Kenya Uganda Tanzania And Rwanda Potato Processing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

553.15 Million

USD

720.84 Million

2023

2034

USD

553.15 Million

USD

720.84 Million

2023

2034

| 2024 –2034 | |

| USD 553.15 Million | |

| USD 720.84 Million | |

|

|

|

سوق معالجة البطاطس في كينيا وأوغندا وتنزانيا ورواندا، حسب الفئة ( غير العضوية والعضوية)، نوع المنتج (مجمدة، محيطة، ومجففة)، الشكل (مكعبات، مستديرة، براميل البطاطس، شرائح، وغيرها)، التغليف (الأكياس، الصناديق الكرتون، العلب وغيرها)، حسب التطبيق (الوجبات الجاهزة للطهي والمحضرة، صناعة الوجبات الخفيفة والمخابز، أغذية الأطفال (المعبأة)، مخاليط العجين، الحساء والمربيات وغيرها)، المستخدم النهائي (قطاع خدمات الأغذية وتجارة التجزئة/الأسر) - اتجاهات الصناعة والتوقعات حتى عام 2034.

تحليل سوق معالجة البطاطس

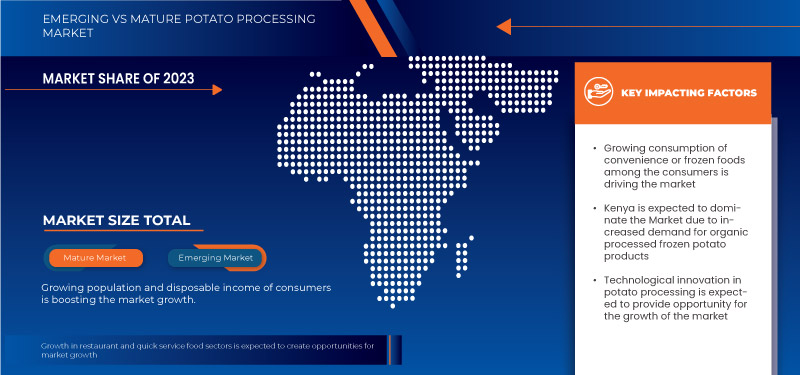

إن الاستهلاك المتزايد للأطعمة الجاهزة أو المجمدة بين المستهلكين والشعبية المتزايدة لقطاعي المطاعم والأطعمة السريعة هو المحرك لنمو السوق. كما أن الابتكار التكنولوجي في معالجة البطاطس والطلب المتزايد على منتجات البطاطس المجمدة المعالجة العضوية يوفر فرصًا في السوق. علاوة على ذلك، فإن توافر مجموعة متنوعة من المنتجات هو المحرك لنمو السوق.

حجم سوق معالجة البطاطس

من المتوقع أن يصل سوق معالجة البطاطس في كينيا وأوغندا وتنزانيا ورواندا إلى 720.84 مليون دولار أمريكي بحلول عام 2034 من 553.15 مليون دولار أمريكي في عام 2023، مع نمو بمعدل نمو سنوي مركب كبير بنسبة 2.5٪ في الفترة المتوقعة من 2024 إلى 2034.

اتجاهات سوق معالجة البطاطس

"تزايد استهلاك الأطعمة الجاهزة أو المجمدة بين المستهلكين"

هناك اتجاه متزايد في الطلب على الأطعمة الجاهزة أو المجمدة . وقد ساهمت عوامل عديدة في زيادة الطلب على منتجات البطاطس المجمدة أو الجاهزة. أولاً وقبل كل شيء، نتيجة لأنماط الحياة الأكثر انشغالاً، يحتاج الناس الآن إلى خيارات وجبات سريعة وبسيطة. توفر المنتجات المصنوعة من البطاطس المجمدة حلاً سريعًا وسهلاً. بالإضافة إلى ذلك، تتمتع منتجات البطاطس المجمدة بفترة صلاحية أطول من منتجات البطاطس الطازجة، مما يجعلها خيارًا معقولًا للعملاء الذين يرغبون في تخزين الضروريات.

وعلاوة على ذلك، ولأن منتجات البطاطس المجمدة قابلة للتكيف ويمكن استخدامها في مجموعة متنوعة من الأطباق، من الأطباق الجانبية إلى الأطباق الرئيسية، فإن كلاً من الطهاة المنزليين ومقدمي خدمات الطعام يفضلونها. وعلاوة على ذلك، فإن تكلفة منتجات البطاطس المجمدة تكون في كثير من الأحيان أقل من تكلفة البطاطس الطازجة، وهو اعتبار مهم آخر للأشخاص الذين يحاولون خفض تكاليف البقالة. وبشكل عام، فإن الطلب المتزايد على منتجات البطاطس المجمدة مدفوع بمزيج من الراحة والفائدة والتنوع والقدرة على تحمل التكاليف.

نطاق التقرير وتقسيم سوق معالجة البطاطس

|

صفات |

رؤى أساسية حول سوق معالجة البطاطس |

|

التجزئة |

|

|

الدول المغطاة |

كينيا، أوغندا، رواندا، تنزانيا |

|

اللاعبون الرئيسيون في السوق |

Tropical Heat. (كينيا)، Norda Industries Limited (كينيا)، Leson Company Ltd (تنزانيا)، Butcher (كينيا)، Wedgehut Foods Ltd (كينيا)، وHollanda FairFoods LTD (رواندا). |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء، وتحليل التسعير، وتحليل حصة العلامة التجارية، واستطلاع رأي المستهلكين، وتحليل التركيبة السكانية، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق معالجة البطاطس

تتضمن معالجة البطاطس العديد من التقنيات لتحقيق المنتجات النهائية المرغوبة. تتم هذه العملية عادةً في مصانع معالجة البطاطس المتخصصة والمجهزة بأدوات ومعدات مختلفة. تشمل الخطوات النموذجية المشاركة في إنتاج البطاطس المقلية والرقائق والنشا تنظيف البطاطس الطازجة وتقشيرها وغسلها وتقطيعها وتبييضها. تستخدم المنازل وسلاسل الوجبات السريعة والمطاعم منتجات البطاطس المعالجة لأنها جاهزة جزئيًا بالفعل، مما يقلل من الوقت المطلوب لإعداد أطباق مثل البطاطس المقلية والحساء والسلطات والوجبات الخفيفة من البطاطس. تُستخدم البطاطس المعالجة في مجموعة متنوعة من التطبيقات من قبل العديد من صناعات المستخدم النهائي، بما في ذلك صناعة الوجبات الخفيفة وصناعة الأطعمة الجاهزة للطهي والمخابز وصناعة خدمات الأغذية وغيرها.

ديناميكيات سوق معالجة البطاطس

السائقين

- تزايد استهلاك الأطعمة الجاهزة أو المجمدة بين المستهلكين

هناك اتجاه متزايد في الطلب على الأطعمة المريحة أو المجمدة. وقد ساهمت عوامل عديدة في زيادة الطلب على منتجات البطاطس المجمدة أو المريحة. أولاً وقبل كل شيء، نتيجة لأنماط الحياة الأكثر انشغالاً، يحتاج الناس الآن إلى خيارات وجبات سريعة وبسيطة. توفر المنتجات المصنوعة من البطاطس المجمدة حلاً سريعًا وسهلاً. بالإضافة إلى ذلك، تتمتع منتجات البطاطس المجمدة بعمر تخزين أطول من منتجات البطاطس الطازجة، مما يجعلها خيارًا معقولًا للعملاء الذين يرغبون في تخزين الضروريات. علاوة على ذلك، نظرًا لأن منتجات البطاطس المجمدة قابلة للتكيف ويمكن استخدامها في مجموعة متنوعة من الأطباق، من الأطباق الجانبية إلى الأطباق الرئيسية، فإن كل من الطهاة المنزليين ومقدمي خدمات الطعام يفضلونها. علاوة على ذلك، غالبًا ما تكون تكلفة منتجات البطاطس المجمدة أقل من تكلفة البطاطس الطازجة، وهو اعتبار مهم آخر للأشخاص الذين يحاولون خفض التكاليف على البقالة. بشكل عام، يتم دفع الطلب المتزايد على منتجات البطاطس المجمدة بمزيج من الراحة والفائدة والتنوع والقدرة على تحمل التكاليف.

على سبيل المثال،

- في عام 2021، وفقًا لمقال نُشر على موقع Researchgate، على مدار الخمسين عامًا الماضية، اشترى المستهلكون الأفارقة بشكل متزايد الأطعمة المصنعة. وقد تسارع هذا الاتجاه في العقود الأخيرة بسبب زيادة جانب العرض في قطاع المعالجة، مع قيام الشركات الصغيرة والمتوسطة الحجم والشركات الخاصة الكبيرة باستثمارات كبيرة. تشكل الأطعمة المعبأة والصناعية فائقة المعالجة والمشروبات المحلاة بالسكر الآن نسبة متزايدة من الأطعمة المصنعة المستهلكة

إن الطلب المتزايد على منتجات البطاطس المجمدة والسهلة الاستخدام مدفوع بالحاجة إلى خيارات وجبات سريعة وسهلة ومتعددة الاستخدامات وسط أنماط الحياة المزدحمة. كما تساهم مدة صلاحية البطاطس المجمدة الطويلة وسعرها المعقول وقدرتها على التكيف في زيادة شعبيتها.

- نمو قطاع المطاعم والمأكولات السريعة

وقد ساهم التوسع في صناعة المطاعم والوجبات السريعة في تعزيز نمو سوق معالجة البطاطس في كينيا وأوغندا وتنزانيا ورواندا بشكل كبير. فقد زاد الطلب على الأطعمة المصنوعة من البطاطس مع بحث المزيد من الناس في جميع أنحاء العالم عن خيارات الوجبات السريعة واللذيذة وبأسعار معقولة. وكثيراً ما تختار مطاعم الوجبات السريعة ومقدمو خدمات الطعام الآخرون البطاطس لأنها مكون متعدد الاستخدامات وبأسعار معقولة. ومن أجل تلبية هذا الطلب المتزايد، عملت شركات معالجة البطاطس على توسيع عملياتها، مما فتح آفاقاً جديدة للمزارعين والمصنعين وغيرهم من اللاعبين في صناعة الأغذية في شرق إفريقيا.

كان لتوسع صناعة الوجبات السريعة والمطاعم تأثير كبير على سوق معالجة البطاطس. فقد زاد الطلب على السلع التي تعتمد على البطاطس مثل البطاطس المقلية والبطاطس المهروسة مع استمرار مطاعم الوجبات السريعة ومقدمي خدمات الطعام الآخرين في توسيع قوائمهم وتوفير المزيد من الخيارات. بالإضافة إلى ذلك، أعطى نمو المطاعم السريعة غير الرسمية لصناعة معالجة البطاطس المزيد من الفرص لأنها تقدم طعامًا أفضل بسعر أعلى قليلاً من الوجبات السريعة التقليدية. وبسبب هذا الاتجاه، تقدم مطاعم الوجبات السريعة غير الرسمية الراقية بشكل متزايد منتجات البطاطس المتخصصة مثل البطاطس المقلية الفاخرة ومنتجات البطاطس المتخصصة الأخرى. ومن المتوقع بشكل عام أن يستمر توسع صناعة المطاعم والوجبات السريعة في تغذية الطلب على المنتجات المستخدمة في معالجة البطاطس، مما يفتح نطاق عمل جديد لأولئك المشاركين في هذا القطاع في السنوات القادمة.

على سبيل المثال،

- وبحسب تقرير صادر عن شركة جلوفو، شهد سوق خدمات الأغذية في كينيا نموًا كبيرًا، مع ارتفاع طلبات الأغذية المحلية بنسبة 160% مقارنة بعام 2021، مما يعكس تفضيلًا متزايدًا لطلب الطعام من الكيبانداس ومتاجر الأطعمة المحلية في الشوارع.

ومن ثم، تأثر سوق معالجة البطاطس بشكل كبير بتوسع صناعات المطاعم والوجبات السريعة. وقد نمت الصناعة نتيجة للطلب المتزايد على خيارات الوجبات السريعة واللذيذة وبأسعار معقولة، مما فتح فرص عمل جديدة للمزارعين والمصنعين وغيرهم من المشاركين في سلسلة توريد الأغذية. بالإضافة إلى ذلك، يمكن الآن لشركات معالجة البطاطس إنشاء منتجات جديدة ومبتكرة بفضل التقدم في تكنولوجيا المعالجة، مما أدى إلى زيادة الطلب. إن التوسع المستمر لصناعات الوجبات السريعة والمطاعم، جنبًا إلى جنب مع الابتكارات المستمرة في معالجة البطاطس، يبشر بالخير للنمو المستقبلي لسوق معالجة البطاطس.

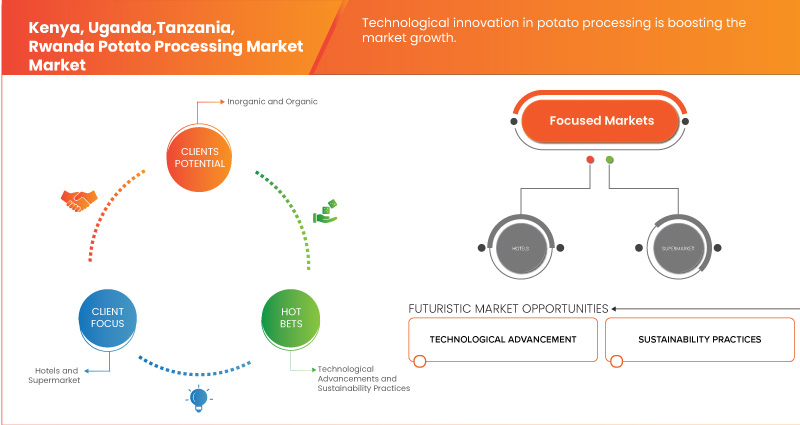

فرص

- الابتكار التكنولوجي في معالجة البطاطس

إن الابتكار التكنولوجي يمثل فرصة كبيرة لسوق معالجة البطاطس في كينيا ورواندا وتنزانيا، حيث يوفر إمكانات تحويلية للإنتاجية والكفاءة ونمو السوق. ومع تطور صناعة البطاطس في هذه المناطق، يمكن للتكنولوجيات المتقدمة معالجة التحديات القائمة وفتح آفاق جديدة للتنمية. تتمثل إحدى الفوائد الأساسية للابتكار التكنولوجي في تعزيز كفاءة المعالجة. يمكن لمعدات المعالجة الحديثة، مثل المقشرات عالية الأداء، والمقطعات، والمقلاة، تحسين سرعة وجودة معالجة البطاطس بشكل كبير. تعمل تقنيات الأتمتة، بما في ذلك الأنظمة الروبوتية للفرز والتعبئة، على تقليل العمالة اليدوية وزيادة القدرة الإنتاجية. تمكن هذه التطورات المعالجات من تلبية الطلب المتزايد على منتجات البطاطس مع الحفاظ على الجودة الثابتة وخفض التكاليف التشغيلية. على سبيل المثال، يمكن للأنظمة الآلية التعامل مع أحجام أكبر من البطاطس بدقة، مما يضمن التوحيد في المنتجات المصنعة مثل الرقائق والبطاطس المقلية وتقليل النفايات.

وتلعب التطورات التكنولوجية أيضًا دورًا حاسمًا في الاستدامة. تساهم معدات المعالجة الموفرة للطاقة وتقنيات تقليل النفايات في عمليات أكثر ملاءمة للبيئة. على سبيل المثال، يمكن للابتكارات في أنظمة استعادة الطاقة وتقنيات إعادة تدوير المياه أن تقلل بشكل كبير من البصمة البيئية لتجهيز البطاطس. لا تتوافق هذه الممارسات المستدامة مع الاتجاهات نحو الإنتاج الأكثر خضرة فحسب، بل إنها تجذب أيضًا المستهلكين المهتمين بالبيئة بشكل متزايد. من خلال تبني مثل هذه التقنيات، يمكن للمعالجين في كينيا ورواندا وتنزانيا تعزيز قدرتهم التنافسية في السوق وجذب المشترين الدوليين الذين يعطون الأولوية للاستدامة.

على سبيل المثال،

- وفقًا لمدونة نُشرت على موقع Potato Business، يستخدم معالجو البطاطس الحديثون البيانات من الآلات الذكية لتحسين إنتاجية الإنتاج وضمان جودة المنتج بشكل ثابت. تعمل أجهزة الاستشعار الموضوعة في نقاط حرجة، مثل قبل التعبئة أو بعد التجميد، على جمع البيانات باستمرار لمراقبة معلمات العملية. تتم مشاركة هذه البيانات عبر خط الإنتاج، مما يسمح بالتكامل السلس والتحكم بشكل أفضل في العملية بأكملها

وبالتالي، تتأثر أسواق معالجة البطاطس بشكل كبير بالتقدم التكنولوجي لأنه يمكّن المصنعين من العمل بشكل أكثر فعالية وتوفير المال واغتنام الفرص الجديدة. وقد سمح تطوير الأتمتة والروبوتات والتكنولوجيات الرقمية بمعالجة البطاطس بكفاءة أكبر وتقليل استخدام الطاقة وتحسين جودة المنتج.

- تزايد الطلب على منتجات البطاطس المجمدة المعالجة عضويًا

لقد أدى تفضيل المستهلك المتزايد للأطعمة العضوية والطبيعية إلى زيادة الطلب بشكل كبير على منتجات البطاطس المجمدة العضوية في السنوات الأخيرة في الدول الأفريقية مثل كينيا ورواندا وغيرهما. تُصنع المنتجات المصنوعة من البطاطس المجمدة العضوية من البطاطس التي تم زراعتها دون استخدام الأسمدة الاصطناعية أو المبيدات الحشرية أو الكائنات المعدلة وراثيًا. وبالمقارنة بمنتجات البطاطس المجمدة التقليدية، تتمتع هذه المنتجات بعدد من المزايا، مثل انخفاض مخاطر التعرض للمواد الكيميائية، وتحسين الاستدامة البيئية، وقيمة غذائية أعلى. يمكن للمستهلكين أن يشعروا بالثقة في جودة وسلامة المنتجات التي يشترونها لأن عملية التصديق العضوي تضمن التزام عملية الإنتاج بمعايير صارمة. ومن المرجح أن يزداد الطلب على منتجات البطاطس المجمدة العضوية مع استمرار المستهلكين في البحث عن خيارات غذائية أكثر صحة وعضوية. وهذا من شأنه أن يوفر للمنتجين فرصًا لتنويع خطوط منتجاتهم والاستفادة من هذه السوق المتوسعة.

يقدم العديد من المنتجين الآن مجموعة واسعة من الخيارات العضوية لتلبية الطلب المتزايد في هذا القطاع من السوق على منتجات البطاطس المجمدة العضوية. تتكون هذه السلع من البطاطس المجمدة بأشكال مختلفة، مثل قطع البطاطس العضوية، والبطاطس المقلية، والبطاطس المقلية. ولتلبية مجموعة أوسع من تفضيلات المستهلكين، ذهب بعض المصنعين إلى أبعد من ذلك من خلال توفير خيارات خالية من الكائنات المعدلة وراثيًا وخالية من الغلوتين. ولتلبية مطالب المستهلكين المهتمين بالبيئة، ينفذ العديد من المصنعين أيضًا تقنيات الإنتاج المستدامة، مثل استخدام مصادر الطاقة المتجددة والحد من النفايات.

على سبيل المثال،

- في كينيا، هناك زيادة ملحوظة في الطلب على منتجات البطاطس العضوية، مدفوعة بوعي متزايد بالأكل الصحي. ويتجلى هذا التحول في صعود الأسواق والمطاعم العضوية، مثل مطعم Bridges Organic في نيروبي. وتؤكد مديرة المبيعات والتسويق سوزان جاثيتو أن المطعم يحصل على البطاطس حصريًا من مزارعين عضويين معتمدين، مما يضمن خلو المنتج من المبيدات الحشرية والمواد الكيميائية والكائنات المعدلة وراثيًا. ويعكس هذا الطلب المتزايد على الخيارات العضوية اتجاهًا أوسع نحو أنماط حياة أكثر صحة والحاجة إلى طعام آمن وخالي من المواد الكيميائية.

وبالتالي، فإن الطلب الاستهلاكي المتزايد على الأغذية العضوية والطبيعية يعزز بشكل كبير سوق منتجات البطاطس المجمدة العضوية في البلدان الأفريقية مثل كينيا ورواندا. وتوفر هذه المنتجات مزايا مثل تقليل التعرض للمواد الكيميائية، وتحسين الاستدامة البيئية، وقيمة غذائية أعلى. ومع تفضيل المستهلكين بشكل متزايد للخيارات العضوية الصحية، يعمل المنتجون على تنويع عروضهم لتشمل أشكالًا مختلفة من البطاطس المجمدة العضوية ودمج الممارسات المستدامة. ولا يلبي هذا الاتجاه الطلب المتزايد فحسب، بل يقدم أيضًا فرصًا لتوسيع السوق والابتكار في قطاع الأغذية العضوية.

القيود/التحديات

- تزايد المشاكل الصحية المرتبطة بارتفاع استهلاك الوجبات الخفيفة المصنوعة من البطاطس المصنعة

البطاطس هي خضروات جذرية متعددة الاستخدامات بشكل لا يصدق، يتم تناولها في مجموعة متنوعة من الأطباق في جميع أنحاء العالم. ومع ذلك، يتم تصنيف البطاطس في شكلها المعالج عادةً على أنها أطعمة عالية الدهون والصوديوم. توجد مستويات عالية من الأكريلاميد في الوجبات الخفيفة المصنوعة من البطاطس المعالجة بسبب استخدام الحرارة العالية في معالجة البطاطس وقليها، مما يجعلها غير صحية لصحة الإنسان. يجعل مؤشر نسبة السكر في الدم المرتفع البطاطس غير مناسبة لمرضى السكري لأنها ترفع مستويات السكر في الدم على الفور.

الآثار الجانبية المرتبطة بالصحة بسبب هذه الوجبات الخفيفة المصنعة من البطاطس مدرجة أدناه:

- الإفراط في تناول الوجبات الخفيفة المصنوعة من البطاطس المصنعة قد يؤدي إلى ارتفاع ضغط الدم

- رقائق البطاطس قد تزيد من فرص الإصابة بأمراض القلب

- تناول البطاطس قد يزيد من خطر الإصابة بالسكتة الدماغية

- يمكن أن يسبب زيادة الوزن الشديدة

- ارتفاع المؤشر الجلوكوزي يجعلهم يرفعون مستوى السكر في الدم

- يؤدي تناول كميات كبيرة من الوجبات الخفيفة المصنوعة من البطاطس إلى رفع مستويات الدهون الثلاثية ومستويات الكوليسترول الكلي

وبالتالي، فإن الآثار الجانبية مثل زيادة الوزن والسمنة تتزايد يوما بعد يوم بسبب زيادة استهلاك رقائق البطاطس والوجبات الخفيفة، مما قد يحد من نمو السوق.

على سبيل المثال،

- في عام 2024، وفقًا لمقال نُشر في صحيفة The New Times، تكشف دراسة حديثة أجراها مركز رواندا للطب الحيوي (RBC) عن ارتفاع في السمنة بين الروانديين. ارتفع معدل انتشار الأفراد الذين يعانون من زيادة الوزن من 14 في المائة في عام 2013 إلى 18.6 في المائة في عام 2022. وأبرزت الدراسة، التي استطلعت آراء 5676 شخصًا في جميع المقاطعات، أن معدل النساء البدينات ارتفع بشكل ملحوظ من 19 في المائة إلى 26 في المائة، بينما شهد الرجال الذين يعانون من زيادة الوزن زيادة متواضعة من 9 في المائة إلى 11.5 في المائة

وبالتالي، فإن تناول كميات كبيرة من الوجبات الخفيفة المصنوعة من البطاطس المصنعة قد يؤدي إلى ارتفاع مستويات الكوليسترول، مما قد يؤدي إلى مخاطر القلب. وبالتالي، فإن الوعي المتزايد بالآثار الجانبية للوجبات الخفيفة المصنوعة من البطاطس المصنعة بين المستهلكين قد يكبح نمو السوق.

- المخاوف البيئية غير المواتية

تواجه زراعة البطاطس في كينيا ورواندا وتنزانيا تحديات بيئية كبيرة تعوق نمو سوق معالجة البطاطس في هذه المناطق. وتؤثر هذه المخاوف البيئية ليس فقط على الممارسات الزراعية ولكن أيضًا على سلسلة توريد البطاطس الأوسع نطاقًا، مما يؤثر على ديناميكيات السوق لمنتجات البطاطس المعالجة.

إن الإفراط في استخدام الأسمدة والمبيدات الحشرية الكيماوية من القضايا البيئية الرئيسية. ففي محاولة لزيادة الغلة ومكافحة الآفات والأمراض، يعتمد العديد من مزارعي البطاطس بشكل كبير على هذه المواد الكيميائية. ومع ذلك، فإن الإفراط في الاستخدام يؤدي إلى تدهور التربة، وانخفاض خصوبتها، وتلوث مصادر المياه. وقد يؤدي هذا الضغط البيئي إلى انخفاض جودة البطاطس وزيادة تكاليف الإنتاج، مما يؤثر في نهاية المطاف على اتساق وسعر المواد الخام المتاحة للمعالجة. ومع نمو سوق منتجات البطاطس المصنعة، أصبحت استدامة زراعة البطاطس أكثر أهمية. ويهدد تدهور التربة قابلية إنتاج البطاطس على المدى الطويل، مما قد يقلل من غلة المحاصيل وجودتها، وبالتالي يؤثر على إمدادات البطاطس الخام للمعالجة.

على سبيل المثال،

- في عام 2017، وفقًا لمقال نُشر على موقع مجموعة البنك الدولي في تنزانيا، كان ندرة المياه تؤثر بشكل متزايد على الممارسات الزراعية، بما في ذلك زراعة البطاطس. وعلى الرغم من وفرة البحيرات والأنهار ذات المياه العذبة في البلاد، فقد أدى النمو السكاني السريع والتوسع الاقتصادي إلى خفض نصيب الفرد من المياه العذبة المتجددة بشكل كبير من أكثر من 3000 متر مكعب إلى حوالي 1600 متر مكعب. وقد أدى هذا الانخفاض إلى ضغوط مائية شديدة، وخاصة في نهر رواها العظيم، الذي يجف الآن لعدة أشهر كل عام. والسبب الرئيسي هو توسيع الري غير الرسمي في المنبع، والذي على الرغم من توفيره لفوائد اقتصادية للمزارعين الأفراد، فقد ساهم في الاستخدام غير المستدام للمياه.

وهكذا، كانت التقلبات الجوية ومتطلبات درجة الحرارة المحددة للبطاطس سبباً في انخفاض إنتاج البطاطس في جميع أنحاء المنطقة، مما يؤثر في نهاية المطاف على السوق، وبالتالي خلق قيد كبير في نمو السوق في المنطقة الأفريقية.

يقدم تقرير السوق هذا تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول السوق، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

تأثير وسيناريو السوق الحالي لنقص المواد الخام وتأخيرات الشحن

تقدم Data Bridge Market Research تحليلاً عالي المستوى للسوق وتقدم معلومات من خلال مراعاة تأثير وبيئة السوق الحالية لنقص المواد الخام وتأخيرات الشحن. ويترجم هذا إلى تقييم الاحتمالات الاستراتيجية وإنشاء خطط عمل فعالة ومساعدة الشركات في اتخاذ القرارات المهمة.

بالإضافة إلى التقرير القياسي، فإننا نقدم أيضًا تحليلًا متعمقًا لمستوى المشتريات من تأخيرات الشحن المتوقعة، ورسم خريطة الموزع حسب المنطقة، وتحليل السلع، وتحليل الإنتاج، واتجاهات رسم الخرائط السعرية، والتوريد، وتحليل أداء الفئة، وحلول إدارة مخاطر سلسلة التوريد، والمقارنة المتقدمة، وغيرها من الخدمات للشراء والدعم الاستراتيجي.

التأثير المتوقع للتباطؤ الاقتصادي على تسعير المنتجات وتوافرها

عندما يتباطأ النشاط الاقتصادي، تبدأ الصناعات في المعاناة. يتم أخذ التأثيرات المتوقعة للركود الاقتصادي على تسعير المنتجات وإمكانية الوصول إليها في الاعتبار في تقارير رؤى السوق وخدمات الاستخبارات التي تقدمها DBMR. بفضل هذا، يمكن لعملائنا عادةً أن يظلوا متقدمين بخطوة واحدة على منافسيهم، وأن يتوقعوا مبيعاتهم وإيراداتهم، وأن يقدروا نفقاتهم على الأرباح والخسائر.

نطاق سوق معالجة البطاطس

يتم تقسيم السوق إلى ستة قطاعات بارزة بناءً على الفئة ونوع المنتج والشكل والتغليف والتطبيق والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

فئة

- غير عضوي

- عضوي

نوع المنتج

- مجمدة

- مجمدة حسب نوع المنتج

- بطاطس مقلية مجمدة

- مجمدة حسب نوع المنتج

- بطاطس مقلية قليلة الدسم

- بطاطا حلوة مقلية

- آحرون

- بطاطس مقلية مجمدة حسب النوع

- بطاطس مقطعة بشكل مستقيم

- بطاطس مقطعة بشكل مجعد

- بطاطس مقلية مجعدة

- آحرون

- بطاطس مقلية مجمدة

- تخصصات البطاطس

- تخصصات البطاطس، حسب القطع

- أسافين

- شرائح

- بطاطس مشوية

- آحرون

- تخصصات البطاطس، من شركة Mash Specialties

- هريس عادي

- كروكيت البطاطس

- ضوضاء

- دوقات

- آحرون

- تخصصات البطاطس، من شركة Shredded Specialties

- هاش براونز

- بطاطس روستي

- تاتير توتس

- آحرون

- تخصصات البطاطس، حسب القطع

- محيط

- المحيط، حسب نوع المنتج

- رقائق البطاطس

- رقائق

- آحرون

- المحيط، حسب نوع المنتج

- مجمدة حسب نوع المنتج

- مجففة، حسب نوع المنتج

- مجففة، حسب نوع المنتج

- حبيبات البطاطس

- النشا

- مجففة، حسب نوع المنتج

- آحرون

شكل

- النرد

- دائري

- طبول التاتر

- تمزيقات

- آحرون

التغليف

- الأكياس

- صناديق من الورق المقوى

- علب

- آحرون

طلب

- وجبات جاهزة للطهي ووجبات معدة مسبقًا

- صناعة الوجبات الخفيفة والمخابز

- أغذية الأطفال (المعبأة)

- خلطات العجين

- الحساء والمربى

- آحرون

المستخدم النهائي

- قطاع خدمات الأغذية

- قطاع خدمات الأغذية، حسب المستخدم النهائي

- مطعم

- المطعم حسب النوع

- سلسلة مطاعم

- مطعم مستقل

- المطعم حسب فئة الخدمة

- مطاعم الخدمة السريعة

- مطاعم الخدمة الكاملة

- المطعم حسب النوع

- الفندق

- مقهى

- الحانات والنوادي

- تقديم الطعام

- آحرون

- مطعم

- قطاع خدمات الأغذية، حسب المستخدم النهائي

تحليل إقليمي لسوق معالجة البطاطس

يتم تحليل السوق وتوفير رؤى حول حجم السوق واتجاهاته حسب الفئة ونوع المنتج والشكل والتعبئة والتغليف والتطبيق والمستخدم النهائي كما هو مذكور أعلاه.

الدول المشمولة بالسوق هي كينيا وتنزانيا ورواندا وأوغندا.

ومن المتوقع أن تهيمن كينيا على سوق معالجة البطاطس بفضل بنيتها التحتية الراسخة وتكنولوجيا المعالجة المتقدمة ومستويات الاستثمار الأعلى في القطاع مقارنة بدول شرق إفريقيا الأخرى ومن المتوقع أن يؤدي ذلك إلى تعزيز نمو السوق بشكل أكبر.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Potato Processing Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Potato Processing Market Leaders Operating in the Market Are:

- Tropical Heat.(Kenya)

- Norda Industries Limited (Kenya)

- Leson Company Ltd (Tanzania)

- Butcher (Kenya)

- Wedgehut Foods Ltd (Kenya)

- Hollanda FairFoods LTD (Rwanda)

Latest Developments in Potato Processing Market

- In April 2022, Tropical Heat. has launched new product lines, including healthy snacks and breakfast cereals. The upcoming range features innovative items such as rice cakes made with brown rice and flavored chocolate rice cakes, which offer a low-calorie alternative to traditional snacks. These products aimed to bridge the gap between health and taste, catering to consumers seeking nutritious yet flavorful options. Additionally, Tropical Heat is expanding its market presence, now operating in 25 countries, with plans to reach 30 soon

- In August 2022, Butcher. (Sereni Fries) has launched new product: frozen chips. The product includes three cuts—matchstick, medium, and standard—and offers convenience, quality, and reduced preparation time. This expansion has helped the company to increase their production capacity to 40 tons per day and tap into the retail and export markets. This launch has also created 15 new jobs, growing the workforce from 48 to 63 employees

- في عام 2022، قدمت شركة Butcher. (Sereni Fries) مبادرة البطاطس الجيدة في الحدث الذي أقيم في الفترة من 30 مايو إلى 2 يونيو، في المؤتمر العالمي الحادي عشر للبطاطس في دبلن، أيرلندا. درب هذا البرنامج صغار المزارعين الكينيين على الممارسات الزراعية الجيدة والممارسات الزراعية الذكية للمناخ للتغلب على التحديات مثل أساليب الزراعة التقليدية والمعلومات غير الكافية. تهدف هذه المبادرة إلى زيادة إنتاجية المحاصيل، والحد من خسائر ما بعد الحصاد، وتحسين مستويات معيشة المزارعين من خلال الزراعة التعاقدية. كما تركز على القضاء على الفقر، وخلق فرص العمل، وتعزيز الأمن الغذائي، مما يعود بالنفع بشكل كبير على النساء والشباب

- في سبتمبر 2022، تتخصص شركة Wedgehut Foods Ltd. في إضافة القيمة إلى أصناف البطاطس مثل Markies وShangi وArizona وDestiny. وباعتبارها جزءًا من برنامج Mavuno Zaidi مع Syngenta وIDH، تخطط الشركة لدعم 100000 مزارع بالتمويل. كما تتعاون مع AgricoPSA لتعزيز سلسلة قيمة البطاطس في كينيا

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICE INDEX

4.2 PRODUCTION CAPACITY OVERVIEW (KILO TONS)

4.3 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 PROCESSING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 BRAND OUTLOOK

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.6.1 OVERVIEW

4.6.2 CONCLUSION

4.7 IMPORT AND EXPORT

4.8 MARKET SHARE OF POTATO PROCESSED PRODUCTS AMONG POTATO BASED SNACKS, 2023, (%)

4.9 TECHNOLOGICAL INNOVATION

4.1 OVERVIEW ON POTATO COLD STORAGE

4.10.1 FOOD-GRADE POTATO STORAGE

4.10.2 PROCESSING-GRADE POTATO STORAGE

4.10.3 STORAGE AND UTILIZATION CAPACITY

4.10.4 UTILIZATION

4.11 FACTORS AFFECTING BUYING DECISION

4.11.1 LARGE PRODUCT RANGE

4.11.2 COMPANY AUTHENTICITY

4.11.3 INCOME

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF KENYA, UGANDA, RWANDA, AND TANZANIA POTATO PROCESSING MARKET

4.12.1 INDUSTRY TRENDS

4.12.2 FUTURE TRENDS

4.13 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS

4.13.1 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY PRODUCT TYPE, 2022-2024, (TONS)

4.13.2 PRODUCTION CAPACITY ANALYSIS ON POTATO PROCESSORS, BY APPLICATION, 2022-2024, (TONS)

4.13.3 PRODUCTION CAPACITY ANALYSIS ON POTATO INDUSTRY, BY GRADE, 2022-2024, (TONS)

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS

6.1.2 GROWTH OF RESTAURANT AND QUICK SERVICE FOOD SECTORS

6.1.3 GROWING POPULATION AND DISPOSABLE INCOME OF CONSUMERS

6.1.4 AVAILABILITY OF A DIVERSE RANGE OF PRODUCTS

6.2 RESTRAINTS

6.2.1 INCREASING HEALTH PROBLEMS ASSOCIATED WITH THE HIGHER CONSUMPTION OF PROCESSED POTATO SNACKS

6.2.2 UNFAVORABLE ENVIRONMENTAL CONCERNS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN POTATO PROCESSING

6.3.2 INCREASING DEMAND FOR ORGANIC PROCESSED FROZEN POTATO PRODUCTS

6.4 CHALLENGES

6.4.1 HIGH COST ASSOCIATED WITH POTATO CHIPS MACHINES

6.4.2 FLUCTUATION IN PRICES OF RAW MATERIALS

7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 INORGANIC

7.3 ORGANIC

8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 FROZEN

8.3 AMBIENT

8.4 DEHYDRATED

9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE

9.1 OVERVIEW

9.2 DICES

9.3 ROUND

9.4 TATER DRUMS

9.5 SHREDS

9.6 OTHERS

10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 POUCHES

10.3 CARDBOARD BOXES

10.4 CAN

10.5 OTHERS

11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 READY-TO-COOK & PREPARED MEALS

11.3 SNACKS AND BAKERY INDUSTRY

11.4 BABY FOOD (BOTTLED)

11.5 DOUGH MIXTURES

11.6 SOUPS AND JAMS

11.7 OTHERS

12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD SERVICE SECTOR

12.3 RETAIL/HOUSEHOLD

13 KENYA, UGANDA, TANZANIA AND, RWANDA POTATO PROCESSING MARKET, BY COUNTRY

13.1 OVERVIEW

13.1.1 KENYA

13.1.2 RWANDA

13.1.3 UGANDA

13.1.4 TANZANIA

14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KENYA, UGANDA, TANZANIA, AND RWANDA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 TROPICAL HEAT.

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENTS

16.2 NORDA INDUSTRIES LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 LESON COMPANY LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 BUTCHER. (SERENI FRIES)

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 WEDGEHUT FOODS LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 HOLLANDA FAIRFOODS LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 1.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 AVERAGE IMPORT OF POTATO CRISPS AND FROZEN READY-CUT POTATO CHIPS, 2020-21, (HS CODE:- 200410) (TONS)

TABLE 2 REGULATORY COVERAGE

TABLE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 8 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 9 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 10 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 11 KENYA, UGANDA, TANZANIA, AND RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 12 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 13 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 14 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 15 KENYA, UGANDA, TANZANIA, AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 16 KENYA, UGANDA, TANZANIA AND RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 17 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 18 KENYA, UGANDA, TANZANIA AND RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 23 KENYA, UGANDA, TANZANIA AND RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 24 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 25 KENYA, UGANDA, TANZANIA AND RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 26 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (USD THOUSAND)

TABLE 27 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, BY COUNTRY, 2022-2034 (TONS)

TABLE 28 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 29 KENYA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 30 KENYA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 31 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 32 KENYA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 33 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 34 KENYA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 35 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 36 KENYA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 37 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 38 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 39 KENYA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 40 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 41 KENYA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 42 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 43 KENYA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 44 KENYA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 45 KENYA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 46 KENYA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 47 KENYA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 48 KENYA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 49 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 50 KENYA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 51 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 52 RWANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 53 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 54 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 55 RWANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 56 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 57 RWANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 58 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 59 RWANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 60 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 61 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 62 RWANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES 2022-2034 (USD THOUSAND)

TABLE 63 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 64 RWANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 65 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 66 RWANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 67 RWANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 68 RWANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 69 RWANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 70 RWANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 71 RWANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 72 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 73 RWANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 74 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 75 UGANDA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 76 RWANDA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 77 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 78 UGANDA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 79 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 80 UGANDA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 81 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 82 UGANDA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 83 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 84 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 85 UGANDA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 86 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 87 UGANDA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 88 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 89 UGANDA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 90 UGANDA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 91 UGANDA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 92 UGANDA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 93 UGANDA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 94 UGANDA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 95 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 96 UGANDA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 97 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (USD THOUSAND)

TABLE 98 TANZANIA POTATO PROCESSING MARKET, BY CATEGORY, 2022-2034 (TONS)

TABLE 99 TANZANIA POTATO PROCESSING MARKET,AVERAGE SELLING PRICE, BY CATEGORY, 2022-2034 (USD/TONS)

TABLE 100 TANZANIA POTATO PROCESSING MARKET, AVERAGE SELLING PRICE, BY CATEGORY, (USD/KG)

TABLE 101 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 102 TANZANIA POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 103 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 104 TANZANIA FROZEN IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 105 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 106 TANZANIA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 107 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY CUT SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 108 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, MASH SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 109 TANZANIA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SHREDDED SPECIALTIES, 2022-2034 (USD THOUSAND)

TABLE 110 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 111 TANZANIA AMBIENT IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 112 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (USD THOUSAND)

TABLE 113 TANZANIA DEHYDRATED IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2022-2034 (TONS)

TABLE 114 TANZANIA POTATO PROCESSING MARKET, BY SHAPE, 2022-2034 (USD THOUSAND)

TABLE 115 TANZANIA POTATO PROCESSING MARKET, BY PACKAGING, 2022-2034 (USD THOUSAND)

TABLE 116 TANZANIA POTATO PROCESSING MARKET, BY APPLICATION, 2022-2034 (USD THOUSAND)

TABLE 117 TANZANIA POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 118 TANZANIA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY END-USER, 2022-2034 (USD THOUSAND)

TABLE 119 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY TYPE, 2022-2034 (USD THOUSAND)

TABLE 120 TANZANIA RESTAURANT IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2022-2034 (USD THOUSAND)

List of Figure

FIGURE 1 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 2 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DATA TRIANGULATION

FIGURE 3 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DROC ANALYSIS

FIGURE 4 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: MULTIVARIATE MODELLING

FIGURE 7 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SEGMENTATION

FIGURE 12 GROWING CONSUMPTION OF CONVENIENCE OR FROZEN FOODS AMONG THE CONSUMERS IS EXPECTED TO DRIVE THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET IN THE FORECAST PERIOD

FIGURE 13 THE INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET IN 2024 AND 2034

FIGURE 14 KENYA, UGANDA, TANZANIA AND RWANDA POTATO PROCESSING MARKET, 2024-2034, AVERAGE SELLING PRICE (USD/KG)

FIGURE 15 SUPPLY CHAIN OF KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET

FIGURE 17 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: CATEGORY, 2023

FIGURE 18 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PRODUCT TYPE, 2023

FIGURE 19 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: SHAPE, 2023

FIGURE 20 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: PACKAGING, 2023

FIGURE 21 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: APPLICATION, 2023

FIGURE 22 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET: END-USER, 2023

FIGURE 23 KENYA, UGANDA, TANZANIA, AND RWANDA POTATO PROCESSING MARKET -COMPANY SHARE 2023 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.