السوق العالمية للتغليف من الجيل التالي، حسب النوع ( التغليف النشط ، التغليف الذكي وتغليف الغلاف الجوي المعدل)، الوظيفة (التحكم في الرطوبة، مؤشرات درجة الحرارة، استشعار العمر الافتراضي، تتبع المنتج، وغيرها)، التكنولوجيا (الزبالون والمستقبلات علامات RFID، رموز QR، علامات NFC، الترميز والعلامات، أجهزة الاستشعار وأجهزة الإخراج، وغيرها)، المواد (البلاستيك والورق والكرتون المموج وغيرها)، التطبيق (الأغذية والمشروبات والعناية الشخصية والرعاية الصحية والخدمات اللوجستية وسلسلة التوريد والإلكترونيات الاستهلاكية وغيرها)، الدولة (الولايات المتحدة وكندا والمكسيك وألمانيا والمملكة المتحدة وإيطاليا وفرنسا وإسبانيا وروسيا وسويسرا وتركيا وبلجيكا وهولندا ولوكسمبورج وبقية أوروبا واليابان والصين وكوريا الجنوبية والهند وسنغافورة وتايلاند وإندونيسيا وماليزيا والفلبين وأستراليا ونيوزيلندا وبقية آسيا والمحيط الهادئ والبرازيل والأرجنتين وبقية أمريكا الجنوبية وجنوب أفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة ومصر وإسرائيل وبقية الشرق الأوسط وأفريقيا) اتجاهات الصناعة والتوقعات 2029

تحليل السوق والرؤى : سوق التغليف العالمي للجيل القادم

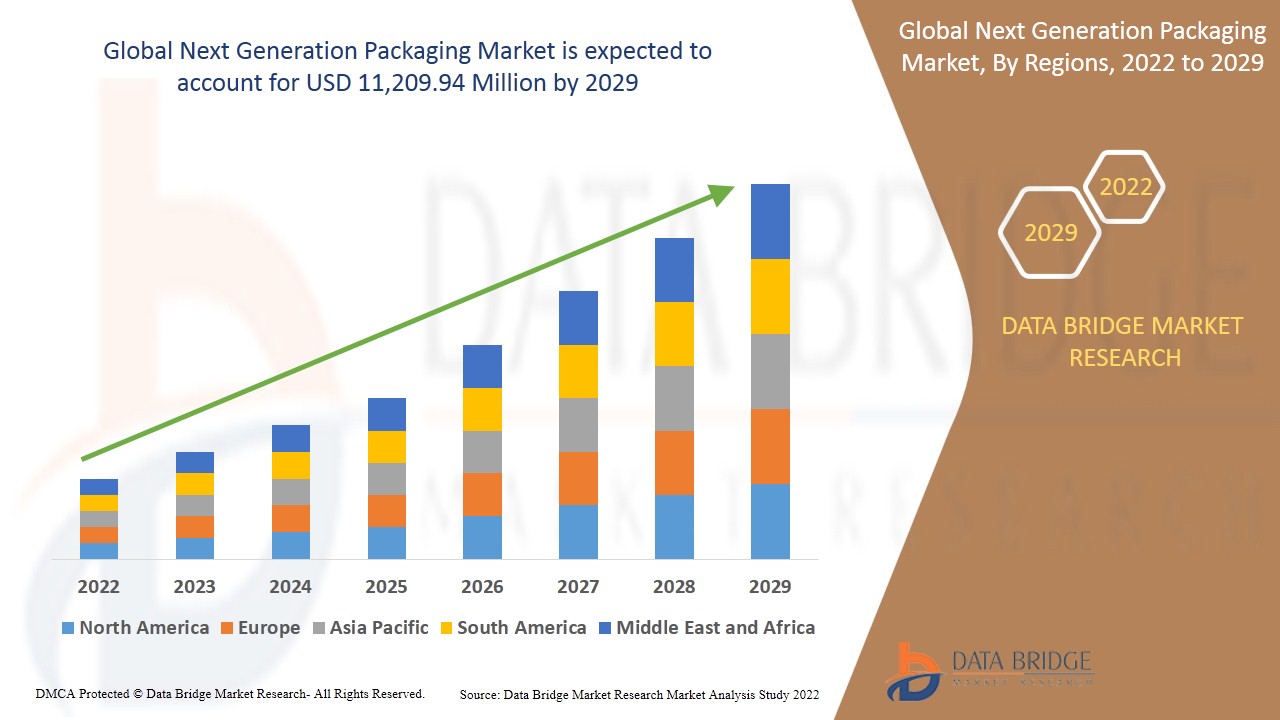

من المتوقع أن يكتسب سوق التغليف العالمي من الجيل التالي نموًا كبيرًا في الفترة المتوقعة من 2022 إلى 2029. تحلل Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 6.5٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 11،209.94 مليون دولار أمريكي بحلول عام 2029.

إن الطلب المتزايد على التغليف الذكي لتجنب هدر الطعام يعمل على تسريع استخدام منتجات التغليف من الجيل التالي، ومن المتوقع أن يدفع نمو السوق. ومع ذلك، من المتوقع أن تعمل التكاليف المرتفعة المرتبطة بأنشطة البحث والتطوير على كبح نمو السوق. يشير الاتجاه الأخير إلى زيادة الطلب على التغليف من الجيل التالي مع استمرار زيادة الاستثمارات في صناعات الأغذية العامة والخاصة. العوامل التي تدفع نمو السوق هي زيادة الوعي الصحي بين عامة السكان والتقدم التكنولوجي المستمر في التغليف. مع النمو السريع للعولمة وزيادة تفويضات الأغذية والمشروبات من قبل مختلف البلدان والمناطق، سيشهد سوق التغليف العالمي من الجيل التالي مسارًا متزايدًا في السنوات القادمة. ومع ذلك، فإن التكلفة العالية للتغليف في التغليف العالمي من الجيل التالي ستقيد نمو السوق.

تتخذ العديد من الشركات قرارات استراتيجية، مثل إبرام اتفاقيات مع مراكز الأبحاث لإطلاق منتجات جديدة، لتحسين حصتها في السوق. ونتيجة لذلك، ينمو سوق التغليف من الجيل التالي بمعدل سريع. من ناحية أخرى، تخلق الابتكارات الحديثة وإطلاق المنتجات الجديدة فرصًا جديدة للسوق. ومع ذلك، فإن سهولة توافر المنتجات البديلة يشكل تحديًا لسوق التغليف من الجيل التالي العالمي.

يقدم تقرير سوق التغليف العالمي للجيل القادم تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود.

نطاق وحجم سوق التغليف العالمي للجيل القادم

ينقسم سوق التغليف العالمي للجيل القادم إلى خمسة قطاعات بناءً على النوع والوظيفة والتكنولوجيا والمواد والتطبيق. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية لديك والاختلاف في أسواقك المستهدفة.

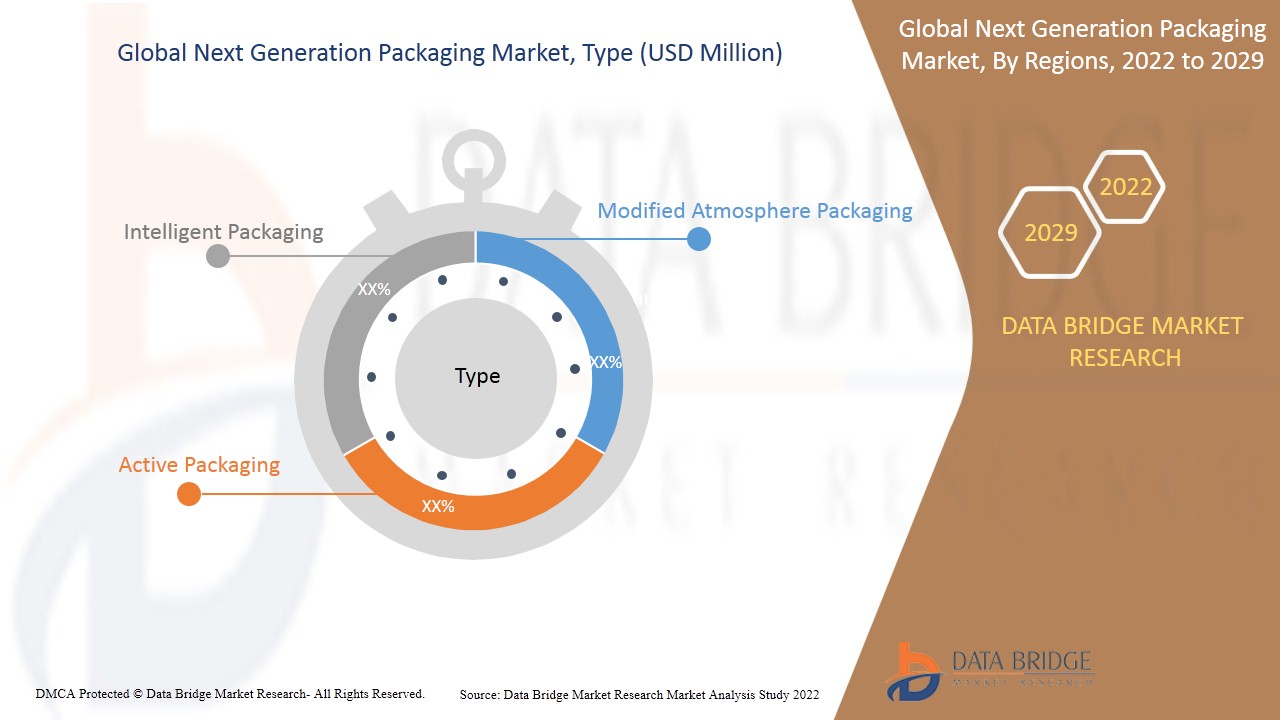

- على أساس النوع، يتم تقسيم سوق التغليف العالمي للجيل القادم إلى التغليف النشط، والتغليف الذكي، والتغليف في الغلاف الجوي المعدل. في عام 2022، من المتوقع أن يهيمن قطاع التغليف النشط على السوق بسبب كمية الإنتاج العالية وسهولة استخدام التغليف النشط.

- على أساس الوظيفة، يتم تقسيم سوق التغليف العالمي للجيل القادم إلى التحكم في الرطوبة ومؤشرات درجة الحرارة واستشعار مدة الصلاحية وتتبع المنتج وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع التحكم في الرطوبة على السوق لأنه وظيفة التغليف الأكثر طلبًا لتمديد مدة صلاحية المنتج.

- على أساس التكنولوجيا، يتم تقسيم سوق التغليف العالمي للجيل القادم إلى أجهزة جمع القمامة وأجهزة الاستقبال، وعلامات RFID، ورموز QR، وعلامات NFC، والترميز والعلامات، وأجهزة الاستشعار وأجهزة الإخراج، وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة أجهزة جمع القمامة وأجهزة الاستقبال على السوق لأنها توفر سهولة الوصول إلى المنتج للمستهلكين.

- على أساس المادة، يتم تقسيم سوق التغليف العالمي للجيل القادم إلى البلاستيك والورق والكرتون المموج وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع البلاستيك على السوق بسبب اهتمام المستهلكين الشديد بحجم تغليف المنتج بسبب قدرته على تحمل التكاليف.

- على أساس التطبيق، يتم تقسيم سوق التغليف العالمي للجيل القادم إلى الأطعمة والمشروبات والعناية الشخصية والرعاية الصحية والخدمات اللوجستية وسلسلة التوريد والإلكترونيات الاستهلاكية وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع الأغذية على السوق حيث يتزايد الطلب على الأطعمة المعبأة في جميع أنحاء العالم بسبب أنماط الحياة المزدحمة.

إن سوق التغليف العالمي للجيل القادم مجزأ وقد استخدم اللاعبون الرئيسيون استراتيجيات مختلفة، مثل إطلاق منتجات جديدة، والتوسعات، والاتفاقيات، والمشاريع المشتركة، والشراكات، والاستحواذات، وغيرها، لزيادة بصماتهم في السوق.

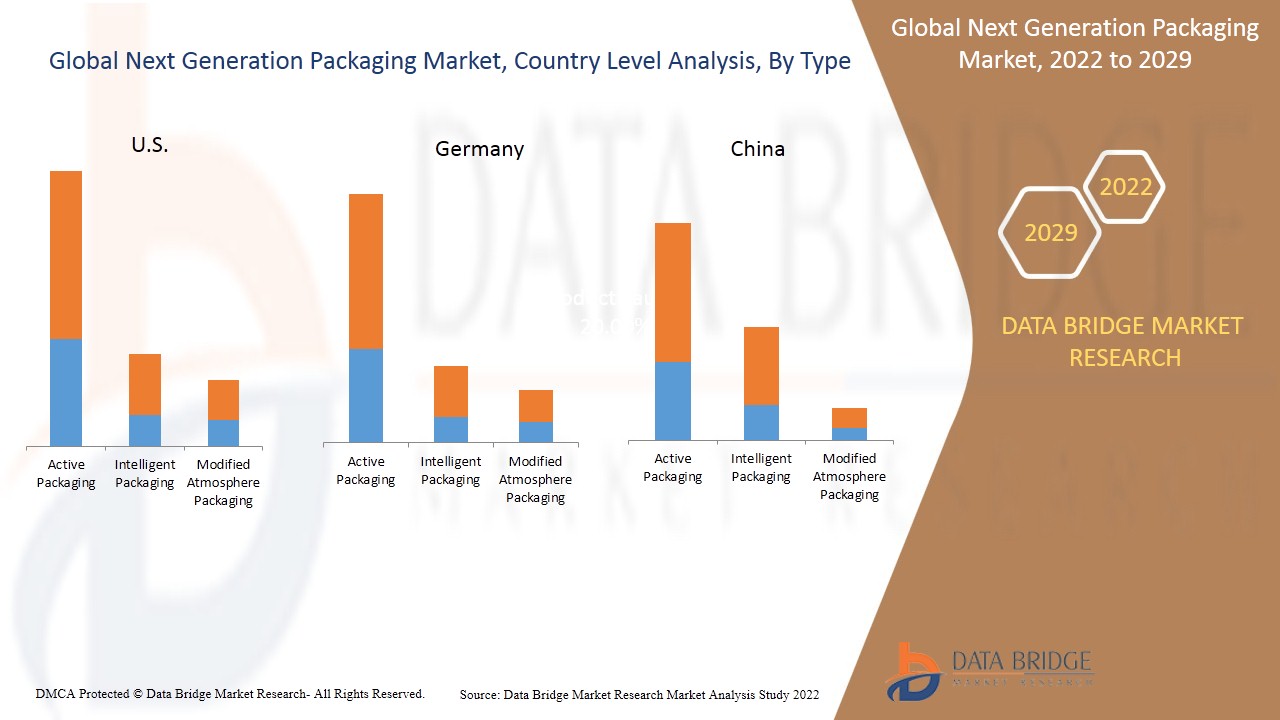

تنقسم أمريكا الشمالية حسب البلد إلى الولايات المتحدة وكندا والمكسيك. في عام 2022، ستسيطر الولايات المتحدة على سوق التغليف للجيل القادم في أمريكا الشمالية، وذلك بسبب التطبيق المتزايد لهذه السوق في صناعة الأغذية والمشروبات.

تحليل على مستوى الدولة لسوق التغليف من الجيل القادم

يتم تحليل سوق التغليف العالمي للجيل القادم ويتم توفير معلومات حول حجم السوق بناءً على النوع والوظيفة والتكنولوجيا والمواد والتطبيق.

من المتوقع أن تنمو منطقة آسيا والمحيط الهادئ بأكثر معدلات النمو الواعدة في الفترة المتوقعة من 2022 إلى 2029 حيث يركز كبار الصناعيين على تطوير منتجات الأغذية والمشروبات المكونة من الجيل التالي من العبوات.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

سيطرت الولايات المتحدة على السوق في أمريكا الشمالية بسبب الطلب المتزايد على التغليف النشط في تطبيقات الأغذية.

لقد أدى زيادة الوعي بسلامة الأغذية وجودتها إلى زيادة الطلب على الجيل التالي من مواد التغليف في ألمانيا.

لقد أدى ارتفاع خطر الإصابة بالأمراض المنقولة عبر الغذاء إلى زيادة سلامة الغذاء في الصين، مما ساعد بدوره على نمو سوق التعبئة والتغليف في البلاد.

ارتفاع الطلب على الجيل القادم من مواد التغليف

يوفر لك سوق التغليف العالمي للجيل القادم أيضًا تحليلًا تفصيليًا للسوق لكل بلد ينمو في الصناعة مع المبيعات ومبيعات المكونات وتأثير التطور التكنولوجي في التغليف للجيل القادم والتغييرات في السيناريوهات التنظيمية مع دعمها للسوق. البيانات متاحة للفترة التاريخية من 2019 إلى 2029.

تحليل المشهد التنافسي وحصة سوق التغليف للجيل القادم

يوفر المشهد التنافسي العالمي لسوق التغليف من الجيل التالي تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والمالية، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق التغليف من الجيل التالي العالمي.

بعض اللاعبين الرئيسيين الذين يعملون في سوق التغليف العالمي من الجيل التالي هم Amcor plc وSealed Air وKlöckner Pentaplast وMicrobeGuard Corporation وTOPPAN INC وBALL CORPORATION وDuPont de Nemours، Inc. وRR Donnelley & Sons Company وVesta وAmerplast Ltd. وMITSUBISHI GAS CHEMICAL وGraham Packaging Company وActive Packaging وAmerican Thermal Instruments وAVERY DENNISON CORPORATION وTemptime Corporation وCortec Packaging وSAES Getters SpA وغيرها.

كما تقوم الشركات في جميع أنحاء العالم ببدء تطوير العديد من المنتجات، الأمر الذي يعمل أيضًا على تسريع نمو سوق التغليف من الجيل التالي.

على سبيل المثال،

- في عام 2017، أطلقت شركة DuPont منتج Tyvek 40L الجديد في الصين، وتخطط لتوفيره عالميًا. تقدم شركة DuPont Protection Solutions منتج DuPont Tyvek 40L للتغليف الطبي، وهو فئة جديدة من Tyvek لتطبيقات التغليف الطبي التي توفر خيارًا فعالاً من حيث التكلفة لحماية الأجهزة خفيفة الوزن ومنخفضة المخاطر.

تعمل الشراكات والمشاريع المشتركة والاستراتيجيات الأخرى على تعزيز حصة الشركة في السوق من خلال زيادة التغطية والحضور. كما أنها تفيد المؤسسات في تحسين عروضها للتغليف من الجيل التالي من خلال مجموعة موسعة من الأحجام.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NEXT GENERATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 GLOBAL NEXT GENERATION PACKAGING MARKET: APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS: GLOBAL NEXT GENERATION PACKAGING MARKET

5.1 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCT

5.2 TEMPERATURE BALANCING SMART PACKAGING:

5.3 SMART PACKAGING TO IMPROVE CONSUMER SAFETY:

5.4 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

6.1.2 INCREASING DISPOSABLE INCOME OF CONSUMERS

6.1.3 INCREASING CASES OF FOOD CONTAMINATION

6.1.4 INCREASE IN THE CONSUMPTION OF PACKAGED PRODUCTS

6.1.5 INCREASING HEALTH AWARENESS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

6.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

6.3 OPPORTUNITIES

6.3.1 RECENT INNOVATIONS AND NEW PRODUCT LAUNCHES

6.3.2 GROWING ALCOHOLIC AND NON-ALCOHOLIC INDUSTRY WITH ACTIVE AND INTELLIGENT PACKAGING

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVES IN THE MARKET

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 IMPACT OF COVID-19 ON THE GLOBAL NEXT GENERATION PACKAGING MARKET

7.1 AWARENESS ABOUT FOOD SAFETY AND QUALITY INCREASED DUE TO THE COVID-19 PANDEMIC

7.2 COVID-19 IMPACT ON DEMAND & SUPPLY CHAIN OF NEXT GENERATION PACKAGING

7.3 IMPACT ON PRICE

7.4 INITIATIVES TAKEN BY MANUFACTURERS

7.5 CONCLUSION

8 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE

8.1 OVERVIEW

8.2 ACTIVE PACKAGING

8.2.1 GAS SCAVENGERS/EMITTERS

8.2.2 MICROWAVE SUSCEPTORS

8.2.3 OTHERS

8.3 INTELLIGENT PACKAGING

8.4 MODIFIED ATMOSPHERE PACKAGING

9 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 MOISTURE CONTROL

9.3 TEMPERATURE INDICATORS

9.4 PRODUCT TRACKING

9.5 SHELF LIFE SENSING

9.6 OTHERS

10 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 SCAVENGERS AND SUSCEPTORS

10.3 RFID TAGS

10.4 NFC TAGS

10.5 QR CODES

10.6 SENSORS & OUTPUT DEVICES

10.7 CODING & MARKINGS

10.8 OTHERS

11 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.3 PAPER

11.4 CORRUGATED BOARD

11.5 OTHERS

12 GLOBAL NEXT GENERATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PACKAGED FOOD

12.2.2 PROCESSED FOOD

12.2.2.1 CHILLED

12.2.2.2 DRIED

12.2.3 MEAT & POULTRY

12.2.4 DAIRY

12.2.5 BAKERY & CONFECTIONERY

12.2.6 FRUITS & VEGETABLES

12.2.7 FROZEN FOOD

12.2.8 OTHERS

12.3 BEVERAGES

12.3.1 NON- ALCOHOLIC

12.3.2 ALCOHOLIC

12.4 PERSONAL CARE

12.5 HEALTH CARE

12.6 LOGISTICS & SUPPLY CHAIN

12.7 CONSUMER ELECTRONICS

12.8 OTHERS

13 GLOBAL NEXT GENERATION PACKAGING MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA-PACIFIC

13.2.1 JAPAN

13.2.2 CHINA

13.2.3 AUSTRALIA & NEW ZEALAND

13.2.4 SOUTH KOREA

13.2.5 INDIA

13.2.6 INDONESIA

13.2.7 PHILIPPINES

13.2.8 THAILAND

13.2.9 MALAYSIA

13.2.10 SINGAPORE

13.2.11 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 FRANCE

13.4.3 U.K.

13.4.4 ITALY

13.4.5 SPAIN

13.4.6 RUSSIA

13.4.7 BELGIUM

13.4.8 NETHERLANDS

13.4.9 SWITZERLAND

13.4.10 TURKEY

13.4.11 LUXEMBURG

13.4.12 REST OF EUROPE

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 SAUDI ARABIA

13.5.3 U.A.E.

13.5.4 EGYPT

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST & AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AVERY DENNISON CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 DUPONT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 BALL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GRAHAM PACKAGING COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 R.R. DONNELLEY & SONS COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIVE PACKAGING

16.6.1 COMPANY SANPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMCOR PLC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AMERPLAST

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMERICAN THERMAL INSTRUMENTS

16.9.1 COMPANY SANPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CORTEC PACKAGING

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KLÖCKNER PENTAPLAST

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MICROBEGUARD CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MITSUBISHI GAS CHEMICAL COMPANY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SAES GETTERS S.P.A.

16.14.1 COMPANY SANPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SEALED AIR

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 TEMPTIME CORPORATION.

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOPPAN INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 VESTA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL INTELLIGENT PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL MODIFIED ATMOSPHERE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MOISTURE CONTROL IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL TEMPERATURE INDICATORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL PRODUCT TRACKING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL SHELF LIFE SENSING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL SCAVENGERS AND SUSCEPTORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL RFID TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL NFC TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL QR CODES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL SENSORS & OUTPUT DEVICES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL CODING & MARKINGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL PLASTIC IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL PAPER IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL CORRUGATED BOARD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL FOOD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICTION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PERSONAL CARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL HEALTHCARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL LOGISTICS & SUPPLY CHAIN IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL CONSUMER ELECTRONICS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 JAPAN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 JAPAN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 JAPAN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 JAPAN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 JAPAN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 JAPAN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 59 CHINA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 CHINA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 61 CHINA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA & NEW ZEALAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA & NEW ZEALAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA & NEW ZEALAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 INDIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 86 INDIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 INDIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 88 INDIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 INDIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 INDIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 INDIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 INDONESIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDONESIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 INDONESIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 95 INDONESIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 97 INDONESIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 106 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 PHILIPPINES FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 PHILIPPINES PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 PHILIPPINES BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 THAILAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 THAILAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 113 THAILAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 114 THAILAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 REST OF ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 142 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 NORTH AMERICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 NORTH AMERICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 NORTH AMERICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 148 U.S. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 U.S. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 151 U.S. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 U.S. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 153 U.S. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 U.S. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 U.S. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 U.S. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 CANADA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 CANADA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 CANADA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 160 CANADA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 161 CANADA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 CANADA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 CANADA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 CANADA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 CANADA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 170 MEXICO NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 171 MEXICO NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 MEXICO PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 174 MEXICO BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 EUROPE NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 176 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 179 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 180 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 181 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 185 GERMANY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 GERMANY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 GERMANY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 188 GERMANY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 189 GERMANY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 190 GERMANY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 191 GERMANY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 GERMANY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 GERMANY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 FRANCE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 FRANCE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 FRANCE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 197 FRANCE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 198 FRANCE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 199 FRANCE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 FRANCE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 FRANCE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 FRANCE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 U.K. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 U.K. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 U.K. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 206 U.K. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 207 U.K. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 208 U.K. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 U.K. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 U.K. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 211 U.K. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 212 ITALY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 ITALY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 ITALY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 215 ITALY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 ITALY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 217 ITALY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 ITALY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 ITALY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 ITALY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 SPAIN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SPAIN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SPAIN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 224 SPAIN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 225 SPAIN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 226 SPAIN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 227 SPAIN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 SPAIN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 229 SPAIN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 RUSSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 RUSSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 233 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 234 RUSSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 235 RUSSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 RUSSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 RUSSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 238 RUSSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 239 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 BELGIUM ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 BELGIUM NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 242 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 243 BELGIUM NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 244 BELGIUM NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 245 BELGIUM FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 246 BELGIUM PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 247 BELGIUM BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 248 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 NETHERLANDS ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 251 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 253 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 NETHERLANDS FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 255 NETHERLANDS PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 NETHERLANDS BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 257 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 SWITZERLAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 260 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 262 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 SWITZERLAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 SWITZERLAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 SWITZERLAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 TURKEY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 TURKEY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 TURKEY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 269 TURKEY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 TURKEY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 271 TURKEY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 TURKEY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 TURKEY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 TURKEY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 275 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 LUXEMBURG ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 278 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 279 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 280 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 281 LUXEMBURG FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 LUXEMBURG PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 283 LUXEMBURG BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 284 REST OF EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 286 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MIDDLE EAST AND AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 289 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 290 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 291 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 292 MIDDLE EAST AND AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 293 MIDDLE EAST AND AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 294 MIDDLE EAST AND AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 295 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 SOUTH AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 298 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 299 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 300 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 301 SOUTH AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 302 SOUTH AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 303 SOUTH AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 304 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 SAUDI ARABIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 307 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 308 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 309 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 310 SAUDI ARABIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 311 SAUDI ARABIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 312 SAUDI ARABIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 313 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 314 U.A.E. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 315 U.A.E. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 316 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 317 U.A.E. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 318 U.A.E. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 319 U.A.E. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 320 U.A.E. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 321 U.A.E. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 322 EGYPT NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 323 EGYPT ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 EGYPT NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 325 EGYPT NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 326 EGYPT NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 327 EGYPT NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 328 EGYPT FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 329 EGYPT PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 330 EGYPT BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 331 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 332 ISRAEL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 333 ISRAEL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 334 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 335 ISRAEL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 336 ISRAEL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 337 ISRAEL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 338 ISRAEL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 339 ISRAEL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 340 REST OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 341 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 342 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 343 SOUTH AMERICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 344 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 345 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 346 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 347 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 348 SOUTH AMERICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 349 SOUTH AMERICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 350 SOUTH AMERICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 351 BRAZIL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 352 BRAZIL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 353 BRAZIL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 354 BRAZIL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 355 BRAZIL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 356 BRAZIL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 357 BRAZIL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 358 BRAZIL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 359 BRAZIL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 360 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 361 ARGENTINA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 363 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 364 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 365 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 366 ARGENTINA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 367 ARGENTINA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 368 ARGENTINA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 369 REST OF SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 GLOBAL NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL NEXT GENERATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NEXT GENERATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NEXT GENERATION PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NEXT GENERATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NEXT GENERATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NEXT GENERATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NEXT GENERATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE GLOBAL NEXT GENERATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH HIGHEST CAGR IN FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 AN INCREASE IN CONSUMPTION OF BEVERAGES AND HEALTH AWARENESS AMONG CONSUMERS IS EXPECTED TO DRIVE GLOBAL NEXT GENERATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PACKAGING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF GLOBAL NEXT GENERATION PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NEXT GENERATION PACKAGING MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL NEXT GENERATION PACKAGING MARKET

FIGURE 15 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2021

FIGURE 16 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2021

FIGURE 17 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2021

FIGURE 18 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2021

FIGURE 19 GLOBAL NEXT GENERATION MARKET, BY APPLICATION, 2021

FIGURE 20 GLOBAL NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2021)

FIGURE 22 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2022 & 2029)

FIGURE 23 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2021 & 2029)

FIGURE 24 GLOBAL NEXT GENERATION PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 40 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 41 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 42 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 45 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 46 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 47 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 50 GLOBAL NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 51 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.