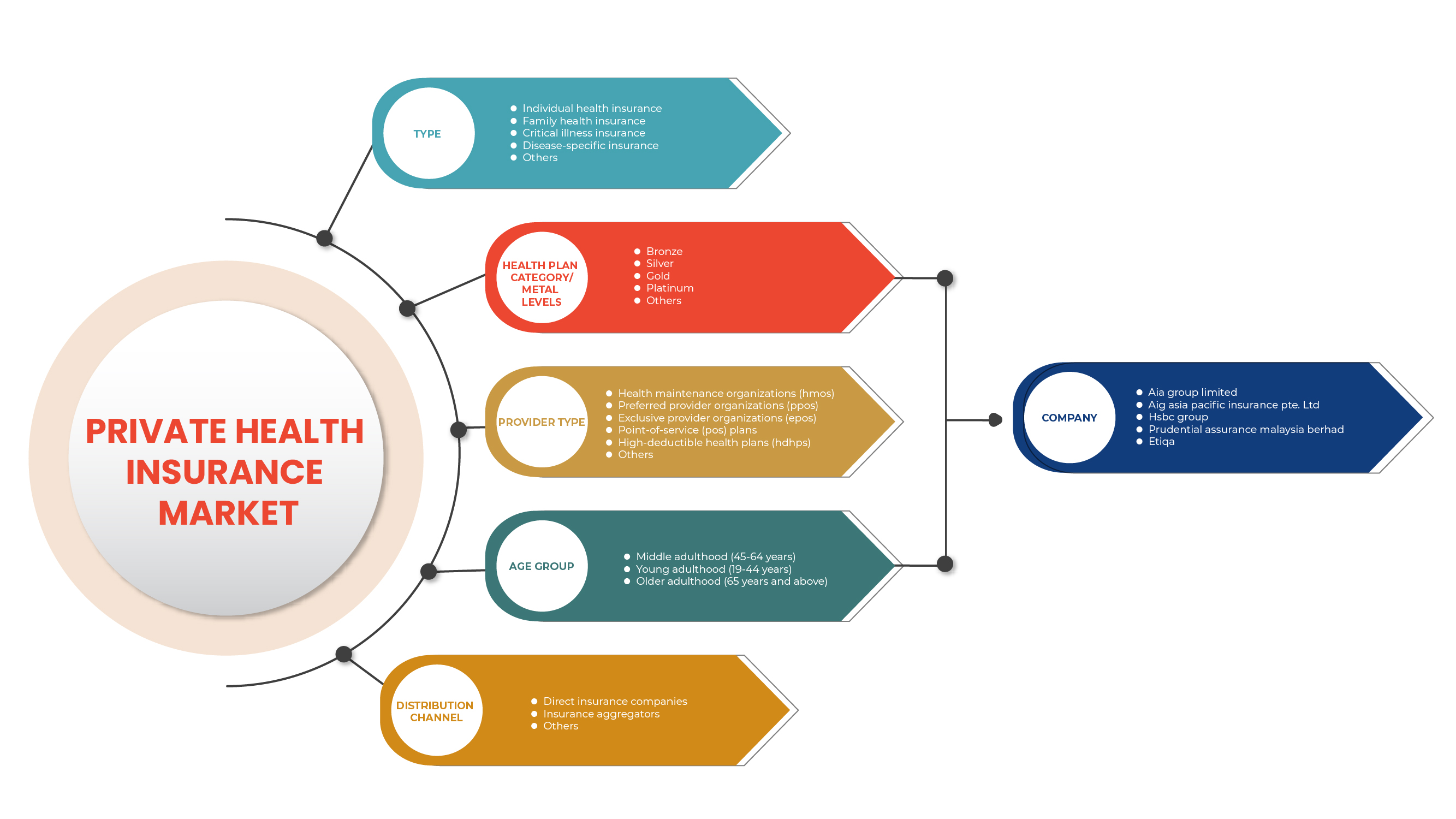

سوق التأمين الصحي الخاص في ماليزيا، حسب النوع (تأمين الأمراض الحرجة، تأمين صحي فردي، تأمين صحي عائلي، تأمين خاص بالأمراض وغيرها)، فئة خطة الرعاية الصحية/المستويات المعدنية (برونزية، فضية، ذهبية بلاتينية وغيرها)، نوع المزود (منظمات صيانة الصحة (HMOS)، منظمات مقدمي الخدمة المفضلين (PPOS)، منظمات مقدمي الخدمة الحصريين (EPOS)، خطط نقطة الخدمة (POS)، خطط صحية ذات خصم مرتفع (HDHPS) وغيرها)، الفئة العمرية (مرحلة الشباب (19-44 سنة)، مرحلة منتصف العمر (45-64 سنة) ومرحلة كبار السن (65 سنة وما فوق))، قناة التوزيع (شركات التأمين المباشرة ومجمعي التأمين وغيرها) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والحجم

تتكون وثيقة التأمين الصحي من عدة أنواع من الميزات والفوائد. فهي توفر تغطية مالية لحاملي الوثائق مقابل علاجات معينة، وتوفر وثيقة التأمين الصحي مزايا بما في ذلك الاستشفاء بدون نقود، وتغطية ما قبل وبعد الاستشفاء، والتعويض، والعديد من الإضافات.

في خطة التأمين الصحي، تتوفر عدة أنواع من التغطية: التغطية غير النقدية أو المطالبة بالتعويض. تتوفر الميزة غير النقدية عندما يتلقى حامل الوثيقة العلاج من المستشفيات التابعة لشبكة شركة التأمين. إذا تلقى حامل الوثيقة العلاج من المستشفيات غير المدرجة في شبكة القائمة، في هذه الحالة، يتحمل حامل الوثيقة جميع النفقات الطبية ثم يطالب بالتعويض في شركة التأمين عن طريق تقديم جميع الفواتير الطبية.

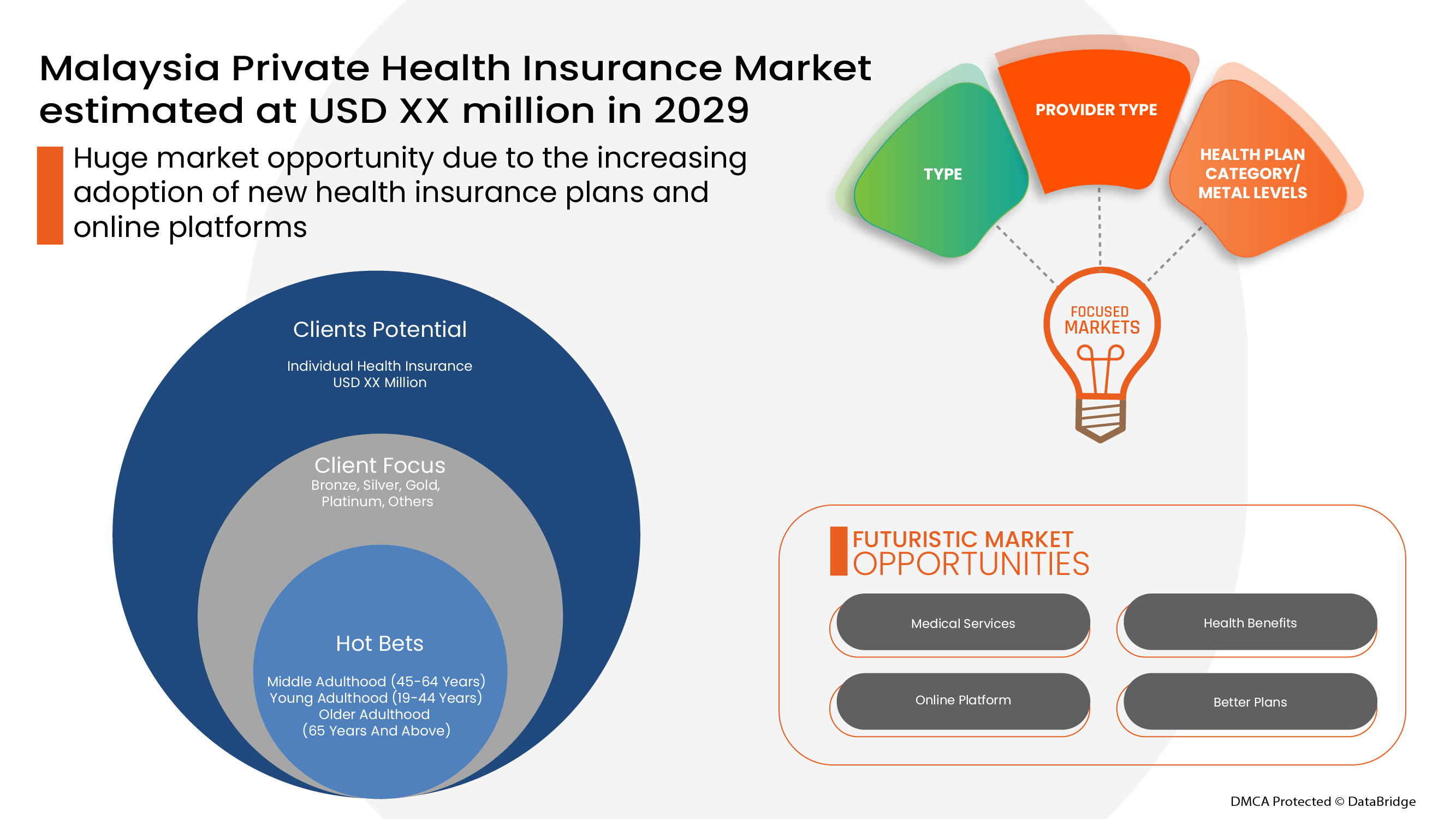

يقدم هذا التأمين الصحي الخاص الدعم المالي لحامل الوثيقة حيث يغطي جميع النفقات الطبية عندما يكون حامل الوثيقة في المستشفى للعلاج. تحلل شركة Data Bridge Market Research أن سوق التأمين الصحي الخاص من المتوقع أن يصل إلى قيمة 2،353.93 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 1.6٪ خلال الفترة المتوقعة. "التأمين الصحي الفردي" يمثل الشريحة الأكثر بروزًا في السوق المعنية بسبب ارتفاع التأمين الصحي الخاص. يتضمن تقرير السوق الذي أعده فريق Data Bridge Market Research تحليلًا متعمقًا من الخبراء، وتحليل الاستيراد / التصدير، وتحليل التسعير، وتحليل استهلاك الإنتاج، وسيناريو سلسلة المناخ.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب النوع (تأمين الأمراض الحرجة، تأمين صحي فردي، تأمين صحي عائلي، تأمين خاص بالأمراض وغيرها)، فئة خطة الرعاية الصحية/المستويات المعدنية (برونزي، فضي، ذهبي بلاتيني وغيرها)، نوع المزود (منظمات صيانة الصحة (HMOS)، منظمات مقدمي الخدمة المفضلين (PPOS)، منظمات مقدمي الخدمة الحصريين (EPOS)، خطط نقطة الخدمة (POS)، خطط الرعاية الصحية ذات الخصم المرتفع (HDHPS) وغيرها)، الفئة العمرية (شباب الرشد (19-44 سنة)، منتصف الرشد (45-64 سنة) وكبار السن (65 سنة وما فوق))، قناة التوزيع (شركات التأمين المباشرة، مجمعي التأمين وغيرها) |

|

الدول المغطاة |

ماليزيا |

|

الجهات الفاعلة في السوق المشمولة |

AIA Group Limited (هونج كونج)، HCF (أستراليا)، Allianz (ألمانيا)، HSBC Group (هونج كونج)، Great Eastern Holdings Limited (ماليزيا)، زيوريخ (سويسرا)، ASSICURAZIONI GENERALI SPA (إيطاليا)، AXA (فرنسا)، عتيقة (ماليزيا)، برودنشيال أشورانس ماليزيا بيرهاد (ماليزيا)، هونغ ليونج للتأمين بيرهاد (ماليزيا)، مانولايف هولدنجز بيرهاد (ماليزيا) |

تعريف السوق

التأمين الصحي هو نوع من التأمين يوفر تغطية لجميع أنواع النفقات الجراحية والعلاج الطبي الناتج عن المرض أو الإصابة. ينطبق التأمين الصحي على مجموعة شاملة أو محدودة من الخدمات الطبية التي تغطي التكاليف الكاملة أو الجزئية لخدمات محددة. يوفر التأمين الصحي الدعم المالي لحامل الوثيقة حيث يغطي جميع النفقات الطبية عندما يكون حامل الوثيقة في المستشفى للعلاج. يغطي التأمين الصحي أيضًا نفقات ما قبل وبعد دخول المستشفى.

الإطار التنظيمي

أصدر بنك نيجارا ماليزيا المبادئ التوجيهية المنقحة بشأن أعمال التأمين الطبي والصحي لشركات التأمين والتي ستحل محل المبادئ التوجيهية الحالية التي تحكم أعمال التأمين الطبي والصحي والتي صدرت لأول مرة في ديسمبر 1998. تهدف المبادئ التوجيهية المنقحة إلى تعزيز معاملة أكثر إنصافًا وتناسقًا للمستهلكين المغطاة بموجب سياسات التأمين الطبي والصحي الصادرة عن كل من شركات التأمين العام وشركات التأمين على الحياة. تنص المبادئ التوجيهية المنقحة على المعايير الدنيا التي يجب على شركات التأمين مراعاتها فيما يتعلق بشروط إصدار سياسات التأمين الطبي والصحي، وتحديد الأقساط، والقيود التي يمكن فرضها على المزايا الأساسية المقدمة بموجب السياسات، والإفصاحات لحاملي الوثائق. تشمل المزايا المحسنة للمستهلكين بشكل عام ما يلي: -

- تقليل فترات الانتظار قبل أن يحق لحامل الوثيقة المطالبة بالفوائد المقدمة بموجب الوثيقة؛

- تقديم فترة "معاينة مجانية" لمدة 15 يومًا على الأقل للمستهلكين لتقييم مدى ملاءمة السياسة الجديدة التي تم شراؤها.

كان لـ COVID-19 تأثير ضئيل على سوق التأمين الصحي الخاص

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية والخدمية في عام 2020-2021 حيث أدت إلى إغلاق أماكن العمل وتعطيل سلاسل التوريد والقيود المفروضة على النقل. ومع ذلك، فإن الخلل بين الطلب والعرض وتأثيره على التسعير يعتبر قصير الأجل ومن المتوقع أن يتعافى مع انتهاء هذا الوباء. وبسبب تفشي كوفيد-19 في جميع أنحاء العالم، زاد الطلب على التأمين الصحي الخاص بشكل كبير. كما ساعد الخوف من الوباء وزيادة تكلفة الخدمات الطبية في نمو سوق التأمين الصحي أثناء الوباء. بالإضافة إلى ذلك، قدمت شركات التأمين الصحي حزمًا وحلولًا لتغطية التكاليف الطبية لعلاج شركات التأمين المصابة بكوفيد-19. وبالتالي، على الرغم من أن الصناعات الأخرى عانت كثيرًا أثناء تفشي كوفيد-19، إلا أن صناعة التأمين الصحي الخاصة كانت تنمو بشكل كبير.

تتضمن ديناميكيات سوق التأمين الصحي الخاص ما يلي:

العوامل المحركة/الفرص المتاحة في سوق التأمين الصحي الخاص

- ارتفاع تكلفة الخدمات الطبية

يوفر التأمين الصحي الدعم المالي في حالات المرض الخطير أو الحوادث. وقد أدى ارتفاع تكاليف الخدمات الطبية للعمليات الجراحية والإقامة في المستشفى إلى خلق وباء مالي جديد في جميع أنحاء العالم. تتألف تكلفة الخدمات الطبية من تكلفة الجراحة، ورسوم الطبيب، وتكلفة الإقامة في المستشفى، وتكلفة غرفة الطوارئ، وتكلفة الاختبارات التشخيصية، من بين أمور أخرى. لذلك، فإن هذه الزيادة في تكلفة الخدمات الطبية تدفع نمو السوق.

- عدد متزايد من إجراءات الرعاية النهارية

تعتبر إجراءات الرعاية النهارية من أنواع الإجراءات الطبية أو العمليات الجراحية التي تتطلب في المقام الأول وقتًا أقل للبقاء في المستشفيات. في إجراءات الرعاية النهارية، يجب على المرضى البقاء في المستشفى لفترة قصيرة. تغطي معظم شركات التأمين الصحي الآن إجراءات الرعاية النهارية في خطط التأمين الخاصة بها، وبالنسبة للمطالبة بمثل هذه الأنواع من العمليات الجراحية، لا يوجد إلزام بقضاء 24 ساعة في المستشفى، وهو الحد الأدنى للإقامة في المستشفى. في حين تغطي معظم خطط التأمين الصحي الإقامة في المستشفى والجراحات الكبرى، يمكن لحاملي الوثائق أيضًا المطالبة بإجراءات الرعاية النهارية بموجب وثيقة التأمين الصحي الخاصة بهم، مما يعزز الطلب في السوق.

- إلزامية الاشتراك في التأمين الصحي في القطاعين العام والخاص

يعد شراء بوليصة تأمين صحي شرطًا إلزاميًا للموظفين في القطاعين العام والخاص. يوفر التأمين الصحي مزايا طبية أساسية يمكن للموظف الاستفادة منها أثناء العمل في شركة. في حالة حدوث أي حالة طوارئ أو مشكلات طبية، يكون غطاء التأمين الصحي مفيدًا للغاية لتغطية نفقات العلاج. يعد التأمين الصحي للموظف منفعة ممتدة يقدمها صاحب العمل الفردي لموظفيه. يغطي التأمين الصحي المقدم الموظف ويغطي أفراد أسرته بموجب خطة التأمين نفسها. أيضًا، في بعض الحالات، قد يدفع صاحب العمل جزءًا من قسط أو تغطية تأمينية لبوليصة التأمين الصحي.

- تزايد عدد السكان المسنين

من المرجح أن يصاب كبار السن بأمراض أو يعانون من مشاكل صحية بسبب الشيخوخة وضعف الجهاز المناعي مثل مشاكل الأسنان ومشاكل القلب ومشاكل السرطان والأمراض المميتة. يمكن أن يساعد التأمين الصحي الجيد لكبار السن كبار السن على اختيار خدمات التأمين الصحي الجيدة لتقليل المخاوف المالية المستقبلية. وبالتالي فإن زيادة عدد كبار السن يمكن أن يعزز الطلب على سوق التأمين الصحي.

- زيادة الوعي حول فوائد التأمين الصحي

في مواجهة حالة طبية طارئة، يسمح التأمين الصحي للمستهلكين بتجاهل الضغوط المرتبطة بتكاليف الرعاية الصحية والتركيز على العلاج بدلاً من ذلك من خلال التأمين الصحي. يمكن أن تحدث حالات الطوارئ الطبية في أي وقت، بغض النظر عن صحتنا الجيدة الحالية أو أسلوب حياتنا المنضبط. لذلك، من المهم التخطيط لحماية أسرنا وأنفسنا من أي مواقف طبية غير متوقعة، خاصة عندما يكون هناك آباء مسنين في المنزل لأنهم أكثر عرضة للإصابة بالعدوى أو الأمراض الأخرى.

القيود/التحديات التي تواجه سوق التأمين الصحي الخاص

- ارتفاع تكلفة الأقساط

يغطي التأمين الصحي كافة أنواع تكاليف العلاج الطبي، فهو يوفر الدعم المالي لحامل الوثيقة حيث يغطي كافة النفقات الطبية عندما يكون حامل الوثيقة في المستشفى لتلقي العلاج. كما يغطي التأمين الصحي النفقات قبل وبعد دخول المستشفى. ولشراء التأمين الصحي، يتعين على حامل الوثيقة دفع أقساط التأمين بانتظام لإبقاء وثيقة التأمين الصحي نشطة. وتكون تكلفة أقساط التأمين مرتفعة في أغلب الحالات بناءً على خطة التأمين، وهو ما يعيق نمو السوق.

- عدم الوعي فيما يتعلق بالتأمين الصحي

في مجال الرعاية الصحية، لا يزال جزء كبير من سكان العالم غير مدركين لفوائد سياسات التأمين الصحي. وتتزايد تكاليف الرعاية الطبية في جميع أنحاء العالم مع التقدم المحرز في هذا المجال. ومن خلال التقدم في التكنولوجيا، أصبح قطاع الرعاية الصحية أحد القطاعات المتنامية، ومع ذلك، يظل معدل انتشار سياسات التأمين الصحي منخفضًا بسبب الافتقار إلى الوعي بشأن الفوائد التي تقدمها

يقدم تقرير سوق التأمين الصحي الخاص هذا تفاصيل عن التطورات الحديثة الجديدة، واللوائح التجارية، وتحليل الاستيراد والتصدير، وتحليل الإنتاج، وتحسين سلسلة القيمة، وحصة السوق، وتأثير اللاعبين المحليين والمحليين في السوق، وتحليل الفرص من حيث جيوب الإيرادات الناشئة، والتغيرات في لوائح السوق، وتحليل نمو السوق الاستراتيجي، وحجم السوق، ونمو سوق الفئات، ومنافذ التطبيق والهيمنة، وموافقات المنتجات، وإطلاق المنتجات، والتوسعات الجغرافية، والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق التأمين الصحي الخاص، اتصل بـ Data Bridge Market Research للحصول على موجز محلل. سيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

التطورات الأخيرة

- في فبراير 2022، وقعت شركة Assicuranzioni Generali SPA اتفاقية للاستحواذ على شركة La Me´dicale، وهي شركة تأمين لمهنيي الرعاية الصحية. وينص هذا التطور أيضًا على بيع محفظة تغطية الوفاة Predica1، التي تسوقها وتديرها شركة La Me´dicale.

- في فبراير 2022، أطلقت شركة مانوليف القابضة بيرهاد منتجين للتأمين يركزان على المرونة والقدرة على تحمل التكاليف. يعد برنامج Manulife Universal Saver خطة هبة حياة مرنة توفر فرصة لبناء الثروة مع البقاء محميًا. يوفر برنامج Manulife Easy 5 الحماية المالية ضد خمسة أمراض خطيرة شائعة. سيساعد هذا الشركة على زيادة محفظة منتجاتها.

نطاق سوق التأمين الصحي الخاص في ماليزيا

يتم تقسيم سوق التأمين الصحي الخاص على أساس النوع وفئة خطة التأمين الصحي/مستويات المعدن ونوع المزود والفئة العمرية وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- تأمين الأمراض الحرجة

- التأمين الصحي الفردي

- تأمين صحي عائلي

- التأمين الخاص بالأمراض

- آحرون

على أساس النوع، يتم تقسيم السوق إلى تأمين الأمراض الحرجة، والتأمين الصحي الفردي، والتأمين الصحي العائلي، والتأمين ضد الأمراض المحددة وغيرها.

فئة الخطة الصحية/المستويات المعدنية

- برونزي

- فضي

- ذهب

- البلاتين

- آحرون

على أساس فئة خطة الصحة/مستويات المعادن، يتم تقسيم السوق إلى البرونز والفضة والذهب والبلاتين وغيرها.

نوع المزود

- منظمات صيانة الصحة (HMOS)

- منظمات مقدمي الخدمات المفضلين (PPOS)

- منظمات المزود الحصري (EPOS)

- خطط نقاط الخدمة (POS)

- خطط الرعاية الصحية ذات الخصم المرتفع (HDHPS)

- آحرون

على أساس نوع المزود، يتم تقسيم السوق إلى منظمات صيانة الصحة (HMOS)، ومنظمات المزود المفضل (PPOS)، ومنظمات المزود الحصري (EPOS)، وخطط نقطة الخدمة (POS)، وخطط صحية ذات خصم مرتفع (HDHPS) وغيرها.

الفئة العمرية

- مرحلة الشباب (19-44 سنة)

- مرحلة البلوغ المتوسطة (45-64 سنة)

- كبار السن (65 سنة وما فوق)

على أساس الفئة العمرية، يتم تقسيم السوق إلى الشباب (19-44 سنة)، ومتوسطي البلوغ (45-64 سنة)، وكبار السن (65 سنة وما فوق).

قناة التوزيع

- شركات التأمين المباشرة

- مجمعي التأمين

- آحرون

على أساس قناة التوزيع، يتم تقسيم السوق إلى شركات التأمين المباشرة ومجمعي التأمين وغيرها.

تحليل المشهد التنافسي وحصة سوق التأمين الصحي الخاص

يوفر المشهد التنافسي لسوق التأمين الصحي الخاص تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في ماليزيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق التأمين الصحي الخاص.

بعض اللاعبين الرئيسيين العاملين في سوق التأمين الصحي الخاص هم AIA Group Limited (هونج كونج)، HCF (أستراليا)، Allianz (ألمانيا)، HSBC Group (هونج كونج)، Great Eastern Holdings Limited (ماليزيا)، زيورخ (سويسرا). ، ASSICURAZIONI GENERALI SPA (إيطاليا)، AXA (فرنسا)، Etiqa (ماليزيا)، Prudential Assurance Malaysia Berhad (ماليزيا)، Hong Leong أشورانس بيرهاد (ماليزيا)، مانولايف هولدينجز بيرهاد (ماليزيا) وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MALAYSIA PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 AGE GROUP LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET- PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SOUTH EAST ASIA INSURANCE SCENARIO VS GLOBAL

4.4 CUSTOMIZED DELIVERABLE

4.4.1 HOW ARE INSURANCE CLAIMS EVALUATED (I.E., PROCESS FOR FILING FROM HOSPITALS, PHYSICIAN JUSTIFICATION)

4.4.2 DATA INTERPRETATION

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS:-

5.1.1 AGE

5.1.2 GENDER

5.1.3 OCCUPATION

5.1.4 FAMILY SIZE

5.2 NUMBER OF CLAIMS BY TYPE

5.2.1 CASHLESS VS. REIMBURSEMENT CLAIMS

5.3 EXTRA CARE/TOP-UP INSURANCE OFFERINGS BY COMPANIES

5.4 INVESTMENT & FUNDING

5.5 PENETRATION OF PRIVATE INSURANCE & DENSITY

5.6 INTERVIEWS WITH KEY HOSPITALS AND INSURANCE COMPANIES

5.7 POLICY SUPPORT FOR LIFE INSURANCE IN SOUTH EAST ASIA

5.7.1 MALAYSIA

5.7.2 PHILIPPINES

5.7.3 THAILAND

5.7.4 VIETNAM

5.8 PUBLIC VS PRIVATE HEALTH INSURANCE

5.9 OTHER KOL SNAPSHOTS

5.1 PREMIUM/COPAY/COINSURANCE

6 REGULATORY FRAMWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING COST FOR MEDICAL SERVICES

7.1.2 GROWING NUMBER OF DAY CARE PROCEDURES

7.1.3 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR

7.1.4 INCREASING OLD AGE POPULATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF PREMIUM

7.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS ABOUT THE BENEFITS OF HEALTH INSURANCE

7.3.2 INCREASING HEALTH CARE EXPENDITURE

7.3.3 GROWING MEDICAL TOURISM AMONG COUNTRIES

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS REGARDING HEALTH INSURANCE

8 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 INDIVIDUAL HEALTH INSURANCE

8.3 FAMILY HEALTH INSURANCE

8.4 CRITICAL ILLNESS INSURANCE

8.5 DISEASE-SPECIFIC INSURANCE

8.6 OTHERS

9 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

9.6 OTHERS

10 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

10.1 OVERVIEW

10.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

10.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

10.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

10.5 POINT-OF-SERVICE (POS) PLANS

10.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

10.7 OTHERS

11 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 MIDDLE ADULTHOOD (45-64 YEARS)

11.3 YOUNG ADULTHOOD (19-44 YEARS)

11.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

12 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT INSURANCE COMPANIES

12.3 INSURANCE AGGREGATORS

12.4 OTHERS

13 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY

13.1 MALAYSIA

14 MALAYSIA PRIVATE HEALTH INSURANCE THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MALAYSIA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CIGNA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 AIA GROUP LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATE

16.4 HCF

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 ALLIANZ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SUNCORP GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 MEDIBANK PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DAI-ICHI LIFE VIETNAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 HSBC GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATE

16.1 ACCURO HEALTH INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 AIG ASIA PACIFIC INSURANCE PTE. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 ASSICURANZIONI GENERALI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 FINANCIAL ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 AXA

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATE

16.14 BNI LIFE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 BUPA GLOBAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 ETIQA

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 GREAT EASTERN HOLDINGS LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 HONG LEONG ASSURANCE BERHAD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 INCOME

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 MANULIFE HOLDINGS BERHAD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

16.21 NIB NZ LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATE

16.22 NOW HEALTH INTERNATIONAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PACIFIC CROSS

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT UPDATE

16.24 PARTNERS LIFE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT UPDATES

16.25 PRUDENTIAL ASSURANCE MALAYSIA BERHAD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT UPDATE

16.26 RAFFLES MEDICAL GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT UPDATE

16.27 SOUTHERN CROSS

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 THE ROYAL AUTOMOBILE CLUB OF WA (INC.).

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT UPDATES

16.29 TOKIO MARINE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT UPDATE

16.3 UNIMED

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 ZURICH

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

List of Table

TABLE 1 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY AGE GROUP, MILLION, 2021

TABLE 2 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY INSURANCE COMPANY, MILLION, 2021

TABLE 3 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY PROVIDER TYPE, MILLION, 2021

TABLE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 5 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 6 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 7 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 8 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 9 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 10 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 11 DETAILS OF CIGNA OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 12 DETAILS OF CIGNA OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 13 DETAILS OF CIGNA OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 14 DETAILS OF CIGNA OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 15 DETAILS OF CIGNA OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 16 DETAILS OF CIGNA OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 17 DETAILS OF AIA GROUP LIMITED OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 18 DETAILS OF AIA GROUP LIMITED OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 19 DETAILS OF AIA GROUP LIMITED OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 20 DETAILS OF AIA GROUP LIMITED OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 21 DETAILS OF AIA GROUP LIMITED OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 22 DETAILS OF AIA GROUP LIMITED OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 23 CHIEF MEDICAL OFFICER

TABLE 24 LIST OF DAY CARE PROCEDURES

TABLE 25 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 27 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 28 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 29 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 33 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 34 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 MALAYSIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: MALAYSIA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: THE AGE GROUP LIFE LINE CURVE

FIGURE 7 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR IS DRIVING THE MALAYSIA PRIVATE HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 INDIVIDUAL HEALTH INSURANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MALAYSIA PRIVATE HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET: PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF MALAYSIA PRIVATE HEALTH INSURANCE MARKET

FIGURE 17 HEALTHCARE EXPENDITURE IN MALAYSIA, (RM MILLION)

FIGURE 18 MALAYSIA REVENUE TRAVEL INDUSTRY SIZE, BY REVENUE (RM MILLION)

FIGURE 19 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 20 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY HEALTH PLAN CATEGORY/METAL LEVELS, 2021

FIGURE 21 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY PROVIDER TYPE, 2021

FIGURE 22 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY AGE GROUP, 2021

FIGURE 23 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: SNAPSHOT (2021)

FIGURE 25 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021)

FIGURE 26 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: BY TYPE (2022-2029)

FIGURE 29 MALAYSIA PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.