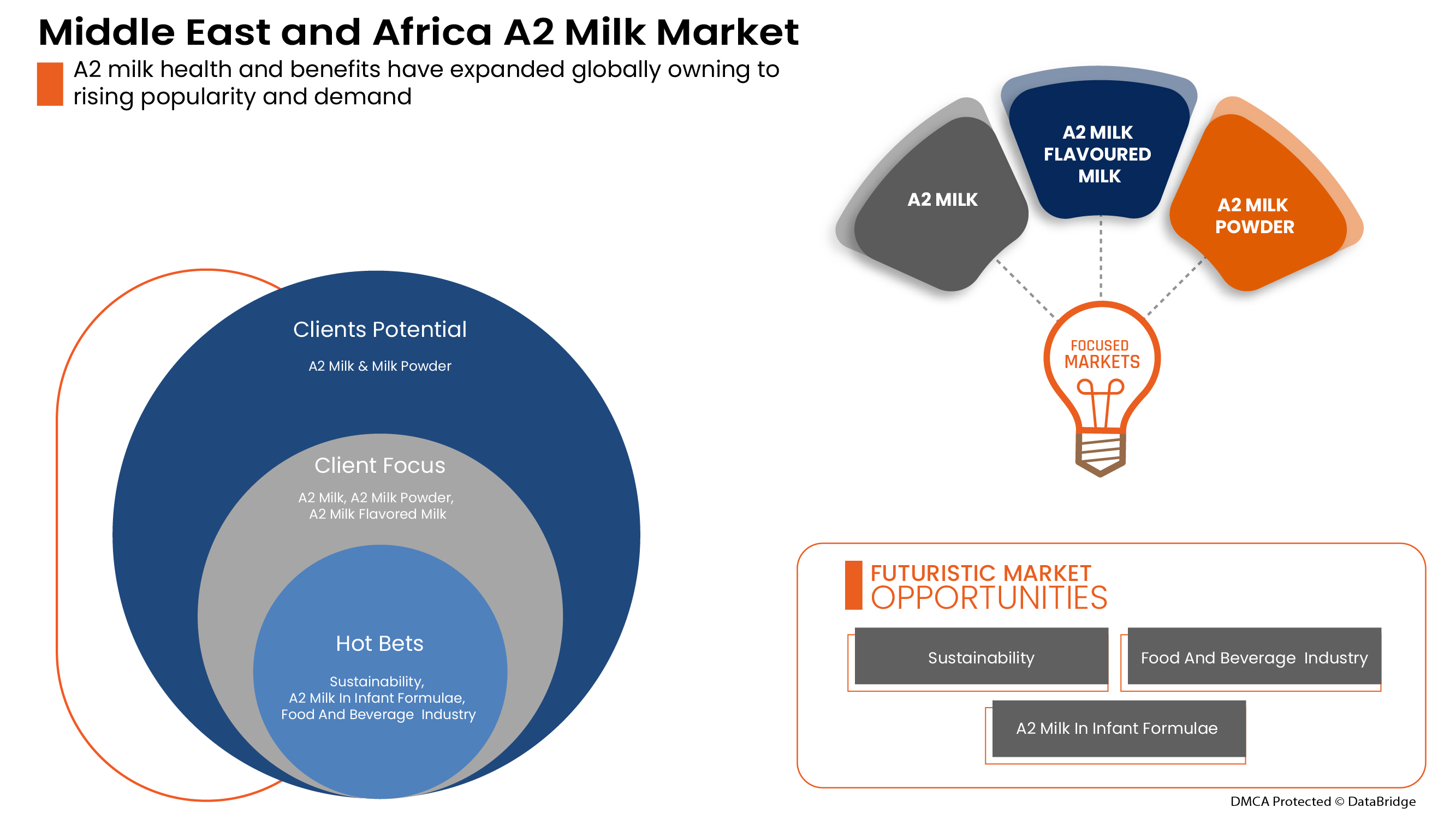

يساعد حليب A2 في تطوير المناعة، ويحفز عملية التمثيل الغذائي، ويوفر أحماض أوميجا 3 الدهنية. ويشهد حليب A2 نموًا كبيرًا بسبب زيادة وعي المستهلكين بصحتهم ومحتوى التغذية العالي في حليب A2 مقارنة بالحليب العادي. وهو متوفر بأشكال مختلفة ومتوفر بسهولة في السوق. ومع ذلك، من المتوقع أن تعمل الأسعار المرتفعة لحليب A2 ومنتجاته على كبح نمو سوق حليب A2 خلال الفترة المتوقعة.

ومن بين العوامل التي تدفع نمو السوق ارتفاع تكنولوجيا حليب A2، وزيادة استخدام حليب A2 في تركيبات الأطفال ، وزيادة الوعي بالصحة بين المستهلكين. ومع ذلك، من المتوقع أن تعيق القيود المفروضة على أسعار حليب A2 المرتفعة نمو السوق.

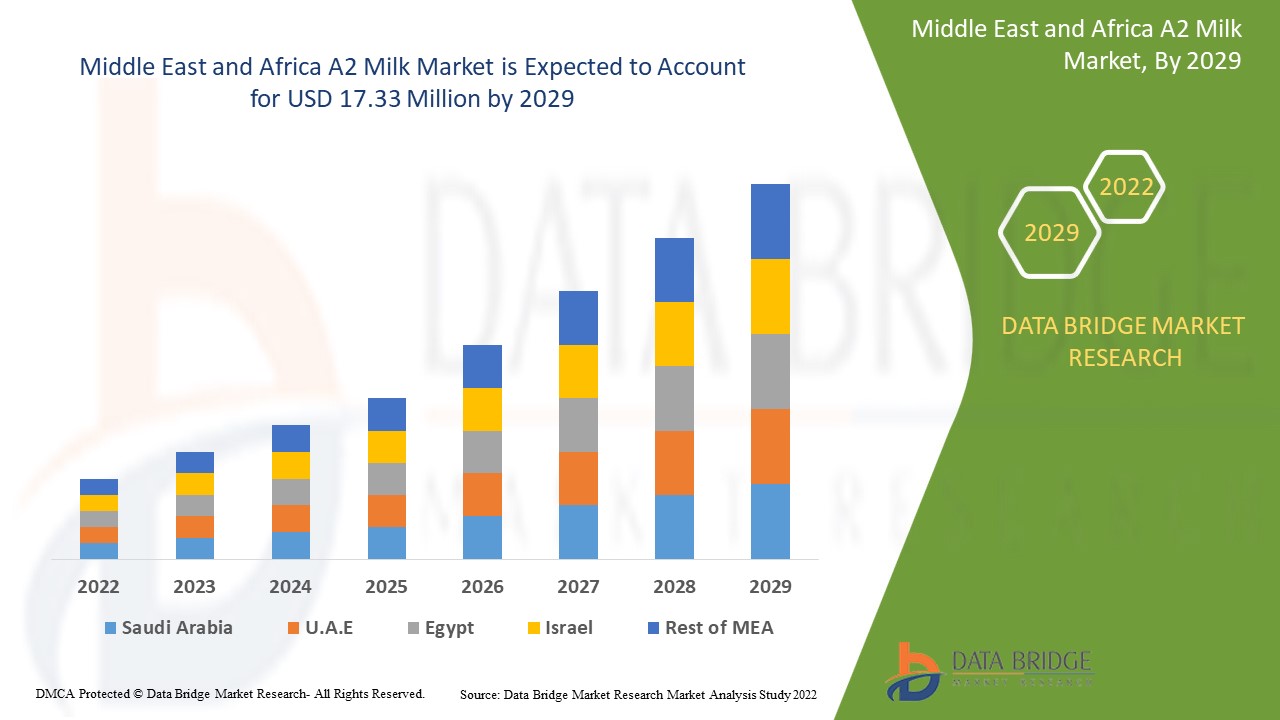

تشير تحليلات Data Bridge Market Research إلى أن سوق حليب A2 من المتوقع أن يصل إلى 17.33 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 14.8٪ خلال الفترة المتوقعة.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب الشكل (مسحوق وسائل)، الطبيعة (عضوي وتقليدي)، محتوى الدهون (بدون دهون، قليل الدسم، قليل الدسم، وكامل الدسم)، حجم العبوة (101-250 مل/جم، 250-500 مل/جم، 501-1000 مل/جم، وفوق 1000 مل/جم)، شكل العبوة (زجاجات، علب، علب، برطمانات، وغيرها) وقناة التوزيع (تجار التجزئة في المتاجر وتجار التجزئة خارج المتاجر) |

|

الدول المغطاة |

جنوب أفريقيا والإمارات العربية المتحدة والمملكة العربية السعودية والكويت وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

-------- |

تعريف السوق

حليب A2 هو نوع من حليب الأبقار يفتقر إلى بروتينات الكازين من النوع A1 ويحتوي في الغالب على بروتين A2. يتحلل بروتين بيتا كازين A2 الموجود في حليب A2 بسرعة إلى أحماض أمينية للهضم السريع، مما يحسن صحتنا العامة ويزيد من القيمة الغذائية لحليب الأبقار. يحتوي حليب الأبقار A2 على معادن مثل الكالسيوم والبوتاسيوم والفوسفور، وهي ضرورية لعظام وأسنان قوية، ووظيفة عضلية أفضل، وتنظيم ضغط الدم، ونمو الأنسجة والخلايا، وتعزيز الكوليسترول الجيد (HDL)، فضلاً عن الحفاظ على التغذية العامة ورفاهية الجسم.

ديناميكيات سوق الحليب A2

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين:

- زيادة الوعي بالصحة بين المستهلكين

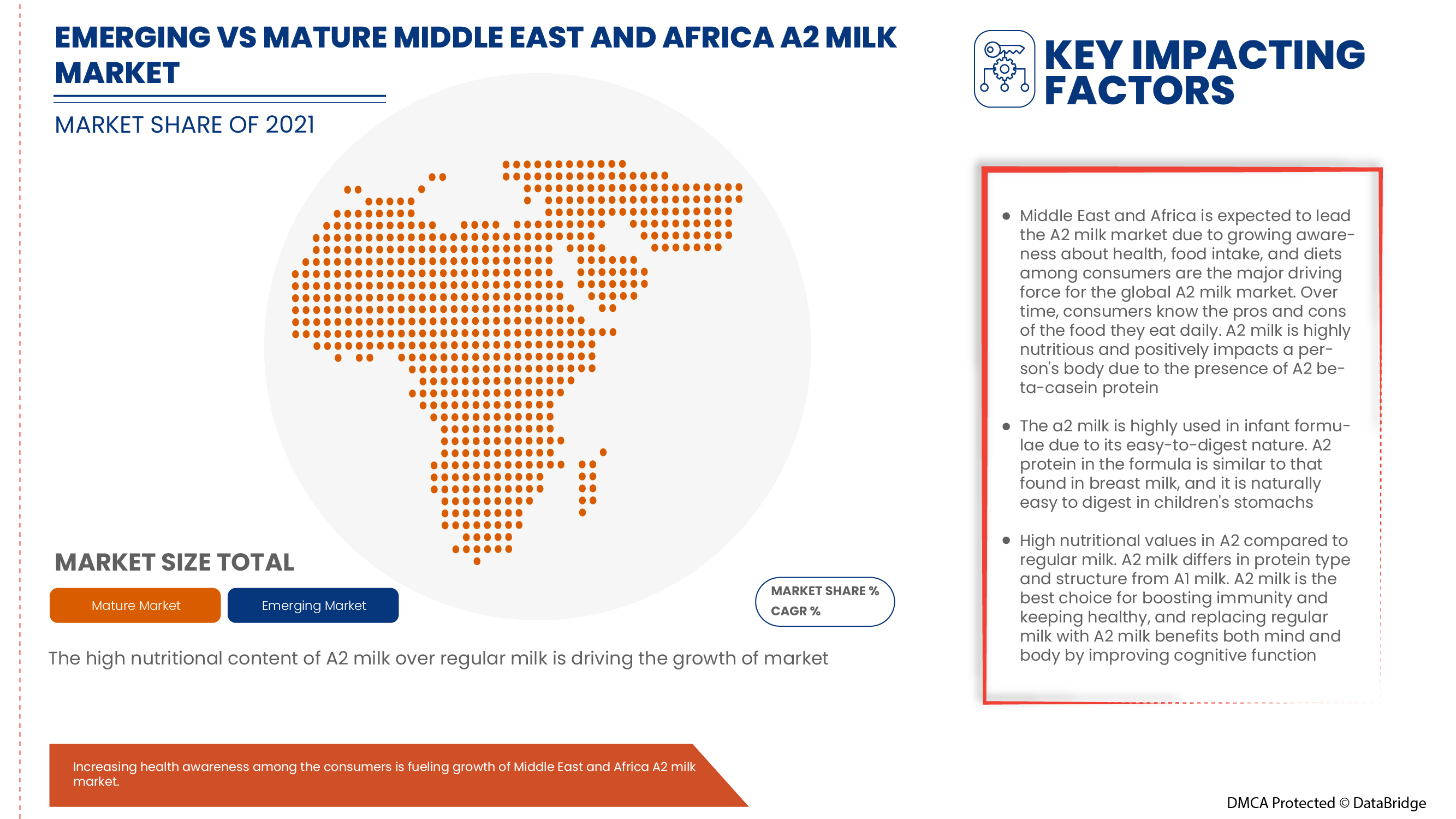

إن الوعي المتزايد لدى المستهلكين بشأن الصحة وتناول الطعام والأنظمة الغذائية هو القوة الدافعة الرئيسية لسوق حليب A2 في الشرق الأوسط وأفريقيا. بمرور الوقت، يعرف المستهلكون إيجابيات وسلبيات الطعام الذي يتناولونه يوميًا. حليب A2 مغذي للغاية ويؤثر بشكل إيجابي على جسم الشخص بسبب وجود بروتين بيتا كازين A2. يمنع هذا البروتين A2 أمراض القلب والسكري والتوحد المختلفة. مع هذا، يستهلك الناس حليب A2 ويفضلونه للاستهلاك المنتظم. ومن المتوقع أن يعزز هذا التغيير في التفضيل وتطور الوعي بالصحة نمو سوق حليب A2 العالمي.

وبالتالي، فإن الوعي الصحي المتزايد وتغير عادات الأكل لدى المستخدمين النهائيين يؤديان إلى زيادة الطلب على حليب A2. ومن المتوقع أن يعزز هذا الطلب المتزايد على حليب A2 سوق حليب A2 في الشرق الأوسط وأفريقيا.

- القيم الغذائية العالية في الحليب a2 مقارنة بالحليب العادي

يختلف حليب A2 في نوع البروتين وبنيته عن حليب A1. يعد حليب A2 الخيار الأفضل لتعزيز المناعة والحفاظ على الصحة. إن استبدال الحليب العادي بحليب A2 يفيد العقل والجسم من خلال تحسين الوظائف الإدراكية وتغذية البشرة والشعر. بالإضافة إلى ذلك، يمنع حليب A2 مشاكل مثل أمراض القلب وعدم تحمل اللاكتوز والسكري والتوحد. مع التغذية الوفيرة والفوائد الصحية العديدة، يرتفع طلب المستهلكين على حليب A2 بسرعة. يفضل المستخدمون النهائيون حليب A2 على الحليب العادي في منتجات الألبان المختلفة للحفاظ على صحة جيدة. وبالتالي، ثبت أن حليب A2 أكثر تغذية من الحليب العادي.

وبالتالي، فإن القيمة الغذائية العالية ومحتوى المعادن الأعلى في حليب A2 يؤديان إلى زيادة الطلب على حليب A2 ومبيعاته في السوق. ومع هذا الطلب المتزايد، من المتوقع أن يشهد سوق حليب A2 في الشرق الأوسط وأفريقيا نموًا كبيرًا.

ضبط النفس

- ارتفاع أسعار حليب A2

إن الأسعار المرتفعة لحليب A2 مقارنة بالحليب العادي تشكل عائقًا رئيسيًا أمام نمو السوق. إن نطاق أسعار حليب A2 ومنتجاته ضعف نطاق أسعار الحليب العادي في السوق. ولا يزال إنتاج حليب A2 محدودًا حيث توفر سلالات أبقار حليب A2 كمية أقل من الحليب يوميًا، ونتيجة لهذا، تفرض الشركات تكاليف عالية على حليب A2 لتحقيق إيرادات أعلى. إن المستخدمين النهائيين لحليب A2 هم عامة الناس، ووجود حليب A2 في السوق بنطاق أعلى ليس في متناول الكثير من الناس. وبسبب الدرجات الأعلى، يفضل الناس الحليب العادي على حليب A2 ومنتجاته. وتعتبر أسعار الحليب المرتفعة هذه عاملًا مقيدًا رئيسيًا في نمو السوق.

وبالتالي، فإن الأسعار المرتفعة لحليب A2 ومنتجاته تمكن المستهلكين من استخدام الحليب العادي. ومن المتوقع أن يؤدي هذا بدوره إلى كبح نمو سوق حليب A2 في الشرق الأوسط وأفريقيا.

فرصة

- ميل المستهلكين نحو الإنتاج المستدام لحليب أ2

إن الاستدامة تحمي صحة البيئة وقدرتها البيولوجية. كما تساعد الاستدامة على تعزيز رفاهية الفرد والمجتمع. وتعزز الاستدامة اقتصادًا أفضل مع تقليل التلوث والنفايات، وتقليل الانبعاثات، وزيادة فرص العمل، وتوزيع الثروة بشكل عادل. إن النهج المستدام لإنتاج حليب A2 يقلل من التأثير البيئي لمزارع الألبان مع زيادة رفاهية الحيوان في قطاع الألبان والدعم الاجتماعي. ومن المرجح أن يهتم المستهلكون الذين يتمتعون بمعايير أخلاقية أعلى بشراء منتجات ألبان حليب A2 التي تستخدم ابتكارات مستدامة. يتمتع المستهلكون العضويون العاديون بموقف أكثر إيجابية تجاه منتجات الألبان التي تستخدم ابتكارات مستدامة. ونتيجة لذلك، تركز العديد من الشركات القائمة على حليب A2 على الاستدامة في عمليات الإنتاج والمعالجة والتعبئة والتغليف وغيرها من العمليات.

ومن ثم، فإن تنفيذ النهج المستدامة في كل مرحلة تقريبًا من مراحل إنتاج حليب A2 ومنتجات الحليب القائمة على حليب A2 قد وفر فرصًا مختلفة لنمو السوق حتى في الفترة المتوقعة لأن المستهلكين يفضلون في الغالب المنتجات المستدامة والعضوية.

التحديات

- نمو اتجاه النباتية بين الناس

النباتية هي أسلوب حياة يدعو إلى إزالة المنتجات الحيوانية من النظام الغذائي، وخاصة منتجات الألبان واللحوم والدواجن. تطورت النباتية إلى اتجاه نحو حياة أكثر صحة حيث أصبح المزيد من الناس على دراية بالضرر الذي تسببه للبيئة وأنواع الحيوانات. إن الأساس المنطقي للنباتية هو التوقف عن إجهاد الحيوانات واستغلالها وقتلها لإنهاء أنواعها. يجلب هذا الاتجاه النباتي المزيد من بدائل الحليب الطبيعية، لذلك يتجنب معظم الأشخاص الذين يتبنون النباتية منتجات الحليب A2، على الرغم من أن حليب A2 له فائدة غذائية أعلى من غيره. نظرًا لأن حليب A2 منتج حيواني، فإن اتجاه النباتية سيشكل تحديًا كبيرًا لنمو سوق حليب A2.

وهكذا، فإن الاتجاه نحو النباتية يؤدي إلى الحد الأدنى من اختيار المستهلكين للمنتجات القائمة على الألبان، لذلك من المتوقع أن يشكل هذا الاتجاه نحو النباتية بين الناس تحديًا كبيرًا لنمو سوق حليب A2 العالمي.

- استثمار كبير في البحث والتطوير لمنتجات الحليب A2

تستثمر الشركات في البحث والتطوير لأسباب مختلفة، بما في ذلك زيادة المشاركة في السوق، وتوفير التكاليف، والتقدم في التسويق، ومواكبة الاتجاهات. يمكن أن يساعد البحث والتطوير الشركة في متابعة اتجاهات السوق أو البقاء في صدارتها، وبالتالي الحفاظ على أهمية الشركة. بعض فوائد البحث والتطوير واضحة، مثل إمكانية زيادة الإنتاج أو خطوط المنتجات الجديدة. لكن الاستثمار المطلوب للبحث والتطوير لمنتجات الحليب A2 مرتفع للغاية ولكنه ضروري أيضًا لإطلاق منتجات جديدة. لذلك، فإن العديد من الشركات غير قادرة على وضع أصول عالية في قسم البحث والتطوير هذا وعدم إطلاق أي منتجات جديدة مفيدة لنمو سوق الحليب A2 العالمي.

علاوة على ذلك، يمكن القول إن الاستثمار المرتفع في البحث والتطوير لشركات الحليب A2 يشكل تحديًا كبيرًا يحد من نمو السوق. كما أن الافتقار المستمر لإطلاق منتجات جديدة والتقدم في منتجات حليب A2 يحد من التغيير في السوق ويقيد أيضًا دخول لاعبين جدد.

تأثير ما بعد كوفيد-19 على سوق زراعة الفطر في الإمارات العربية المتحدة

بعد الوباء، زاد الطلب على حليب A2 حيث لن تكون هناك أي قيود على الحركة؛ وبالتالي، سيكون توريد المنتجات سهلاً. لقد أثر استمرار كوفيد-19 لفترة أطول على سلسلة التوريد حيث تعطلت، وأصبح من الصعب توريد المنتجات الغذائية للمستهلكين، مما أدى في البداية إلى زيادة الطلب على المنتجات. ومع ذلك، بعد كوفيد، زادت الحاجة إلى حليب A2 بشكل كبير بسبب محتوى البروتين الجيد والعناصر الغذائية الأخرى المتاحة.

نطاق سوق الحليب A2 في الشرق الأوسط وأفريقيا

يتم تقسيم سوق حليب A2 في الشرق الأوسط وأفريقيا على أساس الشكل والطبيعة ومحتوى الدهون وحجم العبوة وشكل العبوة وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

استمارة

- مسحوق

- سائل

على أساس الشكل، يتم تقسيم سوق الحليب A2 في الشرق الأوسط وأفريقيا إلى مسحوق وسائل.

طبيعة

- عضوي

- عادي

على أساس الطبيعة، يتم تقسيم سوق الحليب A2 في الشرق الأوسط وأفريقيا إلى عضوي وتقليدي.

محتوى الدهون

- لا دهون

- قليل الدهن

- تقليل الدهون

- الدهون الكاملة

على أساس محتوى الدهون، يتم تقسيم سوق حليب A2 في الشرق الأوسط وأفريقيا إلى خالي من الدهون، وقليل الدسم، ومخفف الدسم، وكامل الدسم.

حجم العبوة

- 101-250 مل/جم

- 250-500 مل/جم

- 501-1000مل/جم

- أكثر من 1000 مل/جم

على أساس حجم التعبئة والتغليف، يتم تقسيم سوق حليب A2 في الشرق الأوسط وأفريقيا إلى 50-100 ملجم / جم، 101-250 مل / جم، 250-500 مل / جم، 501-1000 مل / جم، وأكثر من 1000 مل / جم.

نموذج التغليف

- زجاجات

- كرتون

- يستطيع

- الجرار

- آحرون

على أساس شكل التعبئة والتغليف، يتم تقسيم سوق حليب A2 في الشرق الأوسط وأفريقيا إلى زجاجات وكرتون وعلب وبرطمانات وغيرها.

قناة التوزيع

- تجار التجزئة المخزنين

- تجار التجزئة غير المتاجر

على أساس قناة التوزيع، يتم تقسيم سوق حليب A2 في الشرق الأوسط وأفريقيا إلى تجار التجزئة في المتاجر وتجار التجزئة خارج المتاجر.

تحليل/رؤى إقليمية لسوق الحليب A2

يتم تحليل سوق حليب A2، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والشكل والطبيعة ومحتوى الدهون وحجم العبوة وشكل العبوة وقناة التوزيع.

الدول التي يغطيها تقرير سوق الحليب A2 في الشرق الأوسط وأفريقيا هي جنوب أفريقيا والإمارات العربية المتحدة والمملكة العربية السعودية والكويت وبقية دول الشرق الأوسط وأفريقيا.

تعد جنوب أفريقيا الدولة الأكثر نموًا في سوق حليب A2. إن الوعي المتزايد بفوائد حليب A2 الصحية مقارنة بحليب A1 بين المستهلكين هو السبب الرئيسي لنمو سوق حليب A2 في الشرق الأوسط وأفريقيا. سيؤثر تطوير هذا السوق بشكل مباشر على نمو سوق حليب A2. ومع ذلك، من المرجح أن تحد أسعار حليب A2 المرتفعة من نمو السوق.

يقدم قسم الدولة في التقرير أيضًا عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات التكنولوجية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الحليب A2

يوفر المشهد التنافسي لسوق الحليب A2 تفاصيل حول المنافس. وتشمل المكونات نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج، ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الحليب A2.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA A2 MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT NUTRITIONAL QUALITY

4.1.2 PRODUCT PRICING

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 TRADE ANALYSIS

4.3.1 IMPORTS-EXPORTS OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF MIDDLE EAST & AFRICA A2 MILK MARKET

4.4.1 INDUSTRY TRENDS

4.4.2 FUTURE PERSPECTIVE

4.5 RAW MATERIAL SOURCING ANALYSIS: MIDDLE EAST & AFRICA A2 MILK MARKET

4.6 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

4.6.1 RAW A2 MILK PRODUCTION

4.6.2 PROCESSING AND PACKAGING

4.6.3 TRANSPORTATION AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA A2 MILK MARKET

4.9 PORTER'S FIVE

4.9.1 PORTER'S FIVE FORCES ANALYSIS FOR MIDDLE EAST & AFRICA A2 MILK MARKET

4.9.2 BARGAINING POWER OF SUPPLIERS

4.9.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.9.4 THREAT OF NEW ENTRANTS

4.9.5 THREAT OF SUBSTITUTE PRODUCTS

4.9.6 INTENSITY OF COMPETITIVE RIVALRY

5 REGULATORY FRAMEWORK AND LABELLING FOR THE MIDDLE EAST & AFRICA A2 MILK MARKET

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –MIDDLE EAST & AFRICA A2 MILK MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 PRICING INDEX

7.1 FOB & B2B PRICES - MIDDLE EAST & AFRICA A2 MILK MARKET

7.2 B2B PRICES - MIDDLE EAST & AFRICA A2 MILK MARKET

8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

9 BRAND OUTLOOK

9.1 PRODUCT VS BRAND OVERVIEW

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING AWARENESS ABOUT HEALTH AMONG CONSUMERS

10.1.2 INCREASING APPLICATIONS OF A2 MILK IN INFANT FORMULAE

10.1.3 HIGH NUTRITIONAL VALUES IN A2 COMPARED TO REGULAR MILK

10.1.4 CONSUMERS EXPERIENCING HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR MILK

10.2 RESTRAINT

10.2.1 HIGH PRICES OF A2 MILK

10.3 OPPORTUNITY

10.3.1 INCLINATION OF CONSUMERS OVER SUSTAINABLE PRODUCTION OF A2 MILK

10.4 CHALLENGES

10.4.1 GROWING TREND OF VEGANISM AMONG PEOPLE

10.4.2 HIGH INVESTMENT IN R&D FOR A2 MILK PRODUCTS

11 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 MIDDLE EAST & AFRICA A2 MILK MARKET, BY NATURE

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FAT CONTENT

13.1 OVERVIEW

13.2 WHOLE FAT

13.3 LOW FAT

13.4 REDUCED FAT

13.5 NO FAT

14 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGIING SIZE

14.1 OVERVIEW

14.2 501-1000 ML

14.3 250-500 ML

14.4 101-250 ML

14.5 ABOVE 1000 ML

15 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING FORM

15.1 OVERVIEW

15.2 BOTTLES

15.2.1 PLASTIC

15.2.2 GLASS

15.3 CARTONS

15.4 CAN

15.5 JARS

15.6 OTHERS

16 MIDDLE EAST & AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 NON-STORE RETAILERS

16.2.1 ONLINE

16.2.2 VENDING MACHINE

16.3 STORE BASED RETAILERS

16.3.1 SUPERMARKETS/HYPERMARKETS

16.3.2 CONVENIENCE STORES

16.3.3 GROCERY STORES

16.3.4 SPECIALTY STORES

17 MIDDLE EAST & AFRICA A2 MILK MARKET, BY REGION

17.1 MIDDLE EAST AND AFRICA

17.1.1 SOUTH AFRICA

17.1.2 UAE

17.1.3 REST OF MIDDLE EAST AND AFRICA

18 COMPANY LANDSCAPE: MIDDLE EAST & AFRICA A2 MILK MARKET

18.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THE A2 MILK COMPANY LIMITED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 GCMMF

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 CAPTAIN’S FARM

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 VEDAAZ ORGANICS PVT. LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 URBAN FARMS MILK

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AUSTRALIA'S OWN

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AVTARAN MILK

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AYUDA ORGANICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DOFE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ERDEN CREAMERY PRIVATE LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 KSHEERDHAM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 PROVILAC DAIRY FARMS PVT. LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 RIPLEY FARMS LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 TAW RIVER DAIRY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 VECO ZUIVEL B.V.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 FREE ON BOARD (FOB) OF A2 MILK

TABLE 2 BRAND COMPARATIVE ANALYSIS OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

TABLE 3 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA LIQUID IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA POWDER IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CONVENTIONAL IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ORGANIC IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA WHOLE FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LOW FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REDUCED FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA NO FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA 501-1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 250-500 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA 101-250 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ABOVE 1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BOTTLES IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CARTONS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CAN IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA JARS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE-EAST AND AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE-EAST AND AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE-EAST AND AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 UAE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 UAE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 52 UAE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 53 UAE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 54 UAE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 55 UAE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 UAE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 UAE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 UAE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 REST OF MIDDLE EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA A2 MILK MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA A2 MILK MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA A2 MILK MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA A2 MILK MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA A2 MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA A2 MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA A2 MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA A2 MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA A2 MILK MARKET: SEGMENTATION

FIGURE 10 INCREASING APPLICATION OF A2 MILK IN THE FOOD INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST & AFRICA A2 MILK MARKET IN THE FORECAST PERIOD

FIGURE 11 LIQUID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA A2 MILK MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

FIGURE 13 VALUE CHAIN OF A2 MILK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA A2 MILK MARKET

FIGURE 15 MIDDLE EAST & AFRICA A2 MILK MARKET: BY FORM, 2021

FIGURE 16 MIDDLE EAST & AFRICA A2 MILK MARKET: BY NATURE, 2021

FIGURE 17 MIDDLE EAST & AFRICA A2 MILK MARKET: BY FAT CONTENT, 2021

FIGURE 18 MIDDLE EAST & AFRICA A2 MILK MARKET: BY PACKAGING SIZE, 2021

FIGURE 19 MIDDLE EAST & AFRICA A2 MILK MARKET: BY PACKAGING FORM, 2021

FIGURE 20 MIDDLE EAST & AFRICA A2 MILK MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 MIDDLE EAST AND AFRICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA A2 MILK MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.